Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 16, 2020

Daily Global Market Summary - 16 July 2020

Most equity markets closed lower on the day, despite China's Q2 GDP report indicating that it's the first major economy to return to growth after a significant wave of COVID-19 infections. The positive GDP announcement included strength in its industrial sector counterbalanced by weakness in consumption, with the latter triggering the worst single day sell-off in Chinese equities since February. iTraxx and CDX indices closed modestly wider across IG and high yield, while major benchmark government bonds closed higher. US initial claims for unemployment insurance reported the first increase in non-seasonally adjusted claims in eight weeks, which was potentially driven by the business re-closures that began across several states over the past few weeks.

Americas

- US equity markets closed modestly lower today; Nasdaq/Russell 2000 -0.7%, DJIA -0.5%, and S&P 500 -0.3%.

- 10yr US govt bonds closed -1bp/0.62% yield and 30yr bonds -2bps/1.31% yield.

- CDX-NAIG closed +1bp/73bps and CDX-NAHY +4bps/482bps.

- Crude oil closed -1.1%/$40.75 per barrel.

- Offshore drilling contractor Noble Corp., via wholly-owned

subsidiary Noble Holding International Limited, has elected not to

make on the due date the approximately USD15 million interest

payment due with respect to its 7.750% Senior Notes due 2024.There

is a 30-day grace period to make the interest payment before such

non-payment constitutes an "event of default" under 2024 Senior

Notes. Noble is actively engaged in discussions with certain of its

creditors regarding a potential consensual restructuring

transaction. No agreement has been reached as yet and the company

does not guarantee an agreement will be reached. The below Price

Viewer screen is the 12-month price history for the Noble Holding

International Limited 7.75% 1/2024 bond issue, which closed at a

price of 1.86 today. (IHS Markit Upstream Costs and Technology's

Matthew Donovan)

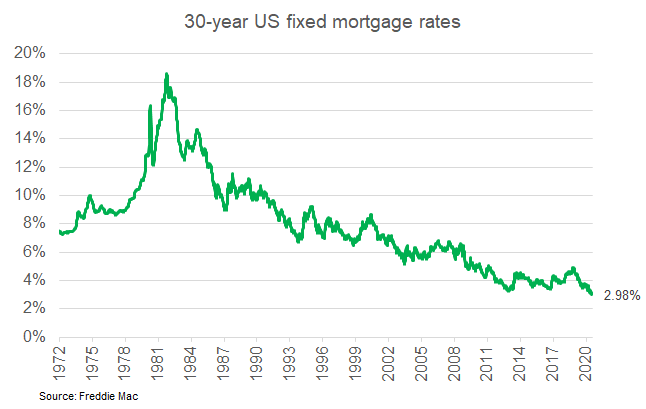

- The average rate on a 30-year fixed mortgage fell to 2.98%,

mortgage-finance giant Freddie Mac said Thursday, its lowest level

in almost 50 years of record keeping. It is the third consecutive

week and the seventh time this year that rates on America's most

popular home loan have hit a fresh low. (WSJ)

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,300,000 in the week ended 11 July, remained at

historically high levels and double the highest level during the

Great Recession. Initial claims have trended down in recent weeks;

however, as the resurgence of COVID-19 cases slows or reverses some

reopening plans, jobless claims could rise again. (IHS Markit

Economist Akshat Goel)

- While the seasonally adjusted number decreased, the non-seasonally adjusted number of initial claims filed in the week ended 11 July rose to 1,503,892, an increase of 7.8%. This is the first time unadjusted initial claims have increased in eight weeks. The unadjusted numbers might prove to be more reliable as the seasonal adjustment procedure may not be appropriate for levels of initial claims that are an order of magnitude higher than the historical norms because of factors unrelated to seasonality.

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, fell by 422,000 to 17,338,000 in the week ended 4 July. This is well below the all-time high of 24,912,000 in the week ended 9 May and indicates that as businesses reopen, furloughed workers are returning to work. The insured unemployment rate in the week ended 4 July fell 0.3 percentage point to 11.9%.

- There were 928,488 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 11 July. In the week ended 27 June, continuing claims for PUA rose by 405,856 to 14,282,999.

- In the week ended 27 June, 936,431 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 27 June, the unadjusted total fell by 433,005 to 32,003,330. Of this total, 51% are from regular state programs and 45% from the PUA program.

