Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 30, 2020

Daily Global Market Summary – 30 September 2020

US equity markets closed higher despite a sharp sell-off in S&P futures overnight, while APAC and most major European markets were lower. Today marked the end of Q3, with all major US and most APAC equity markets ending the quarter higher, while the majority of European markets ended the quarter lower. Benchmark 10yr European and US government bonds were at least 3bps weaker today, while iTraxx and CDX indices were modestly tighter across IG and high yield. The US dollar and gold/silver were lower on the day, while oil regained some ground after yesterday's sell-off. Tomorrow morning's US weekly claims for unemployment report will kick-off the new quarter in the US, which will be followed by Friday's US non-farm payroll report.

Americas

- US equity markets closed higher on the day and on the quarter; DJIA +1.2% (+7.6% Q3), S&P 500 +0.8% (+8.5% Q3), Nasdaq +0.7% (+11.0% Q3), and Russell 2000 0.2% (+4.6% Q3).

- Wednesday night's markets appeared to have reacted to the US Presidential debate, with the S&P futures declining as much as 1.1% during the 70 minutes that followed.

- 10yr US govt bonds closed +3bps/0.68% yield (same closing yield as 1 July) and 30yr bonds +4bps/1.46% yield (+5bps vs 1 July close).

- CDX-NAIG closed -1bp/59bps and CDX-NAHY -4bps/409bps.

- DXY US dollar index closed -0.1%/93.83 per ounce.

- Gold closed -0.4%/$1,896 per ounce and silver -3.9%/$23.49 per ounce.

- Crude oil closed +2.4%/$40.22 per barrel.

- American Airlines Group Inc. will start laying off 19,000 workers on Thursday as originally scheduled, spurning an appeal from Treasury Secretary Steven Mnuchin as he negotiates with Congress about extending payroll support for U.S. carriers. (Bloomberg)

- The US Pending Home Sales Index (PHSI) soared 8.8% in August to

a record-high 132.8, four months after plunging to a record low of

69 (data start in 2001). (IHS Markit Economist Patrick Newport)

- All four indexes have posted solid gains over the past four months. The Midwest and South reached all-time highs in August, despite the raging pandemic.

- What is driving sales? Partly, it is near-record-low mortgage rates, pent-up demand, and record-low inventories, which have led to bidding wars and a rush to buy.

- It is unclear how much telework—which is here to stay—is also driving sales (for those able to work from home living in cities, such as San Francisco, Boston, or New York, where real estate is pricey, it is an ideal time to cash out and move into a larger, less-expensive house where traffic is never an issue).

- Applications to buy homes remain strong, according to the Mortgage Bankers Association. Its Purchase Index for the week ending 25 September was 32% higher than a year earlier, according to a report released today (30 September).

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors (NAR). Expect solid existing home sales, likely higher than August's 14-year high, in September or October or both.

- Might existing sales also set a record high—they would have to rise another 21%? Lawrence Yun, the NAR's chief economist, does not think so—at least in September, partly because inventory is so low.

- Unexpected strength in pending home sales through August implies more residential brokers' commissions in the third quarter. This raised our estimate of third-quarter GDP growth 0.2 percentage point to 32.4% (annual rate).

- The biggest U.S. banks will face restrictions on dividends and share buybacks for another three months, the Federal Reserve said Wednesday, citing the need to conserve capital during the coronavirus-induced downturn. The Fed said it would maintain prohibitions on share buybacks and a cap on dividend payments by 33 banks with more than $100 billion in assets until the end of year. The restrictions, imposed for the third quarter, were due to expire Wednesday. (WSJ)

- As Congress continues to bicker over another coronavirus relief bill, small businesses at the heart of the US food supply chain are still struggling and Wednesday (Sept. 30) warned a House panel they may not survive without federal assistance. Small food producers, distributors and retailers "need help and this is exactly why government is supposed to be here," said Collin Castore, owner of Seventh Son Brewing in Columbus, Ohio, and president of the Ohio Craft Brewers Association. "But I think a lot of us won't be around if it takes much longer." Some 651,000 jobs supported by the US beer industry will disappear by the end of the year because of the pandemic, Castore said. To stem the damage, he urged lawmakers to forgive Paycheck Protection Program (PPP) loans of less than $150,000, add additional funds to the program and provide additional tax credits for expenses related to COVID-19. Castore said Congress should also consider a credit for perishable goods that had to be destroyed due to supply chain interruptions from coronavirus, noting that his industry lost millions of dollars due to beer that expired. Castore provided his comments to the House Small Business Committee along with representatives from the seafood, grocery retail and agriculture industries, offering stark testimony on how the pandemic has upended their businesses and exacerbated existing flaws across the food supply chain. The seafood industry has been hit particularly hard, she told the subcommittee, as some 70% of seafood is served in restaurants and other foodservice establishments. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Dow will record a $500-600 million charge in the third quarter for costs associated with the company's ongoing restructuring program. The program includes a global workforce cost reduction of approximately 6% and previously announced plans to close manufacturing facilities in the US and Europe to enhance its long-term competitiveness as the worldwide economy recovers from the COVID-19 pandemic. Dow will shut certain amines and solvents facilities in the US and Europe in its industrial intermediates and infrastructure business as well as "select small-scale downstream polyurethanes manufacturing facilities," it says. In its performance materials and coatings segment it will shut down manufacturing assets, primarily small-scale coatings reactors, and "also rationalize its upstream asset footprint in Europe and in the United States and Canada by adjusting the supply of siloxane and silicon metal to balance to regional needs." The specific facilities to be closed have not been detailed at this stage. "Given the expected gradual and uneven global economic recovery from COVID-19, we announced in July that we are taking necessary actions to continue to optimize our asset footprint, reduce structural costs, and enhance the competitiveness of our business over the long term," says Jim Fitterling, Dow chairman and CEO. "We continue to stay focused on delivering strong cash flow, strengthening our financial profile, and maximizing our operational advantages, and we remain well positioned to capture significant growth as market conditions improve." The $310-million sale to Watco Companies (Pittsburg, Kansas) of Dow's rail infrastructure assets at six North American sites will also be closed today, three months earlier than planned, Dow says. The sale was announced on 6 July. Earlier this month the company announced plans to divest certain marine and terminal operations and assets to Vopak Industrial Infrastructure Americas for cash proceeds of $620 million, with that transaction expected to close by the end of the year.

