Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 26, 2020

Daily Global Market Summary – 26 August 2020

European equity markets closed higher across the region, while US and APAC markets were mixed. Most credit indices closed tighter on the day, except for CDX IG which closed modestly wider. The market will be closely following both Fed Chairman Powell's virtual Jackson Hole speech tomorrow for potentially some details ahead of the Fed's anticipated changes in monetary policy expected to be announced next month and the US initial claims for unemployment insurance report at 8:30am EST for signs that last week's increase in jobless claims was only an anomaly and not a trend.

Americas

- We had mistakenly stated in yesterday's Daily that Fed Chairman Powell's speech at the virtual Jackson Hole Economic Policy Symposium was today, but it is in fact tomorrow (Thursday).

- Most US equity markets closed higher except for the Russell 2000 -0.7% and the S&P 500 reported a new record high close; Nasdaq +1.7%, S&P 500 +1.0%, and DJIA +0.3%.

- 10yr US govt bonds closed +1bp/0.70% yield and 30yr bonds closed +2bp/1.42% yield.

- CDX-NAIG closed +1bp/67bps and CDX-NAHY -5bps/371bps.

- Gold futures closed +1.5%/$1,952 per ounce.

- Crude oil closed +0.1%/$43.39 per barrel.

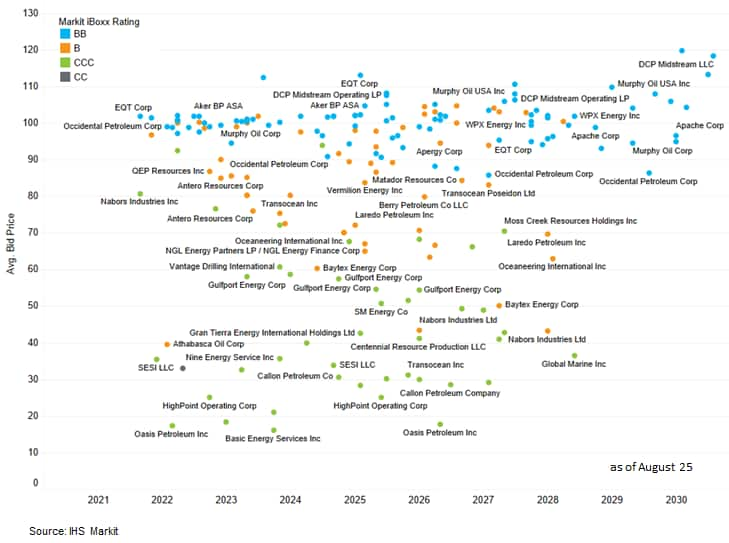

- The chart below shows the average bond prices as of 25 August for the E&P, IOC, and oil services constituents maturing in 2030 or earlier (color coded by rating) in the IHS Markit iBoxx USD High Yield Index. The data indicates that tiering by rating has become much defined now versus March's low's and it's important to point out that there are no longer bonds in this subindex priced under 10-00.

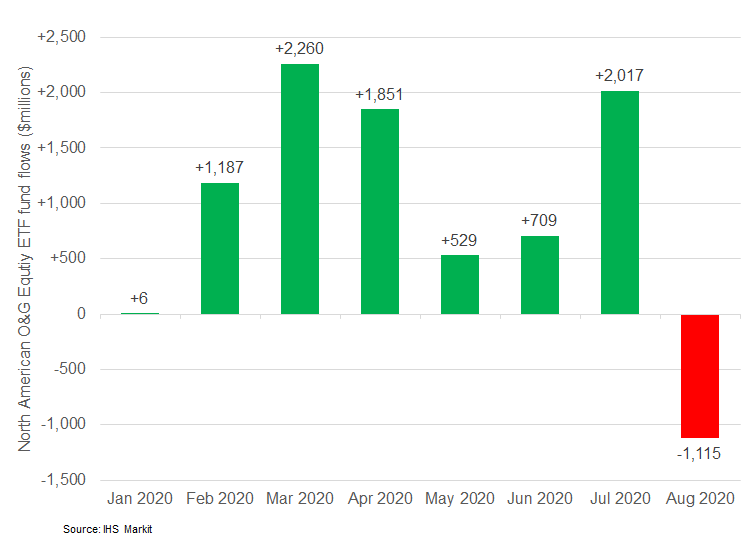

8. The below chart shows the

monthly ETF in/out flows for US/Canadian oil & gas equity ETFs

in $millions. The data indicates that August is reporting $1.1

billion in outflows so far, which is the first monthly outflow for

the sector's ETFs in 2020. There have been outflows every week in

August, but the week of 3 Aug accounts for $982 million of the

month's outflows.

