Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 05, 2023

Banking risk monthly outlook: June 2023

- Increased borrowing costs for small mainland Chinese banks

- An extension to Polish mortgage credit holidays

- Details about the IPO for Citibanamex

- The release of the Bank of Ghana's strategy to recapitalize and strengthen the financial sector

Potential local government debt fall-out will increase borrowing costs for smaller banks in mainliand China.

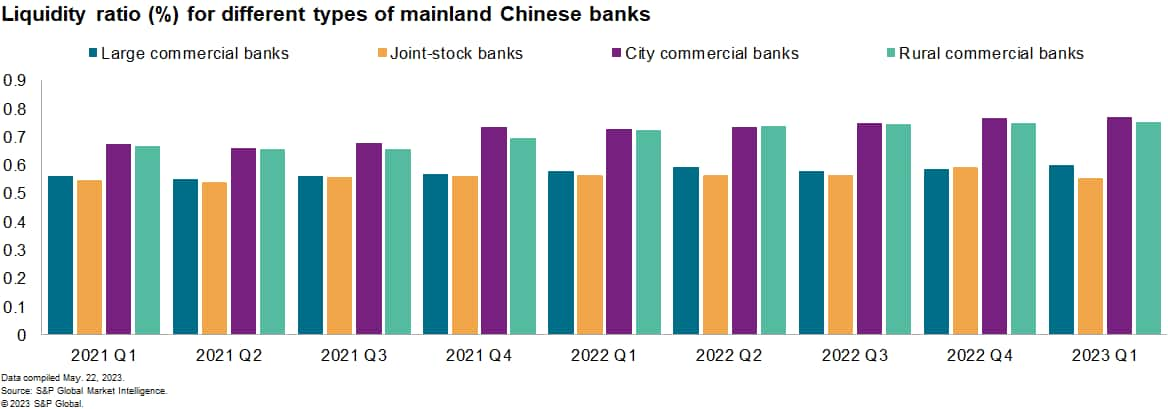

The loan to deposit ratio (LDR) in mainland China increased to 83% when last reported in 2022. The rise in the LDR from 80% (2019) before the pandemic was due to the loan prime rate (LPR) cut and the cut back from cautionary savings as the economy reopened. Although the Chinese regulators do not publish LDR figures for different types of banks, the liquidity ratio (liquid assets / liquid liabilities) points to tighter positions at rural commercial banks (75.3%) and city commercial banks (77.0%) compared to the largest state-owned commercial banks in China (60.3%). The rural commercial banks mainly rely on non-deposit funding, and the potential fall-out of local government financing vehicles (LGFV) will likely lead to even tighter liquidity. Rural commercial banks often have large holdings of LGFV due to their connection with the local governments and, as a result, their worsening asset quality will affect their ability to obtain cheap funding from the debt capital market.

Extension to Polish mortgage credit holidays would weigh on bank profitability but reduce credit risk materialization.

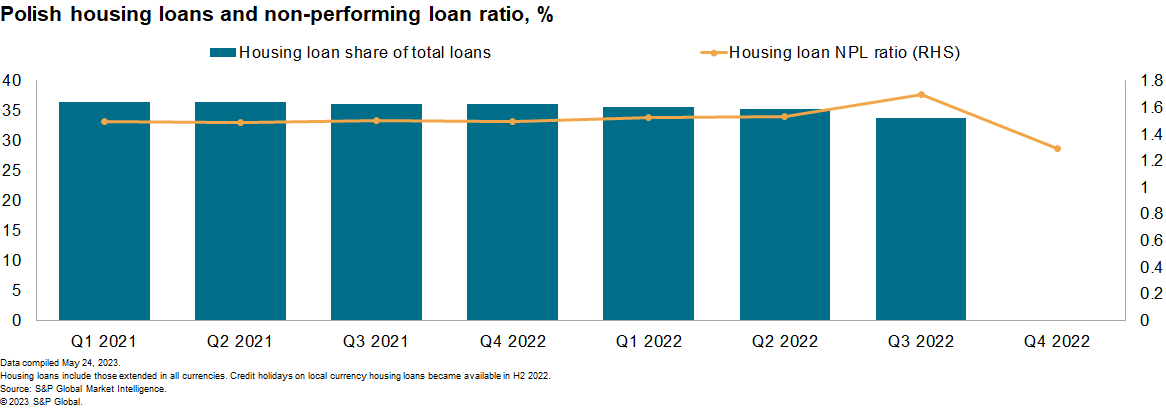

The Polish government is deliberating an extension to local currency housing loan repayment holidays that were first announced as part of borrower support measures in April 2022. Retail borrowers were able to defer payments for four months in the second half of 2022 and for a further four months through 2023. Although likely to limit non-performing loan accumulation on about one-third of the sector's loans eligible for deferment, the package of support measures would continue to weigh on the sector's profitability; the top five banks in the sector recorded expenses related to the mortgage credit holidays amounting to 9.6 billion Polish zloty (US$2.2 billion) through 2022, roughly 9% of the five banks' total equity.

