Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 11, 2021

Daily Global Market Summary - 11 March 2021

All major US and European and most APAC equity indices closed higher. US government bonds closed sharply lower, while most benchmark European bonds were higher. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar and natural gas closed lower, while oil, gold, silver, and copper were higher.

Americas

- US equity markets closed higher, with both the DJIA and S&P 500 reaching new all-time high closes; Nasdaq +2.5%, Russell 2000 +2.3%, S&P 500 +1.0%, and DJIA +0.6%.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -5bps/295bps.

- 10yr US govt bonds closed +2bps/1.54% yield and 30yr bonds +6bps/2.30% yield.

- DXY US dollar index closed -0.4%/91.42.

- Gold closed flat/$1,723 per troy oz, silver +0.2%/$26.19 per troy oz, and copper +2.7%/$4.14 per pound.

- Crude oil closed +2.5%/$66.02 per barrel and natural gas closed -1.1%/$2.70 per mmbtu.

- The American Rescue Plan of 2021 (H.R. 1319) is anticipated to be signed into law on 12 March by President Joe Biden. The inclusion of a provision to eliminate the Medicaid rebate cap represents the Biden administration's first legislative pharmaceutical pricing and reimbursement (P&R) reform. The Congressional Budget Office (CBO) has estimated that removal of the rebate cap would reduce Medicaid spending by USD15.9 billion over 10 years. It is also significant that the 340B discount program relies on a formula to calculate the ceiling price for prescription drugs based the Medicaid rebate amount. There are concerns that elimination of the cap could lead to higher launch prices for new drugs, or some of the revenue declines being offset from increased costs to commercial plans or Medicare. (IHS Markit Life Sciences' Margaret Labban)

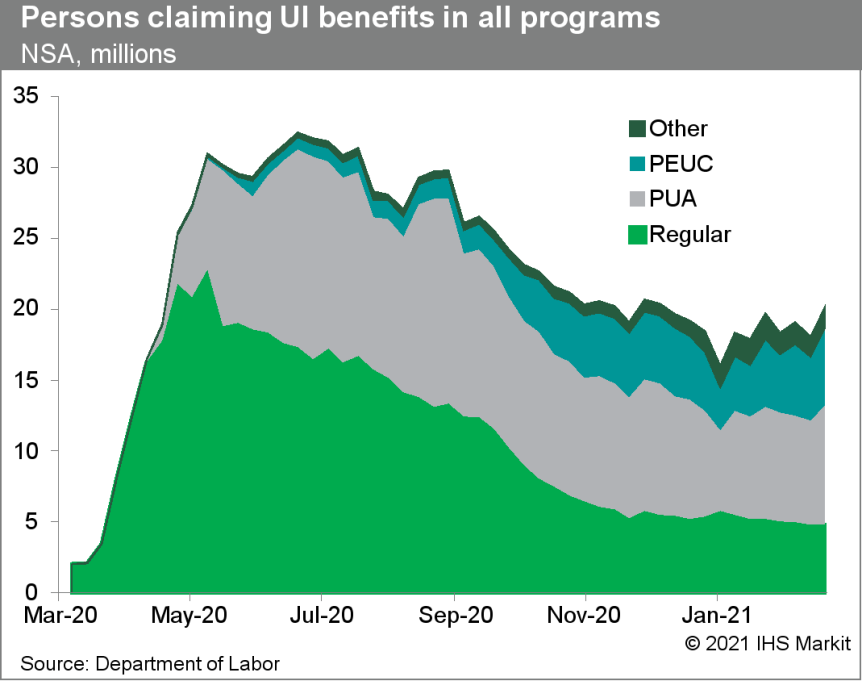

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 42,000 to a four-month low of 712,000 in the week

ended 6 March. The not seasonally adjusted (NSA) tally of initial

claims fell by 47,170 to 709,458. (IHS Markit Economist Akshat

Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 193,000 to 4,144,000 in the week ended 27 February. The insured unemployment rate fell 0.2 percentage point to 2.9%.

- There were 478,001 unadjusted initial claims for the Pandemic Unemployment Assistance (PUA) in the week ended 6 March. In the week ended 20 February, continuing claims for PUA rose by 1,058,022 to 8,387,194.

