Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 09, 2020

Daily Global Market Summary - 9 July 2020

APAC equity markets and the Nasdaq closed higher, while all other major global markets ended the day lower. iTraxx-Europe closed flat, while iTraxx-Xover and CDX-NAIG/CDX-NAHY were wider on the day. US government bonds and the US dollar rallied, while Brent and WTI were lower. The initial claims for US unemployment insurance improved versus last week, but remained in the seven figures and there are growing concerns that the recent reversals in re-openings, due to the rapid increases in COVID-19 cases in parts of the US, could drive claims higher for the first time since late-March.

Americas

- Most US equity markets closed lower except for Nasdaq +0.5%; Russell 2000 -2.0%, DJIA -1.4%, and S&P 500 -0.6%.

- 10yr US govt bonds closed -6bps/0.61% yield and 30yr bonds -8bps/1.32% yield.

- CDX-NAIG closed +3bps/75bps and CDX-NAHY +22bps/504bps.

- Crude oil closed -3.1%/$39.62 per barrel.

- US equity markets sold off sharply after Florida released its latest data during the trading day, reflecting increased nervousness among investors that some of the US's most populous states may have to reverse economic reopening measures. Florida, California, and Texas have recorded their largest single-day increases in coronavirus-related deaths since the start of the pandemic, an alarming indication that the latest outbreak could lead to another surge in fatalities. (FT)

- Seasonally adjusted initial claims for US unemployment

insurance, at 1,314,000 in the week ended 4 July, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. Initial claims have been

trending downward since 28 March; however, the recent spike in

COVID-19 cases could reverse this trajectory. (IHS Markit Economist

Akshat Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lag initial claims by a week, fell by 698,000 to 18,062,000 in the week ended 27 June. This is well below the all-time high of 24,912,000 in the week ended 9 May and indicates that as businesses reopen, furloughed workers are cautiously getting recalled. The insured unemployment rate in the week ended 20 June stood at 12.4%.

- There were 1,038,905 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 4 July. In the week ended 20 June, continuing claims for PUA rose by 1,509,659 to 14,363,143.

- In the week ended 20 June, 850,461 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits with 41 states accepting claims for PEUC so far.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 20 June, the unadjusted total hit an all-time high of 32,922,335 with an increase of 1,410,788 from the previous week. Of this total, 53% is from regular state programs and 44% from the PUA program.

- The Recycling Partnership (TRP) has launched the Polypropylene Recycling Coalition, an industry collaboration aimed at improving recovery and recycling of polypropylene (PP) in the US and developing the end market for high-quality recycled PP. The coalition has simultaneously launched its first initiative, offering financial grants to help material recovery facilities improve the sortation of PP waste and educate local communities. Founding members include Keurig Dr Pepper, Braskem, the Walmart Foundation, the American Chemistry Council (ACC), Danone North America, EFS Plastics, KW Plastics, LyondellBasell, Procter & Gamble, St. Joseph Plastics, and Winpak. The coalition has set an initial funding target of $35 million over five years. The Polypropylene Recycling Coalition's advisory committee includes the Association of Plastic Recyclers, Closed Loop Partners, Sidewalk Infrastructure Partners, the Sustainable Packaging Coalition, and the World Wildlife Fund. Former EPA Administrator Carol Browner will serve as an independent advisor. TRP estimates that single-family homes in the US could supply as much as 1.6 billion pounds/year of PP for recycling into new products.

- Merck Animal Health has agreed a new deal with Zymeworks to develop multi-specific antibody therapeutic candidates. Zymeworks is a clinical-stage biotechnology company headquartered in Vancouver, Canada, focused on the development of multifunctional biotherapeutics for animal and human health. Under the agreement, Merck will be able to develop new animal health candidates using Zymeworks' Azymetric and EFECT discovery platforms. The global license grants Merck the rights to research, develop and commercialize up to three new multi-specific antibodies in exchange for milestone payments and tiered royalties. Zymeworks will receive an undisclosed upfront payment under the deal. The Azymetric platform enables the transformation of mono-specific antibodies into bi-specific and multi-specific antibodies. This enables them to bind to several different disease targets. Zymeworks explained the technology facilitates the development of multi-functional therapeutics that can block multiple signaling pathways, recruit immune cells to tumors, enhance receptor clustering and internalization, and increase tumor-specific targeting. (IHS Markit Animal Health's Sian Lazell)

