Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 16, 2020

Daily Global Market Summary - 16 June 2020

Global equity markets closed higher today on calming of tensions between the US and China, as well as a stronger than expected retail sales report out of the US. IG and high yield European iTraxx indices and CDX-NAIG closed higher, while CDX-NAHY was slightly lower on the day despite a strong open. 10yr US government bonds and German bunds closed lower today. The steady increases in COVID-19 cases in the southern US and parts of China continue to be in the backdrop and are being closely monitored by the markets.

Americas

- US equity markets closed higher today; Russell 2000 +2.3%, DJIA +2.0%, S&P 500 +1.9%, and Nasdaq +1.8%.

- 10yr US govt bonds closed +3bps/0.76% yield.

- Federal Reserve Chairman Powell played down the significance of the central bank's decision to begin buying individual corporate bonds in the secondary market to the Senate Banking Committee today. "We're not actually increasing the dollar volume of things we're buying," he said on Tuesday. "We're just shifting away from ETFs to this other form of index." In its announcement yesterday, the Fed said it will follow a diversified market index of U.S. corporate bonds created expressly for the facility in deciding which individual issues to purchase. (Bloomberg)

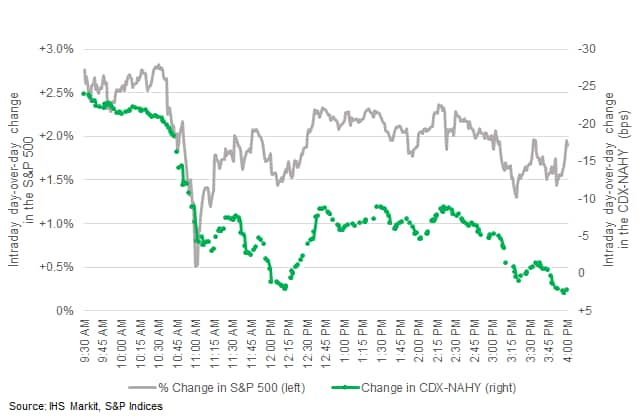

- CDX-NAIG closed -1bp/69bps and CDX-NAHY closed lower

+3bps/462bps. The below chart is today's intraday day-over-day

changes in the S&P 500 vs CDX-NAHY with the direction of the

CDS axis reversed to align directionality. The data shows the sharp

decline in both indices during Fed Chairman's congressional

testimony that began around 10:00am EST and then began diverge at

11:00am EST with the S&P rallying and CDX-NAHY selling off

further.

- Crude oil closed +3.4%/$38.28 per barrel.

- Year to date % changes by sector in the S&P 500 indicates that the Energy and Minerals sector is the worst performer at -34.8%, while technology services at +5.5% and health technology at +3.6% are the only sectors higher YTD.

- Total US retail trade and food services sales surged 17.7% in

May, following a cumulative decline of 21.8% over March and April.

The May recovery brings retail trade and food services sales within

7.9% of the pre-pandemic February level. (IHS Markit Economists

James Bohnaker and David Deull)

- Retail sales came roaring back in all major categories, especially those in which businesses began reopening in late April and May. Some of the monthly percentage increases were astounding; sporting goods and hobby stores (88.2%), furniture and home furnishing stores (89.7%) and clothing and accessories stores (188.0%) led the way.

- Retail categories that were already outperforming maintained momentum in May as well. Nonstore retailers (up 9.0%), building materials & garden supply stores (up 10.9%) and food & beverage stores (up 2.0%) experienced strong demand in May—sales growth in each category is comfortably in the double-digits compared with the same month a year earlier.

- While consumers are still eschewing air travel and public transportation, travel by car has recovered strongly and supported improvement in retail sales of gasoline (up 12.8%) and motor vehicles and parts (up 44.1%) in May.

- We were expecting April to be the low point for retail sales but had not anticipated this rapid initial rebound. While this is encouraging, labor markets and consumer confidence will need to sustain early improvement in order for a wider economic recovery to take hold. Potential setbacks from a second wave of COVID-19 remain a risk.

- Total US industrial production (IP) rose 1.4% in May, while

manufacturing IP rose 3.8%, as many factories resumed at least

partial operations as states across the US began to reopen their

economies. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The details in this report that bear on our GDP tracking (and a separate report on retail inventories for April) left our tracking forecast of second-quarter GDP growth unrevised (to the nearest whole number) at -37%.

