Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 14, 2020

Australia China decoupling

Relations between Australia and Mainland China have deteriorated in recent years, forcing the administration of Prime Minister Scott Morrison to reconsider the country's economic reliance on China, especially against the background of the 'decoupling' of China and the US, a close security partner.

Deteriorating relations

The latest diplomatic spat between Australia and China has a long history. In the last two years, Australia has effectively banned Huawei from its 5G infrastructure; passed the National Security Legislation Amendment (Espionage and Foreign Interference) Act, prompted by concerns over Chinese political interference; and in April 2020 led an international call for an independent inquiry into the origins of COVID-19. In early November Australia joined the India-Japan-US Malabar naval exercises for the first time, further deepening its security cooperation with these strategic rivals of China. Over the last few months China has imposed restrictions on Australian imports citing alleged breaches of trade practices (resulting in tariffs on barley and wine) or quality issues found during product inspections (affecting some shipments of barley, beef, lobster, and timber).

Australian industry representatives have reported that some farming and fisheries businesses are amending their business strategy to preemptively exclude exports to China in anticipation of Chinese restrictions. In early November, The South China Morning Post reported that Chinese traders had been informally notified that some Australian shipments of wheat, barley, sugar, lobster, wine, timber, copper ore and concentrate, and coal would not be cleared in customs from 6 November. Australian mining company BHP Group and grape and wine industry groups have reported that Chinese buyers have either cancelled or deferred some orders.

Coal congestion

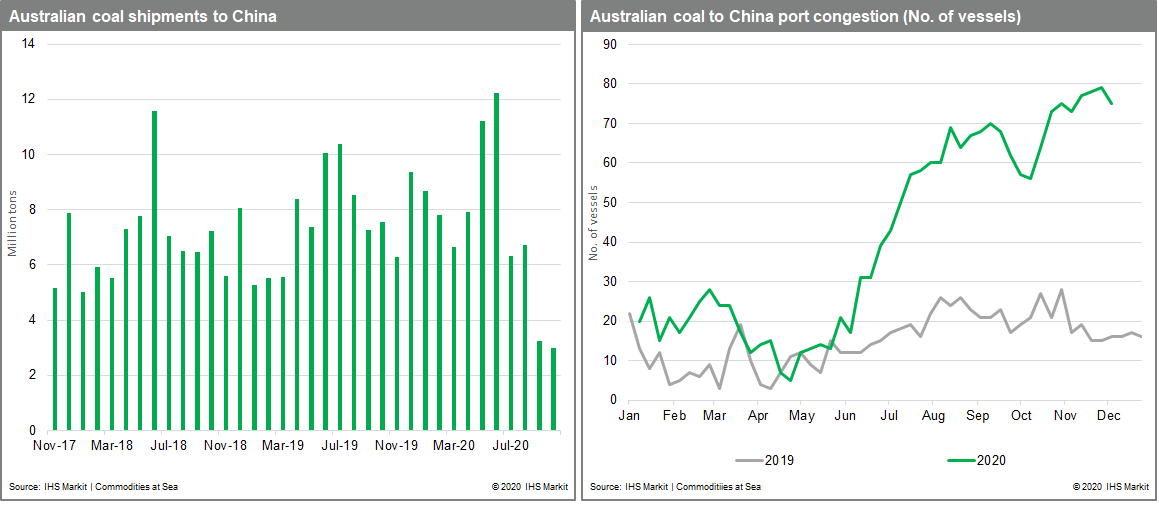

Coal and coal products, which accounted for 16% of Australian exports in 2019, has been among the worst hit. Commodities at Sea data show that Australian coal shipments to China have fallen sharply in recent months and related port congestion in China surged. Australian media report that no thermal coal cargoes have left Newcastle in New South Wales, the largest coal port in the world, for China so far in December.

By October, monthly Australian coal shipments to China had fallen to 3 million tons (both thermal and met), compared with 7.5 million tons a year ago. Congestion is worst at Jingtang and Caofeidian; and a third of the vessels waiting at anchorage are capesize (very large bulk carriers), the rest panamax vessels (typically half the cargo capacity of capsize). Some vessels are being diverted to other countries. Meanwhile, the latest McCloskey Coal Report shows Chinese buyers have turned to the Atlantic market, purchasing several cargoes from South Africa and Colombia.

