Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 12, 2020

Daily Global Market Summary - 12 November 2020

All major equity markets closed lower today except for Japanese markets ending the session modestly higher, as the rapidly increasing number of COVID-19 cases and additional restrictions across the globe continues to cast a shadow on the pace of recovery from the initial wave. US and benchmark European government bonds closed higher on the day, while iTraxx and CDX indices closed wider across IG and high yield. Oil was slightly lower on the day and gold/silver higher.

Americas

- US equity markets closed lower; Russell 2000 -1.6%, DJIA -1.1%, S&P 500 -1.0%, and Nasdaq -0.7%. The S&P 500 has retraced most of the gains from Monday's vaccine announcement and is now only +0.8% versus last Friday's close.

- 10yr US govt bonds closed -8bps/0.88% yield and 30yr bonds -9bps/1.64% yield.

- CDX-NAIG closed +2bps/55bps and CDX-NAHY +19bps/352bps.

- DXY US dollar index closed -0.1%/92.96.

- Gold closed +0.2%/$1,873 per ounce and silver +0.2%/$24.31 per ounce.

- Crude oil closed -0.8%/$41.12 per barrel.

- Since September, the global fundamental picture for the winter has become progressively bleaker for oil, making the next planned supply increase all but impossible for the market to accommodate. A new surge in COVID-19 cases, and subsequent economic restrictions, has seen demand forecasts slashed, eradicating hopes of a sustained sequential recovery in crude demand, especially in the Atlantic Basin. Add to that the swift rebound of Libyan oil production and a once promising market tightening trend looks increasingly shaky. We currently expect global liquids demand to plateau at around 93-94 MMb/d through 1Q2021, roughly flat vs. September 2020 levels. The locus of much of the downward adjustments in recent months has been Europe, where raging outbreaks and renewed lockdowns across major demand markets have pushed us to revise regional demand expectations downwards. From a balances standpoint, given demand revisions and Libyan volumes, the oil market in 1Q2021 appears to barely be able to withstand current OPEC+ production levels, let alone its planned 2.0 MMb/d increase. As market conditions have worsened, the OPEC+ debate has shifted from whether or not the group will be able to go forth with its planned 2.0 MMb/d increase to how it will deal with renewed demand weakness through the winter. As things stand, we believe the most likely adjustment OPEC+ can make is to attempt to offset Libya's 1.0 MMb/d production increase, allocating the corresponding adjustments across the group. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Justin Jacobs, Edward Moe, and Sean Karst)

- The coronavirus pandemic has left business travel and tourism deeply depressed and ravaged the finances of hotels and resorts around the world. The effects have ricocheted into financial markets and hit the nearly $4 billion of hotel mortgages in New York that are bundled into commercial mortgage-backed securities particularly hard. Vijay Dandapani, chief executive of the Hotel Association of New York City, said that if half the city's 640 hotels survive it will be a "great" outcome. Occupancy rates in September remained 20% lower than for the same month in 2019, despite recovering from their worst point in April where occupancy was down more than 60 per cent year on year, according to data from STR. (FT)

- Seasonally adjusted (SA) US initial claims for unemployment

insurance fell by 48,000 to 709,000 in the week ended 7 November.

Despite trending down, initial claims remain at historically high

levels—the high during the Great Recession was 665,000. The not

seasonally adjusted (NSA) tally of initial claims fell by 20,799 to

723,105. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 436,000 to 6,786,000 in the week ended 31 October. Prior to seasonal adjustment, continuing claims fell by 402,298 to 6,486,000. The insured unemployment rate in the week ended 31 October was down 0.3 percentage point to 4.6%.

- There were 298,154 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 7 November. In the week ended 24 October, continuing claims for PUA rose by 100,517 to 9,433,127.

- Pandemic Emergency Unemployment Compensation (PEUC) claims have been steadily rising as claimants are exhausting their regular program benefits. In the week ended 24 October, there were 4,143,389 such claims for PEUC benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 24 October, the unadjusted total fell by 374,179 to 21,157,111.

- The Consumer Price Index (CPI) was unchanged (0.0%) in October

following a 0.2% increase in September and increases averaging 0.5%

from June through August. During October, the CPI for energy edged

up 0.1% while the food index rose 0.2%. (IHS Markit Economists Ken

Matheny and Juan Turcios)

- The core CPI, which excludes the direct effects of movements in food and energy prices, was unchanged (0.0%). Both overall and core CPI inflation were below expectations in October.

- The core CPI has partially recovered to its rising pre-pandemic trend following declines last spring when some components recorded sharp declines amid plummeting demand due to COVID-19.

- The core CPI fell 0.6% (not annualized) during the period from March to May, then rose 1.4% over the period from June to September.

- In October, the core CPI was unchanged on the month (0.0%). The 12-month change in the core CPI has recovered only a few tenths of a percentage point of the sharp decline it experienced last spring, when it fell from 2.4% (in February) to 1.2% (in May and June).

- As of October, the 12-month core CPI inflation rate was 1.6%, down 0.1 percentage point from September.

- Rent inflation has eased in recent months as some landlords have agreed or been forced to accept lower rents. Rent of primary residence and owners' equivalent rent each rose 0.2% in October. Their 12-month rates of change have slowed substantially from 3.8% and 3.3% in February to 2.7% and 2.5% as of October, respectively.

- Prices for used cars and trucks ticked down 0.1% in October after surging a cumulative 15.1% from June to September. As of October, the CPI for used cars and trucks prices was 13.7% higher than in February 2020. The CPI for new cars and trucks rose 0.4% in October and is 1.4% above February's level.

- The CPI for apparel declined 1.6% over September and October, leaving it 7.2% below its February level.

- Based upon today's (12 November) report, we lowered our estimate of the 12-month change in the core personal consumption expenditure (PCE) price index in October by 0.1 percentage point to 1.4%.

