Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 01, 2020

Daily Global Market Summary - 01 October 2020

US equity markets closed higher, while most major APAC and European markets were also higher except for Mainland China and Germany. Yields were lower for most benchmark European government bonds and US bonds closed unchanged after starting the day weaker at the open. The US dollar was slightly lower on the day, gold/silver closed higher, and oil was sharply lower. iTraxx and CDX IG were close to flat on the day and high yield closed modestly tighter across both indices. All eyes will be on tomorrow morning's US non-farm payroll report to gauge the pace of the recovery in employment in September.

Americas

- US equity markets closed higher; Russell 2000 +1.6%, Nasdaq +1.4%, S&P 500 +0.5%, and DJIA +0.1%.

- 10yr US govt bonds closed flat/0.68% yield and 30yr bonds flat/1.46%, despite 10s yields being as high as 0.72% and 30s 1.50% at the open of the US equity markets.

- CDX-NAIG closed -1bp/58bps and CDX-NAHY -7bps/403bps.

- DXY US dollar index closed -0.2%/93.72.

- Gold closed +1.1%/$1,916 per ounce and silver +3.2%/$24.25 per ounce.

- Crude oil closed -3.7%/$38.72 per barrel.

- Monthly US GDP rose 0.6% in August following a 1.5% increase in July that was revised lower by 0.4 percentage point. The increase in August was the smallest so far in the recovery and left the level of GDP still about 4% shy of the February peak. The modest increase in August reflected positive contributions from domestic final sales (mainly personal consumption expenditures) and nonfarm inventory investment partially offset by a decline in net exports. The level of GDP in August was 33.9% above the second-quarter average at an annual rate. Implicit in our latest estimate of 32.8% annualized GDP growth in the third quarter is roughly no change in monthly GDP in September. This would extend the pattern of deceleration exhibited through August. (US Macroeconomics Team)

- The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers' Index (PMI) posted 53.2 in September, broadly in line with 53.1 seen in August, but down slightly from the earlier 'flash' reading of 53.5. The solid improvement in the health of the goods-producing sector was the steepest since January 2019, and signaled a further recovery from April's nadir. (IHS Markit Economist Chris Williamson)

- Contributing to the overall upturn was a quicker rise in output at the end of the third quarter. The rate of growth was the sharpest for ten months and solid overall. A number of firms attributed the expansion to a further uptick in new orders and the resumption of operations at clients.

- Manufacturers indicated a solid, albeit slightly slower, increase in new order inflows. The rate of expansion was the second-fastest for almost a year, as panelists continued to note strengthening demand conditions following the marked contractions seen throughout the second quarter.

- Average cost burdens continued to rise at a sharp pace in September, albeit at a slightly slower rate than August's recent high. Inflation was linked by panelists to greater raw material costs and supplier shortages, with many also mentioning higher PPE prices. A further uptick in client demand allowed firms to partially pass on greater costs to clients through higher charges. Selling prices rose at the steepest rate since January 2019

- Seasonally adjusted (SA) US initial claims for unemployment insurance fell by 36,000 to 837,000 in the week ended 26 September. Initial claims remain at historically high levels, although well below the all-time high of 6,867,000 in the week ended 28 March. The not seasonally adjusted (NSA) tally of initial claims fell by 40,263 to 786,942. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 980,000 to 11,767,000 in the week ended 19 September. Prior to seasonal adjustment, continuing claims fell by 1,020,192 to 11,410,703, the largest decline in more than four months. The insured unemployment rate in the week ended 19 September was down 0.6 percentage point to 8.1%.

- There were 650,120 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 26 September. In the week ended 12 September, continuing claims for PUA rose by 317,450 to 11,828,338.

- In the week ended 12 September, there were 1,828,370 such claims for Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 12 September, the unadjusted total rose by 484,856 to 26,529,810.

- Technical note: The state of California has announced a two-week pause in its processing of initial claims for unemployment benefits. To avoid weekly swings in the national numbers, California's numbers will be held constant at the level reported prior to the pause. The numbers will be revised after the pause.

- US personal income decreased 2.7% in August and real disposable personal income (DPI) fell 3.5%. The decrease in personal income was more than accounted for by a decline in unemployment insurance benefits. The Pandemic Unemployment Compensation (PUC) program, which provided a weekly supplemental payment of $600 for those receiving unemployment benefits, expired on 31 July. (IHS Markit Economists James Bohnaker and David Deull)

- Partially offsetting the decrease in unemployment insurance benefits was an increase in compensation thanks to improving payroll employment in August. Private sector wage and salary disbursements increased $102.4 billion (1.3%) while those from the government sector increased $17.5 billion (1.2%); the latter was boosted by temporary decennial Census workers.

- Real personal consumption expenditure (PCE) edged up 0.7% in August to a level that was still 3.9% below the pre-pandemic peak in February. The monthly profile of real PCE through August, including a sharp downward revision to growth in July, implies less PCE in the third quarter. We revised down our third-quarter estimate for real PCE growth by 0.4 percentage point to 37.9%.

- The core PCE price index increased 0.3% in August to a level that was 1.6% higher than 12 months earlier.

- Real PCE for services increased 1.1% as more service-oriented businesses reopen. Real PCE for durable goods spending was unchanged in August yet still elevated at a level that was 10.2% above February. We expect that spending on durable goods will diminish over the next few months, contributing to softer growth of real PCE in the fourth quarter and a generally tamer economic recovery than we have experienced thus far.

- Total US construction spending rose 1.4% in August, well above our assumption and the consensus expectation. Growth over June and July was revised materially higher. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Core construction spending, which directly enters our GDP tracking, also rose 1.4% in August following upward revisions to prior months.

- These and other details in this report raised our estimate of third-quarter GDP growth 0.5 percentage point to a 32.8% annualized rate of increase.

- As of August, nominal construction spending had reversed nearly two-thirds of a sharp decline over the spring. The recovery over this period has been largely accounted for by private residential housing construction (i.e., not including the category that includes improvements).

- Historically low mortgage rates and a shift toward "telework" have boosted residential construction.

- Telework has been not so kind to private nonresidential construction, which had been sliding prior to the pandemic and is down 3.3% from March.

- This drop, though, is misleadingly small; the current data are mostly measuring activity at ongoing projects. Going forward, the US has too much office and retail space and too many hotels given to the effects of the pandemic, including telework. Hence, nonresidential construction spending will continue to slide.

