Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 13, 2020

Daily Global Market Summary - 13 November 2020

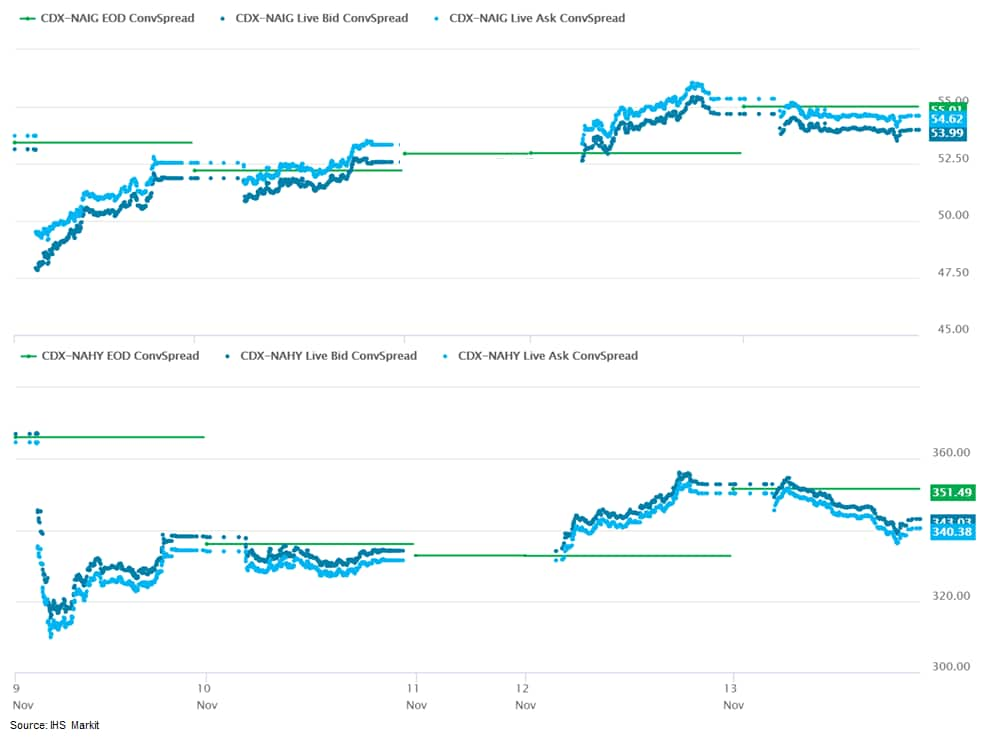

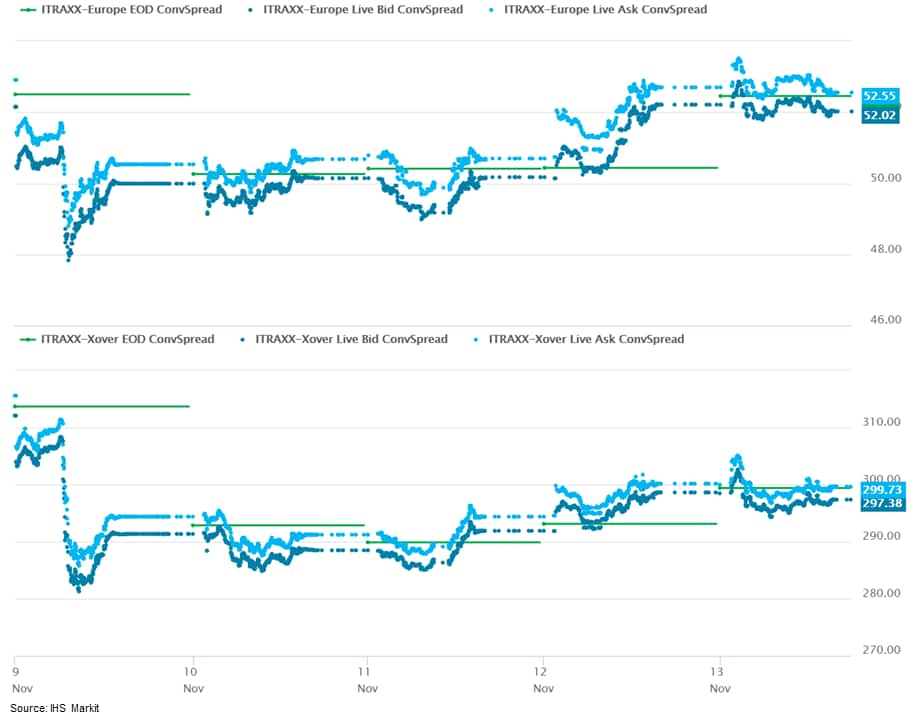

US equity markets closed higher, while European and APAC equity markets were mixed. Benchmark European government bonds closed higher and US bonds were lower. European iTraxx credit indices were almost flat on the day, while CDX-NA was tighter across IG and high yield. The US dollar and oil closed lower and gold/silver were higher. The University of Washington's Institute for Health Metrics and Evaluation that US mortality rates for COVID-19 has noticeably improved since March/April, but predicts that the US peak of infections won't occur until mid-January.

Americas

- US equity markets closed higher and the S&P 500 registered a record close; Russell 2000 +2.1%, S&P 500/DJIA +1.4%, and Nasdaq +1.0%.

- 10yr US govt bonds closed +2bps/0.90% yield and 30yr bonds +1bp/1.65% yield.

- CDX-NAIG closed -1bp/54 bps and CDX-NAHY -10bps/342bps, which

is +1bp and -24bps week-over-week, respectively.

- DXY US dollar index closed -0.3%/92.72.

- Gold closed +0.7%/$1,886 per ounce and silver +1.9%/$24.78 per ounce.

- Crude oil closed -2.4%/$40.13 per barrel.

