Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 31, 2021

Daily Global Market Summary - March 31, 2021

Q1 2021 ended with most major APAC, US, and European equity indices closed lower. US government bonds also closed lower, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed tighter across IG and high yield. Gold, silver, and copper closed higher, while the US dollar, oil, and natural gas closed lower.

Americas

- Most major US equity indices closed lower higher today, except for DJIA -0.3%; Nasdaq +1.5%, Russell 2000 +1.1%, and S&P 500 +0.4%.

- 10yr US govt bonds closed +3bps/1.75% yield and 30yr bonds +4bps/2.41% yield.

- CDX-NAIG closed -3bps/54bps and CDX-NAHY -9bps/308bps.

- DXY US dollar index closed -0.1%/93.23.

- Gold closed +1.8%/$1,716 per troy oz, silver +1.6%/$24.53 per troy oz, and copper +0.4%/$4.00 per pound.

- Crude oil closed -2.3%/$59.16 per barrel and natural gas closed -0.6%/$2.61 per mmbtu.

- The American Jobs Plan announced 31 March by President Joe

Biden in Pittsburgh would invest more than $2 trillion over eight

years in a range of projects to repair existing transportation

infrastructure, expand and fix the power grid, and retrofit homes

for energy efficiency — all with an eye to creating jobs,

reducing carbon emissions, and improving public health. According

to the White House, the plan would include the following elements

that are directly related to the energy transition and future

demand for fossil fuels and renewable power (IHS Markit Climate and

Sustainability News' Kevin Adler and Amena Saiyid):

- Power grid: Hiring of workers for "laying thousands of miles of high-voltage capacity transmission lines" to add at least 20 GW of capacity.

- Clean energy: 10-year extension of the investment tax credit and production tax credit for clean energy and storage projects.

- Clean Energy Standard: This would mandate reductions in US energy sector emissions, similar to the plan in the CLEAN Future Act introduced by Democrats in the House of Representatives in March.

- Electric vehicles (EVs): Invest $174 billion in rebates and tax incentives to buy US-made EVs, install 500,000 EV chargers by 2030, and replace 50,000 diesel buses.

- Climate science: Investment of $35 billion to "position America as the global leader in clean energy technology and clean energy jobs." This includes research on "utility-scale energy storage, carbon capture and storage, hydrogen, advanced nuclear, rare earth element separations, floating offshore wind, biofuel/bioproducts, quantum computing, and electric vehicles."

- Buildings: Retrofitting more than 2 million homes and commercial buildings for energy efficiency, resiliency, and safety, at a cost of $213 billion.

- Roads: Spending $115 billion on modernization of 20,000 miles of highways, roads, and main streets. Fixing the "10 most economically significant bridges in the country in need of reconstruction," and repairing 10,000 smaller bridges.

- Public transport: Double congressional spending to support transit systems to $85 billion.

- President Joe Biden, who made clean energy a core tenet of his campaign, plans to set off one more oil-sector boom before shadows descend on fossil fuels. In a $2.25 trillion infrastructure proposal unveiled Wednesday, Biden earmarked $115 billion for roads (which will require asphalt) and bridges, and another $16 billion to put laid-off oilfield laborers to work plugging abandoned wells across the nation. (Bloomberg)

- Nexans has signed a preferred supplier agreement (PSA) with Empire Offshore Wind to connect the Empire Wind offshore projects to the onshore grid. The turnkey projects cover the full design and manufacturing, as well as the laying and protection of over 300 km of export cables that will deliver renewable energy to over one million homes. Empire Wind is being developed by Equinor and BP through their 50/50 strategic partnership in the Empire Wind is planned for an area of 323 square kilometers (80,000 acres), in federal waters, an average of 33 km south of Long Island, offshore US. Two cable systems will connect the offshore substation for Empire Wind 1 to landfall and substation in Brooklyn, N.Y. In contrast, Empire Wind 2 will link to Long Island by three parallel cables. (IHS Markit Upstream Costs and Technology's Helge Qvam)

