Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 15, 2020

Daily Global Market Summary - 15 June 2020

US equity and credit markets managed to close higher today, with some help from the Fed, as the other regions' equity markets were generally lower on the day. Most European equity markets closed only modestly lower, while some major APAC equity markets closed significantly lower over reports of an increase in COVID-19 cases in China.

Americas

- The Federal Reserve said this afternoon that it will begin buying individual corporate bonds under its Secondary Market Corporate Credit Facility. The Fed said it would follow a diversified market index of U.S. corporate bonds created expressly for the facility. The Fed built the index internally, and a spokesman couldn't immediately say whether its details would be made public. (Bloomberg)

- US equity markets closed higher after being in negative territory for most of the day, with the Fed's announcement triggering a late day rally that was almost fully erased by 3:30pm EST; Russell 2000 +2.3%, Nasdaq +1.4%, S&P +0.8%, and DJIA +0.6%.

- 10yr US govt bonds closed near the lowest point of the day at +3bps/0.73% yield after starting the day higher and being close to unchanged at the time of the Fed announcement.

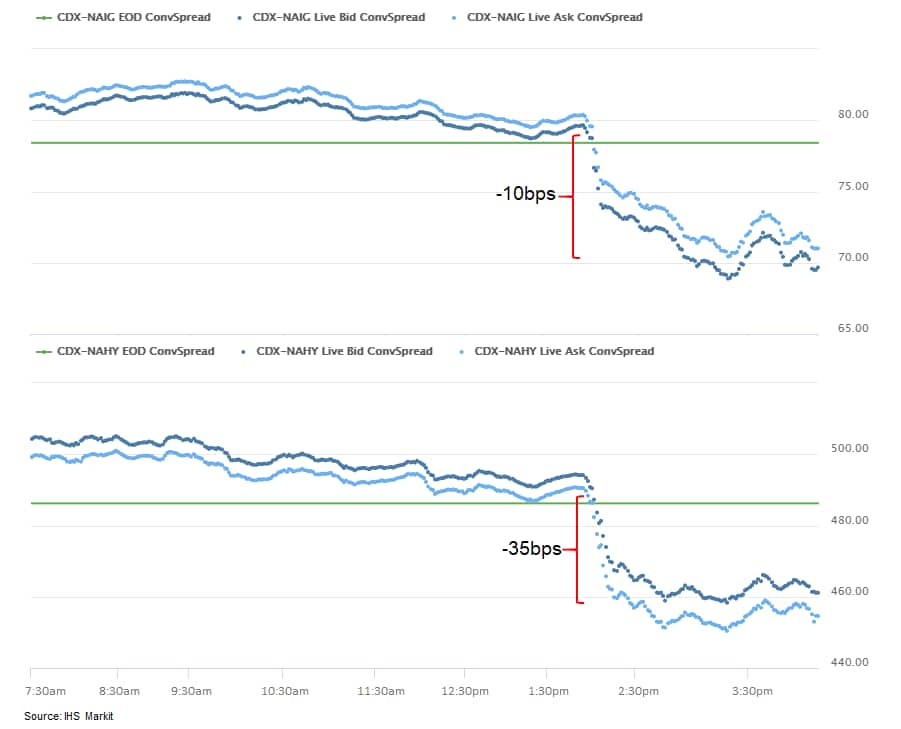

- CDX was lower across IG/HY until both tightened significantly

at 2:00pm EST on the Fed's announcement; CDX-NAIG closed

-8bps/70bps and CDX-NAHY -28bps/458bps:

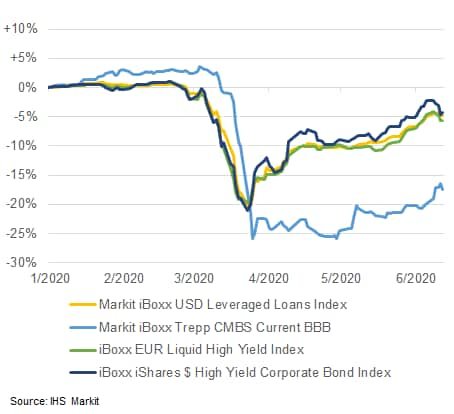

- According to data from the Markit iBoxx Trepp CMBS Current BBB

index, total returns for BBB-rated US CMBS were down almost 26% in

late-March compared to -21% for US/European high yield corporate

bonds and leveraged loans. However, while high yield loans/bonds

closed approximately -6% YTD as of 12 June, BBB rated CMBS are only

-17%.