- The US fatality rate because of COVID-19 has dropped 30% since March/April 2020, according to data from the University of Washington's Institute for Health Metrics and Evaluation (IHME), due to improved medical care and treatments available for the disease. In the US, COVID-19 has a 0.6% fatality rate compared with 0.9% earlier on in the pandemic, according to IHME Director Christopher Murray in an interview with Reuters. Murray noted that physicians have been able to provide better care for patients, including use of blood thinners, oxygen support, and steroids such as dexamethasone. The fatality rate has been difficult to estimate because not all infections are always accounted for in testing, with many individuals hardly experiencing any symptoms. IHME calculates its infection-fatality rate (IFR) based on age-standardized fatality rate data from more than 300 surveys - for every one year of age, the risk of death increases by 9%. The IHME is still predicting that US deaths will total 439,000 by 1 March, with peak deaths reaching 2,200 per day around mid-January. (IHS Markit Life Sciences' Margaret Labban and Brendan Melck)

- The number of workers who went to the office in 10 of the largest U.S. business districts fell to 26.4% from pre-pandemic levels in the week ended Nov. 4, according to data from Kastle Systems. The metro area encompassing New York and Newark and Jersey City, New Jersey, had the lowest figure, at 14.3%. More than 13% of the 454 million square feet of office space in Manhattan was available for rent in the third quarter, with a big increase in new sublease space, which saw the biggest quarterly gain since the global financial crisis, according to brokerage Savills Plc. (Bloomberg)

- If you were to look at only two sets of US producer price

numbers to get an overall impression of what is transpiring in

prices they would be core goods (excluding food and energy) and

"other" services (or services excluding transportation and trade

margins). They scored October gains of 0.0% and 0.2%, respectively,

and both are up 1.2% y/y. Those numbers say that price increases

are just drifting higher with little or no momentum. (IHS Markit

Economist Michael Montgomery)

- Energy has returned to just being in noise mode at levels well under last year. Food prices have been worrisome of late (the last two months) but are almost flat y/y.

- Transportation is coming back after a deadly spring plunge, but not very fast as both traffic and costs remain low.

- Trade margins are almost pure noise and are best ignored.

- That all yields a sanguine environment for buyers but not sellers, a world more stable than when prices are surging or plunging, and a solidly "not-awful" result. While there are things to worry about in a pandemic-riddled world, inflation is not one of them.

- The US University of Michigan Consumer Sentiment Index fell 4.8

points (5.9%) to 77.0 in the preliminary November reading, a

three-month low. The reading is consistent with our expectation for

slowing growth in consumer spending in the fourth quarter. (IHS

Markit Economists David Deull and James Bohnaker)

- The decline was fully accounted for by worsening expectations. The index measuring consumer expectations fell 7.9 points to 71.3, while the measure of views on current conditions edged down 0.1 point to 85.8.

- Two major factors were at play in the period between 28 October and 10 November when surveys for this reading were collected: the dizzying spike in national COVID-19 cases and the presidential elections. News of promising vaccine testing results arrived too late to influence this reading much.

- Individual consumers' expectations are strongly influenced by self-reported political affiliation. A plunge in expectations among Republicans in November outweighed a smaller improvement in expectations reported by Democrats, who were more likely to report that the coronavirus had significantly affected their lives by a margin of 25 percentage points.

- Consumer sentiment plunged 8.1 points to 72.1 among households earning less than $75,000 a year and slipped 2.8 points to 81.1 among households with earnings above that threshold.

- The index of buying conditions for large household durable goods rose by 5 points to 114, and the index for vehicles also rose 5 points to 124. In contrast, the index of buying conditions for homes slipped 5 points to 136. Each of these moves reversed the direction of changes in October.

- The expected one-year inflation rate increased 0.2 percentage point to 2.8%, while expected five-year inflation rose 0.2 percentage point to 2.6%.

- News of the likely efficacy of the Pfizer vaccine arrives just as the national COVID-19 crisis spirals further out of control. With the presidential election also in the mix, cross-currents in consumer attitudes are unusually strong.

- Federal Reserve ("Fed") Vice-Chair Randal Quarles announced on 10 November that the Federal Reserve has applied to join the Network for Greening the Financial System (NGFS). Quarles stated that he expected membership to be granted and that "we could probably join before the spring". NGFS describes itself as a "fast growing international network of central banks and supervisors" targeting "greening the financial system" and to strengthen efforts to meet climate goals, including management of climate risks and mobilizing capital for environmentally positive investments. Its website notes that over "80 central banks, supervisors and other competent authorities have joined" since NGFS was established in 2017, with newer members including Abu Dhabi, Brazil, Canada, Indonesia, Russia, and South Korea. The Fed's application to NGFS and other recent statements it has made indicate growing US regulatory focus on the impacts of climate risks on its financial system. It is hard to envisage NGFS rejecting prompt entry of the United States, with its entry helping it to participate in applying, developing and expanding existing climate-related financial sector regulation, potentially within the six-month outlook. (IHS Markit Economist Brian Lawson)

- Chemicals and gas tanker operator Navigator Holdings (London,

UK) says it expects US ethylene exports to rise through the

remainder of this year as lower US prices widen arbitrage

opportunities to Asia and Europe. (IHS Markit Chemical Advisory)

- The company cites the recent resumption of ethylene production from steam crackers in the Lake Charles, Louisiana, area following the restoration of electricity supplies after damage inflicted by Hurricane Laura. "US domestic ethylene prices are softening, and the market dynamics are returning to what we experienced during the summer months," it says in its preliminary third-quarter results. "[A] low US ethylene price [is] creating arbitrage with the rest of the world, thus providing employment for the ethylene fleet. We expect our utilization level to rise as a result of the widening of the ethylene arbitrage for November and December," it says.

- Navigator says the Morgan's Point terminal, its 50/50 joint venture (JV) with Enterprise Products Partners located near Houston, Texas, was impacted by the fall in US ethylene production following the hurricane, as domestic prices rose sharply due to the reduced supply and limited volumes left available for export. "Expected increased ethylene export volumes for September and October following the severe hurricane season and the impact on the Lake Charles area by Hurricane Laura did not materialize, reducing throughput at the terminal as well as our expected earnings days for the ethylene fleet," it says. "Our utilization for the spot fleet reduced in September and October as a direct consequence." About one quarter of US ethylene production is located in Louisiana, it says.

- The company's midsize ethylene and ethane carriers also had a positive quarter in the ethane market, it says, including confirming a new three-year time charter with a large chemical producer in China.

- Navigator reported preliminary operating sales of $81.4 million for the quarter ended 30 September, up over 7% year on year (YOY), and a swing to a net profit of $1.5 million compared with a prior-year net loss of $2.9 million. Fleet utilization decreased to 78.8% for the quarter, down 5% YOY.