- Karma Automotive has received USD100 million in fresh funding, according to Bloomberg, while it is still looking for an additional USD300 million. Bloomberg says that Karma owner Wanxiang is selling stakes in Karma to private equity partners. The report quotes the president of Wanxiang's US business, Pin Ni, as saying that the company is looking to capitalise on recent high valuations for Tesla and Workhorse. "Karma has real production, real technology and real dealers. Look at Tesla's value and you see Workhouse with their stock going up ten times recently," he said. Karma's chief strategy officer, Greg Tarr, is quoted as saying that Karma will continue selling the plug-in Revero, will add the Revero GTE in the second quarter of 2021, and will then add a supercar based on the SC1. Tarr also denied recent media reports that the company is on the verge of bankruptcy. Separately, Fisker has reportedly raised USD50 million from hedge fund veteran Louis Bacon; the funding is to support a sport utility vehicle (SUV) planned for a 2022 rollout. The report quotes a Fisker statement as saying, "We are radically challenging the conventional industry thinking about developing and selling cars. This capital will allow us to execute our planned timeline to start producing vehicles in 2022." The company plans to offer its vehicles at a lower price point to Tesla by outsourcing production to larger conglomerates, although it has not announced any partnerships to date. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) startup Aurora has introduced a long-range LiDAR sensor called FirstLight. The company claims that this LiDAR will allow the vehicle perception system to track and identify objects that are faster moving and farther away with high precision. Aurora plans to deploy FirstLight LiDAR in its next-generation test vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Total housing starts in Canada increased 8.3% month on month

(m/m) to 211,681 units in June, with multifamily growth more than

offsetting the decline in single-family starts. (IHS Markit

Economist Jeannine Cataldi)

- Alberta, Quebec, and the Atlantic provinces all had lower levels of housing starts in June compared with a month ago, while the strongest rate of increase was in Manitoba.

- In the second quarter, total housing starts were lower by 8.6% quarter on quarter (q/q), falling to 190,683 units, thanks to Quebec's temporary work stoppage in April.

- It seems that the pandemic is having an impact on housing starts as robust building activity is concentrated in only a few provinces along with an uptick in single-family units from last year's low.

- Urban housing starts in Canada increased 8.7% m/m in June. Growth was led by a 13.0% m/m increase in multifamily starts. In Ontario, multifamily starts grew 52.9% to reach 58,893 units, while starts were lower in Quebec, British Columbia, and Alberta. Urban single-family starts decreased 4.5% m/m as Quebec single-family starts led the decline at -25.3% m/m.

- Argentina's industrial production posted a 26.4% year-on-year

(y/y) decrease in May, according to the National Institute of

Statistics and Census (Instituto Nacional de Estadística y Censos:

INDEC). (IHS Markit Economist Paula Diosquez-Rice)

- The seasonally adjusted data show a 9% month-on-month (m/m) drop in May, compared with a 15.5% m/m drop in April and a 20.2% m/m fall in March (revised figures).

- The cumulative change for the first five months of 2020 is a decline of 16.3% year on year (y/y).

- The biggest annual decreases were in the vehicle assembly and automotive parts, non-metal minerals, clothing and apparel, other machinery and equipment, basic metals, and rubber and plastics, among others. Only several sectors posted non-double-digit annual declines in May - the food and beverages sector and the wood, paper, and printing sector.

- A qualitative industrial poll of companies conducted by INDEC shows that 61.6% of the respondents estimate that the situation will deteriorate in June-August compared with the same period in 2019 (down from 74% in the previous month's survey).

- The percentage of respondents expecting demand to pick up decreased to 11.7%, while 55.4% of the respondents expect exports to decrease during the period.

