Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 15, 2020

Weekly Pricing Pulse: Historic weekly jump in MPI

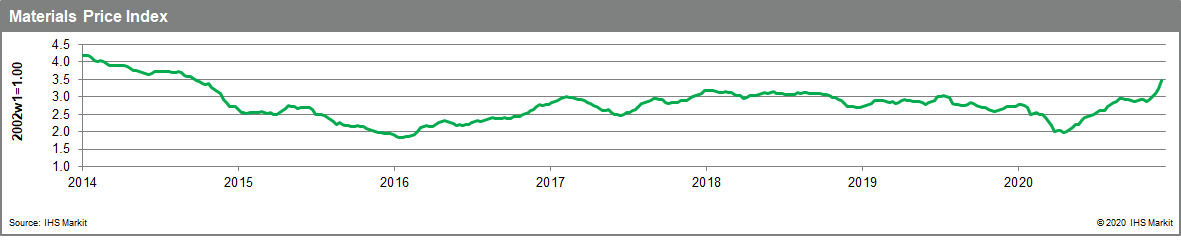

Our Materials Price Index (MPI) rose 7.4% last week, its fifth consecutive increase and the largest one-week gain since IHS Markit began tracking the series in 1996. This latest move lifted the MPI to its highest level since September 2014.

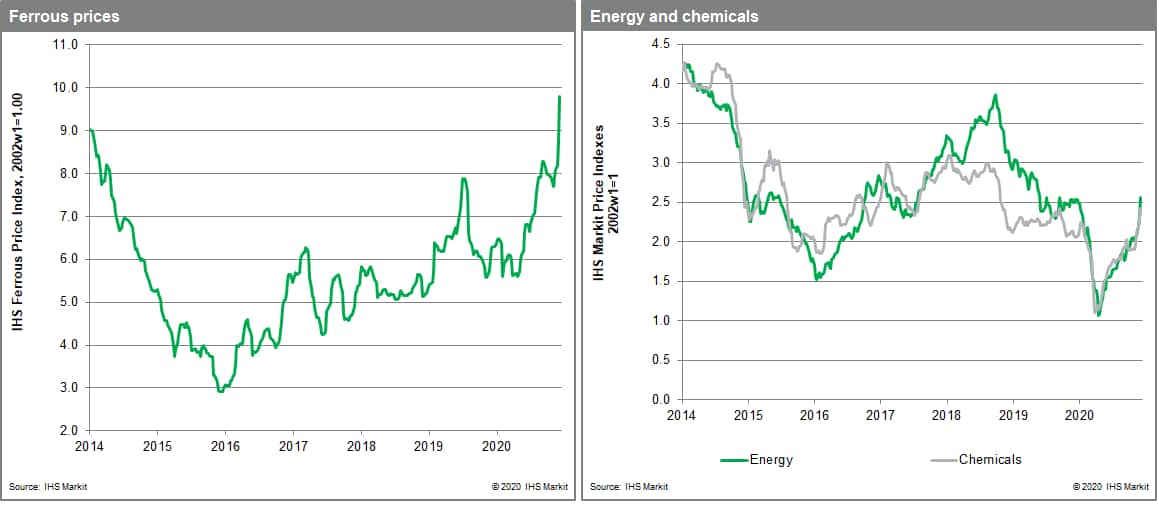

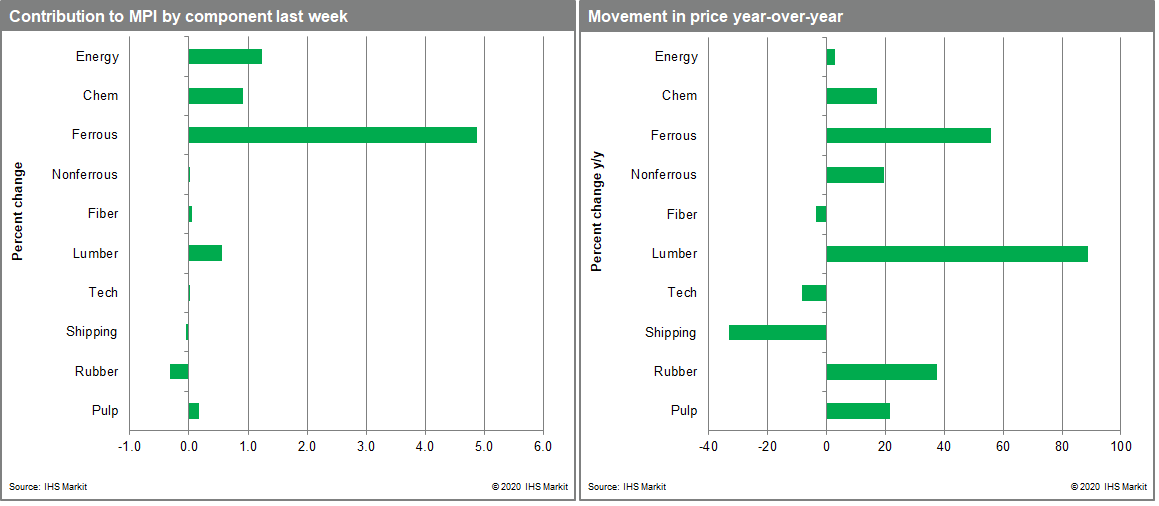

Energy markets led the charge last week with our energy sub-index soaring 10.7%. Broad-based increases in coal, natural gas and oil prices caused the steep rise. Brent crude oil jumped above $50 a barrel for the first time since 2019 and coal prices were at the highest level since 2018. Steel making raw materials had another strong week rising by 11.7%. Vale's announcement of production cuts was compounded by storms in Australia, the world's largest producer of iron ore, to further tighten global supply. Chemicals prices were another major contributor to last week's MPI gain, increasing 5.1%. The chemicals sub-index was boosted by strong price increases for US ethylene and polypropylene. With low inventory levels stemming from disrupted supply chains, demand for ethylene and polypropylene has outstripped supply growth sending prices higher.

Markets are accelerating on the positive news emanating from the COVID-19 vaccine rollouts. With the UK, the US and Canada all beginning mass immunization programs, positive sentiment dominated trading in the past week. It has outweighed the news of persistent COVID-19 infection rates across Europe and North America. In addition, demand from mainland China remains strong and supply chains tight with multiple production issues affecting commodities. Whether good vaccine news alone can support commodity prices as more stringent containment measures take effect remains to be seen. For now, however, markets are bullish on prospects for an earlier rather than later end to the pandemic in 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-historic-weekly-jump-in-mpi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-historic-weekly-jump-in-mpi.html&text=Weekly+Pricing+Pulse%3a+Historic+weekly+jump+in+MPI+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-historic-weekly-jump-in-mpi.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Historic weekly jump in MPI | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-historic-weekly-jump-in-mpi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Historic+weekly+jump+in+MPI+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-historic-weekly-jump-in-mpi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}