- Rivian has announced that the launch editions of its battery electric pick-up and sport utility vehicle (SUV) will be priced at USD75,000 and USD77,500 respectively, according to media reports. The electric pick-up, the R1T, is due to be launched first, in June 2021, with the electric SUV, the R1S, to follow two months later. Automotive News reports that Rivian plans to add more variants in January 2022, including ones at a lower price point. The lower price point is reported to be USD67,500 and these variants will have a 250-mile range. The Launch Edition variants are reported to have 400 miles of range, although some reports state that the range is only 300 miles-plus, specific badging, and a Launch Green color option, an upgraded interior, an onboard air compressor, and an underbody shield. The Launch Edition will also have an Adventure Package, which includes ash wood trim, upgraded audio, and power tonneau for the R1T, reports The Detroit Bureau. There will also be a USD75,000 Adventure edition available in January 2022 with somewhat less equipment as standard compared with the Launch Edition. The base-level model will reportedly be called Explore, which will come without off-road equipment, premium audio, and vented seats, among other features. Options will include 105-, 135-, or 180-kWh battery packs, providing 250 miles, 300 miles, and 400 miles of range respectively. Automotive News reports that all Rivian vehicles will come as standard with a Level 2 Driver+ assistance feature, which enables hands-free driving in certain situations. The system uses 11 cameras, five radars, and 12 ultrasonic sensors. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber Technologies has partnered with US public fast-charging network EVgo to launch an electric vehicle (EV) charging discount program to promote zero-emission transportation. Under this partnership, EVgo will provide discounted EV charging rates to Uber Pro drivers. These drivers maintain high ratings and low cancellation rates and are qualified for the company's rewards program. In addition to the discount, the drivers are eligible for expanded charging session time limits and a waiver on monthly fees. The companies aim to offer more-affordable access to the public fast-charging network of EVgo in the United States to encourage mass adoption of EVs. Adam Gromis, head of sustainability policy at Uber, said, "Sustainability is a team sport, and the path to zero-emissions is being laid with partnerships like these. Making EV charging access more accessible in more places is a crucial step to electrifying the rideshare industry and helping drivers transition to carbon-free options." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Brazilian meatpackers JBS and Marfrig reported a strong set of

results for the third quarter of this year despite the challenges

posed by COVID-19. (IHS Markit's Food and Agricultural Commodities'

Ana Andrade)

- JBS posted its highest ever quarterly revenue, while profit was above market expectations. In the third quarter, net income BRL3.1 billion (USD572 million), an almost ninefold increase year-on-year, while net revenue reached BRL70.1 billion (+ 34.3% y/y). Supported by strong cash balances, the company brought down its leverage ratio to historically low levels (1.6x in US dollars and 1.83x in reais). This puts the company in a strong position to make further investments. JBS still aims to invest BRL8 billion (USD1.5 billion) in Brazil by 2024. The investments announced last year, are focused on expanding Seara's processed food operations of Seara.

- The favorable exchange rate, strong pace of beef exports and profitability above the historical average, led Marfrig Global Foods to one of the best results in its history in the third quarter, with net income growing six times in the quarter, to BRL673.6 million (USD124.23 million). Net revenue reached BRL16.8 billion (USD3.1 billion), a growth of 32% in the annual comparison. Of total sales, 72% was accounted for by the group's National Beef business in the US. In South America, Marfrig's operational performance has improved, due to the strength of beef exports, and hamburger sales that will benefit from further investments next year. Net revenue for the quarter rose to BRL4.8 billion (USD884 million), 26% higher y/y. The reduction in the group's leverage ratio went from 2.07 times in July to 1.88 times in September.

- BRF, the world's largest chicken exporter, reported net income of BRL218.7 million (USD40 million) in the third quarter. This was slightly above analyst expectations of BRL203.2 million (USD37 million) but was 50.9% lower y/y. Net revenue grew by 17.5% y/y, to BRL9.9 billion (USD1.8 billion), as the company increased the average price of its product. Sales volume of processed foods and meats rose 0.7% in the quarter, to a 1.1 million tons, it added. BRF, the world's largest chicken exporter, derived more than half its sales from Brazil, where net revenue rose by almost 21%. Internationally, net revenue rose 13.5%, but production adjustments for the pandemic continued to affect operations.

- According to the Central Bank of Paraguay (Banco Central del

Paraguay: BCP), the monthly index of economic activity (MIEA) rose

by a seasonally adjusted rate of 2.8% month on month (m/m) in

September. (IHS Markit Economist Jeremy Smith)

- An increase in economic activity in September indicates that the Paraguayan economy reversed course after a -3.6% m/m decline in August. This slowdown followed strong recovery in May, June, and July as restrictions enacted to contain the spread of the COVID-19 virus were gradually relaxed.

- September's results were 1.4% below those of the same month in 2019, and the economic activity index is now down by just 0.5% on a year-on-year cumulative basis since January. Although these figures are strong in regional perspective, it should be noted that the relatively strong year-on-year comparison is due in part to the statistical effect of flat growth in 2019, in which prolonged drought damaged agricultural and hydroelectric output.

- In explaining this month's performance, a central bank communique noted weakness in services (especially restaurants, hotels, and retail), agriculture, and the energy sector, which continues to be negatively affected by low water levels on the Paraná River. Nonetheless, bright spots were noted in telecommunications, driven by remote work and education; construction, bolstered by new public and private projects; financial services; and various subsectors of manufacturing.

- Paraguay has fared relatively well in regional perspective in its fight against the COVID-19 virus, and case numbers have plateaued in recent weeks. This has allowed the country to avoid the protracted economic shutdowns endured by many of its neighbors. On 2 October, the Ministry of Health announced the finalization of the prior four-phase Intelligent Quarantine plan in favor of relaxed restrictions. The border with Brazil was reopened on 15 October, and international commercial flights resumed on 21 October.

Europe/Middle East/Africa

- Most European equity markets closed higher except for UK -0.4%; Spain +0.8%, Italy +0.4%, France +0.3%, and Germany +0.2%.

- 10yr European govt bonds closed higher across the region; Italy/Spain/France -2bps and Germany/UK -1bp.

- iTraxx-Europe closed flat/52bps and iTraxx-Xover -1bp/299bps,

which is flat and -15bps week-over-week, respectively.

- Brent crude closed -1.7%/$42.78 per barrel.

