Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 12, 2021

Daily Global Market Summary - 12 February 2021

Major US and European equity indices closed higher, while APAC markets closed mixed. US and European benchmark government bonds were both sharply lower on the day. European iTraxx and CDX-NA were close to flat on the day and on the week across IG and high yield. The US dollar, oil, copper, and silver closed higher, while gold was lower on the day.

Americas

- US equity indices closed higher and on the high end of the day’s range; S&P 500/Nasdaq +0.5%, Russell 2000 +0.2%, and DJIA +0.1%.

- 10yr US govt bonds closed +4bps/1.21% yield and 30yr bonds closed +5bps/2.01% yield. It is the first time 30s closed above 2% since 19 February.

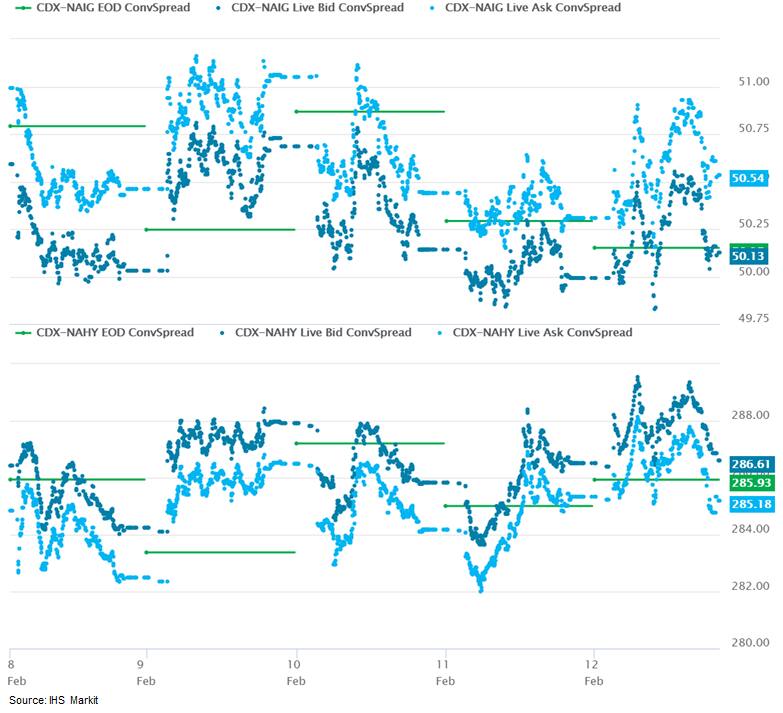

- CDX-NAIG closed flat/50bps and CDX-NAHY flat/286bps, which is -1bp and flat week-over-week, respectively.

- DXY US dollar index closed +0.1%/90.48.

- Copper closed +0.5%/$3.79 per pound, which is the highest close since September 2012.

- Gold closed -0.2%/$1,823 per ounce and silver +1.0%/$27.33 per ounce.

- Crude oil closed +2.1%/$59.47 per barrel.

- The US University of Michigan Consumer Sentiment Index fell 2.8 points (3.5%) to 76.2 in the preliminary February reading. Though modest, the decline is somewhat at odds with our forecast of a sizeable increase in consumer spending in the first quarter. (IHS Markit Economists David Deull and James Bohnaker)

- The majority of the decline was due to deterioration in the index of consumer expectations, which fell 4.2 points to 69.8, a six-month low. The index measuring views on current conditions slipped 0.5 point to 86.2.

- Consumer sentiment fell exclusively among lower-income households. Sentiment reported for households earning less than $75,000 a year fell 4.7 points to 69.8, while sentiment for higher earners ticked up 0.6 point to 83.9, the second-highest reading since the pandemic began. The gap between these two groups was the largest since August 2018.

- Upper-income households have largely recovered from the job losses of the COVID-19 recession, while lower-wage positions comprise the vast majority of eliminated jobs. This report points to continued pain for affected workers. Among households with incomes in the bottom third of the income distribution, the lowest proportion since 2014 (23%) reported improved finances. In contrast, equity indices have continued to move to record highs since November, implying rising wealth for higher-income households.

