Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 12, 2020

Daily Global Market Summary - 12 June 2020

US equity markets closed higher today, while most APAC markets were lower, and European markets closed mixed. US equity markets zig zagged all day, which likely reflects the growing uncertainty after the negative tone of the Fed's statement on Wednesday and yesterday's market rout. Risk appetite appears to have decreased significantly in the wake of the increases in COVID-19 US infections/hospitalizations in addition to many other factors, as evidenced by the sharp declines in government bond yields, wider credit spreads, and the US dollar higher versus last week.

Americas

- US equity markets closed higher on the day after a roller coaster ride of a session; Russell 2000 +2.3%, DJIA +1.9%, S&P +1.3%, and Nasdaq +1.0%.

- 10yr US govt bonds closed -3bps/0.70% yield, which is a -20bps week-over-week.

- DXY US dollar index closed +0.4% today and was as much as 1.8% higher today versus Wednesday's three-month intraday low:

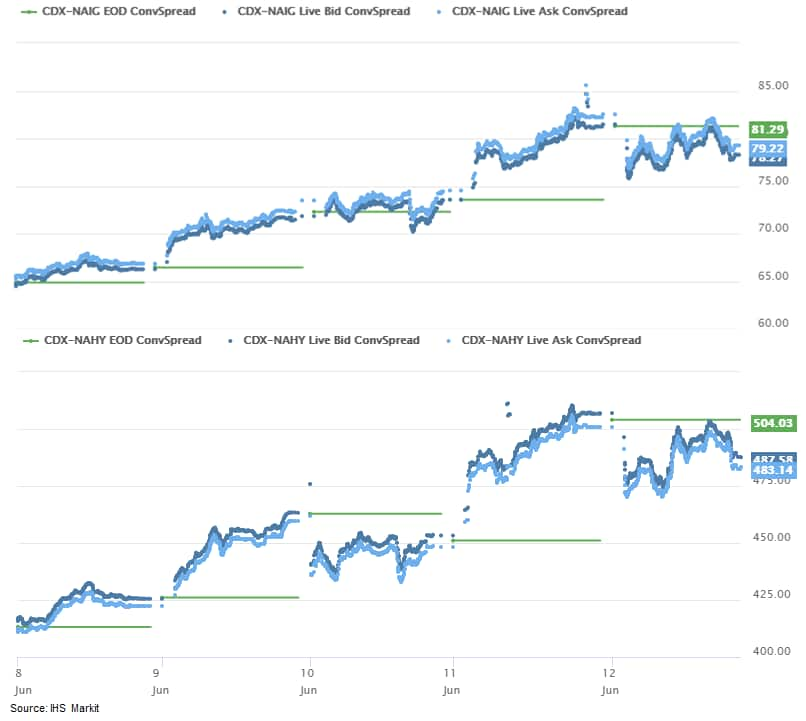

- CDX-NAIG closed -2bps/79bps and CDX-NAHY -19bps/485bps,

widening 14bps and 72bps week-over-week, respectively.

- Crude oil closed -0.2%/$36.26 per barrel.

- The US University of Michigan Consumer Sentiment Index rose 6.6

points (9.1%) in the preliminary June reading after remaining near

its April nadir in May. The index remains 22.1 points beneath its

February peak. This reading is consistent with other high-frequency

indicators we are tracking that show improvement through May and

early June, but the second quarter will still see an extraordinary

decline in economic activity. (IHS Markit Economists David Deull

and James Bohnaker)

- The current conditions index recovered 5.5 points in early June, to 87.8, while the expectations index regained 7.2 points to 73.1.

- Consumer sentiment increased 7.6 points to 82.7 among households earning more than $75,000 a year and rose 4.9 points to 74.0 for those earning less. The strong rally in equity markets through 10 June, coincidentally the cutoff date for survey collection, helped to fuel consumer sentiment for upper-income households in particular.

