Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 12, 2020

Daily Global Market Summary - 12 May 2020

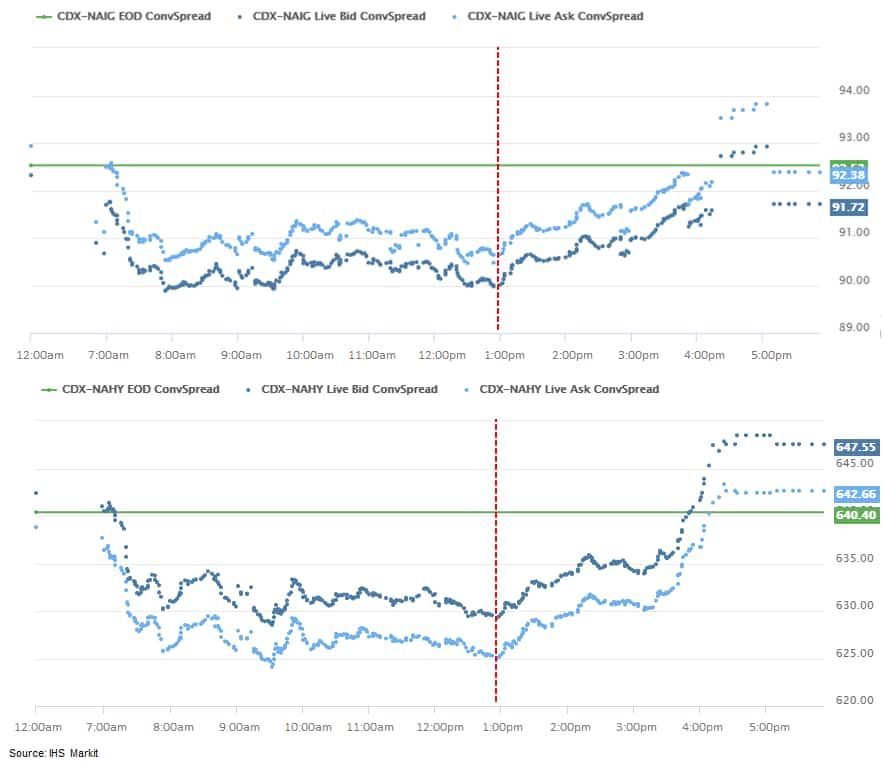

Relatively calm day in global markets until 1:00pm ET when equities and US IG/HY credit began to sell off and US government bonds rallied in sync, as investors continue to assess the economic benefits of reopening businesses now versus the heightened risk of increased COVID-19 infections from reopening too soon potentially curtailing growth even further.

Americas

- US equity markets were close to unchanged until 1:00pm ET when they began to sell off simultaneously and close at or near the day's lows; Russell 2000 -3.5%, S&P 500/Nasdaq -2.1%, and DJIA -1.9%.

- Today's 10yr US govt bond auction was met with strong demand and clearing at a record low 0.70% yield. 10yr US govt bonds closed -4bps/0.67% yield, rallying 3bps between 12:45pm and 2:00pm ET.

- CDX-NAIG and CDX-NAHY started to change course and widen at

almost the same time the US equity markets began to sell-off,

resulting in CDX-NAIG closing almost unchanged/92bps (top graph)

and CDX-NAHY +5bps/645bps (bottom graph):

- Crude oil closed +9.1%/$26.33 per barrel.

- President Donald Trump has ordered the Federal Retirement Thrift Investment Board, an agency that manages almost $600 billion in its "Thrift Savings Plan", to not invest its portfolio in Chinese companies. This order comes as the pension fund was preparing to shift the international component of the fund to the MSCI All Country World ex-US Investable Market index which includes Chinese companies. (FT)

- The US Consumer Price Index (CPI) declined 0.8% in April, pushed lower by a 10.1% decline in energy prices (primarily gasoline). In addition, the core CPI, which excludes the direct effects of moves in food and energy prices, fell 0.4%, a record decline for data that began in 1957. The food index jumped 1.5%, the largest increase in more than 30 years. (IHS Markit Economists Ken Matheny and Juan Turcios)

