Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 12, 2021

Daily Global Market Summary - 12 March 2021

Major US, European and APAC equity indices closed mixed across regions. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed almost flat, with high yield slightly wider on the day. The US dollar closed higher, copper flat, and oil, gas, gold and silver lower.

Americas

- Most US equity markets closed higher, except for the Nasdaq -0.6%; DJIA +0.9%, Russell 2000 +0.6%, and S&P 500 +0.1% all closed at new all-time highs.

- 10yr US govt bonds closed +9bps/1.63% yield and 30yr bonds +8bps/2.38% yield.

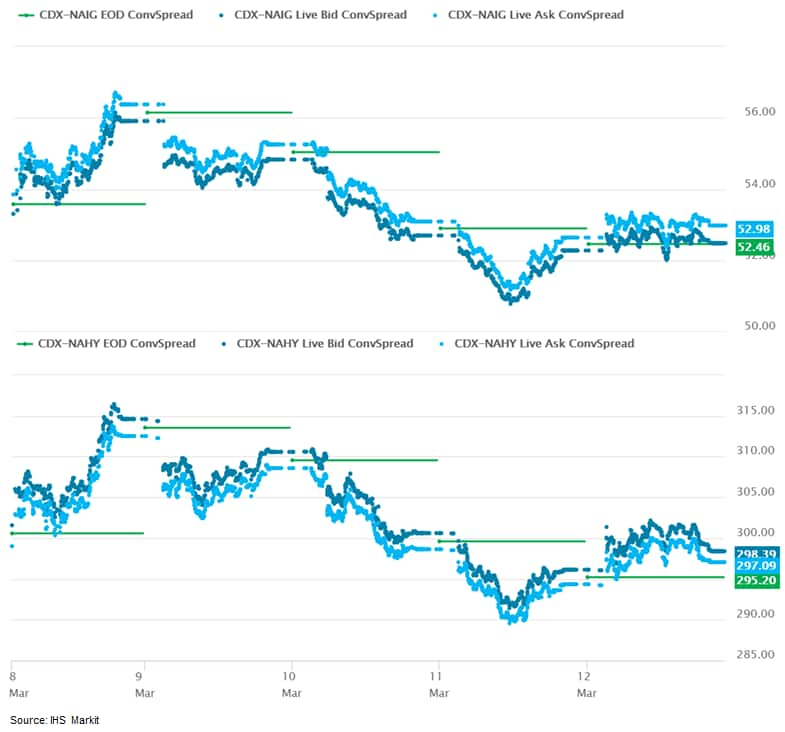

- CDX-NAIG closed flat/52bps and CDX-NAHY +3bps/298bps, which is

-1bp and -3bps week-over-week, respectively.

- DXY US dollar index closed +0.3%/91.68.

- Gold closed -0.2%/$1,720 per troy oz, silver -1.1%/$25.91 per troy oz, and copper flat/$4.14 per pound.

- Crude oil closed -0.6%/$65.61 per barrel and natural gas closed -2.2%/$2.64 per mmbtu.

- The US total producer price index (PPI) for final demand rose

0.5% in February after a large 1.3% jump in January. The 12-month

change was 2.8%, up from 0.8% in December 2020 and the highest

since October 2018. (IHS Markit Economists David Deull and Michael

Montgomery)

- Total goods prices rose 1.4% for a second straight month, but unlike January's gain, the bulk of the increase was in the volatile pieces. The PPI for food rose 1.3% while the PPI for energy jumped 6.0%. Growth of goods prices (final demand) excluding these two components was 0.3%.

- Oil-based products, especially gasoline and, to a lesser extent, heating oil, again drove the monthly rise in energy prices. Gasoline climbed by 13.1%, which was reflected in the CPI earlier in the week. Electricity and natural gas prices also firmed, although at more moderate paces of 1.0% and 1.8%, respectively.

- The US University of Michigan Consumer Sentiment Index rose 6.2

points (8.1%) to 83.0 in the preliminary March reading. The

increase, somewhat larger than expected, is consistent with our

forecast for robust growth in consumer spending in the first

quarter. The index was still 18.0 points beneath its February 2020

peak. (IHS Markit Economists David Deull and James Bohnaker)

- The gain was broadly based, supported by improving views on both the present situation and expectations for the economy. The index of views on the present situation rose 5.3 points to 91.5, the highest since March 2020. The one-year expectations index rose 6.8 points to 77.5, a five-month high.