- Buying conditions improved across the board in June. The index of buying conditions for large household durable goods rose 9 points to 114, still depressed relative to its pre-COVID-19 range. However, the index of buying conditions for homes was back in its 2019 range after a 13-point increase to 132, and the index of buying conditions for vehicles climbed 10 points to 141—the highest since April 2018—assisted by lower interest rates.

- Inflation expectations stepped back in June, although they remained elevated. The expected one-year inflation rate declined 0.2 percentage point to 3.0%, while the expected five-year inflation rate fell 0.1 point to 2.6%.

- The net percent of respondents expecting an improved financial situation in one year was 34%, the highest since July 2019, but this still translated into an average expected probability of increased personal income in the year ahead that was lower than one-half (48.2%).

- The index of US import prices increased 1.0% in May following a

2.6% drop in April, marking the largest monthly increase since

February 2019. The index's 12-month growth rate rose 0.8 percentage

point to -6.0%. (IHS Markit Economist Gordon Greer)

- The index of nonfuel import prices ticked up 0.1% in May, while its 12-month growth rate moved to -0.7%.

- Fuel import price growth found a bottom in April after sliding all year. The index of prices for imported fuel bounced 20.5% month on month (m/m) in May after a 31.0% April decline. The cost of imported fuel was down 49.6% versus May in the prior year.

- Export prices rose 0.5% m/m in May, with the 12-month growth rate rising 0.8 percentage point to -6.0%. The increase was driven by prices for nonagricultural exports.

- According to the Bureau of Labor Statistics (BLS), the collection method for data in the May report was unchanged. The response rate for surveyed firms was 4.5% lower than in May 2019. While top-level price indices were determined to be representative of total trade, several detailed indices were not published because of insufficient data.

- Autonomous truck startup Kodiak Robotics has filed a 49-page safety self-assessment report with the US National Highway Traffic Safety Administration (NHTSA). The document discusses the company's approach in providing long-haul trucks with autonomous vehicle (AV) technology while ensuring a safe driving environment for everyone. Kodiak mentioned that it is following "structured highway driving" as a go-to-market approach. The company has named its AV system Kodiak Driver; it has sensors with overlapping fields of view and uses commercial-grade steering columns. The report also covers other topics such as cybersecurity, regulatory compliance and systems engineering. Kodiak Robotics was founded in April 2018 by Don Burnette and Paz Eshel to develop autonomous technology for long-haul trucking. In August 2019, Kodiak received USD40 million in funding and began its first commercial deliveries in Texas (United States). The company recently laid off about 15 employees, 20% of its total staff, in response to the severe impact of the COVID-19 virus pandemic on the economy. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Guatemala's Minister of Finance Álvaro González Ricci announced

on 11 June that the International Monetary Fund (IMF) has approved

a USD594-million emergency loan to finance government spending

during the COVID-19-virus pandemic. (IHS Markit Country Risk's Kari

Pries)

- Ricci indicated that the funds will be used to fill a projected GTQ5.25-billion (USD667 million) tax revenue shortfall, according to Superintendency of Tax Administration (SAT) forecasts.

- The IMF loan adds to the country's successful USD1.2 billion of bond issuance in late April in helping to fund the GTQ13 billion approved to finance the government's COVID-19-virus-related public and business-relief spending.

- Emergency rescue measures to date include payments of GTQ1,000 for three months to 2 million low-income households, a salary supplement of GTQ75 per day for formal workers with suspended contracts, and a GTQ250-million fund to finance loans for small and medium-sized businesses administered by the National Mortgage Credit (Crédito Hipotecario Nacional: CHN).

- Of the approved government lending, only about USD129 million has been disbursed to date. Guatemala's Congress must approve the IMF loan before its disbursement.

Europe/Middle East/ Africa

- Most European equity markets closed modestly higher, except for Germany -0.2% and Switzerland -0.3%; France/UK +0.5%, Italy +0.4%, and Spain +0.2%.

- 10yr European govt bonds closed mixed; Italy -4bps, Germany/Spain -3bps, UK +1bp, and France +4bps.