- US total retail trade and food services sales jumped 7.5% in

June, following an upwardly revised initial surge of 18.2% in May.

The recovery through June brings retail trade and food services

sales within 0.6% of the pre-pandemic February level. (IHS Markit

Economist James Bohnaker and David Deull)

- By June, most of the country had greatly relaxed restrictions on in-person shopping. Furniture and home furnishing stores (up 32.5%), electronics and appliance stores (up 37.4%), and clothing and accessories stores (up 105.1%) were the leading growth categories in June, but sales in each remained lower than in February.

- Auto dealers benefited from pent-up demand. Mobility trends suggest that driving has made a full recovery as most Americans avoid air travel and public transportation. Sales at auto dealers were up 4.4% from the February level.

- Retail categories that were outperforming took a breather as activity normalized elsewhere. Building materials and garden supply stores (down 0.3%), food and beverage stores (down 1.2%), and nonstore retailer (down 2.4%) sales paused but will remain elevated until virus concerns dissipate.

- Food services sales rebounded by 20% in June yet remain 27.4% below February. We do not expect a rapid recovery, with several high-population states backtracking on restaurant and bar re-openings.

- The initial retail rebound has been stronger than expected, but we remain guarded about the second half of 2020 as COVID-19 infections are rising at a concerning rate.

- The US builder confidence headline index jumped 14 points to

72. The report's headline, "Builder Confidence Rallies to

Pre-Pandemic Level in July," says it all. If only this translated

into single-family housing starts. (IHS Markit Economist Patrick

Newport)

- The current sales conditions index shot up 16 points to 79, the index measuring sales prospects over the next six months climbed 7 points to 75, and the traffic of prospective buyers' index rose 15 points to 58—an all-time high.

- The Northeast sky-rocketed 22 points to 70—its highest reading since June 2005.

- The other three regions also saw large gains for the second straight month with the West up 14 points to 80, the Midwest up 18 points to 68, and the South up 10 points to 73.

- Housing starts will not bounce back to pre-pandemic levels for some time. That is mainly because favorable weather elevated housing starts by about 200,000 units (annual rate) just before the pandemic hit. Instead, we expect starts to bounce back to about normal levels, which are below pre-pandemic levels, by the end of this year.

- The report usually lists an issue. This month's: "Lumber prices are at two-year highs and builders are reporting rising costs for other building materials while lot and skilled labor availability issues persist."

- The report also suggested that the pandemic could change the geographic distribution of new homes. More people working from home is tilting new home demand toward larger houses in small cities, rural markets, and large metro exurbs.

- Navistar and TuSimple have announced a strategic partnership aimed at bringing SAE Level 4 autonomous trucks into production in 2024. According to a joint company statement, Navistar will also make an investment in TuSimple, taking a minority stake. In the statement, Navistar's new CEO, Persio Lisboa, said, "Autonomous technology is entering our industry and will have a profound impact on our customers' businesses. Navistar's strategic partnership with TuSimple positions us to be a leader in developing solutions for our customers by leveraging our organizations' collective expertise to integrate our vehicle design and systems integration capabilities with TuSimple's innovative autonomous technology. This announcement marks a significant milestone in our development journey with TuSimple and we look forward to furthering our relationship in the months to come." The companies aims to have a fully integrated self-driving engineering solution ready for mass production using Navistar's production facilities. Customers will be able to purchase the trucks through Navistar's traditional dealership network in the United States, Canada, and Mexico. Although Navistar produces buses as well as trucks, the partnership with TuSimple is targeting production of Class 8 trucks, and production at scale. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber Technologies is in initial talks with investors to raise USD500 million in investment for its freight unit, reports Bloomberg. According to the report, after this deal, the Uber Freight division will be valued at USD4 billion. However, no transaction has been finalized and the terms could change. An Uber spokesperson said, "While it's not unusual for us to receive interest for investment in Uber Freight, we are not able to comment on rumours about these discussions." Uber Freight was launched in May 2017 as a service that matches truckers with companies needing cargo to be shipped across the United States. In 2018, Uber announced that it would spin off its long-haul trucking business, Uber Freight, into a standalone business unit. In 2019, Uber Freight announced its expansion into Europe and that it was moving its headquarters to Chicago (US), with plans to nearly double the unit's workforce. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Transdev, a public transport operator, is partnering with the Livermore Amador Valley Transit Authority (LAVTA) in the United States to launch a non-passenger, shared autonomous vehicle (SAV) project. The project will involve a low-speed autonomous vehicle (AV) that will operate in mixed traffic with a safety operator on board. The vehicle will travel on a 1-mile route that includes two stops and one traffic light. Following this testing, the project will provide first- and last-mile passenger rides by connecting them between the Dublin/Pleasanton Bay Area Rapid Transit (BART) station and nearby locations. The SAV project has received a grant from the Bay Area Air Quality Management District. Neal Hemenover, Transdev's vice-president of innovation, said, "We are excited to begin testing with LAVTA and bring this area's vision for autonomous vehicles to life. It's important to note that the health and safety of our employees, passengers and communities is our highest priority and all EPA [Environmental Protection Agency] and CDC [Centers for Disease Control] approved social distancing and cleaning protocols will be in place during testing, as well as when we start accepting passengers." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Brazil reported 45,403 new cases of Covid-19 in a 24-hour period, pushing the number of infections to more than 2 million. The death toll rose by 1,322 to 76,688. Brazil trails only the U.S. on both counts. The country has added 1 million cases in less than a month in a rapidly shifting outbreak. (Bloomberg)