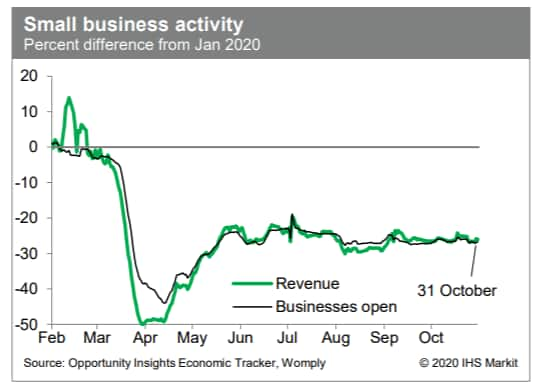

- Both revenues at small businesses and the count of small

businesses open have been roughly 25% below January averages for

several months, according to the Opportunity Insights Economic

Tracker. While some measures of consumer spending have nearly fully

recovered from lows last spring, small businesses have yet to fully

benefit from that recovery. (IHS Markit Economists Ben Herzon and

Joel Prakken)

- USDA this week raised its forecast of China's corn imports for the 2020/21 marketing year, increasing the forecast to 13 million tons from a level of 7 million tons they forecast for several monthly World Agricultural Supply and Demand Estimates (WASDE) reports. The significance of the increase in the WASDE update relates to China tariff rate quotas (TRQs) for various grains, including 7.2 million tons for corn. But through the week ended November 5, US corn export commitments to China (outstanding sales plus accumulated exports) totaled 10.763 million tons, well above the TRQ level. There is some difference on the TRQ data versus the corn forecasts from USDA in that those are on a marketing year basis while the TRQs are on a calendar-year basis. Still, the US is not the only seller of corn to China and many in the trade are well above the updated 13-million-tonne figure, including IHS Markit which forecasts China's corn imports at 20 million tons. Chinese import data through early November suggest corn imports "will far exceed the tariff-rate quota (TRQ) level of 7.2 million tons in calendar year 2020," FAS said in its Grains: World Markets and Trade report. "There have been no public statements that would indicate that additional quota has been allocated by the National Development Reform Commission, the authority governing the TRQs." For coarse grains (corn, barley and sorghum) overall, FAS said higher Chinese imports have been supported by "strong recovery in the swine sector, which has been driving feed demand higher." That demand has in turn pushed imports higher, especially for corn, it said. Lower coarse grain imports by the European Union (EU), Iran and Mexico have been offset by the higher trade to China, it detailed. China has been rebuilding its hog herd after it was decimated by African swine fever (ASF). Meanwhile, USDA expects China wheat imports of 8.0 million tons for 2020/21, which would be the highest level in 25 years. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Cummins and Navistar have announced a new project to collaborate on a Class 8 hydrogen fuel-cell powered truck. The project is being funded through a US Department of Energy (DOE) Office of Energy Efficiency and Renewable Energy (EERE) award; the DOE project aims to support development of affordable hydrogen production, storage, distribution and use. The DOE award contributes more than USD7 million to the project. Amy Davis, vice-president of New Power at Cummins said in the statement, "This vehicle will feature our next generation fuel cell configuration and provides a springboard for us to advance our hydrogen technology for line haul trucks. We are also excited to build on our strong relationship with Navistar, which dates back 80 years, and work together to lower costs and make hydrogen-powered vehicles more accessible for fleets to adopt." Cummins says the powertrain will be integrated into an International RH Series. It will use two HyPM HD90 power modules. These modules have HD45 fuel cell stacks connected in a series. Cummins says that instead of a single large fuel cell operating at inefficient partial load, using two power modules means they can be turned on and off to provide adequate power at efficient full load. The new collaboration uses government support to further research and development. The project seems to be aimed at furthering Cummins development of the propulsion system, as well as enabling Navistar to further research into integration and system development. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Hyundai has provided further details of its plans to increase its range of electrified models in the United States over the next year. Hyundai's plan is for its US product range to include seven electrified sport utility vehicles and three cars, including some models already available, in 2022. In terms of hybrids, Hyundai's US models will be the Elantra, Sonata, Tucson, and Santa Fe. The Tucson and Santa Fe will also both be available with plug-in hybrid powertrain options. In terms of battery electric vehicles, Hyundai's US models will be the existing Kona crossover utility vehicle (CUV), and the automaker plans to add the Ioniq 5 utility vehicle and the Ioniq 6 car. The planned 10 models are rounded off by the Nexo fuel-cell electric utility vehicle, which will continue to be offered. In the company's statement, Hyundai Motor North America's vice-president of product planning and mobility strategy, Olabisi Boyle, said, "We're not only developing the vehicles our customers need now, we're also envisioning smart mobility solutions for pressing environmental and transportation needs of the future. Ultimately, this full spectrum of new technologies will promote a planet-friendly, zero-emission ecosystem as part of our 'Progress for Humanity' global vision." The Hyundai statement released on 11 November followed a series of announcements earlier in the week highlighting the company's aggressive new-product cadence for the next 18 months. The latest statement confirmed the automaker's powertrain plans for the Santa Fe, involving a hybrid electric vehicle (EV) and a plug-in hybrid EV. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed lower across the region; France -1.5%, Germany -1.2%, Spain -0.9%, Italy -0.8%, and UK -0.7%.

- 10yr European bonds closed higher; UK -6bps, Italy -5bps, and France/Spain/Germany -3bps.

- iTraxx-Europe closed +2bps/52bps and iTraxx-Xover +6bps/299bps.

- Brent crude closed -0.6%/$43.53 per barrel.

- UK GDP in volume terms grew by a record 15.5% quarter on

quarter (q/q) in the third quarter of 2020. The rebound reflected

the reopening of the economy after the national lockdown to contain

the coronavirus disease 2019 (COVID-19) virus in the second

quarter. (IHS Markit Economist Raj Badiani)

- Nevertheless, UK GDP was still 9.7% below where it was at the end of 2019, the pre-COVID-19 level.