- Audi, in partnership with Qualcomm Technologies, has deployed cellular vehicle-to-everything (C-V2X) communication technology on Virginia roadways in the United States. This deployment is being supported by Virginia state's Department of Transportation (VDOT), American Tower Corporation, Virginia Tech Transportation Institute (VTTI), and Commsignia. The tests will use Audi Q8 sport utility vehicles (SUVs) and Qualcomm's C-V2X technology, running on 20 MHz of a 5.9-GHz spectrum, to demonstrate two use cases, work-zone warnings, and a green-light countdown. Commsignia will provide roadside units and intelligent transportation systems and VTTI will provide software and systems required for the deployment. Pom Malhotra, director of connected services at Audi of America, said, "Today's milestone will allow Audi to accelerate the deployment of innovative use cases that have the potential to increase driver confidence on the road by providing warning - and in the future, take autonomous action - when sensing an impending collision or even a traffic rule violation." C-V2X technology enables vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure and enables the operation of advanced driver assistance systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Talks between General Motors (GM) and electric vehicle (EV) manufacturer Nikola over a collaboration are continuing despite the latter's CEO having stepped down last week, according to a Reuters report. The two parties had been due to formalize the nature of their alliance today (30 September) but announced yesterday that talks had not finished. GM spokeswoman Juli Huston-Rough said in a statement, "Our transaction with Nikola has not closed. We are continuing our discussions with Nikola and will provide further updates when appropriate or required." When the deal was initially announced, Nikola said that it expected the alliance details to be formalized by 30 September, although it added that both parties could exit the preliminary agreement if it was not completed by 3 December. GM and Nikola announced on 8 September that they had formed a strategic partnership that would see GM provide "in-kind contributions" of USD2 billion in newly issued common stock for an equity stake in Nikola. This would give GM an 11% ownership stake in Nikola. (IHS Markit AutoIntelligence's Tarun Thakur)

- AYRO, a manufacturer of low-speed electric vehicles (EVs), said yesterday (29 September) that it will work with EV manufacturer Karma Automotive to produce more than 20,000 electric delivery vehicles through to 2023. The contract is valued at more than USD300 million and Karma will help design, engineer, and manufacture the vehicles at its southern California factory near Los Angeles, according to Reuters, citing a joint statement from the two companies. AYRO is developing an advisory council that it hopes will include representatives from restaurant chains to advise on what they would like to see in the configuration of delivery vehicles, according to AYRO CEO Rod Keller. The partnership between AYRO and Karma involves a substantial purchase order of more than 20,000 EVs over the course of three years and both companies will have the opportunity to leverage their expertise to develop EVs that meet the needs of businesses and fit local communities. (IHS Markit AutoIntelligence's Abby Chun Tu)

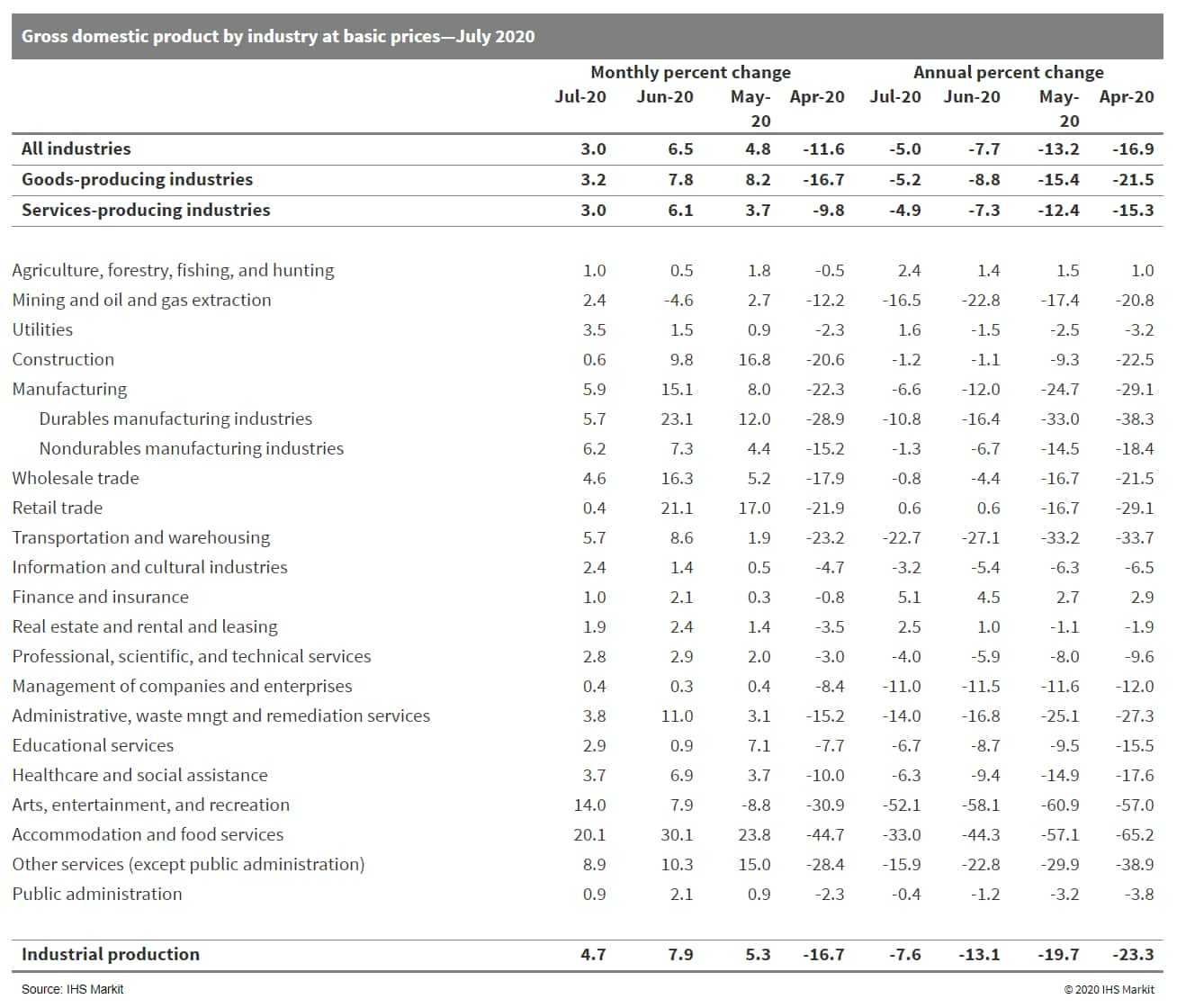

- Canada's real GDP by industry output advanced 3.0% month on

month (m/m) in July, matching the flash estimate from last month as

output climbed in all 20 major industries. (IHS Markit Economist

Arlene Kish)

- The gains in the goods-producing industries (up 3.2% m/m) and the services-producing industries (up 3.0% m/m) were almost evenly matched.

- Industrial production output increased 4.7% m/m, led by robust manufacturing activity.

- Statistics Canada estimates August real GDP by industry output increasing 1.0% m/m as some industries are adjusting to demand conditions.

- Only a handful of industries have returned to their pre-pandemic output levels. Specific restrictions in areas where the coronavirus disease 2019 (COVID-19) virus is spreading increase the downside risk during the economic recovery.

- Most lockdown restrictions were lifted by the end of July, supporting the rise in economic output across all major sectors, especially in services industry output, which contributed the most to the overall upswing in real GDP.

- In the all-important natural resources sector, oil and gas extraction output's pandemic-driven weakness has yet to bottom, with levels hitting the lowest since April 2017.

- On the upside, mining and quarrying output has exceeded pre-pandemic levels by 5.2% given the surges in non-metallic minerals and potash mining.

- Robust manufacturing increases were widespread and the strengthening in the August IHS Markit manufacturing Purchasing Managers' Index points to further upward momentum.

- Some services-producing industries are also outperforming, especially in hot industries like real estate and finance and insurance. Professional, scientific, and technical services output is on a roll and increased competition among big tech firms in Canada should lead to further gains in the near term.

- Tourism-related industries, outside of retail trade, are still dealing with COVID-19's economic constraints and will keep services' output levels subdued. Promised federal government aid may limit potential losses with the spread of the virus going forward.

Europe/Middle East/Africa

- European equity markets closed lower; France -0.6%, Germany/UK -0.5%, Italy -0.2%, and Spain flat.