- Sumitomo Chemical's Latin American operation is to invest some R$50 million (US$10 million) in expanding capacity at its Maracanau, Brazil plant, national media report. The investment is to meet anticipated company growth in the region of some 50% by 2025, the reports add. The water-based herbicide concentrate plant will occupy a 2,000 m2 area with a 60,000 litre/day capacity. Herbicides including Zethapyr (imazethapyr), ZethaMaxx (imazethapyr + flumioxazin) and those based on diuron will be produced there. A new distribution facility will occupy an operation area of 10,0002. It will improve the company's responsiveness in transporting products to markets in the north and north east of the country, in the "Pimatoba" region of the Piaui, Maranha, Tocantins and Bahia states. In April, Sumitomo Chemical acquired Nufarm's South American crop protection and seed treatment business. With the acquisition of formulation facilities in Brazil coupled with the research and development facility that Sumitomo opened in Brazil in 2016, the company aims to pursue integrated business operations in the region from development through to formulation and distribution. (IHS Markit Crop Science's Robert Birkett)

- Argentina's consumer price index increased by 2.2% month on

month during June. The increase in consumer prices was more

pronounced in the clothing and apparel, the leisure and culture,

and the home furnishings and maintenance sectors. (IHS Markit

Economist Paula Diosquez-Rice)

- Argentina's inflation rate in June was driven by price increases in the food and beverages category, with significant price rises for rice, dairy products, bread and cereals, and tomatoes (fresh and canned), as well as rises in the recreation and leisure, clothing and apparel, and the home furnishings and maintenance sectors. The communications, utilities, and education sectors reported small increases compared with May.

- Prices of regulated items increased by 0.7% month on month (m/m), while prices of seasonal items increased by 4.8% m/m. The core inflation rate increased by 2.3% m/m. Meanwhile, wholesale prices climbed by 36.2% year on year (y/y) in May. The annual consumer inflation rate in June was 42.8%, a slight deceleration compared with May.

- Inflation expectations for the next 12 months declined in June; Torcuato Di Tella University reported a median of 40% y/y, down from 50% in the previous two months. The average annual inflation rate expected is at 44.5%. However, the inflation expectation survey by the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) shows a median of 52.5% in June.

Europe/Middle East/ Africa

- European equity markets closed modestly lower except for Italy +0.4%; UK -0.7%, France -0.5%, Germany -0.4%, and Spain -0.2%.

- 10yr European govt bonds closed higher across the region; Italy/UK -3bps and Spain/France/Germany -2bps.

- iTraxx-Europe closed flat/62bps and iTraxx-Xover +1bp/367bps.

