Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 17, 2020

Daily Global Market Summary - 17 December 2020

All major US equity indices and most APAC markets closed higher, while Europe was mixed. US government bonds closed lower and European bonds were mixed. European iTraxx credit indices closed tighter across IG and high yield, while CDX-NA was close to flat on the day. The US dollar closed lower and gold, silver, copper, and oil closed higher.

Americas

- US equity market closed higher; Russell 2000 +1.3%, Nasdaq +0.8%, S&P 500 +0.6%, and DJIA +0.5%.

- 10yr US govt bonds closed +2bps/0.94% yield and 30yr bonds +3bps/1.68% yield. 10s and 30s both rallied (10s and 30s -4bps) on the weaker than expected US initial claims for unemployment insurance report, but then sold off (10s +5bps and 30s +7bps) after 10:30am EST on apparent progress on the $900 billion US stimulus bill.

- CDX-NAIG closed flat/53bps and CDX-NAHY -4bps/297bps.

- DXY US dollar index continued its sell-off closing -0.7%/90.82, which is 12.6% below this year's peak of 102.82 set on 20 March.

- Silver closed +4.5%/$26.18 per ounce, gold +1.7%/$1,890 per ounce, and copper +1.1%/$3.60 per pound.

- Crude oil closed +1.1%/$48.36 per barrel.

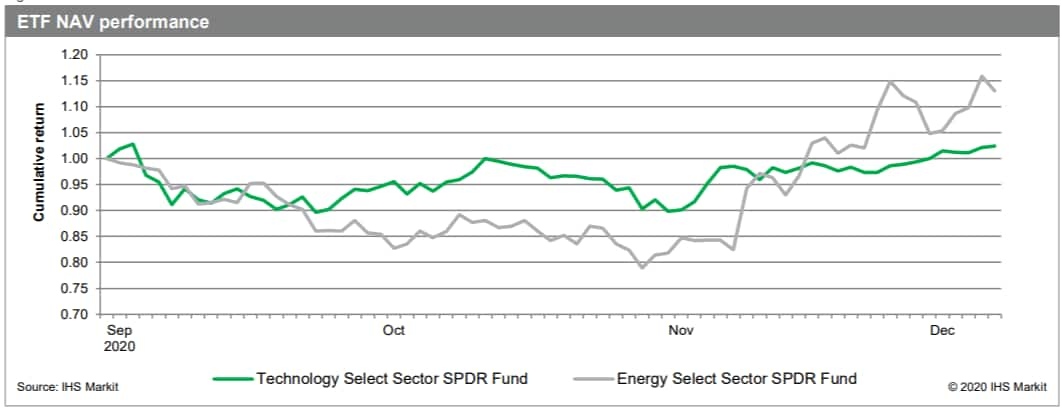

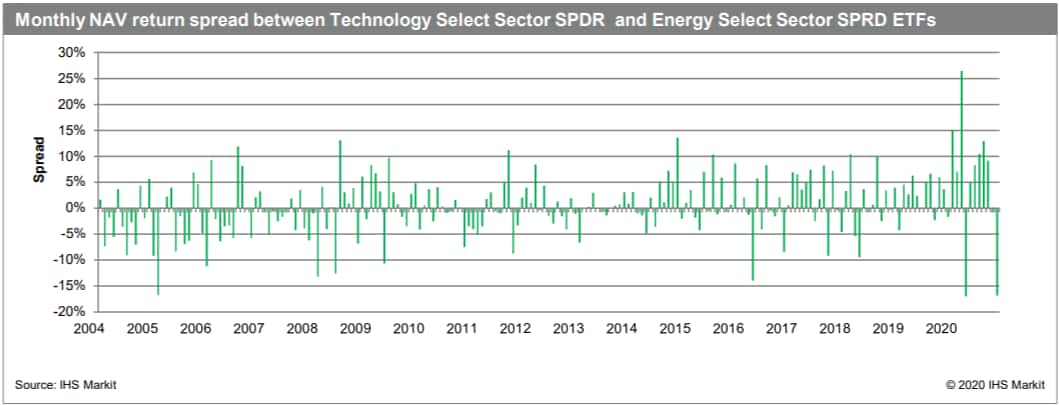

- Over the past five years, Technology has trounced Energy, with

a 217% cumulative return, compared with Energy's loss of 19%.

