Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 29, 2015

Fed fails to halt US corporate bond appeal

Yesterday's FOMC meeting saw bonds retreat, but investors continued their corporate bond binge.

- Markit iBoxx $ Treasuries fell by 30bps as its yield rose by 5bps

- Dollar investment grade bonds on track for best monthly performance since January

- Corporate bonds ETFs have seen the largest inflows on record in October

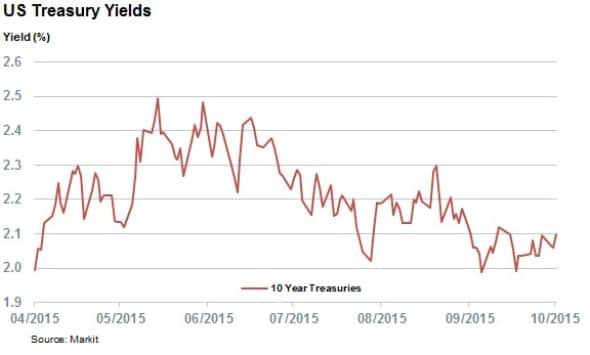

Bonds sold off across the board yesterday as the press release issued in the wake of the Federal Open Market Committee (FOMC) meeting signalled that the US rate setting body was willing to raise interest rates in December, should the labour market and inflation picture warrant it. This selloff saw the yield in 10 year US treasuries rise by 4bps to 2.1%.

These shifts in benchmark US interest rates saw the Markit iBoxx $ Treasuries index yield rise by 5bps to 2.1%. The rise in yield meant that the index total returns fell by 30bps on the day; marking the third such fall in the index for October and takes the index back to an even keel for the month. The selloff hit treasuries-tracking ETFs, with investors withdrawing $136m of assets from funds which track government bonds on Wednesday; the fifth straight day of outflows. These outflows have taken the withdrawals seen by these funds past the $750 m mark, the largest outflow since May.

Corporates continue their form

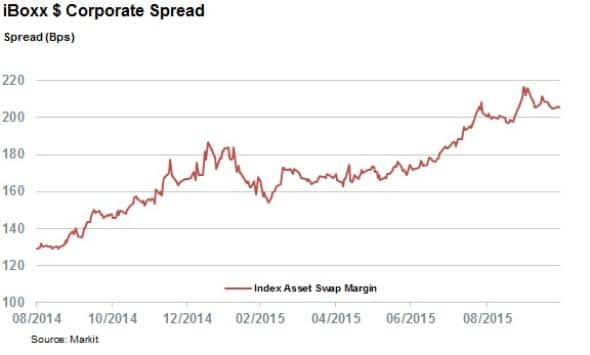

While corporate bonds also fell on the day, the Markit iBoxx $ Corporate index which tracks dollar denominated investment grade bonds, mirrored the yield and return changes seen in its treasury peer yesterday. The index spread, which measures the extra yield required by investors to hold the asset class actually fell by around a third of a basis point, helping push this key risk metric over 10bps tighter for October.

This risk appetite driven rally, coming after spreads hit a multiyear high in the opening week of October, means that US treasuries are on track for their best month since January. The Markit iBoxx $ Corporate index has returned 1.1% month to date, even accounting for yesterday's treasury driven slump.

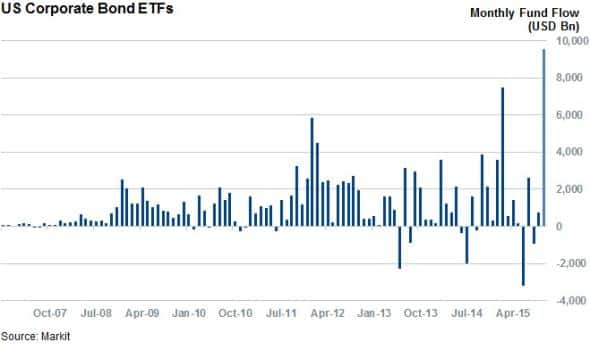

Investors line up for corporate ETFs

The increased investor pragmatism towards corporate bonds has also been mirrored in US exposed corporate bond ETFs. The asset class in on track for its largest monthly inflow on record after investors added over $9.5bn of exposure in corporate bonds. This beats the previous record seen in January by a hefty $2bn.

Corporate bond ETFs also managed to attract more assets over yesterday's selloff as investors bought $228m of exposure into the asset class. The extra spread offered by investment grade bonds over treasuries is now 40bps higher than at the start of the year and the rotation out of government bonds funds into corporate products demonstrates that this extra yield is proving attractive to investors in the current environment. This trend has been further encouraged as continuation of the Fed's accommodative monetary policy could see a further fall in spreads.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-credit-fed-fails-to-halt-us-corporate-bond-appeal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-credit-fed-fails-to-halt-us-corporate-bond-appeal.html&text=Fed+fails+to+halt+US+corporate+bond+appeal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-credit-fed-fails-to-halt-us-corporate-bond-appeal.html","enabled":true},{"name":"email","url":"?subject=Fed fails to halt US corporate bond appeal&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-credit-fed-fails-to-halt-us-corporate-bond-appeal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+fails+to+halt+US+corporate+bond+appeal http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29102015-credit-fed-fails-to-halt-us-corporate-bond-appeal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}