Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 11, 2020

Daily Global Market Summary - 11 May 2020

Relatively subdued volatility today on a limited number of economic and earnings releases, with global equity markets split between closing only modestly higher or lower on the day. On the other hand, benchmark government bonds were lower across the globe to varying degrees and oil was also lower. European investment grade and high yield credit diverged from the US today, with Europe's iTraxx indices finishing the day slightly better and the CDX indices closing lower.

Americas

- US equity markets closed mixed; DJIA -0.5%, Russell 2000 -0.4%, S&P 500 unchanged, and Nasdaq +0.9%.

- 10yr US govt bonds closed lower at +3bps/0.72% yield.

- IHS Markit CDX North America investment grade index closed +2bps/93bps and CDX high yield closed +7bps/641bps.

- KKR has agreed to inject $750m into debt-laden cosmetics maker Coty in the first step towards a broader deal that would see the US private equity group buy a majority stake in the company's professional beauty and haircare division. (FT)

- Saudi Arabia's 8:00am ET announcement that it was cutting oil production to an almost 20 year low triggered a rapid 6.5% price rally to a $25.58 intraday high at 8:20am ET, with the price gradually fading as the day progressed. Crude oil closed -2.4%/$24.14 per barrel.

- Oil demand has very likely passed through its nadir, supply has been cut, curtailed and shut-in at an unprecedented pace, and oil markets are now looking towards the path of the recovery. With that shifting perspective has come the realization that a return to anything resembling "normal" is still a long way away. The next phase for oil markets will be governed by the delicate balance of a highly uncertain demand recovery, inventory trends and the critical question of when and at what price producers will try to push supply back onto the market. (IHS Markit Energy Advisory's Roger Diwan)

- While there remains plenty of volatility in day to day trading, crude prices have moved into a new higher price band as markets turn their attention to the recovery. ICE Brent is holding around $30/bbl, up from lows of just above $20/bbl in late April, and NYMEX WTI front month prices are back to around $25/bbl.

- Major emerging markets such as Brazil, Russia and India, as well as several US states, continue to see accelerating COVID-19 outbreaks, reflecting the risk from the pandemic that continues to loom over global demand.

- Saudi Arabia and its Gulf partners said today that they would cut an extra 1.2 MMb/d of production in June, less than a week after revising June OSP differentials mostly higher. The cuts show a disconnect between the optimism reflected in the nascent price and price structure recovery and the still difficult realities Gulf exporters are facing in terms of nominations and customer demand.

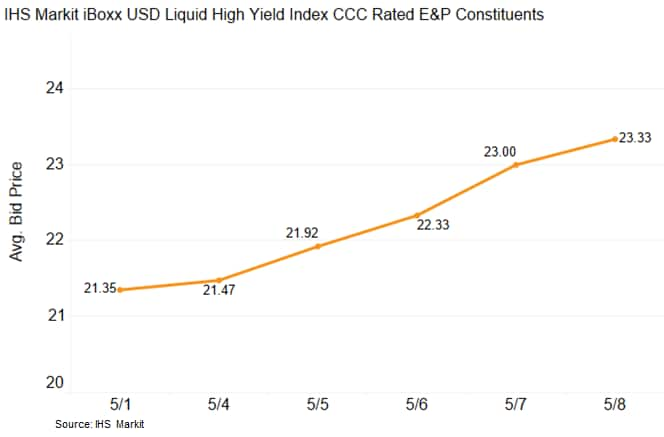

- The average prices of the CCC rated Oil Exploration and Production company constituents of the IHS Markit iBoxx Liquid High Yield index have been gradually improving in May, which is likely driven by the recent rally and stabilization of Crude oil prices over the past week. The average price this month for the 37 CCC E&P bonds in the index has increased 9.2% from 21.35 on 1 May to 23.33 on 8 May.

- The top five Wall St banks' aggregate "value at risk", which measures their potential daily trading risk, increased to its highest level in 34 quarters during the first three months of the year, according to Financial Times analysis of the quarterly VaR high disclosed in banks' regulatory filings. (FT)

- Since the start of this year where the steam coal prices of Colombian origin have declined by 12%, while there has been a 33% reduction in South African coal prices and 22% reduction in Australian grade. In absolute terms, Colombian, Australian and South African Free On Board (FOB) prices have declined by $5.50/t, $14.33/t and $25.71/tonne, respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- Colombian thermal coal prices have not declined as significantly as the other two origins. This is because it was since the start of this year it was already quite low on back of weak European coal demand and this reduced its chances of further significant reduction versus the other two origins.

