Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 30, 2015

European equities trading volumes on tear ahead

European equities trading volumes are on track to beat last year's bumper total as first half volumes surged by 28%, according to the 2015 Markit MSA first half results.

- Aggregate European equities volumes jumped by a quarter to €1.4trn over the first half

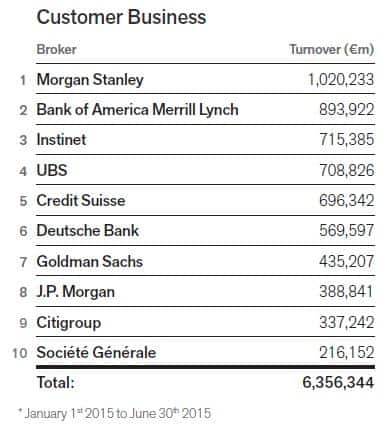

- Morgan Stanley topped the region's league table with 16% of executed client business

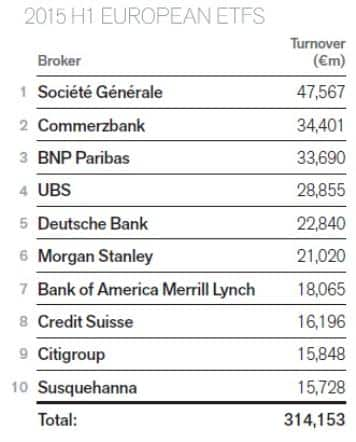

- Secondary ETF trading volumes nearly doubled to €314bn; BlackRock products saw half total

To read the full report with broker rankings, click here

European equity markets have roared back to life, as demonstrated by the 20% surge seen in the Stoxx 600 index in the opening three and a half months of the year. While the index has relinquished some of its gains in the subsequent two and half months amid the Greek crisis, the index still had its best opening half of the year since 1997.

This jump in equities values, combined with the recent market volatility, has seen equity trading volumes in the region jump by more than a quarter in the first half of the year compared to the same period in 2014. On an absolute level, this increase in trading takes the aggregate 2015 first half tally to €6.36trn, compared to €4.95trn in the previous year.

The two standout months of the opening half of the year were March and June, which registered 39% and 36% jumps from the previous year's total. June was height of the Greek crisis which saw plenty of market volatility.

Morgan Stanley remained the top contributing broker, repeating last year's achievement. The bank was the only contributor to report more than €1trn of executed client business for the opening half of the year; over €100bn more than second ranked broker Bank of America Merrill Lynch.

Instinet continued its strong momentum seen in 2014 by climbing two spots to crack the top three. This came at the expense of Swiss banks UBS and Credit Suisse, which each fell one spot on the league table to fourth and fifth place respectively.

Strong trading across the board

A deeper dive into the individual indexes driving these strong volumes reveals that constituents of Western European large cap indexes (the CAC 40, DAX 30, IBEX 35,FTSE MIB and FTSE 100), have been responsible for around 60% of the €1.4trn increase. This cemented Morgan Stanley in top place as it reported the most turnover across four of the five indexes. The FTSE 100 was the only index in which the American bank failed to claim the top spot, losing out to Bank of America Merrill Lynch.

Bank of America's surge in the UK business was also seen in midcap firms, as the bank reported the most business in the FTSE 250 constituents.

Most of the increased flow was seen in Western European equities, with the Nordic region registering a 15% increase in flow to €675bn. Deutsche Bank claimed the top spot in the league table with €124bn of reported business in the first two quarter of 2015. Morgan Stanley overtook Bank of America in second place in the region.

Eastern Europe continued to be an area of relative weakness as volumes stayed roughly flat in the region with contributing banks reporting €75bn of client business.

ETF trading surges

ETFs also had a very strong start to the year in terms of inflows which has been translated in the secondary market, as volumes are nearly twice those seen in the first half of last year. ETF trading reported by clients totalled €314bn in the first six months of the year, as opposed to €159bn in the same period last year.

The changing landscape of the European ETF industry means that eight of the ten largest contributing brokers have seen their ranks change on the league table. French broker Soci"t" G"n"rale managed to claim the top spot on the league table after it reported €47bn of flow, helping it jump two places from its rank in the first half of last year.

BlackRock products saw 43% of the trading over the first six months with over €133bn of flow.

This analysis accompanies a summary of European cash equity and ETF trading for H1 2015 using Markit's suite of equity products. Markit MSA covers an estimated 80% of all cash equity trading in Europe across traditional exchanges, multi-lateral trading facilities and over-the-counter markets. Trade data is sourced directly from contributing brokers and represents what was actually traded, differentiating it from other surveys that rely on indications of interest or trade adverts.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Equities-European-equities-trading-volumes-on-tear-ahead.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Equities-European-equities-trading-volumes-on-tear-ahead.html&text=European+equities+trading+volumes+on+tear+ahead","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Equities-European-equities-trading-volumes-on-tear-ahead.html","enabled":true},{"name":"email","url":"?subject=European equities trading volumes on tear ahead&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Equities-European-equities-trading-volumes-on-tear-ahead.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+equities+trading+volumes+on+tear+ahead http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30072015-Equities-European-equities-trading-volumes-on-tear-ahead.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}