- The Brazilian Institute of Geography and Statistics (IBGE)

reported that seasonally adjusted retail sales jumped by 13.9%

month on month (m/m) in May compared with April. Retail sales had

plunged by 16.9% m/m in April after a relatively minor drop in

March (down by 2.8% m/m) (IHS Markit Economist Rafael Amiel)

- The so-called extended retail sales index - which includes sales of cars, motorcycles, automotive parts, and construction materials - jumped by 19.6% m/m after plunging by 17.5% m/m in April. In March, this index plummeted by 14.5% m/m.

- In annual and unadjusted data terms, the extended retail index contracted by 14.9% in May. In the first five months of 2020, sales declined by 8.6% compared with January-May 2019.

- Industrial production also partially recovered in May, increasing by 7.0% m/m after plunging by almost 30% in the previous two months combined.

- The IHS Markit Brazil Manufacturing PMI rebounded by 13.3 points to 51.6 points in June, returning to expansion territory for the first time since February. Gains in production, new domestic orders, and output expectations were partially offset by declines in export orders and employment. Input prices increased at the fastest pace in 21 months owing to the earlier depreciation of the Brazilian real against the US dollar.

- Brazil's services PMI increased by 8.3 points to 35.9 points in June, a level indicative of a deep recession. With new domestic and foreign orders declining, employment was cut for the fourth consecutive month. Input prices increased at the slowest rate in over 13 years of data collection, while output prices declined at a record pace.

Europe/Middle East/ Africa

- European equity markets closed lower across the region; Italy -2.0%, UK -1.7%, France/Spain -1.2%, and Germany flat.

- Most 10yr Europe govt bonds closed higher; Germany/UK-2bps, France/Spain -2bps, and Italy flat.

- iTraxx-Europe closed flat/63bps and iTraxx-Xover +8bps/374bps.

- Brent crude closed -2.2%/$42.35 per barrel.

- UK Chancellor of the Exchequer (Finance Minister) Rishi Sunak

has announced in his summer statement an additional GBP30 billion

(USD38 billion) to tackle the impact of the national lockdown

imposed to halt the spread of the coronavirus disease 2019

(COVID-19) virus. He argued that "if the first phase of our

economic response was about protection, the second phase - the

phase we are addressing today - is about jobs". (IHS Markit

Economist Raj Badiani)

- The main intention of the new support package is to mitigate concerns that the end of the Coronavirus Job Retention Scheme (furlough scheme) will trigger a second wave of job losses and another spike in the unemployment rate. The furlough scheme covers 9.4 million out of 28 million employees in the United Kingdom. In addition, 1.1 million employers have tapped into the scheme, which ends on 31 October.

- Sunak has introduced a one-off bonus payment of GBP1,000 for firms that retain furloughed workers earning more than GBP520 per month until the end of January 2021. The Treasury estimates that this measure will cost GBP9.4 billion (assuming all furloughed workers are retained).

- Other employment initiatives attempt to support young workers,

and they include:

- A Kickstart Scheme allocating GBP2 billion to pay for six-month work placements for 16-to-24-year-olds on Universal Credit (a benefit payment for working-age people who are on a low income or out of work), providing a national minimum wage for 25 hours per week.

- Firms will receive a GBP1,000 grant when they recruit new trainees aged 16-24 in England.

- In addition, GBP2,000 and GBP1,500 grants will be paid to employers per apprentice hired under 25 and over 25, respectively. This scheme will begin on 1 August in England and last for six months.

- The government will temporarily increase the threshold for stamp duty on residential properties in England and Northern Ireland from 8 July 2020 to 31 March 2021. The threshold will be raised from GBP125,000 to GBP500,000, with the Treasury estimating that almost 9 out of 10 sale transactions will be tax-free. This measure is expected to cost GBP3.8 billion.

- The government will implement a six-month cut in the value-added tax (VAT) rate from 20% to 5% from 15 July 2020 to 12 January 2021 for parts of the hospitality sector. The lower VAT rate will apply to food and non-alcoholic drinks in restaurants, takeaway food, accommodation in hotels and B&Bs, and admission to attractions such as theme parks and cinemas.

