Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2021

Daily Global Market Summary - 04 June 2021

This morning's slightly weaker than expected US nonfarm employment report tempered some inflationary concerns and triggered a sharp rally across equities, credit, government bonds, and commodities. All major US and most European equity indices closed higher, while APAC markets were mixed. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar closed lower, while gold, silver, copper, natural gas, and oil were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Nonfarm payroll employment rose 559,000 in May, less of an

increase than both the Bloomberg consensus and IHS Markit had

anticipated. Meanwhile, the unemployment rate declined 0.3

percentage point to 5.8%, generally in line with expectations. (IHS

Markit Economists Ben

Herzon and Michael

Konidaris)

a. The decline in the unemployment rate reflected an increase in

civilian employment as well as a small decline in labor-force

participation. We anticipate steady increases in labor-force

participation in the months ahead, reflecting firming optimism on

the part of households and a rising comfort level associated with

re-engaging in the workforce, as vaccination becomes widely

available.

b. Average hourly earnings (AHE) rose 0.5%, well above

expectations, following a 0.7% increase in April. As lower-wage

jobs that were lost to the pandemic come back, their rising

prevalence puts downward pressure on average wages. The unexpected

strength in AHE against this backdrop is all the more

impressive.

c. The average workweek was flat in May, consistent with our

estimate and following a flat reading in April that was revised

down from a previously reported increase. As shorter-workweek jobs

come back, this puts downward pressure on the average workweek.

d. With respect to aggregate private wages and salaries, the

unexpected weakness in job gains was essentially offset by the

unexpected strength in AHE, implying no material revision to our

estimate for May private wages and salaries.

2. All major US equity indices closed higher; Nasdaq +1.5%, S&P

500 +0.9%, DJIA +0.5%, and Russell 2000 +0.3%.

3. 10yr US govt bonds closed -8bps/1.55% yield and 30yr bonds

-6bps/2.24% yield.

4. CDX-NAIG closed -1bp/50bps and CDX-NAHY -5bps/283bps, which is

-1bp and -4bps week-over-week, respectively.

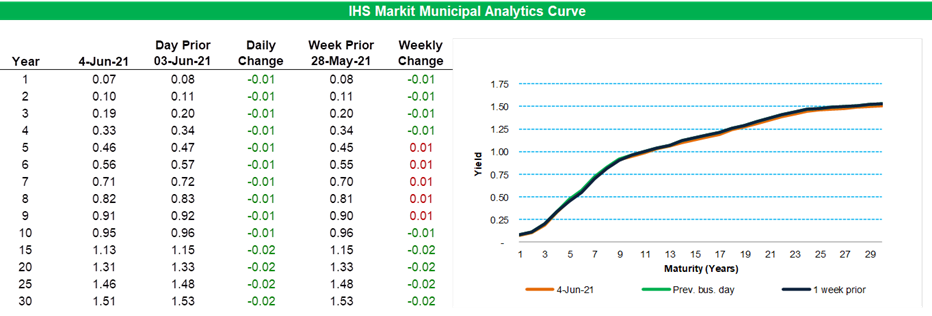

5. IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

rallied 1bps across 1-10 year maturities and 2bps for 15yr and

greater maturities.

6. DXY US dollar index closed -0.4%/90.14. The US dollar declined

0.5% after the release of the US nonfarm payroll report.

7. Gold closed +1.0%/$1,892 per troy oz, silver +1.5%/$27.90 per

troy oz, and copper +1.5%/$4.53 per pound.

8. Crude oil closed +1.2%/$69.62 per barrel and natural gas closed

+1.8%/$3.10 per mmbtu.

