Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 02, 2022

Banking risk monthly outlook: June 2022

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in June.

- Higher lending growth expected for micro, small, and medium-sized enterprises (MSMEs) in mainland China

- Increased losses at Sri Lankan banks

- Stronger macroprudential policy across Emerging Europe

- Sharp rises in interest rates slowly starting to impact impairment ratios at banks in Latin America

- Sale of state-owned enterprises (SOEs) in Egypt amid economic hardships

- Angolan government to sell its stake in Angola's largest bank

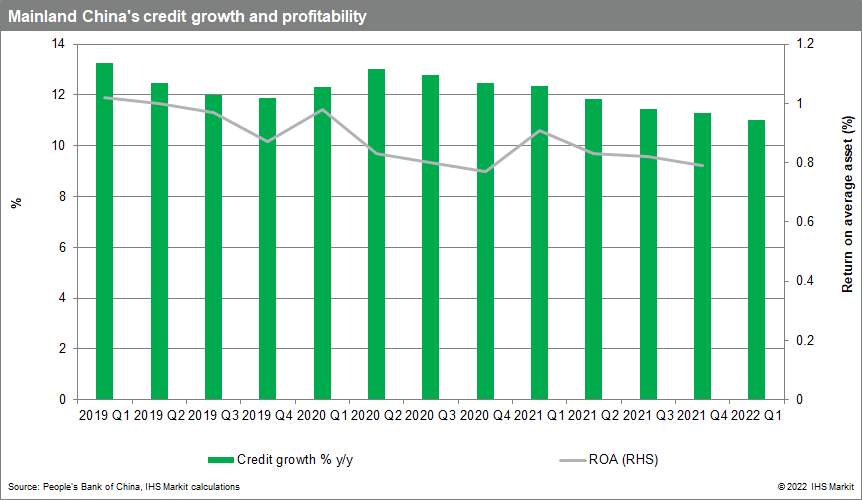

Higher lending growth expected for MSMEs in mainland China.

Owing to the COVID-19 pandemic-related impact on the economy, authorities have lowered the cost of funding and lowered the reserve requirement ratio. Authorities have also directed banks to increase lending to MSMEs and banks are expected to comply; IHS Markit therefore forecasts that credit growth will remain fast in 2022. However, as a result of the push to lower borrowing costs, profitability will likely remain at similar level as in previous years.

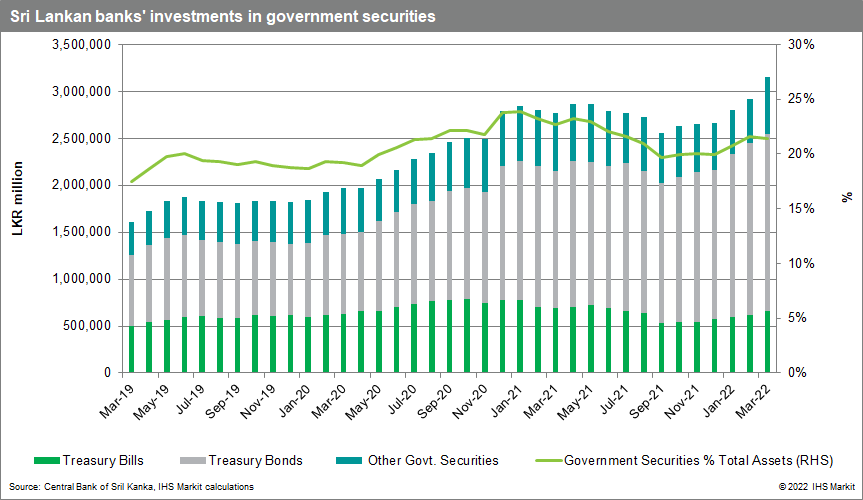

Losses are expected at Sri Lankan banks in the second quarter of 2022.

Sri Lankan banks have already been authorised to drawdown capital conservation buffers to cope with the mark-to-market losses from the fall in prices and interest payments on sovereign bonds. Considering that lending to government accounts for around 25% of total loans and the government's inability to repay these loans, this will likely affect the sector's asset quality and result in losses.