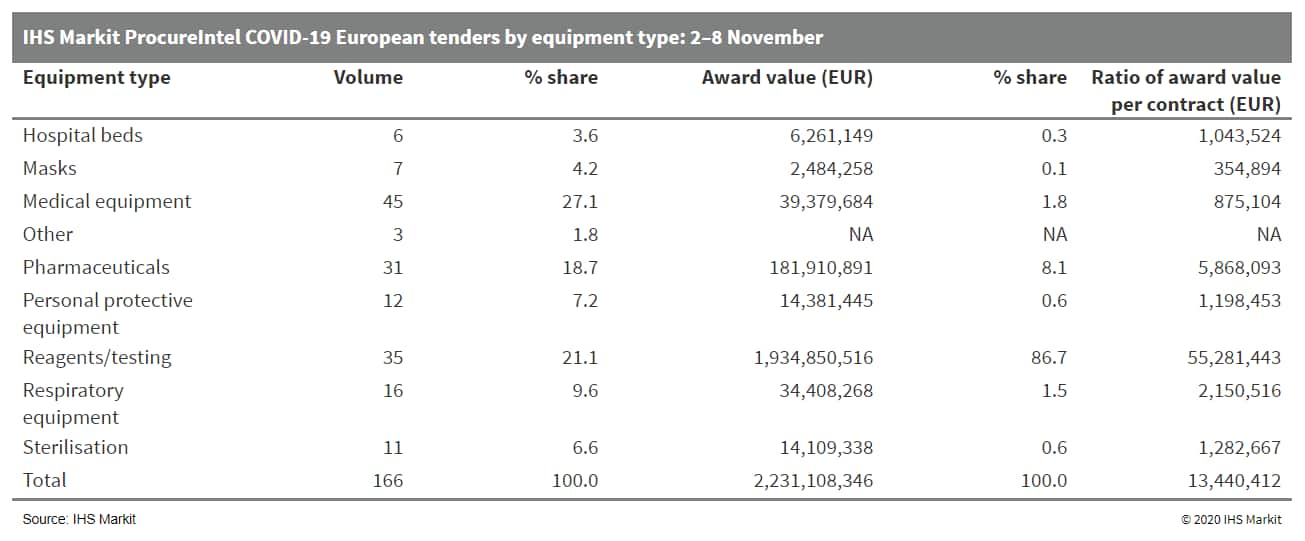

- IHS Markit's weekly ProcureIntel tendering analytics report for

2-8 November identified 166 COVID-19-related European tenders. This

represents a week-on-week increase in volume of 71% compared with

97 tender awards and award notices during the last week of October.

The estimated value of the procurement market, including awards and

award notices, amounted to EUR2.2 billion (USD2.6 billion). This

moves the market dial significantly upwards versus EUR114 million

in tenders in the previous week. IHS Markit analysis of European

COVID-19-linked tender activity from 2 to 8 November shows that

tenders were issued in 23 countries, with 89 contract award notices

(54%) and 77 contract notices (46%). In contrast, for the seven-day

period ending 1 November, a total of 54 contract award notices

(55%) and 44 contract awards (45%) were recorded. Average weekly

activity amounted to 95 tenders during the entire month of October,

with an average potential award value per week of EUR291 million.

The total potential award value registered by IHS Markit throughout

October exceeded EUR1.45 billion. Not all of the contracts of the

tenders registered in the first week of November will be awarded

and the potential award value represents the maximum cost of the

contract. Nevertheless, with a potential award value of EUR2.2

billion, the early November period clearly surpasses October's

activity. (IHS Markit Life Sciences' Choukri Genane and Eóin

Ryan)

- Specialty chemicals producer Elementis (London, UK) has rejected a £621-million ($819 million) all-cash buyout offer from Minerals Technologies (New York, New York), saying the valuation for the company is too low. Elementis's board confirms it received a proposal on 5 November from Minerals Technologies for a possible cash offer of 107 pence per share, and says it has unanimously rejected the conditional proposal as it "significantly undervalued Elementis and its future prospects." There can be "no certainty either that an offer will be made nor as to the terms of any offer, if made. A further announcement will be made when appropriate," it adds. The offer represents a premium of 31% to the closing price of 81.70 pence per Elementis share on 4 November, according to Minerals Technologies. Elementis has more than 580 million issued shares. Mineral Technologies says it is "currently considering its position" following the rejection of its offer. It adds that its proposal represents a premium of 47% to Elementis's 90-trading-day volume weighted average share price of 72.66 pence as of market close on 4 November. "However, any offer would be likely to be solely in cash," it says. Elementis, founded in 1844, manufactures additives for products in the consumer and industrial markets, including personal care, coatings, chromium, energy, and talc. Rothschild & Co. is acting as financial advisor to Elementis. The company in October reported lower volumes year on year for the third quarter, with a sequential improvement in trading compared with the second quarter. Minerals Technologies is required in accordance with stock market regulations by 10 December to announce either a firm intention to make an offer for Elementis or that it does not intend to proceed. (IHS Markit Chemical Advisory)

- Rebounds since May have not recouped COVID-19 virus-related

losses, while recent containment measures point to another

contraction in eurozone GDP in the fourth quarter of 2020. (IHS

Markit Economist Ken Wattret)

- Eurozone industrial production fell by 0.4% month on month (m/m) in September, the first decline since April and well below the market consensus expectation (of +0.7% m/m, according to Reuters' survey).

- Despite the strong rebound in prior months, the level of eurozone industrial production in September remained almost 6% below where it was in February before the pandemic.

- September's unexpected m/m decline in overall production largely reflected a 5.5% m/m plunge in output of consumer durable goods. As this followed a period of exceptional strength from May to August, however, production in this sector as of September was just 2% below its February level. In contrast, production of capital goods has underperformed (8% below February's level).

- Eurozone exports rose by 4.1% m/m in September (on a values basis), the fifth consecutive increase, with the cumulative rise since May running at almost 24%. With imports rising by 2.7% m/m, the eurozone trade surplus rose to EUR24 billion (USD28 billion) in September, its highest level since March.

- Despite the strong rebound in exports, with March and April having suffered extreme declines, the level of exports as of September remained almost 8% below where it was in February.

- The rebound in eurozone economic activity from May onwards due to easing COVID-19 virus-related restrictions generated exceptionally strong "carry over" effects for growth rates in the third quarter of 2020, with GDP rising by a (marginally revised) 12.6% quarter on quarter (q/q), according to the "flash" estimate.

- Despite the rebound, employment remains more than 2% below its

fourth-quarter 2019 level and, with another GDP contraction

looming, the unemployment rate will continue to rise. (IHS Markit

Economist Ken Wattret)

- Eurozone employment rose by 0.9% quarter on quarter (q/q) in the third quarter of 2020, although this followed a record 2.9% q/q collapse in the second quarter (see first chart below). Despite the partial rebound, employment remains 2.3% below its fourth-quarter 2019 level, which translates into a loss of 3.6 million jobs.