- Political factors also played a role in the decline. Consumer sentiment among self-described Democrats was stable in early February, while among Republicans, sentiment fell to the lowest level since 2010.

- Buying conditions worsened in early February. The index of buying conditions for large household durable goods fell 1 point to 114, while the index for vehicles fell 8 points to 109, the lowest since October 2008. The index of buying conditions for homes fell 6 points to 120, a nine-month low.

- A report published by Bloomberg News has suggested that the European Union is looking at ways of supporting semiconductor production locally to reduce its reliance on Asia and the US. Sources have told the news service that the project, led in part by the European Commissioner for Internal Market, Thierry Breton, is exploring how to manufacture semiconductors that have features smaller than 10 nanometers, before eventually reducing this to 2 nanometers. The people added that this could involve the redevelopment of an existing foundry or building a new one. However, the sources added that no final decision has been taken, and the time frame of the project is still to be determined. (IHS Markit AutoIntelligence’s Ian Fletcher)

- The Financial Times (FT) reports that the US government is also looking at ways to address a shortage of semiconductors which has hit domestic vehicle manufacturing, and is said to have been exacerbated by sanctions on Chinese chipmaker SMIC. White House press secretary Jen Psaki said that the new administration was “identifying potential chokepoints in the supply chain” and that President Joe Biden would sign an executive order that would result in “a comprehensive review of supply chains for critical goods” in the coming weeks. This comes in the wake of 15 senators, including the Senate Majority Leader Chuck Schumer, calling on the administration to undertake actions against the shortage, which they have said threatens the country's “post-pandemic economic recovery”. They have recommended that it secures funding that was authorized by the US Congress in 2020 in the CHIPS Act, to boost domestic manufacturing in this area. (IHS Markit AutoIntelligence’s Ian Fletcher)

- Trucking technology platform Locomation has partnered with Rush Enterprises to advance autonomous trucks. Under this partnership, Rush will become a primary installation and maintenance provider for Locomation’s autonomous technology. Çetin Meriçli, CEO and co-founder of Locomation, said, “We know that we can count on Rush’s entire team to bring the expertise and experience needed to quickly build out autonomous capabilities in entire fleets while maintaining industry-leading reliability and safety standards.” (IHS Markit Automotive Mobility’s Surabhi Rajpal)

- Ouster and Plus have entered into a five-year LiDAR sensor supply agreement. Initially, Ouster will supply at least 2,000 digital LiDAR sensors to Plus for the deployment of automated trucks. Over the next five years, Ouster plans to increase its supply. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. In addition, the company will offer engineering support to Plus to enable the deployment of an automated driving system across multiple continents. Angus Pacala, co-founder and CEO of Ouster, said, “We are focused on four industries where we believe digital lidar will be a technology lynchpin, and we see a huge opportunity in automated trucks that is driving significant demand for our sensors today and is growing exponentially in the near future.” (IHS Markit Automotive Mobility’s Surabhi Rajpal)

- Huntsman (The Woodlands, Texas) reports fourth-quarter adjusted net income of $113 million, up 74% from $65 million on strong results in the polyurethanes segment. Adjusted earnings per share were $0.51, beating the average analyst estimate of $0.44 as compiled by Zacks Investment Research. (IHS Markit Chemical Advisory)

- Revenue in the polyurethanes segment totaled $1.03 billion, up 5% YOY on higher average pricing for methylene di-para-phenylene diisocyanate (MDI), mainly in China and Europe, partially offset by lower sales volume, which stemmed from unplanned supplier outages.

- Performance products revenue totaled $265 million, down 5% YOY as sales volume and average selling prices declined owing to to weaker market conditions for several amines businesses.

- Advanced materials revenue dropped 14% YOY to $207 million as weakness, mainly in the aerospace and commodity markets, reduced sales volume.

- Textile effects revenue declined 4% YOY to $173 million on lower average selling price, the result of lower raw material cost, partially offset by higher sales volume, mainly in the Asia region.