However, taking a closer look again at recent performance, we see a

clear rotation out of Technology and into Energy, with an 11.4%

return in November for the former compared with 22.2% for the

latter. Energy's outperformance was supported by an ETF inflow in

October and November at a rate two-and-a-half times that of

Technology. What is more, the spread in monthly returns of the two

funds was the second highest drawdown on record, only outmatched in

April of this year as markets rebounded from the COVID-19-induced

volatility. (IHS Markit Research Signals)

- The federal government faces the possibility of a partial weekend shutdown, the No. 2 Senate Republican, John Thune of South Dakota, said as top leaders in both parties work to complete a pandemic-relief deal that will be tied to a massive government spending measure. The government is operating on stopgap funding that expires at midnight Friday. With negotiations on the aid package dragging on, lawmakers were looking to another short-term measure to buy more time to get it wrapped up and passed by Congress. (Bloomberg)

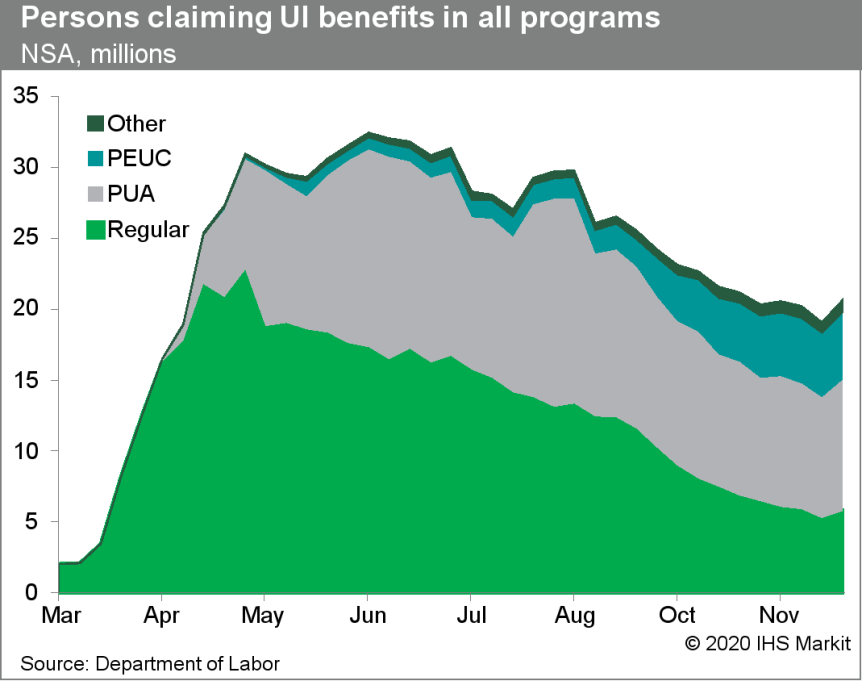

- Seasonally adjusted (SA) US initial claims for unemployment

insurance rose by 23,000 to 885,000 in the week ended 12 December,

its highest level since early September. The not seasonally

adjusted (NSA) tally of initial claims fell by 21,335 to 935,138.

Seasonally adjusted initial claims have risen for four of the last

five weeks, suggesting a flagging recovery in the labor markets

amid the resurgence of the virus that is forcing some states into

tightening restrictions again. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 273,000 to 5,508,000 in the week ended 5 December. Prior to seasonal adjustment, continuing claims fell by 312,357 to 5,492,701. The insured unemployment rate in the week ended 28 November was down 0.1 percentage point to 3.8%.

- There were 455,037 unadjusted initial claims for Pandemic Unemployment Assistance (PUA)in the week ended 12 December. In the week ended 28 November, continuing claims for PUA rose by 688,793 to 9,244,556.

- In the week ended 28 November, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 268,532 to a new high of 4,801,408.

- The Department of Labor provides the total number of claims for

benefits under all its programs with a two-week lag. In the week

ended 28 November, the unadjusted total rose by 1,603,281 to

20,646,779, the largest increase since mid-August.

- US housing starts increased 1.2% (plus or minus 8.6%, not

statistically significant) in November to a 1.547 million rate.

Single-family starts inched up 0.4% (plus or minus 7.9%, not

statistically significant) to a 1.186 million rate, the highest

since April 2007; multifamily starts increased 4.0% to a 361,000

units rate. (IHS Markit Economist Patrick Newport)

- Housing starts, particularly single-family starts, are surging in three regions: the Midwest, where year-to-date (YTD) starts in November were up 14.4% from 2019, the South (YTD housing starts up 7.6%), and the West (YTD housing starts up 5.4%). YTD housing starts in the Northeast were down 3.3% from 2019 in November.

- Single-family permits, arguably the most important number in this report, increased 1.3% (plus or minus 0.8%; statistically significant)—the seventh straight increase—to a 1.143 million rate, which was the highest since March 2007.

- Demand for multifamily homes has dropped. Multifamily housing starts averaged 567,000 annualized units in the three months prior to the pandemic; they averaged 349,000 units in the three months ending with November.

- Interest rates have played a role in boosting housing demand. That role has diminished in recent months as rising house prices and construction costs have more than eroded the cost savings of lower mortgage rates. It is possible—but hard to prove—that telework is behind the second-half surge in single-family new construction.

- We believe that housing starts will peak soon, possibly in the fourth quarter. The current level is too high, given projected population growth.