- Crude oil closed +2.4%/$37.12 per barrel.

- Fresh off the OPEC+ extension of record cuts into July, oil's spring rally appears to have run its course, at least for the time being. Brent prices ended last week at $39/bbl, breaking a string of six consecutive weeks of price gains, and dipped back below $38/bbl in early trading on Monday. In the short term, this means enduring oil price headwinds, although the aggressive actions taken by OPEC+ limit the risk of prices moving into a price band lower than $30-$35/bbl. Ultimately, breaching $40/bbl sustainably on the upside requires clear indications that global demand is on a sustainable recovery path and is tightening fundamentals. Continued weakness in product markets is a clear sign that the market is not yet on that path. A glut of product inventories, especially middle distillates, and weak margins continue to depict a slow return to normal for crude demand. (IHS Markit Energy Advisory's Roger Diwan)

- The US Department of Transportation has awarded a USD4.4-million grant to Ohio state to support the truck automation corridor project on Highway I-70, reports the Dayton Daily News. The project will allow logistics firms to deploy automated truck technology as part of their daily services using Highway I-70 between Columbus, Ohio, and Indianapolis, Indiana. The project is facilitated by a partnership between the Ohio Department of Transportation (ODOT), DriveOhio, the Indiana Department of Transportation (INDOT), and the Transportation Research Center Inc (TRC). The partners have contributed funds of USD4.5 million, bringing the total funding for the project to USD8.9 million. One of these projects is DriveOhio, for which agreements have been signed with cities in the state, including Dublin, Columbus, Athens, and Marysville. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen (VW) and Audi's plans to resume production in Mexico on 15 June have been postponed as the authorities of the state of Puebla, where the automakers' facilities are located, say conditions are not favorable for restarting auto production, reports Reuters. Puebla's governor signed a decree on 12 June saying that the conditions for the return of auto production and construction-sector operations are not favorable; the statement was reportedly posted on Twitter. The governor of Puebla, Miguel Barbosa, said he wants to reopen the state's economy but not if that means people's lives will be at stake. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A consortium of social interest groups have filed a lawsuit against the US FDA that challenges the approval of Elanco's Experior. Experior (lubabegron) is a beta-adrenergic agonist drug designed to decrease ammonia gas released as a by-product of beef cattle waste. Its approval in 2018 marked the first time the FDA authorized a drug that reduces gas emissions from an animal or its waste. The complaint comes from a coalition that includes the Animal Legal Defense Fund (ALDF), Food & Water Watch and Food Animal Concerns Trust (FACT). It claims the FDA had "insufficient information to determine the drug is safe for animals and consumers". (IHS Markit Animal Pharm's Joseph Harvey)

- Arabica coffee futures fell to the lowest level since mid-October amid rising worries that the Covid-19 pandemic will lead to falling demand for pricey arabica beans just as top producer Brazil looks set for another record crop.As a result, the font-month July arabica contract shed another 0.75¢ to 96.00¢/lb, after falling to an eight-month low of 94.60 earlier in the session. The intraday high was touched at 97.65¢. Second-month September settled down 0.85¢ at 97.70¢/lb, while later deliveries shed 0.80-1.05¢. Trading volume increased to 82,572 contracts from 73,855.The most-active September robusta contract fell USD26 to USD1,227 per ton, trading a USD1,221-1,249 range. Front-month July was down USD28 at USD1,196 and the rest of the board lost USD21-24. Trading volume jumped to 27,755 lots from 19,704. (IHS Markit Agribusiness' Max Green)

Europe/Middle East/ Africa

- Most European equity markets closed lower except for Italy +0.4% and Switzerland +0.5%; UK -0.7%, France/Spain -0.5%, and Germany -0.3%.

- Most 10yr European govt bonds closed slightly higher; Spain -3bps, Italy/Germany -1bp, and France/UK unchanged.

- iTraxx-Europe closed flat/70bps and iTraxx-Xover flat/402bps.

- Brent crude closed +2.6%/$39.72 per barrel.

- After the United Kingdom's very severe GDP drop in April, the

door is now open for the Monetary Policy Committee (MPC) to expand

the new quantitative easing (QE) program to provide further support

to both the economy and the Treasury's aggressive borrowing plans.