- The UK endured sharp GDP losses during the first and second quarters, estimated at 2.5% q/q and 19.8% q/q, respectively, due to the emergency quarantine and social-distancing measures implemented to tackle the COVID-19 virus outbreak. Household spending plunged as non-essential physical shops and consumer-facing services were ordered to close, while factory and construction output also retreated dramatically.

- In annual terms, the economy contracted by 9.6% year on year (y/y) during the third quarter, and by 11.0% y/y in the first three quarters of 2020. This implies that the UK economy has been one of the most affected economies in the Organisation for Economic Co-operation and Development (OECD; see chart below). A key reason for this is that the UK entered into lockdown later than most other advanced economies, and for longer.

- In our October forecast, we had estimated that real GDP grew by 14.8% q/q in the third quarter while contracting by 10.2% y/y.

- In monthly terms, the economy grew for the fifth successive month in September following a record fall of 19.5% month on month (m/m) in April.

- The ONS reports that GDP grew by 1.1% m/m in September, preceded by m/m gains of 2.2% m/m in August, 6.3% m/m in July, and 9.1% m/m in June. The dominant services sector lost further momentum in September, with the monthly rate of increase here slowing to 1.0% from 2.4% in August.

- A rebound in consumer spending was the main engine of growth during the third quarter, accounting for 76.5% of the rise in the expenditure measure of GDP. The increase resulted from higher spending on restaurants and hotels and transport. Other improvements occurred in the sales of clothing and footwear and furniture and household equipment.

- The ONS estimates that spending on services rose by 22.7% q/q during the third quarter, which lagged behind a gain of 38.6% q/q in household spending on durable goods.

- Our current forecast in the October update assumes that the economy will contract by 11.0% in 2020. However, it appears that the UK economy is on course for a sharper fall, with the fresh national lockdown measures for November triggering a renewed GDP dip in the final quarter. Therefore, the economy could retreat by 11.5% to 12.0% in 2020.

- Final October data based on national methodology from Germany's

Federal Statistical Office (FSO) have confirmed the flash data

released on 29 October, showing a slight month-on-month (m/m)

increase by 0.1% and a steady annual inflation rate at -0.2%. (IHS

Markit Economist Timo Klein)

- The European Union (EU)-harmonized CPI measure was a little softer at flat m/m and -0.5% year on year (y/y), the latter slipping marginally from September's -0.4%.

- Germany's harmonized inflation thus remains below the eurozone average (-0.3%), owing to July's VAT cut effect. Abstracting from the latter, German harmonized inflation is in fact around 0.5% higher than that of the eurozone average at present.

- At 0.5% y/y, CPI ex-food and energy as a measure of core inflation has remained unchanged from September. This is almost a percentage point below the annual pace measured between mid-2019 and mid-2020, two-thirds of which reflects the VAT cut rather than the recession triggered by the pandemic.

- October's component breakdown reveals that energy prices increased slightly (0.2% m/m, annual rate up from September's -7.1% to -6.8%). The largest dampening effects on the annual rate - compared to y/y rates in September - came from healthcare, followed by "miscellaneous goods and services" and alcohol/tobacco. The chief boosting forces were food/beverages, recreation and culture, and clothing and footwear.

- The split between goods and services show that deflation for the former is letting up a little (y/y rate up from -1.7% in September to -1.5% in October) whereas service sector inflation has once again remained steady at 1.0% (see Chart 2 below for details about the relative influence of key CPI categories).

- Average underlying inflation, which had been at around 1.2% during 2016-17 before firming to the 1.5% area during the last two years, will remain around 0.5% during November-December but rebound to 1.0% or slightly higher in early 2021.

- German headline inflation will remain modestly negative during the remainder of 2020 but increase to a range of 0.5-1.0% during January-June 2021, due to the unwinding of the VAT effect as the original VAT rates are restored. A further increase to the 1.5-2.0% region is in the pipeline for the second half of 2021 due to base effects from the lower VAT rates valid during July-December 2020.

- K+S (Kassel, Germany) has reported an adjusted group net loss

of €1.97 billion ($2.33 billion) for the third quarter, plunging

year on year (YOY) from a loss of €41.8 million, due mainly to a

€2.0-billion write-down of the company's potash assets after it

lowered assumptions for long-term global potash prices. (IHS Markit

Chemical Advisory)

- The company says its adjusted earnings were "strongly negative" due to the extraordinary non-cash impairment of its potash assets and a higher cost of capital rate. EBITDA, however, rose 19% YOY to €96.0 million for the third quarter despite a 9% decline in sales to €821.7 million.

- K+S says it expects a "slight recovery" in potassium chloride (KCl) prices for the rest of this year compared with the third quarter, with prices for fertilizer specialties to remain "largely stable." It has reaffirmed its full-year guidance for EBITDA of about €480 million, down from €640 million in 2019. Adjusted net earnings will fall to a "significantly negative figure" as a result of the €2.0-billion impairment, it says.

- The $3.2-billion sale of the K+S Americas salt business to Stone Canyon Industries Holdings and affiliates, announced in October, is expected to complete in the summer of 2021, according to the company. "With the proceeds from the sale of the American salt business and the consistent implementation of our package of measures, we will significantly reduce the company's debt and secure financing for the coming years," says K+S chairman Burkhard Lohr. "With the impairment in the third quarter, we have now also adjusted the balance sheet. All this increases our flexibility for developing the company further."

- The company's Americas operating unit saw increased earnings contributions in its industry and consumers customer segments, which together with strict cost discipline almost completely offset the effects of lower early de-icing salt fills, it says. EBITDA of €24.4 million for the third quarter was down €1.0 million YOY on sales almost 9% lower at €257.7 million. A higher KCl price level could not compensate for lower volumes and an unfavorable exchange rate, it says.

- The Europe operating unit saw operating earnings rise 26% YOY to €84.8 million despite a decline of more than 9% in revenue to €562.6 million, mainly attributable to the weaker KCl price as well as currency effects.

- The ongoing restructuring of administrative functions within K+S in Germany is expected to be completed by the end of this year and reduce annualized costs by €60.0-140.0 million from 2021, it says.