- Another category at risk, state and local spending, is also down 3.3% from March. Going forward, state and local budgets are strained, and construction spending will contract as a result.

- Manhattan tenants put 2.5 million square feet (232,258 square meters) up for sublease in the third quarter, more than double the space a year earlier and the biggest quarterly increase since the end of 2008, according to a report by Savills. The sublease space added in the third quarter brought the supply to 16.1 million square feet, just 200,000 shy of the high from 2009, when the financial crisis battered New York City. (Bloomberg)

- Employers announced 118,804 planned layoffs in September, according to Challenger, Gray & Christmas, up 2.6% from August's 115,762. In terms of record months, April (671,129) of this year remains in first place, followed by May (397,016) and then July (262,649). September's number was up 186% over the same period last year. (IHS Markit Economist Juan Turcios)

- September was the seventh month to report job-cut announcements specifically because of the COVID-19 pandemic; however, just as in the prior months of this pandemic, the number does not include furloughed workers.

- For the year to date (YTD), 2,082,262 job cuts have been announced, 348% higher than the same period in 2019. The current YTD total has already surpassed the record annual total of 1,956,876 announced job cuts in 2001, with three months remaining in the year (Challenger began tracking job-cut announcements in January 1993).

- Of the total job cuts announced so far this year, 1,091,923 were because of COVID-19, according to employers.

- All told, Challenger recorded 497,215 job cuts announced in the third quarter, down 59.8% from the record shattering 1,238,364 job cuts announced in the send quarter.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "We are beginning to see cuts spread to sectors outside Entertainment and Retail. Especially if another relief package fails to pass, employers are going to enter the fourth quarter hesitant to invest or spend."

- Unsurprisingly, the hardest-hit sector and recipient of the lion's share of the coronavirus-related cuts this year continues to be the entertainment/leisure sector, which encompasses bars, restaurants, hotels, and amusement parks. Year to date, companies in the entertainment/leisure sector have announced 831,150 cuts, 820,289 higher than during the same period in 2019. The entertainment/leisure sector announced 32,099 cuts in September, the highest number of announced cuts out of the 30 industries tracked by Challenger.

- Aerospace/defense and transportation announced the second- and third-highest cuts in September with 18,971 and 16,628, respectively.

- Rounding out the top-five most adversely affected sectors YTD were retail (176,4976 job cuts), transportation (148,199 job cuts), services (141,779), and automotive (85,517 job cuts).

- According to Challenger tracking, the number of hiring announcements (929,860) in September surpassed the number of announced job cuts. In large part this reflected hiring plans in anticipation of the upcoming holiday season.

- BlackRock Inc. is introducing three new active exchange-traded funds in a bet that the COVID-19 crisis will advance major structural changes to how people live and work. The funds focus on health, technology and small- to mid-size innovative companies, the firm said Thursday in a statement. BlackRock also is adding an index ETF that will invest in companies benefiting from the rise of remote work. (Bloomberg)

- General Motors (GM) has announced that it plans to source 180 megawatts of solar power, using it to supply electricity to three US plants from 2023. GM says the power will be used to operate plants in Wentzville, Missouri, and Lansing Delta Township, Michigan, and the remaining power will be allocated to its Lansing Grand River assembly plant in Michigan. The solar energy supply deal has been reached with a company called First Solar and will come from a new solar-power field in Arkansas, using photovoltaic solar modules. GM says the deal means that the company will surpass 1 gigawatt of renewable energy in the United States. GM chief sustainability officer Dane Parker said in the company statement, "As GM continues its transition to an all-electric, zero-emissions future, it is imperative that we also invest in a cleaner grid that can support everything - from our factories to our vehicles. Investments like these have increased access to renewable power, and with this deal we are exploring the next frontier of renewable energy, which integrate the principles of circularity and energy storage, among others." This agreement is significant as much for how it positions GM as for the energy supply to the three plants; it represents a demonstration of GM's firm commitment on sustainable energy sources. GM has announced previously a target of using 100% renewable energy in its US facilities, although it has not stated a specific timeline for achieving this. In the renewable energy supply agreement with GM, First Solar has guaranteed demand for the power it generates in Arkansas. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Velodyne Lidar, maker of sensors used in advanced driver-assistance systems (ADAS) and autonomous cars, expects full-year profitability as soon as 2022, CEO Anand Gopalan has said. The company said a limited rollout of autonomous car services will begin from 2022 and large-scale deployment of robotaxis is projected from 2025 to 2028, reports Bloomberg. Gopalan said, "We have seen a tremendous momentum, even in our own pipeline, of customers moving to mass market commercialization of their applications." Velodyne Lidar projects revenue growth of 60% in 2021, from an estimated USD100 million in sales this year, and expects annual revenue to reach USD680 million by 2024. Velodyne Lidar recently went public through a reverse merger agreement with Graf Industrial, a special-purpose acquisition company. The company is one of the pioneers of LiDAR solutions for ADAS and autonomous vehicle (AV) applications. LiDAR sensors are necessary for AVs as they measure distance via pulses of laser light and generate 3D maps of the world around them. The company's technology is used by automakers including Mercedes-Benz and Ford. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Seattle City Council has approved a minimum pay standard for Uber and Lyft drivers in the US city, reports Reuters. Under the ordinance, which comes into effect in January 2021, the ride-hailing companies will be required to pay their drivers at least USD16.39 an hour. This is the minimum wage settled in Seattle for companies with more than 500 employees. The new rules require Uber and Lyft to pay drivers not only while they are transporting passengers, but also when they are waiting for rides and heading on their way to pick up passengers. Seattle's law will require drivers to be paid at least 56 cents per minute and USD1.33 per mile driven while transporting passengers. These new rates are meant to be high enough to account for driver's expenses and downtime. Seattle is the second city in the United States after New York to implement such a regulation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sherwin-Williams (SW) has increased its full-year 2020 earnings and sales guidance due mainly to stronger-than-expected architectural coatings demand. The company now expects full-year earnings to total $20.96-21.46/share, compared with prior guidance of $19.21-20.71/share. Sales are now forecast to grow by 3-5% year on year (YOY), compared with a prior forecast calling for a low-single-digit percentage decrease. For the third quarter, segment results have shown a stronger trajectory than expected. "The Americas group (TAG) third quarter net sales are expected to be up a low-single-digit percentage compared to our previous guidance of flat to up a low-single-digit percentage," SW says. "The consumer grands group (CBG) third quarter net sales are expected to be up a low-twenties percentage compared to our previous guidance of up a low-double-digit percentage. The performance coatings group (PCG) third quarter net sales are expected to be flat to down a low-single-digit percentage compared to our previous guidance of down a low-to-mid-single-digit percentage." The outlook for full-year segment sales has also improved. CBG sales are expected to increase by a double-digit percentage for the full-year, with TAG sales expected be flat to up by a single-digit percentage, and PCG forecast to fall by a low-to-mid single-digit percentage. The forecast for full-year earnings of $20.96-21.46/share represents a 12.5% YOY increase at the midpoint. "Demand for architectural coatings has been stronger than expected in the third quarter, led by our DIY, residential repaint and new residential segments," says SW chairman and CEO John Morikis. "Demand on the industrial side of our business has also improved, led by continued strength in packaging and emerging momentum in other segments, most notably in automotive refinish and industrial wood. As a result, our sales expectations for the third quarter and full-year 2020 have improved."