(IHS Markit Economist Raj Badiani)

- The Bank of England (BoE) is likely to announce another round of QE at the next MPC meeting on 18 June.

- The extraordinary aspects of monetary policy were left unchanged at the previous meeting on 7 May. Specifically, the BoE refrained from adding to its new QE program, which is to increase its holdings of UK gilts and corporate bonds by GBP200 billion to GBP635 billion, to be financed by printing money.

- At the MPC's May meeting, it was revealed that the additional GBP200 billion of QE announced in March in response to the coronavirus disease 2019 (COVID-19) virus pandemic would be exhausted by the beginning of July at the current pace of purchases.

- Two of MPC's nine members Jonathan Haskel and Michael Saunders voted to increase the latest round of QE by a further GBP100 billion. Our current assessment is that the BoE will announce an additional GBP100 billion in gilts and corporate bond purchases.

- IHS Markit now expects that a new expansion in the BoE's asset purchase program will be backed unanimously after the economy shrunk by 20.4% month on month during April. We also anticipate that the BoE will expand its asset purchase program by at least GBP100 billion to GBP745 billion, which equates to around 33% of UK output.

- BoE's Governor Andrew Bailey has revealed that the MPC is considering negative interest rates after the policy rate was cut from 0.25% to a 325-year low of 0.1% on 19 March.

- Johnson Matthey has announced that it plans to cut around 2,500

staff over the next three years in the wake of the COVID-19 virus,

as it announced its preliminary fiscal year (FY) 2019/20 results.

(IHS Markit AutoIntelligence's Ian Fletcher)

- For the 12 months ending 31 March, the company recorded sales revenues of GBP14,577 million (USD18,265 million), an improvement of 35.7% year on year (y/y), while its operating profit decreased 26.9% y/y to GBP388 million and profit before tax (PBT) dropped 37.5% y/y to GBP305 million.

- However, the company added that its underlying business (which excludes the sale of precious metals) saw its sales slip by 1% y/y to GBP4,170 million in FY 2019/20, while operating profit fell by 4.8% y/y to GBP539 million and PBT retreated by 13% y/y to GBP455 million.

- Turkey's current-account deficit soared in April to top USD5

billion, the largest such gap since May 2018, when the beginning of

the 2018 lira collapse led to a sharp drop-off of import demand

that year. (IHS Markit Economist Andrew Birch)

- In April, merchandise exports plunged by 42.2% year on year (y/y), as shipments to Europe and other key destinations plunged as those economies went into lock-down to fight the spread of the COVID-19 virus pandemic. Merchandise imports also plummeted, but were down by a somewhat more moderate 25.0% y/y. Import demand did not immediately evaporate as did exports due to Turkey's own delay in implementing lockdown measures.

- The country continued to register sharp net outflows of portfolio investment in April. After net portfolio capital poured out of the country in March - by USD7.7 billion - a further net outflow of portfolio capital remained substantial in April; USD2.3 billion. The continued reduction of domestic interest rates, threats of restrictions on capital flows, and falling confidence in the lira led to the substantial capital outflows.

- For the first time since February 2018, Turkey also registered a net outflow of foreign direct investment (FDI) in April 2020, although by just USD133 million. Nevertheless, the net outflow was concerning given the ongoing atrophy of the gross inflows of FDI into the country.

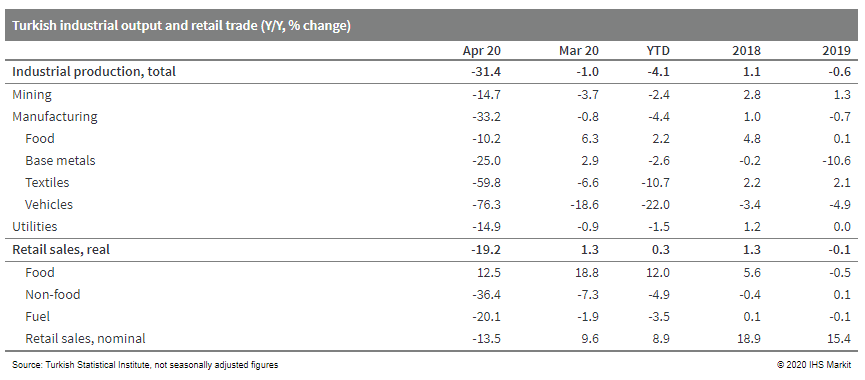

- In April - as Turkish authorities belatedly expanded their

lockdown measures to contain the spread of the COVID-19 virus -

economic activity collapsed. Industrial production dropped by

nearly one-third and retail trade was down by around one-fifth.

