Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2020

Daily Global Market Summary - 10 July 2020

US and European equity markets closed higher, while APAC markets were down across most of the region. Longer maturity US government bonds rallied ahead of the NY open to a low in yields last seen in late-April when the re-openings began, but sold off after the open to end the day modestly weaker. Credit indices were slightly tighter across IG and high yield, and oil also closed higher.

Americas

- US equity markets closed higher today; Russell 2000 +1.7%, DJIA +1.4%, S&P +1.1%, and Nasdaq +0.7%.

- 10yr US govt bonds closed +3bps/0.64% yield and 30yr bonds closed +3bps/1.34% yield. 30yr bond yields rapidly approached the lowest point since late-April (beginning of the re-openings) this week, with today's low yield of 1.25% at 8:30am EST being -22bps from Monday's (6 July) highest yield.

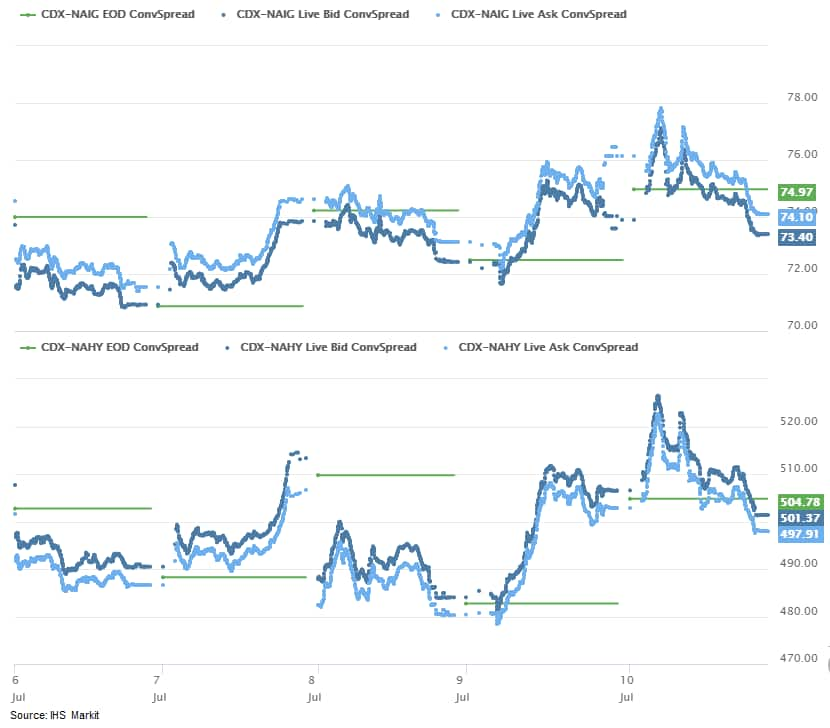

- CDX-NAIG closed -1bp/74bps and CDX-NAHY -5bps/500bps and are

flat and -3bps on the week, respectively.

- Crude oil closed +2.3%/$40.55 per barrel.

- Corporate venturing continues as a strong source of oil company

innovation. Oil and gas corporate venture capital groups

participated in 83 rounds of startup funding during 2019. This

level of investment activity is comparable to that in 2018,

solidifying the arrival of a robust technology development

ecosystem that supports entrepreneurs and strategic and financial

investors seeking to incubate early-stage innovation for the energy

industry. Oil and gas corporate venture activity is enabling the

energy transition. In 2019, 67% of investment activity funded

startups developing clean energy technology (cleantech startups

represented 49% and 45% of investment activity in 2018 and 2017,

respectively). This result represents a dramatic increase in the

industry's support for clean energy innovation as companies execute

their strategies for managing the energy transition and look to

their corporate venture capital groups to support and advance these

strategies. (IHS Markit Upstream Technology's Carolyn Seto)

- Real-estate holdings have climbed to 6.1% of U.S. public-pension portfolios in the first quarter from 3.8% in 2007, according to Wilshire Trust Universe Comparison Service. That share equates to more than $240 billion of the total $4 trillion in state and local government pension holdings reported by the Federal Reserve. Public pension funds invested in malls, apartments and offices over the last decade are now grappling with how much those real-estate investments are worth in a world transformed by Covid-19. (WSJ)

- The total US producer price index (PPI) for final demand ebbed

0.2% in June after bouncing back in May. (IHS Markit Economist

Michael Montgomery)

- Total services prices fell 0.3%, with trade margins down 1.8%, transportation and warehousing up 0.9%, and "other" services up 0.3%. Within the trade margins group, results were dominated by a 9.4% drop in gasoline station margins, as expected.