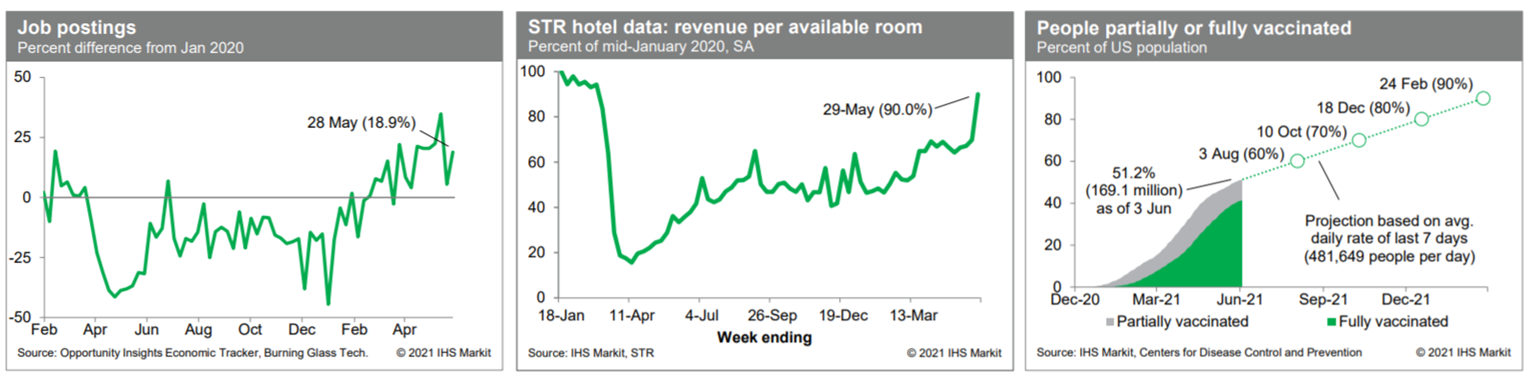

9. Job postings rose last week to 18.9% above the January 2020

level, according to the Opportunity Insights Economic Tracker.

These data are volatile and prone to large weekly moves; the

firming trend that has been in place since early January remains

intact, suggesting a fundamental improvement in labor demand.

Meanwhile, revenue per available room at US hotels last week

(adjusted for seasonal variation) jumped to 90.0% of the

mid-January 2020 level, according to our estimate based on data

from STR. The abrupt rise in the latest weekly data reflected a

boost from the Friday and Saturday of Memorial Day weekend, so it

is too soon to tell if this indicates significant and sustained

progress toward pre-COVID-19 norms in the hotel industry. Over the

week ending yesterday, an average of about 482,000 people per day

received a first (or only) dose of a COVID-19 vaccination, well

below the prior week's pace of 792,000 per day, bringing the total

number of US residents either partially or fully vaccinated to

169.1 million (about 51.2% of the population). At the current rate,

the US would achieve widespread vaccination (70-80% of the

population) in the fourth quarter of this year. (IHS Markit

Economists Ben

Herzon and Joel

Prakken)

10. US manufacturers' orders declined 0.6% in April, while

shipments rose 0.4% and inventories rose 0.3%. Orders and shipments

of core capital goods (nondefense, ex. aircraft) were little

revised through April. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

a. Despite the decline in April, orders remain above their

pre-pandemic trend. Meanwhile, the increase in April shipments puts

this series well above its pre-pandemic trend.

b. The performance in the manufacturing sector has been robust

though supply-chain issues pose a downside risk in the coming

months.

c. The goods sector of the US economy has been boosted by surging

demand for consumer goods as a stand-in for services forgone due to

the pandemic. Supply-chain issues likely reflect the possibility

that manufacturers simply did not plan for this type of demand.

d. Another source of strength in the goods sector is capital

equipment, as businesses get back on track with capital expansion

plans that were put on hold (or otherwise disrupted) during the

pandemic.

e. We look for equipment spending to rise at a 7.8% annual rate in

the second quarter on the heels of robust growth in the prior

quarter that has left the level of equipment spending well above

the pre-pandemic trend.

11. General Motors (GM) has updated its outlook on the impact of

the semiconductor shortage in the United States, according to a

company announcement yesterday (3 June). The automaker's revised

outlook incorporates improved efficiencies at a pick-up plant to

increase output, as well as plans to test and deliver units of

certain vehicles it has held back. GM now expects the company's

performance in the first half of 2021 to be better than the company

predicted when it reported its first-quarter results. However, the

automaker did not provide details of how much better it expects its

performance to be. (IHS Markit AutoIntelligence's Stephanie

Brinley)

12. Waymo has partnered with Google Maps to allow users to book its

fully autonomous ride-hailing service through an app in Phoenix

(Arizona, US). The service, called Waymo One, will be added in the

"ride-sharing and transit" tabs of the Waymo app, reports Reuters.

