Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 30, 2021

Macro indicators and sector exposures

Research Signals - March 2021

A year ago 16 March, US equity markets had one of the worst single-day sell-offs on record, with major indexes recording double-digit declines, as stocks headed to the 23 March pandemic low. Since that time, markets have risen dramatically, supported by near-zero interest rates and the expansion of the Federal Reserve's balance sheet coupled with two rounds of federal stimulus payments, with fresh highs continuing to be recorded as investors look forward to the post-COVID economic recovery. With this in mind, we review thematic trends and sector exposures in light of the current macro-economic setting.

- The recent record issuance level of SPACs suggests heightened speculation and froth in the market

- ETF trends confirm a rotation into small cap and value stocks as large cap and growth stocks are shunned

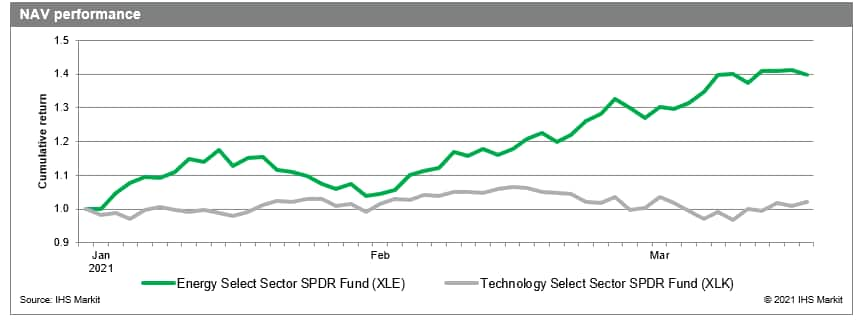

- Energy stocks have been supported by a tailwind of decreasing short interest, higher oil prices and increasing sector ETF flows, though are at higher risk to rising interest rates from a leverage perspective

- The Technology sector was the beneficiary of the pandemic driven economic downturn in 2020, but has given up ground this year as the shares lose favor from retail investors and short sellers

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmacro-indicators-and-sector-exposures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmacro-indicators-and-sector-exposures.html&text=Macro+indicators+and+sector+exposures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmacro-indicators-and-sector-exposures.html","enabled":true},{"name":"email","url":"?subject=Macro indicators and sector exposures | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmacro-indicators-and-sector-exposures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Macro+indicators+and+sector+exposures+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmacro-indicators-and-sector-exposures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}