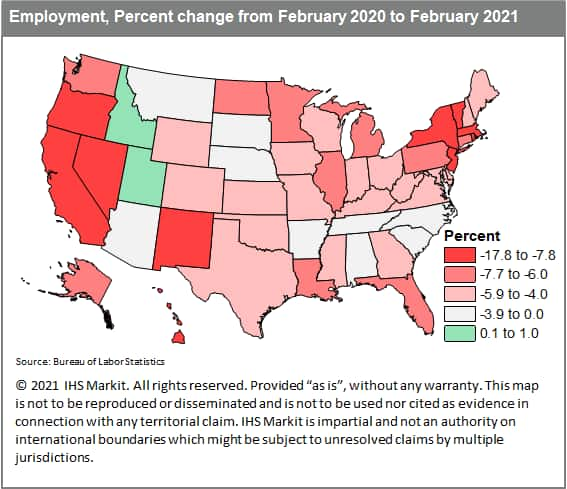

- Total US nonfarm payroll employment increased in 33 states in

February 2021, gaining a net 334,400 jobs from the previous month

on a seasonally adjusted basis, according to the most recent report

from the US Bureau of Labor Statistics (BLS). We now have

employment data for the whole year since the pandemic began in

February 2020. The year-over-year percentage change of total jobs

in February 2021 shows which state economies have fared the best or

worst since the beginning of the pandemic. (IHS Markit Economist

Steven Frable)

- States in the Northeast, specifically New York, New Jersey, Massachusetts, Vermont, Rhode Island, and New Hampshire, suffered the biggest early employment impacts from the coronavirus outbreak and efforts to contain it.

- Tourism- and travel-reliant states like Hawaii and Nevada, and heavily goods-producing midwestern states like Michigan, also sustained heavy blows.

- A good portion of manufacturing jobs have now returned, but businesses dependent upon travel and tourism face a much longer road to recovery.

- States that experienced a more rapid rebound in 2020, such as

those in the South, are also closer to returning to their

pre-pandemic job levels.

- The US Pending Home Sales Index (PHSI) plunged 10.6% in

February to 110.3; the index was down 0.5% from a year earlier.

(IHS Markit Economist Patrick Newport)

- The South saw the largest drop (down 13.0%), followed by the Midwest (down 9.5%), the Northeast (down 9.2%), and the West (down 7.4%).

- Transactions are also down because rising home prices have eroded savings from lower mortgage rates. These headwinds have picked up. The 30-year fixed rate mortgage (Freddie Mac) is up 50 basis points from early January. Housing prices have shot up at unprecedented rates in the last eight months; moreover, with inventory lean in most places, they are likely to continue rising at above-average rates in the coming months.

- Applications to buy homes remain solid but have weakened: the Mortgage Bankers Association's Purchase Index (four-week moving average) is down 8% from early January.

- The US spice processors McCormick, listed on the New York

exchange, reported that its net sales rose by 23% year-on-year to

USD1.48 billion in Q1 (December-February) 2020-21. (IHS Markit Food

and Agricultural Commodities' Jose Gutierrez)

- The operating income rose by 22% to USD236.3 million.

- Consumer sales were the drivers of growth thanks to strong home cooking during the pandemic. They reached USD946.8 million, 32% more y-o-y. The Asia-Pacific region enjoyed 65% growth due to a strong recovery in Chinese consumption after the initial Covid-19 outbreak.

- Flavor segment sales rose by 4% to USD534.7 million.

- Once McCormick has consolidated its FONA and Cholula acquisitions, the company relies on two key points to continue growing: new products and home consumption.