- Swiss firm Novartis has announced an agreement to acquire US private biotech Cadent Therapeutics and its clinical-stage pipeline of small molecules for cognitive, movement, and mood disorders. The agreement will include two clinical-stage candidates for schizophrenia (CAD-9303, Phase I for cognitive symptoms for the condition) and movement disorders (CAD-1883, Phase II), and will include a buyout of milestones and royalties for the clinical-stage NMDA receptor modulator MIJ821, which was previously covered by an exclusive Novartis licence for treatment-resistant depression since 2015. Novartis will acquire all of the outstanding capital stock of Cadent, in exchange for an upfront payment of USD210 million and milestone payments of up to USD560 million. The transaction has been approved by the Cadent board of directors and stockholders, and Cadent and Novartis expect the transaction to close in the first quarter of 2021, subject to closing conditions including Hart-Scott-Rodino antitrust review clearance. This agreement, once finalised, should help expand Novartis's neuroscience portfolio, and builds on the company's drive to develop game-changing medicines for severe and chronic neuropsychiatric conditions. It follows Novartis's recent acquisition of US ocular gene therapy firm Vedere Bio in October. Cadent has been positioning CAD-9303 with potential to fill a gap in schizophrenia treatment, addressing cognitive deficits and the negative symptoms of the disorder such as emotional suppression and withdrawal - compared with many current treatments that address positive symptoms such as hallucinations, delusions, or behavioral changes. Cadent specializes in NMDA receptor allosteric modulators, including the positive modulator CAD-9303, and the negative modulator MIJ-821, and is also developing the SK channel positive allosteric modulator CAD-1883 for movement disorders. Cadent was formed in 2017, following the merger of Luc Therapeutics and Ataxion Therapeutics, and has maintained a focus on small molecules targeting neuronal ion channels. (IHS Markit Life Sciences Janet Beal)

- The US state of Washington has asked the US EPA to grant an emergency exemption for use of BASF's new insecticide, broflanilide, to control wireworms in spring wheat. The request is made under rules allowing emergency use of active ingredients that are not yet registered in the US. The EPA proposed approval of broflanilide in November. The Washington State Department of Agriculture wants to treat sufficient spring wheat seeds to plant up to 206,000 acres (83,400 ha), for which approximately 1,029 lbs (4.1 tons) of broflanilide would be needed. The Department states that currently registered products do not provide adequate control of wireworms, which are having a severe impact, particularly in the dryland wheat growing areas of eastern Washington. The EPA invites comments on the request by December 30th 2020. BASF developed broflanilide jointly with Japanese company Mitsui Chemicals Agro. The proposed US approval would cover cereals, maize, tuberous and corm vegetables, and non-crop areas. (IHS Markit Crop Science's Jackie Bird)

- Velodyne Lidar and May Mobility have entered into a sales agreement. May Mobility will use Velodyne's long-range Alpha Prime LiDAR sensors that provide a 360-degree surround view for its fleet of autonomous shuttles. Alpha Prime LiDAR sensors enable real-time localization and object-detection functions to support autonomous operation in urban and highway environments. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. Edwin Olson, co-founder and CEO of May Mobility, said, "Velodyne Lidar is a valued partner and we've chosen their long-range, surround-view LiDAR sensors because they integrate well with our AV systems. This will allow us to continue to improve the overall operation and safety of our shuttles, and expand the capabilities of our vehicles into a wider range of operational design domains." May Mobility offers low-speed autonomous shuttles, which are produced through a partnership with Magna and are being operated in test programs in cities in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Motional, a joint venture (JV) between Hyundai Motor and Aptiv, has partnered with Lyft to launch driverless robotaxi services in major US cities by 2023. Under this partnership, Motional plans to deploy fully autonomous vehicles in Lyft's ride-sharing network in the United States. The robotaxis will be based on the Hyundai vehicle platform, integrated with sensors, computers, and software to enable driverless operation and remote vehicle assistance. Karl Iagnemma, president and CEO of Motional, said, "This agreement is a testament to our global leadership in driverless technology. We're at the frontier of transportation innovation, moving robotaxis from research to road. Our aim is to not only build safe, reliable, and accessible driverless vehicles, but to deliver them at significant scale. We're partnering with Lyft to do exactly that." This follows Motional's recent announcement that it had received approval to test its autonomous vehicles in the US state of Nevada without a human safety driver. Aptiv and Lyft have been working together for three years on an autonomous vehicle pilot program in Las Vegas, Nevada. Their partnership has provided more than 100,000 paid robotaxi rides in the city, with 98% of passengers awarding their rides a five-star rating. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Plans for an integrated propane dehydrogenation (PDH) and

polypropylene (PP) plant in Alberta, Canada, have been "suspended

indefinitely," according to Pembina Pipeline (Calgary). (IHS Markit

Chemical Advisory)

- Capital expenditure on the proposed 4.5-billion Canadian dollar ($3.5 billion) development by Canada Kuwait Petrochemical Corp. (CKPC), a 50/50 joint venture (JV) between Pembina and Petrochemical Industries Co. (PIC; Kuwait City), was first deferred in March. Pembina now says in a business update that while it continues to believe in the strategic rationale of the project, the "significant risks arising from the ongoing COVID-19 pandemic, most notably with respect to costs under the lump-sum contract for construction of the PDH plant, which remains under force majeure condition, require CKPC to suspend execution of the project indefinitely."