- Consumer sentiment rose sharply among lower-income households, more than compensating for a February decline. Sentiment reported for households earning less than $75,000 a year jumped 8.7 points to 79.2, while sentiment for higher earners rose 1.6 points to 85.4, the highest reading since March 2020. The gap between these two groups narrowed to less than half its February value, which was the largest since August 2018.

- News coverage of the imminent passage of the American Rescue Plan Act authorizing nearly $1.9 trillion in fiscal stimulus, including direct checks to individuals and additional support for families with children, provides impetus for improvement in sentiment among lower-earners particularly. Consumer attitudes should improve still more when stimulus actually arrives.

- Improvement in consumer sentiment varied in magnitude by political party. Consumer sentiment among self-described Democrats rose 7.3 points in March, while sentiment among Republicans was up only 3.3 points.

- Buying conditions improved markedly in early March. The index of buying conditions for large household durable goods jumped 15 points to 128, the highest since one year before. The indices for vehicles and for homes each rose 5 points, to 114 and 130, respectively.

- General Motors (GM) president Mark Reuss, speaking at a virtual conference, provided an update on the automaker's progress regarding lithium-metal (Li-metal) battery development, which will be part of the next-generation Ultium battery chemistry. The Li-metal battery will be developed with SolidEnergy Systems (SES), which GM describes as a Li-metal battery innovator. The initial prototype batteries, GM says, have completed 150,000 simulated test miles at its research and development laboratories. GM announced that it was working on this technology when it revealed the first (and still current) generation Ultium battery in March 2020; the company says it is working with several companies and "making investments that will allow the company to scale quickly". GM and SES now have a joint development agreement, which includes the two companies building a manufacturing prototype line in Woburn, Massachusetts (United States), aimed at production of a high-capacity, pre-production battery by 2023. GM expects the new technology to lead to a battery energy density that enables higher range in a similarly sized pack or comparable range from a smaller pack. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) plans to idle the Lansing Grand River plant in Michigan, United States, from 15 March until the end of the month over the ongoing semiconductor shortage, reports Automotive News. According to the report, a GM spokesperson said, "We continue to work closely with our supply base to find solutions for our suppliers' semiconductor requirements and to mitigate impact on GM." As in prior GM statements, the company says it intends to make up the lost production as much as possible. The Lansing Grand River plant produces the Chevrolet Camaro and Cadillac CT4 and CT5 sedans. The report also states that downtime at GM plants in Kansas City, US, and Ingersoll, Ontario, Canada, will continue until at least mid-April; these plants have been down since 8 February. (IHS Markit AutoIntelligence's Stephanie Brinley)

- LG Energy Solution, LG Chem's battery division, has said it is planning to invest more than USD4.5 billion in its US battery business, reports Reuters. According to the report, the investment is expected to result in an additional 70 gigawatt hours of US battery production capacity. The report states that this planned investment is in addition to the potential USD2-billion second joint venture (JV) battery-cell manufacturing plant being discussed in LG's advanced talks with General Motors. According to the IHS Markit February 2021 powertrain forecast, production of battery electric vehicles (BEVs) in North America is predicted to increase from about 679,000 units in 2021 to 2.2 million units in 2028. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Renewable Fuels Association (RFA) is urging the Environmental Protection Agency (EPA) not to move ahead with a proposal to extend Renewable Fuel Standard (RFS) compliance deadlines for 2019 ad 2020. On January 15, the Trump administration EPA proposed extending the deadline for small refiners to show compliance under the Renewable Fuel Standard (RFS) for 2019 until November 30, 2021 "in light of uncertainty surrounding small refinery exemptions (SREs) under the RFS program." Meanwhile, for 2020 the agency proposed giving all obligated parties a compliance deadline of January 31, 2022, and a June 1, 2022, attest engagement report deadline. EPA sought comments on the proposed extensions by March 11. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Canada's net employment advanced a substantial 259,200

positions in February. IHS Markit was already far above market

consensus, but these upbeat figures surpassed our expectations.

