Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 11, 2020

Daily Global Market Summary - 11 June 2020

Global equity markets sold off at a pace today comparable to some of the most dire trading sessions in March, as the rapid rise in COVID-19 hospitalizations in certain US states is creating growing concerns over the implications of a potential second wave. Benchmark governments bonds closed higher, while credit indices widened significantly.

Americas

- US equity market declined precipitously today; Russell 2000 -7.6%, DJIA -6.9%, S&P 5.9%, and Nasdaq -5.3%. All the US indices progressively ratchetted lower as the day progressed and closed near the session's lows, with the S&P reporting its biggest single day loss since 9 March.

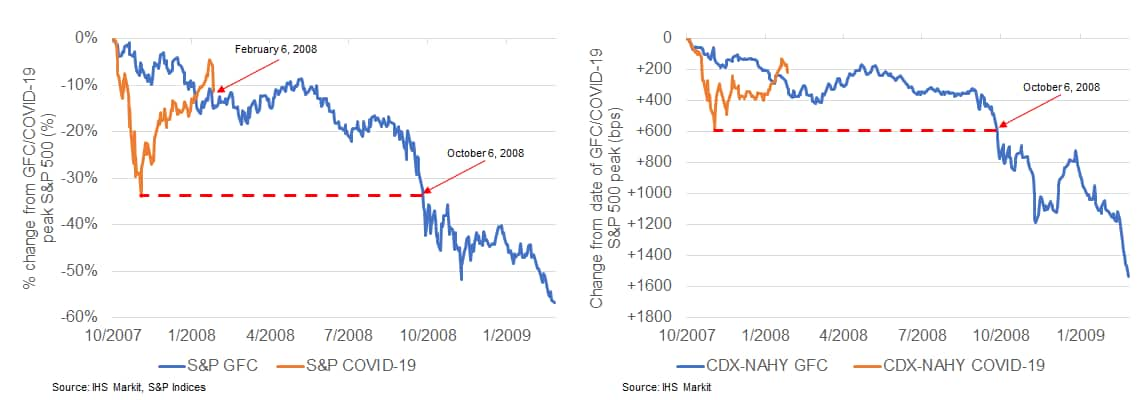

- When comparing the number of trading days past the S&P

500's Great Financial Crisis peak on Oct 12, 2007 and the recent

all-time peak on Feb 19, 2020, the below graphs indicate that we

are currently at the equivalent of Feb 6, 2008, which was about a

month before the collapse of Bear Stearns. In addition, the graph

shows that this year's 23 March S&P 500 nadir corresponds with

almost the same % from peak level on Oct 6, 2008, which was a few

weeks after the collapse of Lehman Brothers. The graph on the right

shows that Oct 6, 2008 was also aligned with the March 23, 2020

close for CDX-NAHY (in terms of spread versus day of the S&P

peaks).

- The US Treasury curve closed higher and flatter on the day, with 10yr US govt bonds closing -5bps/0.67% yield and 30yr bonds -11bps/1.40% yield.

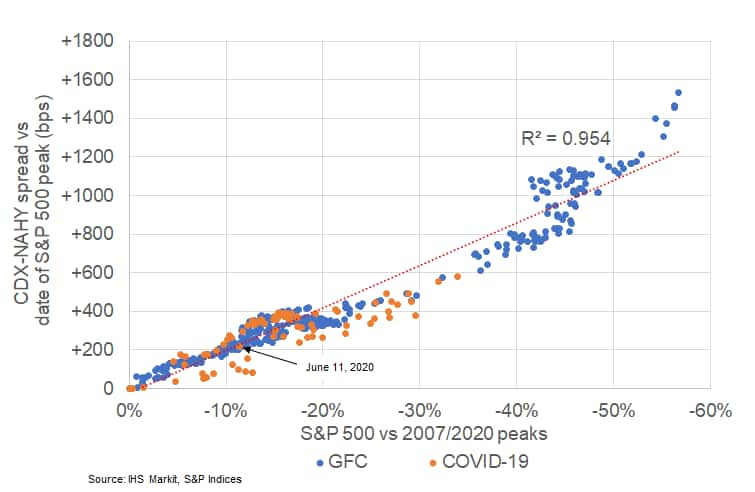

- US credit indices closed sharply lower; CDX-NAIG closed

+8bps/82bps and CDX-NAHY +53bps/504bps. The below scatter plot uses

the same data from the prior two graphs to show the relationship

between CDX-NAHY (in terms of spread versus the day of the S&P

peaks) and the change in the S&P 500 for both the GFC and 2020

peaks. As would be expected the relationship between CDX-NAHY and

the S&P during these two periods is very linear.