- SEAT has announced that it is testing using rice husks as a substitute for plastics. According to a statement, this material is initially being used within the liner of the boot lid, the boot floor and the cabin headliner. It added that the current test program is analyzing how great a proportion of husk can substitute existing ingredients to achieve the same technical and quality requirements as the original. SEAT says that the rice husks will replace polyurethanes and polypropylenes which are typically used in these components. The rice husks are a byproduct of grain harvesting and are typically incinerated by the processor. As well as using up an unwanted byproduct from another industry, the rice husks are said to be lighter than the materials than they replace. At present, the tests are seeing whether 20% of the plastic in the boot floor can be substituted. The company will now see whether it can meet the rigorous tests it has in place for this component, including withstanding up to 100kg concentrated on one small area to check rigidity and strength, as well as thermal tests carried out in a climatic chamber to confirm its resistance to heat, cold and humidity. If the tests are successful, SEAT suggests that it could use up to 12,000 ton of rice husk per year, which would also cut the amount of global husk waste by 8%. SEAT is not alone in looking at alternative materials and seeking new ways of using waste, with the Polestar Precept concept highlighting a range of areas where materials made from flax and recycled bottles can be used. (IHS Markit AutoIntelligence's Ian Fletcher)

- Eni has set up a new joint venture company named Vårgrønn with Norwegian energy investor HitecVision, to pursue offshore wind opportunities in Norway. The new joint venture is part of Eni's overall strategy for decarbonization. The company has earlier embarked on a major overhaul of its business as part of its energy transition plans, where renewable energy plays a key role. According to Eni, Vårgrønn hopes to play a major role in the development, construction, operation, and financing of renewable energy projects in Norway, and has a long-term goal of reaching an estimated installed capacity of 1 GW by 2030. Eni holds a 69.6% stake in Vårgrønn, while HitecVision holds the remaining 30.4%. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- According to all measures, on an annual basis Swedish headline

consumer price inflation remained largely flat in October. The

consumer price index (CPI), which is the national definition, came

in at 0.3% year on year (y/y), compared to 0.4% in September.

According to the EU-harmonized measure (HICP), inflation was 0.4%

y/y, down from 0.6% in September. (IHS Markit Economist Daniel

Kral)

- CPI at fixed interest rates (CPIF), which is the most closely watched indicator by the central bank, remained flat at 0.3% y/y in October, which is 0.15 percentage point (pp) below the Riksbank's September forecast. CPIF excluding energy came in at 1.1% y/y, up from 0.9% in September but still 0.25 pp below the Riksbank's September forecast.

- On an annual basis, electricity (-0.5 pp), fuel (-0.3 pp), and package holidays (-0.2 pp) were the largest negative contributions to headline CPIF inflation. Conversely, food and alcoholic beverages (+0.2 pp), rent (+0.2 pp) and housing (+0.2 pp) were the main positive contributors.

- CPIF was flat month on month (m/m). A small drop in the prices of electricity was offset mainly by higher prices for recreational and cultural services.

- Inflation is likely to remain significantly below the Riksbank's target in the coming months. The broader deflationary environment is reinforced by a strong krona, which is currently trading at more than 10% versus the US dollar and 5% versus the euro compared to the end of February.

- As per IHS Markit's Commodities at Sea, Russian seaborne coal

shipments during October 2020 stood at 15.5mt (up 8% y/y).

Disruption in thermal coal supplies from Colombia as well as

increased demand from Japan, China, Netherlands, Germany, Turkey,

and India increased Russian coal shipments. (IHS Markit Maritime

& Trade's Rahul Kapoor and Pranay Shukla)

- In terms of Russian regions, exports from the Far East, Baltic Sea, Arctic, and the Black Sea ports during the reported period calculated at 8.3mt (up 10% y/y), 3.6mt (down 18% y/y), 1.8mt (up 11% y/y) and 1.8mt (up 141% y/y), respectively.

- For the reported month, shipments increased from Vostochny (3.1mt, up 28% y/y), Vanino (2.6mt, up 23%), Ust-Luga (2.8mt, up 11%), and Murmansk (1.7mt, up 18%). Export coal from Zhelezny Rog Port (Taman) continued to remain strong at 1.1mt versus negligible shipments a year ago.

- During Oct 20, Russian coal shipments declined majorly to South Korea (2mt, down 31% y/y) and Spain (0.2mt, down 57%). While, shipments increased to Japan (2.4mt, up 27% y/y), China (2.1mt, up 26%), Netherlands (1.4mt, up 12%), Turkey (1.1mt, up 37%), Germany (0.8mt, up 73%), and India (0.6mt, up 154%).

- During the first 10-months of 2020, Russian seaborne coal shipments totaled 145.5mt (up 4% y/y). Russian shipments from the Far East, Baltic Sea, Arctic, and the Black Sea ports stood at 81.3mt (up 14% y/y), 34.7mt (down 23%), 14.2mt (down 12%), and 15.4mt (up 120%).

- Recent banking-sector data released by authorities in Czechia,

Poland, and Slovakia reveal significant credit growth deceleration

in the third quarter of 2020. The ongoing economic uncertainty and

deteriorating creditworthiness of borrowers likely led to banks

further tightening their credit conditions, while new restrictions

following the recent surge in the number of COVID-19 cases had a

negative impact on credit demand. The results are consistent with

the latest bank lending surveys, where banks indicated rising risks

to economic outlook because of the effects of the COVID-19 virus.

On the other hand, deposit mobilization remained robust, with

deposit growth rates higher than those of credit in all three

countries, leading to improved loan-to-deposit ratios in Czechia

and Slovakia. (IHS Markit Banking Risk's Greta Butaviciute)

- Czechia lending eased to 4.1% year on year (y/y) in the third quarter, compared with a 6.1% increase in June. This slowdown is partly attributed to the fall in credit to the corporate sector, which registered just 0.7% y/y growth in September, versus 5.3% growth in June. Corporate demand for credit likely decreased because of the fall in fixed investment. On the other hand, credit to households rebounded to 6.4% y/y growth, likely supported by renewed demand for mortgages as a result of falling interest rates.