- Pembina and PIC will continue to evaluate the PDH and PP facilities, each of which are planned to have a nameplate production capacity of 550,000 metric tons/year, Pembina says. "CKPC is working through a process to manage, defer, or cancel existing agreements with, among others, the lump-sum consortium, lenders, and technology licensers, in order to minimize the need for additional capital contributions," it says. The JV will continue to take action to safeguard its existing investment associated with long-lead equipment and intellectual property, it adds. Pembina says it will recognize a material financial impairment on its investment in the JV in the fourth quarter.

- In March Pembina said planning, engineering, and regulatory work done to date on the deferred project adjacent to its Redwater fractionation complex near Edmonton, Alberta, would allow the company to quickly resume activity to meet customers' needs when global energy prices and the broader economic environment support such action. The deferred project was due to receive approximately 23,000 b/d of propane feedstock and was expected to come into service in the second half of 2023.

- CKPC had signed agreements to use Honeywell UOP's C3 Oleflex technology for the PDH plant and W.R. Grace's Unipol process for the PP unit, while a lump-sum engineering, procurement, and construction (EPC) contract was awarded to Heartland Canada Partners, a JV of Fluor and Kiewit.

- According to data from the Colombian National Administrative

Department of Statistics (Departamento Administrativo Nacional de

Estadística: DANE), industrial production fell by 8.0% year on year

(y/y) in September, while retail sales grew in yearly terms for the

first time since the start of the COVID-19-virus pandemic (3.0%).

(IHS Markit Economist Lindsay Jagla)

- Colombia's October 2020 total industrial production remained 8.0% below October 2019 levels, driven primarily by yearly declines in mining and quarrying (-28.6%). Crude oil and gas extraction (-14.4%) and coal mining (-61.3%) remain the greatest negative drivers in this sector.

- Despite remaining below 2019 levels, Colombia's industrial production continues to recover slowly month on month (m/m), from the significant decline seen in April amid the COVID-19-virus pandemic and the resulting economic shutdown. This recovery has been uneven, with initial rebounds in May, June, and July, followed by a monthly decline in August. October's industrial production index recorded the greatest monthly increase (4.6% m/m) since July.

- All four industrial sectors experienced month-on-month growth between September and October, with three of the sectors - industrial manufacturing, water treatment and distribution, and electricity and gas management - nearing 2019 levels.

- Retail sales showed a more significant improvement, growing by 3.0% above 2019 levels in October. A total of 12 out of 19 merchandise lines grew in annual terms, with food products (5.2% y/y), personal technology and communication equipment (30.9% y/y), and household appliances and furniture (28.3% y/y) driving the growth in retail sales.

- Colombia faced severe economic contractions in April and May because of the lockdown measures implemented to contain the COVID-19 virus. In the months that followed, the government began to lift the measures, allowing for economic reactivation and the resurgence of some normal economic activity.

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.8%, Spain +0.2%, Italy +0.1%, France Flat, and UK -0.3%

- 10yr European govt bonds closed mixed; France/Spain -1bp, Italy/Germany flat, and UK +1bp.

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -7bps/240bps.

- Electric vehicle (EV) startup Arrival's founder and CEO, Denis Sverdlov, has outlined a new approach to vehicle manufacturing, aiming for profitability more quickly, reports Automotive News. According to the report, Sverdlov envisions microfactories that will require about USD50 million in investment, compared with a typical plant costing about USD1 billion. Sverdlov says about 10 microfactories could produce as many of its vehicles as one traditional plant, for half the capital outlay, and in about one-tenth of the site space. Sverdlov reportedly said, "Arrival has spent the last five years developing our unique model and proprietary technology and is now laser-focused on delivery. We are not using metal stamping, welding and paint shops. Instead, we are using aluminum for chassis, proprietary composites for bodies and structural adhesive." Sverdlov is reported as saying previously that Arrival expects to be able to sell its electric vans and buses for about the same price as diesel equivalents. Sverdlov, addressing the potential scalability of its production approach, reportedly said, "There are more than 560 cities in the world which have a population of over 1 million people, and each of these cities could have a microfactory producing 10,000 vehicles specifically tailored Arrival has two microfactories and reportedly plans to have 31 by 2024. The first two are in London, United Kingdom, and Rock Hill, South Carolina, United States. Arrival has been moving quickly towards beginning production and sales. Over the past year, the company has received orders from UPS, made plans to test Waymo technology, and has received investment from BlackRock and Hyundai. (IHS Markit AutoIntelligence's Stephanie Brinley)