Waymo is at the forefront of automated transportation development

and has conducted 20 million miles of autonomous vehicle (AV)

testing on public roads in 25 cities and more than 10 billion miles

of simulation. The company launched its fully autonomous

ride-hailing service to the public in Phoenix and has begun a

driverless ride-hailing service with limited rider testing with its

employees in San Francisco. Last year, it announced that a new

funding round raised USD750 million, bringing its total external

funding to USD3 billion. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

13. The Financial Stability Board of global regulators issued a 2

June statement on a "smooth and timely transition away from LIBOR".

The report acknowledges that key US dollar LIBOR rates will

continue to be provided until mid-2023, but reiterated past

statements by US domestic regulators that the creation of new

contracts using dollar LIBOR as a reference rate after end-2021

would "create safety and soundness risks". It warned more widely

that continued reliance on LIBOR in financial markets "poses clear

risks to global financial stability". Given the widespread global

use of US Dollar LIBOR, it sought to reiterate the prior message of

US domestic supervisors on a broader global basis , stressing the

need to avoid creation of new LIBOR-based contracts rapidly and no

later than end-2021. The statement was accompanied by a roadmap

summarizing the migration plans to new safe rates in major global

jurisdictions, warning companies of their responsibilities and the

pending deadlines ahead. (IHS Markit Country Risk's Brian

Lawson)

14. After the plunge in the previous month, the Canadian Ivey

Purchasing Managers' Index (PMI) increased 4.1 points to 64.7 in

May. (IHS Markit Economist Chul-Woo

Hong)

a. The employment index was the biggest mover, up 9.0 points,

followed by the inventories index (up 5.9 points).

b. The supplier deliveries index and the prices index fell 3.0

points and 1.4 points, respectively.

c. Given the modest business spending activities, real GDP output

growth will modestly advance in the coming months after the

expected decline in April.

15. Disappointingly, Canada's net employment declined by 68,000

positions in May, as Alberta, Manitoba, and Nova Scotia

reintroduced lockdown measures. (IHS Markit Economist Arlene

Kish)

a. Job losses in the private sector were greater than the losses in

the public sector. Self-employment gained marginally. Based on the

businesses impacted by the lockdowns, jobs losses in part-time

employment easily exceeded those in full-time employment. However,

the net job reduction in goods-producing industries was more than

double that in services.

b. Additional losses in the labor force pulled the participation

rate down 0.3 percentage point to 64.6% and the unemployment rate

jumped 0.1 percentage point to 8.2%, with the only upward

adjustment to the adult men's unemployment rate.

c. Total average hourly wages were down from the previous month and

extended the loss from a year earlier, but at a slower -1.6%

pace.

d. Total hours worked managed to remain relatively steady with a

small 0.1% upward bump throughout the month.

e. May's labor market slump further exacerbates Canada's economic

and employment slack problem. The Bank of Canada's monetary policy

response will be to sit and wait until there is marked improvement

in the reduction in excess capacity, inflation hits 2% sustainably,

and there is an upturn in labor force measures.

16. Brazilian beef giant Marfrig has added to its stake in rival

meat processor BRF - taking its overall share of the company's

share capital to 31.66%. In an announcement on Thursday (3 June),

Marfrig said it has now purchased more than 257 million common

shares in BRF. The group announced in mid-May that it had acquired

a 24% stake in BRF. The latest share purchases take its stake

closer to the 33.33% threshold which, under BRF bylaws, would

require it to make a tender offer for all remaining shares. Marfrig

said it does not plan to elect members to BRF's board of directors

nor exert influence over the company's activities. The company also

insisted it has not entered into any contracts or agreements to

regulate voting rights, adding that its intention is to diversify

Marfrig investments in a segment that complements its own sector of

activity. (IHS Markit Food and Agricultural Commodities' Ana

Andrade)

17. Argentina's light-vehicle sales grew modestly year on year

(y/y) in May, increasing 4.7%, but declined 32% month on month. In

the year to date (YTD), Argentina's light-vehicle market has

improved 46.7% compared with the pandemic-struck corresponding

period last year. Latin America continues to struggle with the

COVID-19 pandemic, although restrictions in 2021 have not been as

severe as they were in 2020. However, light-vehicle sales in May

were hampered by fewer selling days because of restrictions over

increasing COVID-19 infection rates, and y/y growth was modest

despite comparison with results in a month of 2020 when there were

more restrictions. Light-vehicle sales in May were lower than in

April, and sales in April were lower than in March, so volumes are

trending in the wrong direction. However, there is an expectation

of better sales in the second half. IHS Markit forecasts a

light-vehicle sales increase of 15.8% to just less than 375,000

units in full-year 2021, after Argentina's light-vehicle sales

dropped by 27.2% in 2020. Argentina had been in recession prior to

the pandemic, and the improvement in 2021 barely begins to bring

the market to a healthy state. (IHS Markit AutoIntelligence's Stephanie

Brinley)