- Bank of England (BoE) Governor Andrew Bailey on 13 July rejected calls for the London Inter-bank Offered Rate (LIBOR) transition to new reference rates to be delayed further in response to the COVID-19 virus pandemic. He stated that the volatility experienced in financial markets during March as a result of the pandemic "only reinforces the importance of removing …dependence on LIBOR in a timely way". His views were reinforced by John Williams, president of the Federal Reserve Bank of New York, speaking at the same online event, who repeated that entities need to "be prepared to manage…[the] transition away from LIBOR", urging against delays that could "make the existing hole we're trying to climb out of even deeper". The statements by senior representatives of the Federal Reserve Bank of New York and BoE continue to indicate a clear regulatory desire to promptly replace LIBOR with more liquid and representative reference rates. Bailey specifically warned that all borrowings extending beyond 2021 need to consider the greater certainty offered by the migration to new reference rates, and that those continuing to use LIBOR would need to prepare for its termination. (IHS Markit Economist Brian Lawson)

- The European Central Bank's (ECB) statement following its

latest policy meeting did not contain any radical changes. Although

its assessment of the economy reflected some recent signs of

improvement, it remained rather cautious overall. (IHS Markit

Economist Ken Wattret)

- By way of example, although incoming information since the prior policy meeting in early June has signaled a resumption of economic activity, it remains "well below" the levels prevailing before the COVID-19 virus pandemic and the outlook remains "highly uncertain".

- The recovery in May and June's high-frequency and survey data was described as "uneven and partial".

- Actual and expected job and income losses and "exceptionally elevated" uncertainty are expected to continue to weigh down on consumer spending and business investment.

- Headline inflation is being dampened by lower energy prices and price pressures are expected to remain "very subdued" given the sharp decline in output and the associated "significant increase" in economic slack.

- Weaker demand will put downward pressure on inflation, which will be only partially offset by upward pressures related to supply constraints.

- Market-based indicators of longer-term inflation expectations have continued to increase from the historical lows reached in mid-March but overall remain at subdued levels.

- Against this backdrop, the ECB reiterated the need for ample monetary stimulus and restated that the Governing Council continues to stand ready to adjust "all of its instruments, as appropriate", to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

- One notable addition to the ECB's statement was a reference to the "very high take up" in the latest instalment of the third series of targeted longer-term refinancing operations (TLTRO III). In addition to highlighting that the ECB is doing its job in providing substantial cheap funding to banks to keep the flow of credit to the economy going, the reference might also be aimed at calming any concerns stemming from one aspect of the recent bank lending survey (BLS) for the second quarter.

- The BLS suggested that banks intend to tighten credit standards for loans to enterprises in the third quarter, due in part to the expiry of governments' loan guarantee schemes (see Eurozone: 14 July 2020: Eurozone credit conditions for loans to enterprises remain relatively loose in Q2, while emergency liquidity needs continue to surge).

- A significant tightening of credit conditions would be a major concern given the huge demand for loans from businesses currently, reflected in hard lending data as well as the BLS. Growth in bank lending to non-financial corporations has surged since March, with the year-on-year (y/y) rate of increase more than doubling to over 7%.

- While acknowledging the slower pace of asset purchases, this was attributed to the flexibility of the PEPP to respond to market conditions, while it was made clear that under the baseline scenario, the ECB would use the full envelope of purchases. Only in the event of a significant upward surprise in the outlook for the economy would this not be the case.

- French inflation, measured by the EU-harmonized index, eased

from 0.4% in April and May to 0.1% in June, according to a final

estimate released by the French National Institute of Statistics

and Economic Studies (INSEE). June's reading was the lowest since

May 2016. (IHS Markit Economist Diego Iscaro)

- Energy prices continued to be the main drag on inflation (see chart 1). However, they declined at a slower rate compared with May (by -9.3% compared with 11.0% in June). Given IHS Markit's oil-price projections (oil prices are highly correlated with energy prices; see chart 2), it is likely that the decline in oil prices had peaked in May for this cycle.

- Food price inflation continued to outperform the average but eased from 3.5% to 2.6%, a three-month low. This helps to explain the fall in the inflation rate vis-à-vis May.

- Core inflation fell from 0.6% in May to 0.3% in June. Service price inflation moderated from 1.2% to 1.1%, as lower communication costs more than offset large increases in transport prices. The prices of manufactured goods declined at a slightly stronger pace in June (by -1.0% y/y following -0.7% y/y). The prices of clothing and footwear continued to be a major drag, waning by 4.0% y/y.

- IHS Markit expects inflation to remain subdued during the second half of 2020, although June's inflation is likely to be the cycle's trough.