(IHS Markit Economist Arlene Kish)

- With lockdown restrictions being lifted across the country, many businesses were able to reopen with limited capacity, which boosted part-time employment by 171,000.

- Youth employment made a comeback in the month, but not much as employment remains below December's level.

- The labor force participation rate was steady at 64.7% and the unemployment rate shrank 1.2 percentage points to 8.2%. The labor force grew marginally after three months of declines.

- The services sector was responsible for the bulk of the jobs and total hours worked gained in the month. As such, February's real GDP will easily advance with in-person services industry output having a chance to catch up to the rest of the economy.

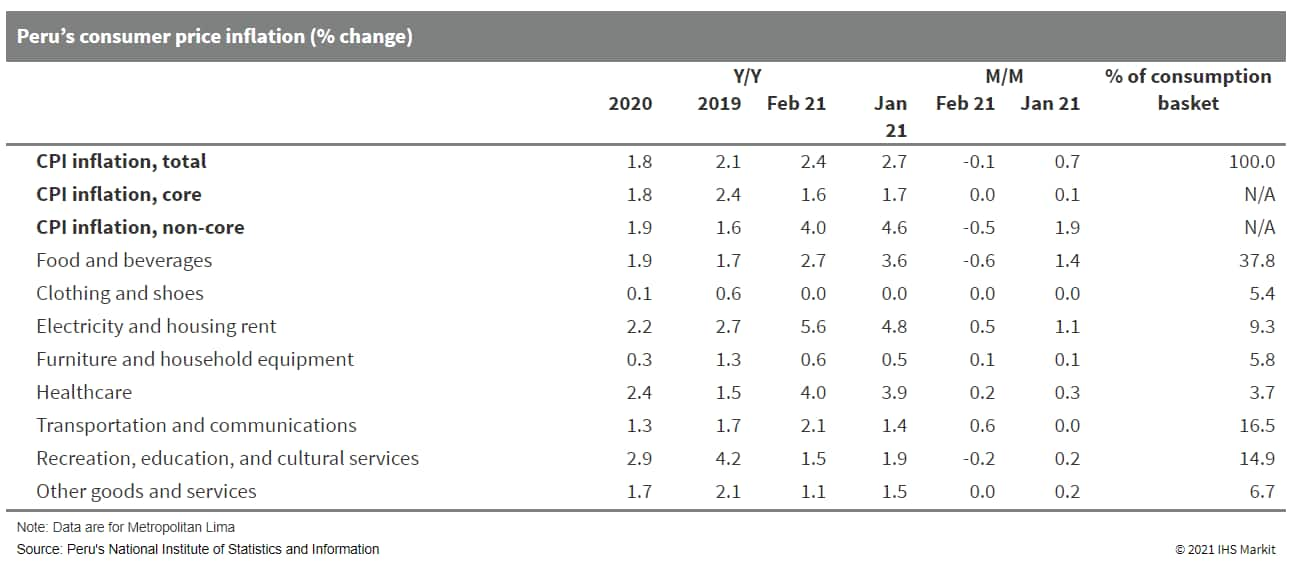

- The Central Reserve Bank of Peru (BCRP) directorate has opted

to hold its policy interest rate constant at 0.25% at its March

meeting, reaffirming its intention to maintain a "strongly

expansionary monetary posture" for a "prolonged period". (IHS

Markit Economist Jeremy Smith)

- In its monthly monetary policy communiqué, the BCRP directorate offered no indication of a shift in its policy stance in the short term, noting that consumer price inflation is expected to stay within the 2% +/-1% target range throughout the next two years amid a substantial output gap.

- Inflation eased slightly in February, with consumer prices falling by 0.1% month on month (m/m). The impact of higher crude oil prices is beginning to filter down to Peruvian consumers; gasoline (petrol) prices rose by 6.2% m/m. Monthly increases in the price of transportation were largely offset by a 0.6% m/m decline in the food and beverages category, which had jumped by 1.4% in January.

- In contrast, core inflation was flat and slid to 1.6% in yearly

terms, reflecting the persistent weakness of domestic demand,

especially amid a new lockdown affecting most of the country during

February.