- Ocean freight on Colombia to China route on capesize vessels has declined by $12.20/t, vs Newcastle to China and South Africa to China route getting reduced by $3.50/t and $7.55/t, reps.

- Overall decline in ocean freight increased competitiveness of Colombian coal in the Asian market. As per IHS Markit's McCloskey, C&F cost of Colombian 6000NAR coal to China is calculated at $53.45/t, vs C&F cost of South African and Australian coal at $57.17/t and $56.62/tonne. Thus, keeping arbitrage still open for Colombian thermal coal cargoes to flow into the Pacific basin.

- Tesla launched a lawsuit against the Alameda county government in the United States on 9 May in a dispute over the opening of its factory in Fremont, California, according to a CNET Roadshow report. Gavin Newsom, governor of California state, announced plans to allow some businesses to reopen starting from 8 May, whereas the authorities in Alameda county in California, within which Tesla's Fremont plant is located, said that the electric vehicle (EV) manufacturer does not have permission to resume operations at its plant. (IHS Markit AutoIntelligence's Tarun Thakur)

- Honda has issued a statement confirming that it is restarting production in Canada and the United States on 11 May and outlining the health-and-safety measures being taken to combat any spread of the COVID-19 virus. The automaker also announced that it is bringing back to work its furloughed salaried personnel. The automaker says its plant start-ups will be staggered and that most will use the first day of the restart to ensure front-line leaders are trained on new procedures and activities relating to COVID-19 virus prevention. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Tenneco has reported a decline in revenue to USD3.8 billion and an adjusted net loss of USD26 million in the first quarter, results that were impacted by production suspensions because of the COVID-19 pandemic. The auto industry supplier also posted a decrease in adjusted EBIDTA to USD239 million in January to March. In the first quarter, Tenneco's revenue declined 7.3% from USD4.5 billion in the corresponding quarter of 2019. The company reported a net loss of USD830 million in January to March, compared with net income of USD117 million in first quarter 2019. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Grenada approached private bondholders for debt relief in 2020, raising prospect of potential near-term default. Latin Finance website published a letter on 11 May reportedly sent by Keith Mitchell, Grenada's Prime Minister and Finance Minister to a holder of the country's private-sector debt, requesting an eight-month moratorium from May on Grenada's outstanding 2030 bond. It cites a projected 10% projected decline in GDP, alongside the closure of the country's borders from 30 March in response to the COVID-19 virus pandemic. This prevented tourist receipts, which previously accounted for 60% of Grenada's foreign exchange income. Key default risk indicators will be whether Grenada makes payment 12 May, and whether bondholders agree to a 2020 moratorium within 30 days thereafter. Grenada's initiative sets an interesting precedent for wider IDA debt relief on publicly held bonds, with a non-default consensus outcome assisted here by its small debt volume and the small number of bondholders involved. (IHS Markit Economist Brian Lawson)

Europe/Middle East/ Africa

- France's industrial production declined by 16.2% month on month (m/m) in March, the sharpest decline in the series history, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- March's fall, driven by the lockdown measures implemented to contain the spread of the COVID-19 virus was more than three times stronger than the largest m/m decline during the 2008/2009 global financial crisis.

- On a year-on-year (y/y) basis, industrial output went down by 17.3% in March.

- With the exception of pharmaceutical products (up by 15.9% m/m), output declined in all other manufacturing sectors. The fall in manufacture of motor vehicles was particularly acute at 49.7% m/m.