8. The below chart shows the

monthly ETF in/out flows for US/Canadian oil & gas equity ETFs

in $millions. The data indicates that August is reporting $1.1

billion in outflows so far, which is the first monthly outflow for

the sector's ETFs in 2020. There have been outflows every week in

August, but the week of 3 Aug accounts for $982 million of the

month's outflows.

9. Hurricane Laura has grown into a powerful Category 4 storm that's poised to be one of the worst ever to hit the western U.S. Gulf, threatening to pummel the Texas-Louisiana border with deadly storm surges, flash floods and destructive gusts that could inflict more than $15 billion in insured losses. With peak winds forecast to reach 145 miles (233 kilometers) per hour, the storm could be the strongest to hit Louisiana in more than 160 years. (Bloomberg)

10. US manufacturers' orders for durable goods rose 11.2% in July, while shipments rose 7.3%. Orders and shipments of core capital goods were stronger than we had assumed through July. In response to this and other developments, we left our estimate of second-quarter GDP growth unrevised at -31.3% and we raised our tracking forecast of third-quarter GDP growth 0.3 percentage point to 27.4%. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

a. The increases in orders and shipments (for total durable goods) were the third consecutive monthly increases following sharp declines over March and April. Over the three months since April, orders have reversed 80% of their two-month drop and shipments have reversed 94% of their two-month drop; i.e., both orders and shipments of durable goods are near their pre-pandemic (February) levels.

b. The outlook for August looks favorable as well, according to August readings on the IHS Markit flash purchasing managers' indexes (PMIs) for new orders and output in the manufacturing sector. Both rose from their July levels, are within expansion territory (above 50), and at their highest levels since early 2019.

c. We should caution, though, that several high-frequency indicators point to a slowing in the broad recovery within July, with some indicators improving into August and others deteriorating into August.

d. In this vein, inventories of durable goods declined 0.5% in July. We expect an inventory dynamic (downward pressure on production to keep inventories in line with final sales) to weigh on manufacturing output into the fall.

11. The Federal Reserve looks likely to keep short-term interest rates near zero for five years or possibly more after it adopts a new strategy for carrying out monetary policy. The new approach, which could be unveiled as soon as next month, is likely to result in policy makers taking a more relaxed view toward inflation, even to the point of welcoming a modest, temporary rise above their 2% target to make up for past shortfalls. (Bloomberg)

12. Tesla CEO Elon Musk has posted information about the potential power capacity and life cycle of the company's batteries in a Twitter comment. The comment increases speculation ahead of Tesla's scheduled 22 September Battery Day event. The event had been scheduled for 15 September, but a company announcement on 21 August moved the date to 22 September. Automotive News quotes the Twitter post as saying, "400 Wh/kg *with* high cycle life, produced in volume (not just a lab) is not far. Probably 3 to 4 years." According to reports, Musk was responding to a query about why the company continues to hint about a potential Tesla plane. According to reports, Musk also said in 2019 that for electric flight to work, the energy density of batteries needed to reach more than 400 Wh/kg and that that threshold could be achieved in five years. (IHS Markit AutoIntelligence's Stephanie Brinley)

13. Waymo has started testing heavy-duty autonomous trucks in Texas, United States, reports Forbes. The company will deploy a fleet of 13 Peterbilt trucks on the I-10, I-20, and I-45 interstate highways and other commercial routes between Texas and New Mexico. Waymo said, "In addition to further advancing our trucking capabilities, we're excited to explore how our tech might be able to create new transportation solutions in Texas, which has a high freight volume and is a favorable environment for deploying autonomous vehicles." Autonomous trucks are part of Waymo's broader business strategy, which includes testing a variety of applications of its autonomous vehicle (AV) technology, including ride-hailing, trucking logistics, public transportation, and licensing. The company announced earlier this year that it will focus on AV testing in Texas and New Mexico. (IHS Markit Automotive Mobility's Surabhi Rajpal).