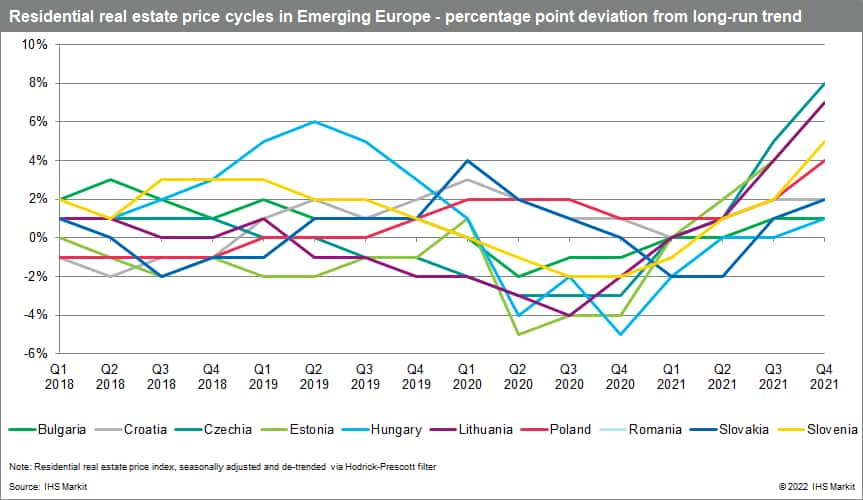

Stronger macroprudential policy across Emerging Europe.

As noted in the European Central Bank's newly released Financial Stability Review, the financial stability outlook has deteriorated in the euro area owing to inflation, especially since the start of the Russia-Ukraine war. Banking sectors in Europe are already exposed to various residential real estate-related vulnerabilities, including strong mortgage lending, elevated house price growth, house price overvaluation, and high indebtedness. In the face of this, authorities have taken action since late-2021 to address residential real estate-related vulnerabilities via scheduled countercyclical capital buffer (CCyB) rate rises between 2022 and 2023. However, pre-existing vulnerabilities could be amplified by a further escalation/sanctioning of the Russia-Ukraine war; shocks in growth or inflation; or a revival of COVID-19 infections. We therefore expect the introduction of tighter macroprudential policy by Emerging European authorities in the near term.

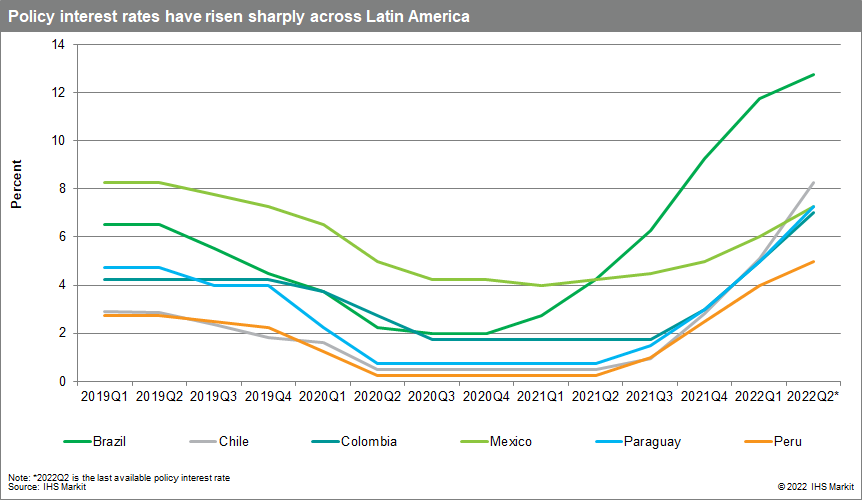

Sharp rises in interest rates slowly starting to impact impairment ratios across Latin America.

Over the end of 2021 and especially so far in 2022, almost all Latin American economies have seen significant rises in the policy interest rates set by their central banks to contain inflation and prevent capital outflows. However, interest rate hikes are typically correlated with rising impairment ratios with a lag of 9 to 12 months on average. Since these interest rate rises started at the end of 2021, we expect that impairment ratios will start to edge up during June and the following quarters.

