Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 08, 2020

Daily Global Market Summary - 8 July 2020

The US and China's equity markets closed higher today, while most other markets closed modestly lower on the day. Gold closed at another multiyear high and US credit indices were tighter across IG and high yield, while US government bonds and the dollar closed lower on the day. The US surpassed 3 million confirmed COVID-19 cases and additional safety precautions and closures are being mandated across the country to slow the spread, as some hospitals are already near or above full capacity.

Americas

- The U.S. surpassed 3 million confirmed COVID-19 cases less than a month after crossing the 2 million mark, as the virus spread rapidly in the nation's three most populous states. Climbing case counts in California, Texas and Florida drove the U.S. to a new single-day record of infections, with 60,000 new cases reported, according to data from Johns Hopkins University. (WSJ)

- US equity markets closed higher; Nasdaq +1.4%, Russell 2000/S&P 500 +0.8%, and DJIA +0.7%.

- 10yr US govt bonds closed +2bps/0.67% yield.

- DXY US dollar index closed -0.4%/96.42 and is at its lowest point since 11 June.

- The US Federal Reserve's unprecedented 10-month intervention in short-term borrowing markets has been wound down today. The volume of the Fed's operations in the repo market fell to zero this week after the central bank's latest 28-day loan matured on Tuesday, taking a final $53.2 billion out of the market. (FT)

- Gold closed +0.6%/$1,820 per ounce and came a bit closer to the all-time high close of $1,876 per ounce on 2 Sept 2011.

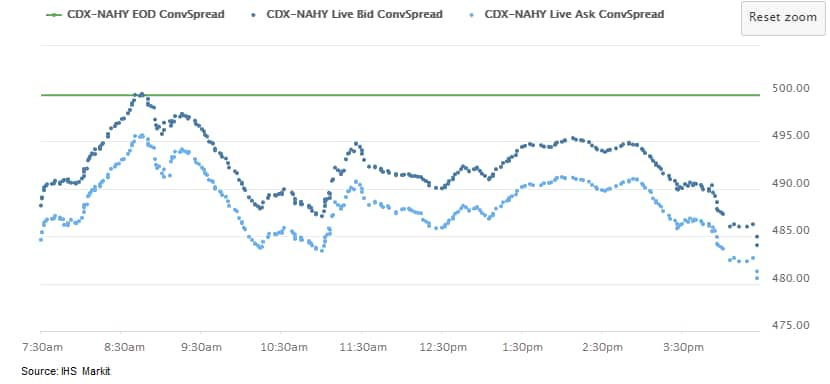

- CDX-NAIG closed -1bp/73bps and CDX-NAHY -24bps/486bps (graph

below).

- Crude oil closed +0.7%/$40.90 per barrel.

- Outstanding US nonmortgage consumer credit fell by $18 billion

(0.4%) in May even as consumer spending rebounded. (IHS Markit

Economist David Deull)

- The 12-month growth rate of outstanding consumer credit fell a further 0.8 percentage point to 0.9%.

- Revolving (mostly credit card) consumer credit accounted for the entire decrease, falling $24 billion (2.4%, seasonally adjusted) after a $58-billion plunge in April, by far the largest on record. This category of outstanding consumer credit contracted 7.2% versus May 2019.

- Nonrevolving credit outstanding increased $6 billion, recovering half of its April decline. Its 12-month growth rate edged down 0.1 point to 3.8%. This category includes student and auto loans.

- In the first quarter of 2020, the average interest rate on all credit card accounts was 15.1%, a return to the highest level seen since 2001.

- The ratio of nonmortgage consumer credit to disposable personal income was 23.1% in May, a full percentage point above its April level, which had been pulled down by a surge in disposable personal income owing to federal stimulus payments.

- Consumer spending plunged in April by 12.6%, then rebounded 8.2% in May. Revolving consumer credit fell only 5.4% in April, but kept falling the next month, a sign that federal income support to households helped to cushion households from the shutdowns in business activity and to stimulate the May rebound in consumer spending.