- Vinícola Aurora, a leading Brazilian grape processor, has announced record annual sales of BRL701.0 million (USD103.5 million) in 2020. Overall volume sales increased to 81 million liters, up 26% from 2019. In a year in which Brazil’s wine consumption rose to 2.8 liters per capita, from below 2.0 liters per capita in 2019, Aurora contributed to the wine market recovery by selling 4.2 million cases of wine. Aurora reported a doubling of its fine wine sales to 9.7 million liters, which represents 40% of the 24.2 million liters of fine wines sold by all Brazilian wineries that year. The company also sold 823,000 cases of sparkling wine, 724,000 cases of wine and fruit juice blend Keep Cooler and 5.3 million cases of grape juice. (IHS Markit Food and Agricultural Commodities’ Vladimir Pekic)

- In January, Colombia’s consumer price index (CPI) rose 1.6% year on year (y/y), remaining well below the Central Bank’s target rate, but food and beverage prices spiked 5.5%. (IHS Markit Economist Lindsay Jagla)

- Colombia’s January CPI grew a mere 1.6% y/y, well below the target inflation rate of 3% ± 1 percentage point set by the Central Bank to guide monetary policy. This continues the trend of low inflation seen throughout the COVID-19 virus crisis as lower economic activity coupled with low energy prices generally kept inflation down – average inflation was 2.5% in 2020 with prices decreasing in five different months.

- On the other hand, food and beverage prices have risen well above this inflationary trend. In January, food and beverage prices rose 5.5% y/y compared to January 2020.

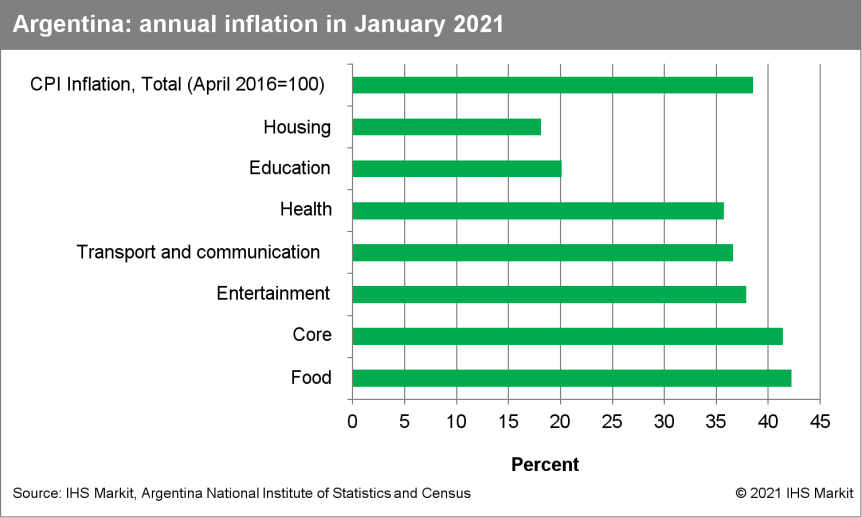

- Argentina’s inflation rate in January 2021 was driven by price increases in the food and beverages category, with significant price rises for beef and other meats, and fresh produce, as well as rises in the communications sector, recreation and leisure, tobacco, and home furnishings and maintenance sectors. The rise in the transportation component was mainly driven by the increase in petrol prices and in the cost of maintenance of personal vehicles. (IHS Markit Economist Paula Diosquez-Rice)

- Prices of regulated items increased by 5.1% m/m, while prices of seasonal items rose by 3.0% m/m. The core inflation rate stood at 3.9% m/m. Meanwhile, wholesale prices climbed by 40.3% year on year (y/y) in December, accelerating when compared with the previous month. The annual consumer price inflation rate in January 2021 continued the accelerating trend of the past few months.

- Inflation expectations for the next 12 months rose in January; Torcuato Di Tella University reported a median of 45% y/y, five percentage points higher than the previous month. The average expected annual inflation rate is 44%. However, the inflation expectation survey by the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) shows a median of 49.4% in January.

- The cost of food and non-alcohol beverages increased by 42.3% y/y in January; the government response has been price control agreements with producers and retailers. However, the expected inflation rate remains on the rising path as consumers anticipate lower supply/scarcity in the precise items that have regulated prices and increased prices in similar, and available, items.

Europe/Middle East/Africa

- European equity markets closed higher and at the high end of the day’s range; UK +0.9%, France +0.6%, Italy +0.4%, Spain +0.2%, and Germany +0.1%.