- EU member states have been given until 4 July 2021 to withdraw authorizations for products containing the fungicide mancozeb, following the European Commission's decision not to renew its EU approval. Any grace periods granted to use up existing stocks must expire by 4 January 2022. The non-renewal was based on concerns over the active ingredient's hazardous properties. Declaring the publication of the final decision in the EU Official Journal, EU Commissioner for Health and Food Safety Stella Kyriakides said: "We cannot accept that pesticides harmful to our health are used in the EU. Member states should now urgently withdraw all authorizations for plant protection products containing mancozeb." She also highlighted that reducing the bloc's dependency on chemical pesticides is a key pillar of the Farm to Fork Strategy. An assessment of mancozeb by the European Food Safety Agency (EFSA) found several health concerns, including a "toxic effect on reproduction and the protection of the environment" and "endocrine disrupting properties for humans and animals". But the EU Mancozeb Task Force (MTF) believes that the EU evaluation process was " rushed" and that approval of a restricted use of mancozeb would have been possible. It warns that there are multiple crop/disease combinations for which no alternative active ingredient exists. Nevertheless, the MTF notes that the last-minute decision to lengthen the phase-out period in the EU should allow farmers to use the fungicide in the 2021 season in most member states. (IHS Markit Food and Agricultural Policy's Jackie Bird and Pieter Devuyst)

- Aker Solutions has signed a contract with Arctic Offshore Farming, a subsidiary of Norway Royal Salmon (NRS), for the assembly of two large fish farming facilities. Fish farming has been identified by Aker Solutions as a market with several interesting prospects. Aker Solutions has together with Norway Royal Salmon developed the design for Arctic Offshore Farming's harsh environment installation. Today's contract means that the company will now also make its first delivery of such facilities. The value of the contract is approximately USD5 million (NOK40 million). Arctic Offshore Farming's facilities are currently being prefabricated as four separate sections at the Fosen Yard in Emden, Germany. During the first quarter 2021, the modules will be transported on a barge to Aker Solutions' specialized yard in Verdal, Norway, where the four sections will be assembled to two circular fish farming units. The fish farm weighs about 3,800 metric tons and has a diameter of 80 meters. Aker Solutions' scope includes preparatory activities for the fabrication, receipt of components, assembly, services to Arctic Offshore Farming and their suppliers, as well as preparation for sea transport. Each of the two fish farming units weighs about 3,800 metric tons, has a diameter of 80 meters and a height of 22 meters. Preparations for the project start early 2021. The activity will be at its highest in April and May when around 50 employees will be working on the project. The fish farming units will be installed at the Arctic Offshore Farming location outside Tromsø in Northern Norway. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- Aker Solutions has been awarded a contract by Equinor for delivering the new CO2 receiving facilities Northern Lights outside Bergen, Norway. The company has also won a contract from Equinor to deliver the subsea equipment for injecting captured CO2 into a reservoir for permanent storage. In total, the new contracts have a value of about USD150 million (NOK1.3 billion). Work will start in January 2021 and the deliveries will be completed within the first part of 2024. Northern Lights is part of the Norwegian government's Longship project for establishing full scale CO2 capture, transport and storage facilities in line with the country's international climate agreements. Aker Solutions has previously been engaged as a subcontractor for the carbon capture and storage technology company Aker Carbon Capture in early phase work to plan a CO2 capture facility at Norcem's cement factory in Brevik, Norway. The intention for the Longship project is that CO2 captured from the cement manufacturing process in Brevik can be transported by ship to the new receiving terminal in Øygarden outside Bergen. At the receiving terminal, CO2 is stored intermittently before being injected into subsea geological structures via a subsea pipeline. With the new contract for Equinor, Aker Solutions is involved in both the carbon capture and the storage part of this value chain. The USD122 million (NOK1.05 billion) contract for the onshore facility covers EPC. The engineering will be carried out by Aker Solutions in Fornebu, Norway. The work at the site in Øygarden will involve employees from several locations, primarily from Fornebu and Stord. The pre-fabrication for the onshore facilities will be done at Aker Solutions' yard at Stord before site installation. The scope for the onshore facility includes facilities at the jetty for import of CO2 from ships, storage tanks for intermediate storage of CO2 and process systems for gas conditioning and subsea injection. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- Estonian-based ride-hailing firm Bolt has raised EUR150 million (USD182 million) in a Series D funding round, reports Reuters. The round was led by D1 Capital Partners with the participation of Darsana Capital Partners. The company plans to use the capital to enhance the safety of its platform by launching driver face verification and automatic trip-monitoring systems using predictive artificial intelligence technology. Bolt CEO Markus Villig said, "We have almost doubled our number of customers [this year] and launched our services from ride-hailing to micromobility and food delivery in 50 new cities." Bolt, previously known as Taxify, operates a food delivery service and ride-hailing service using cars, bikes, and scooters. The company is primarily active in Eastern European and African cities and re-entered the London (United Kingdom) market last year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Russia's RosStat has reported only a 2.6% year-on-year (y/y)

fall in industrial output in November compared to y/y declines of

5.9% in October, 3.6% in September, and 4.2% in August. (IHS Markit

Economist Lilit Gevorgyan)

- The breakdown of the index suggests that the return of the manufacturing sector to growth in November had a positive contributing factor for the overall growth.