- Outstanding nonrevolving credit was back to business as usual in May, as student loans remain unaffected by the pandemic and consumers purchased autos at a brisk pace.

- United Airlines said it could be forced to shed almost half its U.S. workforce, telling 36,000 employees that they could be furloughed from Oct. 1 because of the pandemic-driven slump in passenger demand. The airline said those receiving mandatory WARN notices of potential furloughs include 15,000 flight attendants, 2,250 pilots and 11,000 customer service staff. United said employees could be rehired when demand recovers. (WSJ)

- New York based clothing retailer Brooks Brothers, which has about 500 stores globally and employs 4,000 people, filed for US Chapter 11 bankruptcy protection today and said it had secured $75 million in financing to tide it through the bankruptcy as it intended to find a buyer and avoid liquidation. (FT)

- Chevron Phillips Chemical (CPChem; The Woodlands, Texas) says it will take longer than originally planned to make a final investment decision (FID) on the USGC II Petrochemicals Project, an $8-billion joint venture with Qatar Petroleum (QP; Doha, Qatar). The company cites uncertainty created by the COVID-19 pandemic. Front-end engineering and design (FEED) of the project continues. "As with other capital-intensive activities, we are closely monitoring economic developments and moderating timing to preserve optionality on this project," says a statement from CPChem. "In light of uncertainty created in the wake of the COVID-19 pandemic, our company intends to defer a final investment decision while it revisits market conditions and project fundamentals." The company says it has not set a new date for FID. Orange, Texas, where CPChem already has two high-density polyethylene (HDPE) plants, remains the preferred location for the project, says the company. According to a local newspaper, The Beaumont Enterprise, Orange County authorities have approved a 10-year, 100% tax break for the project that must enter effect no later than 1 January 2024. CPChem and QP announced the USGC II Petrochemicals Project in July 2019. At the time, they expected FID by 2021 and completion in 2024. CPChem would hold a 51% share, provide project management and oversight, and be responsible for the operation and management of the facility. Centered on a 2 million metric tons/year (MMt/y) ethylene plant, the project would also include two downstream 1 MMt/y HDPE plants.

- Canadian company LeddarTech has acquired Israeli-based sensor fusion and perception software company VayaVision for an undisclosed amount. LeddarTech will integrate its open platform with VayaVision's raw data sensor fusion and perception software stack to accelerate time to market while reducing development costs and risks. This will enable LeddarTech to demonstrate its first perception software stack, Leddar Pixell LiDAR sensor, later this year, with production expected next year. LeddarTech CEO Charles Boulanger said, "The acquisition of VayaVision adds a vital building block by combining their sensor fusion and perception technology with LeddarTech's proven LeddarEngine platform. The existing single sensor solutions in the market do not provide the performance, flexibility, scalability, and cost-effectiveness that the market needs for mass deployment." LeddarTech develops high-performance, low-cost LiDAR solutions for advanced driver assistance system (ADAS) and autonomous vehicle applications. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/ Africa

- European equity markets closed lower across the region; Spain -1.6%, France -1.2%, Germany -1.0%, and Italy/UK -0.6%.

- Most 10yr European govt bonds closed slightly higher except for UK being flat on the day; Italy, Spain, France, and Germany all -1bp.

- iTraxx-Europe closed flat/62bps and iTraxx-Europe +2bps/365bps.

- Brent crude closed +0.5%/$43.29 per barrel.

- Statistics Sweden (SCB) reports that Sweden's private-sector

production contracted by 10.0% year on year (y/y) in May, after a

contraction of 9.4% y/y in April. On a monthly basis, production

was down by 0.4% month on month (m/m) in May, after a drop of 7.4%

m/m in April. (IHS Markit Economist Daniel Kral)

- Among the main sub-components, the main drag in May came from industry, down by 15.5% y/y, and services, down by 9.4% y/y. The decline in construction was relatively mild, at just 2.1% y/y (see Chart 1).

- On a monthly basis, the main drag in May came from services, which were down by 0.8% m/m, after a drop of 4.2% in March and 6.3% in April.