- 10yr European govt bonds closed lower; UK +5bps, France/Spain +4bps, and Italy/Germany +3bps.

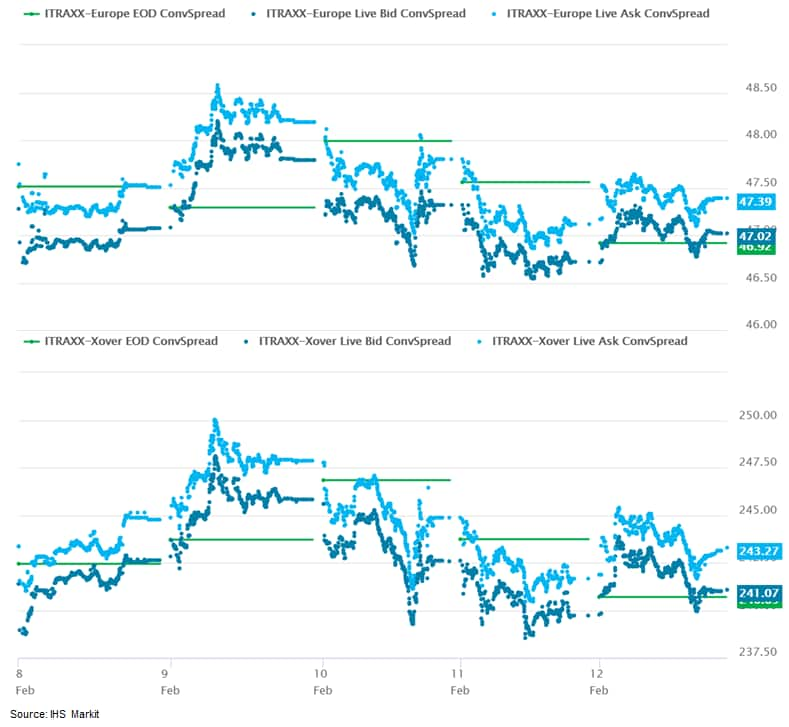

- iTraxx-Europe closed flat/47bps and iTraxx-Xover +1bp/242bps, which is -1bp and flat week-over-week, respectively.

- Brent crude closed +2.1%/$62.43 per barrel.

- The UK economy was more resilient than we had anticipated when GDP in volume terms grew by 1.0% quarter on quarter (q/q) in the fourth quarter of 2020. This compares with an upwardly revised 16.1% q/q gain in the third quarter. (IHS Markit Economist Raj Badiani)

- In annual terms, the economy contracted by 7.8% year on year (y/y) during the fourth quarter, and by 9.9% y/y in the full year 2020.

- In addition, it was 7.8% smaller where it was at the end of 2019, the pre-COVID-19 level.

- Consumer spending lost some ground during the fourth quarter, falling by 0.2% q/q and 9.0% y/y, implying that it fell by 11.0% in the full year 2020.