- Out of the three countries mentioned here, Poland experienced the most dramatic decrease in lending. Credit growth slowed to just 1.1% y/y in the third quarter, down from 3.2% in the previous quarter. Similar to Czechia, lending was dragged down by insufficient demand in the corporate sector; lending to the latter contracted by 3.3% y/y, while credit to households also eased, modestly rising by 2.8% y/y.

- Credit growth slowdown was less severe in Slovakia than in the other two countries. Lending eased to 4.8% y/y in the third quarter, compared with 5.4% rate in June. Corporate credit went up by 10 percentage points to 3.9% y/y, while household lending slowed but remained relatively high at 7%.

- IHS Markit forecasts deposit growth rates to outpace those of credit in the short term in Czechia, Poland, and Slovakia, leading to improved loan-to-deposit ratios across the region, stabilizing the structural liquidity risk profile of banks in the region.

- The risk of asset-quality deterioration is high. So far, increases in non-performing loans (NPLs) have been quite modest because of moratoriums of various lengths. However, banks face risk of severe losses after the moratoriums expire. We expect to see spikes in NPLs and a wave of potential defaults starting in early 2021 and possibly throughout the next year.

- The Polish government will pledge PLN5 billion (USD1.3 billion) to help support the growth of the electric vehicle (EV) manufacturing industry in the country, according to a Reuters report. Local supplier PZL Sedziszow, which traditionally manufactures internal combustion engine (ICE) vehicle components such as air filters, has begun manufacturing battery packs in preparation to become one of the country's main suppliers. The government's pledge to help the local industry move to electrification comes after state-owned ElectroMobility Poland unveiled two EV prototypes earlier this year in the form of the Izera sport utility vehicle (SUV) and hatchback. These models are aimed at the low-cost vehicle market and are due to go into production in 2023. This is a bold and forward-thinking attempt by the Polish government to make the country more attractive as a manufacturing destination for OEMs and suppliers alike for EVs and EV components. (IHS Markit AutoIntelligence's Tim Urquhart)

- Zambia faces a crucial vote that could see it become the first African country to default on sovereign debt payments since the outbreak of the coronavirus was declared a global pandemic almost eight months ago. Holders of its $3 billion in Eurobonds attending meetings at a law company in London on Friday are expected to reject a government request for a payment holiday after the government last month missed an interest payment on $1 billion of bonds due 2024. A 30-day grace period expires on Friday, and should the vote go against Zambia it would put the country in default, giving investors the right to demand immediate repayment of the principal. (Bloomberg)

Asia-Pacific

- Most APAC equity markets closed lower except for Japan +0.7%; India/Australia -0.5%, South Korea -0.4%, Hong Kong -0.2%, and Mainland China -0.1%.

- China's new aggregate financing, the widest measure of net new

financing to the real economy, increased CNY1.42 trillion in

October 2020, up CNY552 billion from the amount a year ago,

according to the release of the People's Bank of China (PBOC). The

stock total social financing (TSF) increased 13.7% year on year

(y/y), further accelerating from September rate. (IHS Markit

Economist Yating Xu)

- Credit expansion slowed to 12.9% y/y from 13.0% y/y a month ago. Short of two working days in October 2020 compared with that of 2019 could be a possible reason for the headline deceleration.

- The increase of new household borrowing contracted from an average level of CNY200 billion during June to September to CNY12.1 billion this month, probably reflecting the tightening risk regulation and housing market control.

- New corporate's medium to long term loans increased CNY189.7 billion from a year ago, declining month on month, but remaining the highest level for the same period in history.

- The increase in TSF was largely driven by local government bonds and corporate bonds. Net financing of corporate bonds (issued minus matured) increased CNY49 billion in October and cumulatively CNY4.35 trillion in the first 10 months, compared with CNY3.24 trillion in the full-year 2019.

- Local government bond issuance declined significantly month on month (m/m) in October as the issuance has largely finished in September, but it still went up by CNY306 billion from a year ago. However, off-balance sheet financing including entrusted loans and trust loans kept declining, and undiscounted bankers' acceptance fell following two consecutive months of increase.

- Broad money supply (M2) growth fell by 0.4 percentage point to 10.9% y/y in October with broad deceleration in deposits of household, corporate and non-banking financial institutions. M1 growth continued to rise, further narrowing the gap between M2 and M1.

- TSF increased by CNY29.9 trillion through October, up CNY9.5 trillion from a year ago. New bank loans reaching CNY17.35 trillion compared with an annual target of CNY20 trillion.

- October TSF suggested sustained demand recovery in the economy. Stable increase in corporate' medium- and long-term loans reflected improvement in industrial profitability and positive outlook for future investment.

- New vehicle sales on a wholesale basis increased by 12.5% year

on year (y/y) to 2.57 million units in China during last month,

while production rose by 11.0% y/y to 2.55 million units. (IHS

Markit AutoIntelligence's Abby Chun Tu)

- Thanks to a rebound in new vehicle demand that began in April, vehicle sales and production volumes in the year to date (YTD) are narrowing the gap each month with the equivalent period of last year.

- In the YTD for October, China's new vehicle sales contracted 4.7% y/y to 19.70 million units, while production volumes were down by 4.6% y/y to 19.52 million units.

- Of the total new vehicle sales and production in October, passenger vehicle (PV) sales increased 9.3% y/y to 2.11 million units, while PV production rose by 7.3% y/y to 2.08 million units. The CAAM definition of PVs includes sedans, sport utility vehicles (SUVs), multi-purpose vehicles (MPVs), and minivans.

- In the YTD, sales of PVs were down 9.9% y/y to 15.50 million units, while production of PVs decreased 10.1% y/y to 15.32 million units.

- Commercial vehicle sales (including medium and heavy vehicles) remained strong in October. Last month, sales volumes of commercial vehicles surged by 30.1% y/y to 464,000 units, while commercial vehicle production increased 30.9% y/y to 468,000 units.