- iTraxx-Europe closed -2bps/69bps and iTraxx-Xover -4bps/398bps

today, widening 10bps and 57bps week-over-week, respectively.

- Brent crude closed +0.5%/$38.73 per barrel.

- The United Kingdom's Office for National Statistics (ONS) has

confirmed deeper GDP losses in April after the emergency quarantine

and social-distancing measures were in place for the whole month to

tackle the COVID-19 virus outbreak. (IHS Markit Economist Raj

Badiani)

- The ONS reports that real GDP fell by 20.4% month on month (m/m) in April, the largest drop since the monthly series began in 1997 and was preceded by falls of 5.8% m/m in March and 0.2% m/m in February. The GDP losses in March were a warning given the enforced lockdown was in place for just seven working days during the period (although voluntary distancing measures having been widely adopted earlier in the month).

- In annual terms, the economy in April was 24.4% smaller when compared with a year earlier.

- The services sector, which accounts for 80% of UK GDP, fell by 19.0% m/m in April, the largest monthly fall on record. The weakest sectors were wholesale, retail, and motor trades, accommodation and food services, and education (see chart below).

- Meanwhile, industrial production tumbled in April, falling by 20.3% m/m, with declines occurring across 12 out of 13 manufacturing sub-sectors. The weakest sector was the manufacture of transport equipment, which fell by 28.3% m/m. The only sector to post an output growth was the manufacture of basic pharmaceuticals, up by 15.4% m/m.

- Construction output was hit even harder by the imposition of the anti-contagion measures, resulting in a very sharp drop in April (down 40.1% m/m).

- Private consumption appeared to fall back aggressively in April after bearing the brunt of squeezed activity during the first quarter when it fell by 1.7% q/q after rising uninterruptedly since the end of 2015.

- Timelier spending indicators point to a sharper deterioration in April, namely the collapse in retail and new car sales. Specifically, retail sales (including fuel sales) in volume terms decreased by a staggering 18.1% month on month (m/m) in April, which was the largest fall in the survey's history. Meanwhile, new car registrations crashed by 97.3% year-on-year (y/y) in April (and 89.0% y/y in May).

- The acute GDP losses in April support our assessment that the United Kingdom is set to be the worst affected economy in Western Europe by the COVID-19 crisis.

- COVID-19 virus disruptions have prompted another record

month-on-month (m/m) decline in Eurozone industrial production,

with consumer durable and capital goods again particularly hard

hit. Leading indicators signal a rebound from May. (IHS Markit

Economist Ken Wattret)

- With March's initially reported 11.3% m/m drop in the eurozone's industrial production being revised down to a fall of 11.9% and followed by a new record 17.1% m/m plunge in April, the level of production in the two months combined fell by an eye-watering 27%.

- To put these declines into some perspective, the largest m/m contraction in industrial production prior to the recent period was just over 4% in January 2009 during the global financial crisis (GFC).

- On a year-on-year (y/y) basis, the eurozone's production declined by 28.0% in April, in line with the peak rate of contraction signaled by IHS Markit's manufacturing PMI output index (see first chart below).

- By type of production, consumer durable goods (-47.7% y/y) and capital goods (-40.9% y/y) both collapsed (see second chart below), with the former partly reflecting exceptional weakness in the automotive sector.

- Non-durable consumer goods fared less badly, helped by less weakness in demand for staples, but even this sector showed a pronounced deterioration in April relative to March (-14.0% y/y; see second chart below).

- Across the eurozone's member states, there were exceptionally large m/m falls in industrial production in April, led by Spain (-22.4%), Germany (-21.0%), and France (-20.3%).

- French inflation, measured by the EU-harmonised index, remained

stable at 0.4% in May, according to a final estimate released by

the French National Institute of Statistics and Economic Studies

(INSEE). The April and May readings were the lowest in four years.