- The increase in IP in May was encouraging and supports our view that the trough in GDP was in April. However, the level of IP in May was 15.4% below the pre-pandemic (February) level, leaving virtually all of the recovery for future months.

- The increase in manufacturing IP was reflected in most major industries, although output within primary metals, machinery, and electronic equipment continued to decline.

- Of note was a rebound in the auto sector, where assemblies were reduced nearly to zero in April as assembly plants were idled to limit the spread of COVID-19. Nevertheless, assemblies in May fell short of our assumption, implying somewhat lower motor vehicle output in the second quarter than we previously forecast.

- Mining output declined 6.8% in May, with sharp declines in crude oil extraction and oil and gas well drilling extending their recent slides.

- The output of electric and gas utilities declined 2.3% in May, with electric power generation down 1.1% and natural gas distribution down 8.1%.

- AT&T Inc. is notifying over three thousand employees that their jobs are being eliminated and it will be closing 250 stores as part of a $6 billion cost-cutting push, which is an attempt to slim down one of the most heavily indebted companies in the U.S. (Bloomberg)

- Tesla is negotiating with a Texan county authority over possible incentives in support of a new auto assembly plant in the area, reports Reuters. According to the report, the Travis County Commissioners Court is scheduled to discuss the terms of the possible deal on 17 June, with a vote due in the coming weeks. However, a report by local newspaper the Austin American-Statesman indicates that it is not clear if the negotiations with the county authority show that the electric vehicle (EV) manufacturer has picked the area as the location for a new plant. Reportedly, neither the Travis county government nor Tesla commented on the matter. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US National Highway Traffic Safety Administration (NHTSA) has launched an initiative to make available nationwide data on autonomous vehicle (AV) testing through an online and public-facing platform. The initiative, called the Automated Vehicle Transparency and Engagement for Safe Testing (AV TEST), aims to improve safety and transparency for the on-road testing of AVs. This is a voluntary and non-regulatory initiative that involves partnerships between state and local governments, along with vehicle makers. So far, nine companies and eight states have signed up for this initiative. The participating companies are Beep, Cruise, Fiat Chrysler Automobiles (FCA), Local Motors, Navya, Nuro, Toyota, Uber, and Waymo. The states are California, Florida, Maryland, Michigan, Ohio, Pennsylvania, Texas, and Utah. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota's Collaborative Safety Research Center (CSRC) and the Massachusetts Institute of Technology (MIT) AgeLab have released the DriveSeg dataset, which gives researchers free access to autonomous vehicle (AV) data. The dataset uses continuous driving scene segments instead of single images to provide a broader view in identifying more amorphous objects. Rini Sherony, senior principal engineer at CSRC, said, "By sharing this dataset, we hope to accelerate research into autonomous driving systems and advanced safety features that are more attuned to the complexity of the environment around them." The dataset comprises two parts: DriveSeg (manual) and DriveSeg (Semi-auto). DriveSeg (manual) is a video consisting of 5,000 frames that are marked manually with per-pixel human labels. DriveSeg (Semi-auto) is a video consisting of 20,100 frames that uses artificial intelligence-based labelling systems to assess the potential of training vehicle perception systems on pixel labels. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The refrigerated pasta, sauces and cheese brand Buitoni will be sold to Brynwood Partners as it has entered into a definitive agreement with Nestlé USA. The transaction, including a 240,000 sq. ft. manufacturing facility in Danville (Virginia), is expected to close within the next 30 days, subject to US regulatory review. Terms and conditions have not been disclosed; however it is worth recalling that Buitoni's sales totaled USD130 million in 2019. The transaction includes the rights to the Buitoni brand in the US, Canada and the Caribbean territories. Since 2017, Nestlé has done more than 50 transactions representing about 12% of its portfolio (USD10.2 billion in value) after failing to meet its own growth targets. Part of those deals were divestitures of slower-growing businesses, such as the sale of its chocolate to Ferrero in 2018 (for USD2.8 bln) or of ice cream business to Froneri (USD4.0 bln). (IHS Markit Agribusiness' Cristina Nanni)