- France's President Emmanuel Macron addressed the French nation

on Bastille Day, 14 July, outlining a plan to support the country's

economic recovery and stating his policy objectives for the second

half of his mandate. New Prime Minister Jean Castex set out his

government's program on 15 July. (IHS Markit Economists Diego

Iscaro and Bibianna Norek)

- Economic recovery, unemployment mitigation efforts, support for the healthcare sector, and climate transition will remain key policy priorities in the 18-month outlook, following the COVID-19 virus outbreak. President Macron announced the planned allocation of EUR100 billion (USD114.1 billion) to fund France's economic recovery, in addition to the EUR460 billion already designated for this purpose.

- A resumption of the pension reform would increase the risk of trade unions staging disruptive labor strikes and associated protests in Paris and other French cities.

- Supporting the economic recovery is key, but fiscal space is limited. The sharp fall in France's GDP, currently projected to be around 10% in 2020, and the large fiscal support needed to counter-balance the economic impact of the COVID-19 virus pandemic are expected to cause a fiscal deficit, as a percentage of GDP, of 12.2% in 2020, from 3.0% in 2019. Macron has ruled out tax increases at this stage, but it is likely that the expected removal of housing tax for high-earners, currently slated for 2021, is unlikely to go ahead.

- The current post-COVID-19 virus incentive program launched by the German government has created an environment in which some electric vehicles (EVs) can be leased almost for nothing, according to a Bloomberg report. The news agency reports that German dealership chain Autohaus Koenig has been advertising a lease deal for the Renault Zoe EV for which subsidies entirely cover the monthly payment. This includes the impact of the EUR9,000 (USD10,266) government- and OEM-paid subsidy on the initial purchase price of the leased vehicle from the OEM and other subsidies and tax breaks for company car users. In addition, online German automotive trading web startup Carfellows is offering the EV version of the Smart ForTwo for a fee of just EUR9.90 a month. (IHS Markit AutoIntelligence's Tim Urquhart)

- Lanxess announced today that it is reorganizing its water treatment portfolio to focus on ion exchange resins, particularly on high-end market applications. As part of this realignment, Lanxess is selling its reverse osmosis membranes business to Suez, a leader in sustainable resource management. The companies signed the deal on Wednesday and expect the transaction to be completed by the end of 2020. Financial details were not disclosed. Lanxess produces reverse osmosis membranes, which play an important role in the treatment of brackish and seawater, at its site at Bitterfeld, Germany. Suez will take over this plant and the research facilities with all the employees. In 2019, the business generated sales in the low-double-digit million euro range, Lanxess says. At the same time, Lanxess plans to beef up its ion exchange resins business. The company plans to invest between €80 million and €120 million to build a new production facility in the next few years. "We [will] invest in additional capacities for ion exchange resins in order to be able to meet the growing global demand. At the same time, we want to grow especially in promising market segments," said Matthias Zachert, chairman of the board of Lanxess. Ion exchange resins are used in cleaning processes in the food and pharmaceutical industries. In the semiconductor industry, they play a key role in the production of ultrapure water, which is needed in microchip production. There is also a high demand for ion exchange resins in the battery industry due to the trend toward e-mobility. They are also used to extract lithium, nickel, and cobalt metals, which are important for battery cell production. Ion exchange resins are also used in power generation, the chemical industry, microelectronics, and drinking water treatment.

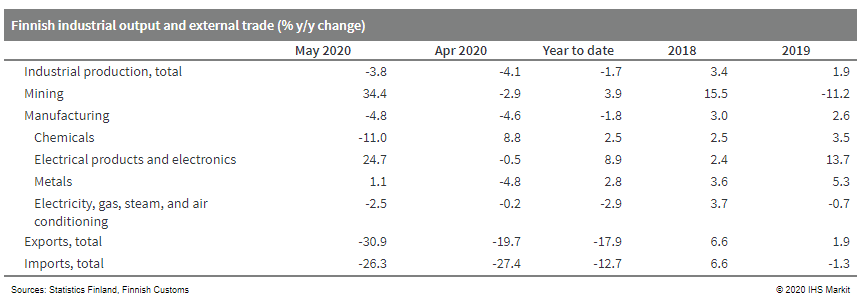

- Finnish industrial output continued to contract in May,

decreasing by 3.8% year on year (y/y) according to

calendar-adjusted data from Statistics Finland. Coming after a

downwardly revised easing of 4.1% y/y in April, this brought the

decline for the January-May period to 1.7% y/y. (IHS Markit

Economist Venla Sipilä)

- Seasonally adjusted figures showed a fall of 1.2% month on month (m/m) in May, after an April decline of 2.7% m/m.