- Crude oil closed -8.2%/$36.34 per barrel.

- Some U.S. states that were largely spared during the early days of the Covid-19 pandemic are now seeing record hospitalizations, causing some experts to fear that loosened restrictions and the approach of summer led many Americans to begin letting down their guard. In Arizona, the state's health department over the weekend reminded hospitals to be in emergency mode as intensive-care units in the state approached 80% capacity. Texas set three straight days of hospitalization records this week, surpassing 2,000 a day for the first time. Utah hospitals have hit records twice in hospital admissions since May 25. (WSJ)

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,542,000 in the week ended 6 June, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. This was the 12th straight

week with claims in seven figures and a total of 40.4 million

initial claims (non-seasonally adjusted) have been filed over this

period. (IHS Markit Economist Akshat Goel)

- There were 705,676 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 6 June. A total of 6,919,486 initial claims for PUA have been filed so far.

- The seasonally adjusted number of continuing claims, which lag initial claims by a week, fell by 339,000 to 20,929,000 in the week ended 30 May. This is well below the all-time high of 24,912,000 in the week ended 9 May and indicates that as businesses reopen, furloughed workers are cautiously getting recalled.

- The insured unemployment rate in the week ended 30 May stood at 14.4%, up from 1.2% in early March.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. The unadjusted total for the week ended 23 May was 29,504,914; 64% of this total is from the "Regular State" program and 33% from the PUA program.

- The total US producer price index (PPI) for final demand rose

0.4% in May after three consecutive declines totaling almost 2%.

(IHS Markit Economist Michael Montgomery)

- Goods prices surged 1.6%, paced by food up 6.0% and energy up 4.5%; core goods prices were flat, however. Total goods prices surged with food and fuels leading (and comprising all) of the charge. Outside of food and fuel, goods prices stalled. Food prices were dominated by a massive 69.1% spike in beef and veal, which should surprise no one who has looked in the meat department at their grocery store recently. The food spike can be laid at the feet of the pandemic as packing plant operations were disrupted.

- Total services prices fell 0.2%, with trade margins down 0.8%, transportation and warehousing up 1.5%, and "other" services flat. Within the trade margins group results were all over the place as fuel margins fell after surging in April, but with vehicle dealer margins plunging.

- Services have borne the brunt of the COVID-19 pandemic with odd quirks in prices—some normal, and others reversing April changes. Trade margins at gas stations exploded to the upside in April and reverted in May. RV and camper margins rebounded. Airline fares dominated transportation and warehousing by rebounding by double-digits after being drubbed by double-digit drops in each of the two prior months. The impact of this would not matter if the results were chain-weighted monthly as volumes were almost nil in both months. The balance of services was held to a standoff as surging sector prices offset collapsing prices in other areas.

- In year-on-year (y/y) terms, the headline figure fell 0.8%; excluding food, energy, and trade margins, prices slid 0.4% y/y.

- Ford CEO Jim Hackett and COO Jim Farley provided some

background on the recovery from the COVID-19 virus pandemic and

confirmed that the F-150 and Transit electric vehicles (EVs) will

arrive by mid-2022. According to Automotive News, the confirmation

also came as part of presentations by Farley and CEO Jim Hackett at

the Deutsche Bank 2020 Global Auto Industry Conference on 10 June.

(IHS Markit AutoIntelligence's Stephanie Brinley)

- In addition, Farley said that Ford expects to lose USD5 billion in the second quarter on COVID-19 virus pandemic-related impacts.

- Farley and Hackett also reiterated the timelines announced earlier, that the Bronco SUV, F-150 pick-up and Mustang Mach-E will be delayed by about two months as a result of factories being shut down, but does not expect further delays.

- Farley says that since production resumed on 18 May in North America, Ford has hit about 96% of its planned volume (although he did not clarify what that number is); Ford is adding shifts and overtime and expects to be back at pre-pandemic patterns by 6 July.

- Farley also said that Ford's new-vehicle sales rose 44% in May 2020, compared with April 2020, and that F-Series in May was up 5.3% compared with May 2019.