- According to the Mortgage Bankers Association, nearly 4 million US homeowners were on a payment forbearance plan on 3 May, which amounts to almost 8% of all mortgages outstanding. These loans, if still in forbearance, will show up as delinquent in the second-quarter report. As a result, the delinquency rate could climb from the record low of 4.36% recorded in the fourth quarter of 2019 to above the 10.1% all-time high reached in the first quarter of 2010. The Coronavirus Aid, Relief, and Economic Security (CARES) Act allows homeowners to delay mortgage payments for 90 days, and apply for a 1-year extension. (IHS Markit Economist Patrick Newport)

- As the pandemic eases its grip, companies with large offices in New York City are considering not just how to safely bring back employees, but whether all of them need to come back at all. Many are now wondering whether it's worth continuing to spend as much money on Manhattan's high commercial rents and they are also mindful that public health considerations might make the packed workplaces of the recent past less viable. With hundreds of thousands of office workers, the number of people that remain working from home for an extended period of time or in perpetuity will have financial implications on public transit, restaurants/shops, and state and city tax collections. (NY Times)

- The Food Price Index of the UN Food and Agriculture

Organization (FAO), which tracks monthly changes in the

international prices of the most commonly trade food commodities,

averaged 165.5 points in April, which was 3.4% lower than last

month and 3% lower than in April 2019. (IHS Markit Agribusiness'

Pieter Devuyst)

- Sugar prices took the largest hit, as this sub-index fell 14.6% from March to a 13-year low, after already declining by 19.1% in the month before. The collapse in international crude oil prices triggered by COVID-19 has reduced demand for sugarcane to produce ethanol, causing output to be diverted to sugar production and leading to higher supplies of the commodity.

- Vegetable oil prices declined by 5.2%, driven by lower values for palm, soy and rapeseed oil. Reduced demand for biofuels and from the food sector, as well as higher-than-expected palm oil output in Malaysia and soil crushings in the US, are the main drivers behind this downward trend.

- The dairy index fell by 3.6%, with butter and milk powder prices recording double-digit drops due to increased inventories and export availabilities, weak export demand, and diminished restaurant sales in the northern hemisphere. IHS Markit's analysis indicates that European dairy prices might have begun to stabilize at lower levels as manufacturers started to adapt to the new market conditions.

- Meat prices declined by 2.7% as a partial recovery in import demand from China was not enough to compensate for a slump in imports from other nations. Major producing countries are suffering from logistical bottlenecks and a steep fall in demand from the food services sector amid coronavirus lockdowns, the FAO explained.

- Tesla resumed operations at its production plant in Fremont, California (United States), on 11 May, despite an order restricting manufacturing in the county where the facility is located. A Reuters report quotes a company email to employees as saying, "We're happy to get back to work and have implemented very detailed plans to help keep you safe as you return." In a post on Twitter, Tesla CEO Elon Musk wrote, "Tesla is restarting production today against Alameda County rules. I will be on the line with everyone else. If anyone is arrested, I ask that it only be me." Musk's move follows comments from US federal and Californian state officials which seem to support Tesla's efforts to resume production. The issue of the different orders of the Alameda county authorities and the state of California authorities has been growing into an increasingly difficult one in recent days, as the state of California indicated that manufacturing could resume if adequate health and safety measures were in place, although the state authorities also acknowledged that the local county order would supersede the state mandate. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Toyota plans to build about 800,000 units at its North American plants from April to the end of October, 29% lower than during the same period in 2019, reports Reuters, citing an unnamed company source. Reuters also reports that the source said that Toyota plans to keep its North American production in May at less than 10% of the level during the same month last year. The information in Reuter's report has not been confirmed by Toyota; however, the company said it planned a slow ramp-up of production during a media and analysts' call in April when Toyota provided an overview of its planned methods for resuming production. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Panama's Ministry of Economy and Finance said on 6 May that the

central government's revenues had declined by USD562 million during

March and April, equivalent to 45% of projected inflows. (IHS

Markit Economists Johanna Marris, Paula Diosquez-Rice, and Veronica

Burford)

- Reduced traffic through the Panama Canal is likely for the rest of 2020, with further tariff flexibility measures likely to incentivise users. Although the canal's transit volumes were higher than projected in January-March, the Panama Canal Authority (ACP)'s administrator Ricaurte Vásquez said on 6 May that 169 fewer vessels passed through the canal in April than expected, compared with the monthly totals of between 1,400 and 1,500 vessels in 2020, causing losses worth USD15.5 million in tolls. The canal and related logistics services contribute around 14% of Panama's GDP, with the canal's direct contributions originally projected at USD1.8 billion for 2020 before the outbreak of the coronavirus disease 2019 (COVID-19) virus.