- Total goods prices rose 0.2% with food down 5.2% and fuels up 7.7%. Core goods managed a feeble 0.1% firming. The food retreat can be laid at the feet of the beef and pork packing plant operations being affected in May by the pandemic but more normal June operations. Beef prices, up 69.1% in May, retreated 44.5% in June. Egg prices continued to retreat to more normal levels after surging a few months ago.

- The final demand category fell 0.2% in June while the old-style stage of processing concept scored a goose egg. That gap was the result of 1.2% spike upwards in government purchases prices rather than more common anomalous moves in export prices caused by carbon steel scrap.

- Services prices firmed, except for margins in wholesale and retail trade. Over short spans these run counter to goods prices, with gasoline station margins the poster child for the anomaly. Gasoline stations trim prices a bit more slowly than wholesale prices fall when the price of oil plunges, but margins return to more normal levels when wholesale prices climb. The 26.3% run up in gasoline prices this month trimmed the gasoline margin back closer to year-earlier levels.

- In year-on-year (y/y) terms, the headline figure fell 0.8%; excluding food and energy up 0.1% and also excluding trade margins prices slid 0.1% y/y.

- US winter wheat production is now estimated lower than June and that contributed to overall US wheat production being smaller than expected, but changes to the balance sheet for 2020/21 kept US forecast carryover near expectations. USDA estimates the 2020 all wheat crop at 1.824 billion bushels, under expectations from traders surveyed by Reuters for the crop to be 1.848 billion bushels. USDA now forecasts the all wheat yield in the US at 49.7 bushels per acre, down from 51.7 bushels in 2019. Much of the smaller-than-expected US total wheat crop came from a cut to the US winter wheat production estimate, with USDA now putting that at 1.22 billion bushels. The yield of 52 bushels per acre was down 0.1 bushel from June and down 1.6 bushels from 53.6 bushels per acre in 2019. The 2020 yield would be the third highest on record and Oklahoma is forecast to see a record yield this year. (IHS Markit Food and Agricultural Commodities' Roger Bernard)

- Electric vehicle (EV) maker Fisker is reportedly working on a deal to take the company public through an investor, similar to the recent deal that saw Nikola begin trading on the NASDAQ stock exchange. Reuters reports that the deal would involve the purchase of Fisker by what is called as a blank-check acquisition company, which would then take the new company public. Reuters reports that a company called Spartan Energy Acquisition Corporation, backed by a private equity firm called Apollo Global Management, is leading a bidding war among special purpose investment firms. The report says that a deal might be closed for USD2 billion in the coming weeks, citing anonymous sources. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's net employment soared by 952,900 positions in June,

far exceeding estimates as a greater number of businesses could

start up again. (IHS Markit Economist Arlene Kish)

- The gain was almost evenly split between full-time (up 488,100) and part-time (up 464,800) positions.

- The labor force participation rate bounced 2.4 percentage points higher to 63.8% and the jobless rate was lowered by 1.4 percentage points to 12.3%.

- The private sector did most of the rehiring, increasing by 867,300. Public sector payrolls were up 74,500 and there were an additional 11,100 self-employed workers.

- While the June net job gain is encouraging, the upward climb may be a bumpy ride going forward.

- The Province of Alberta, Canada, today announced the Alberta Petrochemicals Incentive Program (PIP), a 10-year, grant-based initiative to attract petrochemical investment. Details are still being worked out, and the official launch is scheduled for fall. The new program is significantly different from the Petrochemical Diversification Program, which invited project proposals to compete for feedstock royalty credits. Instead, every project that meets the PIP's criteria will receive funding if built and operational within 10 years. "Compared to previous government petrochemical programs, the Alberta Petrochemicals Incentive Program will cut red tape and increase certainty and flexibility for investors, attracting more financial investment into Alberta's petrochemicals sector," says a government statement. Grants allow companies to better account for the full value of the incentive when calculating a project's return on investment, the statement notes. Additionally, the grants will not be subject to a private evaluation by the government, and the 10-year window will allow projects to align with typical business investment cycles.