- In the week ended 20 February, continuing claims for the Pandemic Emergency Unemployment Compensation (PEUC) rose by 986,351 to a series high of 5,454,740. Eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for

benefits under all its programs with a two-week lag. In the week

ended 20 February, the unadjusted total rose by 2,087,376 to

20,116,302.

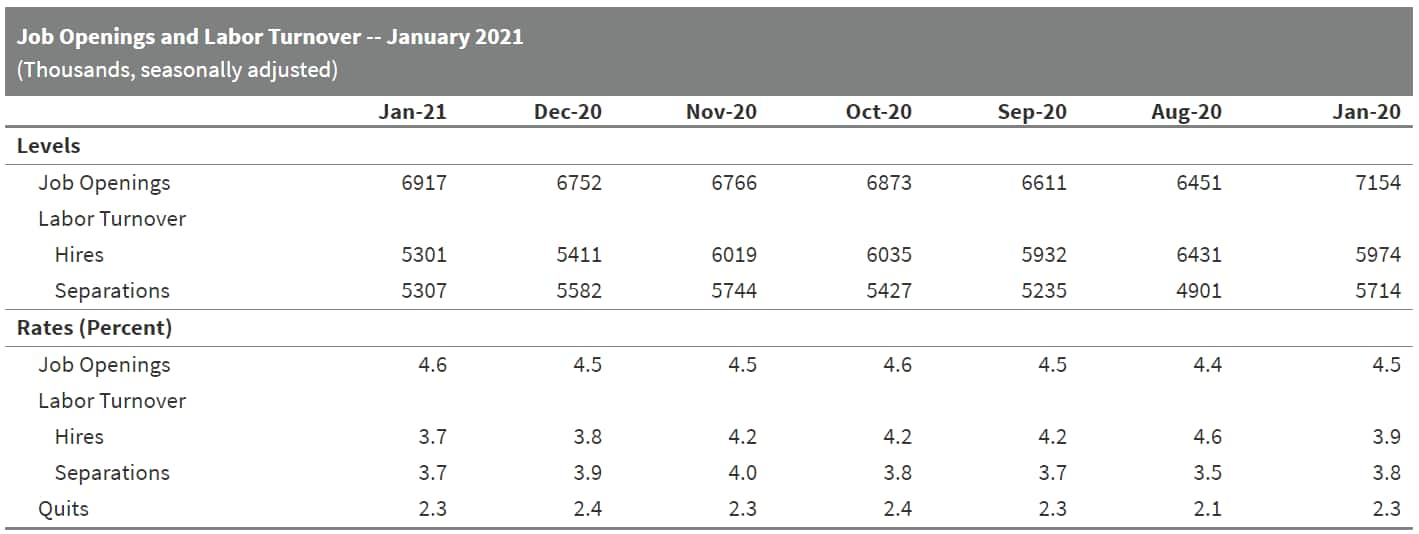

- The January US JOLTS report suggests that the labor market

remained resilient even as businesses were hit by tighter COVID-19

restrictions in January amid surging cases. (IHS Markit Economist

Akshat Goel)

- The number of hires fell to 5.3 million, the lowest since last April. Job openings rose to 6.9 million in January, the highest since March 2020, early in the pandemic.

- Job separations were down to 5.3 million in January with layoffs and discharges edging down to 1.7 million.

- The quits rate, a valuable indicator of the general health of the labor market, edged down to 2.3% but remains at its pre-pandemic average.

- The January report includes not seasonally adjusted annual

estimates for hires and separations. In 2020, there were 73.1

million hires, an increase of 3.1 million. Total separations rose

by 13.5 million to 81.5 million in 2020, even as quits fell for the

first time in 11 years; layoffs and discharges increased by 19.2

million to 41.0 million.