- Welfare cuts and a slow construction-sector recovery will increase the strike risk in the 12-month outlook. The government said in April that 44 state construction projects have been suspended across the country, with the USD25-million Sixaola bridge between Panama and Costa Rica the only infrastructure project still ongoing during COVID-19-virus-related restrictions.

- Panama successfully issued USD2.5-billion worth of 36-year maturity sovereign bonds on 26 March, which were three times oversubscribed.

- Despite successful access to funding, IHS Markit's GDP forecast for Panama has been lowered to -3.6% in 2020 from +3.3% in 2019.

- Fiat Chrysler Automobiles (FCA) announced the resumption of operations at its vehicle production plants in Brazil on 11 May, following 48 days of shutdown, reports Automotive Business. At FCA's plant in Betim, Minas Gerais state, 4,300 employees returned to work and at its plant in Goiana, Pernambuco state, 1,500 employees returned to their jobs. The automaker's engine factory in Campo Largo, Paraná state, restarted activities on 4 May with its 600 employees. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/ Africa

- European equity markets closed mixed; Spain +1.4%, Italy +1.0%, UK +0.9%, France -0.4%, and Germany -0.1%.

- 10yr European govt bonds closed mixed; Spain/UK -2bps, France -1bp, and Italy/Germany unchanged.

- iTraxx-Europe investment grade closed unchanged/84bps and iTraxx-Xover high yield closed higher at -4bps/503bps.

- Brent crude closed +1.2%/$29.98 per barrel.

- Just four days following the announced ban on Citigroup, UBS,

and BNP Paribas, the Turkish Regulation and Supervisory Agency

(BDDK), Turkey's banking watchdog, reinstated the three foreign

banks to full trading rights on 11 May. (IHS Markit Economist

Andrew Birch)

- The BDDK announced that all three had quickly moved to fulfil their outstanding foreign exchange obligations to domestic banks. The failure to pay these obligations had been the official motivation for the initial move the previous week.

- Neither the freezing of these banks' currency transactions nor the re-establishment of their trading rights alters the underlying problems of the lira.

- The lira remains among the most vulnerable emerging market currencies in the world. Without a substantial change in economic policies, IHS Markit believes that the lira will easily reach TRY7.50/USD1.00 in May and could even depreciate close to TRY8.00/USD1.00.

- Greek consumer prices, measured by the harmonized index of consumer prices, fell by 0.9% year on year (y/y) in April, the largest decline since mid-2015. The fall in the headline inflation index was caused by lower energy costs resulting from collapsing oil prices. Energy prices have a weight of around 8% in the headline harmonized index. However, the decline in activity resulting from the containment measures to limit the spread of the COVID-19 virus also led to a large slowdown in core inflation, which stagnated on a y/y basis. Core inflation stood at 0.9% in March and averaged 0.8% during the 12 months to April. (IHS Markit Economist Diego Iscaro)

- Saudi Aramco today announced its financial results for the first quarter amid a challenging macro environment and lower energy demand caused by the COVID-19 pandemic. Group net income was down 25% to 62.48 billion Saudi riyals ($16.66 billion) and EBIT dropped 22.7% to SR128.26 billion. The downstream segment reported an EBIT loss of SR19.0 billion, compared with an EBIT profit of SR5.1 billion in the year-earlier quarter. This was primarily due to inventory remeasurement losses as a result of lower crude and refined product prices. Refining and chemical margins were weakened by slower global economic growth caused by the worldwide impact of COVID-19. Aramco paid total dividends of $13.4 billion in the first quarter, in respect of the fourth quarter of 2019. Dividends of $18.75 billion for the first quarter of 2020 are the highest of any listed company worldwide and will be paid in the second quarter, the company says.

