Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 05, 2023

US Weekly Economic Commentary: Whew!

The US economy avoided a potentially severe self-inflicted slump thanks to the deal last week over the debt ceiling. US equity markets rose on the news, and broad indices have also received a lift from strong advances in tech stocks.

Friday's report that employment rose solidly in May is the latest in a series of recent reports suggesting the US economy has remained resilient in the face of tightening financial conditions. While this may encourage optimism regarding future earnings growth, it also raises the odds that the Federal Reserve will need to do more to squeeze inflation back to 2%.

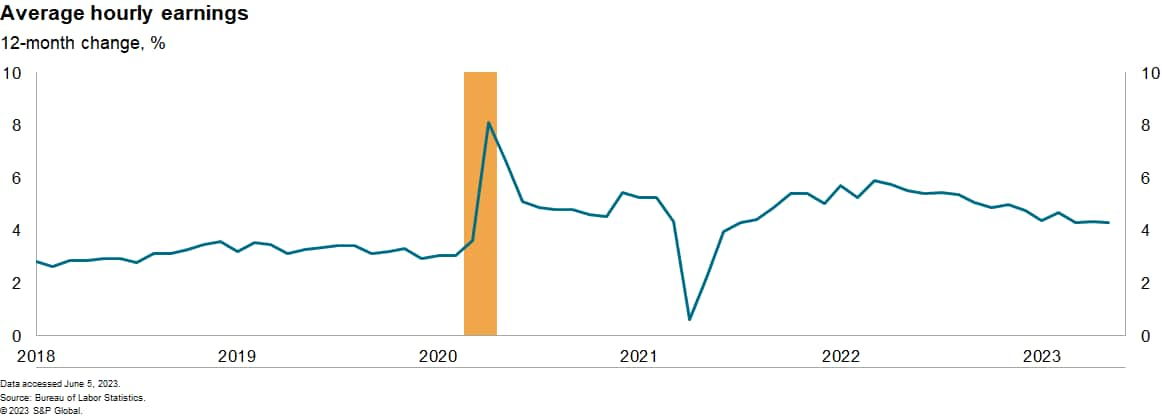

Wage inflation shows little sign of easing, as average hourly earnings rose 0.4% in May and increased 4% (annualized) over the past three months, like the gain of the past 6 months of 3.9%. Wage inflation needs to return to a range of 3% - 3½% to be consistent with 2% price inflation for goods and services.

What would it take to see a material slowing in wage gains? Loosening of the current tightness in labor markets likely cannot occur until job gains slip below roughly 100 thousand per month. So, while the trend growth of employment is gradually slowing, it remains well above where it needs to be for the Fed to return inflation to its target.

From that perspective, the recent news from the labor market must be more than a little troubling to Fed policy makers. This suggests to us that one or more additional Fed tightening moves will be required to further slow the economy to return inflation to 2%. Nevertheless, investors seem to have decided, based on recent Fed speak, that a rate increase at the June meeting is now off the table. Barring a surprisingly benign report on the Consumer Price Index for May or a sudden slump of bank lending, we think a rate hike in June remains viable.

This week's economic releases:

- Manufacturers' shipments, inventories and orders (June 5): Orders for durable goods were already reported to have increased 1.1%. Since reaching a peak in June 2022, nominal orders have been on a flat-to-declining trend. This timing corresponds to the PPI for manufacturing output, which also peaked in June 2022 and has been drifting lower since. Real orders have been on a broadly flat trend since late 2020.

- International trade (June 7): We estimate the nominal trade deficit widened in April by $13.4 billion to $77.6 billion. The goods deficit (on a Census basis) was already reported to have widened in April by $14.1 billion, reflecting a sharp decline in exports of goods and an increase in imports of goods.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-whew.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-whew.html&text=US+Weekly+Economic+Commentary%3a+Whew!+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-whew.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Whew! | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-whew.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Whew!+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-whew.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}