- 10yr European govt bonds were sharply lower across the region; UK +5bps and Spain/Italy/France/Germany +3bps.

- iTraxx-Europe closed -1bp/59bps and iTraxx-Xover -3bps/345bps.

- Brent crude +1.8%/$42.30 per barrel.

- Germany's retail sales surprised positively in August as the

VAT cut enacted on 1 July apparently had a lagged boosting effect.

Shopping-day-adjusted year-on-year (y/y) rates reached 8.8% in

nominal terms and 7.2% in real terms, well above long-term averages

of 1.3% and 0.6%, respectively. (IHS Markit Economist Timo Klein)

- According to Federal Statistical Office (FSO) data, real retail sales excluding cars increased strongly by 3.1% month on month (m/m; seasonally and calendar adjusted) in August, following modest downward corrections in June-July (cumulatively -1.8%) and May's huge post-lockdown rebound (13.2%). Unadjusted y/y rates in August at 3.7% in real terms and 5.2% in nominal terms even understate the annual comparison owing to a missing shopping day - adjusted annual rates at 8.8% and 7.2% are well above average growth in 2019 (3.1% in real terms and 3.6% in nominal terms), let alone long-term averages (0.6% in real terms and 1.3% in nominal terms)

- Recent above-trend retail sales are attributable to three factors: the temporary VAT cut (July-December 2020), catch-up effects due to the inability to make purchases during the March-April lockdown, and substitution effects with respect to income that cannot be used for services that are either not available at all or only available with restricted capacity. Furthermore, with a greater-than-usual time spent indoors, people want to improve their living conditions at home.

- Major categories of the price-adjusted y/y data for August (total 3.7% y/y; see table below) underline this pattern. The increase in food sales (2.6%) now underperforms that of non-food sales (4.5%), with the driving factors for the latter being 'internet and mail orders' (up by 23.0% y/y) and 'furniture/household goods/DIY' (up by 8.1%). In contrast, sales in 'specialty stores such as for toys, books, bicycles' were roughly unchanged from year-ago levels (-0.4%). The other major categories all posted declines: of -1.1% for pharmaceutical and cosmetic goods, of -2.5% for sales at general department stores, and of -10.1% for textiles and shoes.

- The current strong retail sales data must not be confused with the situation for consumer demand in general, given the above-mentioned catching-up, substitution, and tax effects. Although catching-up effects probably were less of a factor in August compared with May-June, the two other effects remain very much at play lately. Many services in the recreation and entertainment sectors will remain underutilized until an effective vaccine is available (thus likely until at least mid-2021), leading consumers to spend their money on retail goods instead.

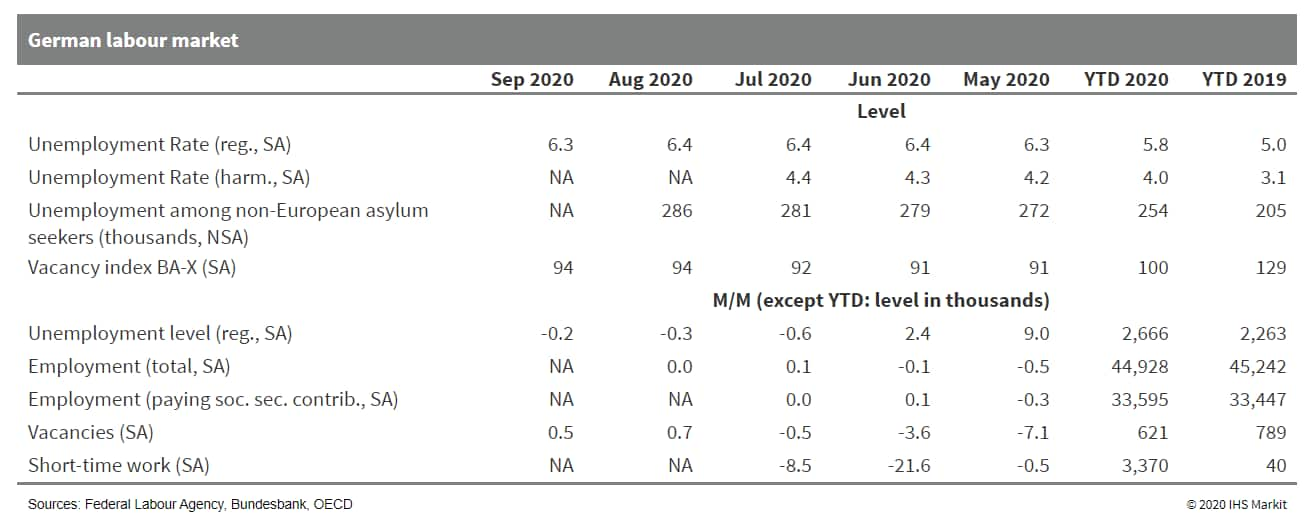

- September's German Labour Agency report sees "modest signs of

improvement", based on a continuing slight decline in seasonally

adjusted unemployment, a large further reduction in the number of

short-time workers, and rising employment and vacancy numbers.

Nevertheless, these developments largely reflect the immediate

correction to the March-April slump triggered by the lockdown,

whereas a full underlying recovery can only start following the

availability of a vaccine. Unemployment is likely to increase anew

in the first half of 2021 before it can embark on a sustained

downward trend thereafter. (IHS Markit Economist Timo Klein)

- Seasonally adjusted German unemployment has declined by 8,000 in September, its third consecutive drop following a cumulative surge by 677,000 during the second quarter. The third-quarter decline by 34,000 is clearly miniscule in comparison. The unemployment level at end-September was 2.907 million, which compares to a cyclical low of 2.264 in February and March.

- Separately, the Labour Agency has calculated that the COVID-19 virus effect on unemployment has switched signs in September, having been near zero in July-August already. Notwithstanding this corrective effect (-23,000), the cumulative boost for April-September that is linked directly to the pandemic is 614,000. The German unemployment rate, which increased from 5.0% in March (close to 40-year lows) to 6.4% during June-August, has slipped marginally to 6.3% in September.

- Employment has started to reverse its February-June plunge (cumulatively -743,000). In August (employment data lag unemployment numbers by one month), seasonally adjusted employment increased by 19,000, following July's initial rebound by 52,000. This compares to an average monthly increase of 21,000 during 2019 and even one of 40,000 during the cyclical upward trend between March 2010 and end-2018.

- The sub-category of jobs for which employers pay social security contributions, i.e. excluding the self-employed, mini-jobs, or other forms of precarious employment, posted an annual decline of -0.3% y/y in July (latest data available).

- Seasonally adjusted vacancies increased by 3,000 m/m to 568,000 in September, following an initial rebound by 4,000 in August. Vacancies had peaked at an all-time high of 808,000 in December 2018 already. They had slipped to 706,000 in February 2020, just before the pandemic hit. By comparison, September's level is still double that of the previous cyclical trough in July 2009 (281,000), then hurt by the global financial market crisis. Meanwhile, the seasonally adjusted vacancy index called BA-X introduced in 2005 - which measures employers' demand for labor, disregarding all seasonal and publicly subsidized job offers - remained steady at 94 points in September, which is 30 points lower than in September 2019, and 40 points below its all-time high of 134 in September 2018.