- On a year-on-year (y/y) basis, the contraction in employment eased in the third quarter of 2020, to -2.1% from a record low of -2.9% in the prior quarter. Among the larger member states, consistent with recent GDP trends, employment declined far less in Germany during the third quarter in y/y terms (-4.2%) than in Spain (-8.7%).

- Surveys of businesses' employment intentions suggest that the peak rates of decline in employment are behind us, including IHS Markit's PMI data, although with the eurozone set for another GDP contraction in the fourth quarter of 2020, employment prospects will remain challenging.

- The unemployment rate in the eurozone has risen comparatively modestly given the huge effects of the COVID-19 virus pandemic on GDP, up from 7.2% to 8.3%. This reflects lags, government support measures, and lower participation rates. As those effects will become less favorable into 2021, we expect further marked increases in the unemployment rate.

- Indeed, recent data in some member states, including France, have highlighted the distorting effect of the pandemic on the participation rate and, in turn, the unemployment rate. This is now going into reverse, pushing up unemployment.

- A breakdown of eurozone employment by sector will be released on 8 December. Manufacturing should continue to outperform services, again in line with output trends and the signals from IHS Markit's PMI data.

- Daimler CEO Ola Kaellenius has said that the company will shrink over the next five years as it accelerates its move towards being a digital mobility provider as well as a being conventional carmaker. According to a Reuters report, Daimler's CEO acknowledged that the move to electrification will necessitate few employees working on the traditional components and powertrain side of the automotive industry. He said, "In the next five years, we will become a smaller company, will have a fundamental change in the industrial footprint on the powertrain side." In addition, reportedly, Kaellenius outlined a new vehicle project that the company's Formula One team and engineers are helping to work on. The project involves the EQXX, an electric vehicle (EV) which the company aims to be the most-efficient EV capable of taking passengers from Stuttgart, Germany, to Marseille, France, on a single charge. He said, "It is a pre-development project to introduce new technologies." Kaellenius is beginning to acknowledge the elephant in the room regarding the shift to electrification. This is that pure battery electric vehicles (BEVs) have far fewer moving parts and components than traditional ICE vehicles. Conventional ICE powertrains require huge casting, manufacturing, and assembly operations and hundreds of externally supplied components. One estimate by ING Bank has determined that the battery and motor of pure BEVs have only 200 components, compared with at least 1,400 parts found in an ICE engine and transmission. This is going to cause a big headache for those traditional carmakers which are looking to reduce their conventional powertrain footprint, especially with Germany's biggest industrial union, IG Metall, seemingly determined to stand against the tide. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The latest official German tax revenue estimates are somewhat

more sanguine than those released as an interim projection in

September. These upward adjustments owe to better near-term GDP

growth forecasts, whereas growth projections from 2023 onward have

become slightly more cautious. Changes in tax legislation relative

to the status of September play only a minimal role. (IHS Markit

Economist Timo Klein)

- The absolute amounts of changes in expected public-sector tax revenues during 2020-24 - compared to projections made in September - are as follows. The government expects additional revenues of EUR10.6 billion in 2020, followed by extra revenues of EUR3.4, EUR5.4, and EUR0.6 billion in 2021, 2022, and 2023, respectively. Only in 2024, the level is now estimated to be EUR4.2 billion lower than before. Changes in tax legislation since September are having only a minimal impact (none in 2020, around -EUR0.6 billion each year thereafter), which means that altered macroeconomic projections account for most of the changes.

- The underlying assumption for nominal GDP growth in 2020 was lifted from -4.0% (September projection) to -3.8% y/y, that for 2021 was left unchanged at 6.0%, and the assumption for 2022 was raised significantly from 3.0% to 4.3%.

- By contrast, the assumptions for 2023-25 have been cut from 3.0% to 2.6%. This implies greater government optimism about a vaccine-led cyclical upswing in 2022 but some anticipated damage to medium-term growth potential.

- Wage growth assumptions, which are even more important for tax revenue estimates, show a slightly more pessimistic -1.6% y/y for 2020 (down from -1.2%), whereas those for 2021 and 2022 have been raised by 0.3-0.4 percentage points to 3.5% and 3.2%, respectively. The assumptions for 2023-25 were left at 2.8%.

- Corporate and asset income is much more sensitive to both the economic cycle and changes in legislation, implying greater volatility of the estimates.

- The projection for 2020, which had been at a catastrophic -21.1% y/y back in May before being raised to -8.3% in September, now has been set back again to -10.3%.

- By contrast, the government has raised the projection for 2021 from 3.5% to 8.7%. The projections for 2022-24 were reduced from the 3.6% pace assumed in September to 0.9%, 2.7%, and again 2.7%, respectively; growth of corporate and asset income in 2025 is also seen at 2.7%.

- The final outcome is that the government projects overall public-sector tax revenues to decline from EUR799.3 billion in 2019 (then up 3.0% year on year) to EUR728.3 billion in 2020 (-8.9% y/y) before rebounding to EUR776.2 billion in 2021 (6.6%) and EUR816.0 billion in 2022 (5.1%). Revenue growth in 2023-25 is projected to slow down further to around 3.6% (see table below).

- The somewhat improved tax revenue projections in November are due to better growth projections for the period 2020-22 than had been foreseen only two months ago, whereas the slight further decline of the level projected for 2024 reflects more cautious assumptions about growth from 2023 onwards.

- The government clearly fears that structural changes triggered by the pandemic will damage productivity and thus growth potential in the medium term. This may improve again in the long run, but - according to the government - not in the 3-5-year horizon in which firms and consumers will have to adapt to a changing environment.