- Germany's Federal Statistical Office (FSO) external trade data

for May (customs methodology, seasonally adjusted, nominal) provide

initial signals of a recovery, not least as car manufacturers

resumed production after a five-to-six-week shutdown during

March-April. (IHS Markit Economist Timo Klein)

- The increase in exports of 9.0% month on month (m/m) during May compared with a fall of 33% in the two preceding months, however, and imports, which had only declined by 21% in March-April, only rebounded by 3.5% m/m in May.

- Year-on-year (y/y) rates (unadjusted) show very little improvement as yet, with exports in May nudging up from April's -31.1% to -29.7% and the annual change for imports even staying put at -21.7%.

- Continental's CEO has said that the second quarter of 2020 will be the worst the automotive industry has experienced since the Second World War. According to a Reuters report, Elmar Degenhart said that the slowdown in the industry triggered by the impact of COVID-19 virus-related lockdown restrictions on business activity and consumer confidence will have an impact the like of which has not been seen since 1945. At the company's AGM, Degenhart said, "The second quarter is just behind us. It will be the historically weakest quarter for the auto industry since 1945." Degenhart also stated in the speech that Continental forecasts a "very difficult" third quarter, with revenues expected to be higher than during the second quarter but remaining significantly below year-earlier levels. The impact of the COVID-19 virus pandemic on the manufacturing operations of OEMs and consumer demand has had an obvious knock-on effect on the fortunes of the major Tier-1 suppliers. Continental has cut investment spending by 20% and extended its credit line by EUR3 billion (USD3.38 billion) to help ensure capital needs as it responds to the crisis. (IHS Markit AutoIntelligence's Tim Urquhart)

- The BMW Group has announced it has secured a sustainable source of cobalt for use in electric vehicle (EV) batteries by signing a EUR100-million (USD113.2-million) contract with Moroccan mining company Managem Group. The contract will cover about one-fifth of its cobalt needs for the brand new fifth-generation electric powertrain. The company will source the remaining four-fifths of its cobalt needs from Australia. The signing of the contract progresses the memorandum of understanding (MoU) the two companies signed in January, with the contract running for five years. BMW's board member for supply and procurement Andreas Wendt said, "Cobalt is an important raw material for electromobility. By signing this supply contract with Managem today, we are continuing to secure our raw material needs for battery cells… We are systematically driving electrification of our vehicle fleet. By 2023, we aim to have 25 electrified models in our line-up - more than half of them fully-electric. Our need for raw materials will increase in line with this. For cobalt alone, we expect our needs to roughly triple by 2025." This deal will help secure the BMW Group's supply of an essential battery raw material as it begins a push to hugely extend its electric vehicle (EV) range. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler held a virtual annual general meeting (AGM) in

Stuttgart yesterday in response to the COVID-19 virus pandemic and

against the backdrop of a 17.6% year-on-year (y/y) decline in

first-half sales of Mercedes-Benz brand cars to 935,089 units,

according to a company statement. Daimler's management, led by CEO

Ola Källenius, outlined the firm's ongoing strategy to deal with

the new economic reality of the post-COVID-19 environment. (IHS

Markit AutoIntelligence's Tim Urquhart)

- Daimler also revealed its global sales data for the first half of the year, which was obviously hit hard by the global COVID-19 virus pandemic. The Mercedes-Benz passenger car brand posted a 17.6% y/y decline in global sales to 935,089 units during the first half of 2020.

- The Smart brand took a huge sales hit in the first half of the year, with an 83.3% y/y decline in sales to 10,101 units. This left combined Mercedes-Benz passenger cars for the first half of the year down by 20.9% y/y to 945,190 units.

- Mercedes-Benz vans also had an extremely difficult first half of the year as the pandemic had an obvious negative impact on the business environment, with a 25.6% y/y decrease in sales during the first half of 2020 to 125,946 units.

- Looking at the regional sales split in Europe, Mercedes-Benz sales fell 31.5% y/y to 313,490 units in the first six months of 2020.

- In the Asia Pacific region, the brand enjoyed its second-best quarter to date with unit sales of 259,404 passenger cars. This was an 8.9% y/y rise with a hugely strong second-quarter recovery, thanks to a 21.6% y/y rise in China to 207,017 units.