Europe/Middle East/Africa

- Most European equity markets closed modestly higher, except for Germany -0.2%; France +0.4% and Italy/Spain/UK +0.2%.

- Most European 10yr govt bonds closed higher except for UK +1bp; Italy -4bps, Spain/Germany -2bps, and France -1bp.

- iTraxx-Europe closed flat/59bps and iTraxx-Xover -3bps/343bps.

- Brent crude closed -3.2%/$40.93 per barrel.

- The board of Continental has signed off on a plan to reduce the company's global headcount by up to 30,000 over the next few years, according to a Reuters report. The program will be focused on the tire business and conventional vehicle components business, with the former in particular being hit by increasing competition from Asian manufacturers. CEO Elmar Degenhart said, "We had so far been able to withstand this development, but now reached a point where the overcapacity in Western Europe is between 13 and 15 million passenger-vehicle tires." Partly as a result of this, Continental plans to shut its tyre plant in Aachen at the end of the year in one of the first major measures of the job reduction program. This will result in the loss of 1,800 of the 2,000 jobs currently at the plant. This announcement confirms an earlier one that Continental had put 30,000 roles under review. About 13,000 of the jobs under review will be in Germany, and the program will also target other high-cost production locations, with the roles in question either 'modified, relocated, or made redundant'. Continental will complete 90% of this program by 2025. Continental currently employs about 232,000 people worldwide, including 59,000 in Germany. While it is an aggressive plan, and there will be an undoubted human cost that will result from it, it is difficult to see what else a major supplier can do in the current climate, with suppliers coming under significant pressure as a result of the changing business environment. OEMs themselves are under huge pressure and there will be a knock-on effect as they also look to generate cost-savings; and these are very likely to include trying to reduce already squeezed supplier contracts as much as possible. (IHS Markit AutoIntelligence's Tim Urquhart)

- Bayer has provided a business update confirming its adjusted outlook for 2020, and says it expects 2021 sales to be at approximately the same levels as in 2020 despite significant headwinds from the COVID-19 pandemic, especially in the agricultural market. As a result, the company's board has decided to introduce additional operational savings that may lead to more job cuts. Bayer says it also plans to optimize further its working capital and capital expenditure and is reviewing options to exit nonstrategic businesses or brands that are below the divisional level, it says. The additional savings from the planned measures will be more than €1.50 billion ($1.76 billion) on an annualized basis from 2024, on top of annualized earnings contributions of €2.6 billion as of 2022, which were announced in November 2018, Bayer says. The incremental cash flow from these efforts will mainly be allocated for investments in innovation, profitable growth opportunities, and debt reduction, it says. Bernstein Research (London, UK) estimates that the additional cost savings announced will boost Bayer's margins by approximately 330 basis points (bps) in 2024. These measures are currently in the early stages of development and will be discussed with the relevant internal bodies, including employee representatives, and announced in detail once finalized, the company says.

- The eurozone's manufacturing recovery gained further momentum in September, rounding off the strongest quarterly rise in production since the opening months of 2018. However, the region's recovery has become increasingly reliant on Germany. (IHS Markit Economist Chris Williamson)

- A rise in the Manufacturing PMI survey's output index from 55.6 in August to 57.1 in September indicated the fastest manufacturing production growth since February 2018. The increase marks a strong turnaround from the low of just 18.1 in April, when demand slumped and many production facilities were shut due to the coronavirus disease 2019 (COVID-19) pandemic. The latest index reading is broadly consistent with manufacturing output growing at an annual rate in excess of 3%.

- Order book growth and exports also accelerated, indicating a welcome strengthening of demand. Inflows of new orders expanded at the quickest pace since February 2018, while exports (which include intra-euro area trade) likewise surged higher and at the fastest rate seen over this two-and-a-half-year period. Given the high degree of intra-eurozone trade, new orders and export orders typically follow very similar trends.

- Backlogs of work, a key gauge of capacity utilization, likewise rose to the greatest extent for almost two-and-a-half years, underscoring how output is not just rising as firms eat into pre-placed orders, but that inflows of new business are leading to further improvements in the pipeline of work for coming months.

- The recovery would have been far more modest without Germany, however, where output has surged especially sharply to account for around half of the eurozone's expansion in September. The striking gain reported in Germany contrasts with relatively weak production growth in Spain and France, offset slowdowns in Italy and Austria, and countered a particularly worrying return to contraction in Ireland. Excluding Germany, eurozone output growth would have weakened to the lowest since June.

- The recent increases in Eurozone unemployment have been much lower than those during the global financial crisis (GFC), but various factors, including waning policy support, point to much larger rises going forward. (IHS Markit Economist Ken Wattret)

- The unemployment rate in the eurozone edged up from 8.0% in July to 8.1% in August, in line with market consensus expectations (based on Reuters' survey). Prior months' data were revised upwards. This leaves the eurozone unemployment rate 0.9 percentage point above its cycle low of 7.2% back in March.

- The level of unemployment in the eurozone rose by 251,000 in August, the second successive month to show a moderation. The average month-on-month (m/m) increase in the five months since April stood at 274,000, well below the peak m/m rise of 637,000 at the height of the GFC in January 2009 (see chart below).

- Unemployment rates in some eurozone member states have been very volatile since the onset of the COVID-19 virus and are subject to large revisions. Some have experienced temporary sharp declines in unemployment rates, reflecting the exclusion of those not considered to be actively seeking work.

- IHS Markit's current baseline forecast projects that the eurozone's unemployment rate will rise towards 10% by mid-2021.