- Mexico's health ministry on 9 July reported its highest

recorded daily increase in confirmed coronavirus disease 2019

(COVID-19) cases of 7,280, increasing the total number of cases to

282,283. (IHS Markit Economists Rafael Amiel and Johanna Marris)

- The government is likely to continue struggling to contain transmission of the COVID-19 virus in the coming weeks. The increase in COVID-19 cases has accelerated alongside the gradual reopening of the economy on 1 June (by geographical region according to criteria such as availability of hospital beds), with around 5,000 new daily cases since then and 33,526 deaths in total as of 9 July. Real figures are likely to be significantly higher because many people are not being tested.

- The failure to reduce virus transmission and ongoing restrictions, combined with limited government fiscal relief measures for businesses and stimulus to support demand, indicate increased bankruptcy risks.

- Consequently, IHS Markit as of early July projects a decline in GDP growth of 10.8% in 2020, stemming primarily from falling government revenues and domestic demand. This contraction is being driven by a combination of the COVID-19-virus-associated operating restrictions, the recession in the United States (which is the destination of 80% of Mexican exports), and by lower oil prices.

- The government's weak fiscal and public health response is likely to reduce support for AMLO and the ruling National Regeneration Movement (Movimiento Regeneración Nacional: MORENA) at the 2021 mid-term election. AMLO has generally enjoyed high approval ratings. However, these have declined in recent months, to 47.8% on 8 July 2020 from 67.1% in February 2019, according to Mitofsky polls.

- Any future presidential incapacitation due to the COVID-19 virus would slow policy-making, but broad policy continuity is likely. AMLO tested negative for COVID-19 on 7 July, although senior officials including finance minister Arturo Herrera have recently tested positive (Herrera on 25 June).

- The US ambassador to Mexico says Ford is concerned that COVID-19 restrictions that are slowing production in the Mexican state of Chihuahua may impact on the automaker's US production. A Reuters report quotes Ambassador Christopher Landau as saying that Ford executives told him on 8 July that the automaker is concerned about the supply of engines produced in the Mexican state. The governor of the state has limited industrial production to 50% of capacity in reaction to the COVID-19 pandemic. Mexico's federal government has given automakers, mining companies, and construction firms permission to resume operations, but state governments are able to impose stricter conditions. According to the Reuters report, Landau said, "They're saying that they're going to start shutting down factories in the United States as of next week if they don't get that rolling." An Automotive News report quotes Ford's president of the Americas and International Markets Group, Kumar Galhotra, as saying in a statement, "Due to COVID-19, the State of Chihuahua in Mexico has limited employee attendance to 50 percent, a region in which we have several suppliers. With our U.S. plants running at 100 percent, that is not sustainable. While we do not expect any impact to production next week, we are continuing to work with government officials on ways to safely and constructively resume remaining production." Automotive News reports Galhotra as saying no production shutdown is imminent. (IHS Markit AutoIntelligence's Stephanie Brinley)

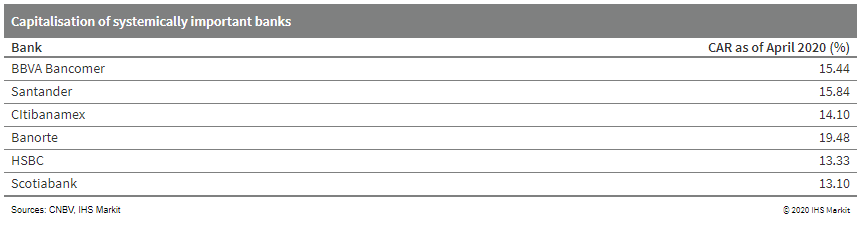

- The National Banking and Securities Commission (Comisión

Nacional Bancaria y de Valores: CNBV) on 7 July published its list

of Mexico's systemically important banks. Banks in this category

are required to hold a capital buffer (D-SIB) ranging between 0.6%

and 1.5% of their risk-weighted assets (RWA), on top of their

required capital adequacy ratio (CAR) of 10.5%. The classification

was based on the December 2019 figures. The selected banks are

Scotiabank (with a required D-SIB of 0.6% of RWA), HSBC (0.6%),

Banorte (0.9%), Citibanamex (1.2%), Santander (1.2%), and BBVA

Bancomer (1.5%). Banco Inbursa (which was considered systemically

important between 2016 and 2019) has been taken out of the list.