- China even managed to boost its first-half sales tally into positive territory with a 0.4% y/y rise to 346,067 units.

- Deliveries in North America were down by 16.0% y/y during the first six months to 146,538 units, while in the US they were down 13.7% y/y to 127,207 units.

- The impact on Daimler's first-half sales and the forthcoming first-half financial results will of course be marked. However, the company has enjoyed a very strong and hugely encouraging rebound in China as the world's biggest car market has rebounded in the second quarter after the country became the epicenter of the global pandemic in the first quarter.

- Covestro says its forecast preliminary EBITDA for the second

quarter will be above market consensus at €124 million ($141

million), with an expected preliminary net loss for the period of

€60 million also beating consensus.

- Ahead of the scheduled release of its second-quarter and half-year results on 23 July, Covestro says in the course of preparing its half-year report that "preliminary key financial data deviate from capital market expectations." The market expectations are based on the latest consensus estimates of financial analysts provided by Vara Research, it says.

- Covestro's estimate of a preliminary net loss of €60 million for the quarter compares to a steeper estimated consensus loss of €107 million, while its forecast EBITDA of €124 million compares to a lower consensus estimate of €80 million, according to the company.

- Preliminary sales are forecast by Covestro to come in lower than the consensus estimate of €2.22 billion at €2.16 billion, it says.

- Preliminary sales volumes were down 22% in the quarter, with consensus putting the decline at 22.5%.

- In April Covestro reported a fall of almost 90% year on year in its first-quarter net income to €20 million on sales that declined more than 12% to €2.8 billion, with all business segments hit hard by the COVID-19 pandemic and lower selling prices.

- Last month it also placed a Eurobond with a total volume of €1 billion in the capital markets, the proceeds of which would be used to strengthen the company's liquidity in the current macroeconomic environment.

- In May it announced it was reducing working hours in Germany and cutting salaries of all employees for six months starting 1 June in response to the pandemic and the decline in consumer demand.

- Novozymes has provided a trading update for the first half of 2020 and says it achieved overall organic growth of 4% for the period and an EBIT margin of approximately 27.5%. Overall organic sales in the second quarter declined by 2% compared with the same period of the previous year, with an EBIT margin of 26%, the company says. This is mainly due to the negative impact that measures against COVID-19 had on gasoline consumption and on its US bioenergy business, and the adverse impact that pressure on the textile industry had on the company's technical and pharma business, Novozymes says. Profits for the period have not been announced.

Asia-Pacific

- APAC equity closed higher across the region; China +1.4%, India +1.1%, Australia +0.6%, Japan/South Korea +0.4%, and Hong Kong +0.3%.

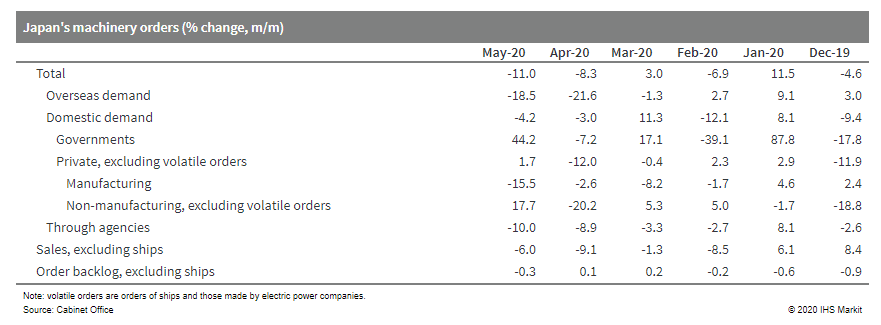

- Japan's private machinery orders (excluding volatiles) - a

leading indicator for capital expenditure (capex) - rose by 1.7%

month on month (m/m) in May following two consecutive months of

decline. (IHS Markit Economist Harumi Taguchi)

- The improvement was thanks to a 17.7% rise in orders from non-manufacturing, which was largely offset by a fourth straight month of decline in orders from manufacturing (down 15.5% m/m).

- Orders from overseas also continued to decline sharply, slipping by 18.5% m/m following a 21.3% m/m drop in the previous month.