- To compensate for the revenue losses, Saudi Arabia's value-added tax (VAT) rate will be raised from 5% to 15% as of 1 July 2020. Moreover, the cost of living allowance for Saudi citizens that had been introduced in 2018 to offset the introduction of VAT will be cancelled from 1 June 2020. VAT revenues equaled SAR46.7 billion (USD12.45 billion) in 2019, with a VAT rate of 5%. Without considering any second-round effects and assuming the same rate of tax compliance, a tripling of the VAT rate would result in revenues equal to around SAR140 billion. The combined impact of the VAT rate hike and the allowance elimination will likely throw Saudi consumer spending back into recession. (IHS Markit Sovereign Risk's Ralf Wiegert)

- COVID-19 control measures prompt unprecedented fall in

Norwegian mainland economic activity in March, with larger GDP

losses expected in Q2. (IHS Markit Economist Raj Badiani)

- Total real GDP (mainland economy plus petroleum activities, pipeline transport, and ocean transport) shrank by 1.5% quarter on quarter (q/q) in the first quarter; this included a 5.5% month-on-month (m/m) drop in March.

- The impact on the mainland economy was greater when falling by 6.9% m/m in March and 2.1% q/q in the first quarter.

- Household consumption fell severely in both the first quarter of 2020 and March, by 3.6% q/q and 11.7% m/m, respectively.

- Consumption of goods contracted by 4.0% m/m in March because of falling demand for clothing and footwear and cars.

- Spending on services retreated by 15.2% m/m in March, with the most damaged sectors being arts, entertainment and other leisure services, passenger transport, hotel and restaurant services, daycare services and personal services such as hairdressers and beauty care.

- According to the Labor and Welfare Agency, the unemployment rate climbed to a record high of to 15.4% in April, up from 14.7% in March. This accentuates the downside risks of an overvalued housing market and high household debt.

- Given the GDP losses in March, we anticipate a further downward revision in our next forecast release.

- Moody's Investors Service has downgraded Ethiopia's long-term

foreign-currency bonds' rating to B2 from B1, and the bank

deposits' rating has been lowered to B3 from B2, while maintaining

long-term local-currency bonds' and bank deposits' ratings at Ba3.

(IHS Markit Sovereign Risk's Alisa Strobel)

- The recent shock from the COVID-19 pandemic on Ethiopia's external liquidity position, combined as a ratio with high public debt, is the key concern for rating agency Moody's, prompting the rating downgrade.

- Furthermore, Moody's stated that the shock is being manifested mainly in lower exports and foreign direct investment (FDI) receipts and higher external financing needs, leading to a further depletion of the low foreign-exchange reserves.

- IHS Markit is concerned that, through the downbeat government revenue performance caused by inefficient state-owned enterprises and worsening of the export performance amid the global macroeconomic fallout from the COVID-19 pandemic, Ethiopia's import cover will reach critical levels. The country's external financing needs are rising, while apart from official support, obtaining some of the key additional financing requirements through bilateral co-operation may be difficult in the one-year outlook.