- Continental has posted a 63.8% y/y improvement in its net loss in the third quarter to EUR673 million, in comparison with a net loss of EUR1,971 million in the special item-impacted third quarter of 2019. Meanwhile, the company has appointed the head of its automotive division, Nikolai Setzer, as its new CEO to replace Elmar Degenhart. Setzer was appointed as CEO by the supervisory board because he is seen as a safe pair of hands who has improved the competitiveness of the automotive division. Meanwhile, the company's financial metrics showed an upward trajectory in the third quarter after a difficult COVID-19-impacted period earlier in the year. (IHS Markit AutoIntelligence's Tim Urquhart)

- BMW is considering options for its mobility services joint venture (JV) with Daimler, said CEO Oliver Zipse. The companies merged their mobility activities by forming a JV in 2019 which includes services such as Share Now (car-sharing solutions), Park Now (mobile parking by app), Free Now (a ride-hailing app), Reach Now (multi-modal), and Charge Now. BMW said it will continue to participate in the mobility services market and might do it by bringing in new partners or through partial sale, reports Reuters. The COVID-19 virus pandemic has battered demand for mobility services and companies are looking for opportunities to keep the market afloat. A month ago, Mobimeo acquired business-to-business (B2B) and business-to-government (B2G) division of moovel, a joint subsidiary of BMW and Daimler Mobility. Daimler and BMW have recently considered a sale of their JV Park Now, and have reportedly received an offer of more than EUR1 billion (USD1.2 billion) for their JV Free Now. (IHS Markit Automotive Mobility's Surabhi Rajpal)

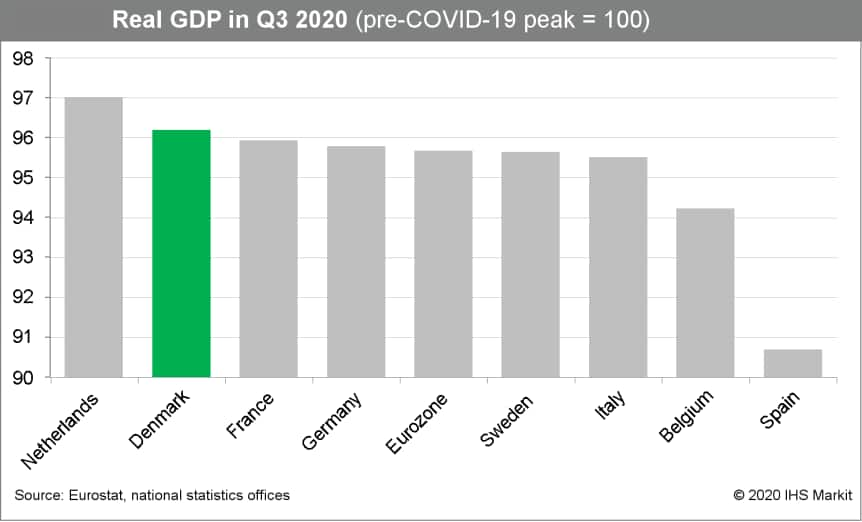

- According to a 'flash' GDP estimate for the third quarter by

Statistics Denmark, the Danish economy grew by 4.9% quarter on

quarter (q/q) and declined by 3.9% year on year (y/y) on a

calendar-adjusted basis. (IHS Markit Economist Daniel Kral)

- This is a better performance than our forecast growth of 4.0% q/q and means that the Danish economy recovered around half of the output lost in the first half of 2020, when it contracted by 8.3% q/q.

- This makes Denmark the second-best performer among major Western European economies in terms of loss of output. In the third quarter the Danish economy was 3.8% smaller compared with the pre-COVID-19 virus peak.

- There is no breakdown available accompanying the release, but Statistics Denmark notes that trade, transport, and business services made a strong comeback. However, despite the strong performance, service industries generally remain below the pre-COVID-19-virus peak.

- The large rebound in domestic demand reflects the significant relaxing of restrictions in the third quarter and successful fiscal measures to protect incomes and employment (see IHS Markit: COVID-19 Government response).

- The external sector is likely to have provided key support, too, driven by a strong goods trade. The current-account surplus in the third quarter of 2020 amounted to 8.3% of GDP or 8.0% on a four-quarter rolling basis, among the highest in Europe.

- As with GDP releases earlier in the year, Statistics Denmark highlights the exceptional uncertainty surrounding the measurement of economic activity during the pandemic. Specifically difficult to measure are companies' purchases and sales, the relationship between value added and production for affected industries, and the output in public administration.

- A revised estimate, together with a detailed breakdown of the

underlying drivers, will be released on 30 November. IHS Markit

expects it to confirm that third-quarter growth was driven by a

rebound in both domestic demand and exports.

- South Africa's unemployment rate increased to 30.8% in the

third quarter of 2020, from 29.1% for the same period a year

before. The Statistics South Africa (StatsSA) service reported that

the number of employed persons increased by 543,000 during the

third quarter; however, the number of unemployed persons shot up by

2.2 million to 6.5 million over the period. (IHS Markit Economist

Thea Fourie)

- Employment during the third quarter recovered for all sectors in the economy, compared with the previous quarter, except in the transport and utilities sectors. Sectors that showed the biggest gains in employment were finance (200,000), community and social services (137,000), and private households (116,000).

- The biggest job losses were recorded in the trade (400,000), manufacturing (300,000), community and social services (298,000), and construction sectors (259,000), compared with a year earlier.

- The third-quarter employment numbers lift the curtain on the impact of the COVID-19 pandemic on South Africa's labor market. Higher numbers of unemployment were expected during the second quarter as South Africa lived through the country's level 5 extreme lockdown measures, which coincided with business closures for almost all sectors in the economy. By the third quarter, the South African economy was almost fully opened, but the employment numbers show that not all were able to return to their previous work.

- In September, PetroNor E&P announced that it had reached an agreement with the Gambian government to resolve a dispute over the A1 and A4 offshore licenses initiated by African Petroleum, which merged with PetroNor last year. African Petroleum had claimed that Gambia improperly terminated its petroleum exploration licenses for the blocks in 2017. PetroNor will reportedly relinquish claims to the A1 block, which the authorities licensed to BP in 2019 following the close of the country's first bid round. The Norwegian-listed independent will also have the option to sign a new license for the A4 block. Arbitration proceedings at the International Centre for Settlement of Investment Disputes (ICSID) will be discontinued. The out-of-court settlement ends a contract dispute that has distracted the government and which may have also inadvertently set back the country's upstream investment prospects. In particular, the disagreement may have deterred some firms from bidding in last year's licensing round, which resulted in only the one acreage award to BP. That less-than-hoped-for outcome may be more consequential than previously expected because of the COVID-19-virus pandemic, the associated oil-price downturn, and growing concerns about the impact that the global energy transition away from fossil fuels will have on the hydrocarbon industry. (IHS Markit E&P Terms and Above-Ground Risk's Josh Holland)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China -0.9%, Japan -0.5%, Australia -0.2%, India +0.2%, and South Korea +0.7%.