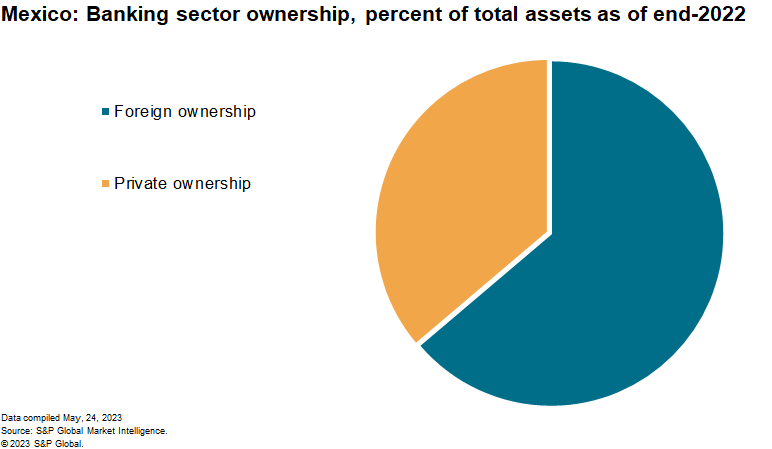

Details about the IPO for Citibanamex, potentially bringing the state as a bank shareholder for the first time in the last twenty-five years.

Originally expected to be announced in the early part of the year, there were several constraints reducing the demand for Citigroup's Mexico branch. The president's preference to limit the pool of potential buyers to only local institutions, additional costs via recently announced fines on Citibanamex, and the seizure of one of the main business units of a frontrunner in the bidding process resulted in the final cancellation of the sale, with Citi opting instead for an initial public offering (IPO). The details on the IPO are still to be announced, but the government has shown interest in acquiring some stake at the bank; if concretized, this acquisition would represent the first attempt of the government to be present in the commercial banking sector since the early nineties.

The Bank of Ghana is expected to conclude its strategy to recapitalize and strengthen the financial sector.

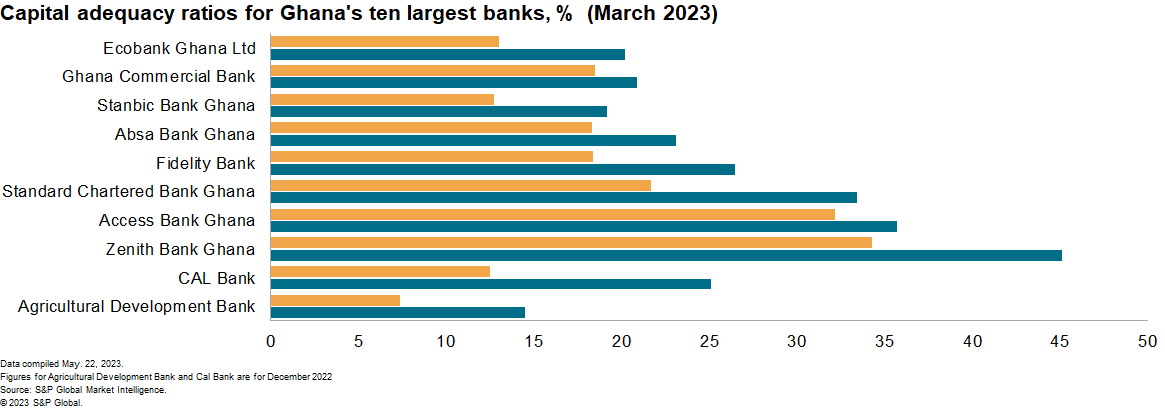

The Bank of Ghana, with the assistance of the International Monetary Fund (IMF), is expected to release its strategy for rebuilding capital buffers of financial institutions that are found to have shortfalls because of the Domestic Debt Exchange Program (DDEP). The strategy will include clear steps and timelines to be followed by financial institutions with capital shortfalls with the aim to strengthen the financial sector by the end of the DDEP. Following the DDEP, banks' capital adequacy ratio declined sharply to 14.8% as of end-April 2023, from a CAR of 21.3% at end-April 2022. The weakening is primarily because of valuation losses on government bonds (Ghanaian banks held about 35% of their total assets in sovereign debt holdings in December 2022) because of the DDEP and from currency depreciation impacts and other mark-to-market investment losses affecting some banks.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2023.html&text=Banking+risk+monthly+outlook%3a+June+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2023.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: June 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+June+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}