(IHS Markit Banking Risk's Alejandro Duran-Carrete)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Italy +1.3%, Germany/Spain +1.2%, France +1.0%, and UK +0.8%. Germany's DAX reached its best level of the week shortly after the open on Monday of +2.3% versus Friday's close and had since retreated to -0.8% W/W at today's nadir, but rallied in the afternoon to close a modest +0.8% on the week.

- 10yr European govt bonds closed mixed; Spain/Italy +1bp and France/UK/Germany flat.

- iTraxx-Europe closed flat/63bps and iTraxx-Xover +3bps/378bps,

ending the week -1bp and +5bps, respectively.

- Around half of Europe's speculative-grade chemical companies

will be able to cope with the economic downturn caused by the

COVID-19 pandemic "relatively well," according to Moody's Investors

Service (New York, New York).

- About 50% of the rated speculative-grade companies will be able to withstand the downturn based on factors such as widely diversified end markets or a focus on a resilient end market, limiting revenue decline, says Moritz Melsbach, assistant vice president/Moody's. "Low raw material prices will support EBITDA margins for some companies, while cost savings will also help. Companies with strong liquidity should have the financial flexibility to weather weaker demand," he says.

- "These companies typically have one or more characteristics that will make their credit quality more resilient than their peers over the next 12-18 months. This follows a broad-based deterioration in credit quality across the sector since the pandemic began," according to Melsbach.

- A report by Moody's flags companies including Nouryon, Clariant, and Synthomer as having more widely diversified end markets or a focus on more resilient end markets such as pharmaceuticals or agriculture that it says will help to mitigate the effects of the downturn and limit earnings and sales declines. Some will also benefit from lower raw material prices for feedstocks such as ethylene, propylene, and their downstream derivatives, supporting their EBITDA margins, it says.

- The credit ratings agency says that since March this year it has taken 15 negative rating actions among the 33 speculative-grade chemical companies that it rates publicly in Europe, Russia, and Turkey. Nine were downgrades and six were outlook changes, it notes.

- Sales volumes among the more diversified companies will still be hurt overall by the broader deterioration in demand, with volumes for these companies expected to fall by around 5-12%. "However, these declines will be smaller compared with our overall expectations for North American and European chemical producers, whose declines in sales we expect to translate in a fall in average EBITDA of at least 20%," says Melsbach.

- Brent crude closed +2.1%/$43.24 per barrel.

- BASF has issued preliminary second-quarter results and says it expects to report a net loss of €878 million ($993 million) for the period compared with a net profit of €5.95 billion in the same period last year, well below analysts' estimates. This is mainly due to a non-cash-effective impairment of about €800 million for the company's stake in upstream oil and gas joint venture Wintershall DEA, as a result of lower oil and gas price forecasts and changed reserve estimates, BASF says. Sales declined 12.4% in the second quarter to €12.68 billion from €14.48 billion in the same period the year before, the company says. EBIT before special items was €226 million, which is in the range expected by BASF and above market expectations, the company says. However, it is much lower than the €995 million the company recorded in the second quarter of 2019, mainly as a result of lower demand from the automotive industry—the company's most important customer industry—that caused a significant reduction in the earnings of BASF's materials, surface technologies, chemicals, and industrial solutions segments, BASF says. The negative impact of the COVID-19 crisis on the automotive industry was partially offset by year-on-year growth of the company's nutrition and care, and "other" segments, BASF says. Earnings in BASF's agricultural solutions segment were at the level of the prior-year quarter, the company says.

- Italy's industrial production rose by 42.1% month on month

(m/m) after drops of 20.5% m/m in April and 28.4% m/m in March.

(IHS Markit Economist Raj Badiani)

- Improving output between April and May was across all the main categories. The largest increases on a m/m basis arose from consumer durables (381.2% m/m) and investment goods (65.8% m/m).

- Despite the uptick in May, output was still 19.2% below February's level, the month prior to the COVID-19 lockdown.

- Meanwhile, on a working-day-adjusted basis, the picture was bleaker, with industrial output falling by 20.3% year on year (y/y) in May. This implies that production contracted by 19.3% y/y in the first five months of this year, compared with a 1.0% drop in 2019.

- Some of the largest y/y falls occurred in manufacture of textiles, wearing apparel, leather and accessories (-34.1%), transport equipment (-37.3%) and machinery and equipment (-21.1%).