- Aurora has announced a new partnership with Volvo Autonomous Solutions aimed at developing and commercializing Level 4 Class 8 trucks in North America. Aurora announced the arrangement in a blog post, while Volvo Autonomous Solutions posted a press release. The first commercial truck with Volvo will be adapted to the requirements of the Aurora Driver and intended for hub-to-hub service. The two envision the Level 4 autonomous system handling the driving, mostly highway, from hub to hub, with an on-board human driver taking over to drive the vehicles from the hubs, or truck ports, on surface streets to warehouses. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Visteon CEO Sachin Lawande says the supplier is partnering with General Motors (GM) on the automaker's wireless battery management system, speaking to Automotive News this week and echoing a statement from 2020. Lawande said, "A battery management system is a critical element of the battery pack itself. If you do not manage them well, it could cause a fairly significant impact to the health of other electronics and health of the vehicle… [it is] the brains of the entire powertrain of the EV." GM announced the system in 2020. Each set of modules within a pack has a wireless transmitter that communicates wirelessly with the central unit. According to GM, the software was co-developed with software company Analog Devices, while GM led the vehicle integration. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous shuttle startup Optimus Ride has partnered with power sports vehicle manufacturer Polaris to co-develop fully autonomous low-speed vehicles. Polaris GEM electric vehicles (EVs) will be integrated with Optimus Ride's autonomous software and hardware suite and will be launched in the market during the second half of 2023. These vehicles will be deployed on streets in residential communities, corporate and academic campuses, and other local environments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