- According to the European Union-harmonized measure, consumer price inflation in Italy dropped to -0.9% in September 2020 from -0.5% in August. (IHS Markit Economist Raj Badiani)

- We expect Italy's consumer price inflation to average 0% in 2020 but this is likely to be revised down modestly in the October update. Extended summer sales triggered lower than expected inflation developments in September.

- On the national measure (NIC), inflation was unchanged at -0.5% during the same month.

- The difference between the harmonized and NIC rates is that the latter does not include the impact of summer sales.

- The breakdown of the harmonized index reveals that lower overall inflation in September was due to extended summer sales, which lowered clothing and footwear prices by 2.2% y/y after 3.9% y/y gain in August.

- Nervous consumers continue to maintain pressure on high street retailers to price generously to drum up new business in the aftermath of the national lockdown to contain the coronavirus disease 2019 (COVID-19) virus.

- In addition, most consumer-facing services reported weak price developments during the month.

- Meanwhile, energy-related prices continued to fall when compared to a year earlier. Specifically, transport and housing and utility prices in September fell by 3.3% y/y and 3.9%, respectively.

- The main lever remained lower global crude oil prices, which fell by 34.5% year on year (y/y) to average USD41.2 per barrel in September.

- Finally, the harmonized core inflation rate (excluding energy and fresh food) was -0.3% in September, a sharp turnaround from 0.4% in August.

- The French passenger car market has recorded further declines during August, according to data published by the French Automobile Manufacturers' Committee (Comité des Constructeurs Français d'Automobiles: CCFA). Registrations slid by 3% year on year (y/y) to 168,290 units this month. There was some benefit from working day factors as September had 22 days versus 21 days in 2019. (IHS Markit AutoIntelligence's Ian Fletcher)

- Taking this factor out of the equation, registrations fall 7.4% y/y. The latest decline means that the market has now fallen by 28.9% y/y to 1,166,699 units during the first nine months of 2020.

- From an OEM perspective, the two dominant domestic automakers reported similarly sized declines.

- Groupe PSA led the way in terms of volume with 55,116 units, and this represented a fall of 4.3% y/y. Helping it to achieve these only modest declines has been its leading Peugeot brand which recorded an increase of 6.7% y/y to 32,308 units, likely to have been helped by the latest generation 208 and 2008.

- Citroën was down by 10.3% y/y to 16,779 units, while DS Automobiles retreated by 25.4% y/y to 1,599 units and Opel dropped by 31.7% y/y to 4,430 units.

- Renault Group contracted by 5.8% y/y to 42,998 units. The main reason for this has been the 16% y/y fall suffered by the Renault brand to 30,634 units, while Dacia rose by 34.9% y/y to 12,320 units. Furthermore, Alpine's registrations improved slightly as the number of units registered grew from 43 to 44 units.

- Portuguese industrial production rose by 10.0% month on month (m/m) in August, according to seasonally adjusted figures released by Statistics Portugal. Compared against the same month in 2019, output rose by 3.0% in August. (IHS Markit Economist Diego Iscaro)

- Production had recovered strongly in the previous two months, rising by 12.6% m/m in July and 11.2% m/m in June. Output levels are now 2.5% above their pre-coronavirus disease 2019 (COVID-19) virus pandemic level in February.

- Compared with February, the recovery was driven by energy production, which rose by 13.6% compared with its pre-pandemic level. Investment goods also recovered strongly (+6.2%), while production of consumer durables was up 1.8% compared with February.

- Meanwhile, production of consumer non-durables and intermediate goods remained below pre-pandemic levels, despite increasing by 2.1% m/m and 9.9% m/m, respectively, in August.

- August's growth in production was stronger than expected and is likely to drive an upward revision of our industrial production forecast in our October update.

- Vauxhall is aiming for its Corsa-e to be the UK's biggest selling battery electric vehicle (BEV) during 2021. Autocar quoted Stephen Norman, the brand's managing director, as saying that while its ambitions had been dented by the COVID-19 virus pandemic during 2020, there is "no reason why we can't build that back up in 2021". He added that there was interest around such small cars that is "aroused by what we are hearing from authorities and a genuine desire from consumers to be green". Norman said that for now, the biggest demand Vauxhall has seen for BEVs has been for the light commercial vehicle (LCV) and the new Vivaro-e, and that it has had "several thousand customer orders for delivery in the coming weeks and months." He noted, "There is a significant appetite for what is a unique Vauxhall product, the Vivaro electric, which has a 200-mile range and unaltered carrying capacity - in weight, towing capacity and square metres - versus the diesel variant. The demand, not just for the last mile but for genuine transportation of objects, is going to surprise everybody." PSA's takeover of the Vauxhall brand in mid-2017 has enabled it to take a considerable step forward in terms of vehicle electrification, and specifically the BEV space. The Vivaro-e benefits from the move onto the same platform as the Citroën Jumpy and Peugeot Expert vans, which have a battery electric powertrain in their latest-generation vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

- Volta Trucks has announced that it has received its first orders for its Zero battery electric truck. The company said in a statement that Drinks Cubed, a sustainable drinks brand based in the UK, has signed a "multi-million-pound deal for the supply of a fleet of Volta Zero vehicles into their distribution operations between 2022 and 2023." Volta added that the Zero will complement the company's approach to innovation and sustainability. Chief executive officer of Volta Trucks, Rob Fowler, stated that they will also be "trialing pilot fleet vehicles in H1 2021 to understand how full-electric vehicles can integrate into their operations," before adding, "They'll also help us learn more about customer requirements so we can adapt and modify the final specification of customer vehicles that start production in 2022 so they are perfectly suited to our varying customer's requirements." Volta Trucks revealed the full specifications of its Zero truck around a month ago. According to a statement released at the time, the vehicle has a gross vehicle weight (GVW) of 16 tonnes and a payload of 8,600kg and has been designed specifically for inner-city parcel and freight distribution. Among its key features are the driver sitting far lower than a conventional truck, allowing easier "visual communication" with those around, while the driver also has 220 degrees of direct vision around the vehicle thanks to the large glasshouse cab and central seating position. Visibility is further helped by rear-view cameras that replace traditional mirrors, and a 360-degree "birds eye" camera. The vehicle uses sustainably sourced natural flax material and biodegradable resin in the construction of exterior body panels, which has been developed with Switzerland's Bcomp of Switzerland, in collaboration with the European Space Agency. Production is due to begin in 2022 and investigations are said to be ongoing to secure a contract manufacturing partner to assist with production, which is anticipated to be in the UK. By the end of 2022, Volta Trucks aims to have built around 500 customer-specification vehicles, rising to 5,000 vehicles a year by 2025, and increasing thereafter. (IHS Markit AutoIntelligence's Ian Fletcher)

- After an initial recovery accompanying the relaxing of social distancing requirements in the second quarter, economic momentum in Croatia has fizzled out in the third quarter. Industrial activity has faltered once again in August while retail trade has been slipping for two months. The sluggish economic activity in the third quarter is in line with expectations that a renewed COVID-19 spread and a poor tourism season would restrain the recovery. (IHS Markit Economist Andrew Birch)

- With the relaxation of social distancing requirements in May and June, Croatian industrial activity - as measured by seasonally and calendar adjusted data - recovered by 8.7% month on month (m/m) in June and by another 2.9% m/m in July. In August, however, total output slipped once again, by 1.1% m/m.