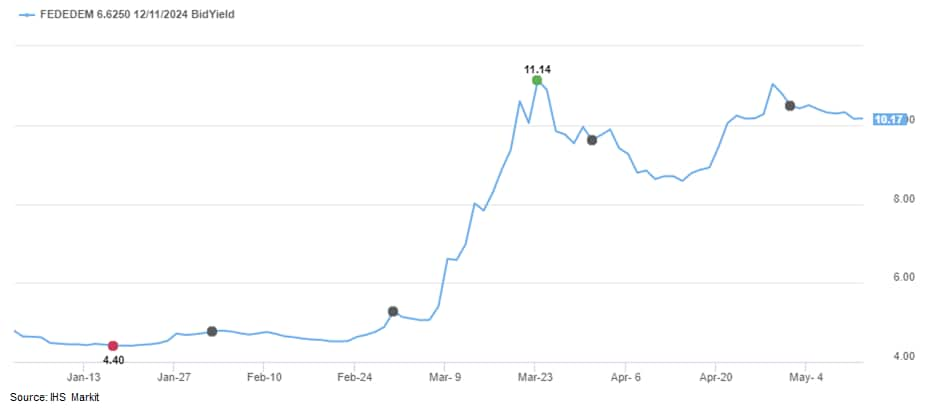

- The below is a Price Viewer chart of the 2020 daily historical

yields for the Federal Democratic Republic of Ethiopia's 6.625%

12/2024 USD denominated bond issue. The chart clearly shows that

the bond's yield has recently remained more than double the yields

from mid-February before the COVID-19 triggered volatility emerged

later that month:

- The Moldovan government is finding itself in difficult financial straits after a loan agreement with Russia that was ratified in April by the parliament was ruled unconstitutional. During its session on 11 May, the executive committee of the National Bank of Moldova (NBM) voted unanimously to keep the policy interest rate unchanged at 3.25%, after cuts in December 2019 and March worth 425 basis points. The NBM highlighted the increasing uncertainty regarding the magnitude of the COVID-19 virus crisis and a subsequent recovery, as well as the direction of commodity prices. Currently, Moldova is experiencing disinflationary pressure, bringing consumer price inflation down to 5.2% year on year (y/y) in April, from a peak of 7.5% y/y in December 2019. Despite interventions and external loan repayments, Moldova's foreign exchange reserves strengthened in April owing to the IMF's emergency loan. Moldova has been hit hard by the COVID-19 virus pandemic, with 4,927 cases as of 11 May, translating to one of the highest per-capita rates in Central and Eastern Europe. (IHS Markit Economist Sharon Fisher)

Asia-Pacific

- APAC equity markets closed lower across the region; Hong Kong -1.5%, Australia -1.1%, South Korea -0.7%, India -0.6%, and China/Japan -0.1%.

- Terminal operator COSCO Shipping Ports has completed a trial of 5G-based driverless trucks in the Chinese port of Xiamen, reports CAAM News. The company has worked with China Mobile and Dongfeng Commercial Vehicle to demonstrate driverless trucks loading and delivering containers around the terminal. The three partners announced their plan to establish an intelligent system at China's major container hub ports by 2025. Tianjin port in northeastern China has completed pilot tests of 25 driverless electric trucks developed by Sinotruk and Truck Tech. According to a Tianjin Port Group press release, in the past two years, autonomous trucks have enabled Tianjin port to increase efficiency and cut operational costs and energy spending by 25% and 50% respectively. (IHS Markit Automotive Mobility's Surabhi Rajpal)