While resumption of activity over the rest of 2020 will lead to a

moderation of losses, economic contraction will nonetheless be

severe for the year as a whole. (IHS Markit Economist Andrew Birch)

- The full impact of the spread of the COVID-19 virus hit Turkish economic activity in April 2020. Total industrial production in April was nearly one-third less than it had been just a month earlier as the country belatedly implemented more aggressive social distancing requirements in response to the spread of the pandemic into the country.

- Total output in April 2020 was also nearly one-third of what it had been a year earlier. While some sectors were more resilient: food, tobacco, and pharmaceuticals, sectors of less critical products: clothing, automobiles, furniture, and so on, saw output plummet against year-earlier levels.

- The expansion of lockdown measures also decimated retail trade activity within Turkey in April. The volume of retail trade dropped by 21.0% month on month (m/m) in seasonally adjusted data, with total activity down by more than 19% year on year (y/y).

- The shuttering of production and closing of retail trade

activity led to a severe drop of employment. Although data for

employment was only available through March, total employment that

month was more than 4% lower than it had been two months earlier,

and was 6.6% down from the previous year.

- Saudi Aramco bought 2.1 billion Sabic shares on the stock market, equivalent to 70% of Sabic's total, for 259 billion Saudi riyals ($69.1 billion) in four special transactions on Sunday, Al Arabiya, the Saudi TV channel has reported. The price per share was SR123. "The deal completion is on track with expectations to be finalized before the end of the second quarter. All necessary pre-closing regulatory clearances have been obtained. We will make a completion announcement in due course," Aramco told Al Arabiya. Aramco signed a deal last year with Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF), to acquire the 70% stake in Sabic. The rest is traded on the Riyadh stock exchange. The payment will be funded in part by four bonds issued by Aramco to the PIF. Aramco said earlier that 36% of the purchase price—which could be adjusted for certain expenses—would be paid in cash and 64% would be paid in the form of a seller loan.

- Cash-strapped Sasol (Johannesburg, South Africa) has received offers from companies including CPChem, LyondellBasell, and Ineos for a large stake in Sasol's Lake Charles, Louisiana, petrochemical complex, according to a Bloomberg report citing people familiar with the matter. These companies and others are moving into a second round of bidding for a stake in the almost-completed complex, which could raise more than 29 billion South African rand ($1.68 billion) for Sasol, according to Bloomberg. The cost of the Lake Charles complex has risen sharply from early estimates to R192 billion and this, together with falling oil prices, has hurt Sasol's finances. The Lake Charles complex is based on a 1.54-million metric tons/year ethane cracker that started production last year. The ethylene will be used in six downstream plants on site to produce ethylene oxide, ethylene glycol, ethoxylates, and low-density and linear low-density polyethylene (PE), as well as Ziegler and Guerbet alcohols. About 10% of the ethylene will be surplus to requirement and sold on the merchant market as well as supply Sasol's share of its high-density PE joint venture (JV) with Ineos in Texas. The 50/50 JV is designed to produce 470,000 metric tons/year.

Asia-Pacific

- APAC equity markets closed lower; South Korea -4.8%, Japan -3.5%, Australia/Hong Kong -2.2%, India -1.6%, and China -1.0%.