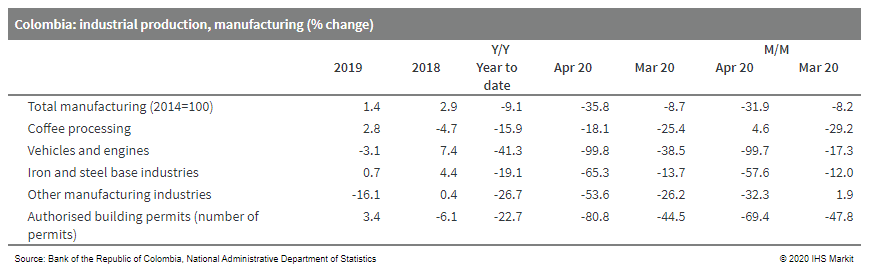

- According to data from the Colombia National Administrative

Department of Statistics (Departamento Administrativo Nacional de

Estadística: DANE), industrial production declined by a sharp 29.6%

in April. At the same time, retail sales plunged by 42.9%. (IHS

Markit Economist Ellie Vorhaben)

- Manufacturing was the leader in the decline, falling by 35.8%, underpinned by a 30% decline in beverage production and an 82% decline in non-metallic mineral production. Mining and quarries also played an important role, falling nearly 30% because of a 68% drop in carbon extractions.

- Out of 26 activities, only 2 grew positively: the distribution of water and the production of food, which grew by 3.5%.

- Retail sales plunged significantly in April, led by a 54% decline in the purchase of fuel for cars and a 94% drop in the purchase of cars and motorcycles. As expected, sales of household cleaning products and food were the only positive drivers of growth.

- Colombia's lockdown policies are slowly being removed, although

some key hotspots will remain under lockdown until 15 June,

including the capital city of Bogota. According to the

International Development Bank, movement in Colombia is still 40%

lower than it was in early March, on par with movement data in

Argentina and Chile.

Europe/Middle East/ Africa

- European equity markets closed sharply higher; Italy +3.5%, Germany +3.4%, Spain +3.3%, UK +2.9%, and France +2.8%.

- Most European govt bonds closed higher, except for Germany +2bps and UK flat; Italy -5bps, Spain -4bps, and France -1bp.

- iTraxx-Europe closed -6bps/64bps and iTraxx-Xover -35bps/368bps.

- Brent crude closed +3.1%/$40.96 per barrel.

- According to the Office for National Statistics (ONS), the

number of UK workers on payroll plunged by 612,000, or 2.1%,

between March and May. The new release is based on experimental

data of the number of employees on payroll using HM Revenue and

Customs's Pay As You Earn Real Time. Employees who are "furloughed"

through the Coronavirus Job Retention Scheme have their payments

reported through this system and contribute towards the employment

measure. (IHS Markit Economist Raj Badiani)

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, increased to 2.8 million in May, representing an increase of 125.9%, or 1.6 million, since March 2020. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support, although still employed.

- The ONS also published its traditional headline employment and unemployment data in the three months to April, which are lagging behind more timely data, namely a sharp rise in claimant counts and the dwindling workers on payroll. According to the ONS, total UK employment (all aged 16-plus) rose by 6,000 to stand at 33.144 million compared with the three months to January.

- The ONS data indicates year-on-year (y/y) growth in total employment was solid, standing at 245,000 in the three months to April, or 0.7%. This was preceded by gains of just over 1.0% throughout 2018, 2019, and early 2020.

- The ONS reported that there were about 4.90 million self-employed people (14.9% of all people in employment) in the three months to April: the 11,000 y/y drop was the first since August-October 2018. In quarterly terms, the number of self-employed workers fell by 131,000 in the three months to April compared with the three months to January.

- UK Prime Minister Boris Johnson and other high-ranking UK government officials connected on 15 June 2020 via a video call with the leaders of EU institutions, marking the first of multiple top-level Brexit meetings scheduled until the end of July. Prior to the new negotiations on future UK-EU relations, the UK government had formally notified the European Union that it will not extend the current post-Brexit transition period beyond the previously agreed date of 31 December 2020. However, Cabinet Office Minister Michael Gove stated that the United Kingdom would not impose full customs checks on goods coming from the EU before July 2021. (IHS Economists Raj Badiani and Jan Gerhard)