- A breakdown by a broader type of good reveals that the production of capital goods contracted 51.5% y/y in April, reflecting the worsened investment landscape at home and abroad. Meanwhile, consumer durables output plunged by 84.2% y/y over the same period comparison.

- France's industrial production in May was still 23.4% below

where it was during the same month in 2019, although the annual

contraction eased from 35.0% in April. (IHS Markit Economist Diego

Iscaro)

- Manufacturing production rose by a stronger 22.0% m/m in May, although it had declined by a larger 22.3% m/m in April. Production in all sectors rebounded strongly in May, but the increase was particularly marked for transport equipment. Nevertheless, production of transport equipment was half its February level, illustrating acute weakness in the automotive sector (see Chart 1).

- Energy production, which had declined by 12.1% m/m in April, rose by 9.2% m/m in May. It was still 13.3% below its level in May 2019.

- The breakdown by main industrial grouping shows production of consumer durables jumping by 186.7% m/m, while production of capital and intermediate goods rose by 28.5% m/m and 28.8% m/m, respectively. Meanwhile, production of consumer non-durables, which had fallen more moderately in March/April, increased by 7.7% m/m.

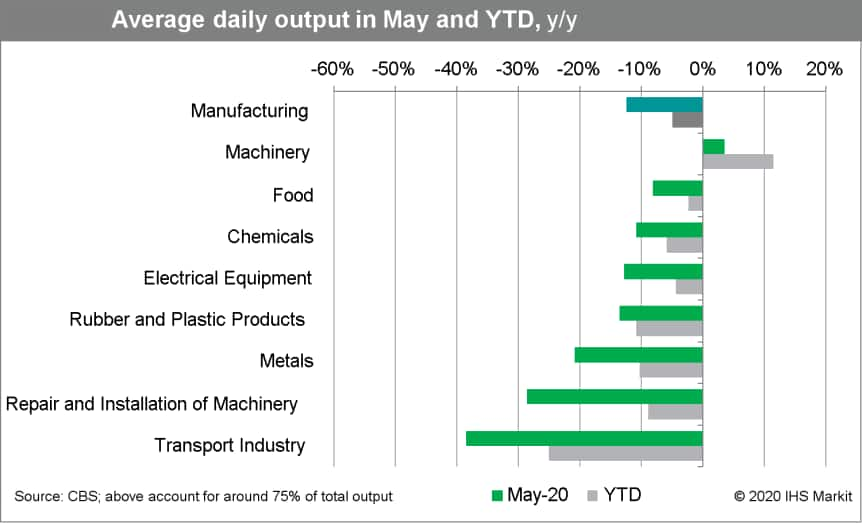

- In May, average daily output of the Dutch manufacturing sector

was down by 12.5% year on year (y/y) on a seasonally unadjusted

basis. This is the largest monthly drop since 2009. On a

three-month moving average basis, output was down by 8.3% y/y, down

from 4.6% in April. (IHS Markit Economist Daniel Kral)

- On a seasonally and working-day-adjusted basis, manufacturing output was down by 1.9% month on month (m/m) or 11.9% y/y in May. Even prior to the COVID-19 virus pandemic, manufacturing output has been on a declining trend, peaking in early 2018.

- In May, the only support was provided by machinery, which was up by 3.5% y/y. The biggest drops were recorded in transport industry, declining by 38.5% y/y, repair and installation of machinery, which fell by 28.9% y/y, and metal products, down by 20.9% y/y.

- At 45.2 in June 2020, the Dutch manufacturing purchasing

managers' index was at its lowest since the financial crisis. The

output sub-index rose slightly in May, but still remains in

contraction territory, consistent with ongoing annual output

losses.

- A statistical low base effect, along with higher food prices

led the Russian consumer price index gains in June, as annual

inflation rose to 3.2% from 3.0% in May, as forecast by IHS Markit.

(IHS Markit Economist Lilit Gevorgyan)

- The breakdown of the CPI published by the Russian Federal State Statistical Service (RosStat) points at the acceleration in prices of food and alcoholic beverages as key upwards drivers behind the headline annual inflation.

- Specifically, demand for cereal and oat products remained high, leading to double-digit annual price gains in June.

- As expected, pharmaceutical product prices also continued to rise, up by 8.8% year on year (y/y) in June. Transport fuel prices also rose, along with construction material costs. Supply side disruptions have contributed to the price increases in the latter category.