- The US Department of Labor (DOL) announced on 10 March that it will not enforce two rules written by the Trump administration that would restrict retirement plan advisors from considering corporate environmental, social and governance (ESG) as a risk factor when making investments. DOL is not rescinding the rules, but said it will "revisit" them. Until it publishes further guidance, it will not enforce any alleged violations of the rules. In writing the "Financial Factors" rule last year, however, DOL expressed concern that investors could be harmed by using ESG factors. Because there is no single definitive definition of ESG, it is prone to "inconsistencies … lack of precision and rigor … [and is] vague and inconsistent." (IHS Markit Climate and Sustainability News' Kevin Adler)

- The US EPA is encouraging the pesticide industry to explore alternative packaging options to fluorinated high-density polyethylene (HDPE) containers, as it continues to investigate cases of contamination with per- and polyfluoroalkyl substances (PFAS). It suggests steel drums or non-fluorinated HDPE as options. The Agency acknowledges that many companies are using fluorinated HDPE containers to store and distribute products. It is working with state authorities and industry organizations to raise awareness of the issue and discuss product stewardship. The US EPA became aware last year that HDPE containers used to store and transport a mosquito control product contained PFAS compounds that were leaching into the pesticide product. In March, it released new testing data that showed that the PFAS were most likely formed from a chemical reaction during the container fluorination process. The EPA detected eight different PFAS from the containers, with levels ranging from 20-50 parts per billion. The data indicates that the amount of PFAS that has entered the environment from the contamination is "extremely small", the Agency says. (IHS Markit Crop Science's Jackie Bird)

- Autonomous truck startup Plus will deploy NVIDIA's DRIVE Orin system-on-a-chip (SoC) in its next-generation system, which will be rolled out across the US, China, and Europe in 2022. The autonomous operation will be enabled by NVIDIA's Orin SoC architecture, which is capable of 254 trillion operations per second and has a processing performance seven times higher than the company's previous SoC, Xavier. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On-demand shuttle service Via has acquired mapping startup Remix for USD100 million in cash and equity, reports TechCrunch. This acquisition will combine Remix's strength in planning and Via's expertise in software and operations in establishing a complete technology platform offering efficient transportation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Waymo has released the updated version of its Open Dataset that gives researchers free access to the data collected through its multimodal sensor for autonomous vehicle (AV) development, according to a company statement. It will now include a "motion dataset", which helps to predict the behavior of other road users essential for AVs to mitigate crashes. Waymo said the dataset contains more than 570 hours of unique data, which it claims to be "the largest interactive dataset yet released for research into behavior prediction and motion forecasting for autonomous driving". It includes over 100,000 segments, each around 20 seconds long, containing object trajectories and corresponding 3D maps. The dataset features a wide variety of road types and driving conditions captured in San Francisco, Phoenix, Mountain View, Los Angeles, Detroit, and Seattle, to help developers create motion forecasting models for varied driving environments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