- MG is expanding its operations with a presence in Germany and other Western European countries, according to an Automotive News Europe (ANE) report. The brand, which is owned by China's Shanghai Automotive (SAIC), is currently advertising for senior sales roles in Germany, Italy, and Spain. MG itself has not provided a specific timeline for when sales would be launched in these countries but MG's German language website said the brand's return to that market was 'coming soon'. MG currently has 112 dealerships in the UK, and outlets in Austria, Belgium, Luxembourg and Netherlands. The MG ZV EV currently accounts for about 65% of all sales in the Europe, but MG is about to expand its electrified car range in the region with the MG5 C-segment estate EV and the HS plug-in hybrid (PHEV) with the latter going on sale across Europe by the end of 2020 while the former should come to the region some time in 2021. The MG5 has potential to carve out share as result of its competitive price. In the UK, after incentives, its price should start at GBP24,495 (USD30,982) while it has a combined range of 214 miles on the WLTP cycle. IHS Markit sees MG's sales in Europe as actually stagnating, although we will obviously be tracking efforts to expand into new markets closely. Between 2020 and 2023 we see sales at between 18,000 and 20,000 in the Western European region. (IHS Markit AutoIntelligence's Tim Urquhart)

- DSM has reached an agreement to sell its resins and functional materials to Covestro for an equity value of €1.6 billion ($1.9 billion). Completion of the transaction is expected in first half 2021, subject to customary conditions and approvals. The businesses, which includes the associated businesses DSM Niaga, DSM additive manufacturing, and the coatings activities of the DSM advanced solar business, represented €1.01 billion of DSM's 2019 total annual net sales and €133 million of DSM's 2019 total EBITDA, the company says. DSM will provide re-stated figures for its materials cluster ahead of its third-quarter results, it says. Meanwhile, DSM anticipates a book profit on the transaction to be recognized on closing. It expects to receive approximately €1.4 billion in cash following closing, including repayment of the net debt of the businesses being sold to Covestro, and after transaction costs and capital gains tax. Covestro says that the acquisition creates one of the leading suppliers in the field of sustainable coating resins. The integration of DSM's resins and functional materials businesses is a substantial opportunity to expand annual revenue at Covestro's coatings, adhesives, and specialties segment by more than 40% to about €3.4 billion, on a 2019 pro-forma basis, Covestro says. The company expects cost savings to build up to about €120 million on an annualized basis from full integration by 2025. Covestro says the transaction will be financed with a combination of equity, debt instruments, and own cash generation, consistent with the company's commitment to maintaining a solid investment-grade rating. For this purpose, Covestro is planning to utilize its existing, authorized share capital for an equity issuance to raise approximately €450 million, it says.

- French households' consumption of goods rose by 2.3% month on

month (m/m) in August, following a 0.9% m/m decline in July. At the

same time, the National Institute of Statistics and Economic

Studies (INSEE) revised the estimates for the second quarter,

showing slightly shallow declines compared with February's levels:

-31.9% instead of -32.1% in April, -7.0% instead of -8.0% in May,

+2.7% instead of +1.5% in June. (IHS Markit Economist Diego Iscaro)

- Despite having fallen by 32% between March and April, the strong recovery in May-June means that consumption of goods now stands 4.1% above its pre-pandemic level.

- The four-week postponement of the summer sales because of the COVID-19 virus pandemic (they usually start during the last Wednesday of June) injected some volatility to the figures in July-August. Particularly, sales of household durables and textile and leather products in September rose by a strong 6.2% m/m and 17.4% m/m, respectively, following falls of 10.1% m/m and 1.7% m/m in August.

- Sales of transport equipment, which had rebounded strongly in May-June, declined by 7.3% m/m in September. They stood 2.9% above their level in February.

- Meanwhile, consumption of food products rose by 2.4% m/m following falls of 3.7% m/m in June and 1.1% m/m in July.

- The strong rebound in consumption of goods was partly driven by a substitution effect away from services, which have been substantially affected by some of the containment measures put in place to limit the spread of the virus. Given the negative outlook for labor markets and the likelihood of households keeping elevated precautionary savings, we expect consumption of goods to lose momentum during the final months of 2020.

- Shell says it will cut up to 9,000 jobs worldwide as part of a major restructuring that will enable annualized cost savings of $2.0-2.5 billion by 2022. The company has also outlined plans to grow its chemicals business and integrate it further with a more streamlined refining business. Shell CEO Ben van Beurden outlined the restructuring today as part of the company's ongoing response to the challenge of dealing with the impact of COVID-19 and the slump in oil demand, as well as its longer-term stated goal of achieving net-zero carbon emissions by 2050. Shell says it will reduce its refining footprint to less than 10 sites, keeping those facilities that have "flexibility to adapt and further integrate with the growing chemicals and trading businesses." The refining business "will be smaller but smarter. We will keep only what is strategically essential to us and integrate those refineries with our chemicals business, which we plan to grow. We will keep sites in key locations which have the flexibility to adapt," says van Beurden. "It is also worth noting that, if we want to be a large player in biofuels, a lot of the biofuel capability will be built within our refining infrastructure. We will end up with fewer than 10 refineries, compared to 55 around 15 years ago, but they will be set up to serve the changing needs of society," he says. No details have been given on which assets it will keep.

- British beef is returning to the US for the first time in more than two decades with the first shipment being sent today (30 September) by Northern Ireland-based Foyle Food Group. The company is one of four UK businesses given the green light to supply beef to the US market earlier this month. UK Environment Secretary George Eustice hailed news of the first shipment as a 'landmark milestone' for the British beef sector. "This is great news for our food and farming industry, who have estimated it will bring a GBP66 million boost to beef producers over the next five years alone, helping the sector go from strength to strength," he stated. UK officials have previously pointed to progress in negotiations on beef as an indication of how new opportunities will open up to meat exporters with Britain outside the EU. Eustice originally said he expected British red meat to be available for US consumers by early 2017, but then saw various other European countries gain access to the US ahead of the UK. The USDA's Animal Plant Inspection Service (APHIS) first cleared the way for a resumption of EU beef imports when it brought its BSE regulations into line with international standards in November 2013. The new rules came into force on schedule in March 2014 - although EU countries still needed to be approved on a case-by-case basis before trade could resume in practice. Ireland was first in line to resume exports following a successful inspection of its beef production systems and market access was confirmed in early 2015. Lithuania secured market access in September 2015, with approval extended to the Netherlands in February 2016 and then France in 2017. (IHS Markit Food and Agricultural Policy's Max Green)

- Electric-vehicle (EV) battery start-up Northvolt has announced that it has raised a further USD600 million of funding in a private placement. According to a statement, this was led by Baillie Gifford, Goldman Sachs Merchant Banking Division, and the Volkswagen Group. IMAS Foundation, Scania, Baron Capital Group, Bridford Investments Limited, Norrsken VC, and PCS Holding also participated, alongside private investors Cristina Stenbeck and Daniel Ek. This will enable the company to make further investment in expanding its production and recycling capacity, as well as supporting its research and development (R&D) activities with the expansion of its Northvolt Labs Campus. The latest round of funding has been raised through a combination of existing and new investors. This will support Northvolt's current strategic aim of increasing the production capacity of battery cells and systems to 150 GWh of manufacturing output in Europe by 2030. Its Northvolt Ett facility in Skellefteå (Sweden), which will eventually have the capacity to produce 40 GWh, is already under construction and scheduled to start production in 2021. This will have a recycling facility next to it, with an initial capacity of 4 GWh and capable of recycling lithium in addition to cobalt, nickel, manganese, and other metals. It has also said that the permitting process is under way for its Northvolt Zwei battery production facility in Salzgitter (Germany), which is scheduled to begin operations in 2024 with an initial output of 16 GWh. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Saudi economy had a challenging second quarter, with the

lockdown measures taking full effect. Oil GDP dampened the fall

somewhat, though still posting a decline. (IHS Markit Economist

Ralf Wiegert)

- Saudi Arabia's GDP declined by 7.0% year on year (y/y) in April through June, according to the Saudi General Authority for Statistics. In quarter-on-quarter, seasonally adjusted terms, activity fell by 4.9% at the same time. The decline follows -1.0% y/y in the first quarter and represents the steepest year-on-year (y/y) drop in a quarter since the beginning of quarterly GDP statistics in 2010.