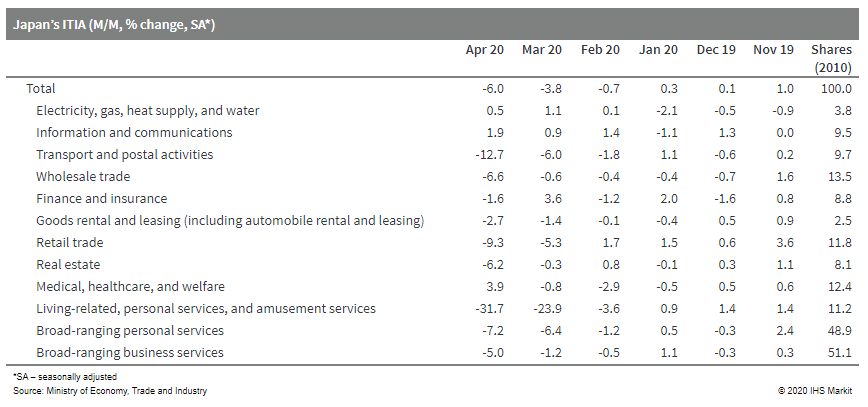

- Japan's Indices of Tertiary Industry Activity (ITIA) recorded

the largest month-on-month (m/m) decline (6.0% m/m) in April, for

the third consecutive month of decline, leading to a 11.5% drop

from a year earlier. The sizeable decrease reflected stricter

measures to contain the COVID-19 virus spread in line with the

introduction of a state of emergency. (IHS Markit Economist Harumi

Taguchi)

- A broad range of service activity declined, particularly non-essential personal services, which saw a 31.7% m/m drop in living-related personal services and amusement services, including eating, drinking, take-out, and delivery services (down 42.6% m/m), accommodation (down 52.6% m/m), sports facilities (down 39.4% m/m), and laundry, beauty, and bath services (down 30.0% m/m).

- Although activity rose in three industries (medical, healthcare, and welfare; information and communications; and electricity, gas, heat supply, and water), the contraction of retail sales widened as retailers saw declines in all classifications except for sales in medicine and cosmetic, with particularly steep drops for autos, apparel, and apparel accessories.

- Transport and postal activities were another major driver behind the severe contraction, dropping 12.7% m/m because of sluggishness in passenger and freight transportation.

- Business services also declined, reflecting sluggish exports

and industrial production in addition to repercussions from

containment measures.

- Honda was forced to halt production temporarily in North America following a problem affecting its global computer network on 9 June, reports Reuters. According to the report, a Honda spokesperson stated that the automaker's car and motorcycle plants globally were affected by the cyber-attack and they have since resumed production. Honda's production in the United States resumed on 11 June, the report states. The report also states that Honda does not believe that customers' personal information was affected by the computer problem, though the company declined to comment further on the nature of the attack. The report also states that Honda has indicated that it will halt some production shifts at three Japanese plants in July over lack of demand and problems in procuring parts. Honda's Yorii plant will be idled over four consecutive days in July, Sayama plant's production will be halted for a day, and Suzuka plant will see a three-day closure. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Japan's government has added medical fields to its list of domestic industrial sectors subject to foreign investment restrictions, the Ministry of Finance (MoF) said in a statement on 15 June. Under the law, foreign investors are required to notify the government ahead of time of any plans to acquire a stake of 1% or larger in 558 designated Japan-headquartered companies in regulated sectors. However, overseas investors are exempt from this requirement if they plan to buy stocks of such firms simply for asset management purposes, in order not to discourage direct investment into the country. (IHS Markit Life Science's Sophie Cairns)

- China's industrial value-added grew 4.4% year on year (y/y) in

May, up from 3.9% y/y in April. However, the month on month (m/m)

growth softened from a 2.3% m/m expansion in April to 1.5% y/y in

May, suggesting a continuous but slowing recovery as the industrial

production largely went back to normal level. According to the NBS,

67.4% of surveyed large industrial firms has resumed over 80% of

their production as of 27 May, up 6.6 percentage points from April.

The year-to-date contraction at 2.8% y/y narrowed by 2.1 percentage

points from a month ago. (IHS Markit Economist Lei Yi)

- 30 out of 41 surveyed sectors reported y/y production growth in May, compared to 28 in April. Equipment and high-tech manufacturing led the headline growth, which grew 9.5% y/y and 8.9% y/y respectively. Auto manufacturing value-added rose 12.2% y/y, the fastest since the July 2018. However, consumer good production slid from a 0.7% y/y expansion in April to 0.6% y/y contraction in May, with the decline concentrating in export related sectors like clothes, furniture and feather as well as education related stationary and art supplies.

- By products, production of auto rose 19% y/y, up 13.9 percentage points from a month ago. Construction machinery, such as excavators, scrapers and other transportation equipment related to infrastructure rose by 38.4% y/y. Meanwhile, power generation, crude steel, cement and non-ferrous metals production all registered significant improvement.

- Service production index recovered to expansion as well, but at a slower pace compare to industrial sector. Information, software, real estate and financial services reported faster growth while wholesale and retail, catering and accommodation remained in contraction.