- Industry expanded modestly in May, at 0.5% m/m, but from a low base, given the cumulative decline of almost 17% between January and April.

- On a cumulative basis, private-sector production in May was down by 10.7% compared with January. Industry was down by 16.2%, services down by 11.3%, while construction was up by 5.7%.

- The drop in Sweden's private-sector production in May is unlike that in many European economies, for which the bottom was reached in April with a rebound from May.

- In Sweden, the cumulative decline in January-April was much milder than in other European countries, with the overall economy growing in the first quarter, as Sweden has pursued a fundamentally different approach in handling the COVID-19 virus.

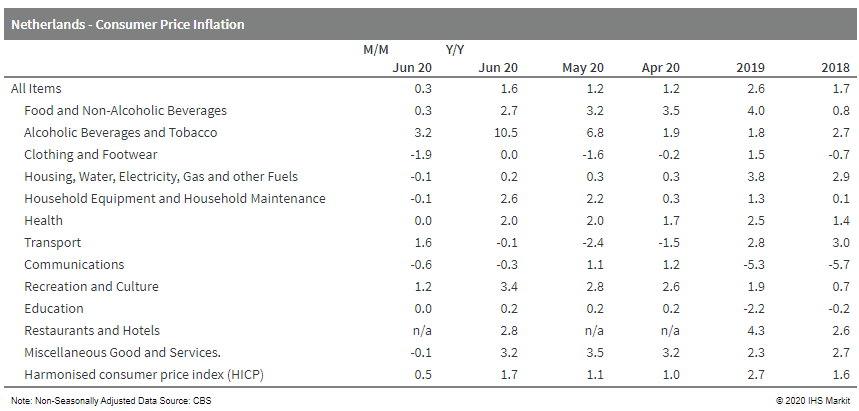

- Dutch consumer prices increased by 1.6% year on year (y/y) and

0.3% month on month (m/m) in June, according to the national

consumer price index (CPI) measure, and by 1.7% y/y and 0.5% m/m

according to the EU-harmonized measure. This means that the large

positive differential versus the eurozone, present through 2019 due

to higher VAT and energy taxes, has again started to open up. (IHS

Markit Economist Daniel Kral)

- Among the biggest drivers of the increase in June were prices of alcohol and tobacco, which increased by 10.5% y/y, and food prices, which were up by 2.7% y/y. The large increase in the former is due to higher excise duties on tobacco, coming into effect on 1 April, which is gradually feeding into higher prices as old stocks, with the lower excise duty, are sold off.

- Prices on transport jumped in June, in line with an increase in oil price. This follows few months of declines, when oil was trading at multi-year lows.

- Core inflation jumped to 2.6% y/y in June, up from 2.2% in May. This was among the highest rates in the eurozone, linked to a still historically tight labor market due to limited employment losses thanks to government support measures.

- Dutch core inflation, which excludes energy, food, alcohol and tobacco, is close to the highest since mid-2013. It reflects government support measures being successful in maintaining employment and demand in the economy.