(IHS Markit Economist Diego Iscaro)

- Collapsing energy prices were the main cause of the deceleration in inflation (see Chart 1). They fell by 11.0% year on year (y/y) in May, following a decline of 8.6% y/y in April, owing to lower oil prices. Food price inflation also eased, but remained high, from 3.7% to 3.5%.

- Core inflation, on the other hand, accelerated from 0.3% in April to 0.6% in May. Service price inflation doubled from 0.6% to 1.2% owing to higher transport prices (+0.8% in May, following a fall of 6.0% in April). Communications costs also rebounded from -1.0% to 1.6%, while the prices of services classified as 'other' accelerated from 1.4% to 1.6%.

- Meanwhile, the prices of manufactured goods declined at a slightly stronger pace in May (-0.7% y/y following -0.5% y/y). The prices of clothing and footwear continued to be a major drag, waning by 2.7% y/y in May.

- The recovery in oil prices since late April and IHS Markit's oil-price projections suggest that the declines in energy prices are likely to ease from June onwards. However, we expect inflation to remain subdued during the rest of 2020 because of the still-substantial impact of the COVID-19 virus on the economy and labor markets.

- Domo Chemicals says it will cease production of biaxially oriented polyamide (BOPA) films at Leuna, Germany, closing its plant there in August 2020. The company's Domo Film Solutions (DFS) subsidiary will continue operating its BOPA and cast non-oriented polyamide (CPA) film plants at Cesano Maderno, Italy. The company says it has informed employees at Leuna about the closure but has not specified how many jobs will be lost. Domo says it employs about 2,200 people worldwide. Domo says it decided to close the Leuna BOPA plant because of worldwide overcapacity for nylon films. Following the acquisition of Solvay's Europe-based nylon 6,6 business at the beginning of this year, Domo says it has become a leading integrated nylon 6 and 6,6 player worldwide. Despite the current market slowdown, which is hurting the automotive and other industrial segments served by Domo's polymers and intermediates, and engineering materials units, the company says it remains on course to achieve its growth objectives.

- Royal DSM has entered an agreement to acquire Austria's Erber

Group for €980 million ($1.1 billion). The value of the acquisition

represents a multiple of about 14 times Erber's 2020 estimated

EBITDA. While DSM will capture Erber's Biomin and Romer Labs

businesses, the acquisition does not feature the group's other two

subsidiaries - Sanphar and Erber Future Business (EFB), which

represent around 7% of Erber's revenues. The transaction is

expected to close in the fourth quarter of 2020. (IHS Markit Animal

Pharm's Joseph Harvey)

- Founded in 1983, family-run Erber sells products in 140 countries and had sales of €350m in 2018. Biomin and Romer provide DSM with expertise in mycotoxin risk management, gut health performance, food safety diagnostics and feed safety diagnostics.

- Biomin specializes in patented and proprietary technology - including phytogenic and probiotic feed alternatives to antibiotics - that provide mycotoxin protection. According to Biomin, the mycotoxin detoxifier market is worth around €700m and is growing at around 5% per year. In this particular area, Biomin is growing at a high single-digit rate each year.

- The deal also bolsters DSM's strong portfolio of eubiotics for gut health (such as prebiotics, probiotics, organic acids, essential oils and phytogenics) and feed premises.

- DSM claims the animal eubiotics sector is worth approximately €2bn and will grow by 8-10% annually over the next five years. This space is being driven by a shift away from antibiotics.