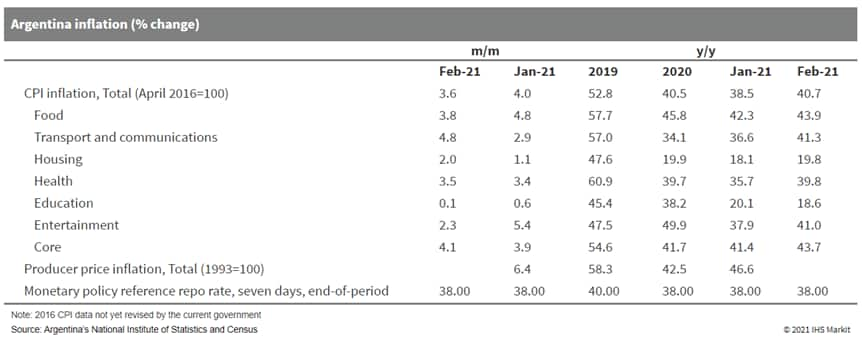

- Argentina's consumer price index (CPI) increased by 3.6% month

on month (m/m) during February. The increase in consumer prices was

the most pronounced in the restaurants and hospitality,

transportation, home furnishings, and food and beverages sectors.

(IHS Markit Economist Paula Diosquez-Rice)

- Argentina's inflation rate in February was driven by price increases in the food and beverages category, with significant price rises for bread, beef, and other meats, and fresh produce, as well as rises in the restaurants and hospitality, home furnishings, and maintenance sectors. The rise in the transportation component was mainly driven by the increase in vehicle prices and the cost of maintenance of personal vehicles.

- The prices of regulated items increased by 2.2% m/m, while the

prices of seasonal items rose by 3.1% m/m. The core inflation rate

stood at 4.1% m/m. Wholesale prices climbed by 46.6% year on year

(y/y) in January, an acceleration compared with the previous month.

The annual CPI rate in February continued the accelerating trend of

the past few months.

Europe/Middle East/Africa

- European equity markets closed mixed; Spain +0.6%, UK +0.4%, France +0.2%, Italy flat, and Germany -0.5%.

- 10yr European govt bonds closed sharply lower; UK +8bps, France/Italy/Spain +4bps, and Germany +3bps.

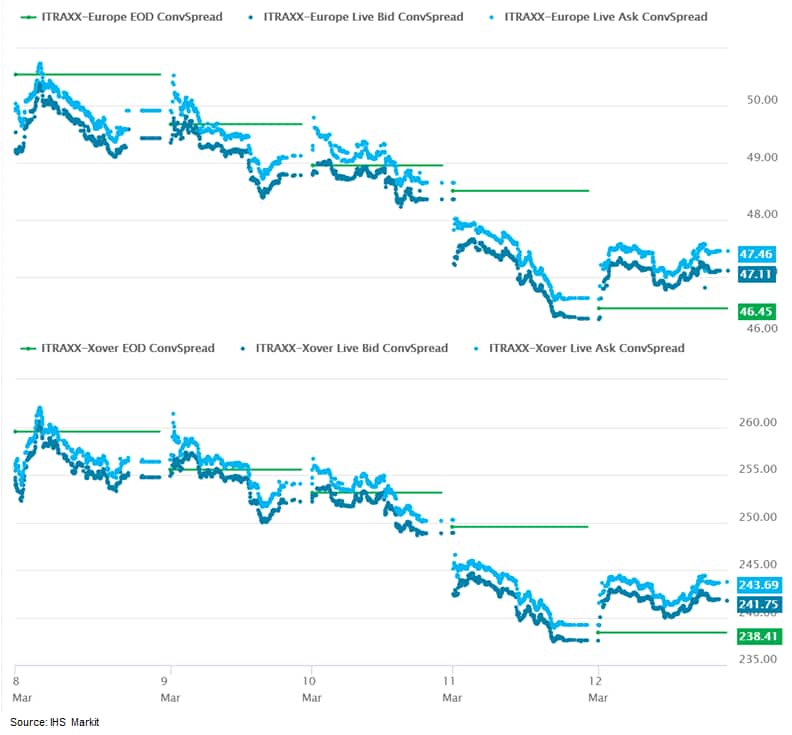

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +4bps/243bps,

which is -4bps and -17bps week-over-week, respectively.

- Brent crude closed -0.6%/$69.22 per barrel.