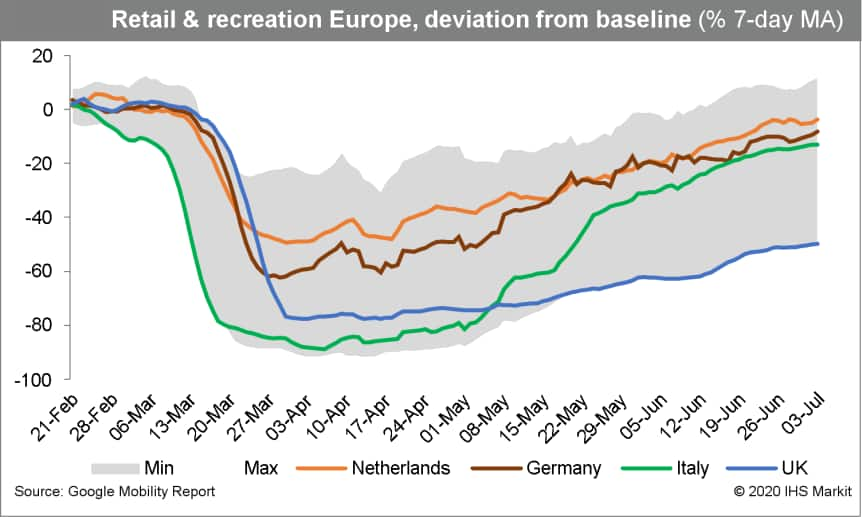

- Real-time activity trackers, such as Google's mobility report,

also show that consumer activity has picked up strongly. By early

July, the Netherlands has among the strongest improvements in

Europe in retail and recreation traffic compared to the

pre-COVID-19 baseline.

- The BMW Group has posted a decline in sales for the first half

of the year of 23% year on year (y/y) to 962,575 units. (IHS Markit

AutoIntelligence's Tim Urquhart)

- The rate of decline at least moderated substantially in June with a 9% y/y fall to 218,876 units.

- In terms of the brand by brand breakdown for the first half of the year, the BMW passenger car brand fell 21.7% y/y to 842,153 units.

- Mini experienced a larger decline in sales during the first half of 31.1% y/y to 118,862 units, while Rolls-Royce, like the overall ultra-premium passenger car market, took a significant hit with a 37.6% y/y fall to 1,560 units.

- The Group did report an increase in its sales of electrified vehicles, which were up 3.4% y/y to 61,652 units.

- In terms of the company's major sales regions, combined BMW and Mini sales were down 32.3% y/y to 372,428 units in Europe in the first half of the year.

- In the US, they were down 30.6% y/y to 133,844 units, while China is further ahead in its recovery cycle with only a 6.0% fall of BMW and Mini brand sales to 329,069 units in the first half of the year.

- Belgian agrochemical company Globachem (Sint-Truiden) has increased its capital participation in the German plant protection product company, Plantan. Globachem has been a minority shareholder in Plantan since 2010. The increased stake follows the exit of the French agrochemical group, Phyteurop, from the business. Part of the French company's share is being acquired by Globachem's holding company, while Plantan's founders, the Rübner family, is purchasing the rest. The two have become the only shareholders of Plantan. Globachem is a family-owned business. In 2019, it acquired the research and development capabilities of UK company Redag Crop Protection and renamed it Globachem Discovery. Plantan supplies crop protection products for all arable and specialty crops in Germany and Austria. (IHS Markit Crop Science's Sanjiv Rana)

- CGG's Sercel has acquired a 34% shareholding in AMBPR, a start-up company that designs and markets autonomous robots for repairing (sanding and painting) large metallic structures, used in the maritime and energy industries. The two companies have also signed an exclusive industrial partnership agreement whereby Sercel will manufacture AMBPR robots at its Saint-Gaudens site in France. The terms of this agreement also provide for Sercel increasing its stake in AMBPR to 51% in 2021. Since its creation in 2017, AMBPR has developed a prototype robot based on an instrumented articulating boom lift that can work autonomously to clean, sand and paint the sides of ships in dry dock. With the manufacturing support of Sercel, AMBPR expects to sell its first units within the next six months. (IHS Markit's Upstream Costs and Technology's Kamila Langklep)

- State Secretariat for Economic Affairs (SECO) data reveal that

Switzerland's seasonally adjusted unemployment increased modestly

by 5,503 people or 3.7% month on month (m/m) to 155,200 in June.

(IHS Markit Economist Timo Klein)

- This is lower than the 159,925 originally reported for May, which has now been revised down sharply to 149,647. Nevertheless, the declines between roughly 150,000 in mid-2016 and an interim low-point of around 105,000 in the third quarter of 2019 have been unwound during the last nine months.

- Upward momentum thus has slowed earlier than expected. The seasonally adjusted unemployment rate, which had hovered at a 17-year low of 2.3% in 2019, increased from 3.2% in May (revised down from 3.4%) to 3.3% in June. Note that this is measured against a fixed labor force figure used as the denominator, which is currently at 4,636,100 (2015-17 average; last adjusted in June 2019).