- Faster food price increases were offset by weaker annual gains in services prices. Although communication costs rose notably in June, tourism and sanatorium services remained in deflationary territory, as expected due to healthcare concerns and lingering restrictive measures.

- Core annual inflation modestly picked up most likely due to increased social payments, as the index moved from 2.8% in May to 2.9% in June.

- In monthly comparison, the headline CPI also rose to 0.3% in June to 0.2% in May, despite a significant easing in the price gains in the services sector. The latter posted only 0.1% month-on-month (m/m) increase in June, compared to 0.5% m/m gains in May. The slowdown is largely due to higher base effect in May when lockdown measures started to ease, boosting services prices.

- The Russian light vehicle market posted a 14.6% year-on-year

(y/y) decline in sales during June to 122,622 units, according to

the latest set of data released by the Association of European

Businesses (AEB). (IHS Markit AutoIntelligence Tim Urquhart)

- For the first six months of the year this left the market down by 23.3% y/y to 635,959 units following massive declines in April and May that resulted from the Russian government's COVID-1) virus-related lockdown measures and consequent collapse in vehicle demand and sales as dealers across the country were shut down.

- Dr Thomas Staertzel, Chairman of the AEB Automobile Manufacturers Committee commented, "Although dealers are operational, state support measures additionally stimulate sales and delayed purchases contribute on top, June still marks a decrease of 14.6% vs. June 2019. These 6 months have been a rollercoaster for manufacturers and dealers with slow climbing in the beginning of the year, followed by a sharp and never experienced downhill April/May and finished by a slow recovery in June. The decrease of 23% y/y June is close to the new AEB 2020 forecast of 1.34 million LV sales for 2020, which is also a decrease of 23.9%."

- On a brand-by-brand basis, Russia's best-selling Lada brand had a strong month during June, outperforming the overall market with only a 9% y/y decline to 28,020 units, claiming significant amounts of existing inventory.

- The consistent best-selling model the Lada Granta rose to 11,631 units, from 10,422 in June last year.

- The Vesta was in second place and managed sales of 11,172 units in comparison to the 12,850 units in June last year when it had a rare stint at the top of the sales chart. The Russian passenger car market's leading brand posted a 24% y/y decline during the first half of the year to almost exactly match the performance of the overall market.

- The latest release from the National Statistics Office of Malta

shows that seasonally adjusted industrial production fell by 4.5%

year on year (y/y) in May, after falling by 7.4% y/y in April. (IHS

Markit Economist Michal Plochec)

- In month-on-month (m/m) comparison, output rose 2.9% in May, after falling 6.9% m/m in April, which is an encouraging result, signaling that the worst effects caused by the COVID-19 virus-related shutdowns are starting to slowly diminish.

- Looking at the industrial groups, the fastest decline in May occurred in the output of capital goods (down by 15% y/y) and Intermediate goods (down by 8.7% y/y), while consumer goods category already witnessed modest growth (increase of 1.6% y/y).

- The unemployment rate in Malta has risen substantially since the beginning of this year, from 3.4% in January to 4.2% in May.

- The number of people registering as unemployed in April and May oscillated at over 4,000 as compared to the average of around 1,700-1,800 throughout 2018 and 2019. The current unemployment level is the highest since 2016.

- Activity in tourism, which is a crucial branch of the Maltese economy, is still significantly diminished. Due to the pandemic, Statistical Office of Malta did not publish monthly indicators on tourism for April and May. The latest release for March showed that the number of inbound visitors fell by 56.5%, even though the country's borders were shut from the middle of the month.

Asia-Pacific

- APAC equity markets closed lower across the region; China -2.0%, Hong Kong -1.8%, Japan -1.1%, South Korea -0.8%, Australia -0.6%, and India -0.4%. China's Shanghai Composite closed the week +7.3%, which is its best weekly performance since June 2015.

- Shanghai's "Double Five" shopping festival has ended with

significant boost for local retail sales, according to the local

commerce department on 8 July. The festival, offering promotions

both online and offline, was part of the consumption revival

efforts announced by the municipal government at the end of April.

(IHS Markit Economist Lei Yi)

- Over 520,000 online and 100,000 offline businesses participated in the two-month long festival. Sales of the 200 large commercial enterprises reported growth of 4.5% year on year (y/y) and 33.5% month on month. Offline payment data showed that offline physical goods consumption had recovered to the level of a year ago, up by 11.6% from the March-April period.