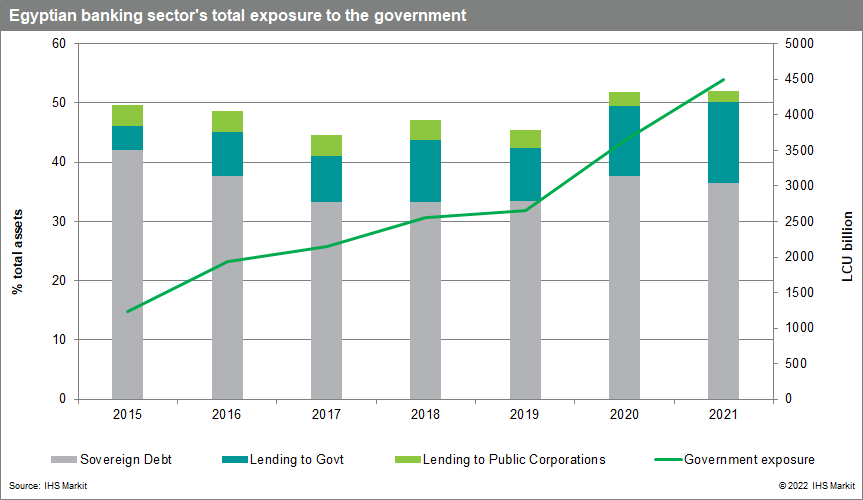

Egypt to sell state-owned enterprises (SOE) amid economic hardships, which is likely to reduce banks' lending to SOEs but also increase banks' sovereign debt holdings.

Amid economic hardships with a currency devaluation of 17%, a budget deficit of USD20 billion, and an inflation rate of 13.1%, the Egyptian government announced in May the start of a large-scale privatisation initiative to attract USD40 billion in private investment in the next four years by selling state-owned companies. The total on-balance sheet exposure to the government and SOEs is currently estimated at 52% of total sector assets. The privatisation initiative is likely to reduce banks' lending to SOEs. However, to make up a budget deficit of USD20 billion, Egyptian banks are expected to continue increasing sovereign debt holdings (36.5% of total sector assets) as fiscal deficit pressure persists.

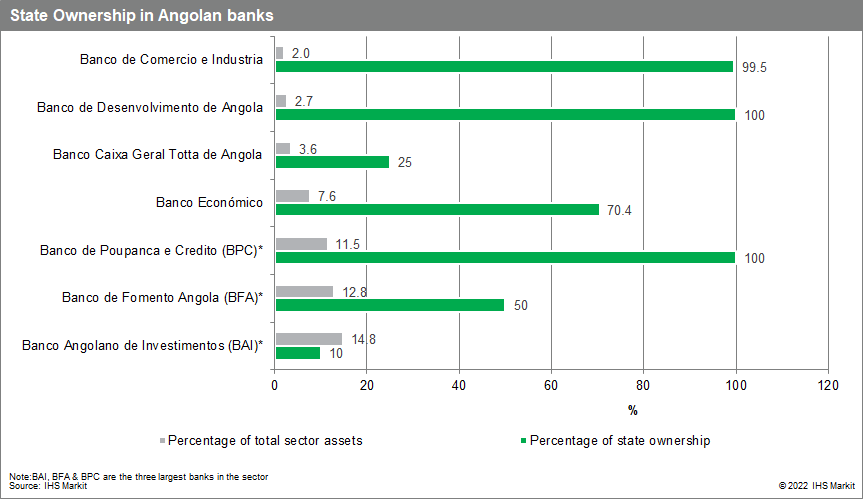

Angolan government to sell its stake in the banking sector's largest bank.

The government of Angola will be selling its 10% stake in Banco Angolano de Investimentos (BAI) on the Luanda Stock Exchange through an initial public offering (IPO); BAI's listing is scheduled for 9 June 2022, and it will be the first IPO in Angola's stock exchange. BAI is Angola's largest bank by assets, accounting for about 14.8% of total sector assets at the end of 2021. The government is the biggest shareholder through Sonangol Holdings (with an 8.5% stake) and Endiama (with a 1.5% stake). The sale is part of a larger government effort to decrease state participation in the banking sector in co-ordination with the International Monetary Fund (IMF) and includes the sale of the government's stake in two other banks (Banco Económico and Banco de Comercio e Industria). State-controlled banks have long been associated with direct lending to major SOEs and have been too closely allied with politically exposed persons, so their privatisation is considered a key part of completing structural improvements in the banking sector.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2022.html&text=Banking+risk+monthly+outlook%3a+June+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2022.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: June 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+June+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}