Europe/Middle East/Africa

1. Most major European equity indices closed higher except for

Spain -0.6%; Italy +0.5%, Germany +0.4%, France +0.1%, and UK

+0.1%.

2. 10yr European govt bonds closed higher on the weaker than

expected US employment report; UK -5bps, Germany -3bps,

France/Italy -2bps, and Spain -1bp.

3. iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -3bps/244bps,

which is -1bp and -2bps week-over-week, respectively.

4. Brent crude closed +0.8%/$71.89 per barrel.

5. BP's Lightsource bp joint venture continued to pick up

acquisitions in the decarbonizing US and European markets over the

last week or so. The venture with UK-based Lightsource is active in

at least 13 countries, compared with five in 2017 when the two

first teamed up. (IHS Markit Climate and Sustainability News'

Cristina Brooks)

a. In Portugal, Lightsource bp will acquire five solar projects to

add over 1.35 GW of renewable power capacity to its portfolio,

according to a 28 May statement. The Portuguese solar farms will

not only serve corporate buyers but will count towards the

government's aim of reaching a 47% renewable share of national

energy consumption by 2030. The target was outlined to EU

authorities in the country's 2019 National Energy and Climate

Plan.

b. The major has 2 GW under development in Spain, and its Madrid

affiliate participated in a Spanish government PV auction in March,

gaining a 5-MW project. Elsewhere in Europe, a partnership of

Lightsource bp and Greek construction company Kiefer TEK succeeded

with bids into a government PV auction on 24 May. The partners won

over 40% of the 350 MW awarded at the auction.

c. BP's biggest transaction came with the acquisition of 9 GW of

solar projects across 12 US states announced on 1 June. Under the

agreement with independent US solar developer 7X Energy, around 2.2

GW of the projects will reach final investment decision in 2025,

and the rest will reach that stage by 2030. Texas-based 7X Energy

develops utility-scale solar for large corporations, utilities,

municipalities, and electric cooperatives.

6. Insurance company Aviva plc has entered a five-year partnership

with research and development company Darwin Innovation Group to

trial autonomous vehicles (AVs) in the UK. Darwin will trial an

autonomous shuttle at the Harwell Science and Innovation Campus in

Oxfordshire and has mapped the area, giving the vehicle all the

information, it needs to navigate. The shuttle, which is

manufactured by Navya, is controlled by 5G and satellite

connectivity and has Level 4 autonomy. These features allow the

shuttle to pick passengers up, transport them around the campus and

drop them off at their destination, without a human operator. A

second shuttle is expected to be added in the second year of

operation. These trials will allow Aviva to build its first

comprehensive insurance model for the autonomous shuttle, which

will evolve as the trial progresses. (IHS Markit Automotive

Mobility's Surabhi Rajpal)

7. European pig prices have risen once again over the past week,

driven primarily by tight supplies of slaughter-ready pigs in a

number of regions. But prices may be set to plateau over the coming

weeks, with processors claiming that demand is not strong enough to

justify prices at their current elevated levels. For the first time

in over a year, the EU average pig price is now above the level of

the year before, having gained almost 30% since the start of 2021.

However, there is growing concern about marketing prospects for

pigmeat over the coming months. The continuing restrictions on

travel and tourism are making it highly unlikely that southern

Europe will see the demand boost which is usually evident during

the summer months, while demand is also continuing to be sluggish

in northern European countries. Market analysts are reporting that

Spain, which has been exporting record volumes of pigmeat to China

over the past year, is now facing a slowdown in its Asian export

trade, in the face of cheaper competition from countries such as

Brazil. If this materializes, Spain will inevitably divert growing

quantities of its own pigmeat to the EU internal market, which

would be certain to dampen prices. (IHS Markit Food and

Agricultural Commodities' Chris Horseman)