- Previously, a faltering of export gains in July had suggested the revival of industrial activity might be interrupted. Total, cumulative industrial output through August remained more than 5% lower than it had been a year earlier.

- Similarly, after an initial strong recovery, retail trade activity has been faltering in recent months as well. According to seasonally and calendar adjustments, retail trade activity soared in May after contracting sharply in the preceding months. Since May, however, total retail trade turnover grew very slowly in June and contracted by 0.3% m/m in July and by another 1.1% m/m in August.

- With domestic demand still strong, import growth accelerated sharply in August, fueling a sharp widening of Turkey's merchandise-trade deficit that month. Exports continued to contract. Further monetary policy tightening may stem the widening of the trade deficit in the final months of 2020. (IHS Markit Economist Andrew Birch)

- Turkey's merchandise-trade deficit soared to USD6.3 billion, up by nearly USD4 billion as compared to a year earlier. The trade gap has been widening sharply year on year (y/y) throughout most of 2020, resulting in a shortfall of USD33.0 billion for the first eight months as a whole, nearly 70% larger than it had been in the same period of 2019.

- A more than 20% y/y jump of merchandise imports in August fuelled the sharp worsening of the trade gap. As the lira began to depreciate in late July, a surge of demand for gold sent those imports soaring by nearly USD3.3 billion as compared to a year earlier. Without that surge, non-gold imports actually contracted by 0.6% y/y.

- With gold more in demand within Turkey, their exports of gold dropped by more than one-quarter y/y, contributing to the ongoing export losses. However, lost foreign demand nonetheless undermined key industries such as automobiles, iron and steel, and energy.

- Lira instability persisted throughout September, suggesting demand for gold will have remained high within Turkey. This demand for gold will keep imports growing even though a weaker lira would typically dampen these inflows.

- With gold imports likely to continue to grow in September, other import demand will need to weaken significantly if Turkey hopes to stymie the rapid deterioration of the current-account deficit to which this widening of the trade deficit is contributing.

- Tightening monetary policy in order to stabilize the lira may help offset gold demand and should dampen non-gold import demand as well. At its September rate-setting meeting, the central bank raised policy interest rates by 200 basis points. Since that cut, the central bank has continued to take other measures to tighten monetary policy, reducing minimum asset ratios on 28 September and cutting taxes on lira deposits on 30 September.

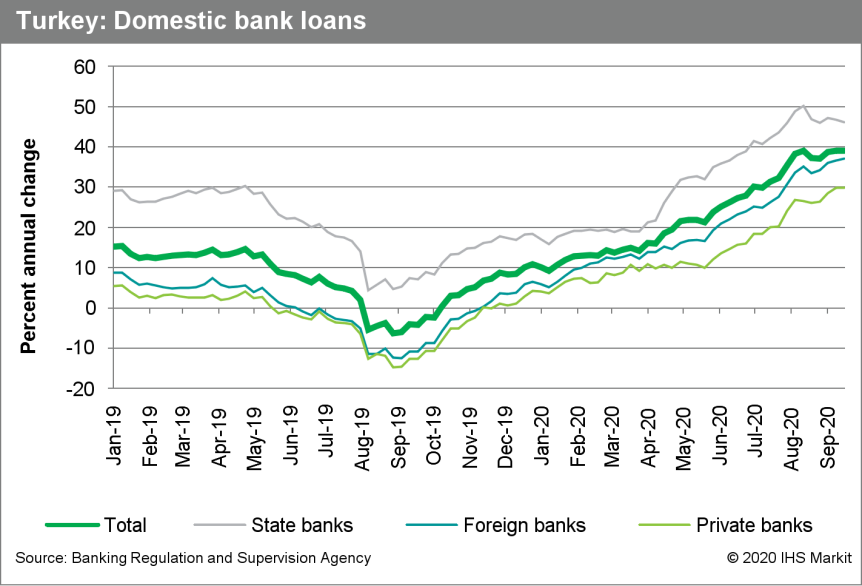

- To date, however, the measures have done little to tame the previous, sharp acceleration of credit growth that is continuing to fuel non-gold import demand and to undermine demand for the lira. As of late September, annual total banking credit growth remained at approximately 40%.

- Turkey's President Recep Tayyip Erdoğan has reduced taxes on foreign currency transactions and local currency bank deposits with a presidential decree signed on 30 September. The Daily Sabah reported that the withholding tax on local currency deposits was lowered to 5% (from 15%) for deposits maturing in six months or less, to 3% (from 12%) for deposits maturing in up to 12 months, and to 0% (from 10%) for deposits maturing in more than a year. The withholding tax on foreign currency-denominated deposits was left unchanged. The tax on foreign currency by retail buyers was reduced to 0.2% from 1% previously. The tax reductions will remain in place through the end of 2020. (IHS Markit Banking Risk's Alyssa Grzelak)

- Although the reduction in withholding taxes would normally make local currency-denominated deposits more attractive, expectations of a continued lira depreciation raise questions as to how effective the tax reduction will be in shifting deposits from foreign currency to the lira.

- In August 2018, Turkey made a similar move to reduce withholding taxes on lira deposits while raising withholding taxes on foreign currency deposits to 20% (from 18%) on deposits with a six-month maturity. Following that measure, the lira continued to depreciate and has lost half of its value against the US dollar since the start of 2018; and foreign currency deposit growth decelerated but remained well above local currency deposit growth throughout 2018 and most of 2019.

- Foreign currency deposits have surged from a low of 29% of deposits in 2010 to over 50% of deposits as of August 2020. If the withholding tax reduction is successful in engineering a shift to local currency deposits, it will be a risk-positive move for banks that have significant direct exposure to lira depreciation on their balance sheets.