- Tesla CEO Elon Musk has written to the company's employees saying that it is time to bring the Tesla Semi, an electric Class 8 semi-truck, to "volume production", report Reuters, citing a company internal email. However, the news agency, which says it saw the email directly, says that Musk did not specify a timeframe for ramping up production of the electric semi-truck. On Twitter, Musk replied "Yes" to a posted question about whether the report about bringing the Semi model to production was true. Reuters reports that Musk wrote, "Production of the battery and powertrain will take place at Giga Nevada." He reportedly added that most of the other work for the semi-truck would take place in other US states, although he did not say where. Musk said that initially he wanted production of the Semi to begin in 2019, but that target had shifted to 2021, reports Reuters. Following the news of the Semi production plans, Tesla's stock price exceeded USD1,000 per share. The report on Musk's email also comes in the same week that Nikola has joined the NASDAQ stock market with its plans for electric vehicle (EV) and fuel-cell hydrogen EV medium and heavy commercial trucks. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors' (GM) self-driving technology subsidiary, Cruise, has hired its first dedicated safety chief, while electric vehicle (EV) startup Nikola has appointed a new manufacturing executive, as well as an executive to head its hydrogen-fuelling and battery-recharging business. Cruise has hired Louise Zhang as the company's vice-president of product safety, reports Automotive News. Zhang has joined Cruise after working at Lucid, Tesla, and Delphi, leading safety system integration projects with Chinese automakers in Shanghai. Automotive News reports that Nikola has hired former Tesla executive Mark Duschene to head manufacturing and former Caterpillar executive Pablo Koziner to head its hydrogen-fueling and battery-recharging business. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Agricultural chemicals company Nufarm (Melbourne, Australia) sees its proprietary omega-3 canola oil product, first sales of which are expected shortly, as "potentially a very transformational opportunity." CEO Greg Hunt told the Credit Suisse 2020 London Chemical and Agricultural Conference last month that the company could envisage its Nuseed subsidiary capturing 20-30% of the approximately $2-billion growth expected in the world market for fish oil by the end of the decade, with an EBITDA of about A$8.5 million ($6 million) for every 1% of market share gained. Nufarm's underlying EBITDA was A$420.3 million in the fiscal year ended 31 July 2019 (FY2019). Hunt said the industry estimates that the aquaculture and human healthcare industry will require approximately twice the current world supply of fish oil by the end of the decade. The present supply, estimated to be worth about $2 billion/year, is constrained by quotas on fish catches.

- USDA'S June WASDE report showed corn carryout only marginally increased, while the market was anticipating a 50-million-bushel increase. USDA lowered its 2019 US corn production 45 million bushels on lower harvested acreage and lower yield (down to 167.4 bushels per acre). This was offset by a 50-million-bushel reduction in its forecast for corn use for ethanol. IHS Markit was anticipating a higher reduction, of about 100 million bushels. The net result is USDA's carryout increased 5 million bushels to 2,103 million in 2019/20 and to 3,323 million in 2020/21. Both figures were below trade expectations. (IHS Markit Agribusiness' Anamaria Martins)

- During the first five months of 2020, total coal shipments from

WC Canada are calculated at 21.6mt, up 1.8mt y-o-y. Shipments from

Vancouver port (comprises of Neptune and Westshore terminal)

totaled at 16.6mt (up 0.9mt y-o-y) and similar surge was also

witnessed from Prince Rupert (comprises of Ridley Terminal) where

shipments totaled at 5mt (up 1mt y-o-y). (IHS Markit Maritime &

Trade's Rahul Kapoor and Pranay Shukla)

- The surge in coal exports from Ridley Terminal is expected to increase further this year and onwards on back of increase in thermal coal shipments from Cline's Group Vista coal mine.

- Vista mine located in Alberta Province is a thermal coal mine developed in two stages - Under stage 1 thermal coal production to be increased to 7mtpa and under stage-2 production capacity to be increased further to 14mtpa. Coal produced at the mine is railed to Ridley Terminal via Canadian National Railway.

- Ridley Terminal also had signed a contract in Jan 2020, to increase metallurgical coal shipments from Teck Resources under existing contract of 3mtpa to 6mtpa starting from Jan 2021. Teck Resources also has an option to increase its shipments to a maximum of 9mtpa under the terms of the agreement. The contract is signed to run until Dec 2027.

- Ridley terminal currently has a handling capacity of 16mtpa and can handle vessel up to 250,000dwt. The terminal is planning to increase its capacity to 20mtpa.