- Among other labor market indicators, seasonally adjusted job vacancies also appear to be stabilizing. They increased by 1.0% m/m to 28,561 in June, with May's level revised up quite massively from 21,013 to 28,288.

- The latest data suggest that the Swiss unemployment rate will not exceed the 4% level during this crisis. That said, some of the people that were on short-time work scheme in April may well end up losing their jobs during the next 6-12 months, therefore the cyclical peak in unemployment will probably be reached only in mid-2021 or even later.

- Credit ratings agency Fitch Ratings has changed its rating

outlook for Ethiopia to Negative amid increased risks stemming from

the COVID-19 virus pandemic, while reaffirming its rating at B

(equivalent to 57.5/100 on IHS Markit's numerical scale). Fitch

stated that the slowdown in economic growth amid the pandemic will

put pressure on the already weak external financing needs. (IHS

Markit Economist Alisa Strobel)

- Fitch's outlook revision suggests that an upgrade to Ethiopia's investment-grade rating is less likely, as Ethiopia's import coverage remains critically low and political instability and balance-of-payments strains present downside risks.

- According to the ratings agency, Ethiopia's rating reflects a modest expected increase in general government debt, while taking into account that debt levels are expected to decline gradually once growth momentum returns.

Asia-Pacific

- APAC equity markets closed mixed; China +1.7%, Hong Kong +0.6%, South Korea -0.2%, Japan -0.8%, India -0.9%, and Australia -1.5%.

- The Reserve Bank of Australia (RBA) maintained its targets for

the cash rate target and yield for three-year Australian Government

Securities (AGS) at 0.25% following the 7 July meeting of the

bank's monetary policy board. Economic data has largely remained

weak, and the RBA indicated that the current uncertainty is likely

to keep the current loose monetary policy settings in place for

some time. (IHS Markit Economist Bree Neff)

- The RBA's decision to hold was largely expected, with recent retail sales, labor market, dwelling approvals, and trade data continuing to show the negative effects of the COVID-19 virus pandemic. Additional uncertainty is arising from the outbreak of COVID-19 infections in Victoria state, and the announcement that New South Wales is to close their shared state border for the first time since 1919 to limit the spread of the virus.

- The RBA again reiterated that it would not raise the policy interest rate until progress is made towards full employment, and that it believes that headline consumer price inflation will hold sustainably within the bank's inflation target range of 2-3%. The bank's policy board assessed that both monetary and fiscal policy support would be necessary "for some time".

- Trade data continues to highlight the weakness in domestic demand, with broad-based weakness in imports during May, led by a sharp 47% m/m plunge in consumer imports of transport equipment. Merchandise exports have proven slightly more resilient, although there was a sharp fall in coal product exports in May (down 13% m/m, seasonally adjusted) and cereals exports (down 31% m/m). The result is that the country has maintained a goods and services trade surplus despite the COVID-19 virus pandemic.

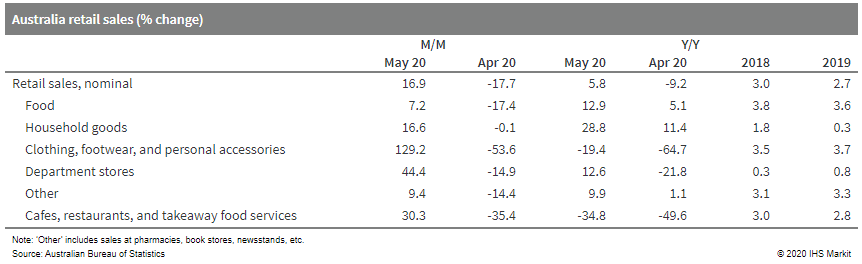

- The recent economic data highlights the uncertainties in the

economy. Retail sales surged back to a seasonally adjusted 16.9%

month on month (m/m; see below), led by a likely one-off spike in

spending at apparel retailers and department stores. However,

dwelling approvals were down - led by a 29.9% year-on-year (y/y)

contraction in non-house dwellings in May - whereas home approvals

have proven far more stable.