14. Evonik Industries says it is acquiring catalyst rejuvenation firm Porocel Group (Houston, Texas) for $210 million. The purchase price is 9.1 times adjusted EBITDA in 2019, which Evonik says "is an attractive valuation for a high-quality asset in the catalyst sector." The transaction will be financed by Evonik's "strong cash position" and is expected to close by the end of 2020 subject to approval by the relevant authorities, the company says.

a. The acquisition of Porocel significantly expands Evonik's catalyst portfolio and especially its catalyst production capabilities, the company says.

b. Sales of the combined catalyst business are expected to grow to more than €500 million ($590 million) by the end of 2025 without the need for investment in new capacities, Evonik says.

c. Porocel generated sales of approximately $100 million with an EBITDA of about $23 million and EBITDA margin at about 23% in 2019, which is above Evonik's target range of 18-20%, the company says.

d. Porocel has significantly increased its EBITDA in the last three years, driven by new product development through an expansion of R&D capabilities, Evonik says. It has more than 300 employees worldwide and production facilities in the US, Canada, Luxembourg, and Singapore.

e. Porocel offers a technology for rejuvenation of desulfurization catalysts, which are in increasing demand for producing low-sulfur fuel, Evonik says. Rejuvenation reduces CO2 emissions by more than 50% compared with the production of new desulfurization catalysts, it says.

15. Canned tuna consumption has increased worldwide for the first half of the year. Major global industries managed to honor contracts while production and supply chain continuity were secured by government policies in most of the cases. However, the second half of the year remains uncertain given the global economic decline in the pandemic. (IHS Markit Food and Agricultural Commodities' Estela Cuesta)

a. Among global canned tuna markets, the US is likely to have experienced the strongest impact because of the Covid-19 outbreak. Customs data shows canned tuna imports rose 17% year-on-year to nearly 130,000 tons for the January to June period, while overall retail sales increased 30% year to date.

b. Panic buying also influenced canned tuna retail sales in the EU, which jumped by 80% in week 11 compared with the same week of the previous year. Demand has since stabilized at above 20%, on average, compared with the first half of last year. In the meantime, the foodservice channel and gourmet continue to experience dismal sales amid the virus outbreak sanitary restrictions.

c. As opposed to the global canned tuna trade, the fresh and frozen tuna market has weakened in 2020, all speakers at the Infofish webinar agreed. Independent consultant on international fishery trade, Fatima Ferdouse highlighted demand and supply of fresh tuna meant for sushi and sashimi consumption across the foodservice chain has been "derailed" from the market growth seen in recent years. Imports significantly declined in the two largest markets, Japan and the US, because of the pandemic.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Germany +1.0%, France +0.8%, Italy +0.5%, Spain +0.2%, and UK +0.1%.

- 10yr European govt bonds closed mixed; Spain -2bps, Italy -1bp, France flat, Germany +2bps, and UK +4bps.

- iTraxx-Europe closed -1bp/54bps and iTraxx-Xover -5bps/323bps.

- Brent crude closed +0.7%/$46.16 per barrel.

- French consumer confidence index remained unchanged between July and August at 94, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Households' fears of unemployment have eased somewhat in August, but remain extremely high. (IHS Markit Economist Daniel Kral)

a. This comes after a fall from 104 in February to 92 in May, an improvement to 96 in June, and a small deterioration in July.

b. Although households' perception of future unemployment eased somewhat compared with the June peak of 77, at 70 in August it remains highly elevated by historical standards. Moreover, it is significantly weaker than would be historically consistent with the current level of the overall consumer confidence index.

c. Among the main subcomponents, between July and August the largest change was in respondents' assessment of past consumer prices (from -28 to -17), and expectations of unemployment (from 76 to 70). Major savings capacity and major purchases intentions both declined by 4 points, to 5 and -19, respectively.

d. Several sub-components in August continue to significantly deviate compared with the historical average. In particular, expectations of unemployment are 37 points higher (70 versus 33), expectations of standard of living are 28 points lower (-53 versus -25), and expected savings capacity is 14 points higher (5 versus -14).

e. The large discrepancy between the headline index and the expectations of unemployment points to the success of the government's current income-support measures. However, it also highlights that households appreciate their temporary nature and expect a rise in unemployment, which is also translating into a higher propensity to save.