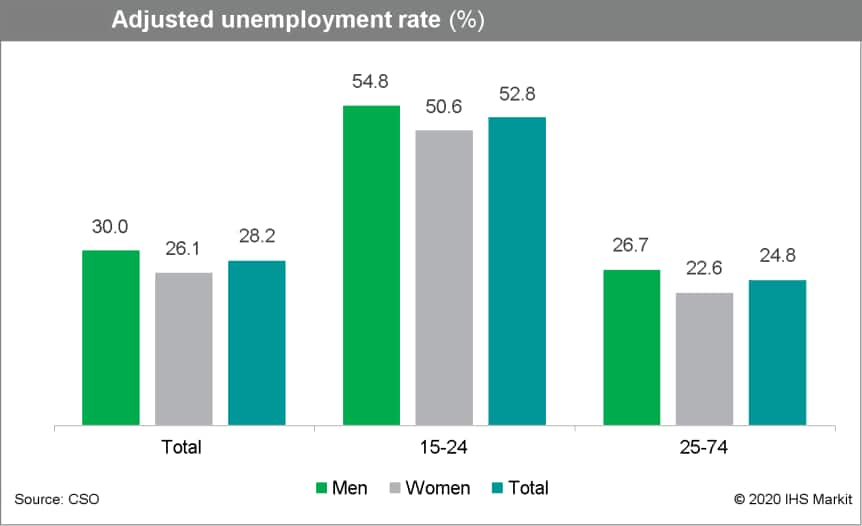

- The latest release from the Irish Central Statistics Office (CSO) reveals the severe deterioration in the Irish labor market. In April, the adjusted unemployment rate, which includes people in receipt of the Pandemic Unemployment Payment (PUP), was reported at 28.2% of the labor force. The most affected demography is the youngest cohort of the labor market with almost 53% unemployed people, according to the adjusted definition (see chart below). Overall, the unemployment rate among men is slightly higher than that among women across all age groups. The standard seasonally adjusted unemployment rate was 5.4% in April, up from 5.3% in March. However, this indicator is calculated based on the number of people on the Live Register and excludes those on the PUP, which is inadequate in the current circumstances. In the aftermath of the banking crisis, the unemployment rate peaked at 16% in January 2012. Although the deterioration is unprecedented, the April unemployment rate is likely the peak. The government recently announced a gradual reopening of the economy in multiple phases, starting on 18 May. (IHS Markit Economist Daniel Kral)

- Automotive loans in Russia fell by 81% year on year (y/y) in April as a result of the massive decline in demand as a result of the country's response to the COVID-19 virus outbreak, according to Autostat data reported by Esmerk Russian News. Loans for new cars fell by 84% y/y, while on used cars they fell by 71% y/y. The average size of loans for new car grew by 4% y/y to RUB809,000 (USD12,145.09), and the average loan for used cars decreased by 2% y/y to RUB547,000. The share of loans on used cars rose to 34.4% in the total auto loan volume against 24% in March 2020. (IHS Markit AutoIntelligence's Tim Urquhart)

- The National Statistical Institute (NSI) has published the latest high frequency data for Bulgaria. Bulgarian industrial output fell 2.2% year on year (y/y) in the first quarter of 2020, with the decline accelerating from 0.5% y/y in January to 5.5% y/y in March. The manufacturing sector, specifically transport equipment and machinery has been particularly hard hit, reflecting the impact of the lockdown and social distancing on factories as well as the collapse of external demand, although trade data is not yet available for the first quarter. Basic metals were also down significantly amid the weakness in global commodity prices. In a separate release from NSI, consumer price inflation has undergone a sharp deceleration through the first quarter. Consumer price growth has slowed from 4.1% y/y in January to just 3.0% y/y in March, reflecting the global collapse in oil prices (amid oversupply and the drying up of demand) and moderating food price increases. (IHS Markit Economist Dragana Ignjatovic)

- According to data published by The Central Statistical Office (KSH), Hungarian industrial output increased by just 0.1% year on year (y/y) in the first quarter of 2020, with the quarterly high of 3.6% y/y in February plummeting to a contraction of 5.6% y/y in March. Although detailed data has not been released yet, the manufacturing sector, specifically transport equipment and machinery (similar to Bulgaria mentioned above), is likely to have been particularly hard hit, reflecting the impact of the lockdown and social distancing on factories. In a separate KSH release, the collapse of external demand was demonstrated as exports fell by 7.3% y/y in March, with the first-quarter average stagnating following robust results in January and February. The collapse in imports in March was more modest at 5.5% y/y, although the drop was more severe across the first quarter at 0.8% y/y. As a result of the weakness of March trade data, the trade gap was more than one-third smaller y/y, although it was up 10% y/y in the first quarter. (IHS Markit Economist Dragana Ignjatovic)

- The Volkswagen (VW) Group has given an update on its electric vehicle (EV) manufacturing project with Swedish startup Northvolt AB. According to a company statement, Volkswagen will make the investment in constructing the battery factory near an existing VW components manufacturing facility in Salzgitter, Germany. VW will be in charge of and pay for the construction of the facility, which will then be commercially leased back to the JV. A figure of EUR450 million (USD487.2 million) is to be invested in this project. (IHS Markit AutoIntelligence's Tim Urquhart)