- Specifically, the production of pharmaceutical products grew by 35% y/y, metal products (excluding machinery) was up by 19% y/y, textile and tobacco output up by 16% y/y and 10% y/y respectively.

- Food production fell by 0.3% y/y, while the beverages sector was down by 4.6% y/y. Production of transport equipment saw the sharpest decline, down by 10.9% y/y in November.

- IHS Markit Manufacturing PMI released on 1 December signaled some deterioration in the operating environment for Russian business firms. Seasonally adjusted headline index eased to 46.33 in November, from 46.9 points in October.

- The respondents reported continued worsening in demand conditions. Output and new orders fell, along with employment. At the same time price pressures rose at fastest rate since February 2015.

- The latter was confirmed by a separate data release by RosStat on 16 December, showing 1.3% y/y increase in producer price index in November. This ended a period of contraction in producer price since July 2019.

- This notable increase in input costs are a result of the ruble's recent weakness, leading to import price inflation. The USD/RUB pair hit 80 earlier in November. The ruble was affected by geopolitical events such as the uncertainty around the US election results, and concerns over new sanctions against Russia.

- The extractive sector remained a drag on the overall sector in November shrinking by 7.6% y/y, although the rate of contraction moderated from annual declines of 9.0% in October, 9.4% in September and 10.6% in August.

- Oil and natural gas extraction fell by 9.6% y/y in November, slightly moderating from the annual losses of 9.8% in October, 10.7% in September and 11.9% in August.

- Russian manufacturers will remain under pressure in the coming months due to poor demand conditions. Input costs are likely to moderate as the ruble regains some of its lost ground.

- In October, Turkey's current-account deficit narrowed

significantly on the back of a sharp narrowing of the merchandise

trade gap compared with that earlier in the year. The country had a

net inflow of portfolio investment of more than USD400 million for

the first time since November 2019. A tightening of monetary policy

at the end of November could keep the current-account deficit low

and maintain net inflows of portfolio investment heading into 2021.

(IHS Markit Economist Andrew Birch)

- In October 2020, merchandise export growth accelerated to 4.3% year on year (y/y), driving down the monthly merchandise trade deficit compared with the huge gaps noted throughout the first three quarters of the year. After averaging USD3.3 billion per month in January-September, the merchandise trade deficit dropped to just USD1.3 billion in October because of the recovery of export growth.

- The narrowing of the merchandise trade deficit allowed the current-account gap to drop to just USD273 million in October after having averaged over USD3.4 billion through the first three quarters of the year. The cumulative deficit of USD31.1 billion through the first 10 months of 2020 nonetheless still represented a massive turnaround from the USD9.6-billion surplus registered in the same period of 2019.

- Also in October, Turkey attracted significant net inflows of portfolio investment for the first time since November 2019. After suffering net outflows of portfolio investment of USD14.8 billion through the first three quarters of 2020, the country attracted net inflows of nearly USD2.9 billion in October. A government bond issue of USD2.5 billion on the international capital markets provided the basis for the inflow of portfolio investment that month.

- A lower current-account deficit and greater foreign capital inflows allowed foreign currency reserves to climb from September to October, by approximately USD3 billion over the course of the month. Foreign reserves have been severely depleted in 2020, as the Central Bank of the Republic of Turkey (TCMB) has spent tens of billions of US dollars and other hard currencies to defend the lira. Rebuilding these reserves will be critical to meet short-term obligations of the TCMB.

- IHS Markit forecasts that Turkey's current-account deficit will soar to 5.6% of GDP in 2020 as a whole, its biggest gap since 2013. Although merchandise exports are growing again, the renewed lockdowns across Europe are likely to mute these gains over the final couple of months of the year. Turkey continues to suffer from substantial service-export losses that have slashed the services surplus.

- The Bank of Uganda (BoU) maintained its benchmark policy rate

at 7% at its monetary policy committee (MPC) meeting on 14

December. The central bank rate (CBR) was lowered from 8.0% to 7.0%

in June 2020. (IHS Markit Economist Alisa Strobel)

- The central bank's MPC announced that it would maintain the CBR at 7% in December amid uncertainty surrounding global macroeconomic developments. The band on the CBR is also maintained at plus or minus 2 percentage points, while the margin on the rediscount rate and bank rate is unchanged at 3 and 4 percentage points on the CBR, respectively. The rediscount rate and the bank rate were maintained at 10% and 11%, respectively, at the MPC meeting.

- At the meeting, the BoU highlighted that economic growth in October reached 3.3% following a steep decline of 6% in June. The MPC continued to be concerned about Uganda's vulnerability to periodic bouts of global financial volatility. Following the severe global economic slowdown and remaining downside risks, the country's economic growth is expected to remain below its potential up to its 2023/24 fiscal year.

- The decision to keep the key interest rate unchanged remains in line with the central bank's aim of supporting private-sector growth, while committing to provide liquidity support. IHS Markit maintains that there is some moderate scope to cut rates further, particularly with anticipated core inflation easing during the second half of 2021. However, a depreciating Ugandan shilling together with increased fiscal pressure would challenge further rate cuts.