8. Renault Group has announced that it has reached an agreement

with US-based Plug Power on a new hydrogen commercial vehicle joint

venture (JV). According to a statement, HYVIA will be jointly owned

by the two partners and plans to offer "turnkey hydrogen mobility

solutions". This will include light commercial vehicles (LCVs) with

fuel cells, hydrogen charging stations, supply of carbon-free

hydrogen, maintenance, and fleet management. The JV will be based

out of four sites in France. Villiers-Saint-Frédéric will be its

headquarters and will also undertake research and development

(R&D) alongside Renault Group's traditional LCVs. (IHS Markit

AutoIntelligence's Ian Fletcher)

9. Saipem has signed an agreement with Naval Group's subsidiary

Naval Energies to acquire the latter's floating wind business. The

agreement will comprise the acquisition of Naval Energies'

engineering know-how on floating units, intellectual property

rights, and approximately 30 resources with expertise in modelling

and simulation. Naval Energies has more than 10 years of experience

in floating offshore wind and has developed a semi-submersible

floater concept. The transaction will be complete when

administrative authorizations have been received. Saipem has

further informed that, with this acquisition, it is positioned for

the award of the French Groix & Belle-Île offshore wind farm

project developed by EOLFI. (IHS Markit Upstream Costs and

Technology's Sophie Dear)

10. Vestas has entered into an agreement to sell its tower

manufacturing facility in Pueblo, Colorado to South Korean firm CS

Wind for USD150 million. The deal will see CS Wind acquire the full

100 percent stake in the Danish wind turbine manufacturer's

specialized tower manufacturing facility, along with a 5-year

contract to supply wind turbine towers manufactured at that

facility to Vestas from July 2021 to June 2026. This part of the

deal is reportedly worth USD1.35 billion. CS Wind intends to ramp

up sales to its other customers, including GE, and its biggest

customers, Siemens, and Nordex-Acciona. CS wind currently produces

towers for the US market at its Malaysian plant, with exports

amounting to USD155 million in 2020. (IHS Markit Upstream Costs and

Technology's Monish Thakkar)

11. Vestas will produce 99 out of the 114 units of V164 wind

turbine blade sets domestically for the 1,075MW Seagreen offshore

wind project in the United Kingdom. The 297 individuals

80-meter-long blades will be completed by the end of 2022.

Commercial operation is targeted for 2022/23. Seagreen offshore

wind farm is located 27 kilometers off the coast of Scotland in the

North sea's Firth of Forth. The project is developed by SSE

Renewables and Total Energies and will feature 114 Vestas V164-10MW

offshore wind turbines in the first phase. (IHS Markit Upstream

Costs and Technology's Monish Thakkar)

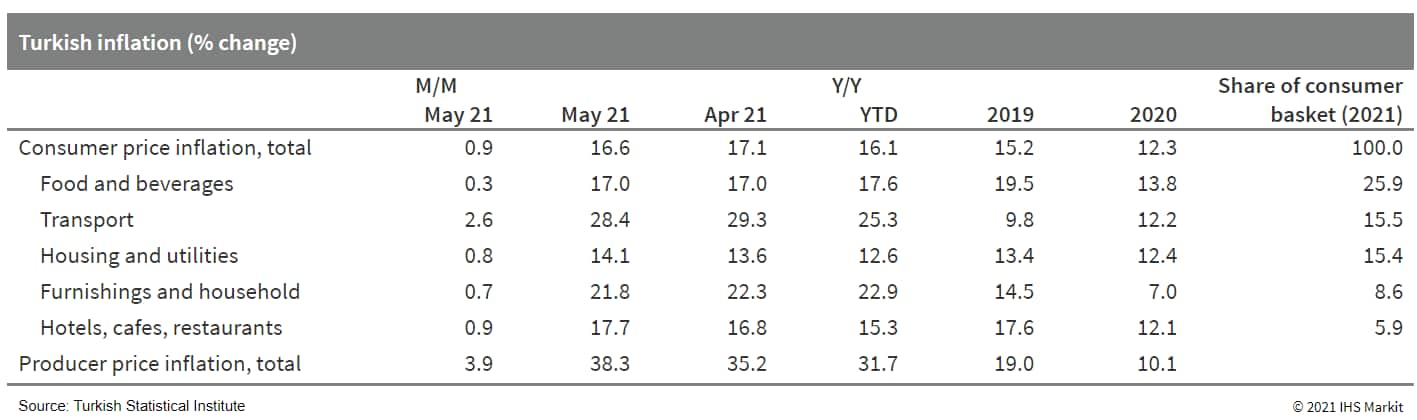

12. The Turkish Statistical Institute (TurkStat) reported annual

consumer price inflation of 16.6% as of May 2021, easing from its

peak the previous month of 17.1%. The rolling, 12-month average

annual inflation rate stood at 14.1%, two percentage points higher

than it had been a year earlier. (IHS Markit Economist Andrew

Birch)