- Siemens has confirmed its plans to complete the spin-off and public listing of Siemens Energy before the end of fiscal 2020—31 September 2020. At the end of the second quarter of fiscal 2020—31 March 2020—Siemens classified Gas and Power and Siemens Gamesa Renewable Energy (SGRE) as held for disposal and discontinued operations. With the spin-off, Siemens Energy will be deconsolidated. Siemens intends to hold a minority stake in Siemens Energy after the spin-off. The spin-off will be confirmed when it is approved at the extraordinary shareholders' meeting scheduled for 9 July 2020. In May 2019, Siemens announced its intention to transfer its energy business into a new company, Siemens Energy, and list it on the stock market via a spin-off. Siemens Energy includes Gas and Power and Siemens' 67% stake in SGRE—8.1% of which was purchased in February 2020 from Iberdrola SA for a purchase price of EUR1.1 billion (USD1.2 billion). (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Toyota Motor Europe has announced that it will open two more production sites today (11 May). According to a statement, the company said that it will gradually resume output at its Toyota Motor Manufacturing Turkey (TMMT) vehicle manufacturing facility in Sakarya (Turkey), with the first day being used to acquaint staff with the new protocols, while production will begin tomorrow (12 May) at reduced volumes. (IHS Markit AutoIntelligence's Ian Fletcher)

- United Arab Emirates' Ministry of Health and Prevention (MoHAP) has deployed artificial intelligence (AI)-based autonomous shuttle to deliver personal protective equipment for people of a residential complex in Sharjah, reports Gulf News. This initiative is undertaken in partnership with Sharjah's Family Health Promotion Centre and Huawei as a social distancing measure to contain the spread of the COVID-19 virus. Autonomous vehicles are increasingly being deployed to deliver medical and food supplies in regions affected by the COVID-19 virus. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Pony.ai has partnered with e-commerce platform Yamibuy to launch an autonomous delivery service in Irvine, California.

- Nuro has also announced that it is using its small fleet of road-legal delivery robots to transport medical supplies to two Californian stadiums for COVID-19 treatment.

- Neolix had received increased orders for its driverless delivery vans during the COVID-19 virus outbreak in China, and has booked orders for more than 200 vehicles in the past two months.

- Brent Crude closed -4.3%/$29.63 per barrel.

- Saudi Aramco is in early talks to restructure its deal to acquire a 70% stake in Sabic and to reduce the price tag following a more than 40% drop in the Sabic share price due to the COVID-19 pandemic, according to reports on Reuters and Bloomberg. Bloomberg further reports that Aramco is also seeking to delay payments to the Public Investment Fund (PIF; Riyadh) beyond the current agreed schedule. The two sides have already agreed to stagger the payments once. Under a deal signed in October, Aramco agreed to pay a third of the deal in cash, down from half originally. The deadline for paying the rest was extended by four years until September 2025. Aramco's chairman, Yasir al-Rumayyan, who is also head of the PIF, is leading the talks for Aramco, according to Reuters.

- IHS Markit's iTraxx Europe investment grade index closed -2bps/84bps and the iTraxx-Xover high yield index -8bps/507bps.

- 10yr European government bonds closed lower across the region; Italy +7bps, UK +3bps, Germany/France +2bps, and Spain +1bp.

- European equity markets closed lower across the region, except for UK +0.1%; Spain -1.6%, France -1.3%, Germany -0.7%, and Italy -0.4%.

Asia-Pacific

- The Carlyle Group is one of two investors combining to purchase India's SeQuent Scientific. Mumbai-based SeQuent owns Alivira Animal Health, which is the largest veterinary medicines business in India and is on the cusp of entering the global industry's top 20 rankings. US firm Carlyle and CA Harbor Investments - an affiliated entity of CAP V Mauritius - will purchase a 74% stake in SeQuent via a private share purchase. The firms will offer INR86 ($1.13) per share. Among the shareholders of SeQuent is Ascent Capital, which will divest its 5.69% holding that was acquired in 2014. The proposed transaction will trigger a mandatory open offer by CA Harbor and CAP V Mauritius for the remaining 26% equity shares of SeQuent from public shareholders. The overall deal is expected to close in the third quarter of 2020. (IHS Markit Animal Pharm's Joseph Harvey and Sandeep Juneja)

- Tata Motors announced in a filing to the Bombay Stock Exchange (BSE) that it has withdrawn its issue for a private placement of unsecured non-convertible debentures (NCDs) to raise INR10 billion (USD133.5 million). "This is in view of the higher cost expectations from the market participants due to the tight money market conditions. The company continues to have sufficient liquidity and would consider issuance of NCDs at appropriate time and under normalized market conditions with necessary approvals," the company stated. Tata Motors first disclosed in the filing on 28 May its plans to raise INR10 billion through NCDs in three tranches, and on 5 May received approval from its duly constituted committee of the board. (IHS Markit AutoIntelligence's Isha Sharma)