- The oil economy sagged by 5.3% y/y in the second quarter, while the non-oil economy dropped by 8.2% y/y. Oil output had surged in April by almost 20% y/y when the taps were fully opened, but then was reined in following the OPEC+ accord at the end of April. As a result, oil production dropped by 12% and 23% y/y in May and June, respectively.

- The fall of the non-oil economy is distorted by the hike of the value-added tax (VAT) rate from 5% to 15% on 1 July, which brought forward purchases of many larger consumer items. Although spending in the second quarter has been lifted as a result, spending in the third quarter will have been dampened.

- At this point, it is difficult to assess the magnitude of the distortion effect. A conservative estimate would likely suggest anything between 1% and 2% of GDP, or 3% to 6% of consumer spending.

- Even with that effect taken into account, consumer spending still declined by 17% y/y in the second quarter, as lockdown measures forced households to curtail activities. Furthermore, investment activity fell by almost 25% y/y.

- The staggering decline of investment shows how severe the impact of the pandemic has been for the Saudi economy. This holds especially since construction declined by just 4.7% y/y in Q2, which suggests that the bulk share of cutbacks to investment was in machinery and other equipment, rather than in real estate and infrastructure investments.

- Retail trade, restaurants, and hotels had the steepest decline of all sectors reported by Saudi Statistics. Dropping by 18% y/y, this sector was followed by transport, storage, and communication, with a 16% decline y/y.

- The General Authority for Statistics also reported that the total unemployment rate went up from 5.7% in Q1 to 9.0% in Q2, and the unemployment rate among Saudis went up from 11.8% to 15.4%. The surge of unemployment among Saudis is particularly concerning and will test the social fabric of the kingdom, unless it comes down again, as has happened in other countries.

- IHS Markit has projected an 8.4% decline for Saudi real GDP in the September round of forecasts. We currently estimate a recovery of 3.0% in 2021. Although we will likely trim the projection for 2020 down to close to 8.0%, we maintain our outlook for 2021.

- Uganda has signed host government agreements (HGAs) with Tanzania and Total for the construction and operation of the 1,443-km East Africa Crude Oil Pipeline (EACOP) that is designed to carry over 200,000 barrels per day (b/d) of crude from the country's Lake Albert development (operated by Total and the Chinese National Offshore Oil Corporation (CNOOC)) to the Tanzanian coast. The move marks a key step towards a final investment decision (FID) on the development of Uganda's first oil production as the agreements establish the principal framework by which the country's oil output will be commercialized via exports. The HGAs set key pipeline terms such as revenue sharing - it is believed that 40% of the USD12-13/barrel transit fee will go to Uganda and 60% to Tanzania since 79% of the EACOP is located there; shareholding - the state-owned Uganda National Oil Company (UNOC) and Tanzania Petroleum Development Corporation (TPDC) will have the ability to back in and acquire pipeline stakes of 15% and 5%, respectively; and dispute resolution - the HGAs specify the jurisdiction and laws that will apply for arbitrating any disagreements. (IHS Markit E&P Terms and Above-Ground Risk's Josh Holland)

- Chad is seeking a freeze on repayments on its oil-for-cash loan

contracted with Glencore, according to a Bloomberg report on 20

September. The country is due to make a loan repayment of USD115

million this year, but sharply lower oil prices, compounded by the

economic damage caused by the coronavirus disease 2019 (COVID-19)

virus pandemic, have significantly weakened Chad's external and

fiscal positions, compromising its ability to meet its financial

commitments. (IHS Markit Economist Archbold Macheka)

- Chad, through the state-owned Société des Hydrocarbures du Tchad, contracted nearly USD2 billion in debt from Glencore to finance its budget deficit and "buy a stake in an oil project" between 2013 and 2014. The loan was subsequently restructured in 2015 following a sharp downturn in the price of oil exports and again in 2018 to support debt sustainability and alleviate budgetary pressures.

- According to the IMF, the 2018 Glencore debt restructuring agreement allows for the deferral of amortization up to USD75 million for the period 2021-26 if government oil export receipts are lower than the Glencore debt service, and if oil prices are lower than USD42 per barrel.

- The twin COVID-19 and terms-of-trade shocks have resulted in Chad receiving a total of USD183.59 million under the IMF's Rapid Credit Facility (RCF) to address the country's resultant elevated external financing needs. The country also benefited from the Group of 20's (G20) Debt Service Suspension Initiative (DSSI) in June, waiving USD61 million in debt repayments until the end of 2020. However, external liquidity and budgetary pressures remain elevated, threatening the sustainability of external debt.

- We expect Chad's risks of external and overall debt distress to remain high. Trade disruption, declining remittances and foreign direct investment (FDI) inflows, coupled with weaker global commodity prices and demand, will put increased pressure on Chad's foreign liquidity needs. Total foreign-exchange reserves are thus expected to remain well below the critical three months of import cover, largely reflecting the impact of low oil prices and subdued FDI inflows.

Asia-Pacific

- APAC equity markets closed mixed; Australia -2.3%, Japan -1.5%, Mainland China -0.2%, India +0.3%, Hong Kong +0.8%, and South Korea +0.9%.