- Fitch Ratings affirmed Australia's long-term rating at AAA (0

on IHS Markit's numerical scale) but shifted the sovereign's

outlook to Negative from Stable. The shift in outlook stemmed from

the anticipated sharp contraction in economic activity and build-up

in government debt related to the COVID-19 viral pandemic. (IHS

Markit Economist Bree Neff)

- Fitch expects Australian GDP growth to contract sharply (May forecast -5%) for 2020 due to the pandemic, and indicated that the high level of uncertainty and risk to the country's economic outlook from the COVID-19 virus was a key factor behind the Negative outlook for the sovereign.

- Additionally, Fitch indicated that sustained weak economic growth over the medium term could heighten Australia's economic and financial stability risks due to high household debt levels, which stood at 186.8% of disposable income at the end of 2019.

- Fitch highlighted that the Commonwealth government has announced multiple fiscal packages worth 10% of GDP to be carried out over the next four years (although the bulk of the spending is for 2020-21). According to Fitch, the fiscal deficit is expected to swell to 6.9% of GDP for the fiscal year (FY) ended 30 June 2020 and to 9.0% of GDP in FY 2020-21 from the increased spending, as well as weaker-than-expected revenues.

- As a result, the agency expects gross general government debt to rise to just over 60% of GDP by June 2024, up from 41.9% in June 2019 and well above the 44% median value for AAA-rated peers.

- According to Fitch, a downgrade could arise from a failure to implement adequate fiscal consolidation measures to rein in the general government debt accumulation over the medium term.

- Japan's current-account surplus for May fell by 27.9% year on

year (y/y) to JPY1.2 trillion (USD11.0 billion) on a non-seasonally

adjusted basis, but rose by 225.3% (or JPY568.7 billion) to JPY821

billion on a seasonally adjusted basis. (IHS Markit Economist

Harumi Taguchi)

- The y/y decline was largely due to a 10.9% y/y (or JPY249 billion) drop in primary income, reflecting lower income from portfolio investment, while the trade deficit softened by 18.1% y/y (or JPY123 billion).

- The trade deficit softened, reflecting a larger contraction of imports (down 27.7% y/y), although the decrease of exports widened to 28.9% y/y.

- Although the service balance deficit narrowed from the previous month on a seasonally adjusted basis, the deficit was largely due to a decrease in the travel balance because of a 99.9% y/y drop in the number of tourist arrivals in response to entry bans from an expanded list of countries/regions.

- Mobileye has partnered with Japan's largest transport operator, WILLER, to begin testing robotaxis on public roads in Japan in 2021. Following this, the companies plan to launch fully driverless mobility services in 2023, while conducting similar services in Taiwan and other Southeast Asian markets. The companies will leverage each other's expertise as Mobileye will provide its automated vehicle technology and WILLER will offer services adjusted to each region and user tastes. Mobileye, an Israeli-based company acquired by US chip-maker Intel, offers vision-based systems to support advanced driver assistance systems (ADAS) and automated vehicle solutions. Recently, Intel acquired Israeli public transit app Moovit to help Mobileye develop robotaxis, with plans to launch them in early 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nissan has received JPY832.6 billion (USD7.8 billion) in financing from its creditors since April this year to improve its cash position and help to offset declining sales due to the COVID-19 virus pandemic, according to Reuters citing the latest annual securities report by the automaker. In addition to this funding, Nissan has said it has JPY1.1 trillion in net cash in its automotive business, and credit lines of up to JPY1.3 trillion. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Mainland China's foreign exchange (FX) reserves increased for

the third consecutive month to USD3.1 trillion in June, up CNY10.6

billion from May, according to a release by the State

Administration of Foreign Exchange (SAFE) on 7 July. (IHS Markit

Economist Yating Xu)

- Rising valuation for FX held is the main contributor to the sequential increase in FX reserves while the current account as well as capital and financial account were stable. USD index fell by 0.9% during June, driving up assets dominated in euros and pound sterling.