a. Consumer prices rose by 0.9% over the course of May. High energy

prices contributed to a 2.6% month-on-month (m/m) increase in

transportation costs. Clothing and footwear prices also drove

inflation forward, rising by 1.8% m/m in May. On the other hand,

after surging forward in late 2020, food price grew more modestly

in May, up only 0.3% m/m.

b. While annual consumer price inflation relented in May, annual

producer price inflation continued to soar, reaching 38.3%, up by

more than three percentage points from just the previous month and

well above the 5.5% rate a year earlier. Energy prices surged in

May, fueling the further acceleration of producer price

inflation.

13. The monetary policy committee (MPC) of the Central Bank of

Mauritania's meeting on 28 May analyzed the development of economic

conditions highlighting that the economy continues to recover led

by strong growth in iron production as well as a recovery in the

service and telecommunications sector. Nevertheless, the MPC

pointed out that the recovery is still suffering from the lingering

aftermath of the COVID-19 virus pandemic. (IHS Markit Economist

Alisa Strobel)

a. The MPC decided to maintain the central bank's key interest rate

in May 2021. The last time the rate was cut was on 24 March 2020,

from 6.5% to 5%. However, monetary policy was tightened back in

December in response to high liquidity. On the money market, the

easing of rates continued through the first quarter of 2021. For

central bank liquidity recovery operations, the weighted average

rate stood at 0.4% in the first quarter of 2021 compared to 2.2% in

the fourth quarter of 2020.

b. The monthly weighted average rate of Treasury bills reached

2.46% in March 2021, down from 2.97% in December 2020. The

interbank rate remained mostly stable, standing at 5.6% in the

first quarter of 2021 compared to 5.5% in the fourth quarter of

2020.

Asia-Pacific

1. APAC equity markets closed mixed; Australia +0.5%, Mainland

China +0.2%, Hong Kong/South Korea -0.2%, India -0.3%, and Japan

-0.4%.

2. China's domestic prices for pork and other meats weakened in

May, running counter to the upward trend prevailing in many other

parts of the world. The UN Food and Agriculture Organization's

(FAO) meat price index registered its eighth consecutive monthly

increase to reach 105 points in May. This was 2.2% up on the

previous month and 10% higher than this time last year. In

contrast, prices of pork, beef, chicken and sheepmeat have all

decreased in China over the past four weeks. Demand for pork is

experiencing a seasonal dip, while supplies have been lifted by a

rise in the number of animals sent to slaughter and a steady

increase in import volumes. Wholesale pork prices fell for the 18th

straight week to stand at CNY24.71 per kg (USD3.86 per kg) in the

final week of May, according to data from the Chinese Commerce

Ministry. Wholesale prices are now 35% down on year-ago levels,

while retail prices have fallen by 26% y/y. Live pig prices also

fell again in the final week of May to average CNY19 per kg, down

36.3% y/y, according to Agriculture Ministry figures. (IHS Markit

Food and Agricultural Commodities' Max Green)

