Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 31, 2017

Thoughts from the yearly MSF Securities Finance Forum

The annual Markit Securities Finance Forum finds the industry in a state of flux as it adapts to shrinking bank balance sheets and the imminent challenge posed by SFTR.

- Regulation is still the largest driving force in the market

- Industry looking to leverage external solutions as it gets up to speed with SFTR

- Balance sheets still constrained but CCP not may not be the golden bullet

The ten years since the financial crisis have not brought around a "new normal" for the securities lending industry, according to the consensus at the annual Markit Securities Finance forum. The relentless pace of regulation and ever-shifting market dynamics have been a constant agent of change for the industry and the onset of SFTR, MiFID II and growing pressure on bank balance sheets will ensure that the year ahead will continue to see plenty of change across the industry.

While the challenges are evident, panelists were cautiously optimistic, especially since overall industry revenues have held up well so far this year despite the current lack of market volatility. The opening panel, which focused on the current and future state of the industry, was keen to point out that securities finance had more to look forward to than a resurgence of market volatility. The two main potential structural tailwinds that were singled out were the opening up of new market, most importantly China, and the normalization of global monetary policy which would bring back the cash reinvestment opportunities which have disappeared after ten years of ultra-lose monetary policy.

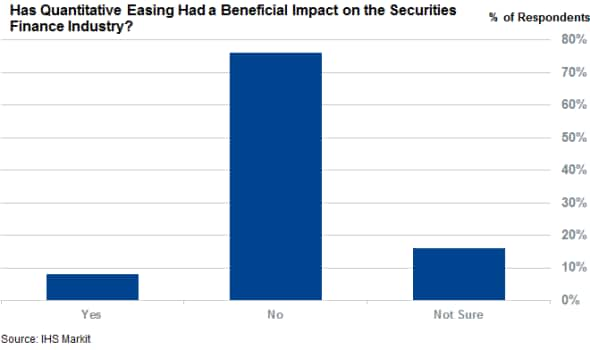

Delegates were nearly unanimous in agreeing with the latter point as over 70% agreed that central bank quantitative easing has had a detrimental effect on the industry.

Panelists also noted that securities finance is not the only challenged area of the wider financial industry and that securities lending revenues are increasingly being factored into investment decisions from ever more engaged beneficial owners.

SFTR

SFTR shaped a large part of the dialogue throughout the afternoon, which featured a panel on the regulation as well as a fireside chat from ESMA's Nikolay Arnaudov. The overall mood from panelists was that the path towards implementation is getting clearer which is encouraging given that ESMA just released the final Regulatory Technical Standards. This sentiment was largely echoed by an audience poll where only 4% of the audience stated that they had yet to give the regulation any thoughts while 43% of delegates admitted that their firm had either started implementing the regulation or had a clear strategy for the path ahead.

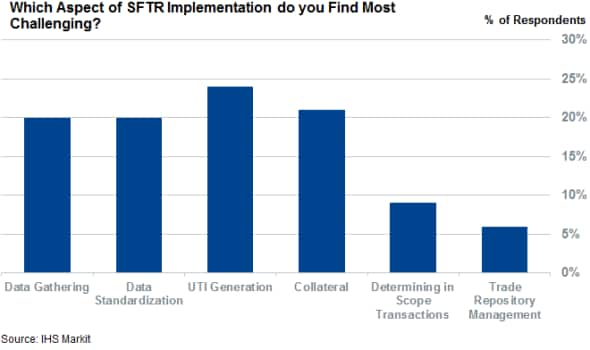

The technical challenge that delegates were most worried about was the ability to reconcile trades and generate Unique Trade Identifiers (UTIS). UTI generation only plays part of the implementation headache however, as delegates nearly ranked data marshaling and standardization on par with the UTI generation when polled about the most challenging part of SFTR implementation.

Panelists were keen to point out that double sided reporting poses a global challenge for the industry as even single sided reporting needs cooperation from both parties, regardless of whether one is exempt from reporting. This could put European market participants at a disadvantage when counteracting with out of scope participants who lack either the willingness or infrastructure to deliver their end of the reporting bargain.

Market participants who have so far avoided the scrutiny placed on the industry by SFTR may not do so for long as ESMA was clear that SFTR was part of a wider global push on Securities Finance Transactions (SFT) transparency by the Financial Stability Board.

One positive point highlighted by one panelist was that SFTR, by virtue of the costs that will likely be passed on to beneficial owners, has the potential to push out marginal, unresponsive lenders - which could alleviate the "chronic oversupply" that has dogged the industry for much of the last few years.

CCPs

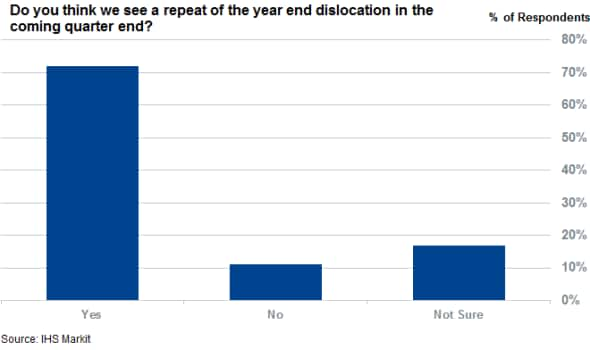

Looking beyond SFTR, balance sheets were a constant theme throughout the afternoon, especially in the third panel which focused on recent developments in the European fixed income and repo markets. Constrained bank balance sheets thanks to the onset of new balance sheet regulations such as the Net Stable Funding Ratio and Liquidity Coverage Ratio played a large role in the year end market dislocation. These dislocations could be an ongoing phenomenon as the majority of delegates are expecting a repeat of the year end in the coming quarter end.

All three panels did mention that Central Counterparties (CCPs) had the potential to alleviate some of the balance sheet constraints with the caveat that expanding CCP usage is a double edged sword as a CCP is only as creditworthy as its members. Broadening CCP adoption, especially to buyside participants, could in turn lower their overall credit worthiness and the balance sheet relief that clearing through CCPs brings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Equities-Thoughts-from-the-yearly-MSF-Securities-Finance-Forum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Equities-Thoughts-from-the-yearly-MSF-Securities-Finance-Forum.html&text=Thoughts+from+the+yearly+MSF+Securities+Finance+Forum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Equities-Thoughts-from-the-yearly-MSF-Securities-Finance-Forum.html","enabled":true},{"name":"email","url":"?subject=Thoughts from the yearly MSF Securities Finance Forum&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Equities-Thoughts-from-the-yearly-MSF-Securities-Finance-Forum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thoughts+from+the+yearly+MSF+Securities+Finance+Forum http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31032017-Equities-Thoughts-from-the-yearly-MSF-Securities-Finance-Forum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}