Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 31, 2016

CDS bond-basis tightens as sentiment improves

Positive market sentiment fuelled by global central bank action has tightened the CDS-bond basis over the past month.

- European banks have seen their CDS-bond basis tighten over the last 30 days

- Buoyed by a bounce in commodity prices, EQT Corp has seen its basis tighten 340bps

- Improved sentiment around Japanese banks has seen their basis return to negative territory

Positive market sentiment fuelled by global central bank action has tightened the CDS-bond basis over the past month.

Fears in Europe's banking sector have subsided and credit default swaps (CDS) have tightened, opening up a large difference between bank CDS spreads and their cash spread equivalent; known as the CDS-bond basis. Likewise a bounce in commodity prices has seen US energy companies' basis move more positive.

CDS-bond basis

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. It is defined as an entity's bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Both bond and CDS spreads measure an entity's credit risk, so theoretically the basis should be zero. In practice other factors such as liquidity and transaction costs come into play, distorting the basis and giving rise to arbitrage opportunities.

Taking advantage of a positive basis would involve selling the cash bond (paying spread) while selling protection (receiving spread) on the same credit. Conversely, a negative basis trade would involve buying the bond (receiving spread) while buying protection (paying spread) on the same credit.

An analysis of investment grade corporate bonds sees many such discrepancies that could be arbitraged away. Our sample of bonds is taken from Markit's iBoxx indices, which incorporate bonds of specified issue size and bond type. Since the 5-yr point on a CDS curve is typically the most liquid tenor, corresponding bonds maturing in 2020 and 2021 have been taken for practical reasons. This analysis is based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

Markit iBoxx " Corporates

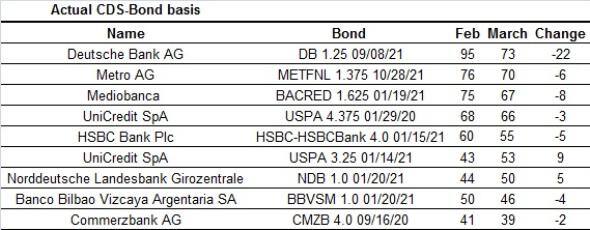

Amid the global market volatility at the start of the year, fear around Europe's banking sector was the prominent theme that saw a large positive shift in the CDS-bond basis as investors turned to CDS contracts to hedge macroeconomic and counterparty risks. However, sentiment has improved over the past month, as major central banks have reiterated their support for risky assets.

Global or defensive corporations such as Heineken NV, Coca Cola HBC Finance BV and Accor continue to exhibit a low or negative basis, with little basis volatility. But this group remains a minority as Europe remains predominately on the positive basis side.

The European Central Banks's decision earlier this month to expand its current QE programme and extend cheap loans to banks has seen credit risk in the region subside. This is best reflected among bank bonds with Deutsche Bank AG's 1.25% bond maturing in 2021 seeing its basis fall 21bps over the past month, to 72bps. Likewise banks Metro AG, Mediobanca, Unicredit and HSBC all saw their basis tighten, although they continue to exhibit a large positive basis.

Markit iBoxx $ Corporates

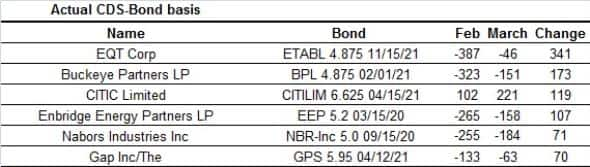

Large shifts in the CDS-bond basis among US dollar investment grade corporate bonds over the past month were dominated by the bounce in energy prices and a brighter outlook for the global banking system.

The oil & gas and basic materials sectors have in particular seen risk tumble. Bond prices have recovered in these sectors, tightening asset swap spreads and shifting the basis in a positive direction. Buckeye Partners' 4.875% 2021 bond exhibited a basis of -323bps last month, but the recovery has meant this has tightened to 150bps. Likewise Enbridge Energy Partners' 5.2% bond maturing in 2020 and EQT Corp's 4.875% bond maturing in 2021 have both seen their large negative basis tighten 107bps and 340bps, respectively, over the past month.

On the positive basis side, which is far less dominant in the US than in Europe, reverse Samurai bonds (Japanese entities issuing in US dollars) saw their basis return back into negative territory this month. Mizuho Bank Ltd (-32bps), The Bank of Tokyo-Mitsubishi UFJ Ltd (-29bps) and Sumitomo Mitsui Banking Corp (-29bps) all had a positive basis last month, due to heightened credit risk in reaction the Bank of Japan introduction of negative interest rates in late January.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032016-credit-cds-bond-basis-tightens-as-sentiment-improves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032016-credit-cds-bond-basis-tightens-as-sentiment-improves.html&text=CDS+bond-basis+tightens+as+sentiment+improves","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032016-credit-cds-bond-basis-tightens-as-sentiment-improves.html","enabled":true},{"name":"email","url":"?subject=CDS bond-basis tightens as sentiment improves&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032016-credit-cds-bond-basis-tightens-as-sentiment-improves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS+bond-basis+tightens+as+sentiment+improves http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032016-credit-cds-bond-basis-tightens-as-sentiment-improves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}