- Aided by a base effect, the mining sector switched to annual growth in May, while among the most important manufacturing sectors, only the metal branch managed to grow. Along the lines of April's developments, the chemical industry fared particularly weakly, contracting by 11.0% y/y and 9.8% m/m.

- Finnish Customs reported that goods exports in May collapsed by 30.9% y/y according to preliminary data, while they fell by 17.9% y/y in January-May. The corresponding decreases for imports were 26.3% y/y and 12.7% y/y.

- Consequently, following a temporary surplus in April, the trade balance in May showed a deficit of EUR280 million (USD320 million), which compares unfavorably with virtually balanced trade in May 2019, while the January-May deficit of EUR1.5 billion (USD1.7 billion) represents a dramatic widening from a shortfall of just EUR65 million in the same period a year earlier.

- Similar to April, both exports and imports contracted in May, mainly as a result of significantly falling values for trade of transport equipment (exports fell 70% y/y) and oil and oil products (exports decreased 52% y/y). In addition, forestry industry exports fell significantly, as did exports of machinery and equipment.

- Exports to other EU countries declined at an accelerated rate

of 31.7% y/y in May, while the contraction in extra-EU exports

quickened to 30.0% y/y. In particular, exports to Germany collapsed

by nearly 52%, exports to Russia halved, while exports to the

United States dwindled by more than 45% y/y.

- Ford Otomotiv Sanayi (Ford Otosan), a joint venture (JV) between Ford Motor and Koç Holding in Turkey, has announced the signing of an agreement with the International Finance Corporation (IFC), a member of the World Bank Group, for a USD150-million loan. In addition, Ford Otosan has announced the suspension of production for maintenance at Ford plants in Turkey. The JV, in a filing with Borsa Istanbul (BIST), said it will use the loan for vehicle development and production facility investments to improve efficiency and capacity, and for modernisation of the facility. The loan has six-year term, and comes with a two-year grace period. According to the statement, "Principal and interest payments will be made semiannually. Indicative annual interest rate excluding bank charges is 2.15% and final rate will be determined at the date of disbursement which is planned to be before September 2020." Meanwhile, Ford Otosan also announced the suspension of production at Ford's Yenikoy and Eskisehir plants in Turkey from 30 July to 13 August and at the Golcuk plant from 30 July to 15 August for maintenance work. In a statement, the company said, "There will be a shutdown period in our plants due to scheduled annual vacation. During this time periodical maintenance will take place in all our plants." (IHS Markit AutoIntelligence's Tarun Thakur)

- As per IHS Markit's Commodities at Sea, during the week 28, Richards Bay Coal Terminal coal shipments slipped to 1.2mt (5.3mt on the 30-day basis) versus 1.8mt (7.9mt on the 30-day basis) a week before. The shipping schedule for RBCT was quite slow during the reported week. However, in the second half of the month, significant tonnage is expected to be loaded at the coal terminal. During the reported week, Transnet railings were calculated at 1.3-1.4mt (vs 1.4-1.5mt a week before), and coal stocks at the terminal firmed up to 4.1mt from 3.8mt a week before. During 01-14 days of July 2020, RBCT shipped just 2.4mt (5.2mt on the 30-day basis) with shipments to India, Pakistan, Vietnam, and Korea (South) at 0.9mt (1.9mt on the 30-day basis), 0.5mt (1.2mt), 0.2mt (0.4mt) and 0.2mt (0.3mt), respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

Asia-Pacific

- Most APAC equity markets closed lower, except for India +1.2%; Shanghai Composite -4.5%, Hong Kong -2.0%, Japan/South Korea -0.8%, and Australia -0.7%.

- China's economy has returned to growth. Real GDP rose 3.2%

year-on-year (y/y) in the second quarter, up from 6.8% y/y decline

in the first quarter. (IHS Markit Economist Todd Lee)

- Secondary sector (industry and construction) grew 4.7% y/y in the second quarter, up from 9.6% contraction in the first quarter.

- Service sector rose 1.9% y/y in the second quarter, compared with 5.2% y/y decline in the first quarter.

- For the first half of 2020, real GDP contracted by 1.6% y/y, secondary sector declined 1.9% y/y, and service sector fell 1.6% y/y.