- IHS Markit has revised its short-to-medium-term growth outlook for Uganda, amid demand-side trade disruptions caused by the COVID-19-virus outbreak. The lower foreign direct investment (FDI) forecast is expected to hamper growth, with a slow uptick in growth during the second half of 2021. Furthermore, real GDP has been lowered to 0.1% in 2020, reflecting an anticipated steep decline in remittance inflows. However, the government's complementary fiscal and monetary policy actions have provided a foundation for economic activity to recover to 3.9% in 2021.

Asia-Pacific

- Most APAC equity markets closed higher, except for South Korea -0.1%; Australia +1.2%, Mainland China +1.1%, Hong Kong +0.8%, India +0.5%, and Japan +0.2%.

- After returning to growth in September, India's industrial

output gained more traction in October, while retail inflation

finally started to ease in November thanks to slower food price

rises. While growth momentum may still slow as pant-up demand

wanes, the economic outlook for India has broadly improved, with

IHS Markit's forecast for FY 2020 revised up to -9.5% from -10.6%.

(IHS Markit Economist Hanna Luchnikava-Schorsch)

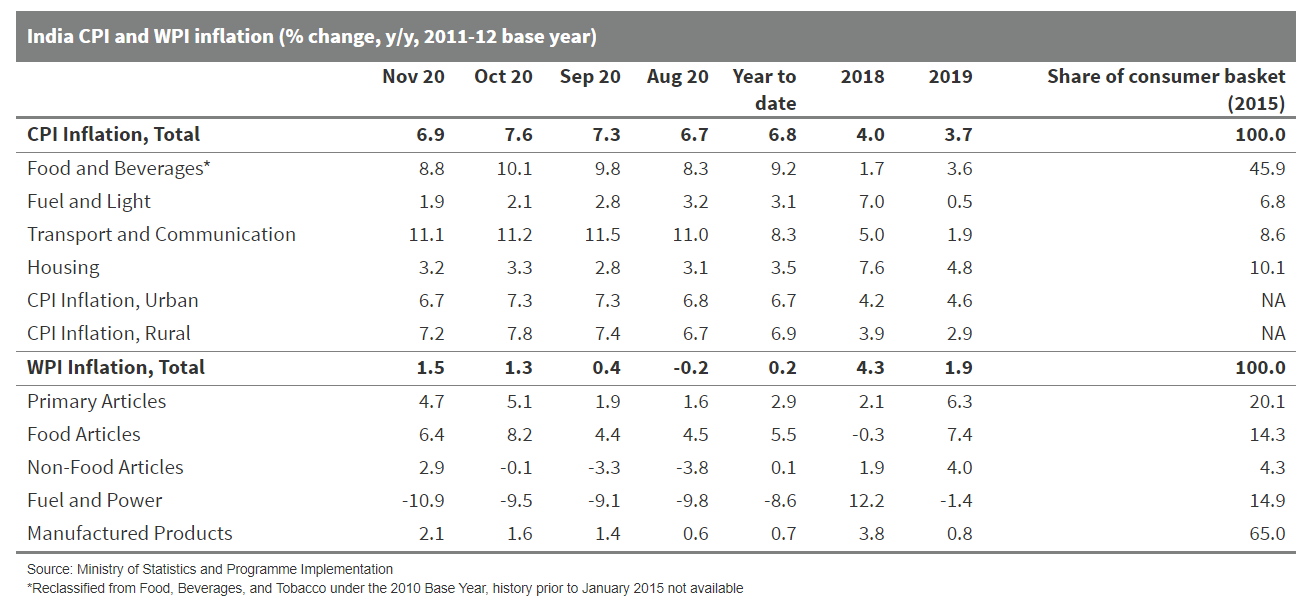

- Headline consumer price index (CPI) inflation moderated for the first time in three months - to 6.9% y/y in November from 7.6% y/y in October - according to data released by the Ministry of Statistics and Program Implementation (MOSPI).

- The moderation was almost entirely driven by the easing pressures on food prices, with inflation in vegetables group in particular easing to 15.6% y/y in November from 22.5% y/y in the previous month. Inflation in the transport and communication group also eased marginally.

- On the other hand, prices remained sticky in some categories of core inflation, like clothing and personal care as well as health, education and housing.

- Wholesale price index (WPI) inflation also continued to accelerate, recorded at 1.5% y/y in November, up from 1.3% y/y in October. Manufactured products inflation, previously considered as a measure of core inflation, accelerated to 2.1% y/y from 1.6% y/y in October.

- In a separate data release by the MOSPI, the index of industrial production grew 3.6% y/y in October, a month after it returned to growth following six months of contraction.

- Electricity production jumped by 11.2% y/y, while manufacturing output finally also turned positive, up by 3.5% y/y. Mining, on the other hand, contracted by 1.5% y/y in October after a brief expansion in September.