- The year-to-date FAI continued to improve from a 10.3% y/y contraction in April to 6.3% y/y decline in May. The May FAI increased 5.9% from a month ago, slowing from a 6.2% m/m expansion in April. The estimated de-cumulative FAI registered a 3.9% y/y expansion in May, compared to contraction in April.

- Thanks to the ongoing work resumption and easing monetary policy that guided mortgage rate to decline, housing sales market continued to improve in May. The decline in the floor space and value of commercial housing sold softened to 11.8 % y/y and 8.4% y/y respectively through May and the estimated de-cumulative figures recovered to double-digit expansion. Housing price inflation in 70 surveyed cities rose for the second consecutive month in May, led by the inflation in tier-one cities.

- Nominal retail sales contracted 2.8% y/y in May, compared to a 7.5% y/y decline in April. The retail sales in large firms improved to 1.3% y/y expansion. The contraction in catering sales narrowed by12.2 percentage points to 18.9% y/y in May, while the commodity sales has largely returned to the normal level, reporting a 0.8% y/y reduction, compared to a 4.6% y/y decline in April.

- Online sales growth accelerated to 4.5% y/y through May with online hotel booking and table reservation rising over 20% y/y and online commodity sales rose 11.5% y/y.

- Domestic economy improved as expected in May. However, the

recovery remained quite uneven between industry and services, and

between investment and consumption. The recovery in industrial

sector was largely benefited from real estate and infrastructure

investment, while manufacturing investment and private consumption

remained weak.

- Beijing issued guidelines for high-quality economic growth, but

the near-term benefits likely overshadowed by escalated pandemic

control measures. Published ahead of the recent surge in

infections, the guidelines focused on digital transformation and

consumption upgrade to revitalize local economic growth; yet the

re-imposed lockdown measures will most likely diminish growth

tailwinds from the unveiled policies. (IHS Markit Economist Lei Yi)

- The municipal government of Beijing issued a guideline on 10 June to foster new growth drivers for stabilizing economic growth in the capital city. The guideline provides action plans for five aspects, including new infrastructure, digital economy, consumption upgrade, opening-up, and business environment improvement.

- By 2022, Beijing aims to basically build up a new infrastructure ecosystem featuring a safe and solid network foundation, smart data integration, complete industry ecology, and abundant intelligent applications. In 2020 alone, the city plans to add 13,000 5G base stations, bringing the total number to over 30,000.

- Expanded new infrastructure investment will help to set the stage for the city to achieve digitalization in a wide range of areas, including transportation, healthcare, city governance, education, manufacturing, entertainment, and regional cooperation, therefore fostering new growth drivers for high-quality economic growth.

- The city also set the target of further widening services market access for foreign investors especially in the financial sector, and promised to cut red tape and reduce inappropriate market interventions for a more favorable business environment.

- Beijing has been lagging behind the national consumption recovery due to its prolonged epidemic control measures, which were only eased at the end of April. Consequently, while the nationwide cumulative retail sales contraction narrowed from 20.5% y/y in February to 16.2% y/y in April, Beijing's contraction widened from 17.9% y/y to 20.4% y/y during the same period.

- Dongfeng Motor has announced that its 5G-based driverless vehicle, named Dongfeng Sharing-VAN 1.0 plus, has entered mass production, reports CAAM News. The company says the vehicle is equipped with four lidars, one millimeter-wave radar, 16 ultrasonic radars, and 12 cameras, and can perform 13 functions. The automaker also announced that the first batch of six units of the Dongfeng Sharing-VAN 1.0 plus will serve the National Oceanic Laboratory in China's Qingdao city. The company also expects that in the next one to two months, customers will receive more than 70 vehicles of this series. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indian industrial production contracted by 55.5% year on year

(y/y) in April due to the impact of the protracted lockdown of the

economy that commenced on 25 March 2020. (IHS Markit Economist

Rajiv Biswas)

- Manufacturing output, which accounts for 77.6% of the total industrial production index, declined by 64.2% y/y in April. Production in many sectors ground to almost a complete halt for most of April, although there was some easing of restrictions on certain industries implemented from 22 April.

- Among the worst affected sectors in which production fell to very low levels were motor vehicles and other transport equipment, electrical equipment, fabricated metal products, furniture, leather products, textiles, and tobacco.

- Sectors that continued to produce a significant proportion of their normal production capacity included food products, refined petroleum products, chemicals, and pharmaceuticals.