- Specifically, auto sales reported growth of 9.9% y/y, thanks to both the large promotions and the relaxation of purchase restrictions. Number of express deliveries registered 20.6% y/y growth as online sales surged, according to the local postal services.

- WeRide, a Guangzhou-based autonomous vehicle company, has announced that it has started testing fully driverless vehicles in China, reports Reuters. The company said in a statement that it had started tests on 8 July on open roads in a designated area of Guangzhou city, after city authorities granted permission. Other companies like Pony.ai, Baidu Inc, and Didi Chuxing are also testing autonomous cars in China with a safety driver on board in case of an emergency, while WeRide said that it will use a remote centre to override the vehicles if required. (IHS Markit Automotive Mobility's Tarun Thakur)

- Neles Corporation, previously Metso's Flow Control division, has opened a new valve technology center in Jiaxing, China to produce its valve and related products. The new plant has a production capacity of 100,000 valves per year. With access to a variety of competitive logistic options, the products from Jiaxing can be shipped to customers or Neles supply centers around the globe with reduced lead-times. Neles aims to improve its service and delivery capabilities to meet the diverse and evolving needs of its clients. The new technology center will also play a role in strengthening Neles' research and development capability in China. Today, the company has valve technology or production centers in Germany, Finland, India, South Korea, Saudi Arabia, and United States. In addition to Jiaxing, Neles' another valve technology center in Waigaoqiao Free Trade Zone, Shanghai continues operations, focusing on highly engineered products. Neles employs approximately 400 flow control specialists at four main locations in China, serving all process industries. (IHS Markit Upstream Costs and Technology's Yi Tan)

- Dongfeng posted a 10.1% year-on-year (y/y) increase in sales to

273,161 units during June, with year-to-date (YTD) sales reaching

1.144 million units, down 16.7% y/y, according to figures released

by the company. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Last month, Dongfeng's passenger vehicle sales reached 212,758 units, up 1.2% y/y, including sedans, sport utility vehicles (SUVs), and multi-purpose vehicles (MPVs), while commercial vehicle sales reached 60,403 units, up 60.0% y/y.

- Dongfeng has joint ventures (JVs) with global automakers in China including Groupe PSA, Honda, Liuqi, Nissan, and Renault. Dongfeng Motor Company Limited (DFL), the JV between Dongfeng and Nissan, had growth in sales of 9.8% y/y in June to 139,566 units, with YTD sales of 584,167 units, down 18.1% y/y.

- The Dongfeng-Honda JV's sales stood at 77,363 units in June, up 16.8% y/y, with YTD sales of 302,425 units, down 17.0% y/y.

- Sales at the Dongfeng-PSA JV were down 46.8% y/y to 5,380 units in June, with YTD sales of 23,237 units down 63.1% y/y.

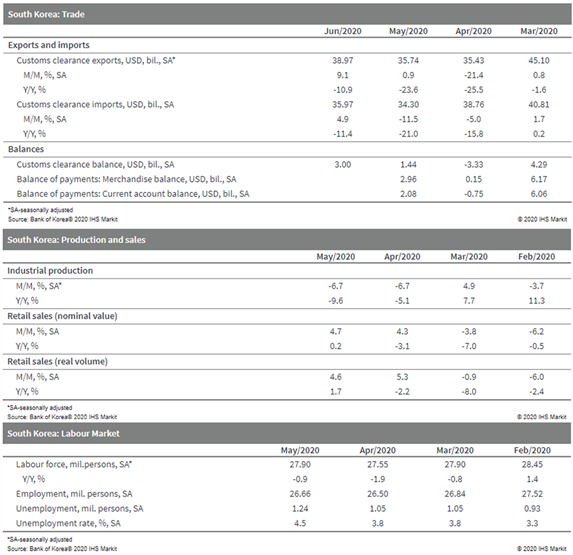

- South Korea's consumer spending, and overseas demand for

exports, are spearheading what appear to be the initial signs of

recovery. (IHS Markit Economist Dan Ryan)

- Customs clearance exports (seasonally adjusted, US-dollar basis) rose for the second consecutive month in June, suggesting that the effects of the global pandemic are easing, at least for South Korea's main trading partners.

- Imports rose moderately in June, but this came after two months of serious decline. As an indicator of domestic demand, this is a good sign but shows that domestic spending remains depressed.