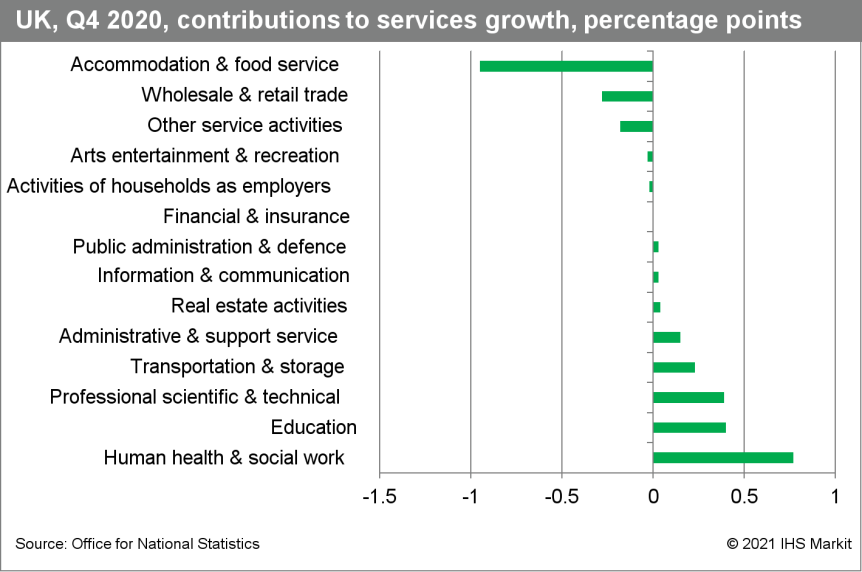

- Services-sector output grew by 0.6% q/q in the fourth quarter of 2020 but was still 7.3% below the pre-COVID-19 level. The rise in services output in the fourth quarter primarily occurred in the health and education industries, with the latter boosted by the rollout of the COVID-19 testing and tracing schemes across the country.

- The UK economy fared better than expected in the fourth quarter of 2020, which now implies that it will not face a double-dip recession in early 2021. We had assumed that strict COVID-19 restrictions targeting the hospitality, transport, and retail sectors would spark a short-lived double-dip recession in the final quarter of 2020 and the first quarter of 2021.

- The mix of risks is as follows:

- The new variants of the virus could sustain high infection rates and strict restrictions deeper into 2021.

- The end of the furlough scheme in April 2021 triggers job losses in the hospitality, leisure, and retail sectors.

- Deep fiscal challenges await with the public-sector budget deficit projected at 20% of GDP in the 2020–21 financial year. Households will soon expect a notable rise in their tax burdens to meet the cost of the government’s extensive COVID-19 support measures.

- More positively, elevated savings during the lockdowns is likely to fuel a brisk recovery in household spending once the restrictions are lifted. However, we note that household balance sheets remain vulnerable, given high debt and inflated house prices.

- Some members of the German parliament are calling on their government to end exports of pesticides that are not allowed to be used in the EU. On 11 February, German lawmakers discussed a proposed law from the Greens and Die Linke, two parliamentary groups in the Bundestag, which would prohibit the export of pesticides made in in the country but banned from use in the EU because of their environmental and health impacts. In a joint motion, the parties stated that Germany exports 10,000 tons of the banned pesticides in 2018, which they said contributes to the 41 million accidental poisonings worldwide each year, of which around 20,000-40,000 are fatal. Die Linke’s spokesperson for food policy Eva-Maria Schreiber said in a statement that agrochemical companies, like BASF and Bayer, are benefitting from this health impact. “They take advantage of the fact that approval in countries in the global south is often less strict than in the EU. These are double standards that are no longer allowed to exist.” CropLife Europe, a trade group representing these companies, disagreed and said some pesticides are not authorized in the EU because they have no or limited use in the bloc. “If the EU were to impose a production ban on the EU territory, it would directly impact the availability of much needed, thoroughly tested, legally compliant products in other jurisdictions,” a CropLife Europe spokesperson told IHS Markit. (IHS Markit Food and Agricultural Policy’s Steve Gillman)

- Sandoz (Swiss firm Novartis’s German-based generics and biosimilars division) has announced the signing of an agreement to acquire UK firm GlaxoSmithKline’s (GSK) cephalosporin antibiotics business in a deal worth up to USD500 million. The agreement includes rights in more than 100 markets to three established antibiotic brands – Zinnat (cefuroxime), Zinacef (cefuroxime), and Fortum (ceftazidime) – but it will exclude rights previously divested by GSK for specific products in the United States, Australia, and Germany, and rights retained by GSK in India, Pakistan, Egypt, Japan (for specific brands), and China. Under the terms of the agreement, Sandoz will pay GSK USD350 million on closure of the deal, plus additional milestone payments of up to USD150 million. (IHS Markit Life Sciences’ Janet Beal)

- In an online vote held on 11 February, registered members of the Five Star Movement (Movimento Cinque Stelle: M5S) voted in favor of supporting a government of national unity led by former European Central Bank (ECB) president Mario Draghi. (IHS Markit Country Risk’s Dijedon Imeri)

- The center-left Democratic Party (Partito Democratico: PD), the centrist Italia Viva (IV) party led by Matteo Renzi, and the right-wing League (Lega) had already announced their preparedness to participate in a government led by Draghi. President Sergio Mattarella had mandated Draghi to form a government on 3 February after the previous coalition government collapsed and earlier rounds of coalition talks failed.