6. Chinese ride-hailing giant Didi Chuxing (DiDi) is making its debut in Russia, its first Eurasian market, reports Caixin Global. The company is launching the DiDi Express service in the southwestern city Kazan, the capital and largest city of the Russian Republic of Tatarstan. DiDi began recruiting drivers in Russia in late July. In Russia, DiDi will compete against Yandex Taxi, a joint venture between Russian internet giant Yandex and Uber. DiDi is strengthening its presence in markets beyond China and operates in Japan, Australia, Latin America, and now Russia. In Latin America, DiDi's service is available in Brazil, Chile, Colombia, Costa Rica, Mexico, and Panama. DiDi has over 31 million drivers globally registered on its platform and has attracted 550 million customers who use the company's range of app-based transportation options. This year, DiDi announced plans to achieve 800 million monthly active users globally over the next three years. (IHS Markit Automotive Mobility's Surabhi Rajpal)

7. Engineering and technology firm ABB has launched a new facility to produce electric vehicle (EV) charging infrastructure in Italy, reports Daily News Egypt. A total sum of USD30 million has been invested in the facility, which is expected to be operational by the end of 2021. The facility spans 16,000 square meters. ABB will produce a complete range of chargers for direct current (DC) EV batteries including chargers for passenger cars and public transport vehicles. Frank Mühlon, head of ABB's global e-mobility infrastructure solutions, said, "As global demand for sustainable transport continues to increase, this new facility will ensure that ABB meets this demand, positioning it as the preferred supplier of e-mobility infrastructure solutions." ABB intends to sell EV chargers in the Egyptian market after obtaining the government's approval. In January, Egypt announced that it is planning to set up 3,000 fast-charging stations for EVs over the next three years. (IHS Markit AutoIntelligence's Tarun Thakur)

8. The Tunisian economy contracted 21.6% year on year (y/y) in the second quarter, its worst contraction ever recorded by the Tunisian National Institute of Statistics (INS), with market services and manufacturing leading the contraction. The INS revised down its first-quarter contraction to -2.2% y/y from -0.5% y/y. Please note that the numbers reported by the INS are using prices of the previous year, and not prices from 2010 as we currently have in our economic model; consequently, the numbers are slightly different, but still it is a good approximation to Tunisia's economic performance. (IHS Markit Economist Francisco Tang Bustillos)

a. GDP significant contraction during the first and second quarters were mainly caused by the containment measures applied in Tunisia and abroad to tackle the COVID-19 virus outbreak. However, constant protest in the oil and phosphate industry has also taken a toll on the economy.

b. According to the INS's first estimate, hotels and restaurants and transport suffered the worst contraction within all the sectors, 77.5% y/y and 51.4% y/y, respectively. These figures show how international borders being closed down has affected the Tunisian tourism sector. On a related note, the Central Bank of Tunisia (BCT) stated that tourism revenues dropped nearly 59% on an annual basis during the first seven months of 2020.