- Scania has revealed new compact power systems component concepts to support the increased electrification. According to a statement, these have been designed for hybrid and fully electric applications and use a common management system that interfaces with CAN J1939 and SAE 1, which will simplify the integration with external components. The systems are designed to be both modular and scalable, allowing customers to select and combine a number of components based on the application and specific demands. It adds that the hybrid system components will be combined with the internal combustion engine either together or as standalone power sources which measures that it can be deployed in an exceptionally broad range of applications. These powertrain concepts seem to meet a burgeoning market to electrify this wider customer base. With regards to the hybrid concept, it suggests that a 92% reduction of carbon dioxide (CO2) emissions might be possible from certain applications, as well as reducing fuel consumption and operational costs, supported by the torque of the electric motor being available from idle. The plan would be to deploy this in excavators, dump trucks, stone crushers, mobile cranes, concrete pumps and airport crash tenders, while in marine applications it can be used in commuter vessels, road ferries, pilot vessels, and fish farm support vessels. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ghana's communications minister, Ursula Owusu-Ekuful, announced on 8 June that the telecoms regulator, the National Communications Authority (NCA), would enforce price-floor provisions of the Electronic Communications Law and the National Telecommunications Policy (NTP) to address inadequate competition in Ghana's telecommunications sector. The regulator aims to maximize "consumer welfare" and correct "the growing market imbalance and the creation of a near-monopoly", according to media reports. Ghana's NTP stipulates that operators with a market share above 40% - voice, data, and value-added services such as mobile money - have "significant market power". MTN had a 67.8% market share in mobile data subscriptions and 57.07% in mobile voice services as of March 2020. Other market participants include Vodafone, AirtelTigo, and Glo Mobile with shares of 15.49%, 15.81%, and 0.92%, respectively, in voice traffic. The government action aims to reduce the market dominance of South Africa's MTN Group. The NCA is likely to set a price floor for voice, data, and mobile money services. It is also seeking to approve all pricing set by the dominant market player (MTN) and to require it to apply a differential mobile interconnect rate between its network and smaller rivals to help entrants attain scale and market share, thereby enhancing consumer welfare. (IHS Markit Country Risk's Theo Acheampong)

Asia-Pacific

- APAC equity markets closed lower, except for India +0.7%; South Korea -2.0%, Australia -1.9%, Japan -0.8%, Hong Kong -0.7%, and China flat.

- Itochu Enex (Tokyo, Japan), an energy distributor and retailer;

trading house Itochu Corp. (Tokyo); and Vopak Terminals Singapore,

a Vopak (Rotterdam, Netherlands) subsidiary, have signed a

non-binding memorandum of understanding to study jointly the

feasibility of developing infrastructure in Singapore to support

the use of ammonia as an additional source of marine fuel for

vessels.

- The move follows the launch of the International Maritime Organization's (IMO) strategy to reduce CO2 emissions from ships by at least 40% by 2030 compared with 2008, by 50% by 2050, and to achieve zero emissions this century. "In order to achieve these goals, the early adoption of ammonia as a suitable zero-emission alternative marine fuel in ships is one of the key elements," Itochu Corp. says.

- Under the terms of the agreement, Itochu Enex will promote the development of an ammonia fuel supply chain in Singapore by using its experience and know-how in the operation of ships that supply fuel as well as its track record of supplying fuel for ships. Itochu Corp. will promote the development of offshore facilities such as floating tanks and/or fuel supply ships, together with Itochu Enex and other partners in Singapore.

- Takeda (Japan) has signed an agreement to divest 18 non-core over-the-counter (OTC) and prescription treatments marketed in the Asia-Pacific region to Celltrion (South Korea) in a deal worth USD278.3 million, Celltrion said in a statement. Under the agreement, Celltrion will acquire Takeda's Primary Care businesses in the Asia-Pacific region, as well as gaining the rights for patent, trademark, approval, and sales of 18 prescription and OTC brands currently marketed in Australia, Hong Kong SAR, Macao SAR, Malaysia, the Philippines, Singapore, South Korea, Taiwan, and Thailand. The acquired portfolio includes diabetes treatments Actos (pioglitazone) and Nesina (alogliptin) and hypertension drug Edarbi (azilsartan). In addition, Takeda and Celltrion have entered into a manufacturing and supply agreement, under which Takeda will continue to manufacture the divested treatments and supply them to Celltrion. (IHS Markit Life Science's Sophie Cairns)