- The Volkswagen (VW) Group's chief financial officer (CFO) Frank Witter has said that the company is still maintain its goal of making a full-year operating profit despite second quarter results which will be 'very bad'. According to a report by German publication WirtschaftsWoche, Witter made the comments at an internal managers' meeting that was also attended by CEO Herbert Diess. He added that the entire VW Group would have to be extremely disciplined in terms of its cost management if it is to meet its 2020 financial target of remaining in the black. VW confirmed the comments by the two executives were made in the meeting to Reuters. (IHS Markit AutoIntelligence's Tim Urquhart)

- Germany's final consumer price index (CPI) inflation data for May have confirmed a decrease in the rate to 0.6% year on year (y/y). In net terms, energy prices explain all of May's inflation decline, whereas the core measure ex-energy and food has steadied at 1.2%. This is also due to service-sector price increases linked to new hygiene restrictions, which are unlikely to unwind in the foreseeable future, helping to put a floor under inflation in the months ahead. Germany's final CPI inflation data based on national methodology from the Federal Statistical Office (FSO) have confirmed the flash data released on 28 May, showing slippage of 0.1% month on month (m/m) and a fall of the annual inflation rate to 0.6% from April's 0.9%. (IHS Markit Economist Timo Klein)

- Germany's federal government will pay EUR300 million (USD338 million) for shares amounting to approximately 23% of the share capital of unlisted German biotech CureVac, under a capital increase deal that was announced yesterday (15 June) by economic affairs minister Peter Altmaier and Dietmar Hopp, who is the co-founder of life sciences investment company dievini Hopp BioTech Holding, which owns more than 80% of CureVac's shares. The CureVac shares will be acquired by the state-owned development bank Kreditanstalt für Wiederaufbau (KfW); according to press release published by dievini Hopp BioTech Holding, the details of the investments were agreed in draft contract. The funds will reportedly be made available for the continued development of CureVac's proprietary pipeline and messenger RNA (mRNA) platform technology, as well as business expansion. (IHS Markit Life Sciences Brendan Melck)

- The Spanish government has revealed details of measures

designed to boost demand and encourage investment in its domestic

automotive industry in the wake of the COVID-19 virus pandemic.

According to an announcement made by Spanish Prime Minister Pedro

Sánchez yesterday (15 June), the government has allocated

EUR3.75-billion-worth of funding to the "Plan to Promote the value

chain of the Automotive Industry, towards a Sustainable and

Connected mobility". The plan features 20 measures of an economic,

fiscal, regulatory, logistical, competitiveness, training and

professional qualification, of sustainable public purchasing and

strategic planning that cover the entire value chain of the

industry. (IHS Markit AutoIntelligence's Ian Fletcher)

- In the near term, in order to prop up the domestic vehicle market, the country is introducing a parc renewal scheme. Under the terms of the plan, applicants will be able to a scrap a car that is 10 years old or more and gain a benefit from the government of EUR800 which is then at least matched by an OEM. Customers will be able to replace with a car with carbon dioxide (CO2) emissions of less than 120 g/km and with a Manufacturer Suggested Retail Price (MSRP) below EUR35,000. However, this price limit is increased to EUR45,000 for those with reduced mobility or for battery electric vehicles (BEVs).

- Spain is also using EUR100 million of funding to incentivize customers through the second iteration of the MOVES scheme. To support the market for BEVs, private customers and businesses will receive up to EUR4,000 to buy such a vehicle, although this rises to EUR5,500 when a car up to 10 years old is scrapped. It will also be open for the purchase of heavy commercial vehicles (HCVs) fueled by natural gas.

- The Spanish government has also allocated a budget of EUR415 million that will be used to support R&D in the country. This will include R&D into renewable hydrogen, industrial innovation projects in sustainable mobility and improved connectivity.

- Following the surprisingly weak performance in late 2019,

Moldova's unadjusted GDP growth accelerated to 0.9% year on year

(y/y) during the first quarter. In seasonally adjusted terms,

Moldova's GDP increased by 0.5% quarter on quarter (q/q) and 1.2%

y/y. (IHS Markti Economist Sharon Fisher)

- Data by expenditure indicate that the country's first-quarter GDP was driven primarily by fixed investment, which benefitted from the rising spending on construction (partly owing to the Ungheni-Chisinau gas pipeline, which is scheduled for completion by 1 August). In contrast, household demand and net exports deteriorated, particularly in the latter's case.