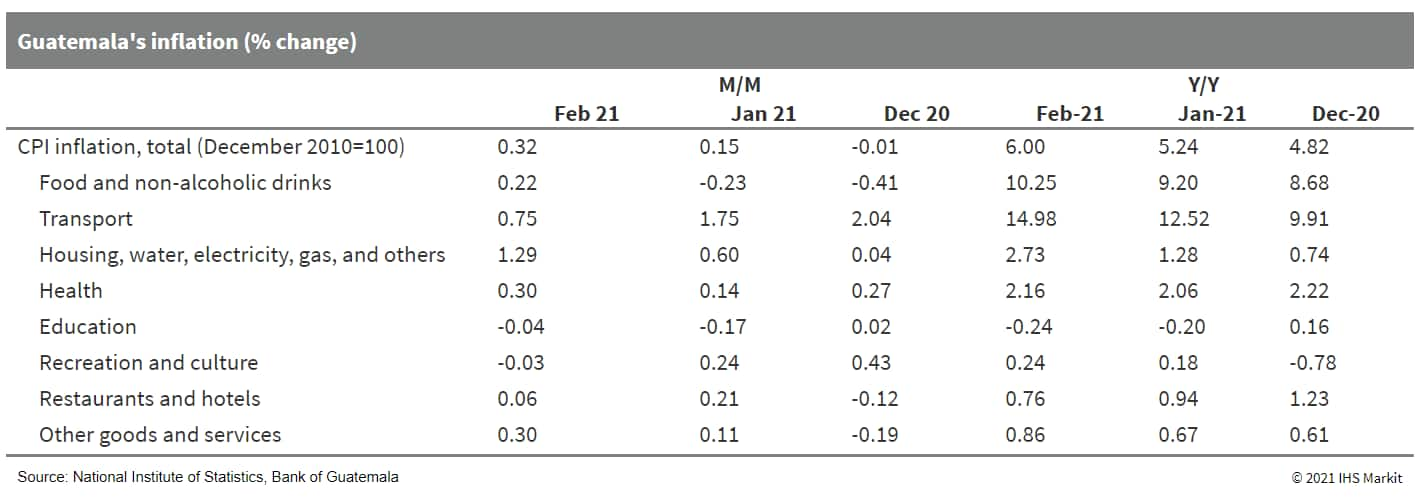

- In February, Guatemala's inflation rate rose to 6.0% y/y,

settling above the central bank's target of 4.0% ± 1.0%, amid

recovering demand in the wake of the COVID-19-virus pandemic,

rising oil prices, and supply shocks such as Hurricanes Eta and

Iota. (IHS Markit Economist Lindsay Jagla)

- The primary drivers of this price growth were transportation and food and non-alcoholic beverage prices, which increased by 14.98% and 10.25% y/y, respectively. Housing and utilities prices, including gas and other fuels, also played a role, rising by 2.73% y/y.

- In monthly terms, prices have been growing consistently month

on month (m/m), with only December 2020 (-0.01% m/m) showing

negative price growth since the beginning of the pandemic. Monthly

inflation peaked in June at 1.41% m/m and in February inflation

rose by 0.32% m/m.

Europe/Middle East/Africa

- European equity markets closed higher; UK +0.2%, France +0.7%, Germany +0.2%, and Italy/Spain +0.8%.

- Most 10yr European govt bonds closed higher, except for UK +2bps; Italy -9bps, Spain -7bps, France -3bps, and Germany -2bps.

- iTraxx-Europe closed -2bps/46bps and iTraxx-Xover -11bps/238bps.

- Brent crude closed +2.5%/$69.63 per barrel.

- Pandemic Emergency Purchase Programme (PEPP) purchases will be

stepped up over the next quarter but various indications from the

latest press conference hint at internal tensions regarding how far

the European Central Bank (ECB) will ultimately be willing to go.

(IHS Markit Economist Ken Wattret)

- Of the various key points from the ECB's latest policy statement and press conference, the one with the highest near-term significance is the commitment to "a significantly higher pace" of asset purchases under the PEPP "over the next quarter".

- This is based on a "joint assessment of financing conditions and the inflation outlook". Not surprisingly, the recent pick-up in bond yields has led to some concern about an unwelcome tightening of financing conditions in the eurozone.

- At the same time, the reference to the inflation outlook is also significant as it demonstrates that the ECB is not so worried about the recent sharp pick-up in Harmonised Index of Consumer Prices (HICP) inflation rates. Rather, as we expected, this is seen as largely transitory.

- According to the ECB's statement, in addition to higher energy prices, the upswing in headline inflation reflects "a number of idiosyncratic factors", including higher value-added tax (VAT) rates in Germany, delayed sales, and unusually large changes in HICP weights. These factors will "fade out" early in 2022.

- Underlying price pressures are expected to increase "somewhat" in 2021, due in part to current supply constraints, but pressures are expected to remain "subdued overall".

- The ECB reiterated that it continues to stand ready to adjust all of its instruments, retained its explicit easing bias for policy rates, and again referred to the need for close monitoring of the exchange rate and its implications for inflation.