- The Office for National Statistics (ONS) reports that the UK

economy contracted by 2.9% month on month (m/m) in January, which

followed a 1.2% m/m gain in December 2020. (IHS Markit Economist

Raj Badiani)

- Nine of the 14 services sub-sectors reported falling output between December 2020 and January 2021 because of tight COVID-19 virus-related restrictions across the UK. Wholesale and retail services were the most exposed, followed by education and accommodation and food activities. Meanwhile, health activities and information and communication services posted gains during the month.

- The automotive sector's output provided the largest drag on activity, plunging by 16.9% m/m in January. Car manufacturers had stockpiled cars and components ahead of the Brexit transition period at the end of December 2020.

- GE Renewable Energy is in advanced stages of planning to build a new blade manufacturing facility in Teeside in the North East of England, United Kingdom. The plant, to be built and operated by LM Wind Power, a fully owned subsidiary of GE, will manufacture 107 meter long Haliade-X offshore wind turbine blades. The plant is expected to be fully operational by 2023, in time for delivery to the Dogger Bank project. The facility will be located on Teesworks, at the Teeside port. The port has recently been designated as a freeport by the UK government in its bid to promote the supply chain and installation of up to 40GW of offshore wind capacity by 2030. The port, which will be upgraded later this year pending receipt of a GBP20 million grant from the UK Government, will house the Teesworks Offshore Manufacturing Centre. The port and center will have infrastructure to accommodate up to seven manufacturers to support the offshore wind industry's supply chain and an estimated 9 GW of offshore wind projects. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- UK firm GlaxoSmithKline (GSK) has announced an expansion within the Cell and Gene Therapy (CGT) Catapult manufacturing facility in Stevenage, England, to perform good manufacturing practice (GMP) cell processing and support accelerated progress of its pipeline products through clinical trials. According to a CGT Catapult statement, this expansion will allow advancement of GSK's early-stage advanced therapeutic medicinal products (ATMPs), and should help streamline technical transfer and scale-up of manufacturing of products for trials and beyond. (IHS Markit Life Sciences' Janet Beal)

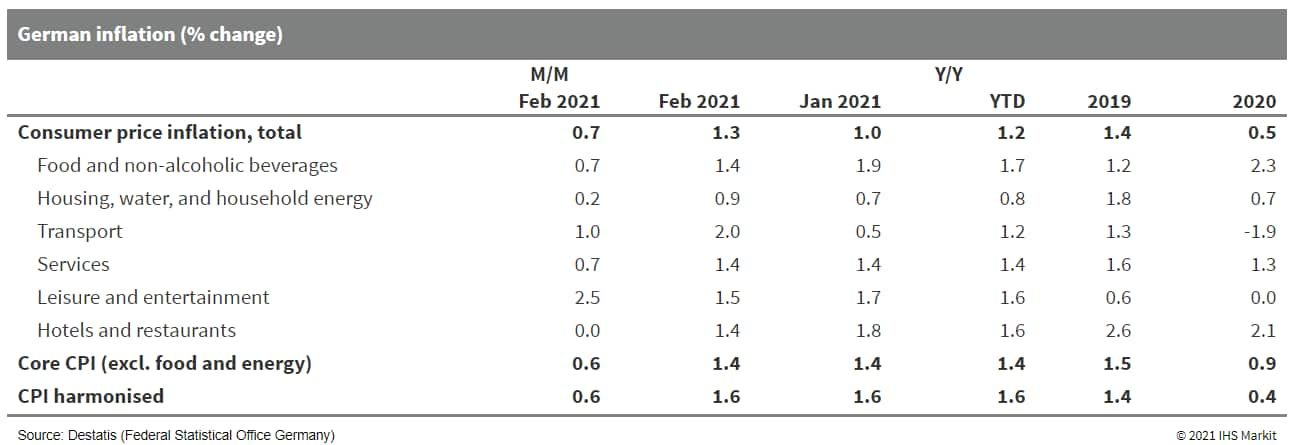

- Final February consumer price index (CPI) data based on

national methodology from the German Federal Statistical Office

(FSO) confirm the "flash" data release of 1 March, showing rates of

0.7% month on month (m/m) and 1.3% year on year (y/y), the latter

increasing from 1.0% y/y in January. This compares with average

inflation of 1.4% in 2019 and 0.5% in 2020. (IHS Markit Economist

Timo Klein)