- The Municipal Ecology and Environment Bureau of Beijing

released a plan for air pollution control on 11 November, setting

precise targets for the 2020-21 winter heating season. (IHS Markit

Economist Lei Yi)

- In the fourth quarter of 2020, the average PM2.5 density of Beijing should be limited within 45 μg/m3, and there should be no more than one heavily polluted day. In the first quarter of 2021, the upper limit of average PM2.5 density and number of heavily polluted days are set at 54 μg/m3 and five days, respectively.

- Contrary to setting one target for the entire heating season, this year's "two-stage" targets were explained by the government as "consolidating the achievements of three-year (2018-20) 'blue sky' campaign", as well as taking into consideration the pandemic impact in early 2020".

- In terms of implementation, the government would allow for differentiated contribution by each district to reach such a citywide pollution control target. Detailed measures will focus on five areas, including vehicle and factory emissions, dust control, replacing coal with cleaner energy, as well as building effective emergency response mechanisms.

- Unveiled pollution control target set for this winter suggests only limited disruptions to Beijing's industrial production and other economic activities, as the targets appear relatively close to the actual levels seen during 2019-20. Average PM2.5 density registered 47 μg/m3 from fourth quarter 2019 to first quarter 2020, approximating the simple average of the two-stage targets of 49.5 μg/m3 set for fourth quarter 2020 until first quarter 2021. While during the comparable period of 2018-19, average PM2.5 density recorded 52 μg/m3.

- Still, this is not suggesting that the local government is giving up its efforts in pollution control, but only being more realistic and minimizing economic costs. That said, recovery in Beijing's industrial production is set to continue, which has been gradually erasing its pandemic-induced loss and reported only 0.1% decline year on year through September.

- As per IHS Markit's Commodities at Sea, total coal imports into

China (Mainland) during October 2020 stood at 10.8mt, down 44% y/y.

(IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- There was a significant cut in imports from Indonesia (4.1mt, down 55% y/y) and Australia (2.5mt, down 67% y/y).

- There was an increase in arrivals from Russia (2.9mt, up 74% y/y) and Canada (0.7mt, up 109%).

- During October 2020, Mongolian overland coal shipments stood at 4mt, up 9% y/y, and most of the coal destined for China. There were some weather-related disruptions at the end of the month, which restricted the Mongolian overland coal movement at 4mt.

- As per China's General Administration of Customs, coal (including lignite) imports during October 2020 was announced at 13.7mt, down 47% y/y, which is mostly in-line with CAS estimates after including Mongolia overland coal transport.

- In terms of cargo grades, arrivals of thermal and metallurgical coal during October 2020 stood at 8.5mt (down 42% y/y) and 2.3mt (down 52%), respectively.

- Due to the import quota restrictions there has been a significant built-up of vessels outside the Chinese ports. As of 13 November, a total of 144 vessels laden with coal are at the Chinese anchorage area waiting to get discharged.

- Around 81 bulk carriers (8.8mt) are laden with Australian coal, 28 carriers (1.8mt) with Indonesian coal, and 22 carriers (0.8mt) with Russian cargoes.

- Out of all 144 bulk carriers, five vessels are waiting at the Chinese anchorage area for more than 150+days, and all are of Australian origin coal.

- Due to the long queue, some vessels got diverted. For example, MV NAVIOS STELLAR (169,001 dwt) had loaded coal at Newcastle (sailed 5 October 2020) initially destined for Zhoushan; however, around 19 October 2020 got diverted to Krishnapatnam, India.

- BAIC Group plans to begin mass production of Level 4 autonomous technology products by 2025, reports Gasgoo. This was announced by BAIC Group chairman Jiang Deyi at the 2020 World Intelligent Connected Vehicle Conference (WICV). The company aims to launch platforms for intelligent connected vehicle (ICV)-related core technologies, including autonomous vehicle (AV) domain controllers, ethernet safety gateways, 5G technology, and intelligent driving algorithms by 2025. In the AV segment, BAIC has partnered with Baidu to develop Level 3 autonomous driving capabilities. At the Auto China 2018 expo in Beijing, BAIC BJEV unveiled its artificial intelligence (AI) vehicle system, Darwin System, and the LITE autonomous model. Recently, BAIC has partnered with Didi Chuxing (DiDi) to custom-build vehicles with a high level of autonomy in China. The development of ICVs has progressed rapidly in China in the past few years, with the government and automakers strongly supporting the technology. Last year, BAIC launched a new brand, BEIJING, which will develop intelligent cars. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup Xpeng Motors (Xpeng)

announced its third quarter financial results on 12 November.

Xpeng's total revenues reached CNY1,990.1 million (USD279.6

million) for the third quarter of 2020, up 342.5% year on year

(y/y). (IHS Markit AutoIntelligence's Abby Chun Tu)

- Gross margin was 4.6% for the third quarter, compared with -10.1% for the third quarter of 2019.

- Revenues from vehicle sales stood at CNY1,898 million for the reporting period, up 376.0% y/y.

- Vehicle margin for the third quarter of 2020 was 3.2%, compared to -10.8% for the same period of 2019.

- The automaker's net loss widened during the third quarter to CNY1,148.8 million, compared to CNY776.3 million for the third quarter of 2019.

- Xpeng delivered 8,578 vehicles during the third quarter, up 65.7% from 3,228 vehicles in the second quarter of 2020. Of this total, deliveries of the P7 reached 6,210 units.

- Xpeng also shared an update on its sales and charging network expansion. By the end of September, Xpeng had 116 stores and 50 service centers in China. It has set up 135 supercharging stations in 50 cities.

- For the fourth quarter of 2020, Xpeng said it aims to deliver 10,000 vehicles, an increase of 210.8% y/y.

- Xpeng Motor's deliveries in the third quarter nearly tripled compared to the second quarter. The surge is mainly attributable to new orders for the P7 electric sedan which began deliveries in July this year.

- According to Xpeng, deliveries of the P7 totaled 8,639 units by the end of October. Xpeng is expected to keep ramping up production of the P7 throughout the remainder of the year, leveraging its Zhaoqing plant in Guangdong province.

- The plant, which has a capacity of 100,000 units per annum, may face capacity issues.

- Xpeng is building a new plant in the Guangzhou Economic and Technological Development Zone of Guangzhou city in an effort to expand its production capacity to compete with startup rivals, NIO and WM Motors. The new plant is expected to begin production by the end of 2022.