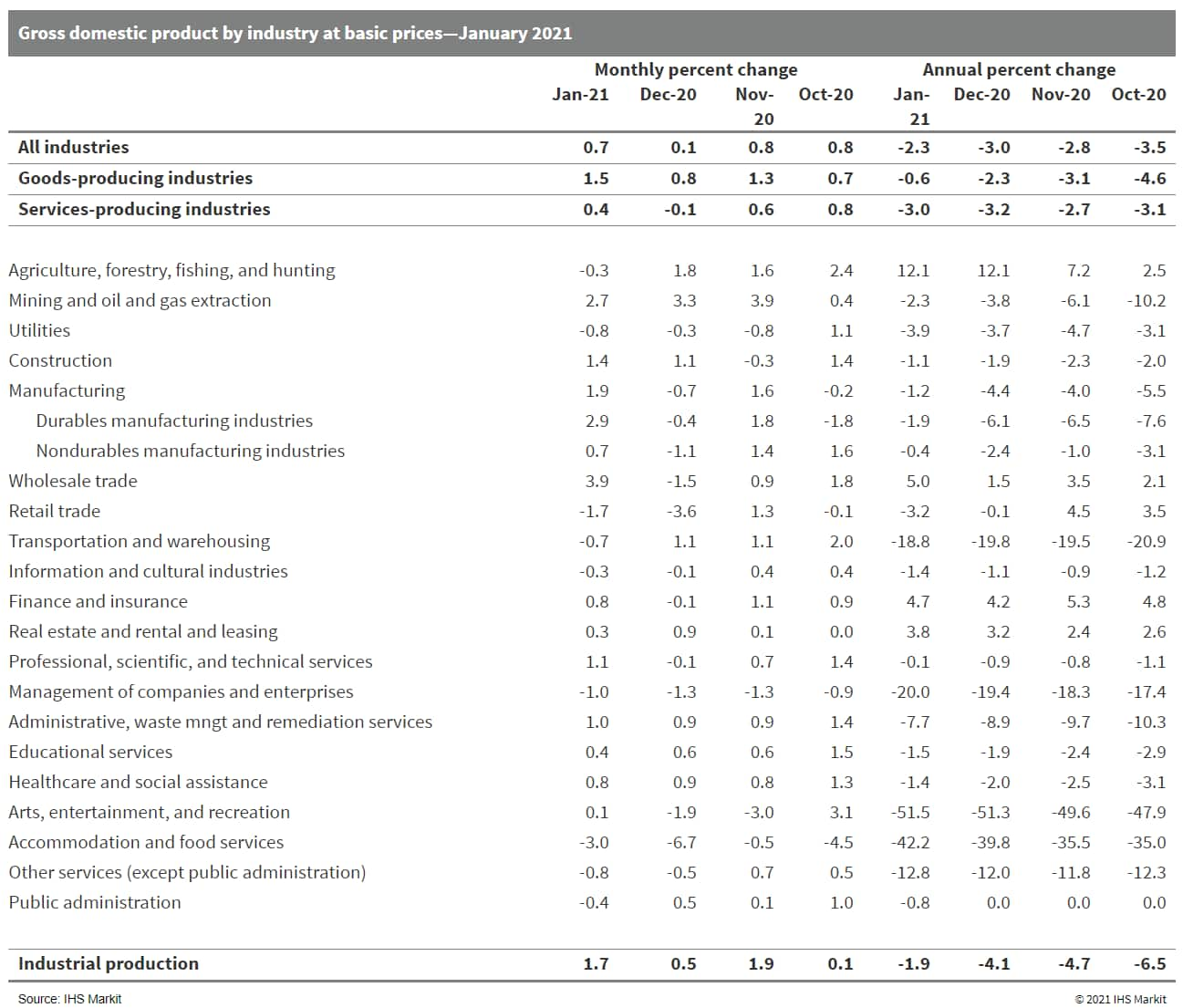

- Canada's real GDP by industry output jumped 0.7% month on month

(m/m) in January, surpassing market expectations and Statistics

Canada's initial estimate. (IHS Markit Economist Arlene Kish)

- Output gains in the goods-producing industries (up 1.5% m/m) led the overall gain as services-producing industry output rebounded (up 0.4% m/m).

- Solid increases in mining and oil and gas extraction as well as manufacturing contributed to the 1.7% m/m jump in industrial production.

- Stronger-than-expected growth coupled with more stimulus

spending previously announced in the upcoming 19 April federal

budget increases the upside risk to this year's growth outlook,

above the 5.6% increase in the March forecast.

- At its 30 March meeting, all members of the Board of the

Central Bank of Chile (Banco Central de Chile: BCC) voted to keep

its monetary policy rate at 0.5% and maintain the use of

unconventional liquidity measures. (IHS Markit Economist Claudia

Wehbe)

- Monthly inflation rose by 0.19% during February, after spiking by 0.7% in January. The most volatile components include gasoline (petrol), fruits, and vegetables. Annual inflation decelerated to 2.85% from 3.12% during January.

- Chile's unadjusted monthly economic activity indicator - a proxy for GDP - dropped for the second consecutive month by 3.1% year on year (y/y) in January, the worst performance since October 2020, owing to the healthcare emergency.

- IHS Markit currently forecasts real GDP growth at close to 5.7% in 2021. The external context remains broadly favorable, thanks to the improved growth outlook for Chile's main trading partners.