Europe/Middle East/ Africa

- European closed significantly lower across the region; Spain -5.0%, Italy -4.8%, France -4.7%, Germany -4.5%, and UK -4.0%.

- 10yr European govt bonds closed sharply higher across the region; Germany/France -8bps, UK -7bps, and Italy/Spain -5bps.

- Brent Crude closed -7.6%/$38.55 per barrel.

- iTraxx-Europe closed +4bps/71bps and iTraxx-Xover closed +29bps/366bps.

- Italian industrial production fell by a cumulative 42.1% in

March and April. (IHS Markit Economist Raj Badiani)

- Industrial production fell by 19.1% month on month (m/m) in April after a 28.4% m/m drop in March. It also implied that output retreated in four of the last six months.

- Meanwhile, on a working-day-adjusted basis, industrial output fell plunged by 42.5% year on year (y/y) in April. This implies that production contracted by 18.8% y/y in the first four months of this year, compared with a 1.0% drop in 2019.

- Falling output between March and April was across all the main categories. The largest drags on a y/y basis were from manufacture of textiles, wearing apparel, leather and accessories (-80.5%), transport equipment (-74.0%) and machinery and equipment (-51.0%).

- A breakdown by a broader type of good reveals that the production of capital goods contracted 51.5% y/y in April, reflecting the darkened investment landscape at home and abroad. Meanwhile, consumer durables output plunged by 84.2% y/y over the same period comparison.

- The Swedish Association of the Pharmaceutical Industry

(Läkemedelsindustriföreningen: LIF) has released a short statement

indicating that pharmaceutical exports surged by an estimated 35%

year on year (y/y) during the first quarter of 2020. (IHS Markit

Life Science's Eóin Ryan)

- Total pharmaceutical exports during the first three months of the year amounted to a reported SEK35.0 billion (USD3.8 billion), compared with SEK27.0 billion during the corresponding 2018 period. This builds upon consecutive sequences of very large quarterly increases reported by the LIF. Export data for 2019 as a whole increased by a reported 28% y/y growth.

- The LIF does not provide an in-depth analysis for the reasons for surge in pharmaceutical export growth. However, the main drivers are likely to be similar to those that contributed to growth in 2019, namely the growth in exports to China and the US as key trading partners and the consolidation and slight expansion of growth volumes to Europe. A further part of the explanation for the sharp increases during the quarter is the growth in global demand for pharmaceutical products ahead of, and during, the COVID-19 virus outbreaks.

- Ford and Volkswagen (VW) have announced that they have signed agreements for joint projects including commercial, electric and autonomous vehicles. The outline of the plans was announced in July 2019, and little has changed with the 10 June signing, although several details were clarified. The companies confirmed they intend to produce a combined 8 million units of the three commercial vehicles (CVs) included in the commercial relationship, much of which was announced in January 2019. These projects include VW selling a medium pick-up produced on Ford's Ranger from 2022 as the Amarok, Ford and VW each selling a city van created by VW Commercial Vehicles, which is now confirmed to be a version of VW's Caddy as soon as 2021; and Ford developing a 1-tonne van for both brands; these products are expected primarily for the European market. Ford and VW say that the three vehicles expected to sell about 8 million units over their respective lifecycles. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Johnson Matthey, one of Europe's leading producers of autocatalysts, today announced massive cost cuts as it battles the COVID-19 impact on its business. The company is to slash 2,500 jobs over the next three years, accounting for 17% of its total. These measures form part of a new plan to target annualized savings of at least £80 million ($102 million) over the next three years. Johnson Matthey said cost cuts would come from consolidating plants in its main division, clean air, which accounts for about 60% of sales, and by using better technology to simplify its organization.

- Continental is preparing to lay off some of its workforce as part of a cost-saving plan, reports Wirtschaftswoche. Sources have told the newspaper that Elmar Degenhart said in an internal video that the company is looking to save around EUR100 million, adding, "It will be very painful. But we have no choice." He went on to say, "We cannot currently provide job guarantees. The likelihood that we have to speak about layoffs is very, very high." The senior executive said that it will not be relying on the hope of further government support, stating, "We have given up hope that the economic stimulus packages are good and effective enough to bring momentum to the automotive markets in the short term." Although the German government has revealed some plans to support the automotive industry through domestic market incentives, they are not as generous as those which were launched in 2009 during the global economic crisis, and instead mainly focus on pivoting demand towards battery electric vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

- AkzoNobel today provided an update on its business in light of

the COVID-19 pandemic. The company says that the steps it took to

reduce costs rapidly are proving successful and keeping the

organization intact and able to respond quickly to changes in

end-market demand. The company's revenue in the first quarter

dropped by about 5% with Asia the most affected region throughout

the period. Other regions were impacted only from the second half

of March.