- The most pressing issue for Draghi in the immediate term will be to decide how to spend the EUR209 billion Italy is due to receive from the EU Recovery Fund, as well as implement public-sector reforms to improve fund absorption by strengthening administrative capacity.

- Italy’s absorption rate of EU funds in the 2014–20 EU budget period was a mere 43%. Draghi enjoys the highest approval rating (71%), according to an opinion poll from 3–5 February by Demos & Pi.

- Popular support for Draghi – and the desire of coalition partners to influence the allocation of the EU Recovery Fund – is likely to ensure a stable government for five months, after which President Mattarella enters the final six-month period of his presidency, during which time an early election cannot be called.

- However, if Draghi pushes a tough line on economic policies that emphasize Italy’s long-term debt sustainability and its commitment to EU fiscal rules, which remains moderately likely, he is likely to be challenged by the political parties supporting him, increasing the likelihood of another government collapse before 2022.

- Stellantis is investing in the Fiat Auto Poland (FAP) site in order to prepare for the company's new generation of plug-in hybrid (PHEV) and battery electric vehicles (BEVs), according to a Fakt report. The report states that the plant will be expanded and modernized, to have three production lines for the first time. The launch of the production line for the first of the three car models is planned in the second half of 2022. Stellantis will benefit from these investments due to the location in a special economic zone (SEZ); it will receive almost PLN800 million (USD215.1 million) in tax refunds for this investment round. (IHS Markit AutoIntelligence’s Tim Urquhart)

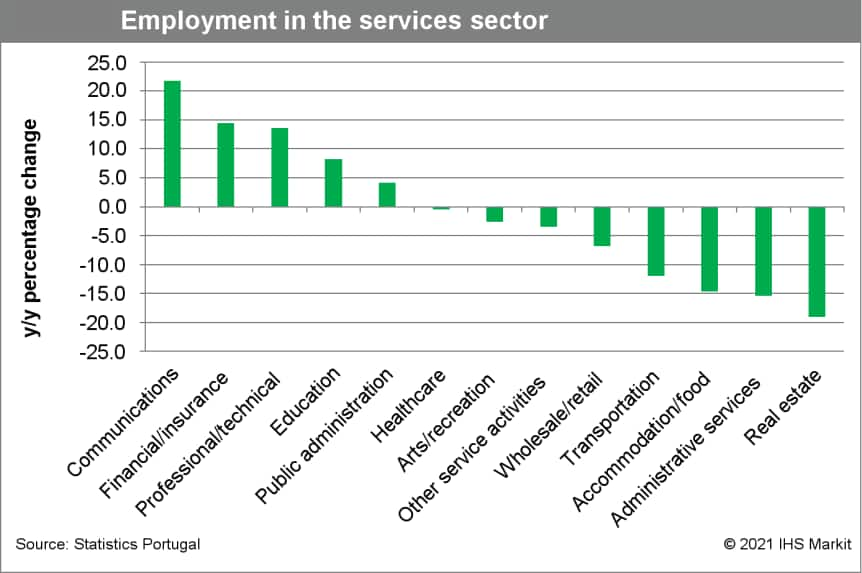

- Portugal’s unemployment rate stood at 7.1% during the fourth quarter of 2020, according to non-seasonally adjusted figures released by Statistics Portugal. It rose by 0.4 percentage point compared with the same period of 2019. (IHS Markit Economist Diego Iscaro)

- Compared with the previous quarter, the unemployment rate declined from 7.8%. The unemployment rate averaged 6.8% in 2020, up from 7.0% in 2019.

- Employment rose by 1.2% quarter on quarter (q/q) but was still down by 1.0% on a year-on-year (y/y) basis. Employment in services declined by 2.0% y/y, while the number of employed people in the industrial and agricultural sectors fell by 1.6% y/y and 4.2% y/y, respectively.

- The number of unemployed people, which had jumped by a record 45.1% q/q during the third quarter of 2020, declined by 7.7% q/q but still rose by 5.9% y/y in the fourth quarter.