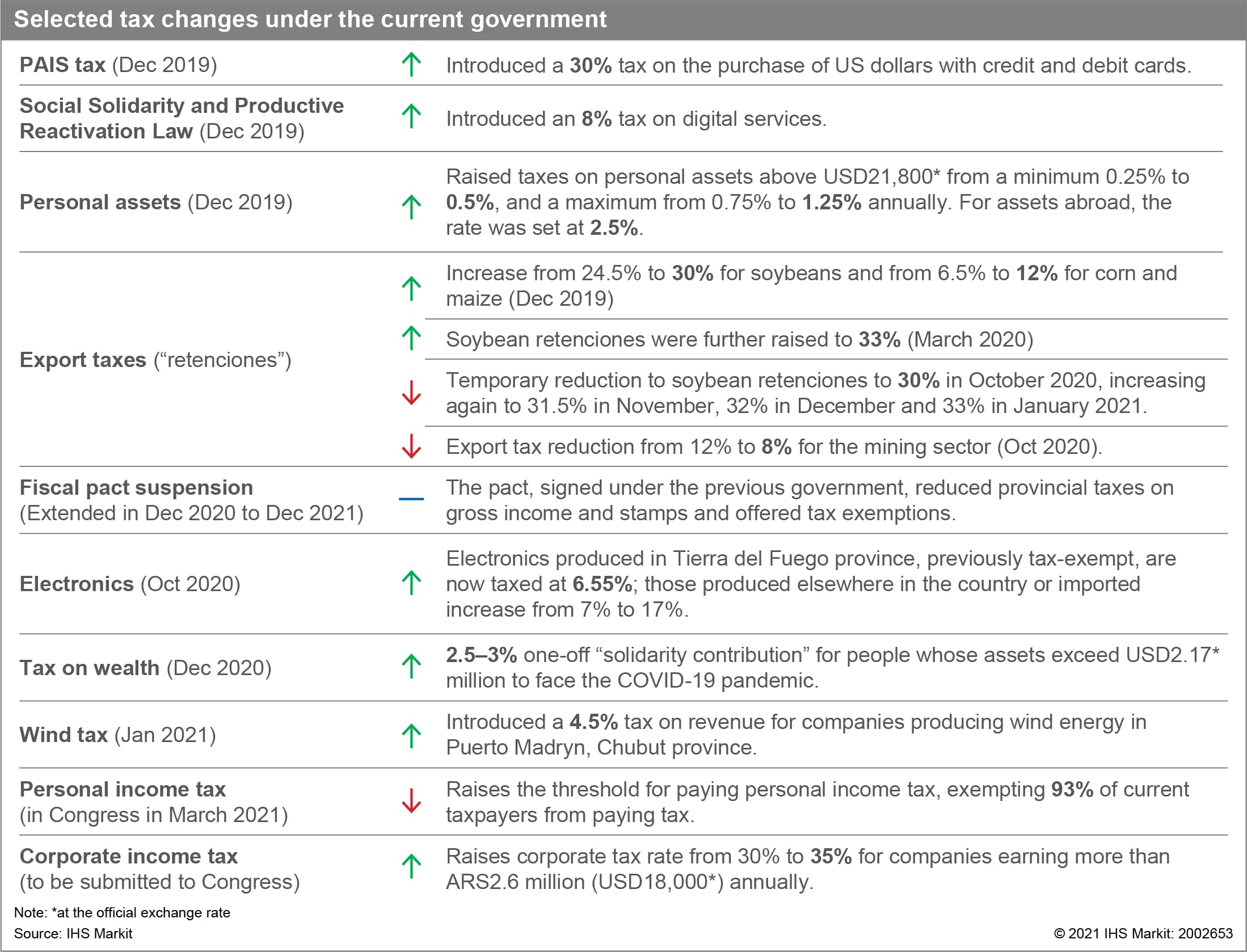

- Argentina's Senate Budget Commission on 30 March approved a

bill to reduce personal income tax by raising its threshold on

those who earn ARS150,000 a month (USD1,600) from ARS74,810. The

bill had already been approved in the lower chamber, and will be

discussed in the Senate plenary in the first week of April, where

it is likely to be approved. To fund this, the government is

seeking to increase corporate taxation. (IHS Markit Country Risk's

Carla Selman)

- Corporate tax increases are likely in 2021. The government estimates that the personal tax reduction would diminish revenue by ARS40 billion in 2022.

- Even with possible amendments, the tax burden will remain high for large companies. The bill, to be submitted to Congress in the coming weeks, has been criticised by the private sector, which claims it will further deter investment in Argentina while hurting small and medium-sized enterprises (SMEs) since the proposed threshold to pay the highest rate is relatively low.

- Tax breaks and incentives for mining and energy are likely to be considered. Despite the planned corporate tax increases, the Argentine government insists that it is keen to attract private investment into key sectors, particularly mining and energy.

- Argentina's fiscal deficit remains high (if below COVID-19-affected levels for 2020), raising the likelihood of more tax increases. IHS Markit forecasts a fiscal deficit of 5.2% of GDP in 2021.

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +0.1%, Germany 0%, Spain -0.2%, France -0.3%, and UK -0.9%.

- 10yr European govt bonds closed mixed; Italy -3bps, France/Spain -2bps, Germany -1bp, and UK +2bps.

- iTraxx-Europe closed -1bp/52bps and iTraxx-Xover -9bps/253bps.

- Brent crude closed -2.2%/$62.74 per barrel.

- Eurozone HICP inflation rose from 0.9% to 1.3% in March according to Eurostat's "flash" estimate, its highest level since January 2020 and matching the market consensus expectation. Energy prices were responsible for the acceleration, with the y/y rate of change jumping by six percentage points to 4.3%, the first positive rate for 14 months and the highest in almost two years. (IHS Markit Economist Ken Wattret)

- Germany's Federal Statistical Office (FSO) has reported, based

on data from various regional states, that the country's national

consumer price index (CPI) increased by 0.5% month on month (m/m)

in March, which matches the average m/m rise expected for seasonal

reasons. The annual inflation rate accelerated from 1.3% in

February to 1.7% last month. (IHS Markit Economist Diego Iscaro)

- Energy prices in NRW increased by 1.6% m/m, pushing up their y/y rate from 1.3% to 5.3%, the second consecutive annual increase.

