Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 31, 2016

Short sellers clouding out residential solar

Average short interest across solar stocks has once again started to heat up with residential US operators being widely targeted as the industry matures and incumbents face increased competition.

- Average short interest of solar ETF TAN constituents reaches two year high

- Solarcity and Sunworks see frenzied demand to short sell as short sellers pay up to borrow

- Vivint Solar sees aggressive surge in short interest as losses mount

Short sellers ramp up solar exposure

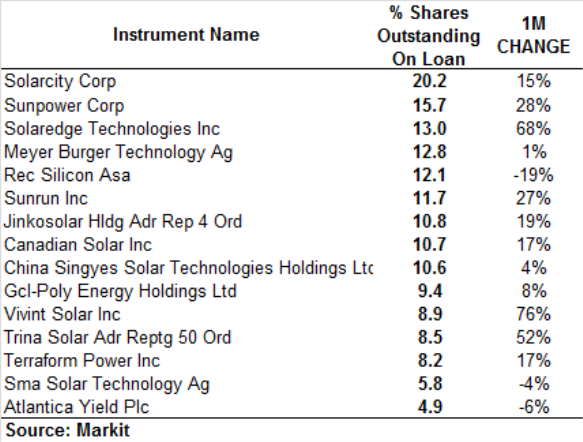

It's been another tough year so far for solar stocks as short sellers target the largest residential solar players, with Solarcity currently the most in demand to short.

As leasing solar installations become less attractive versus upfront purchase as costs decline, the extension to tax credits adds to competitive dynamics expected in the US residential market. With incumbents losing barriers to entry, short sellers have begun to increase their positions. This has seen average short interest across the Guggenheim Solar ETF (TAN) increase to above 8%.

In 2015 and prior to the to sell off in Chinese equities, shares of Hong Kong listed Hanergy Thin Film Power group (HFT) helped propel shares in TAN to staggering heights, before its subsequent dramatic collapse.

TAN, although still trading 50% lower than its April 2015 highs, has seen short interest levels across constituents jump while the ETF itself has less than 1% of its shares sold short currently.

Shorts pay up to lease solar shorts

While companies involved in large renewable projects like SunEdison have floundered recently for a variety of reasons, driving the average increase in shorting levels currently has been the rise in short interest at residential focused firms.

This may have been driven by a reduction in expectations of near and longer term sales for incumbent companies due to the extension of investment tax credits expected to expire this year. These credits, which provide a 30% discount on residential solar installations - has now been extended to 2019 and provides a more attractive proposition for consumers and an even playing field for new smaller entrants into the market.

With a fifth of its shares currently out on loan and the most shorted constituent of TAN currently, short interest in Solarcity has surged back towards the record highs last seen in November 2015. The company has come under increasing pressure, along with other solar panel leasing firms as the industry begins to mature and sales growth slows.

Shares in Solarcity have now fallen almost three quarters from all-time highs but remain 88% above its 2012 IPO price.

The second most shorted constituent of TAN is Sunpower, a supplier of solar systems to homeowners and commercial users with 70% of its revenues coming from within the United States.

Sunpower has seen a 140% increase in shorting levels in the past year with shares declining by 40%. The company posted a loss for the first quarter of 2016 as revenue growth stagnated.

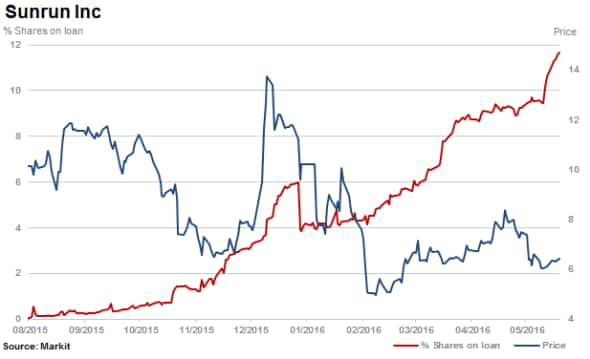

The trend is the same at San Francisco based Sunrun whose shares have struggled since its IPO last year. Short interest has continued to increase since listing, with 11.7% of shares out on loan currently and the stock is down by almost 50%.

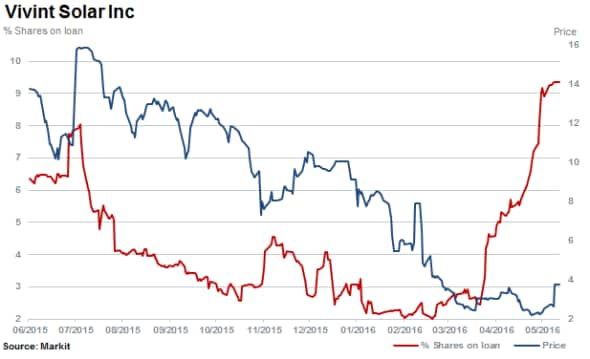

Vivent solar has seen an impressive take off in short interest levels since the beginning of April with short interest rising almost five fold. Additionally demand to short the company has seen the benchmark cost to borrow increase.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Equities-Short-sellers-clouding-out-residential-solar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Equities-Short-sellers-clouding-out-residential-solar.html&text=Short+sellers+clouding+out+residential+solar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Equities-Short-sellers-clouding-out-residential-solar.html","enabled":true},{"name":"email","url":"?subject=Short sellers clouding out residential solar&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Equities-Short-sellers-clouding-out-residential-solar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+clouding+out+residential+solar http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31052016-Equities-Short-sellers-clouding-out-residential-solar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}