- Portuguese passenger car production slipped during January. According to data released by the Automobile Trade Association of Portugal (Associação do Comércio Automóvel de Portugal: ACAP), output fell by 12.1% year on year (y/y) to 20,588 units last month. Light commercial vehicle (LCV) production was also down by 12.6% y/y to 5,111 units, while production of medium and heavy commercial vehicles (MHCVs) amounted to 244 units in January, a drop of 37.3% y/y. (IHS Markit AutoIntelligence’s Ian Fletcher)

- Manufacturing production in South Africa decreased by 11% in 2020. All manufacturing sectors in the South African economy contracted last year, but the steepest decline was recorded in the export-dependent motor vehicles, parts and accessories and other transport equipment category. (IHS Markit Economist Thea Fourie)

- South Africa’s real seasonally adjusted manufacturing production fell by 0.1% month on month (m/m) during December 2020, leaving the year-on-year (y/y) growth rate at 0.4% – the first positive annual growth rate since May 2019. South Africa’s manufacturing production contracted by 11.0% during January–December 2020.

- All manufacturing categories in the South African economy recorded negative growth during 2020.

- The sharpest slowdown was recorded in the motor vehicles, parts and accessories and other transport equipment category (down 26.0% y/y). This was followed by the wood and wood products, paper, publishing and printing category (down 13.3% y/y); the basic iron and steel, non-ferrous metal products, metal products and machinery category (down 13.1% y/y); the petroleum, chemical products, rubber and plastic products category (down 9.1% y/y); and the food and beverages category (down 4.2% y/y).

Asia-Pacific

- Multiple APAC equity markets remained closed for the Lunar New Year holiday; India closed flat, Japan -0.1%, and Australia -0.6%.

- Polestar has announced that production of the Polestar 1 coupé is set to finish at the end of 2021. According to the company statement, the final build slots at its manufacturing site in Chengdu (China) have now been made available. The Polestar 1 was the first model to be launched by the then-newly spun-off Polestar brand and was designed as a halo model to create interest around the brand. The model has since been built in very limited numbers, with IHS Markit forecasts showing that this is even below the 500 units per annum (upa) that had been initially reported. However, the plug-in hybrid vehicle has become far less important in recent times as the battery electric Polestar 2, built in Taizhou Luqiao (China), has created huge amounts of interest for the brand as it positions itself as a battery electric vehicle (BEV)-only marque. The company will now focus on the introduction of the Polestar 3, a crossover model, production of which is to begin in Chongqing (China) during 2022. The statement also indicated that progress is being made on bringing to production the Precept concept, which was revealed in 2020 and could be launched as early as 2023, according to IHS Markit forecasts. (IHS Markit AutoIntelligence’s Ian Fletcher)

- Chinese meat imports reached record levels in 2020 with some USD30 billion spent on combined purchases of pork, beef, chicken and sheep meat. Almost 10 million tons of meat was brought into the country over the twelve months to December – up by more than 60% on the previous year. The USD30 billion import bill was almost three times more than in 2018 – the year when African Swine Fever (ASF) first arrived on Chinese territory. The disease subsequently led to the death of tens of millions of pigs – either to ASF itself or to preventive culls. Although China has since been rebuilding its herd more quickly than expected, the country remains heavily dependent on imports of all types of meat. (IHS Markit Food and Agricultural Commodities’ Max Green)

- SK Innovation has announced that sales in its battery business more than doubled to KRW1.61 trillion (USD1.5 billion) during the full year 2020, compared with KRW690.3 billion in 2019, according to a company press release. The company reported an operating loss of KRW426.5 billion in the battery business during the year. In total, its net sales touched KRW34.1 trillion in 2020. “Facing an unprecedented business environment due to COVID-19, SK Innovation’s business performance showed substantial outcomes resulting from its new business for growth. This year is the first year to begin the company’s financial story and we are also focused on adopting green business models in our existing business as well as new business while promoting breakthrough innovation,” said SK Innovation president and CEO Kim Jun. SK Innovation said that its battery sales increased sharply owing to the stable operation of its first plant in Hungary and the Changzhou plant in mainland China, which began mass production in 2020. (IHS Markit AutoIntelligence’s Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-february-2021.html&text=Daily+Global+Market+Summary+-+12+February+2021++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+February+2021++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}