- Food price inflation decelerated modestly from 1.1% y/y in February to 1.0% y/y, while the increase in the prices of furniture/household goods also eased from 1.9% y/y to 1.4% y/y.

- Germany's largest trade union, IG Metall, has said that it has agreed a 2.3% pay rise in the key industrial region of the Ruhr valley, that will be paid either in full or as part of a switch to a four-day week, according to a Reuters report. The settlement in the Germany's largest industrial region is significant for the automotive industry, as it will set the tone for future wage negotiations with automotive production workers, the majority of which are also IG Metall members. It is difficult to understand how such a generous wage settlement at a time when many companies are under huge financial stress as a result of the pandemic helps with the 'structural challenges of our industries'. The automotive industry in particular faces huge structural challenges and massive cost burdens as a result of the shift to electrification and associated rising R&D costs and uncertainty over the pace of consumer acceptance. IG Metall's leadership and its automotive members are likely to get something of a shock at the pace of change that some senior management figures are increasingly willing to adopt, especially when tens of thousands of jobs engaged in the manufacturing of traditional powertrain components will no longer be needed. (IHS Markit AutoIntelligence's Tim Urquhart)

- On 30 March, the Central Bank of Russia (CBR) recommended banks

to extend loan restructuring for retail and SME borrowers from 1

April until 1 July 2021, as the number of loan restructuring

applications from individuals "is still significant". It stated

that support should be considered in circumstances where a

borrower, or family member, has a confirmed case of COVID-19, or if

their income has declined "to an extent that the borrower is no

longer capable to service the debt". Based on the CBR's survey of

76 credit institutions, 74% of borrowers have been able to resume

scheduled payments after the termination of banks' own loan

restructuring programs and the number of applications is

"continuously decreasing". (IHS Markit Banking Risk's Natasha

McSwiggan)

- According to the CBR, between 20 March 2020 and 24 February 2021, banks received 3.36 million applications to restructure loans, and approved almost 60% of applications, amounting to RUB895 billion (USD11.85 billion). Approved loans amount to around 12% of total sector loans.

- The corporate segment accounted for 97% of approved loans, with around RUB550 billion originating from large companies, 40% of which are "financially vulnerable".

- The CBR has highlighted that corporations in the real estate and construction sector, oil and gas industry and metallurgy segments account for two-thirds of total restructuring involving large companies. It has also identified 30% of restructured loans to individuals and SMEs as at risk of "potentially" going into default.

- Coca-Cola Co may sell its African bottling operation. Coke owns 66.5% of Coca-Cola Beverages Africa, having taken the majority stake in 2016 when it bought Anheuser-Busch's shareholding for USD3.15 billion, and, according to Bloomberg, is considering options for its disposal. This could take the form of an outright sale or an Initial Public Offering (IPO). Bloomberg says that the company is talking with potential advisers about its exit options. A sale or IPO of the stake could value the African business at about USD6 billion, depending on the level of buyer interest. Coca-Cola initially tried to dispose of the stake in 2017, drawing interest from Heineken NV and Coca-Cola HBC AG. Coca-Cola Beverages Africa business serves 13 countries, including Kenya, Ethiopia and Ghana, and accounts for about 40% of the Atlanta-based parent company's drinks sold on the continent. Coca-Cola concluded a deal earlier this year to increase local shareholding in its South Africa bottling unit. (IHS Markit Food and Agricultural Commodities' Neil Murray)

Asia-Pacific

- Most APAC equity markets closed lower except for Australia +0.8%; South Korea -0.3%, Mainland China -0.4%, Hong Kong -0.7%, Japan -0.9%, and India -1.3%.