- Growth in value added was boosted by a positive performance in a range of sectors, including construction, information and communications, trade, agriculture, and manufacturing. Sectors reporting declines included utilities, hotel and restaurant services, transport and storage, and public administration.

- Into the second quarter, foreign trade data indicate that exports slumped by 28.7% y/y in local currency terms in April, signaling that industrial output declined sharply as well. In US dollar terms, money transfers from abroad fell by 11.5% y/y in April, while the volume of new loans plunged by 21.2% y/y.

- IHS Markit has downgraded Kenya's short-term sovereign-risk

rating by 5 points to 35/100 (BBB, Supportive Credit Fundamentals),

with no change to our medium-term rating of 55/100 (B+, High

Payments Risk). We also put a Negative outlook on both the short-

and medium-term ratings to account for greater external liquidity

pressures through increased risk of foreign exchange transfer

payment delays. (IHS Markit Sovereign Risk's Ama Baidu-Forson)

- IHS Markit currently projects that Kenya's real GDP growth rate to contract by 2.0% in 2010 due to adverse impacts from the coronavirus disease 2019 (COVID-19) virus outbreak. As of 9 June, 2,862 COVID-19 cases had been reported in the country with 85 deaths, according to the World Health Organization (WHO).

- We expect economic growth slowdowns across several key sectors - especially trade and transport, tourism, construction, manufacturing, financial services, and real estate. The ongoing locust invasion will also dampen agricultural output in parts of the country.

- Our short-term sovereign ratings downgrade underscores elevated liquidity needs over the next 12 months as headwinds facing the external sector prevail. We expect deterioration in the balance of payments, especially via the current and financial and capital accounts.

Asia-Pacific

- APAC equity markets closed higher across the region; South Korea +5.3%, Japan +4.9%, Australia +3.9%, Hong Kong +2.4%, China +1.4%, and India +1.1%.

- Issuance of CNY100 billion special government bonds in June may

lead to liquidity shortage in the short term; the market-oriented

issuing way may ease concerns of monetarization of fiscal policy

and inflation surge in the longer term. (IHS Markit Economist

Yating Xu)

- China will issue CNY 100 billion (USD14.1 billion) of special government bonds on 18 June for COVID-19 control measures in a bid to stabilize economic development, according to a release by the Ministry of Finance (MOF) on 15 June.

- The bonds will be issued with two batches on fixed-rate, including CNY50 billion of five-year bonds and CNY50 billion of seven-year bonds. Both will be listed and traded on 23 June.

- To be noted, all of the special government bonds will be issued on the open market and individual investors are allowed to purchase.

- Domestic thermal coal prices in China continued to firm up on back of increased demand from cement and chemical industries coupled with production controls at the mines (on back of safety measures implemented at Shaanxi after an accident) and sales licensing (from Inner Mongolia) on the supply side. As per McCloskey, reflecting strong sentiment, offers from some domestic suppliers, particularly for low sulphur material, were at RMB10/t ($1.27/t) above the mainstream transactions. Prices for 5,500NAR coal are now close to the upper limit of the government's desired green zone of RMB500-570/t ($70.52-80.39/t) FOB. As per Commodities at Sea, total coal arrivals in June 2020 are calculated at 24.5mt (Thermal coal~17.7mt and Metallurgical coal ~6.8mt). Overall, in first half of this year total coal arrivals are calculated at 133.7mt (Thermal coal ~105.4mt and Metallurgical coal ~28.3mt) vs 117.3mt (Thermal and Metallurgical at 95mt and 22.4mt, resp) a year ago. (Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- Chinese imported iron ore demand is also quite strong and during May 2020 crude steel production stood at 92.3mt (surpassing 90mt levels for the first time this year). Imports are unable to keep pace with crude steel production as a result portside imported iron ore inventories continued to decline. Iron ore arrivals in June 2020 are forecasted at 97.7mt (bringing 1H20 imports at 505.7mt, up 48.8mt y-o-y). Amidst decline in supplies from Brazil, there has been a surge in arrivals from Australia, India and Ukraine. (Maritime & Trade's Rahul Kapoor and Pranay Shukla)

- The Bank of Japan (BoJ) held its Monetary Policy Meeting (MPM)

on 15 and 16 June as originally scheduled for the first time since

the January MPM. Although the BoJ maintained its monetary policy,

including the amount of asset purchases temporarily increased in

response to the coronavirus disease COVID-19 virus crisis. (IHS

Markit Economist Harumi Taguchi)

- The bank increased the cap on a special program to support corporate financing: special operations (fund-provisioning against private debt pledged as collateral and fund-provisioning against eligible loans) to JPY90 trillion (USD838 billion) from about JPY55 trillion.