- A solid increase in orders from non-manufacturing reflected rebounds in orders from transportation and postal services and telecommunications, while orders from finance and insurance continued to rise.

- Orders from a broad range of manufacturing industries continued

to decline. The largest drop in orders from manufacturing since

February 2016 was driven by weakness for orders from

general-purpose and production machinery, chemical and chemical

products, business-oriented machinery, and iron and steel,

reflecting severe declines in exports and production because of

global containment measures for the COVID-19 virus pandemic.

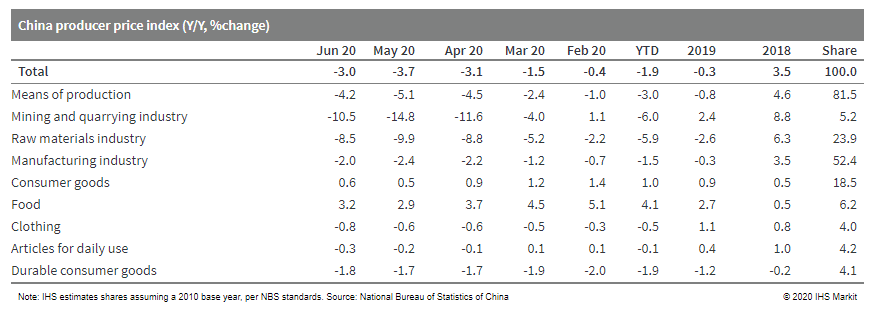

- China's year on year (y/y) consumer price index (CPI)

registered 2.5% in June, up from May's 2.4%, according to the

National Bureau of Statistics (NBS). It was the first uptick

following fourth consecutive month of decline. (IHS Markit

Economist Yating Xu)

- The month on month (m/m) CPI remained in deflation, but at a slower pace compared to a month ago. Rising food price inflation was the main contributor to the headline CPI as flooding in southern China drove up prices of fresh vegetables and supply shortage led to reinflation in pork price.

- Non-food price inflation and service CPI declined with sustained weakness in tourism and transportation. Core CPI excluding crude oil and food fell to 0.9% y/y from 1.1% y/y in May.

- M/M producer price index (PPI) inflated by 0.4% in June, ending the four-month lasting deflation. The deflation in y/y PPI narrowed to 3.0% y/y compared to 3.7% y/y in May. Improvement was broad based across upstream to downstream sectors. 22 amid the 40 surveyed industrial sectors reported m/m price decline, 12 increasing from May.

- Prices in oil related sectors such as petroleum and natural gas exploration, fuel processing and chemical products re-inflated with global oil price rise. Prices in ferrous metals and non-ferrous metals smelting and pressing saw larger inflation, reflecting recovery in production and investment.

- Industrial inflation of consumer goods manufacturing rose for the first time over the past four months, entirely due to strength in food manufacturing, while prices of durable consumer goods and clothing deflated further.

- The CPI rose by 3.8% y/y in the first half, compared to 4.9%

y/y inflation in the first quarter; PPI deflated by 1.9% y/y in the

first half, expanding from a 0.6% y/y deflation in the first

quarter.

- Tesla sold 14,954 units of its locally made Model 3 electric vehicle (EV) in China during June, up 35% month on month (m/m), reports Reuters, citing data from the China Passenger Car Association (CPCA). According to CPCA data, deliveries of Tesla's locally made Model 3 totaled 29,684 units during the second quarter of 2020. Its June sales marked another record for the Model 3 since local production began in late 2019. The strong performance of the Model 3 contrasts with falling demand in the Chinese market for battery electric vehicles (BEVs). CPCA data indicate that wholesale volumes of passenger BEVs in China totaled 67,000 units in June, down 35% compared with June 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Ford's sales in the Greater China region advanced by 3.0% in

the second quarter compared with the same period a year earlier to

158,589 units, according to the company's sales report released

today (9 July). (IHS Markit AutoIntelligence's Abby Chun Tu)

- This figure also marked growth of 78.7% over the first quarter of 2020. The data for the Greater China region (mainland China, Hong Kong SAR, Macao SAR, and Taiwan) include Ford and its joint ventures (JVs), Changan Ford, Jiangling Motors Corporation (JMC), and Ford Lio-Ho. Sales of Ford-brand vehicles totaled 30,462 units in Greater China during the second quarter, flat year on year (y/y).