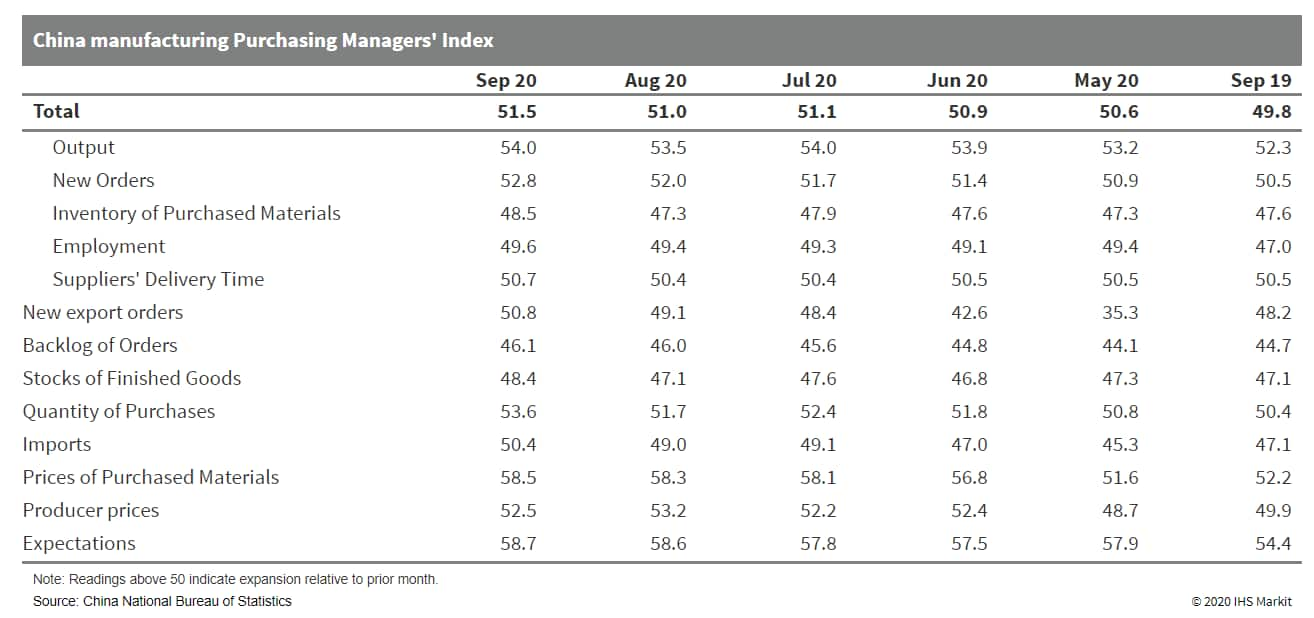

- Demand and supply both accelerated in September; normalization

of services and consumption activity and recovery in manufacturing

are expected to drive economic recovery in the second half of 2020.

(IHS Markit Economist Yating Xu)

- China's official manufacturing Purchasing Managers' Index (PMI) reading came in at 51.5 in September, up 0.5 percentage point from August, the highest figure since March and the strongest August reading since 2018.

- Both demand and supply accelerated as the production sub-index rose to its highest since 2018 and the new orders subindex increased for the fifth consecutive month. Notably, the imports and new export orders subindexes improved to expansionary territory.

- With improved demand and production, firms started to build up inventory and input prices rose further. The producer price subindex edged lower but remains the second-highest reading in 2020. Employment sentiment registered slower contraction.

- By sector, the high-tech and equipment manufacturing sectors continue to report above-average growth. Consumption goods manufacturing accelerated as the National Day holiday and Mid-Autumn Festival coming up in October in China boosted orders of related commodities. However, more than 50% of firms in the textile and furniture manufacturing sector reported insufficient demand.

- The manufacturing PMI reading for large firms continued to improve and returned to expansionary territory in small firms, while the PMI of medium-sized firms edged downward.

- China's non-manufacturing PMI rose by 0.7 percentage point to 55.9 in September, entirely owing to the acceleration in services, while the construction activities PMI stabilized at above 60.0. New orders and expectation sub-index for construction rose further, suggesting ongoing strength with advanced infrastructure investment. Service PMI rose by 0.9 percentage point to 55.2, with expansion noted in all subsectors except the capital market service subsector, which registered contraction. Notably, the PMI of the renting and environmental protection sectors rose by at least 6 points month on month.

- The composite output PMI, covering both manufacturing and non-manufacturing sectors, came in at 55.1, up 0.6 percentage point from the previous reading and the highest level recorded since October 2017.

- China's economic recovery accelerated in August and September as several regional COVID-19 outbreaks were successfully contained. This growth momentum is likely to continue into the fourth quarter. Positive drivers may include the ongoing recovery in exports, normalization of consumption and services activity, recovery in manufacturing investment given improving profitability, and expected strength in infrastructure investment.

- In 2019, China imported 6.83 million tons of fruits, up from 3.1 million tons in 2011. The country sent 3.6 million tons to the world. Improved living standards and income allow Chinese consumers to trade up to high quality imports. Additionally, China has established trade agreements with many suppliers, widening the variety of imports. Chinese fruit growers have felt the impact of imports. "Local fruit farms are running at low margins, not only because of high labor costs, but also their small scale despite lots of support from the government. Local fruits are fresh and affordable for consumers," a local industry source told IHS Markit. Nevertheless, demand for quality fruits exceeds domestic supplies. Thailand led the volume, sending 1.7 million tons to China in 2019, up by 66% over the previous year. Vietnam and the Philippines were large suppliers, at 1.4 million and 1.2 million tons, respectively. South America saw its shipments increase significantly. Chile earned USD1.4 billion in 2019, for 476,000 tons. That said, Chilean fruits fetch a very high price in China. Popular fruits for fresh or processing include cherries, durian, banana, coconuts, kiwifruits, oranges, pineapple, grapes, longan, pitaya/dragon fruit and apples. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Volkswagen (VW) and three local joint-venture (JV) partners - FAW Group, SAIC Motor, and JAC Motor - plan to invest around EUR15 billion (USD17.44 billion) in electric mobility in China between 2020 and 2024, reports Reuters. In a separate report, Wang Xiaoqiu, president of SAIC Motor, is quoted as saying that SAIC plans to have nearly 100 new-energy models with its partners by 2025. These models include new and existing models introduced by SAIC, General Motors, and VW. VW and SAIC made the comments at the Beijing Motor Show to reiterate their commitment to electrification and electromobility in general. No specific details have been revealed regarding these investments. In 2019 alone, VW Group says that it invested more than EUR4 billion in electrification, connectivity, new mobility services, and new products to support the Group's transition to a fully electrified future. (IHS Markit AutoIntelligence's Abby Chun Tu)

- SAIC Motor, in co-operation with the Shanghai government, has launched a new taxi-hailing app, Shencheng Travel, reports SHINE. The move will see the installation of around 200 devices at busy places across the city, enabling users to call a taxi at the press of a button. After a user presses the button, nearby taxis receive a notification through the app and come to pick up the passenger. The service is designed for members of the elderly population who are not adept at using smartphones. So far, more than 100 taxi companies with a total of 20,000 taxis have signed up on the platform. Wang Hengjie, deputy director of the Shanghai Road Transportation Department, said, "The introduction of the new app aims to simplify the process of taxi-hailing for both passengers and taxi drivers." SAIC is involved in multiple mobility services and is primarily known for its new-energy vehicle-based car-sharing service EVCARD. EVCARD has 4 million registered users in 64 cities, with over 45,000 cars in use. In November 2018, SAIC Motor announced plans to launch a ride-hailing service in China. The service, called Xiangdao Chuxing, will be a holistic solution in the ride-hailing sector, providing vehicles, repairs, maintenance, automotive financing, and insurance services for its drivers. Recently, SAIC acquired a 28.9% stake in Hong Kong-based car rental firm CAR Inc. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Great Wall Motors plans to invest CNY3.7 billion (USD542 million) to upgrade its production plant in Tula (Russia). According to China Daily, the investment is part of the special investment contract signed with the Russian Ministry of Industry and Trade. Great Wall Motors, the first Chinese carmaker to sign such a contract, says that the money will be spent on improving the Tula plant's capabilities in localized production of core components including engines, transmissions, and vehicle control systems. The deal will allow the automaker to enjoy government incentives such as tax breaks and eligibility for state procurement designed to encourage companies to boost investment in Russia. The new investment in Russia marks an important step in Great Wall's plan to tap into the European market. The automaker has recently suffered a setback in India, where it originally planned to set up a production base by acquiring a facility owned by General Motors. (IHS Markit AutoIntelligence's Abby Chun Tu)