- The Singapore Food Agency (SFA) has awarded a German company a grant to help build a vertical farm in the Southeast Asian city state. The agency launched the grant scheme to promote innovative food production technology amid the challenges posed by the COVID-19 epidemic. The grant scheme, called "30x30 Express", was launched earlier this year to help the support the country's agri-food industry meet an aim of producing 30% of food produced locally by 2030. The vertical farm company, called &ever Singapore Pte, a fully owned subsidiary of &ever GmbH from Germany, will grow and deliver pesticide-free leafy greens to consumers in Singapore from a 15m high, multi-layer, vertical farm. The company says the farm's design makes it possible to grow crops locally, in any climate condition, anywhere in the world. The farm is expected to produce up to 500,000kg of leafy greens every years using the company's Dryponics method. Dryponics keeps the plants alive, with the roots intact, until they reach the consumer who can then harvest the plants seconds before consumption. The company says this results in higher nutritional value because green leaves usually lose most of their nutritional value after being washed in chlorine, chilled, packed, stored in warehouses, and then sent on the road for transportation. The system also uses 90% less water, 60% less fertilizer and no pesticides. The company's fully automated technology also allows for everything inside the farms to be controlled digitally- from the seeding to harvesting, CO2 levels, temperature and airflow. (IHS Markit Food and Agricultural Policy's Peter Rixon)

- The government of Singapore has announced new initiatives to promote the adoption of alternative-powertrain vehicles and discourage purchases of more polluting vehicles. According to the news release by the Singaporean government's Land Transport Authority (LTA), the current Vehicular Emissions Scheme (VES) for new cars, taxis and imported used cars, will be enhanced with increased rebates and higher surcharges. The enhanced scheme will take effect on 1 January 2021, when the current VES expires at the end of this year, and will last until 31 December 2022. The rebates for vehicles in Bands A1 and A2 will be increased by SGD5,000 for cars, and SGD7,500 for taxis from 1 January 2021. This means a car in Band A1 will enjoy a SGD25,000 rebate instead of SGD20,000, and a car in Band A2 will enjoy a SGD15,000 rebate instead of SGD10,000. With the enhanced VES, coupled with the Electric Vehicle Early Adoption Incentive (EEAI), effective from 1 January 2021, buyers will be able to enjoy combined cost savings of up to SGD45,000 when they purchase a new electric vehicle (EV), and up to SGD57,500 for a new all-electric taxi. Meanwhile, increased surcharges will be effective from 1 July 2021 and will be applicable until 31 December 2022. The surcharges for vehicles in Bands C1 and C2 will increase by SGD5,000 for cars, and SGD7,500 for taxis. A car in Band C1 will incur a surcharge of SGD15,000 instead of SGD10,000, and a car in Band C2 will incur a surcharge of SGD25,000 instead of SGD20,000. Vehicles in Band B do not come with any rebates or surcharges under the scheme. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai has signed a business co-operation agreement with Singapore's utility company, SP Group, to supply its electric vehicles (EVs), establish charging infrastructure in the country and research recycling used batteries, reports Korea JoongAng Daily. The two will also work together on the Battery-as-a-Service (BaaS) business to prepare for the rising demand. Baas is a breakthrough business model mainly for EV battery rental and replacement services. "Hyundai Motor Group plans to utilize SP Group's database on its charging infrastructure to introduce a lease-type of battery for EVs, ways to recycle used batteries and extract useful components from dead batteries such as lithium, nickel and cobalt to make additional economic value," said Hyundai in a statement. Hyundai and SP Group will also work together to lower the entry barrier for EVs for local residents, such as making the vehicle cheaper or offering new types of EV mobility services as eco-friendly vehicles do not have a strong presence in the country yet. (IHS Markit AutoIntelligence's Jamal Amir)

- The Reserve Bank of New Zealand's (RBNZ) Monetary Policy

Committee (MPC) decided to hold the OCR at 0.25% during its 11

November meeting. (IHS Markit Economists Bree Neff and Andrew

Vogel)

- This was in line with the guidance initiated in March, which stated that it would leave the OCR unchanged. It also left the large-scale asset purchase (LSAP) program unchanged from the level decided in the August meeting. However, the MPC agreed to provide additional monetary stimulus through alternative channels, including a Funding for Lending Programme (FLP), which will commence in December.

- The FLP is a lending facility designed to reduce banks' funding costs and lower interest rates, with these declines anticipated to be passed to business and lower-income household borrowing costs. The FLP is likely to total up to NZD28 billion (USD19.28 billion) in three-year loans at a floating interest rate linked to the OCR, and will be available to banks for the next 18 months (with the option of a six-month extension). Eligible lenders can access the FLP in amounts up to 4% of their total loans and advances to New Zealand households, private non-financial businesses, and non-profits serving households, with a conditional additional allocation of NZD0.50 for every NZD1.00 increase in the stock of loans, up to 2% of eligible loans (for a maximum of 6%).

- Progress has also been made on the RBNZ's operational ability to deploy a negative OCR, which it believes could be mutually supported by the new FLP in bolstering economic activity. The RBNZ's governor Adrian Orr said it was "too early to tell" if the OCR will need to be pushed into negative territory, but the RBNZ is leaving all options open and will revisit the decision during its next MPC meeting in February 2021.

- The unemployment rate came in at 5.3% for the September quarter according to Statistics New Zealand (SNZ), up significantly from the rate of 4.0% in the previous quarter - marking the largest quarterly rise since the series began in 1986. This is likely due to unemployed individuals starting to actively seek work after being unable to in the June quarter due to the lockdown. On an annual basis, every age group experienced significant increases in unemployment, with those aged 15-24 years the most affected and those aged over 65 the least affected.

- Additionally, employment registered its largest fall since the March 2009 quarter (the peak of the global financial crisis) at -0.8% quarter on quarter (q/q). Annual falls in filled jobs in industries such as accommodation and food services, wholesale trade, and professional/scientific/technical/administrative support services were balanced out by rises in industries like construction, healthcare and social assistance, and education and training.

- IHS Markit does not expect that the OCR will need to go negative, with a prevailing rate between 0% and 0.25% being most likely. That said, a slip into negative territory is possible if conditions deteriorate well beyond our current expectations, because the RBNZ has adopted a "least regrets" strategy - that is, preferring to do too much too soon, rather than too little too late.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-november-2020.html&text=Daily+Global+Market+Summary+-+13+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 13 November 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+13+November+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}