- Market headwinds were strongest during April and resulted in revenue falling almost 30% below last year. Demand improved as some lockdown measures started to ease, although revenue for May remained about 20% below 2019.

- Distribution channels for decorative paints have mostly reopened in China and Europe, with demand returning toward previous levels. Varying degrees of market disruption persist in the rest of Asia and South America.

- Segments related to the automotive and aerospace industries continue to be more significantly affected than others. Market headwinds are expected to ease further throughout June, although they continue to vary between regions and segments.

- Monthly data reveal dramatic declines in industrial output and

exports owing to closures at Slovakia's automotive plants caused by

the coronavirus disease 2019 (COVID-19) virus pandemic. A gradual

recovery is expected from May onwards. (IHS Markit Economist Sharon

Fisher)

- Working-day-adjusted industrial production plunged by 42.0% year on year (y/y) in April, a historic low. In seasonally adjusted terms, output was down by 23.4% month on month (m/m) after falling at nearly the same pace in March.

- While all major manufacturing branches reported double-digit declines, April's drop was the steepest in transport equipment, which plummeted by 78.9% y/y owing to the closures at Slovakia's four automotive producers. Kia partially reopened on 6 April, followed by Volkswagen (20 April), PSA Peugeot (12 May), and Jaguar (18 May); however, a resumption of full production will depend on the recovery of demand in key export markets.

- Outside the transport sector, other key manufacturing branches were also hit hard, including rubber and plastics, machinery and equipment, metals, and computer and electronics. Even food and beverages output fell by double digits.

- The poor industrial output results were matched by plummeting exports, which dropped by 43.0% y/y in April. Imports fell a more modest 36.6% y/y, triggering a widening of the monthly trade deficit.

- Construction data were also quite negative, down by 13.7% y/y, owing to declines in both building and civil engineering construction. In seasonally adjusted terms, construction activity fell by 10.0% m/m.

Asia-Pacific

- APAC equity markets closed lower across the region, but most to a lesser degree than the US and Europe; Australia -3.1%, Japan -2.8%, Hong Kong -2.3%, India -2.1%, South Korea -0.9%, and China -0.8%.

- China's new aggregate financing, the widest measure of net new

financing to the real economy, increased CNY3.19 trillion in May

2020, up CNY96 billion from the previous month and CNY1.48 trillion

higher than the amount a year ago, according to the release of the

People's Bank of China (PBOC). The stock TSF increased 12.5% year

on year (y/y), 0.5 percentage points up from April. (IHS Markit

Economist Yating Xu)

- Bank loans increased CNY1.48 trillion with an acceleration of corporates' long and medium-term loans and improvement in households borrowing, which was the major contributor to May's new TSF. Loans injected to real economy increased by CNY1.55 trillion. Under the acceleration of infrastructure investment and ongoing production resumption, new corporates' long and medium-term loans increased 110% y/y, compared to 47% y/y and 96% y/y in March and April respectively.

- Under the expansion of local government special-purpose bond quota and the end-may deadline to finish the issuance of pre-announced quota, new local government bond issuance reported CNY1.14 trillion in May, up CNY804 billion from the previous month and CNY754 billion from a year ago. However, corporate bond issuance declined sharply from April due to the rising interest rate in May.

- In contrast to the acceleration of stock TSF growth, broad money supply (M2) growth stayed at 11.1% y/y, unchanged from the previous month.

- The China Passenger Car Association (CPCA) released sales

results for passenger vehicle in May. The market data indicates

monthly retail sales of passenger vehicles in China returned to

growth for the first time since the COVID-19 virus outbreak hit the

country in December 2019. Retail sales of passenger vehicles in May

totaled 1.61 million units, up 1.8% year on year (y/y), in China.

The data only cover sedan, sport utility vehicle (SUV), and

multipurpose vehicle (MPV) models. (IHS Markit AutoIntelligence's

Abby Chun Tu)

- In the year to date (January to May), retail volumes of passenger vehicles totaled 6.05 million units in the Chinese market, down 26.0% y/y.

- The premium passenger car segment outperformed the broader market during May. Retail sales of premium vehicles jumped 28% y/y in May, underpinned by replacement demand. Export volumes of new passenger vehicles are reported at 58,000 units during May, marking a sharp decline of 36% y/y.

