Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 29, 2015

Rise of US non-cash loans

Borrowing US equities using non-cash collateral has surged in popularity in the last few years, a trend that non US beneficial owners have been best placed to capture.

- Aggregate value of non-cash loans of US equities is $118bn, an all-time high

- 75% of US equity loans from non US beneficial owners are against non-cash collateral

- Meanwhile, aggregate value of cash US equities balance has remained flat

The overarching theme coming out of the recently held Markit Securities Finance forum was that regulation holds as big a sway as ever over the industry's behaviour. To this end, lenders which are best able to adapt to regulatory developments stand to see a strong demand for their assets.

One particular area of area of change singled out by both panellists and delegates was GC balances which have fallen out of favour in the wake of recent capital regulation such as Basel III. The increased cost of balance sheet stands to see borrowers increasingly ration high cost collateral and favour the lenders which are willing to lend out on more pragmatic collateral terms.

This regulatory driven trend is behind the rise of the use of non-cash collateralised loans for US equities.

Non cash growing in popularity

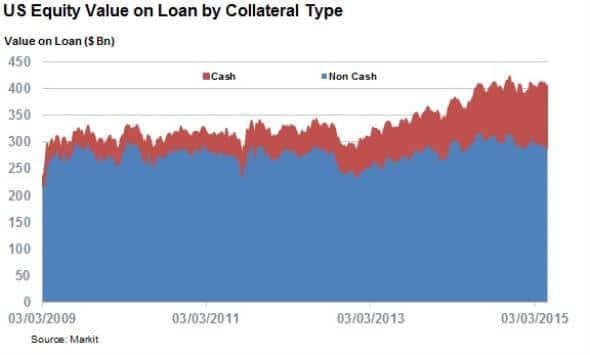

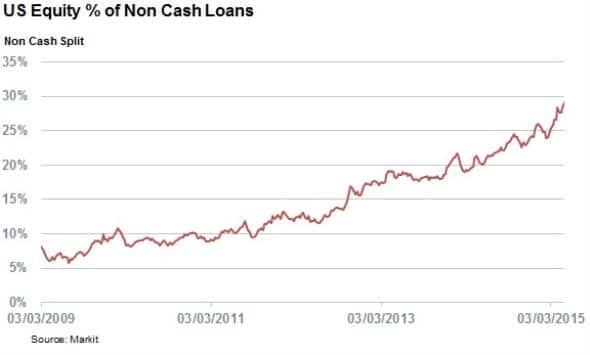

Loans for US equities have historically been overwhelmingly tilted towards cash securitised loans. But the recent wave of balance sheet regulation has heralded the increased use of non-cash collateral in the seven years since the financial crisis. The aggregate value of non-cash collateralised US equity loans has jumped more than fivefold since 2009, surging from $20bn to a current all-time high of $118bn.

Non cash loans now make up 29% of the total US equity value on loan, up from 7% at the start of 2009.

This increased use of non-cash seems to be driven by GC balances. The proportion of S&P 500 loans, which are overwhelmingly GC names are now made up of 44% of non-cash borrow.

Non US beneficial owners take the helm

This trend looks to be playing into the hands of non US beneficial owners as non US domiciled funds tagged in the Markit Securities Finance database have 76% of their US equity loans secured against non-cash collateral. US domiciled beneficial owners have been less able to capitalise on this trend, with less than one tenth of their US equity securities lending transactions collateralised against non-cash.

The willingness of non US beneficial owners to accept non cash collateral has seen the aggregate value of US equity loans from these beneficial owners jump by 40% over the last 12 months.

Cash loans remain flat

While non-cash collateralised loans have surged in popularity over the last few years, the value of the relatively less capital efficient cash collateralised loans has remained relatively flat at $280bn since the start of 2009. This represents a massive atrophy in real terms given the recent strong market run.

US domiciled beneficial owners, which are less able to accept non cash collateral look to be on the losing side of this trend as their utilisation of US equities has fallen to an all-time low 4.5% recently, down from 6% three years ago. This puts flesh to the argument that the lenders which stand to best capitalise from the recent regulatory regime are those with the ability to be pragmatic about the collateral they accept. To this point, non US domiciled beneficial owners have over 6.5% of their US equity out on loan, much higher than their US peers.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-Equities-Rise-of-US-non-cash-loans.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-Equities-Rise-of-US-non-cash-loans.html&text=Rise+of+US+non-cash+loans","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-Equities-Rise-of-US-non-cash-loans.html","enabled":true},{"name":"email","url":"?subject=Rise of US non-cash loans&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-Equities-Rise-of-US-non-cash-loans.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rise+of+US+non-cash+loans http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-Equities-Rise-of-US-non-cash-loans.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}