- On a use-based approach, all but primary goods category showed expansion, with consumer durables goods production, likely boosted by the seasonal holiday demand, increased by 11.6% y/y, sharply up from 3.4% y/y in September and double-digit contraction only three months ago. Capital, as well as infrastructure and construction output also improved in annual terms, suggesting a gradual revival in investment activity.

- Reported improvements in industrial output and inflation are good news for the economy that is still in technical recession, with latest national accounts data showing the real GDP shrinking for the second quarter in a row in the September quarter, albeit at a smaller-than-expected rate of 7.5% (see India: 1 December 2020: Indian economy enters technical recession in September quarter but contraction is smaller than expected).

- As anticipated, inflation has started to ease as supply

disruptions caused by the lockdown are being resolved. We expect

this easing to continue in the first half of 2021. Nevertheless,

headline CPI inflation still remains above the central bank's

target ceiling of 6% and core inflation is still rising, suggesting

that the Reserve Bank of India (RBI) will remain cautious for some

time before it decides to cut rates again.

- China Mengniu Dairy, through its subsidiary Inner Mongolia, has agreed to increase ownership in Shanghai Milkground Food Tech Company, a cheese manufacturer, for a total value of CNY3 billion (USD459 million). The transaction will increase Inner Mongolia's stake in Milkground to 23.8% from the 5% it acquired earlier this year, becoming the controlling stakeholder. Milkground is involved in the manufacturing and distribution of dairy products and it operates five manufacturing facilities across China. According to the official filing, its cheese business has seen rapid expansion in recent years and has become a leading enterprise in the cheese industry in China. Inner Mongolia says the investment is in line with its development strategies as it recognizes Shanghai's long-term potential and future prospects. In a statement, Mengniu Dairy: "The company is optimistic about the future prospects of the cheese market and recognizes Shanghai Milkground's long term development potential." (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- China's vehicle export volumes grew for the third consecutive month in November, and set a new record for the month. Data from the China Association of Automobile Manufacturers (CAAM) indicate that 122,000 vehicles were exported from China in November, up 11.6% compared with October and an increase 46.7% compared with November last year. In January to November, China's vehicle exports totaled 850,000 units, down 7.3% year on year (y/y). Of this total, passenger vehicle exports fell by 0.4% y/y to 644,000 units, while commercial vehicle exports contracted 23.8% y/y to 207,000 units. The data indicate passenger vehicles remain the main driver of the growth in China's vehicle exports. Although the CAAM did not provide a breakdown of the data by vehicle type, electric vehicles (EVs) are expected to grow their share of China's vehicle exports amid automakers' push to ship more EVs to developed markets with favorable EV policies, especially Europe. The CAAM compiles Chinese vehicle export data each month from data provided by automakers on voluntary basis; therefore, the data may not cover all the manufacturers shipping new vehicles from China to overseas markets. SAIC Motor, Chery Auto, Geely Auto, SAIC General Motors, and SAIC General Motors Wuling are leading vehicle exporters in the Chinese market. The five automakers account for nearly 63% of China's total passenger vehicle exports, according to the CAAM. (IHS Markit AutoIntelligence's Abby Chun Tu)

- StarRides, a ride-hailing joint venture (JV) between Geely Technology and Daimler Mobility, is now available in six Chinese cities. The service was initially launched in Hangzhou in December 2019. Since then, the service has expanded to other cities including Guangzhou, Chengdu, Xi'an, Beijing, and Shanghai. In addition, StarRides has announced the launch of an English version of its ride-hailing app for international users based in China. Liu Jin Liang, Geely Technology Group president, said, "As the first strategic cooperation project between Geely Technology Group and Daimler Mobility AG, StarRides has ensured a win-win cooperation, provided high-quality of services, and has set -new industry standards amongst mobility service providers. Together with our partners, we strive to create more possibilities in the future of mobility services through synergies and leverage resources through our network of suppliers." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japanese chipmaker Renesas Electronics has established a joint research center in China with Chinese automaker FAW Group to develop technologies for electric vehicles (EVs) and autonomous vehicles, reports Nikkei Asia. The research center, located in Changchun, Jilin Province, has begun operation in early December. Renesas will contribute technologies related to its high-performance automotive processors as well as system chips and software. Technologies developed by the partnership will first be used in vehicles introduced by Hongqi, FAW's premium vehicle brand. Renesas also has a joint venture (JV) center with SAIC Volkswagen (SAIC VW), VW's joint venture with SAIC Motor. According to the source, the chipmaker generates half of its revenue from its automotive business. The new joint research facility it set up with FAW Group will enable the Chinese automaker to secure critical electronics component supply for the Hongqi brand. Japanese electronics component manufacturers are investing heavily to expand their business in the automotive sector, driven by the automotive industry's rising demand for electronic components. Toshiba and Fuji Electric will invest a combined JPY200 billion (USD1.9 billion) to ramp up output of power-saving chips for EVs, according to a Nikkei report. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-december-2020.html&text=Daily+Global+Market+Summary+-+17+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}