- Production of consumer non-durables, such as essential food products, was the most resilient, contracting by 36.1% y/y in April. Production of consumer durable goods, such as autos, came to almost a complete halt, falling by 95.7% y/y in April. Production of capital goods also virtually ceased, declining by 92% y/y, while production of infrastructure/construction goods declined by 83.9% y/y.

- Mahindra & Mahindra (M&M) has recorded a net loss of

INR32.55 billion (USD429.3 million) in the fourth quarter of fiscal

year (FY) 2019/20 ended 31 March 2020 on account of a one-time

impairment, according to a filing to the Bombay Stock Exchange

(BSE). This compares with the INR9.69-billion net profit in the

corresponding period last FY. The results are for the combined

operations of M&M's automotive and farm equipment units, as

well as Mahindra Vehicle Manufacturers Limited (MVML), the

company's passenger vehicle manufacturing arm. (IHS Markit

AutoIntelligence's Isha Sharma)

- The utility vehicle specialist has posted sales revenues of INR90.05 billion, down by 34.8% year on year (y/y) from INR138.08 billion from the same quarter last year.

- Within the combined entity, the automotive unit contributed revenues of INR55.05 billion in the fourth quarter of FY 2019/20, down from INR102.21 billion in the same period of FY 2018/19.

- M&M's total vehicle sales during January-March 2020 stood at 86,351 units, down by 47% y/y, from 163,937 units in the corresponding period of 2019.

- Tractor sales improved 57,164 units, up from 56,903 units in the same period last year, while total exports reached 5,783 units, down by 57% y/y.

- For the full fiscal year (FY), the automaker's profit after tax (PAT) after exceptional items (EIs) plunged by 86.3% y/y to INR7.4 billion and revenues declined by 15% y/y to INR448.66 billion.

- The automaker revealed that it is looking for a financial investor for its South Korean subsidiary SsangYong and may give up control of the unit as part of a plan to exit all loss-making businesses.

- The US International Trade Commission (ITC), in a decision released in 11 June, has stated that Mahindra & Mahindra (M&M), with its off-road recreation vehicle Roxor, has violated the 'trade dress' of Fiat Chrysler Automobiles (FCA)'s Jeep Wrangler sport utility vehicle (SUV), reports Reuters. The ITC, in its decision ruling in the favour of FCA, said that M&M's Roxor vehicle infringed the intellectual property rights (IPR) of FCA's Jeep brand with respect to its trade dress. 'Trade dress' consists of the distinct characteristics that the public associates with a product/brand. In this case, FCA sees the Jeep Wrangler's boxy body shape, front grille, as well as round headlights to be a part of its product's identity. The ITC issued a limited exclusion order that prohibits the sale or import of the infringing vehicles and parts. The commission also issued a cease and desist order, effective immediately, to stop M&M from continuing assembly activity of the vehicle in question at its North American unit. The Roxor is not a certified for production for US roads and is primarily designed as an off-road recreation vehicle. It is meant for use on trails and dunes, but not the Rubicon Trail. (IHS Markit AutoIntelligence's Tarun Thakur)

- Due to the national lockdown measures in place during May, India's National Statistical Office (NSO) released a more limited version of the consumer price index (CPI) statistics for May. According to the CPI data released, the all India year-on-year (y/y) inflation rates for the consumer food price index (CFPI) for the month of May 2020 rose by 9.28% y/y. On a month-on-month basis, the CFPI was little changed, up just 0.13% compared with April. (IHS Markit Economist Rajiv Biswas)

- In developing nations which are heavily dependent on coal-fired power generation the lockdown where on one hand reduced demand for electricity but also increased domestic coal stockpiles at the mines and at the plants. This has been the case for India which was the largest importer of Indonesian coal last year; however ongoing pandemic has negatively impacted Indonesian coal demand in India especially in the second quarter of this year. Interestingly, shipments to China have witnessed a surge in the first five months of this year. Amidst weak demand for seaborne coal globally, both metallurgical as well as thermal coal prices have been following downwards trajectory and Indonesian coal prices are no exception. Indonesia's Ministry of Energy and Mineral Resources had recently announced benchmark Harga Batubara Acuan (HBA) price for June 2020 at $52.98/ton, which were at a four-year low levels. HBA is based on 6322 GAR coal with 8% total moisture, 15% ash and 0.8% sulphur. (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2020.html&text=Daily+Global+Market+Summary+-+15+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}