- In the YTD, sales of commercial vehicles have risen by 20.9% y/y to 4.20 million units, while production of commercial vehicles has increased 22.5% y/y to 4.20 million units.

- Demand for new energy vehicles (NEVs) remained buoyant during October. Sales of NEVs, which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), increased 104.5% y/y to 160,000 units in October.

- Last month, NEV production rose by 69.7% y/y to 167,000 units.

- Sales of BEVs grew by 115.4% y/y to 133,000 units in October, while production of BEVs increased 72.4% y/y to 141,000 units.

- Sales of PHEVs were 27,000 units, up 63.7% y/y, in October, while production of PHEVs increased 56.7% y/y to 26,000 units.

- In the YTD, sales of NEVs were reported at 901,000 units, down 7.1% y/y, while NEV production volumes were posted at 914,000 units, down 9.2 y/y.

- Sales of Chinese brands' PVs totalled 869,000 units in October, up by 12.4% y/y, and their market share rose to 41.2%, up 1.1 percentage point compared with last October. From January to October, the combined sales volumes of Chinese brands in the PV market contracted 14.1% y/y to 5.75 million units.

- For the full year 2020, IHS Markit currently expects light-vehicle sales in mainland China to decline 6.8% to 23.1 million units, followed by a rebound to 5.9% growth in 2021.

- SAIC Motor and Great Wall Motor have teamed up to push forward development of fuel cell technology. SAIC subsidiary Shanghai Hydrogen Propulsion Technology (SHPT) and Great Wall subsidiary Weishi Energy Technology (Weishi) signed an agreement on 11 November to collaborate on the research and development (R&D) of core parts related to fuel cell technologies. The joint initiative will focus on R&D activities regarding hydrogen storage systems, fuel cells and the scale production of fuel cell vehicles (FCVs). Great Wall and SAIC have both recently announced plans to tap into China's FCV sector. The collaboration between the two will certainly lead to faster model launches to promote FCVs in the commercial vehicle sector. SAIC aims to take a market share of 10% in the FCV market by 2025. To achieve this goal, the automaker said it will roll out at least 10 FCVs by 2025. SAIC's first fuel-cell multi-purpose vehicle (MPV), the Maxus Euniq 7, started production in 2020. Great Wall also has ambitious plans to bring a fuel-cell passenger vehicle to market. Great Wall's first FCV, a sport utility vehicle, is slated for market debut in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China expects vehicles with partially autonomous functions to account for 50% of new vehicle sales by 2025, reports the Nikkei Asian Review. Under a new plan, new vehicles with Level 2 or Level 3 automation will represent 70% of new vehicle sales by 2030. Increasing automation capabilities may be ranked on a scale from Level 0 to 5. At Level 2, the driver is assisted with steering, acceleration, and braking features, while Level 3 vehicles drive themselves under certain conditions, such as on highways. The plan also considers having Level 4 autonomous vehicles (AVs), which require no human input except in emergencies, available in the market by 2025 and to account for 20% of new vehicle sales in 2030. In addition, the report states that China plans to promote high-level AV technology nationwide by 2035 and deploy these vehicles in smart cities. China is pushing to commercialize autonomous smart vehicles, which is a key part of the country's 'Made in China 2025' plan. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's private machinery orders (excluding volatiles) - a

leading indicator for capital expenditure (capex) - fell by 4.4%

month on month (m/m) in September following two consecutive months

of increases. (IHS Markit Economist Harumi Taguchi)

- Private machinery orders (excluding volatiles) fell by 0.1% in the third quarter of 2020 for the fifth consecutive quarter of decline. That said, seasonally adjusted figures by industry groupings rebounded from decreases in the previous month. Private machinery orders from manufacturing and non-manufacturing (excluding volatiles) rose by 2.0% m/m and 3.2% m/m, respectively.

- The improvement in private machinery orders from manufacturing largely reflected rebounds in orders from chemical and chemical products and shipbuilding, as well as continued increases in orders from general-purpose and production machinery and electric machinery.

- The improvement in orders from non-manufacturing (excluding volatiles) was thanks largely to rebounds in orders from telecommunication, finance and insurance, and wholesale and retail trade.

- The September figures were weaker than IHS Markit had expected, but orders from some industries have bottomed out in line with improved industrial production and business activities. However, the recovery is likely to remain weak and patchy because of slack demand and sluggish corporate profits.

- The industry expects the decline in private machinery orders to continue in the fourth quarter with a 1.9% quarter-on-quarter (q/q) slide, signaling that corporations remain cautious about increasing investment.