- Argo AI has selected the Lab-Campus innovation center at Munich Airport as a test site for the development of its autonomous vehicles (AVs), according to a company statement. Argo AI will build a test track at Munich Airport and lease space at the first LabCampus office building, LAB 48, which is scheduled to open in 2022. The vehicles will be tried under realistic conditions in various traffic circumstances at the testing site. Jost Lammers, CEO of Munich Airport, said, "This deal illustrates the vast potential of the LabCampus as a think tank and test laboratory for forward-looking mobility concepts. Argo AI's commitment is therefore an important signal to all other firms that can benefit from the vast opportunities of this innovation center". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Danish central bank (Danmarks Nationalbank: DNB) has

announced unexpected changes to its main monetary policy

instruments, effective from 19 March. Their purpose is to reduce

fluctuations in the Danish money market rates and thus smooth the

transmission of monetary policy. (IHS Markit Economist Daniel Kral)

- Specifically, the lending rate will be cut by 40 basis points from 0.05% to -0.35%, the current account rate by 50 basis points from 0.0% to -0.5% and the certificates of deposit rate will be raised by 10 basis points from -0.6% to -0.5%. The result will be a much narrower interest rate corridor between the lending and the deposit rates.

- The move thus simplifies the main monetary policy instruments by introducing a single deposit rate, at -0.5%, removing the two-tier system, where banks could previously deposit excess liquidity, up to a limit, at 0.0% in the current account facility, with the rest deposited at a negative interest rate in the certificates of deposit facility.

- Luminar has partnered with Volvo Cars' subsidiary Zenseact to develop and sell autonomous systems to automakers. The companies will leverage each other's expertise to develop autonomous vehicle (AV) stack, called Sentinel, for series-production vehicles. The stack will integrate Zenseact's AV software solution OnePilot with Luminar's Iris LiDAR, perception software, and other components as a foundation. The system will offer highway autonomy and activate proactive safety features to avoid collisions with evasive maneuvers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Royal Dutch Shell and Russian state-controlled oil and gas company Gazprom concluded the first carbon-neutral LNG delivery in Europe, they said. It was also Gazprom's first foray into the emerging carbon-neutral LNG segment. The LNG was delivered to Shell's Dragon LNG import terminal at Waterston, Wales. The move follows various countries, including the UK, pledging to reach net-zero emissions nationwide by decarbonizing energy supplies by 2050, while LNG suppliers attempt to decarbonize in line with customer goals. Shell itself aims to reach net-zero emissions for its energy businesses by 2050. Its plan for transitioning to net zero while still producing fossil fuels revolves around nature-based solutions that offset emissions, and access to carbon capture, utilization, and storage projects such as the Quest project in Canada. Shell sells nature-based carbon credits to offset carbon dioxide (CO2) emissions of its fuel-station clients in the UK and the Netherlands. Shell has in the past relied upon projects using the Verified Carbon Standard (VCS), which has been the most frequently cited standard for carbon-neutral LNG offsets to date, but Shell's portfolio of carbon offsets also features credits from other registries and standards. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- Turkey posted a current-account deficit of USD1.867 billion in

January 2021, narrowing from the same period of a year earlier. A

more than USD1 billion year-on-year (y/y) narrowing of the

merchandise-trade deficit caused the improvement in the headline

figure. The narrowing of the merchandise-trade deficit more than

offset the continued worsening of the services surplus. (IHS Markit

Economist Andrew Birch)

- The tightening of monetary policy since November 2020 led to the reduction of merchandise imports in January, which was the primary impetus for the reduction of the trade deficit. Merchandise exports also slipped y/y, but only minimally. Greater gold exports buoyed the headline export total.

- With monetary policy defensive, gross inflows of portfolio investment remained strong in January, topping USD5 billion. That month, a USD3.5-billion government bond issuance significantly boosted gross inflows. In January-September 2020, portfolio investment registered a net outflow of nearly USD14.9 billion. In October 2020-January 2021, portfolio investment switched to a net inflow of USD14.2 billion, a remarkable turnaround.

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.7%, South Korea +1.4%, Australia +0.8%, Mainland China +0.5%, India -1.0%, and Hong Kong -2.2%.