- China is likely to step up fiscal and monetary stimulus on top

of the package released in the government work report if any

heightened uncertainties and unexpected pressure in the second

half. A positive growth is expected for the whole year 2020. (IHS

Markit Economist Yating Xu)

- China may further increase fiscal budget deficit and adopt more accommodative monetary policies to shore up growth if the economy faces heightened uncertainties and renewed downward pressure in the second half, reports China Daily citing State Council counselor and former officials. (IHS Markit Economist Yating Xu)

- Liu Huan, a counselor with the State Council said that China's economy is expected to revive in the second half of this year as the country retains huge market potential and ample policy room. There is still possibility for the government to further increase fiscal deficit to support the economy on top of the stimulus package announced in the 2020 government work report.

- Also, Wang Zhaoxing, former vice-chairman of the China Banking and Insurance Regulatory Commission (CBIRC) said that China has more room to adjust its interest rate compare with other major global economies.

- IHS Markit forecasts China's GDP to recover to expansion in the second quarter and gain a 0.5% y/y growth for the whole year 2020.

- The Chinese vehicle market experienced a strong month in May.

New vehicle sales on a wholesale basis increased by 14.5% year on

year (y/y) to 2.19 million units during the month, while production

rose by 18.2% y/y to 2.19 million units, according to preliminary

data from the China Association of Automobile Manufacturers (CAAM).

Thanks to a rebound in new vehicle demand that began in April,

vehicle sales and production volumes in the year to date (YTD) are

narrowing the gap with the same period last year. (IHS Markit

AutoIntelligence's Abby Chun Tu)

- For the YTD, China's new vehicle sales are down 22.6% y/y at 7.96 million units, while production volumes have fallen by 24.1% y/y to 7.79 million units.

- The passenger vehicle (PV) market posted its first increase of the year during May, ending a prolonged decline since July 2018. Sales of PVs rose by 7.0% y/y to 1.67 million units last month, while PV production increased by 11.2% y/y to 1.66 million units. In the YTD, sales of PVs are down 27.4% y/y at 6.11 million units, while production of PVs has fallen 29.1% y/y to 5.96 million units.

- Commercial vehicle sales surged 48.0% y/y to 520,000 units during May, contributing to the strong rebound in new vehicle sales. Commercial vehicle production increased 47.7% y/y to 527,000 units. In the YTD, sales of commercial vehicles are down by 1.0% y/y at 1.85 million units, while production of commercial vehicles has dropped by 1.4% y/y to 1.83 million units.

- Broken down by commercial vehicle type, heavy-truck sales increased 65.6% y/y to 179,000 units in May, while sales of light trucks grew by 43.4% y/y to 215,000 units. Both vehicle categories posted their sales record in May.

- Sales of new-energy vehicles (NEVs), which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), declined 23.5% y/y to 82,000 units in May, while NEV production fell by 25.8% y/y to 63,000 units. In the YTD, sales of NEVs are reported at 289,000 units, down 38.7% y/y. NEV production volumes have retreated by 39.7% y/y to 295,000 units in the YTD.

- Sales of BEVs fell by 25.1% y/y to 64,000 units in May, while production of BEVs dropped 33.8% y/y to 63,000 units.

- Sales of PHEVs totaled 18,000 units, down 16.1% y/y, while production of PHEVs increased 17.1% y/y to 21,000 units.

- Tesla's Model 3 equipped with a lithium-ion phosphate (LFP) battery has gained approval from Chinese industry regulator, the Ministry of Industry and Information Technology (MIIT). The vehicle has appeared on MIIT's recent product category, indicating that it is likely to hit to the market soon. The new model with the LFP battery will be made in China and is expected to further reduce the cost for the US automaker. Reuters first reported Tesla's intention to introduce LFP batteries to the China-made Model 3 in February. The initiative is believed to be part of Tesla's goal to lower the costs of the Model 3 to gain quicker adoption in China. Compared with lithium-ion batteries equipped in Tesla's current models, LFP batteries are less expensive as they do not contain cobalt - one of the most expensive materials in lithium-ion batteries. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Ministry of Agriculture and Rural Affairs regularly