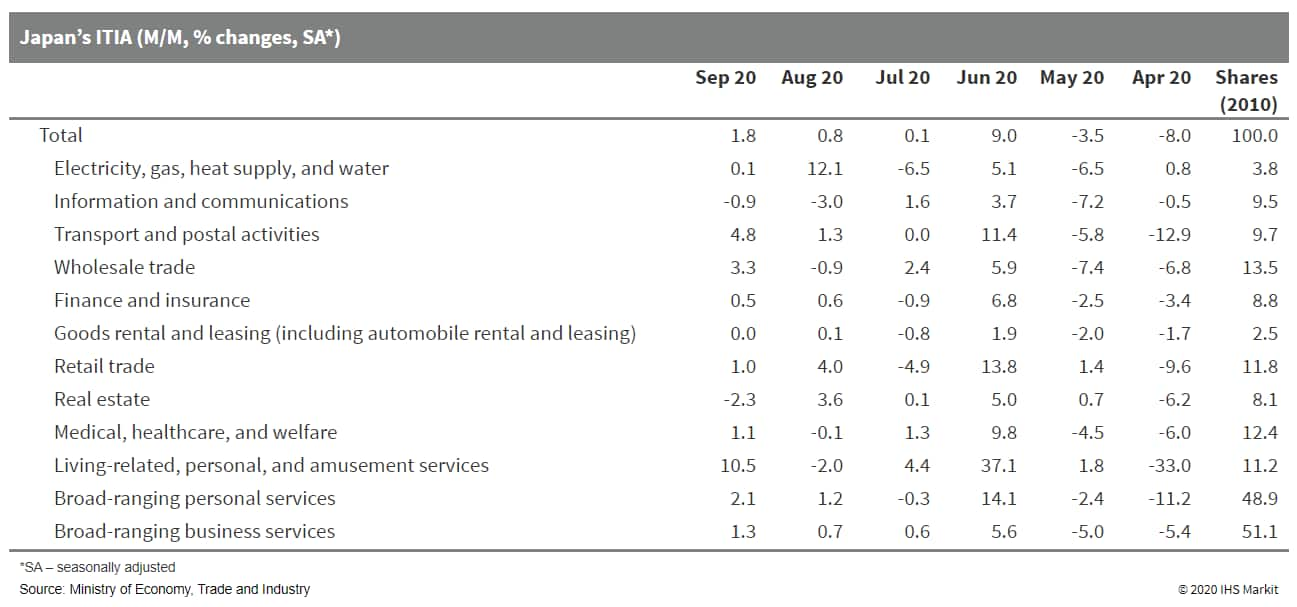

- Easing social distancing guidelines and government stimulus

measures boosted Japan's Indices of Tertiary Industry Activity

(ITIA) in September, but the resurgence of COVID-19 could weigh on

recovery. (IHS Markit Economist Harumi Taguchi)

- Japan's ITIA rose by 1.8% month on month (m/m) in September for the fourth consecutive month of increase (although the level remains below the March level) and declined by 9% year on year (y/y).

- The stronger m/m rise in September was largely attributed to solid increases in living-related, personal, and amusement services (including eating and drinking services, accommodations, and domestic travel) and transportation services thanks to easing social distancing measures and the government's travel subsidies.

- Business-related activity also continued to rise (by 1.3%), largely reflecting improved exports and private consumption that lifted a wide range of wholesale trade. These improvements were partially offset by declines in real estate and information services.

- The introduction of additional stimulus measures is likely to support the resumption of spending in personal-related services, lifting Japan's ITIA in October, as a travel campaign and other stimulus moves have encouraged consumers to go out from home.

- The Economic Watchers Survey (EWS) improved to 54.5 in October 2020, topping 50 for the first time since January 2018. This highlights a continued rise in personal and business activity in October 2020.

- However, the recent resurgence of COVID-19 could make people

more cautious about going out from home, which could weigh on

recovery in business activity. Although the government does not

intend to halt travel and other subsidies, Hokkaido and some other

local governments have begun asking restaurants and drinking places

to reduce their business hours.

- The Indian government has approved a proposal for a new Production Linked Incentive (PLI) scheme to boost manufacturing in the country for a total of 10 sectors. According to a report by CNBCTV18, the automotive and components sector will receive INR570.42 billion (USD7.6 billion) over the next five years. Final details of the scheme will be revealed in the next few weeks. Commenting on the PLI scheme, Finance Minister Nirmala Sitharaman said, "Over the next five years, this is today estimated, that the new PLIs that we are bringing in for these 10 identified sectors will involve an expenditure of about INR2 trillion … We are yet again proving that the policy that we are taking up even in PLI through which we want manufacturers to come to India is clearly to say we want to build on our strength but yet link with the global value chains." The latest PLI scheme is a welcome move for original equipment manufacturers (OEMs) and component manufacturers as it will help to make them more competitive and increase their production scale. The Indian government has been working to introduce programs to leverage the country's size and scale to develop a competitive domestic manufacturing ecosystem. The move is also expected to translate into more investments from existing domestic and foreign manufacturers in the automotive sector. (IHS Markit AutoIntelligence's Isha Sharma)

- The South Korean government has tested an unmanned air taxi service in the capital city, Seoul, reports the Yonhap News Agency. It has tested six drone taxis in Yeouido, western Seoul. This is the first time that the government has tested the drone taxi service in a densely populated city. Similar tests were previously conducted at designated test sites in Incheon, just west of Seoul, and Yeongwol, 200 kilometers (km) east of Seoul. The six drones used in the test were EH216s made by Chinese pilotless air taxi firm Ehang. They have two seats and weigh 650 kg per drone, according to the South Korean Ministry of Land, Infrastructure and Transport (MLIT), which added that the "K-drone traffic management system" is being developed under a state-financed project. Furthermore, Hanwha Systems, a defense industry and ICT service unit of chemical-to-finance conglomerate Hanwha Group, has unveiled the Butterfly, a mock-up of a personal air vehicle it is developing with US-based air taxi startup Overair. The company said it is seeking to establish a "verti-hub," a terminal for the take-off and landing of air taxis, at Gimpo International Airport in western Seoul in co-operation with Korea Airports Corporation. Hyundai also exhibited an aircraft model first introduced at the 2020 CES event earlier this year. This is being made in co-operation with Uber Technologies. The latest development is in line with the South Korean government's aim to commercialize urban air mobility (UAM) services in 2025 in a bid to overcome the country's worsening traffic congestion problem (see South Korea: 25 June 2020: South Korean government launches urban air mobility task force). As reported earlier, the government expects the UAM market to reach KRW13 trillion (USD11.7 billion) in 2040 and believes that UAM services will help to transport passengers faster than buses and subways. (IHS Markit AutoIntelligence's Jamal Amir)