- South Africa's expanded unemployment rate reached 42% in the second quarter. Around 1 million permanent job losses are forecasted in the second half of 2020. (IHS Markit Economist Thea Fourie)

- The number of employed persons in South Africa fell by 2.2 million during the second quarter of 2020 compared with the first quarter, latest statistics from the South Africa Statistical Service (StatsSA) show. This pushed the expanded unemployment rate up to 42% in the second quarter, from 39.7% in the previous quarter and 38.5% during the second quarter a year earlier.

- All sectors of the South African economy shed jobs during the second quarter of 2020, with the biggest contractions recorded in the utilities sector, down 25.4% year on year (y/y); construction, down 21.8% y/y; and manufacturing, down 18.6% y/y.

- Overall formal sector employment fell by 13.6% quarter on quarter (q/q) and 13.3% y/y during the second quarter.

- During the third quarter of 2020, Richards Bay Coal Terminal (RBCT) exported 18.1mt of coal, up 17% year on year. During the reported period, there was an increase in shipments to India (9.4mt, up 13% y-o-y), but also to Pakistan (3.2mt, up 13% year on year), Vietnam (1.3mt, up 120% y-o-y), and Turkey ( 0.8mt, from negligible shipments a year ago). In terms of logistics, TFR railings during 3Q20 are calculated at 1.39mt/week versus 1.26mt/week a year ago. Last year TFR scheduled its annual maintenance during the first half of July; however, this year postponed to early next year. Despite an increase in loadings from the terminal, there was little increase in loadings on the Capesize vessel segment but more on mini-capes (10 vessels versus three vessels a year ago), Kamsaramax (26 ships versus 20), and Ultramax (52 ships versus 41) as buyers opted for smaller parcel sizes. As per IHS Markit's Commodities at Sea for 4Q20 and 2020, RBCT coal exports are forecasted at 18.6mt (down 2.5mt y-o-y) and 71.2mt (down 1.7mt y-o-y), respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China -0.2%, Japan flat, Hong Kong +0.8%, South Korea +0.9%, and Australia +1.0%.

- The Bank of Japan (BoJ)'s September Tankan, the short-term economic survey of Japan's enterprises, suggests only modest improvement for business conditions after the easing of COVID-19 containment measures, and outlooks remain sluggish. Persistently severe business conditions are likely to suppress private capital expenditure (capex). (IHS Markit Economist Harumi Taguchi)

- The diffusion index (DI) of current business conditions in BoJ's September Tankan survey for large manufacturing groupings moved up seven points to -27 after a decline of 26 points to -34 in the previous survey. The softer contraction reflects the resumption of business activity in Japan and Japan's trade partners, driven by improvements in the DIs for electrical machinery, shipbuilding and heavy machinery, motor vehicles, and petroleum and coal products. However, the DIs for production machinery and some other industries showed further declines.

- The DI for large non-manufacturing groupings moved up five points to -12 following a 16-point drop in the previous survey. Stay-home/working-from-home lifestyles under the resurgence of new confirmed cases continued to lift the DIs for retailing, communication, and information services, while there were only modest improvements for the DIs for accommodation, eating and drinking services, services for individuals, and transport and postal activities.

- The DIs for small enterprises suggest business conditions remain severe, with only a one-point rise to -44 for manufacturing groupings and a four-point rise to -22 for non-manufacturing. The DIs for domestic and overseas supply and demand conditions suggest modest improvement in business conditions in line with severely weak domestic and external demand and supply conditions for large and small enterprises, with only marginal improvement in domestic demand and supply conditions from the previous survey.

- Persistent severe business conditions and sluggish outlooks led to downward revisions for sales and profit outlooks for fiscal year (FY) 2020/21 (beginning from April). All sized enterprises revised down sales plans, leading to a decline of 2.2 percentage points to -6.6% year on year (y/y) for all enterprises and a decrease of 10.8 percentage points to -28.5% y/y for current profits plans.

- The September figures suggest business conditions have bottomed out. That said, the overall DIs of business conditions were weaker than IHS Markit had expected. The au Jibun Bank Purchasing Managers' Index (calculated by IHS Markit) signaled steadier improvement for business conditions for manufacturing (47.2 in September) and services (flash service business activity index at 45.6 in September) from the lowest points (May and April, respectively), although contractions continue. While the difference partly reflects differences in methodology and the sample base, the sluggish results could prompt the government and the BoJ to consider increasing budgets for measures to support businesses and special lending programs and to extend the duration of these plans.

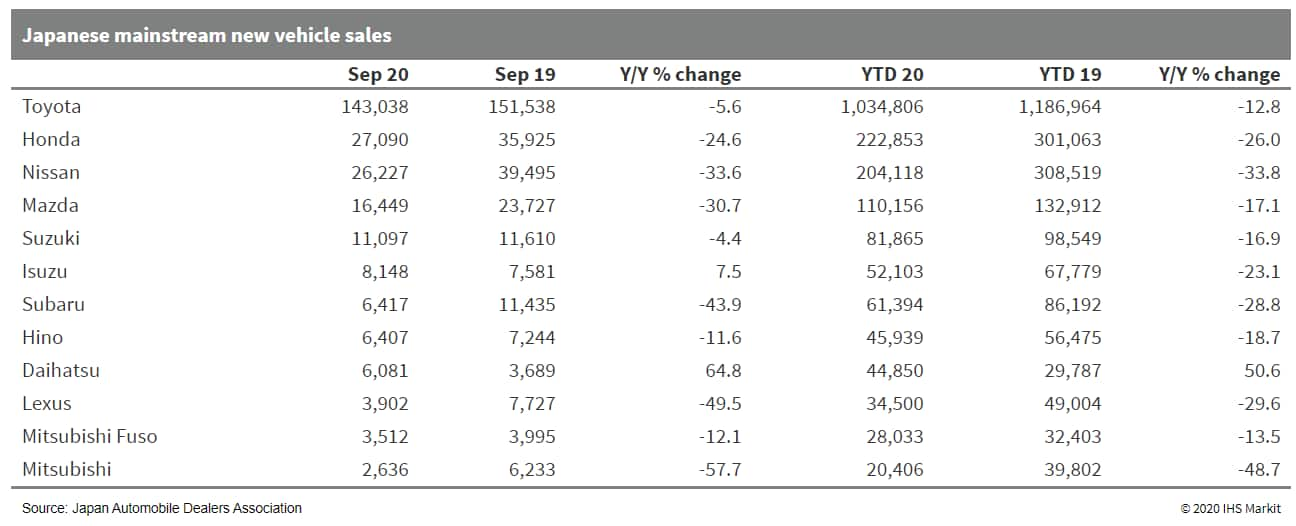

- Japanese new vehicle sales, including mainstream and mini-vehicles, were down by 14.3% year on year (y/y) to 469,705 units in September. In the year to date (YTD), sales declined by 18.06% y/y to 3.400 million units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japanese sales of mainstream registered vehicles were 293,520 units, down by 15.6% y/y during September, according to data released by the Japan Automobile Dealers Association (JADA).