updates its estimates of key agricultural production,

imports/exports and prices for the whole year. The latest data

shows Covid-19 has reduced consumption. On June 11, it released

estimates of annual plant-based edible oil production of 26.43

million tons, a reduction of 390,000 tons from last month's

estimate. The total consumption of plant-based edible oil is

predicted to go down by 2% from 2019. The country is set to see a

massive increase of stocks from the previous year. China expects to

import 8.35 mln tons of plant-based edible oil for 2020, revised up

by 470,000 tons compared with last month's estimate. In 2019, the

actual imports were 8.55 mln tons. (IHS Markit Agribusiness' Hope

Lee)

- Affected by Covid-19 and generally weak world trade, soybean oil factory-gate price and palm oil import prices were revised down by a range of CNY100-200 (USD14.3-28.6) per ton, at CNY5,600-6,600/ton and CNY4,700-5,500/ton, respectively.

- However, the peanut oil factory-gate price was adjusted up by CNY500/ton, at CNY14,500-15,500/ton. This is attributed to the expected increased price of raw material peanut. In 2019, the actual price was CNY12,449/ton.

- Vietnamese automaker VinFast has opened a research and development (R&D) centre in Melbourne, Australia, reports Reuters. The centre will have a staff of around 100 people and will initially focus on developing both gasoline (petrol)-powered vehicles and electric vehicles (EVs), according to the automaker. VinFast, a new entrant in the car manufacturing segment, aims to produce 500,000 cars a year by 2025, with a local content rate of 60%. VinFast also aims to be one of the top car manufacturers in the Southeast Asian region by 2025. In June 2019, the automaker began deliveries of its Fadil hatchback, and in August it began deliveries of its two luxury models - the LUX A2.0 sedan and LUX SA2.0 SUV. VinFast has partnered with world-leading automotive technology and manufacturing consulting firms such as BMW, Magna Steyr, and AVL. It has also signed agreements with companies such as Pininfarina, Siemens, Bosch, Torino Design, Italdesign, Zagato, and the German Chamber of Commerce and Industry to develop products. (IHS Markit AutoIntelligence's Jamal Amir)

- Tata AutoComp Systems, a key supplier of automobile components and engineering services, has signed a memorandum of understanding (MoU) with US-based electric vehicle (EV) infrastructure manufacturing company Tellus Power Green to set up EV charging stations in India, reports the Financial Express. Under the deal, Tellus Power Green will supply AC and DC fast chargers for passenger cars, commercial vehicles, and two- and three-wheelers. The companies will jointly provide AC chargers from 3 kW to 11 kW size for home and residential complexes as well as DC fast chargers from 20 kW to 300 kW to be set up in public places such as office and commercial car parks. (IHS Markit AutoIntelligence's Isha Sharma)

- A joint venture (JV) has begun production of Chevrolet-branded vehicles in Kazakhstan for domestic sale. Caspian News has reported that local company AllurGroup and Uzbekistan's UzAuto Motors started building a range of vehicles in late March. The article adds that these include the Cobalt, Malibu, Tracker and Trailblazer passenger cars, as well as the Damas and Labo light commercial vehicles (LCVs). The Saryarka AvtoProm site in Kostanay (Kazakhstan) will manufacture 26,000 vehicles in the first year, of which 13,000 will be exported to neighboring countries, while it expects that 100,000 units per annum will be built some time in the future. AllurGroup has built vehicles for a large range of automakers at the Kostanay site during the past decade. This includes Geely, Hyundai, Jianghuai, Peugeot, SsangYong, Toyota and UAZ, several of which continue to be built there. It already builds the Chevrolet Nexia and Niva at the site as well. (IHS Markit AutoIntelligence's Ian Fletcher)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-june-2020.html&text=Daily+Global+Market+Summary+-+12+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}