Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Feb 27, 2018

High-yield ETFs attract record demand from short sellers

High-yield ETFs attract record demand from short sellers

- Outflows from HY ETFs accelerate in 2018

- HY ETFs equal 26% of demand for constituent issues

- Energy most shorted sector above index weighting

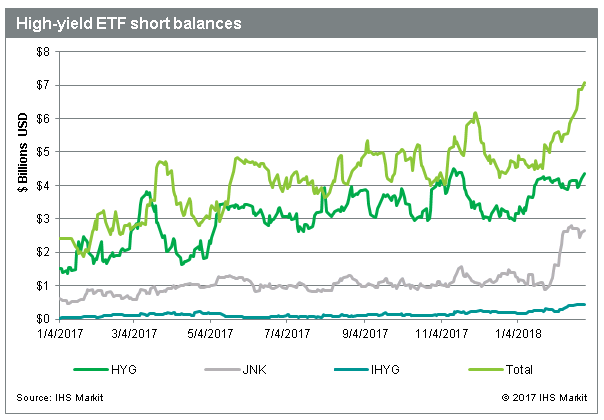

Short demand for high yield ETFs is at the highest level recorded, currently over $7bn in total. Demand remains elevated despite a rally off the lows, which recovered half of the YTD losses for the products.

The ability to achieve HY short exposure via exchange listed products has allowed a wider range of market participants to put the trade on, and has contributed to rising demand for the underlying HY corporate bonds, which is also at a post-crisis high. The ETF short demand is equal to 26% of total borrow demand for the underlying issues.

Short sellers aren’t the only ones selling – the most popular high-yield ETF, HYG, has seen outflows of nearly $2.9bn so far in 2018, after seeing $1.4bn in outflows in 2017.

Demand to borrow the JNK ETF has increased sharply in 2018 as the result of a relatively lower borrow rate than HYG, however, the gap has narrowed in recent weeks. While increasing demand was the dominant factor in rising borrow costs for both issues, the inventory from agent lenders in both securities has declined 10% YTD.

A fair amount of the demand for shorts, either expressed via the ETF or the underlying issues, will be based on a general desire to have short exposure to the asset class, as opposed to expressing a negative view on specific issues. It’s a more interesting exercise then to look at the issues and sectors which have the greatest short demand beyond index weight.

At a sector level, Energy has the largest short demand beyond index weight, having less than 15% weight in the iBoxx High Yield index, while contributing 20% of constituent short demand.

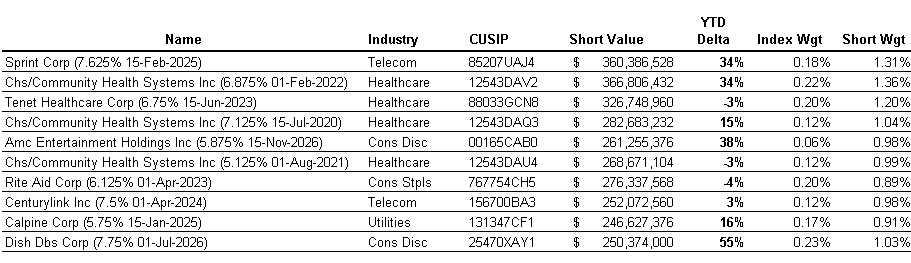

The table below shows the most borrowed issues relative to index weight. It’s notable that there aren’t Energy names at the top of the individual issue list, which is the result of a more even distribution of short demand across Energy issues. Half of Energy issues are more shorted than their index weight, versus only a quarter of issues in the other sectors.

Given that there are a large number of HY issues not included in the indices, it’s worth noting that HY ETF demand is only equivalent to 15% of all HY borrows. The significance of ETFs as a source of demand is increasing, however, as they made up less than 5% of HY at the start of 2017.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fHigh-yield-ETFs-attract-record-demand-from-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fHigh-yield-ETFs-attract-record-demand-from-short-sellers.html&text=High-yield+ETFs+attract+record+demand+from+short+sellers+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fHigh-yield-ETFs-attract-record-demand-from-short-sellers.html","enabled":true},{"name":"email","url":"?subject=High-yield ETFs attract record demand from short sellers &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fHigh-yield-ETFs-attract-record-demand-from-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High-yield+ETFs+attract+record+demand+from+short+sellers+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fHigh-yield-ETFs-attract-record-demand-from-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}