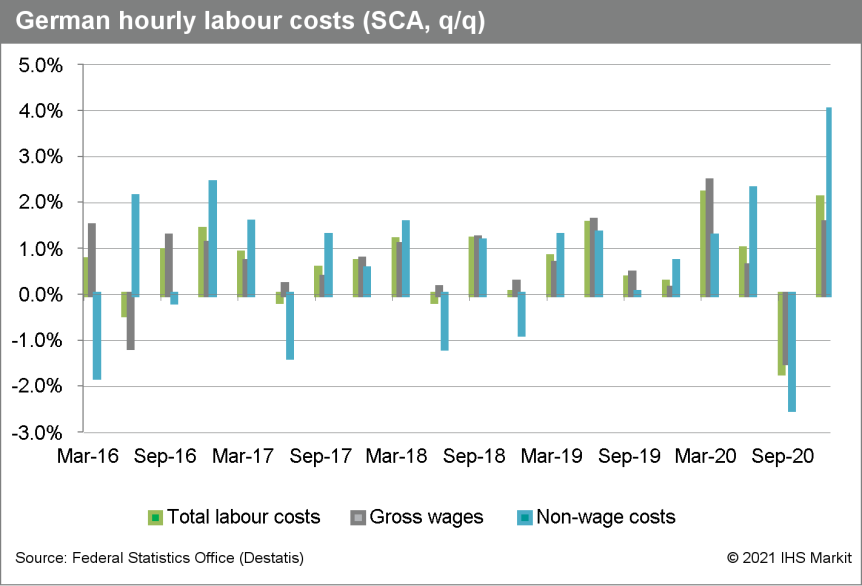

- Germany's Federal Statistical Office (FSO) data gleaned from a

quarterly earnings survey show that labor costs per hour - in the

producing sectors (manufacturing, construction, mining, and

energy/water) and the entire service sector - rebounded by 2.1%

quarter on quarter (q/q) in the fourth quarter of 2020 (seasonally

and calendar adjusted). This fully unwound the 1.7% q/q decline in

the third quarter, which had reflected the temporary rebound in the

number of hours worked after most of the tight initial restrictions

imposed in reaction to the first wave of the COVID-19 virus

pandemic were lifted during the summer. (IHS Markit Economist Timo

Klein)

- Bosch is planning to cut around 750 jobs at its Rodez (France) facility by 2025 in response to a shift away from diesel powertrains, reports La Depeche. The president of Bosch for France and Benelux, Heiko Carrie, said, "We will reduce the teams in the coming years, by 2025, to 500 people." He added that it will "avoid forced departures" through early retirement and voluntary departures. Rodez has been caught in the eye of the storm of the slump in diesel light vehicle demand in Europe during recent years as a result of the components that it manufactures: injectors and glow plugs for diesel engines. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Volkswagen (VW) Group is set to aggressively increase its battery requirements in Europe for the end of the decade. Two people familiar with the matter have told Reuters that the company expects to need around 300 gigawatt hours (GWh) of battery cells per annum in this region by 2030. It is expected to make this announcement at its online Power Day event next week that will be hosted by CEO Herbert Diess and member of the board of management of VW Group with responsibility for technology and CEO of VW Group Components Thomas Schmall. (IHS Markit AutoIntelligence's Ian Fletcher)

- Spanish consumers spent USD3.7 billion more in supermarkets in

2020 than in 2019 due to restrictions and lockdowns as a

consequence of COVID-19, according to the USDA and A C Nielsen.

(IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- The Spanish food and beverage consumption in Horeca is very high and retailers have benefited from restaurant and bar closures, especially in tourist areas on the coast.

- Expenditures on food and beverages increased by 6.4% y-o-y to USD115 bln, after several years of minimal growth. The volume of purchases rose by 4.4%, pushing up prices, especially in fresh products, which rose by 5.5% y-o-y. Packaged food prices grew by 0.4%.

- This completely new scenario has changed market shares. Mercadona, the largest food retailer lost 1.1% market share and accounted for 24.4%, although it is still the domestic market leader.

- Carrefour's market share fell by 0.3% to 8.4%, remaining the second-largest retailer although with poor performance during lockdowns.

- Most analysts expect a generalized price war in the retail industry. Aldi and Lidl have been the first companies to cut prices. Aldi has pushed prices down by 0.75% y-o-y on average. Lidl has announced up to 50% discounts on 15% of their products. More recently, Carrefour, Alcampo, Eroski and Supercor announced softer price cuts. Finally, Mercadona is outside this strategy and is focused on recovering its market share in fresh products, increasing offers and developing take-away sections.

- As per the Russian Ministry of Energy, coal production and

exports (seaborne and overland) during February 2021 stood at 35mt

(up 10% y/y) and 14.7mt (up 9% y/y), respectively. (IHS Markit

Maritime and Trade's Pranay Shukla)

- As per IHS Markit's Commodities at Sea, Russian seaborne coal export shipments during February 2021 stood at 12.8mt (up 20% y/y). Thus, indicating around 1.9mt Russian coal was exported via overland to Europe and China (Mainland).