Economic dependence, strategic realignment

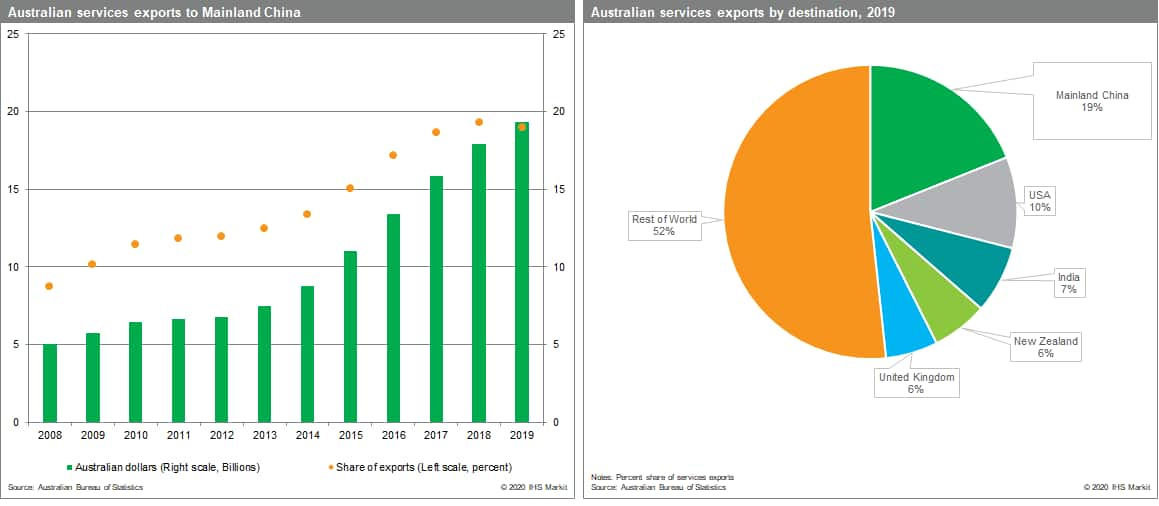

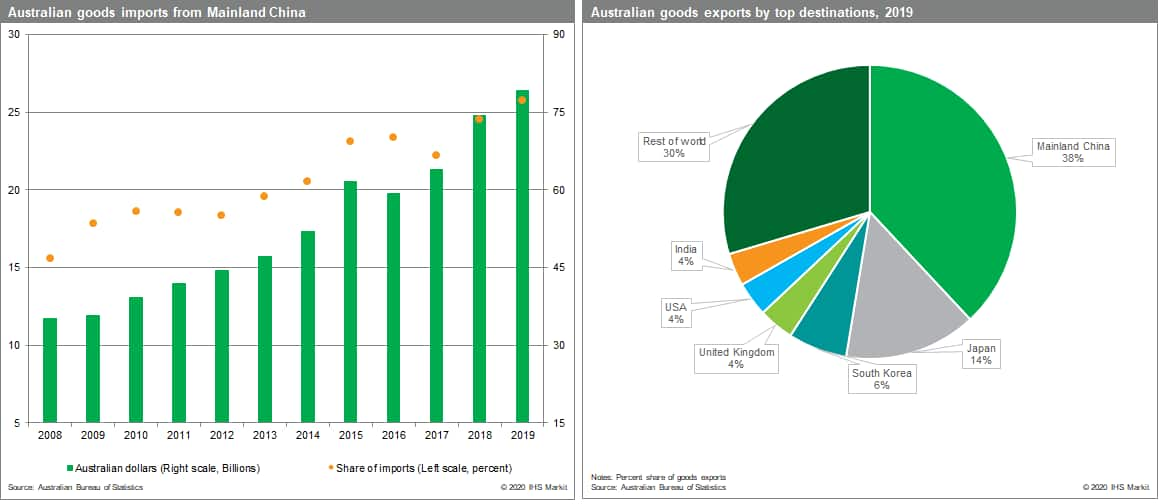

Australia's exposure goes well beyond coal. China is its largest trading partner - accounting for a third of Australia's total goods and services exports in 2019, according to the Australian Bureau of Statistics.

And this is in the context of

Australia's increasing reliance on its external sector. Exports of

goods and services only accounted for a fifth of GDP in 2009 but as

the rest of the domestic economy slowed in 2014 with the end of the

mining boom, exports have grown to account for a quarter of GDP.

Further highlighting their increased importance to the economy over

the past decade, real exports for 2010-2019 contributed on average

0.26 percentage point to GDP growth each quarter, up from only 0.15

in 2000-09. The Australian Department of Foreign Affairs and Trade

(DFAT) estimates that Australian trade is directly responsible for

one in five Australian jobs.

And this is in the context of

Australia's increasing reliance on its external sector. Exports of

goods and services only accounted for a fifth of GDP in 2009 but as

the rest of the domestic economy slowed in 2014 with the end of the

mining boom, exports have grown to account for a quarter of GDP.

Further highlighting their increased importance to the economy over

the past decade, real exports for 2010-2019 contributed on average

0.26 percentage point to GDP growth each quarter, up from only 0.15

in 2000-09. The Australian Department of Foreign Affairs and Trade

(DFAT) estimates that Australian trade is directly responsible for

one in five Australian jobs.

While some lobby groups, notably for grain producers, and parliamentarians are calling for economic diversification, the Morrison government has so far hoped to resolve issues through diplomacy - a strategy supported by the influential Australian Industry Group, wary of alienating one of its main markets. (The Minerals Council of Australia has not yet commented on the coal congestion.) Nevertheless, Australia is taking steps to reduce its reliance on China. Ratification of the 15-member Regional Comprehensive Economic Partnership ( RCEP) in the next year or two will help. Australia is in early stages of negotiations with India and Japan - two members of the 'Quad' and close US allies - for a Supply Chain Resilience Initiative (SCRI). 'Decoupling' from China will also be through new legislation. In June Australia's federal government proposed changes to tighten scrutiny of foreign investments in assets categorized as a 'sensitive national security business'. On 8 December, the Federal Parliament passed the Foreign Relations (State and Territory Arrangements) Bill 2020, which empowers the federal government to cancel any arrangement or contract between Australian states and territories and foreign governments if these are inconsistent with Australian foreign policy.

The weight of trade with China, however, is heavy. Against a background of post-pandemic economic fragility, Australia will need more political resolve than most to reset its relationship with China.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-china-decoupling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-china-decoupling.html&text=Australia+China+decoupling+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-china-decoupling.html","enabled":true},{"name":"email","url":"?subject=Australia China decoupling | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-china-decoupling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+China+decoupling+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralia-china-decoupling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}