9. The Bank of Botswana's MPC maintained the key policy rate at 4.25% during its latest meeting on 20 August. A favorable domestic and foreign short- to medium-term inflation outlook and weak GDP underpin the interest-rate decision. (IHS Markit Economist Archbold Macheka)

a. Depressed domestic demand pressures, accentuated by the COVID-19 virus containment measures, are likely to keep inflation below the lower bound of the Bank of Botswana's objective range of 3-6% through 2021.

b. The latest consumer price index data from Statistics Botswana show inflation was unchanged at 0.9% year on year (y/y) in July, largely reflecting price stability in most major categories of goods and services, as well as compensating movements in the annual price changes of other commodity groups.

c. Upside risks to the inflation outlook noted by the central bank come from higher-than-anticipated increases in global commodity prices and supply-side interruptions due to COVID-19-related travel restrictions and lockdowns. Weak global growth, softer global oil prices, and subdued domestic demand might see an inflation outturn lower than anticipated.

d. Domestic output is expected to contract sharply in 2020, largely driven by COVID-19-induced containment measures, which are curtailing economic activity and weakening global demand.

e. Revised estimates from the International Monetary Fund (IMF) show Botswana's economy shrinking by 9.6% in 2020, before rebounding to 8.6% growth in 2021.

f. Revised estimates by the Ministry of Finance and Economic Development (MFED) show a GDP contraction of 8.6% in 2020, and a recovery of 7.7% in 2021.

g. IHS Markit expects Botswana's inflation to average 2.2% in 2020 and 2.7% in 2021. We expect food prices to continue to soften, largely reflecting favorable inflation trends in neighbor South Africa.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China -1.3%, Australia -0.7%, Japan flat, Hong Kong flat, South Korea +0.1%, and India +0.6%.

- Caixin reported on 25 August that the Chinese central government is looking to relax the types of debt instruments that local authorities can purchase to support smaller banks. According to Regulation Asia, the central government is looking to allow local authorities to purchase tier-2 capital bonds, as well as devising a new deposit product called "bank investment contract" to boost local authorities' deposits into smaller local banks. (IHS Markit Banking Risk's Angus Lam)

a. The Chinese central government has previously allowed local governments to use up to CNY200 billion (USD28.9 billion) of the CNY3.75-trillion worth special bonds to be issued in 2020 to purchase convertible bonds from smaller banks.

b. Recently, there has been signs of Chinese authorities supporting local banks, such as Huishang Bank's large stake purchase by the People's Bank of China's Deposit Insurance Company

c. The potential expansion of the types of bonds that local governments can purchase suggests that more supports are likely for smaller banks, which stand to be most affected by more lending micro, small, and medium-sized enterprises (MSMEs).

3. The China Association of Automobile Manufacturers (CAAM) has released its first set of sales and production data for new vehicle sales in the first half of August. (IHS Markit AutoIntelligence's Abby Chun Tu)

a. New vehicle sales of 11 major auto manufacturers in China fell by 4.2% year on year (y/y) during the first half of August to 939,000 units, according to CAAM.

b. New vehicle production volumes of the same group of automakers, however, increased by 46.4% y/y during the same period. CAAM did not release the list of auto manufacturers that had submitted their sales and production data during the reporting period; however, the list should contain some of the key players in the auto market including the SAIC Motor Group, the GAC Motor Group, and Geely Auto. The data released by CAAM comprises sales and production results of China's major automotive groups, accounting for more than 90% of vehicle productions and sales in the market.

c. Given the strong results of the 11 major automakers, production in August is likely to trend higher, supported by a continued recovery in vehicle demand.

d. On the wholesale front, sales slowed down during the first half of August, which will likely drag demand growth in the passenger vehicle market during the rest of 2020.

e. IHS Markit during our August forecast round updated our outlook for mainland China's light-vehicle market to reflect the impact of recent government stimulus and improved consumer sentiment. For full-year 2020, we expect light-vehicle production volumes in mainland China to decline by 11.2% y/y to around 21.69 million units, up from a forecast decline of 12.8% y/y, given in July.

4. Beijing's municipal authorities have announced new incentives to accelerate the adoption of electric light commercial vehicles (LCVs) in the city. According to a statement by the Beijing Transportation Bureau, companies are encouraged to scrap their gasoline (petrol) or diesel engine vans and replace these high-emission vehicles with fully electrified light vans. As incentives to business owners, Beijing will provide a subsidy of CNY70,000 (USD10,130) for each electric LCV that meets certain technical criteria under the scheme. The program will come into effect on 1 September and run through to 31 August 2021. The stimulus measure announced by Beijing sets an example for other cities to facilitate the adoption of LCVs in the private sector. The program will also benefit leading automakers in the electric LCV market, including SAIC Motor, Great Wall Motor, BAIC Motor, and Chery Auto. Electric LCVs, primarily consisting of electric vans and pick-ups, only account for a small share of China's battery electric vehicle (BEV) market. (IHS Markit AutoIntelligence's Abby Chun Tu)

