Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2023

China PMI signals tentative growth revival in November, prices edge higher for third month

PMI survey data from S&P Global and Caixin showed the mainland Chinese economy regaining some growth momentum midway through the fourth quarter. Output, new orders and expectations for the year ahead all ticked higher, with a broad-based improvement seen across manufacturing and services.

However, the overall pace of expansion remains very subdued, and business expectations in particular continue to run far below their long-term average, prompting firms to trim their headcounts for a third successive month in November.

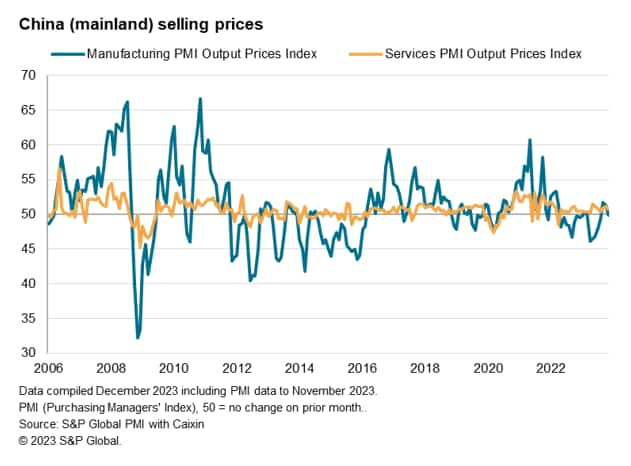

In this environment, firms reported scant pricing power, though average prices charged for goods and services rose slightly for a third successive month to signal a broadly flat inflation picture.

Economy regains momentum

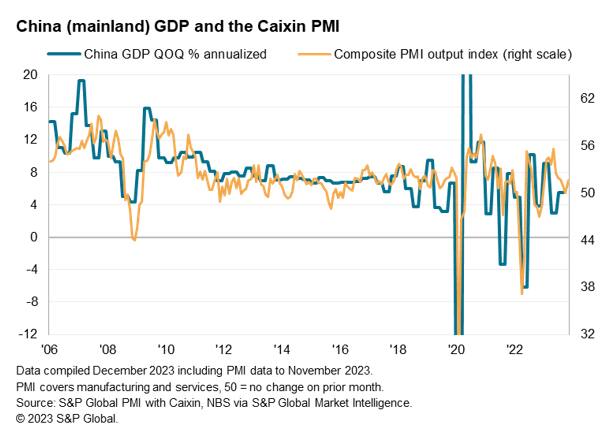

Signs of improved business conditions were evident in mainland China during November, according to the Caixin PMI, compiled by S&P Global. The headline index, covering output of the combined manufacturing and service sectors, rose from 50.0 in October to 51.6, its highest since August.

The latest data are the first sign of the economy regaining growth momentum, hinting at a tentative bottoming out of the recent slowdown. Having peaked in May, buoyed principally by the post-pandemic reopening of the economy at the start of the year, the composite PMI had been on a consistent downward trend in the five months to October as the post-pandemic tailwind faded.

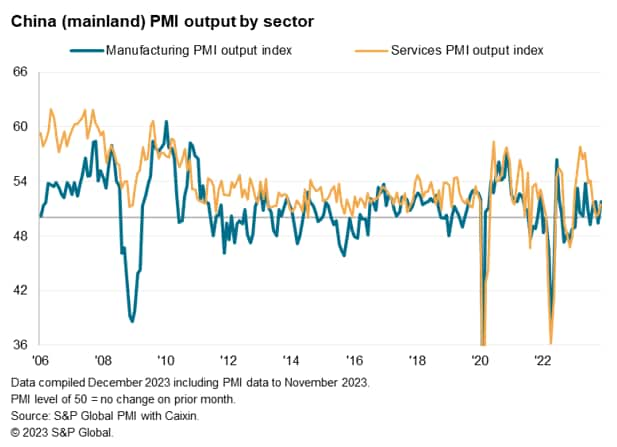

Services and manufacturing report higher output, but growth remains subdued

Encouragingly, the improvement in business conditions in November was broad-based across both manufacturing and services. Factories reported a renewed increase in production after a slight decline in October, and growth of service sector activity revived in November from the near-stalled picture seen in the prior two months, albeit with growth in both cases remaining considerably weaker than seen earlier in the year (especially in the case of services).