- The performance of the Ford Escape sport utility vehicle (SUV) is highlighted in Ford's sales report: total sales of the Escape SUV reached 11,290 units in the second quarter.

- Lincoln-brand vehicle sales reached 13,896 units during the quarter, up 12.0% y/y. JMC's total sales, which primarily consist of light commercial vehicles (LCVs), rose by 33.8% y/y to 80,224 units in the second quarter, while Ford Lio-Ho sold 5,223 vehicles in Taiwan in the quarter, an increase of 1.8% y/y.

- Ford is seeing improvement in its sales in the Greater China region after a prolonged decline since 2018. The US automaker's sales in mainland China, including both the Ford and Lincoln brands, suffered a dramatic fall of 48% y/y in 2018 to around 510,000 units. This slump was attributed to several factors, including the rise of Chinese OEMs and a slowdown in the broader market.

- Great Wall recorded a 29.6% year-on-year (y/y) increase in

sales to 82,036 units during June, according to a company

statement. (IHS Markit AutoIntelligence's Abby Chun Tu)

- In the year to date (YTD), the automaker's sales are down 20.0% y/y at 395,097 units. Sales of the automaker's sport utility vehicles (SUVs), including Haval- and WEY-branded models, rose by 1.23% y/y to 52,651 units last month.

- Total deliveries of the Haval brand increased by 3.85% y/y to 46,998 units in June, while sales of the premium WEY brand retreated by 16.3 y/y to 5,653 units.

- Sales of the automaker's Wingle and P-series pick-ups totaled 11,677 units and 15,003 units, respectively, last month.

- Sales of the Ora electric vehicle (EV) brand, including the R1 and iQ models, totaled 2,635 units last month, down 30.0% y/y. Meanwhile, Great Wall's export volumes declined by 46.5% y/y to 3,592 units in June.

- Taiwan's exports fell 3.8% year on year (y/y) in June, slightly

outpacing a 2% y/y contraction in May. Mainland China and the

United States were the two major markets to witness increasing

sales in June on the back of restoring capacity in mainland China

and rising demand related to working from home and online learning

and entertainment. (IHS Markit Economist Ling-Wei Chung)

- Boosted by climbing demand for technology products, exports to mainland China were up 8.6% y/y and those to the United States gained 3.7% y/y

- That said, they were more than offset by the further contractions in sales to Europe, ASEAN, and Japan as demand there has continued to be dampened by the COVID-19 virus pandemic. These came despite the gradual reopening of the economies and a moderate increase in international oil prices.

- Shipments to Europe, ASEAN - where non-technology exports accounting the largest share - and Japan slumped 18.2% y/y, 12.1% y/y, and 11.2% y/y, respectively.

- By products, electronic exports continued to provide the key support to overall export growth, surging by 23.9% y/y in June, reaching the highest monthly level on record. June marked the fifth straight month of double-digit expansions and benefited from a 27.4% y/y increase in exports of semi-conductor products. Robust demand for high-performance chips amid the applications of advanced technology continued to offer the main boost to electronic exports.

- Concurrently, exports of information and communication products increased 13.8% y/y in June, after expanding 10.9% y/y in May.

- Shipments of laptop computers and related products surged 34.4% y/y, sales of storage devices jumped 26.1% y/y, and exports of servers and routers increased 11.8% y/y. They mainly benefited from increasing demand for products related to working from home, telecommunicating, and remote learning. These came despite a very high base effect.

- On the other hand, exports of non-technology products continued to plunge at a double-digit pace, as overseas demand weakened further by the COVID-19 virus pandemic, despite a gradual reopening of the economies around the world and a moderate pick-up in global oil prices. Shipments of mineral products remained the hardest hit, plunging at a record pace of 65.5% y/y in June. This was followed by more than 20% y/y drops in exports of chemicals, base metals, and plastics.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2020.html&text=Daily+Global+Market+Summary+-+9+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 9 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+9+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-9-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}