- This figure excludes mini-vehicles, thus covering all vehicles with engines bigger than 660cc, including both passenger vehicles and commercial vehicles (CVs), sold in Japan.

- Sales of passenger and compact cars declined by 16.0% y/y to 252,371 units in September, while truck sales were down by 12.3% y/y to 40,482 units and bus sales by 46.4% y/y to 667 units.

- In the YTD, sales of mainstream registered vehicles declined by 18.9% y/y to 2.130 million units.

- Sales of passenger cars were down by 19.0% y/y to 1.827 million units, while truck sales fell by 17.8% y/y to 295,022 units and bus sales by 29.6% y/y to 7,770 units.

- Although demand for new vehicles has started to pick up, a higher base of comparison caused the higher rate of decline. There was a rush in demand for new vehicles in August and September 2019 as the VAT rise was scheduled for implementation in October 2019, which brought forward the demand to August and September 2019.

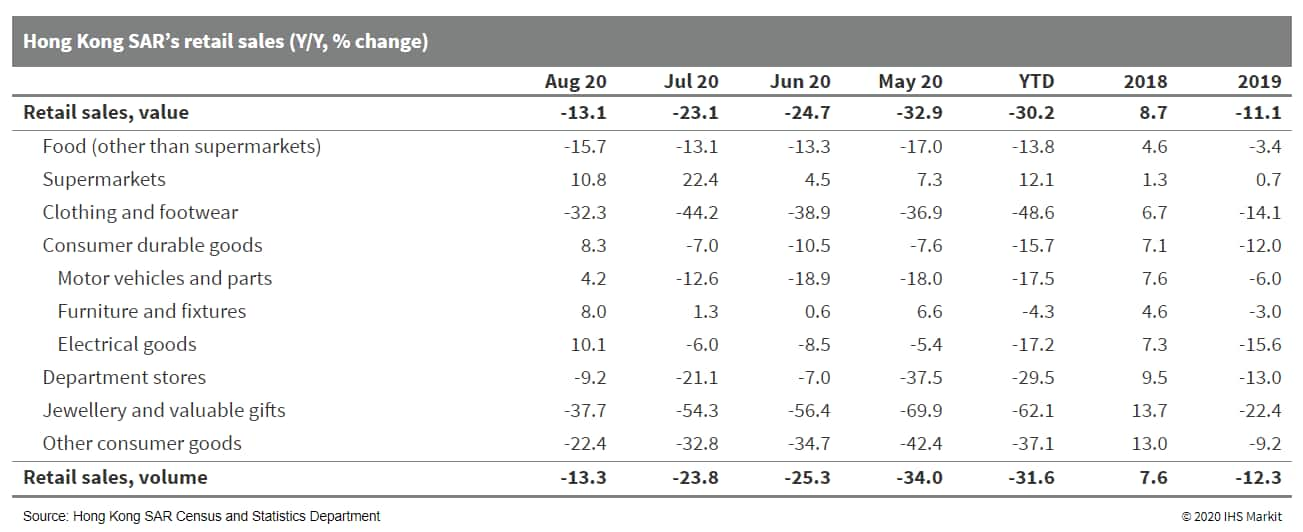

- Hong Kong SAR's retail sales remained in the doldrums during August as sales dropped at the double-digit pace for 14 straight months, along with the plunges in tourist arrivals. Battered by the COVID-19 virus pandemic and political unrest, tourism activities have remained at a standstill, while consumer spending have remained weak, despite some recent pick-ups. Although the gradual easing in virus containment measures and a low base effect will help moderate the contraction ahead, the still-troubled labor conditions, the travel restrictions, and lingering political unrest will provide further constraints to retail sales. (IHS Markit Economist Ling-Wei Chung)

- Retail sales contracted further in August, down markedly by 13.1% year on year (y/y) in value terms, although the rate of decline narrowed from a 23.1% y/y drop in July. The deceleration in contraction was more evident when compared with four straight months of plunging 30-40% y/y during February-May. Concurrently, sales in volume terms - stripping out price effects - fell 13.4% y/y in August.

- With the tourism sector remaining at a standstill amid the pandemic, visitor arrivals plunged 99.9% y/y in August, marking the fifth straight month of slumping more than 99.6% y/y since April. It was mainly driven by a similar 99.9% y/y slump in tourists from mainland China. The outbreak, tightening social distancing measures, and travel restrictions prompted tourist arrivals to start plunging in February, by more than 96% y/y since then.

- As a result, tourist-related spending remained the hardest hit in August, led by a 37.8% y/y slump in sales of jewelry and other luxury items, although the rate of contraction decelerated from about 55% in June-July and around 75% in February-May. Other tourist-related spending, such as sales of medicines and cosmetics, followed a similar trend, down 39.8% y/y in August, after plunging 50-60% y/y during February-July.

- Local consumer spending, on the other hand, showed some improvement. In particular, sales of consumer durable goods resumed growth for the first time since October 2018, rising by 8.3% y/y, which reversed a 7.0% y/y decline in July. It was driven by a marked turnaround in sales of motor vehicles and electrical goods. In addition, furniture purchases remained positive, up 8% in August, supported by recent pick-ups in sales of residential properties. That said, purchases of clothing and footwear continued to slip, down 32.2% y/y in August, while sales of department stores fell 9.2% y/y, although the declines narrowed than previous months.

- A separate report shows that the nominal wage rate - including regular earnings - continued to increase in the June-quarter, up 1.3% y/y, although the rate of gain slowed from a 2.2% y/y increase in the previous quarter. In real terms, the wage rate resumed growth in the June-quarter, after slipping into the slightly negative territory for four consecutive quarters. The real wage rate gained 0.6% y/y, reversing a 0.3% y/y fall in the previous quarter.