- Given the sustained recovery in domestic economy over the past months, the exchange rate of CNY rose by around 1% in June and overseas capital continued to flow into the share market.

- China's passenger vehicle retail sales dropped 8% in June from

a year earlier, according to the China Passenger Car Association

(CPCA). Total retail volumes have not been released by the

association. The CPAC's data tracking weekly retail sales show that

retail passenger vehicle sales were under pressure in June. (IHS

Markit AutoIntelligence's Abby Chun Tu)

- The China Association of Automobile Manufacturers (CAAM) still expects strong wholesale growth of 11% year on year in June as the market continues to recover from the COVID-19 virus outbreak.

- IHS Markit expects light-vehicle sales to have increased by 3.7% in the second quarter, followed by growth of 1% in the third quarter and a decline of 10% in the fourth quarter.

- The market will face headwinds heading into the second half of 2020 as Chinese economic growth is forecast at 0.5% this year owing to the expected severe export collapse resulting from the global economic recession.

- For the full year 2020, we anticipate light-vehicle sales in China to decline by 13.4% to 21.5 million units, followed by a rebound of 9% in 2021.

- Ford has announced plans to begin testing vehicle-to-infrastructure (V2I) technology on designated roads in the Chinese city of Changsha, reports Gasgoo. The V2I function is based on cellular vehicle-to-everything (C-V2X), a technology that allows vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure. The automaker has partnered with Hunan Xiangjiang Intelligent Science and Technology Innovation Center to test the function, which is set to be launched for trial use this year. The function will be available to Ford owners in China through over-the-air (OTA) updates to the automaker's in-vehicle communication and infotainment system, SYNC+. This move is in line with Ford's aim to deploy C-V2X technology in its vehicles in China during 2021. In September 2018, Ford demonstrated C-V2X technology at the 2018 World Internet of Things Expo in Wuxi (China) for the first time on public roads in China, with a view to improving automated vehicles and safety worldwide. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korean battery maker LG Chem has partnered with GS Caltex to develop electric vehicle (EV) battery specialized services using big data, according to a company statement. For this, the two companies have also signed a memorandum of understanding (MoU) with Signet EV, Soft Berry, KST Mobility, and Green Car. The companies are planning to develop services by 2021. After completing the empirical project by 2021, LG Chem and GS Caltex will launch domestic service businesses and expand the battery specialized service business to overseas charging markets starting in 2022. The purpose of this MoU is to use EV big data collected at charging stations to find various battery specialized services, and LG Chem and GS Caltex agreed to first develop a battery safety diagnostic service. The battery safety diagnostic service will save driving and charging data in a cloud server while an EV (Green Car, KST Mobility) charges at a GS Caltex Charging Station, and using the LG Chem big data analysis and battery service algorithm, the current status and dangers of the battery will be checked and provided not only on the charger panel (Signet EV), but also the driver's mobile phone (Soft Berry). (IHS Markit AutoIntelligence's Jamal Amir)

- The police at Visakhapatnam in Andhra Pradesh State, India, say they have arrested the CEO and two directors, as well as nine other officials, of LG Polymers India (LGPI; Mumbai), an affiliate of LG Chem, for a styrene gas leak from tanks at the company's polystyrene (PS) plant near Visakhapatnam. The gas leak on 7 May killed 15 people and made about 1,000 people ill. The arrests were made a day after a high-level committee, appointed by the state government to probe the accident, submitted its report to the chief minister of Andhra Pradesh. The police say that the committee's report disclosed that the accident occurred due to poor design of the tanks; an inadequate refrigeration and cooling system; the absence of circulation systems; inadequate measurement parameters; weak safety protocols; poor safety awareness; and inadequate risk assessment and response.

- Vehicle production in Vietnam plunged 46.8% year on year (y/y) during May to 9,156 units, according to data released by the ASEAN Automotive Federation (AAF). During January-May, total vehicle production in the country fell by 42.1% y/y to around 46,245 units. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2020.html&text=Daily+Global+Market+Summary+-+8+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 8 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+8+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-8-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}