- In terms of import regions, during February 2021, Russian shipments increased to JKT (3.6mt, up 42% y/y on a 30-Day basis), Mainland China (2.8mt, up 59%), NW Europe (1.9mt, up 4%), and the Mediterranean (0.9mt, up 52%).

- Shipments declined to South East Asia (0.6mt, down 34% y/y) and the Indian Subcontinent (1.1mt, down 21%).

- Russian coal shipments to South Korea during February 2021 stood at 1.6mt (up 57% y/y on a 30-Day basis). The surge has come after four consecutive monthly declines as the South Korean government had placed restrictions on the coal-fired plants generation limiting capacity at 80% during Dec-March 2021.

- South Africa's GDP increased 1.5% quarter on quarter (q/q)

during the fourth quarter of 2020, after the lifting of COVID-19

pandemic-related lockdown restrictions during the quarter. Overall,

the South African economy contracted by 7.0% during 2020. (IHS

Markit Economist Thea Fourie)

- South Africa's real GDP increased by 1.5% q/q, or 6.3% q/q annualized, during the fourth quarter of 2020, after a 13.7% q/q rise in the previous quarter. South Africa's headline GDP fell by 7.0% in 2020.

- The sectors that showed the largest contribution to GDP in the fourth quarter included the manufacturing sector (contributing 2.4 percentage points to the q/q annualized growth), followed by the trade, catering and accommodation industry (contributing 1.3 percentage points) and the transport, storage and communication industry (contributing 0.5 percentage point). The only sectors recording q/q annualized contractions in the fourth quarter were the financial and mining sectors.

- Estonian-based ride-hailing firm Bolt has announced the launch of Bolt Green in Kenya, a new category that offers rides in hybrid and electric vehicles (EVs), reports Business Today. With the introduction of Bolt Green, Bolt aims to reduce emissions and offer greener transport options. The Bolt Green ride service will have a minimum fare equivalent to KES300 (USD2.70), which is the same as the Bolt Base category. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Most APAC equity markets closed higher, except for Australia closing flat; Mainland China +2.4%, South Korea +1.9%, Hong Kong +1.7%, and Japan +0.6%.

- On 10 March, Reuters reported that China's new bank lending was

stronger than expected in February, despite the central bank's

efforts to curb lending growth in 2021. According to the People's

Bank of China data quoted in the report, new local-currency loans

were down from January, but nonetheless surged by 50% year on year

(y/y), likely fueled by continued lending to micro, small, and

medium-sized enterprises (MSMEs). (IHS Markit Banking Risk's Greta

Butaviciute)

- As previously reported, Chinese regulators have asked banks to curb lending this year as credit growth expanded by 12.5% y/y in 2020, boosted by government support measures, particularly to MSMEs.

- Despite the central bank's efforts to curb credit growth in 2021, IHS Markit expects that lending to MSMEs will continue to increase as regulators seek to rebalance lending away from large corporations and the real estate sector to create a more balanced loan portfolio.

- Because of the continued push to lend to MSMEs and expected rapid economic growth in 2021, we forecast credit growth of around 12.1% for 2021 followed by 12.5% in 2022, thus keeping credit growth close to its trend.

- Singaporean multinational ride-hailing firm Grab is exploring the idea of going public in the United States through a merger deal with a special-purpose acquisition company (SPAC). Grab has selected investment banks Morgan Stanley and JPMorgan Chase for a potential US initial public offering (IPO) and the companies are currently working together to identify a SPAC. However, the companies have not ruled out listing via a traditional IPO, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mahindra & Mahindra (M&M) has announced plans to divide its electric vehicle (EV) business into two verticals, according to ET Auto. One will be called the Last Mile Mobility vertical, which will incorporate the company's electric three-wheeler and quadricycle business and will be headed by Mahesh Babu; and the other will be called the EV Tech Centre, which will be headed by Pankaj Sonalkar. The EV Tech Centre will function like a software development center and will focus on product planning and development and converting M&M's existing internal combustion engine (ICE) vehicles into EVs. The creation of separate verticals dedicated to the EV business indicates the automaker's shift from its core diesel- and gasoline (petrol)-powered vehicles towards EVs. (IHS Markit AutoIntelligence's Nitin Budhiraja)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-march-2021.html&text=Daily+Global+Market+Summary+-+11+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}