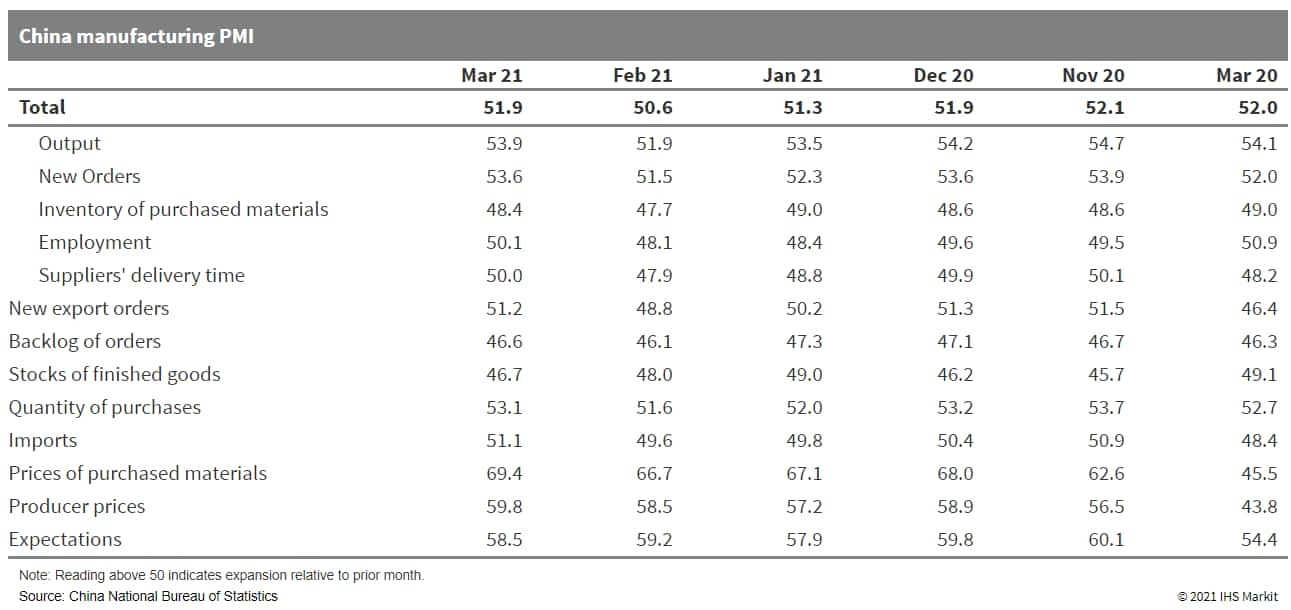

- China's official manufacturing Purchasing Managers' Index (PMI)

rebounded to 51.9 in March, ending the trend of consecutive

declines since December 2020. (IHS Markit Economist Yating Xu)

- The headline PMI and the reading for most of the sub-indexes remained below end-2020 levels.

- By sector, high-tech and equipment manufacturing continued to

record above-headline PMIs and their employment sub-index rose to

expansion territory. Petroleum processing, chemical and plastic,

general-purpose equipment and special-purchase equipment

manufacturing suffered most from the material price rise.

- Xiaomi Corporation, a leading Chinese consumer electronics company, has confirmed previous media reports regarding its plan to launch an electric vehicle (EV) business. According to a company statement issued in the name of Xiaomi CEO Lei Jun, Xiaomi will set up a wholly owned subsidiary to manage its smart EV business. The company plans to spend CNY10 billion (USD1.5 billion) in the initial phase of the development and has committed to a total investment of USD10 billion over the course of the next 10 years to support its EV business. Lei will serve as CEO of Xiaomi's smart EV subsidiary. According to Bloomberg, Xiaomi will finance its EV projects on its own to have full control of the EV business. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Great Wall Motor plans to roll out its first hydrogen-powered sport utility vehicle (SUV) this year. The company also plans to deploy its hydrogen-powered vehicle fleet during the Winter Olympics in China in 2022, reports Bloomberg, citing Zhang Tianyu, head of FTXT Energy Technology, a Great Wall subsidiary specializing in development of hydrogen fuel-cell systems. Great Wall has invested CNY2 billion (USD305 million) over the past five years to develop hydrogen power-related technologies to be used in vehicles, as well as marine and rail transport, according to Zhang. Great Wall chairman Wei Jianjun says the company plans to invest another CNY3 billion over the next three years in hydrogen-related vehicle technologies and plans to become a top-three seller of hydrogen-powered vehicles by 2025. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japanese automaker Toyota will form a joint venture (JV) with Chinese fuel-cell manufacturer Beijing SinoHytec to manufacture systems for fuel-cell vehicles. The two companies signed a contract on 30 March to set up the 50-50 venture, Toyota Sinohytec Fuel Cell, with a total investment of about JPY8 billion (USD72.5 million), reports Kyodo News. (IHS Markit AutoIntelligence's Abby Chun Tu)