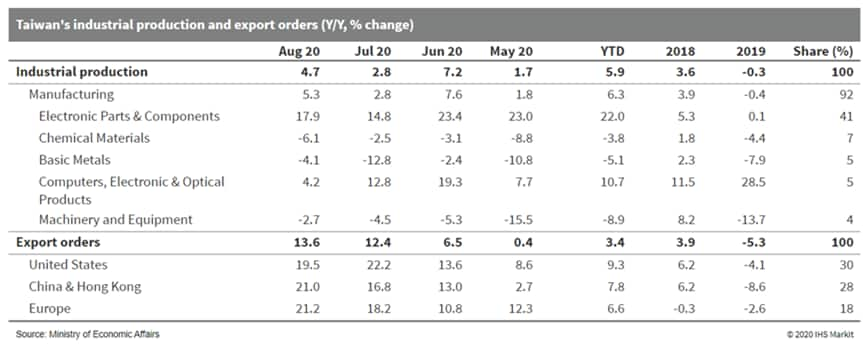

- Taiwan's business indicators flashed a green light for the

first time in six months during August this year, boosted by

further improvement in industrial production and merchandise

exports. Booming technology demand and one key mainland Chinese

company's stockpiling ahead of US bans have provided major support

to exports and related economic performance. However, uncertainties

from US-mainland China trade tensions and the fallout of the

pandemic will remain the key downside risks ahead. (IHS Markit

Economist Ling-Wei Chung)

- Official business cycle indicators flashed a green light in August this year, pointing to a stable economic condition. It marked the first green light since February this year after slipping to yellow-blue lights for five straight months since March when the economy fell into sluggishness during the COVID-19 virus pandemic. The index of monitoring indicators reached 26 points in August, rising 5 points from July and representing the highest reading since December 2019.

- The increase in August was mainly attributed to a further improvement in manufacturing sectors as the sub-index for the industrial production (IP), producer's shipments for manufacturing, manufacturer's sentiment, and imports of machinery and electrical equipment all returned to green lights in August.

- In addition, the sub-index for the stock market flashed a red light in August, indicating the possibility of overheating. Although the sub-index for merchandise exports as well as wholesale, retail, and food services sales flashed sluggish yellow-blue lights in August, their changes returned to positive territories for the first time in six months. That said, the labour market, represented by non-agricultural employment, flashed a blue light, indicating a continued contraction in August.

- Industrial production has been rising for seven straight months this year, supported by surprisingly strong export orders. industrial output expanded by 4.7% y/y in August, accelerating from a 2.8% y/y gain in July. Surging technology production continued to lead the expansion, while the narrower declines in the non-technology production help the improvement in overall manufacturing production during the month.

- Output of the key electronic component industry surged 17.9% y/y, marking the ninth month of a double-digit expansion and accelerating from a 14.8% y/y increase in July. It was mainly bolstered by a 22.9% y/y surge in production of integrated circuits, maintaining the above-20% y/y increasing trajectory since the beginning of this year. Increasing demand for laptops, tablets, and TV also boosted panel output by 7.6% y/y in August.

- The production of computers, electronic and optical products continued to expand but at a slower pace in August. They increased by 4.2% y/y, slowing from a 12.9% y/y in July and a 19.3% y/y surge in June. The boost continued to come from thriving demand for telecommuting and other products related to remote working, online learning, and online entertainment, including increasing production of servers, routers, wireless communication equipment, laptops, and computer-related components. However, they were partly offset by a very high comparison base and lower output of camera lens used in mobile devices amid the delay of product launch by international brands.

- On the other hand, output of non-technology sectors continued to contract in August, although at a narrowing pace. A 24.8% y/y drop in output of the petroleum industry led the decline in non-technology sectors, dragged down by weak demand amid the pandemic. That said, the falls in production of automotive, chemical, metal, and machinery narrowed to single digits in August.

- Concurrently, export orders - representing a leading indicator of actual exports - climbed 13.6% y/y in August, accelerating from a 12.4% y/y expansion in July and marked the fastest increase since January 2018. It was driven by a 21% y/y jump in orders from mainland China and Hong Kong SAR, mainly boosted by a 43.7% y/y surge in orders of electronic products. Surging electronic orders, coupled with thriving orders of information and communication products, also bolstered the jumps of 21.2% y/y and 19.5% y/y from orders of Europe and the United States, respectively.

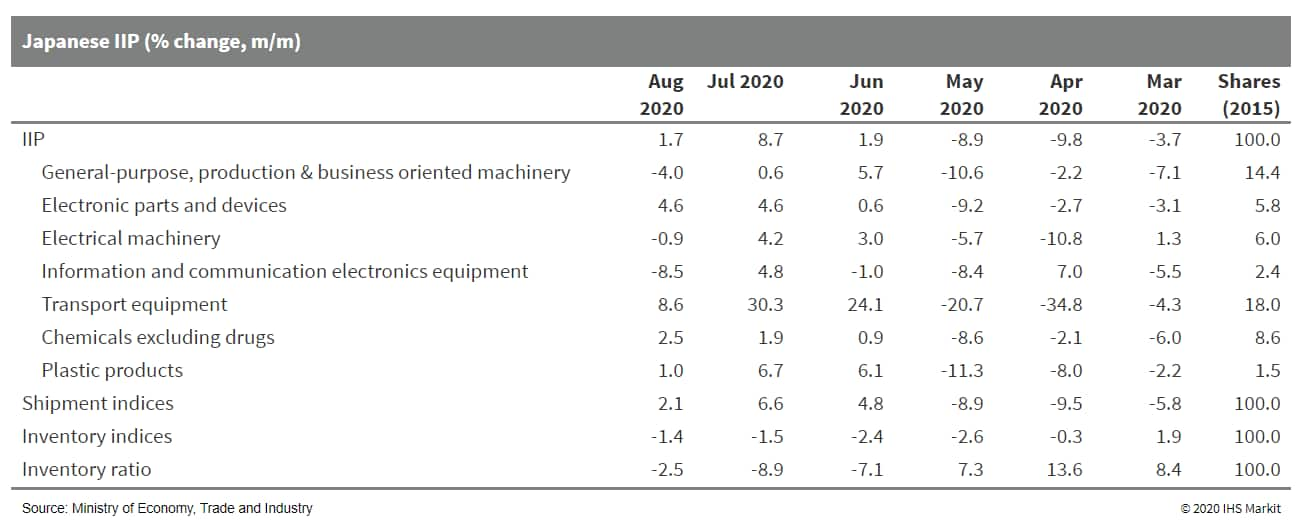

- Although Japan's index of industrial production (IIP) continued

to rise in August, the high inventory ratio could mean the recovery

in production remains moderate over the near term. (IHS Markit

Economist Harumi Taguchi)

- Japan's IIP rose by 1.7% month on month (m/m) in July for the third consecutive month of increase and manufacturers' shipments also continued to rise (by 2.1 % m/m). The outpaced rise in shipments resulted in the fifth straight month of decline for inventory (down 1.4% m/m) and the third consecutive month of decline in the index of inventory ratio (down 2.5% m/m).

- The improvement for the IIP largely reflected a broad range of industry groupings, particularly a continued solid rise in production of autos, iron and steel, and electric parts and devices, thanks largely to the resumption of production and rising demand related to mobile phones and solid-state drives. These improvements were partially offset by declines in production of general-purpose machinery, electrical machinery, and information and communication machinery.