- Tesla has entered into an agreement for a working capital loan of up to CNY4 billion (USD565.51 million) with Industrial and Commercial Bank of China for its Shanghai car plant, reports Reuters citing a regulatory filing on Friday (8 May). According to the report, the loan will be used only for expenditures related to production at the Shanghai plant. According to data from China Passenger Car Association, sales of the locally made Model 3 in April stood at 3,635 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's passenger car sales fell 5.6% year on year (y/y) to 1.43 million units during April, according to retail data from the China Passenger Car Association (CPCA). In the first four months, retail sales volume for passenger vehicles fell by 32.7% y/y to 4.45 million units. The data only include sedans, multi-purpose vehicles and sport utility vehicles. Retail sales data from CPCA indicate a recovery taking hold as the market heads into the second quarter. Sales in April reached over 1.4 million units, up 37% from March. Despite a y/y drop of 6% in retail volumes, the decline has narrowed thanks to government incentives to boost auto sales and automakers' initiatives to approach consumers proactively with generous discounts. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Bridgestone has reported a 65.1% year-on-year (y/y) decline in net income to JPY19.5 billion (USD182.7 million) during the first quarter of the financial year ending 31 December 2020, according to a company statement. Net sales declined by 11% y/y to JPY752.2 billion during the quarter. Operating income during this period totaled JPY49.8 billion, down by 39% y/y, while the company's sales in Japan declined by 9% y/y to JPY194.9 billion. Operating income during first-quarter FY 2020/21 declined as gains from price increases worth JPY7 billion and the decline in raw material costs worth JPY8 billion were offset by a decline in volumes (JPY29 billion); depreciation losses (JPY2 billion); an increase in selling, general, and administrative (SG&A) expenses (JPY19.2 billion); and currency headwinds (JPY2 billion). (IHS Markit AutoIntelligence's Tarik Arora)

- Toyota will resume passenger vehicle production operations in Malaysia from today (11 May), reports NNA Business News. However, the automaker's commercial vehicle production operations will remain suspended as it expects weak demand for such vehicles in the domestic market, according to an unnamed Toyota Motor spokesperson. (IHS Markit AutoIntelligence's Jamal Amir)

- Bangladesh Bank (BB) issued a circular on 10 May regarding credit risk framework for the BDT300 billion (USD3.5 billion) of stimulant lending to industries. According to New Age Business website, the Bengali-only circular noted that BB has abandoned its credit risk framework, which required banks to lend to businesses with at least a 'marginal rating'. BB has called on banks to decide whether to lend to businesses based on "banker-customer relationship, analyzing credit risk following their own guidelines". BB and the government do not provide loan guarantees or bear the responsibility for loan defaults related to the stimulant loan scheme. The government will only provide subsidies on the difference between the headline 9% cap and the lower 4-4.5% interest rate for businesses under the BDT300-billion scheme. Such state-directed lending policy and sanctioned relaxed lending standards will push more loans into the non-performing category in the next 12 months. (IHS Markit Banking Risk's Angus Lam)

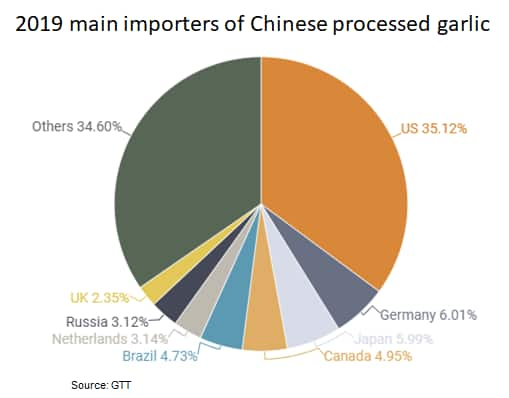

- China's processed garlic prices have suffered a strong fall now that transport activity has resumed in the domestic market. The sales manager of the Chinese garlic processor Liangyungan Yuda Food Co., Ting Zhu, told IHS Markit's IEG Vu that prices for initial fresh garlic shipments are at 20 US cents per kilo, falling by 8 cents to 38 cents/kg for hospitality industry standard in the first week of May compared with April, and down by a third compared with last September. In addition, international demand is still weak, especially from the US, whose purchases fell by one-third year-on-year in Q1 2020, according to customs data. Ting explained that international shipping lines have recovered their usual frequency, but the US and Germany are not pushing up demand and dehydrated prices are expected to continue falling in the mid-term. (IHS Markit Agribusiness' Jose Gutierrez)

- APAC equity markets closed mixed; Hong Kong +1.5%, Australia +1.3%, Japan +1.1%, China unchanged, India -0.3%, and South Korea -0.5%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-may-2020.html&text=Daily+Global+Market+Summary+-+11+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}