- Data for April and May show mixed developments for the economy. The industrial sector in particular continued its decline, leaving the sector down nearly 10% from a year earlier.

- Consumer spending, on the other hand, rebounded. Retail sales, both nominal and real, increased steadily and surpassed the levels of a year ago.

- The unemployment rate, not surprisingly, increased as the overall economy contracted. Since the labor market lags demand, the unemployment rate is likely to rise before it levels off in a few months.

- The labor force, though lower than a year ago, has been

relatively stable. This is a good sign, in that workers have not

become discouraged and have not stopped looking for work.

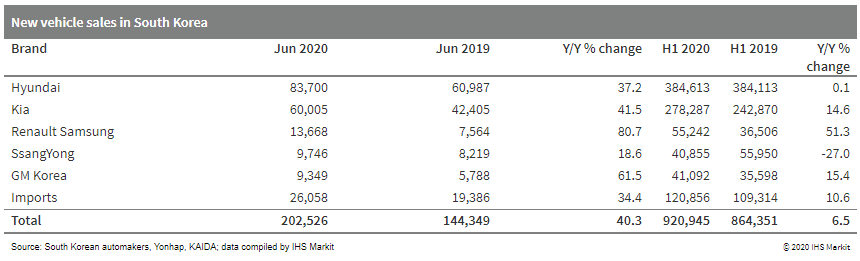

- New vehicle sales in South Korea, including passenger vehicle

imports, surged 40.3% year on year (y/y) during June to 202,526

units, up from 144,349 units in June 2019, according to reports by

the Yonhap News Agency and the Korea Automobile Importers and

Distributors Association (KAIDA), as compiled by IHS Markit. (IHS

Markit AutoIntelligence's Jamal Amir)

- During the first half of 2020, total vehicle sales in the country stood at 920,945 units, up 6.5% y/y.

- Hyundai and Kia maintained their lead of the South Korean vehicle market in June with a combined share of 70.9%.

- Hyundai posted a 37.2% y/y increase in its monthly sales to 83,700 units, while affiliate Kia recorded growth of 41.5% y/y to 60,005 units.

- Hyundai said that the Grandeur (Azera) led its sales in South Korea last month with 15,688 units. A strong performance by its premium Genesis brand, with the all-new G80 sedan and GV80 sport utility vehicle (SUV) models, also helped to maintain robust sales momentum in the country

- Recently launched models, such as the next-generation K5 (Optima) sedan released last December and the Sorento SUV launched in March, contributed to Kia's sales increase in South Korea last month.

- Renault Samsung was the third-largest automaker with sales of 13,668 units during the month, up 80.7% y/y, thanks to strong demand for the newly launched XM3 SUV.

- SsangYong's sales increased 18.6% y/y to 9,746 units, while

General Motors (GM) Korea's sales jumped 61.5% y/y to 9,349

units.

- LiveMint reported on 9 July that the Punjab National Bank (PNB)

is looking to raise INR100 billion (USD1.3 billion) through an

INR70-billion share sale (either through a qualified institutional

placement, a follow-on public offering, or a rights issue) and the

rest likely through a tier-2 bond. (IHS Markit Banking Risk's Angus

Lam)

- The PNB follows the technically partly state-owned Yes Bank (although it is still a private-sector bank) in raising capital through the markets.

- The PNB is one of the largest state-owned banks in India, pre-merger with the Oriental Bank of Commerce and the United Bank of India, accounting for nearly 5% of total sector assets.

- In recent months, the regulator has mandated banks to start assessing the impact of the COVID-19 virus on their balance sheets using a stress test. IHS Markit expects that this will lead to the government injecting capital into state-owned banks.

- If the PNB decides to go through a follow-on public offering instead of the other two options, this may suggest that the bank might experience a slight reduction in government holdings as a follow-on public offering will allow the bank to seek funding from the open market. However, we maintain the view that the privatisation of state-owned banks is currently highly unlikely owing to the expected capital needs and subdued valuation.

- Despite the bank reporting the above-required level of tier-1 capital of 11.9% in March, it still needs to raise capital, which suggests that its asset quality is likely to deteriorate; this is likely to become clear three months after the moratorium ends in August. We expect that the government will continue to provide capital to state-owned banks if necessary; however, healthier state-owned banks are likely to go to the markets to raise additional capital.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-july-2020.html&text=Daily+Global+Market+Summary+-+10+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}