- Continued declines in inventory for a range of industries contributed to progress in destocking, particularly for production goods including iron and steel, chemical products, and pulp and paper products. Nevertheless, the index of inventory ratio remained 12.3% higher than a year ago.

- The August results were weaker than IHS Markit expected, largely reflecting sluggish production and delays in destocking of general-purpose machinery and other capital goods. While persistent uncertainties over the COVID-19 virus pandemic weigh on global demand for capital goods, a 8.7% m/m decline in shipment of capital goods (excluding transport equipment) and weak machinery orders suggest the decline in private capital investment in the third quarter of 2020.

- Japan's retail sales rose for a broad range of retailers in

August, but weak wages and uncertainties over the COVID-19 virus

pandemic could contain a recovery. (IHS Markit Economist Harumi

Taguchi)

- Japan's retail sales rose by 4.6% month on month (m/m) in August following a 3.4% m/m drop in the previous month. Despite unexpectedly strong increases, retail sales remained below the year-earlier level for a sixth consecutive month, recording a 1.9% year-on-year (y/y) drop.

- Sales continued to rise for motor vehicles and fuel and rebounded for other retailers, partially reflecting the impact of unusually hot weather on sales of seasonal items. A continued rise in sales of non-store retailers (up 7.9% y/y) also contributed to a recovery. That said, the shift to stay-home/working-from-home lifestyles continued to subdue sales of fabrics/apparel and accessories and general merchandise (department sales in particular).

- The August results were better than IHS Markit expected and came in the face of headwinds from a resurgence of new confirmed cases and weak consumer confidence. The average of July and August figures (up 7.7% rise from the average for the second quarter of 2020) signals a stronger rebound in private consumption than our current projection.

- According to figures released by the Japan Automobile

Manufacturers Association (JAMA) today (30 September), Japanese

vehicle production experienced a decline of 22.1% year on year

(y/y) to 697,867 units during July mainly because the COVID-19

virus outbreak affected automakers' production operations. The

figure includes passenger vehicles, trucks, and buses. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Output in the passenger car category reached 606,013 units during the month, down by 21.6% y/y. Within the passenger car category, production of standard cars with an engine displacement of more than 2.0 liters was down by 30.4% y/y to 352,263 units during the month, while output of small vehicles was down by 7.5% y/y to 126,673 units.

- Production of mini-vehicles, categorized as vehicles equipped with engines smaller than 660cc, was down by 2.0% y/y to 127,077 units.

- Similar declines were recorded in the truck and bus segments, falling by 21.4% y/y to 87,359 units and by 60.9% y/y to 4,495 units, respectively.

- In January-July, Japanese vehicle production declined by 26.4% y/y to nearly 4.318 million units. Output in the passenger car category reached 3.700 million units during the period, down by 26.7% y/y, while truck production declined by 23.7% y/y to 573,732 units and bus output by 35.7% y/y to 44,022 units.

- By brand, Toyota continued to lead the overall vehicle output with a huge margin during July. The automaker's domestic production declined by 22.0% y/y to 253,857 units, representing the 10th consecutive month of decline.

- Suzuki and Daihatsu held the second and third spots during the month with 96,602 units, up by 25.5% y/y, and 85,928 units, down by 0.1% y/y, respectively.

- Mazda's production volumes totaled 69,101 units, down by 22.3% y/y. Subaru followed with 61,439 units produced, down by 1.6% y/y.

- In the sixth spot, Honda's output totaled 58,011 units, down by 27.0% y/y, followed by Nissan and Mitsubishi with output of 31,173 units, down by 58.9% y/y, and 17,946 units, down by 69.1% y/y, respectively.

- Hino occupied the last spot with 8,070 units, a decline of 43.1% y/y.

- Trans-Pacific Petrochemical Indotama (TPPI; Tuban, Indonesia), a subsidiary of state-owned oil company Pertamina, says it will invest $180 million to hike its para-xylene (p-xylene) production capacity by 30% by the first quarter of 2022. TPPI plans to increase its p-xylene capacity to 780,000 metric tons/year from 600,000 metric tons/year and boost reformer output to 55,000 b/d from 50,000 b/d, according to a statement issued by Pertamina. The expanded facility is expected to be fully operational in the first quarter of 2022, says TPPI's president director Yulian Dekri. The expansion is being undertaken in an effort to reduce imports and cut Indonesia's current account deficit but will, however, add to an already oversupplied market in Asia, industry sources say. To reduce p-xylene imports, TPPI switched production back to aromatics-mode in September, which will be increased gradually, Yulian says. The plant had been running in gasoline mode since August of last year but reverted back in favor of petrochemicals in the face of poor domestic fuel demand because of COVID-19 lockdown measures, market sources said previously. Indonesia currently needs 1 million metric tons/year of p-xylene with the only other domestic supply coming from Pertamina's Cilacap refinery, which has 200,000 metric tons/year of p-xylene capacity, according to the parent company's statement. In 2021, TPPI aims to produce 280,000 metric tons/year, raising the country's total p-xylene production to about 500,000 metric tons/year. "This can reduce imports by 50% of domestic demand and reduce the current account deficit," says TPPI marketing director Darius Darwis. Indonesia imported 386,454 metric tons of p-xylene in the first seven months of 2020, 89.7% of the 430,919 metric tons purchased in 2019, according to IHS Markit chemical data. The expansion is expected to add to a p-xylene supply glut in Asia, says Ashish Pujari, IHS Markit's research and analysis director/Singapore. "Asia's p-xylene market is already oversupplied and TPPI's volumes will add length to the spot market," Pujari says. Even without the TPPI expansion, regional p-xylene supply is forecast to grow further, with some 12 million metric tons of capacity expected to be commissioned in China alone by 2023, according to IHS Markit.

- Vietnam's GDP rose by 2.62% y/y in the July-September quarter

of 2020, improving on the 0.39% y/y pace recorded in the April-June

quarter. The Vietnamese economy grew by 2.12% y/y during the first

nine months of 2020. While this was the weakest pace of economic

growth in a decade, nevertheless the positive pace of growth

reflected the resilience of Vietnam's manufacturing exports and

domestic economy despite the global recession triggered by the

COVID-19 pandemic. (IHS Markit Economist Rajiv Biswas)

- The industry and construction sector grew by 3.08% y/y in the first nine months of 2020, while agriculture grew by 1.84% y/y and the services sector grew by 1.37% y/y.

- According to Vietnam's General Statistics Office, exports in September are estimated to have risen by 18% y/y to USD27.5 billion, while imports likely increased 11.6% y/y to USD24.0 billion, leaving the trade surplus stable at USD3.5 billion for the month of September.

- Exports are estimated to have risen by 4.2% y/y for the first nine months of this year, while imports fell 0.8%, resulting in a strong trade surplus for the first nine months of USD17 billion. Exports to the US rose rapidly during this period, up 12.7% y/y.

- Latest consumer price index (CPI) inflation data showed that the CPI in the third quarter grew by 0.92% quarter on quarter and was up 3.81% y/y. For the first nine months of this year, the CPI rose by 3.85% y/y.

- The Vietnamese economy has been one of the most resilient economies in the Asian region to the global COVID-19 pandemic, having continued to record positive growth on a y/y basis for each of the first three quarters of 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-september-2020-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-september-2020-.html&text=Daily+Global+Market+Summary+%e2%80%93+30+September+2020++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-september-2020-.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary – 30 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-september-2020-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+%e2%80%93+30+September+2020++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-september-2020-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}