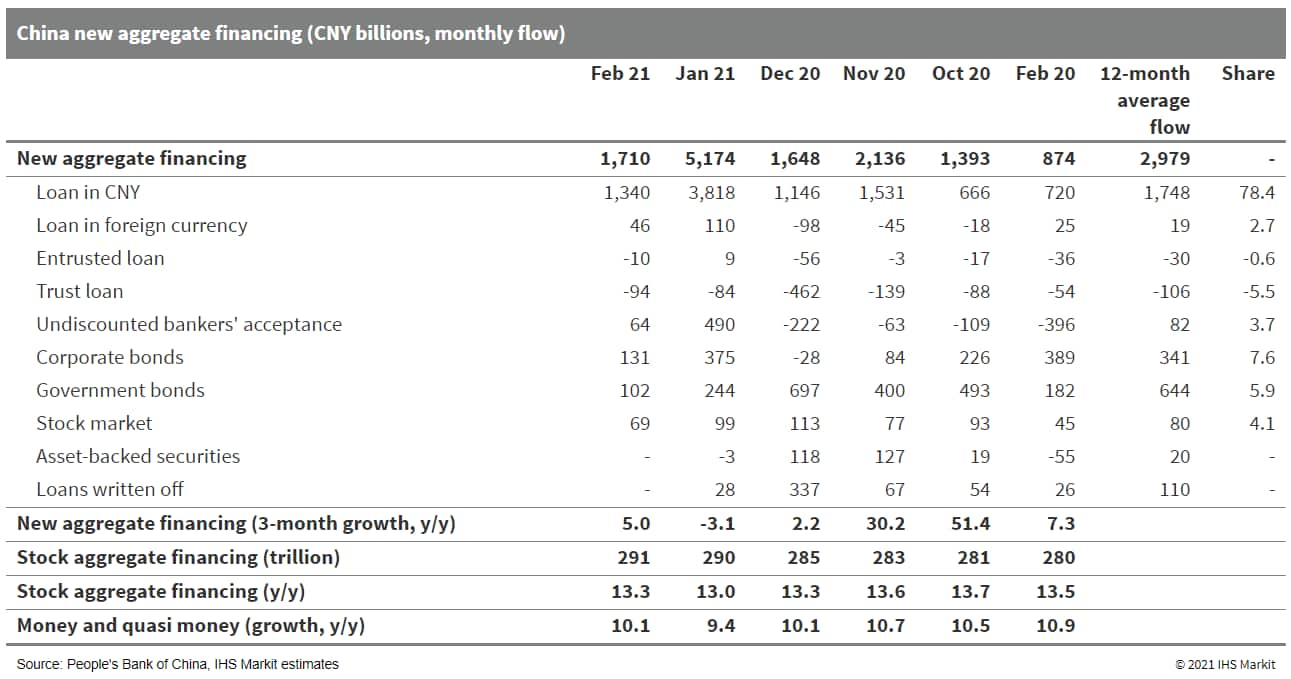

- Mainland China's new total social financing (TSF), the broadest

measure of net new financing to the real economy, amounted to

CNY1.7 trillion (USD264.35 billion) in February 2021, according to

the data release by the People's Bank of China (PBOC). (IHS Markit

Economist Lei Yi)

- The latest reading is down by CNY3.46 trillion from January owing to disruptions from the Lunar New Year holiday, but up by CNY836 billion year on year (y/y) as February 2020 was the month in which the COVID-19 outbreak in China was at its height. Stock TSF increased by 13.3% y/y in February, slightly up by 0.3 percentage point from January, returning to the December 2020 level. Broad money supply (M2) expanded by 10.1% y/y in February, up by 0.7 percentage point from January. This can be partially attributed to an increase in fiscal spending, as reflected by the CNY848 billion decline in fiscal deposits. M1 growth fell by 7.3 percentage points to 7.4% y/y in February, as year-end compensation dispersions transferred deposits from corporates to households.

- TSF increased by CNY6.88 trillion through February 2021, up

CNY957 billion y/y; bank loans totaled CNY4.94 trillion in the

first two months.