- The decision probably reflected significant slowdowns for corporate profits, as well as severe economic conditions because of the virus crisis at home and abroad, leading to increased difficulties for corporate funding in a broad range of industries. The bank assessed that financial conditions have been accommodative on the whole, but less so in terms of corporate financing.

- While the BoJ announced it will continue with Quantitative and Qualitative Monetary Easing with Yield Curve Control, aiming to achieve the stability target of 2% inflation in a stable manner, its near-term outlook for year-on-year (y/y) change in the consumer price index (all items less fresh food) remains negative.

- Despite maintaining its monetary policy, the bank hinted that it could leave short- and long-term policy interest rates to drift below their current levels under the severe effect of COVID-19.

- Kobe Steel has acquired a majority share of Wuxi Compressor Co., based in Wuxi, China, turning the company into a subsidiary. Wuxi Compressor manufactures, designs, and sells non-standard (process gas) compressors, a core component used in petroleum refining, chemical, and natural gas plants. In response to the growing demand for non-standard compressors in China, Kobe Steel acquired a 44.3% equity share of Wuxi Compressor from Wuxi Victor Group Co. in 2011. Kobe Steel reached an agreement with Wuxi Victor to acquire an additional 25.7% in Wuxi Compressor in April 2020, turning it into a 70% owned subsidiary of Kobe Steel. The company explained that by turning Wuxi Compressors into a subsidiary, Kobe Steel will be able to provide more flexible business operations and further strengthen its marketing capabilities while offering more attentive service in China. The Kobe Steel Group has manufacturing locations for non-standard compressors in Japan, the United States and China, along with sales and service locations in Germany, the United Arab Emirates, Brazil, the Philippines, and Singapore. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Japan's Sumitomo Corporation has acquired a stake in Israel-based Anagog, a developer of smartphone-based position and movement information analysis tools, according to a company statement by Sumitomo. Currently, Anagog is developing JedAI, a software package that works on smartphone apps to perform data analysis. JedAI uses information obtained through GPS, Wi-Fi, and acceleration sensors installed on devices to analyses elements such as users' positions, movements, habits, and tastes. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai has decided not to pay interim dividends for 2020 as part of its preemptive measure to secure liquidity amid deteriorating business conditions owing to the COVID-19 virus pandemic, reports Maeil Business Newspaper. The automaker said that it would consider normalising dividend payouts in the second half of the year depending on the state of global markets and recovery in sales. Its auto components-making affiliate Hyundai Mobis also announced that it will suspend interim dividends owing to uncertainties in the business environment. Hyundai's dividend payout ratio had grown steadily over the past few years, from 16.8% in 2015 to 35.4% in 2019. Last year, it paid out interim dividends of KRW1,000 (USD0.83) per share for a total payout of KRW263 billion. However, its shareholder reward program has hit a snag in 2020 owing to the COVID-19 virus pandemic, which resulted in sluggish sales. (IHS Markit AutoIntelligence's Jamal Amir)

- In a filing to the Bombay Stock Exchange (BSE), Tata Motors has

reported a consolidated net loss of INR98.63 billion (USD1.30

billion) for the fourth quarter of fiscal year (FY) 2019/20 ended

31 March 2020. (IHS Markit AutoIntelligence's Isha Sharma)

- The automaker had posted a net income of INR11.08 billion in the corresponding quarter of FY 2018/19. Revenues from operations declined by 27.7% year on year (y/y) to INR624.92 billion.

- British unit Jaguar Land Rover (JLR) remained the biggest contributor to Tata's top line during the fourth quarter of FY 2019/20.

- Hit by the COVID-19 virus pandemic, JLR has reported a GBP539-million net loss while its revenues declined by 24% y/y to GBP5.4 billion. JLR's retail unit sales fell by 30.9% during the quarter to 109,900 units.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-june-2020.html&text=Daily+Global+Market+Summary+-+16+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}