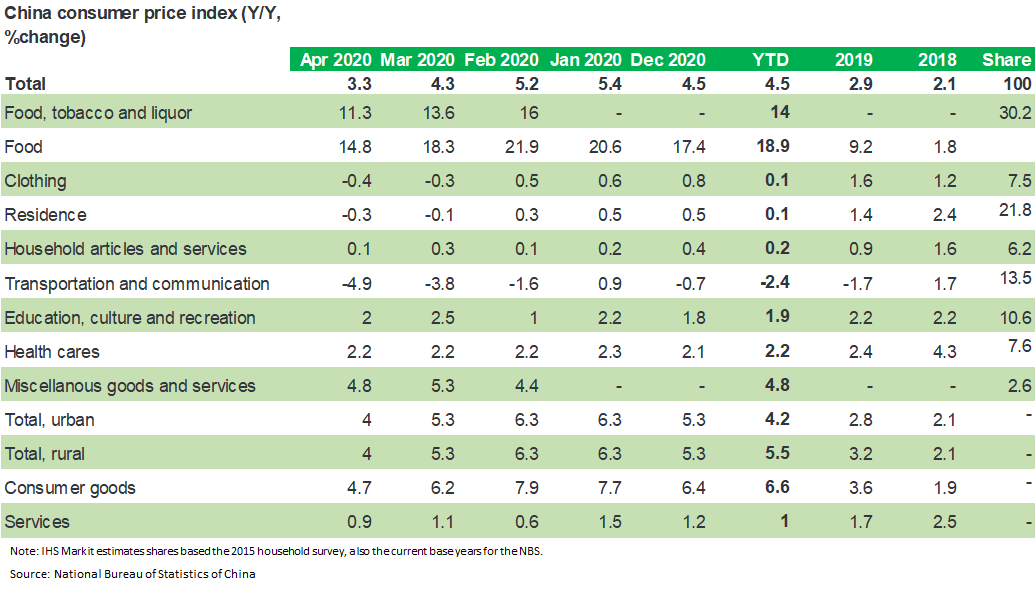

- China's consumer price index (CPI) recorded 3.3% year on year

(y/y) in April, down 1 percentage point from the previous month,

according to the National Bureau of Statistics (NBS). The month on

month (m/m) CPI reported 0.9% deflation, compared to a 1.2%

deflation a month ago. Producer price index (PPI) deflated by 3.1%

y/y in April and m/m PPI deflated by 1.3%. Deflation in both y/y

and m/m PPI widened from the previous month. (IHS Markit Economist

Yating Xu)

- SAIC-GM-Wuling, General Motors' (GM) joint venture (JV) with SAIC Motor and Wuling Motor, has launched an electric version of the Rongguang van in two variants. According to a company statement, the commercial model is priced at CNY83,800 (USD11,819) and has an all-electric range of 252 km, while the passenger version is priced at CNY89,800 and has a range of 300 km. Wuling's Honguang and Rongguan series are the brand's main sellers in the minivan market, with Wuling's sales have been on the decline over the past three years. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Toyota says net income surged 10.3% y/y during FY 2019/20. The

growth in the automaker's net income during FY 2019/20 was mainly

driven by a good performance during the first nine months of the FY

when net income surged by 41.4% y/y. (IHS Markit AutoIntelligence's

Tarik Arora)

- Sales declined in Japan, North America, and Europe to 583,000 units (down by 7.6% y/y), 600,000 units (down by 8.3% y/y), and 259,000 units (down by 3.7% y/y), respectively. In Asia, its sales declined by 9.8% y/y to 370,000 units, and were up by 1.6% y/y to 317,000 units in other regions.

- Toyota has announced its financial forecast for the year 2020/21. It expects to report consolidated global sales of 7 million units during the FY, down by 21.9% y/y. The revenue is forecast at JPY24 trillion, down by 19.8% from FY 2019/20. Operating income during the year is forecast to decline by 79.5% y/y to just JPY500 billion.

- The automaker attributes the projected sharp decline in earnings to a decline in vehicle sales caused by the COVID-19 virus pandemic that has sapped global demand for cars.

- In the full financial year FY 2019/20, Honda reported a 12.8% y/y decline in operating profit to JPY633.6 billion due to currency headwinds and effects from COVID-19 virus spread. The automaker sold 981,000 units during this period, down 28.1% y/y from 1.364 million units it sold during the fourth quarter of FY 2018/19. (IHS Markit AutoIntelligence's Tarik Arora)

- Asahi Kasei reports a 29.5% decline in net income to ¥103.93 billion ($968.2 million) for the fiscal year ended 31 March. Operating income decreased 15.4% to ¥177.2 billion on sales of ¥2.15 trillion, down 0.9%. The company says that sluggish Chinese market growth, slowing automotive markets, lower petrochemical market prices, and the worldwide economic deterioration caused by the COVID-19 pandemic weakened its performance.

- IHS Markit's Commodities at Sea's data indicates that Australian iron ore loadings during week-19 are calculated at 17 metric tons(mt) (translates into 71.6mt on 30-day basis) vs 80mt (on 30-day basis) shipped in the last two weeks. The recent week softness in exports could be on back of restocking activity done by the miners after strong shipments in the last two weeks and shipments may again rebound in the coming weeks. According to China Iron & Steel Association (CISA), steel production in the last 10-days of the April 2020 increased by 3.1pc m-o-m and 0.5pc y-o-y on a year basis. The trend reported by CISA is for its member companies but could be representing overall industry trend in the country. Since the lockdown has ended in Wuhan on 8 April there has been resumption in commercial activities in the country. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-may-2020.html&text=Daily+Global+Market+Summary+-+12+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}