Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 30, 2015

Risk falls before Turkish election; Puerto Rico fluctuates

This week saw Turkish CDS spreads improve in the run-up to this Sunday's election while Puerto Rican bonds fluctuated with the debate rages on regarding its on-going restructuring.

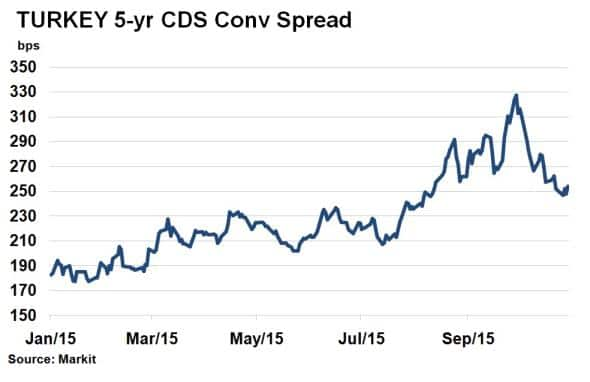

- Turkey's 5-yr CDS spread has fallen 22% this month in the lead up to this weekend's election

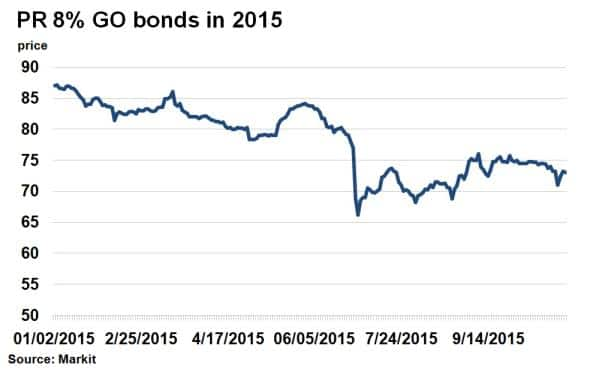

- Puerto Rico's 8% general obligation bond currently priced at 72.25 as interest payment looms

- Rite Aid saw its credit spread tumble as acquirer Walgreens offers investment grade status

Turkey tries again

Five months after an election which resulted in a hung parliament, the people of Turkey return to the polls this weekend to elect their leader.

The time in between has been turbulent, as represented by the rising cost to insure against Turkish government bonds. Political uncertainty can have a major negative impact on a country's finances, and credit markets react by pricing in the additional risk. From mid June to the end of September, Turkey's 5-yr CDS spread widened from 207bps to 328bps, as the country's leaders botched efforts to form a coalition government while terrorism and conflict with Kurd separatists added to the complexity.

October has, however, been a positive month for Turkey's credit. CDS spreads have tightened to two and a half month lows, and investors in Turkish government bonds have enjoyed heathy returns of 5.16%, according to Markit's iBoxx indices. The diminishing credit risk may signal optimism around this weekend's election and its belated conclusion.

Puerto Rico

Puerto Rico's (PR) plan to reduce its $72bn debt burden took another turn in complexity as holders of its General Obligation (GO) bonds, which hold the highest seniority, hired advisors to negotiate the islands' debt restructuring.

PR's 8% GO bond maturing in 2035 had an evaluated price of 72.25 (where par is 100) on October 28th, according to Markit's municipal bond pricing service. There was slight optimism last week as the Obama administration proposed an amendment to the bankruptcy code (which would require congressional approval). Despite the support, the 8% GO bond sold off, falling to 71 (implying a greater haircut), but has since retraced.

Time is running out, however, as a chunky GO interest payment is due at the beginning of 2016. PR has already defaulted on its Public Finance Corporation bonds in August.

CDS movers

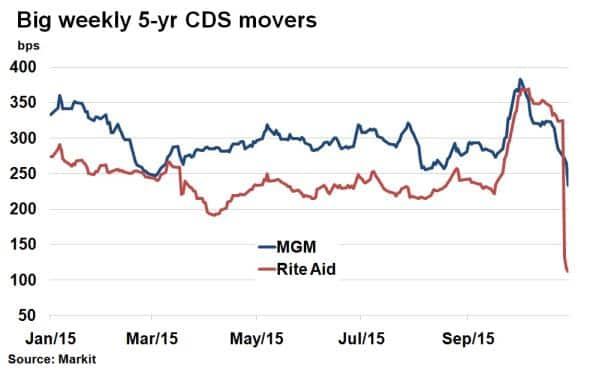

Among the corporate credits which saw the biggest weekly tightening in credit spreads were casino operator MGM Resorts and US pharmacy chain Rite Aid.

For MGM, poor recent operating performance, which prompted activist pressure earlier this year, was followed by a steep slowdown in revenue growth from its Chinese operations in Macau. 5-yr CDS spreads hit a two year high on October 1st. This week, however, has seen the firm post positive third quarter results and announced that it will form a new real estate investment arm. The restructuring was seen as a positive by credit investors as CDS spreads tightened 32bps on the day to 233bps, a yearly low.

The US healthcare industry has been in the news recently, led by drug pricing and Valeant, but it was an m&a deal that caused the biggest movement in credit markets this week. Walgreens agreed to buy pharmaceutical chain Rite Aid for $17.2bn, a deal which saw an investment grade credit (BBB) buying a junk rated name (B). Rite Aid's 5-yr CDS spread subsequently tightened almost threefold, from 324bs to 112bps, highlighting the impact of a highly prized investment grade status.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-risk-falls-before-turkish-election-puerto-rico-fluctuates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-risk-falls-before-turkish-election-puerto-rico-fluctuates.html&text=Risk+falls+before+Turkish+election%3b+Puerto+Rico+fluctuates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-risk-falls-before-turkish-election-puerto-rico-fluctuates.html","enabled":true},{"name":"email","url":"?subject=Risk falls before Turkish election; Puerto Rico fluctuates&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-risk-falls-before-turkish-election-puerto-rico-fluctuates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+falls+before+Turkish+election%3b+Puerto+Rico+fluctuates http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102015-credit-risk-falls-before-turkish-election-puerto-rico-fluctuates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}