- The recovery has remained uneven throughout the second quarter, with supply outpacing demand and investment outdistancing consumption. Industrial output grew 4.8% y/y in June, while service sector output index rose 2.3% y/y.

- Fixed asset investment rose 1.1% y/y in June (calculated from the year-to-date investment spending data), while retail sales remained in contraction, falling 1.8% y/y.

- Exports have been resilient amid extremely negative external conditions. Goods exports rose 0.1% y/y in the second quarter, compared with first quarter's 13.3% y/y plunge that was largely caused by China's COVID shutdown.

- The expected export tsunami from the deep world recession has not materialized so far. Compared with IHS Markit's Global Composite Purchasing Managers Index (excluding China), the export orders index of the Caixin China PMI (by IHS Markit) suffered a much shallower drop. This is a reversal of the Great Financial Crisis downturn in which China's export orders fell more sharply than the global PMI. A key factor for the less severe than expected exports decline in the current downturn is that the COVID world recession is heavily concentrated in the service sector, which is much less open to trade.

- China's economic recovery should continue in the second half of 2020. Periodic small-scale COVID-19 outbreaks are probably inevitable. But with China's newly established capacity for large scale COVID testing and infrastructure for contact tracing, these outbreaks should be quickly contained and will not impact overall economic activities. But without a vaccine and effective treatment, the threat of COVID-19 infection will keep the economic recovery subdued.

- Shenzhen (Guangdong Province) steps up restrictive measures for

local property market in a notice issued by local housing and

construction bureau on 15 July. Last major adjustment in

transaction policies was announced back in 2016. (IHS Markit

Economist Lei Yi)

- Adjustments mainly aimed at increasing transaction costs to cool down the demand of those buying for profit rather than residential purposes. The move could help stabilize near-term local housing price growth, though upward pressure persists given the relative supply shortage

- According to the latest policy, home buyers need to have obtained local residency registration (known as "hukou") and paid income tax or social security for three consecutive years to be eligible for making a purchase in Shenzhen. While formerly for attracting skill workers, Shenzhen used to make newcomers eligible for buying immediately after getting the local residency status.

- Down payment was raised by 10% for non-first-time buyers trying to purchase a "luxury" apartment and kept unchanged for non-luxury purchases. For those with a mortgage record yet no homeownership in the city, down payment was raised to 60%; for those trying to buy a second home, down payment now stands at 80%. Housing ownership before divorcement will also be taken into consideration, making it no longer possible for couples to exploit the policy loophole.

- The definition for "luxury" apartments was modified to re-include the price element, which was only removed at the end of 2019. The new "luxury" line has been raised and set at CNY7.5 million (USD1.07 million).

- For home resale, non-luxury apartments need to be owned by at least five years to be applicable for capital gain tax exemptions, up from two years previously.

- Shenzhen becomes the fourth city to impose tighter housing transaction restrictions entering July, following Dongguan (Guangdong Province), Hangzhou, and Ningbo and appears to be strictest of all.

- Imported vehicle sales in the Philippines plunged by 54.8% year

on year (y/y) to 19,455 units during the first half of 2020,

reports The Philippine Star, citing data released by the

Association of Vehicle Importers and Distributors (AVID). (IHS

Markit AutoIntelligence's Jamal Amir)

- Imported passenger vehicle sales totaled 6,111 units during the first half of the year (down by 60.0% y/y), imported light commercial vehicle (LCV) sales stood at 13,207 units (down by 51.6% y/y), and imported medium and heavy commercial vehicle sales fell by 72.8% y/y to 137 units.

- AVID president Ma. Fe Perez-Agudo said "While AVID members and their partner dealerships have gone to great lengths to COVID-proof their facilities, strengthen online e-commerce assets, and offer extraordinary promotions and deals to win back customers and encourage buying, headwinds remain. These include lower remittances, weaker demand, and the prospect of a second wave, so we can't let our guard down."

- Subsea 7 has been awarded a renewables contract for work offshore Taiwan. The contract, valued at between USD50 million and USD150million, covers installation of a submarine cable system on an offshore windfarm project for an unnamed client. Project engineering will begin immediately at Subsea 7's offices in Leer, Germany, and Taipei, Taiwan. Offshore activities are expected to begin in 2023. (IHS Markit Upstream Costs and Technology's Mark Rae)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-july-2020.html&text=Daily+Global+Market+Summary+-+16+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-july-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}