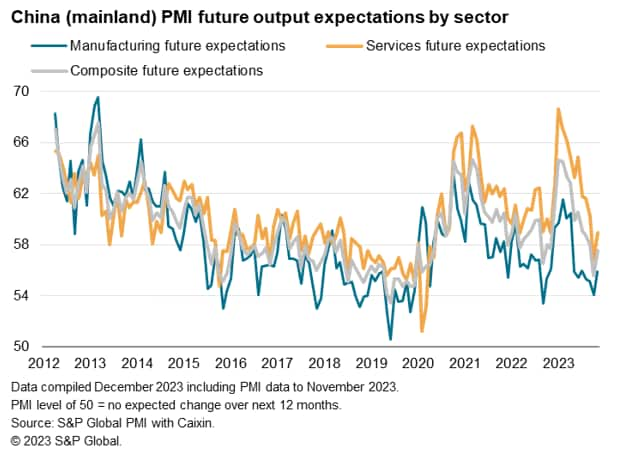

Improved, but subdued, confidence

The upturn in current production was matched by an improvement in business confidence about the year ahead in both sectors, in turn buoyed in part by the strongest inflows of new business recorded for three months. However, the overall degree of confidence remained among the weakest recorded since the start of the pandemic, and especially low by historical standards in manufacturing.

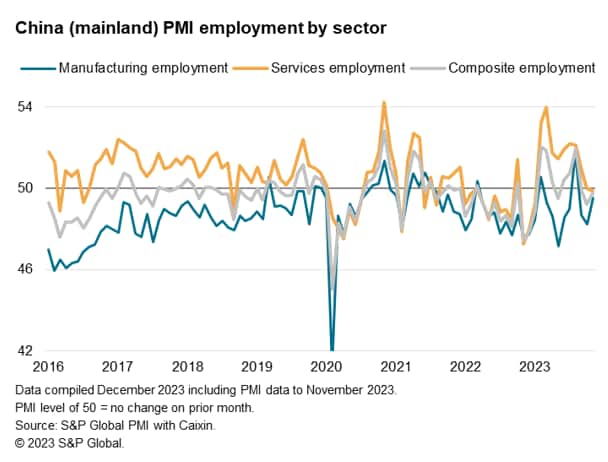

Third month of job losses

The subdued outlook promoted a third month of labour market decline in November, as factories trimmed their payroll counts for a third successive month and service providers tweaked their headcounts lower for the first time since January. The renewed fall in services employment marks a notable turnaround in the hiring picture in the service sector compared to the surge in recruitment recorded throughout much of the year to date.

Prices edge higher for third month

From an inflation perspective, average prices charged for goods and services edged higher to help allay deflation fears. Although rising at a reduced rate compared to September and October, the past three months of price rises represent an improvement on the continual declines seen over the prior five months.

However, deflationary forces are by no means absent. Average prices charged for goods fell marginally in November, dropping for the first time in three months, and prices charged for services barely rose.

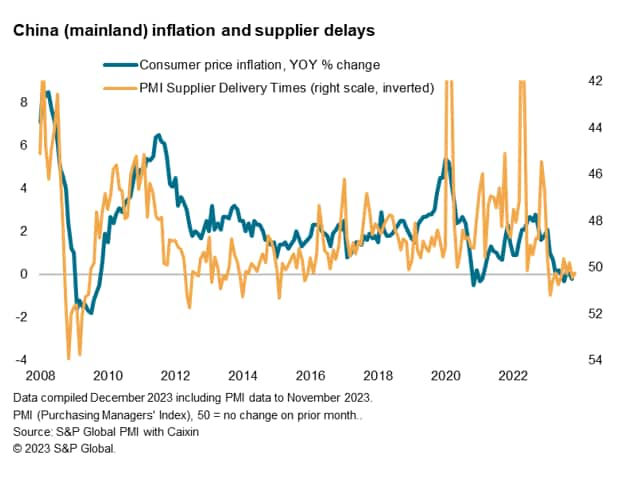

Supply chains signal low inflation

Similarly, broadly unchanged supplier delivery times in November are consistent with a fairly flat inflation picture. Supply chain pressures are highly correlated with inflation, being indicative of capacity utilisation and hence the development of either buyers' or sellers' markets. While heightened supply delays during the pandemic fed through to an upturn in consumer prices inflation, supplier performance has improved marginally in eight of the past ten months, reducing pricing power in the goods-producing sector. However, it would typically require supplier delivery times to shorten on a more widespread basis to indicate broad-based price declines.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-tentative-growth-revival-in-november-prices-edge-higher-for-third-month-dec23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-tentative-growth-revival-in-november-prices-edge-higher-for-third-month-dec23.html&text=China+PMI+signals+tentative+growth+revival+in+November%2c+prices+edge+higher+for+third+month+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-tentative-growth-revival-in-november-prices-edge-higher-for-third-month-dec23.html","enabled":true},{"name":"email","url":"?subject=China PMI signals tentative growth revival in November, prices edge higher for third month | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-tentative-growth-revival-in-november-prices-edge-higher-for-third-month-dec23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+signals+tentative+growth+revival+in+November%2c+prices+edge+higher+for+third+month+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-tentative-growth-revival-in-november-prices-edge-higher-for-third-month-dec23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}