- In May, export demand declined by 45% compared with April, indicating further worsening of demand for new vehicles in overseas markets.

- IHS Markit forecasts premium vehicle sales in China to fall by 7% to 2.9 million units during 2020, before rebounding to 8% growth in 2021.

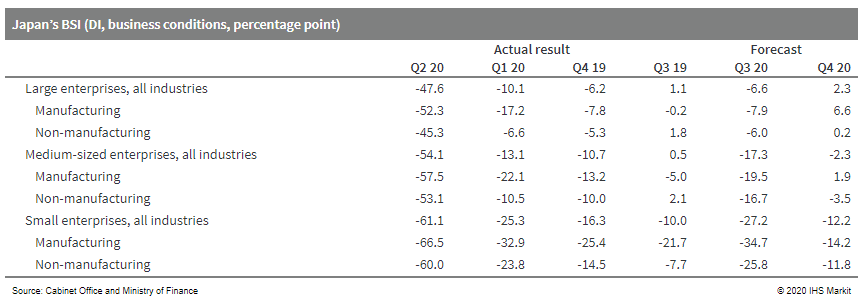

- According to the Business Outlook Survey for the second quarter

of 2020, Japan's current Business Survey Index (BSI) for large

enterprises fell by 37.5 points, the sharpest quarter-on-quarter

(q/q) decline since the survey started in the second quarter of

2004, to -47.6, which is the lowest level since the first quarter

of 2009. (IHS Markit Economist Harumi Taguchi)

- The contraction of the seasonally adjusted reference series of the BSI for large manufacturing enterprises also fell by 34.7 points from the previous quarter to -43.6 in the second quarter of 2020. The BSI for all sized non-manufacturing enterprises dropped to a historical low, suggesting severe business conditions because of COVID-19-related containment measures.

- The future conditions BSI suggests all enterprises anticipate a gradual ease of containment measures to lift business conditions. However, the outlook is still gloomy, as medium-sized non-manufacturing enterprises and small-sized enterprises expect a continued deterioration of business conditions even in the fourth quarter of 2020.

- Despite severe business conditions, all sized non-manufacturing enterprises are still experiencing labor shortages, even though labor demand has eased sharply.

- The Diffusion Index (DI) of machinery and equipment for all

sized enterprises (except for small-sized non-manufacturing) turned

negative, suggesting rapid drops in capacity utilization. This

resulted in a downward revision for plans for software and

investment in plant and equipment to -4.4% for fiscal year (FY)

2020, down from a 0.5% year-on-year (y/y) rise in the previous

survey.

- South Korean OEMs - Hyundai, Kia, General Motors (GM) Korea,

Renault Samsung, and SsangYong - have reported a 36.9% year-on-year

(y/y) plunge in their combined domestic output to 231,099 units

during May, reports Yonhap News Agency, citing data released by the

South Korean Ministry of Trade, Industry, and Energy. (IHS Markit

AutoIntelligence's Jamal Amir)

- Vehicle exports from the country also nosedived during the month by around 57.6% y/y to 95,400 units, and the total value of overseas shipments fell by 54.1% y/y to USD1.81 billion.

- The report highlights that shipments to North America declined

by 54.0% y/y in May, while vehicle exports to the European Union

fell by 30.3% y/y and to Asian countries by 65.0% y/y.

Hyundai, South Korea's biggest automaker, experienced a 58.5% y/y decline in exports last month, while its affiliate Kia's overseas shipments shrank by 58.0% y/y. - Exports by Renault Samsung and SsangYong fell by 66.3% y/y and 83.2% y/y, respectively. Outbound shipments by GM Korea also halved during the month.

- The decline in South Korean vehicle production and exports during May was largely the result of sluggish demand in overseas markets caused by a contraction in consumer spending amid the COVID-19 virus pandemic, as well as the fact there were fewer working days last month compared with May 2019, coupled with a components shortage.

- Hyundai Heavy Industries (HHI) has entered into a technical cooperation memorandum of understanding (MOU) with CADMATIC, a Finnish software firm, to jointly collaborate in the development of next-generation design systems. The newly developed designs will be applied to the latest technologies, such as AI, Big Data analysis, advanced modeling and drawing automation. (IHS Markit Upstream Costs and Technology's Jessica Goh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-june-2020.html&text=Daily+Global+Market+Summary+-+11+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}