- Retail sales' narrower contraction in August came roughly in line with IHS Markit expectation as a very low year-earlier comparison base - when political unrest escalated and undermined consumer and tourist sentiment during the same month last year - helped restrain some of the drop. Despite the smaller contraction, however, the retail sector appears to be remaining in the doldrums as sales have fallen 19 consecutive months through August, with double-digit declines for 14 straight months.

- Horizon Robotics and Continental have signed a memorandum of understanding (MoU) to co-operate in the fields of advanced driver-assistance systems (ADAS) and automated driving for the Chinese market, according to a blog posted on the Medium website. As part of the partnership, Horizon Robotics will offer its artificial intelligence (AI) processors and AI algorithms and the companies will jointly develop intelligent driving solutions. Kai Yu, founder and CEO of Horizon Robotics, said, "Continental is a world-leading automotive technology company with a long history of deep industry experience. It is of great importance for Horizon Robotics to form the cooperation with Continental to jointly promote AI solutions in the field of intelligent driving, which is conducive to jointly accelerating the development and mass production of forward-looking intelligent driving products, and further accelerating the advancement in the automotive industry." Continental has built a demonstration vehicle called CUbE (Continental Urban mobility Experience), based on French company EasyMile's EZ10 platform. Continental's researchers are using the CUbE to get a range of its technologies - such as brake systems and surroundings sensors - market-ready for use in series production of robotaxis. Leveraging the CUbE platform, Continental has developed a production-ready radar system that helps a driverless vehicle generate a 360-degree image of its environment by combining data from different sensor technologies. Meanwhile, Horizon Robotics is focusing on developing AI solutions for computer vision purposes for automated vehicles. Audi has chosen Horizon Robotics to deploy with hardware and software for autonomous vehicles in China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's growing demand and an increasingly diverse diet have created plenty of opportunities for international farmers. The USDA report about China's agricultural imports, Evolving Demand in the World's Largest Agricultural Import Market, says that, despite the pandemic impact and the trade tension, Chinese consumers are keen to have an animal protein-rich diet. They are also seeking healthy fruits and nuts while consumption of grains are on the decline. China is now the world's largest agricultural importer, with imports worth USD133.1 billion in 2019. Although the Chinese government aspires to be self-sufficient in food supplies and advocates this idea to its people internally as a part of national pride campaign, in reality, the country's appetite for imports is likely to stay before large-scale industrialized farming becomes commonplace. That said, domestic agricultural produce can no longer fully meet the rising middle-class demand. The USDA report highlights the changing composition of China's imports. Higher-value consumer-oriented foods are growing, exceeding bulk commodities for the first time in 2019. Rising income and living standards, increasing urbanization, food safety concerns and limited areas of arable land have fueled imports since China has become part of the World Trade Organization (WTO) in 2001. The Chinese diet is changing, leaning towards more meat, dairy and processed foods. Between 2000-19, poultry per capita consumption grew by 32%, soybean oil consumption more than quadrupled and liquid milk intake tripled. From the US exporters' perspective, the implementation of the Phase One deal has helped. However, China is actively seeking to strike agricultural deals with a growing number of countries. This diversification of supplier strategy has impacted the US. Brazil has emerged as a strong supplier for meat and soybean to China. Given China's very limited capacity to produce beef, and the rising demand, China has become a large beef importer, with imports worth USD8.4 billion in 2019. Top suppliers are Brazil, Australia and Argentina. The country is also a top market for dairy imports, driven by infant formula milk. The EU and New Zealand are major suppliers. Fresh fruits and tree nuts are growth categories in China. ASEAN, Chile, Australia and New Zealand are major suppliers for fruits. China's tree nut imports have achieved nearly 30% annual growth since 2001, reaching USD2.8 billion in 2019. The US is the largest supplier, followed by Australia and Vietnam. Pistachios and almonds from the US lead the growth. IHS Markit noted that China is also actively promoting trades with Eurasian countries following the Belt & Road Initiative. The Sino-Euro Railway operation may eventually facilitate the trade. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- India's Department of Heavy Industries (DHI), under the Ministry of Heavy Industries and Public Enterprises, has extended the deadline for the localization of several components for electric vehicles (EVs) from 1 October 2020 to 1 April 2021, reports the Economic Times. Components for which the DHI has extended the deadline include traction motors, motor controllers, vehicle control units, on-board chargers, convertors, and instrument panels. The deadline has been extended under the Phased Manufacturing Programme (PMP) after the localization plans of several companies were derailed by the COVID-19 virus pandemic. The government approved the PMP in March 2019 (see India: 8 March 2020: Indian government approves new program to promote manufacturing of EV components, batteries) to support the establishment of a few large-scale, export-competitive integrated battery and cell-manufacturing "giga-plants" in India, and localization of production across the entire EV value chain. The program is valid until 2024. (IHS Markit AutoIntelligence's Isha Sharma)

- The year-on-year (y/y) contraction of Thailand's industrial production continued to narrow in August. However, economic recovery is likely to remain moderate without the return of international tourists. (IHS Markit Economist Harumi Taguchi)

- Thailand's industrial production for August rose by 3.3% from the previous month for the third consecutive month of increase, and the y/y contraction continued to narrow, reaching 9.3% on a non-seasonally adjusted basis. The sustained improvement largely reflected a softer decline in production of motor vehicles and rubber/plastics products.

- The improvement in industrial production reflected stronger external and internal demand in line with the resumption of economic activity. The contraction of exports softened to a 7.9% y/y drop in August from an 11.4% y/y fall in the previous month thanks largely to a continued rise in exports to the US and softer declines in exports to the European Union, Japan, and ASEAN regions.

- The Bank of Thailand's private consumption index fell by 1.5% y/y in August, but the weakness in spending for non-durable and semi-durable goods as well as services was partially offset by a milder decline in spending for durable goods, which was mainly sales of passenger cars. Upticks in the number of newly registered motor vehicles for investment purposes and domestic machinery sales also signal a softer decline in private investment.

- The August results suggest continued moderate recovery for Thailand's economy. Domestic and external data point to a rise in real GDP for the third quarter from the previous quarter. Although the resumption of business activity is likely to continue to lift Thailand's economy over the near term, the resurgence of the COVID-19 virus pandemic remains a risk for recoveries in external demand and private investment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--01-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--01-october-2020.html&text=Daily+Global+Market+Summary+-+01+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--01-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 01 October 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--01-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+01+October+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--01-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}