- Inceptio Technology has launched an autonomous trucking system, called Xuanyuan, reports Gasgoo. This system will be deployed in two heavy-duty trucks with Level 3 automated capabilities, developed in collaboration with Dongfeng Trucks and Sinotruk. These trucks are in their final stages of development, and delivery and mass production are expected at the end of 2021. By employing over-the-air (OTA) upgrade, the system will enable the trucks to achieve Level 4 autonomous capabilities in future. Xuanyuan features a computing platform that is compatible with diversified autonomous vehicle chips. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Despite a high base effect, Taiwan's merchandise exports

maintained a strong expansion in February, up 9.7% year on year

(y/y), after soaring 36.8% y/y in January. The results for the

first two months were typically volatile mainly because of the

different timing of the Lunar New Year holidays. (IHS Markit

Economist Ling-Wei Chung)

- Taking the first two months together to exclude seasonal factors, exports surged by 23.2% y/y, accelerating from the 12% gains posted in November-December 2020.

- By products, electronic exports - accounting for 39% of total exports - continued to provide the major support to overall export growth, surging by 30.6% y/y in January-February, with January's reading reaching the highest monthly level on record. It extended the double-digit trajectory that began in November 2019, barring only January 2020. A 30.5% y/y jump in exports of semiconductor products continued to boost electronics shipments thanks to robust demand for high-performance chips.

- Japan's current Business Survey Index (BSI) for large

enterprises fell by 16.1 points to -4.5 in the Business Outlook

Survey for the first quarter. The BSI for large manufacturing (1.6)

suggests business conditions continued to improve at a moderate

pace thanks largely to improved external demand for capital goods

and information and communication machinery. However, the

resurgence of COVID-19 and negative effects of the state of

emergency dampened business conditions for a broad range of

industries, particularly for small-sized enterprises. Although

large enterprises and medium-sized non-manufacturing enterprises

anticipate improved business conditions from the second quarter,

small enterprises expect continued sluggishness, but to a lesser

degree, through the third quarter. (IHS Markit Economist Harumi

Taguchi)

- Despite headwinds for business conditions, projected sales for all industries in fiscal year (FY) 2020/21 (ended March 2021) were revised up to a 7.1% year-on-year (y/y) drop from a 7.5% y/y decrease. Ordinary profit outlooks were also revised up to a 20.3% y/y decline from a 24.8% y/y fall.

- Labor demand also remained resilient, as a broad range of enterprises (particularly non-manufacturing industries) faced labor shortages, but fixed investment plans for FY 2020/21 were revised down from a 7.6% y/y drop to a 9.2% y/y decrease.

- However, in line with outlooks for improved business conditions, outlooks for sales and ordinary profits for FY 2021/22 anticipate rises of 3.2% y/y and 8.8% y/y, respectively. Fixed investment plans for FY 2021/22 are also expected to rise by 7.6% y/y.

- Hyundai Motor Group is expanding its electric vehicle (EV) charging network in South Korea to meet growing demand for such vehicles in the country, reports the Maeil Business Newspaper. Kia and GS Caltex have signed a contract to install EV charging units at GS Caltex filling stations and to provide benefits such as discount options and free charging coupons to Kia EV drivers who use the facilities. A total of eight chargers will be installed under the contract - one 350-kW super-speed unit and seven 200-kW rapid units at four locations in Seoul and near other cities. GS Caltex, in charge of operation and management of the charging stations, aims to start providing the EV charging service within the first half of this year. Separately, Hyundai Motor Group is also working on transforming existing filling stations in South Korea into EV charging stations this year. It aims to install a total of 120 super-speed and high-efficiency chargers in 20 locations this year - eight in major cities and 12 at highway rest stops across the country. (IHS Markit AutoIntelligence's Jamal Amir)

- Ride-hailing firm Grab is in talks over a merger deal with Altimeter Capital Management, a special-purpose acquisition company (SPAC), reports the Wall Street Journal. The report does not mention which of the two SPACs affiliated with Altimeter Capital - Altimeter Growth Corp. and Altimeter Growth Corp. 2 - is involved in the talks. This potential deal would value Grab at between USD35 billion and USD40 billion. If the deal is realized, Grab will raise funding of between USD3 billion and USD4 billion from private investors. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-march-2021.html&text=Daily+Global+Market+Summary+-+12+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}