- US-based startup BlueSpace.ai has partnered with LG Uplus to develop and commercialize an autonomous electric bus by the third quarter of 2021, reports Aju Business Daily. The two companies will share their expertise as BlueSpace will provide its autonomous vehicle (AV) technology and LG Uplus will provide its vehicle-to-everything (V2X) technology, which allows cars to communicate with other cars and infrastructure. LG Uplus will also provide a high-precision dynamic map and real-time kinematic (RTK) technology, as well as a control system that can monitor the operations of autonomous buses remotely. The electric bus technology will be provided by Woojin Industrial Systems and Metroplus will build the user interface for the vehicle. Cho Won-seok, senior vice-president of the new business group at LG Uplus, said, "We hope this business cooperation will greatly strengthen the competitiveness related to autonomous driving by gathering the technical skills of leading companies in various fields at home and abroad." LG Uplus aims to deploy 5G infrastructure in major South Korean cities. The mobile carrier will establish 5G mobile communication infrastructure for South Korea's AV test-bed, K-City. This year, the company partnered with Chemtronics to demonstrate an autonomous shuttle service in a residential area in Sejong city. LG Uplus has also partnered with Hanyang University to demonstrate a 5G-connected AV, named the A1, capable of Level 4 autonomy. BlueSpace was founded in April 2019 and builds software using high cognitive capabilities that can accurately identify the surrounding environment. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Farmers in the state of South Australia will be permitted to plant genetically modified food crops in time for the 2021 grain season with no councils approved to operate as a GM-free area. The South Australian state Parliament lifted a moratorium on mainland South Australia in May through the Genetically Modified Crops Management (Designated Area) Bill 2019. That also granted local councils a six-month leave to apply to be a GM crop cultivation-free area, while the moratorium remained on Kangaroo Island. Of the 68 local councils, 11 made such an application. However, the Minister for Primary Industries and Regional Development, David Basham, has rejected them all. A GM Crop Advisory Committee advised the State Government after assessing the economic benefits of remaining GMO-free. "By lifting the GM moratorium everywhere except Kangaroo Island, we are backing our farmers and researchers to grow the state's agriculture sector and create jobs," the Minister said. "Under the legislation councils had a once-off six-month opportunity to apply to remain GM free but under the Act passed by Parliament, applications could only be considered on trade and marketing grounds." The Minister adds that "so-called premiums" under a GM moratorium in the state were "a myth and had cost its grain growers some Aus$33 million [US$23.2 million at the current rate] since 2004". (IHS Markit Crop Science's Robert Birkett)

- The Philippine economy suffered another steep, double-digit

contraction during the third quarter as the spike of COVID-19 virus

infections and the reimposition of stricter virus containment

measures in Metro Manila and neighboring provinces during early

August further restrained public movement, disrupted business

operations, and dampened consumer and business sentiment. (IHS

Markit Economist Ling-Wei Chung)

- Real GDP dropped 11.5% year on year (y/y) in the third quarter, although the rate of decline moderated from a revised 16.9% y/y plunge posted in the second quarter. The second-quarter result represented the economy's worst slump in history, highlighting the dire effect of the pandemic.

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy showed signs of recovery as real GDP expanded 8% from the previous quarter, reversing a steep plunge of 14.9% in the second quarter. It also ended two consecutive quarters of q/q declines.

- Despite some improvement, the further collapse in domestic demand - a key driver of growth before the pandemic - remained as the main drag on overall economic momentum during the third quarter. The slump in domestic demand subtracted 17 percentage points from the third-quarter GDP, although the drag narrowed from the record 21.5-percentage-point deduction posted in the second quarter.

- Net exports continued to provide positive contribution to economic performance during the third quarter as the slump in imports further outpaced the contraction in exports, reflecting that domestic demand took the brunt of the pandemic and virus containment measures.

- In particular, plunging investment spending continued to drive the collapse in domestic demand as the business operating environment remained difficult because of the reimposed quarantine measures in August that eased later that month. Gross investment spending slumped further by 41.6% y/y in the third quarter of 2020, after plunging 53.7% y/y in the second quarter, which marked the worst contraction since the second quarter of 1985.

- Within that, fixed investment tumbled 37.1% y/y in the third quarter of 2020, after slumping 36.5% y/y in the second quarter. It was driven by a 43.5% y/y plunge in total construction investment, which widened from a 31.4% y/y drop in the second quarter as household-related construction investment tumbled 59.2% y/y and construction spending of financial and non-financial corporations contracted 38.7% y/y.

- With virus containment measures disrupting the all-important infrastructure projects, coupled with a high base effect, public construction investment plunged 28% y/y in the third quarter, accelerating from a mere 0.9% y/y fall in the second quarter. Combined with the continued slump in business spending on durable equipment, down 34.4% y/y, gross investment subtracted 11.1 percentage points from the third-quarter GDP.

- Household consumption slumped further in the third quarter but at a slower pace. Accounting for about 70% of real GDP, household consumption dropped 9.3% y/y in the third quarter, although it moderated noticeably from the record 15.3% y/y slump in the second quarter.

- The result for the third quarter came in line with IHS Markit projections, reinforcing our view for a slow recovery in the economy, after hitting the bottom in the second quarter. It suggests that our annual forecast of an 8.4% contraction for 2020 - a record slump and followed by a 7.8% expansion for 2021 - could be maintained. Nonetheless, risks to the near-term economic prospects remain on the downside amid the fallout from the pandemic locally and globally and the authorities' ability to carry out fiscal spending plans.

- The Republic of Philippines 5yr CDS closed at 35bps today,

which is slightly more than 2bps wider than the tightest closing

level of the year of 32.90bps set on 20 January.

- Vehicle production in the Philippines declined 21.8% year on year (y/y) during September to 7,457 units, according to data released by the ASEAN Automotive Federation (AAF). During January-September, total vehicle production in the country plunged 31.4% y/y to 46,628 units. Meanwhile, new vehicle sales in the country fell 22.9% y/y in September to 24,523 units and were down by 44.6% y/y to 148,012 units during the first nine months of the year. The plunge in Philippine new vehicle production during the first nine months of 2020 can be attributed to the fact that the country was in a state of public health emergency and that the government imposed an enhanced community quarantine (ECQ) order from the second half of March owing to the COVID-19 virus pandemic. Vehicle manufacturers in the country, including Hino, Hyundai, Isuzu, Mitsubishi, Nissan, and Toyota, initially announced production suspensions at their plants from 16 March to 12 April. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-november-2020.html&text=Daily+Global+Market+Summary+-+12+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 12 November 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+12+November+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-12-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}