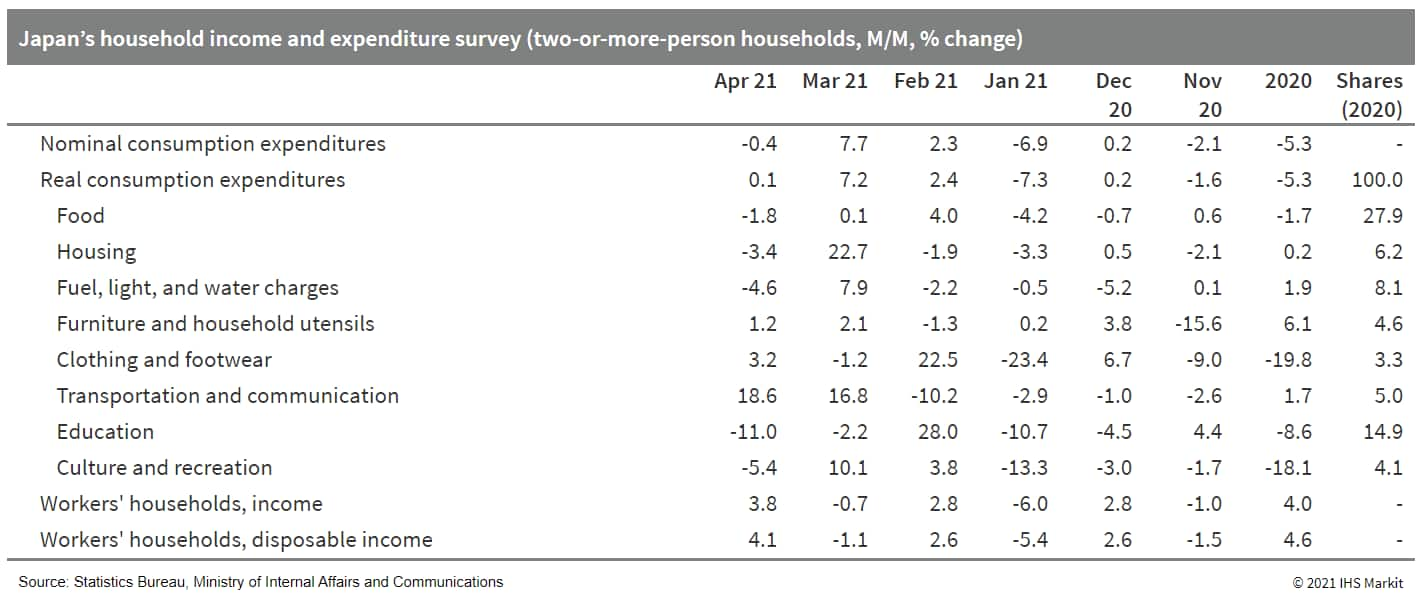

3. Japan's real household expenditures rose by 0.1% month on month

(m/m) in April for the third consecutive month of growth. Low base

effects lifted year-on-year (y/y) growth to a 13.0% rise from a

6.2% drop in March. (IHS Markit Economist Harumi

Taguchi)

a. Although retail sales declined sharply in April, the resilient

m/m figures largely reflected solid increases in spending for

transportation and communication, such as purchases of autos as

well as commuter rail passes in tandem with the beginning of new

fiscal/school year. Spending on clothing and footwear and furniture

and household utensils also increased, but this was largely offset

by declines in spending for other groupings, particularly for

culture and recreation and education.

b. Although the April figures are stronger than IHS Markit

expected, the extension of the state of emergency in many

prefectures to 20 June is likely to weigh on household

expenditures. We expect consumer spending to continue to decline in

the second quarter.

4. Daewoo E&C has been awarded a contract by Yeongwol Ecowind

to construct an onshore wind power complex to be built in

Sangdong-eup, Yeongwol-gun, Gangwon-do in South Korea. The 46.2MW

wind farm is scheduled to be carried out by 2023. The contract

awarded to Daewoo E&C is valued at around USD82 million (KRW92

billion). Daewoo E&C is targeting the onshore and offshore wind

market as a key part of its energy transition strategy. This

contract represents a crucial stepping stone in helping the Korean

contractor to increase its experience in wind power construction

with the goal of winning larger contracts in the future. (IHS

Markit Upstream Costs and Technology's William Cunningham)

5. Hyundai and Kia together sold 75,336 alternative-powertrain

vehicles, including electric vehicles (EVs), fuel-cell electric

vehicles (FCEVs), and hybrid vehicles, in South Korea during

January-May, up by 42.0% year on year (y/y), reports the Business

Korea Daily News. By type, they sold 54,560 hybrid vehicles (up

35.6% y/y) during the period; 17,111 EVs (up 62.2% y/y), and 3,665

FCEVs (up 59.7% y/y). The strong growth came on the back of

positive demand for new models, as well as favorable policies and

infrastructure initiatives by the South Korean government. (IHS

Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-04-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-04-june-2021.html&text=Daily+Global+Market+Summary+-+04+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-04-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 04 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-04-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+04+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-04-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}