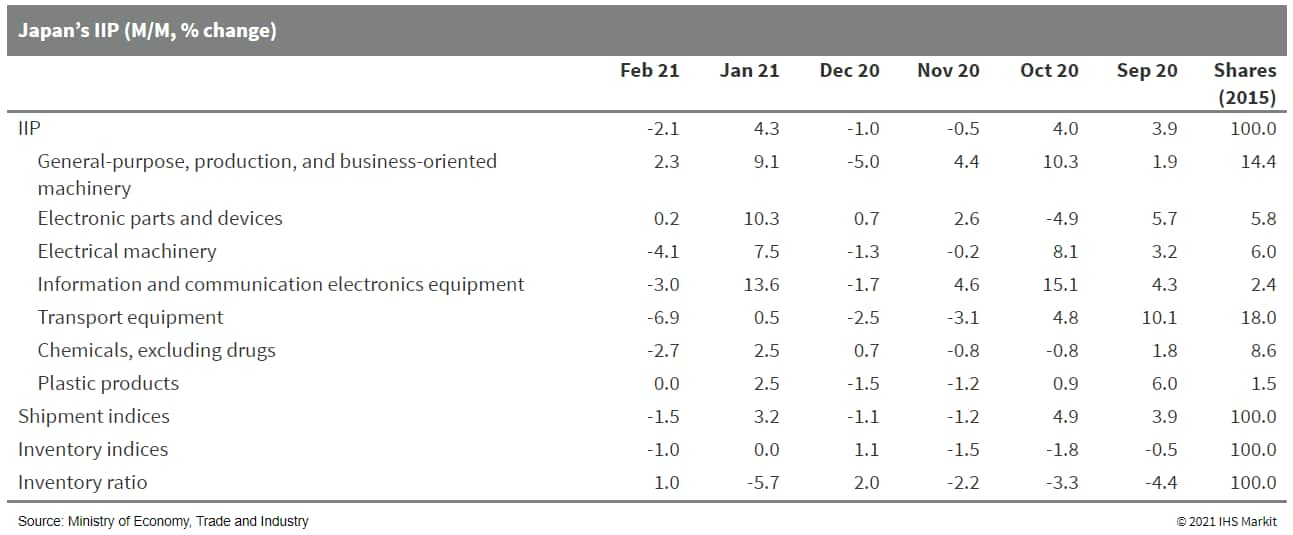

- Japan's index of industrial production (IIP) fell by 2.1% month

on month (m/m) in February following a 4.3% m/m rise in January.

Manufacturers' shipments also decreased by 1.5% m/m, while

inventories contracted by 1.0% m/m. The sharper decline in

shipments relative to inventory prompted the index of inventory

ratio to increase by 1.0% m/m. (IHS Markit Economist Harumi

Taguchi)

- The contractions were mainly due to an 8.8% m/m fall in production of autos, reflecting supply chain disruptions caused by semiconductor shortages and the 13 February earthquake.

- The decline in shipments was also due largely to a 7.7% m/m

drop in shipments of autos.

- SK IE Technology, a material business subsidiary of South Korean petroleum firm, SK Innovation, has announced that it is investing KRW1.13 trillion (around USD1 billion) to build two electric vehicle (EV) battery separator plants in Silesia (Poland), according to a company statement. This investment will be used to build plants 3 and 4. These two plants will have an annual production capacity of 430 million square meters each. Accordingly, SK IE Technology will be able to produce 1.54 billion square meters of separators in total per year in Poland by combining the production capacity of 680 million square meters of the existing plants 1 and 2. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--march-31-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--march-31-2021.html&text=Daily+Global+Market+Summary+-+March+31%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--march-31-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - March 31, 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--march-31-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+March+31%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--march-31-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}