5. Chinese automotive news website iyiou.com has reported that Tesla will open a new delivery center in Shanghai's Pudong district in September. The facility will be located 70 km from the Tesla Shanghai Gigafactory and will become Tesla's first vehicle delivery facility in Shanghai. The report also indicates that Tesla is planning to set up another delivery center in the inner city to serve consumers in Shanghai and surrounding areas. Tesla is expanding its service network with new showrooms and delivery centers to keep up with the growth of new orders. The new delivery center in Pudong will be set up as a multi-functional facility for vehicle display, test-drive reservations, vehicle delivery, and after-sales service, as well as a Tesla theme park. With a delivery capacity of 200 to 300 vehicles per day, the new delivery center will play an important role in supporting Tesla's expansion in China's east coast cities. (IHS Markit AutoIntelligence's Abby Chun Tu)

6. Ola Electric Mobility (Ola Electric) is planning to soon launch its first product, an electric two-wheeler, to scale up its operations and expand globally, reports Livemint. To achieve this, the company intends to hire 2,000 people across various roles including software, vehicle design, and engineering and battery technology. Bhavish Aggarwal, co-founder and CEO of Ola, said in an email statement, "Our aim is to build electric vehicle [EV] products and BaaS systems for a global market and across all the segments. We will soon be launching many new programs towards this. To achieve this, we will be launching a large hiring initiative to hire over 1000 engineers globally over the next quarter and another 1000 people across other functions." Ola established Ola Electric Mobility in 2018, and the company was led by Ola executives Anand Shah and Ankit Jain. Ola already operates its two-wheeler service, Ola Bike, which is available in 150 Indian cities and towns. The company announced last year that it intended to grow this business threefold in the next year. Recently, Ola Electric acquired Dutch-based electric two-wheeler manufacturer Etergo for an undisclosed amount. (IHS Markit Automotive Mobility's Surabhi Rajpal)

7. Tata Motors Group aims to significantly reduce its consolidated automotive net debt, excluding the company's vehicle finance business, in the next three years, reports Business Standard. At its 75th annual general meeting yesterday (25 August), the company's chairman N Chandrasekaran told shareholders, "Currently the group has a net automotive debt of INR480 billion [USD6.4 billion] and we are deleveraging this business substantially. The target is to bring it to near zero debt levels in the next three years." The company seeks to focus on sharpening the brand portfolio and enhancing sales and service experience and sustainable mobility. The automaker also aims to "have reduced overall investments by 50% during this fiscal year [FY], and we will continue to manage this tightly going forward", added Chandrasekaran. The latest measures to reduce debt and generate free cash flow come as Tata Motors' earnings have taken a severe hit as both its Indian business and Jaguar Land Rover (JLR), its UK subsidiary, faced headwinds. (IHS Markit AutoIntelligence's Isha Sharma)

8. Thailand aims to have 1.2 million electric vehicles (EVs) on the country's roads by 2030, according to a report by Xinhua Net, citing the country's Ministry of Energy. "We have set a goal to have 1.2 million EV cars by 2030, and we are already building facilities such as charging stations, electric system, and EV car technology," said Wattanapong Kurovat, chief of the Ministry's Energy Policy and Planning Office. The ministry is already laying the groundwork for infrastructure and battery development for EVs. In addition, it is studying the option of EV users selling extra energy from their batteries to the national power grid, which will help strengthen the country's electricity security. Thailand is also looking at installing about 2,000 charging stations 50 km apart nationwide. The government plans to pilot EVs first in public transport, taxis, and government cars fleet. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--27-august-2020-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--27-august-2020-.html&text=Daily+Global+Market+Summary+%e2%80%93+26+August+2020++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--27-august-2020-.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary – 26 August 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--27-august-2020-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+%e2%80%93+26+August+2020++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--27-august-2020-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}