Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 30, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- RH sees shorts hang on despite a rally which has seen its shares double

- Elekta short sellers have covered after the firm's shares rallied strongly

- Japanese software firm Access targeted by shorts over the last month

North America

Homeware retailer Rh is the high conviction short among the firms announcing earnings this week. Rh is no stranger to short sellers as the firms featured as one of the most heavily shorted stocks the last time it announced earnings. Short sellers weren't rewarded for their skepticism back then as RH's better than expected earnings sparked a rally which saw its stock price double in the subsequent three months. Shorts have been willing to stay in the trade however as demand to borrow RH shares has actually increased in the three months since RH's last earnings update. It's worth noting that a portion of Rh's short interest is likely driven higher by the large pile of convertible bonds the company has outstanding.

RH is joined by a slew of fellow retailers among the high convictions short plays announcing earnings this week as Zummiez, Conn's and Five Below all have at least 10% of their shares outstanding on loan to short sellers.

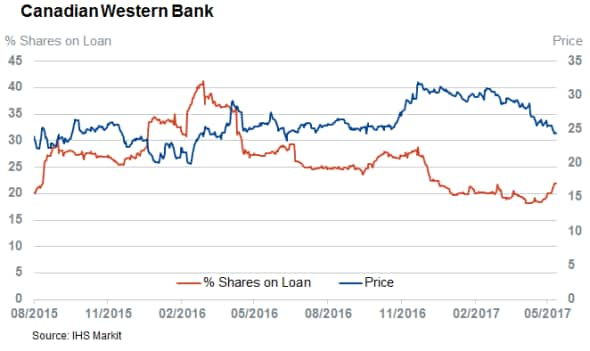

Canadian housing, which has been another top short this earnings season, will also play a role this week when Canadian lender Western Bank releases earnings. Demand to short shares in Canadian Western has surged in the last few weeks after fellow mortgage lender Home Capital faced a liquidity crush amidst accusations of improper underwriting standard. Home Capital's implosion has so far been relatively contained however the recent surge in Canadian Western's short interest may indicate that short sellers are starting rethink this position.

Europe

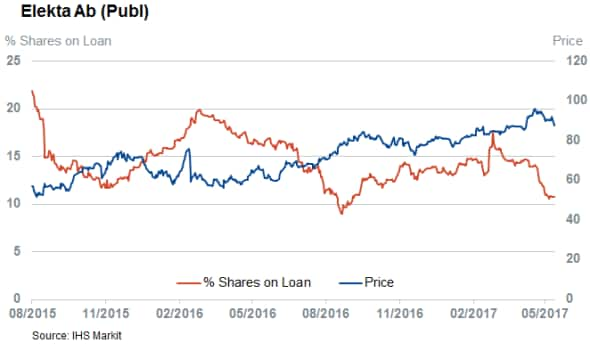

Swedish radiotherapy equipment manufacturer Elekta is the only firm to see more than 10% of its shares out on loan among the European firms announcing earnings this week. Elekta has been a top European short for quite some time however demand to borrow its shares has fallen to the lowest in nearly three years after its shares rallied to a two year high.

While short sellers have been actively covering in Elekta in the wake of a rally, the same can't be said for Rocket Internet short sellers as they have increased their positions by a third after a similar rally in its share price. The fact that short sellers are continuing to increase their positions in Rocket indicates their ongoing scepticism about how the company's lack of transparency surrounding its portfolio companies despite a slew of recent write-downs which tripled the company's net loss over 2016.

Asia

Asia doesn't see much in the way of interesting shorting among the firms announcing earnings this week. The only exception is Japanese mobile software firm Access which has seen its short interest more than double in the last four weeks to 4% of shares outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30052017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30052017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}