Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 18, 2020

Daily Global Market Summary - 18 December 2020

APAC equity markets closed mixed, while the US and European markets were lower. US government bonds closed modestly lower and benchmark European bonds were mixed across the region. European iTraxx and CDX-NA credit indices were slightly wider on the day across both IG and high yield. Oil and copper closed higher, while gold and silver were lower on the day. Debate over the essential $900 billion US stimulus bill continues to weigh on the markets, as late additions to the legislation may increase the risk of it not passing before the new year.

Americas

- The US equity market closed modestly lower; DJIA/S&P 500/Russell 2000 -0.4% and Nasdaq -0.1%.

- 10yr US govt bonds closed +1bp/0.95% yield and 30yr bonds +1bp/1.69% yield.

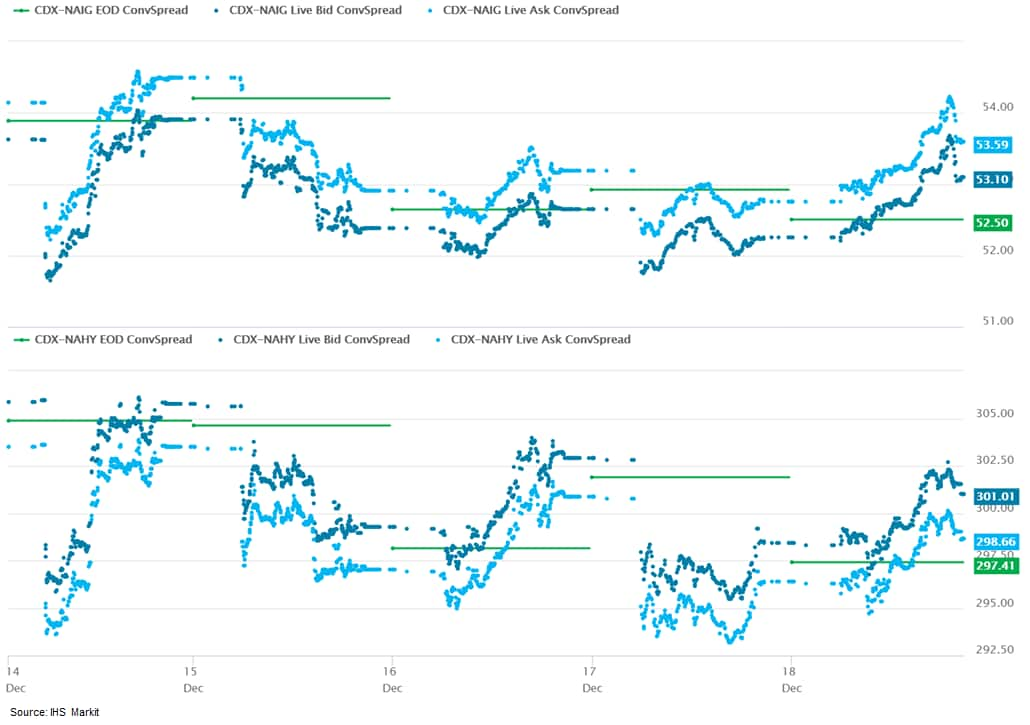

- CDX-NAIG closed +1bp/53bps and CDX-NAHY +2bp/300bps, which is

-1bp and -5bps week-over-week, respectively.

- DXY US dollar index closed +0.2%/90.02.

- Copper closed at +0.8%/$3.63 per pound, which is the highest close since February 2013.

- Gold closed -0.1%/$1,889 per ounce and silver -0.6%/$26.03 per ounce.

- Crude oil closed +1.8%/$49.24 per barrel.

- A bid by Republicans to constrain the Federal Reserve's crisis lending programs is threatening to derail negotiations on a pandemic relief plan and has drawn the incoming administration of President-elect Joe Biden into the 11th hour fight. Senator Pat Toomey, a Republican from Pennsylvania, wants a provision in the relief bill that would bar the Fed from restarting five programs that expire at the end of the year, or create similar ones going forward. The roughly $900 billion proposal being debated by Congress, would, among other things, extend support to out-of-work Americans and thousands of small businesses. (Bloomberg)

- The Federal Reserve has given America's most profitable banks the green light to resume share buybacks for the first quarter of next year, even as it found that the country's biggest lenders could face pandemic-related loan losses of more than $600 billion. The US central bank's decision to lift a six-month-old ban on buybacks followed months of public protests by profitable lenders including Morgan Stanley and JPMorgan Chase, several of whom immediately signaled their intention to restart purchases. The Fed said it was giving banks more freedom on payouts because they had already significantly increased their capital buffers and all 33 in the exercise would be above minimum capital levels even under the most severe stress they were tested against. (FT)

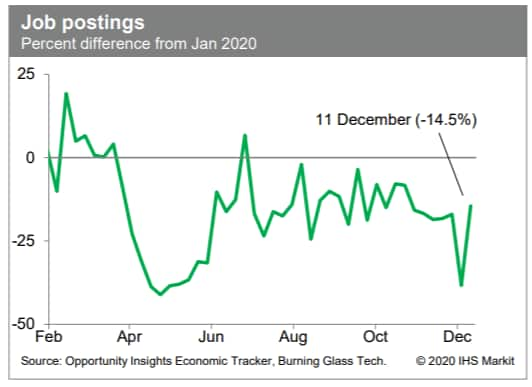

- Revenue per available room at US hotels last week was 57.3%

below the year-earlier level, according to STR. This was a slight

improvement over the prior week's reading, but still one of the

weakest year-over-year comparisons over the last several months. By

this metric, recovery in the travel sector stalled during the

summer months and has yet to gain renewed traction. Meanwhile, job

postings for the week ending 11 December were 14.5% below the

January average, according to the Opportunity Insights Economic

Tracker. This was a significant improvement over the prior week,

when job postings likely were well below what is typical for the

week after Thanksgiving. Still, last week's level of job postings

indicates continued weakness in labor markets. (IHS Markit

Economists Ben Herzon and Joel Prakken)

- The US Conference Board Leading Economic Index (LEI) increased

0.6% in November, to 109.1 (2016=100). Seven of the 10 components

made positive contributions in November, led by initial claims for

unemployment insurance, building permits, and the S&P 500

index. (IHS Markit Economist Gordon Greer)

- The coincident index rose for the seventh consecutive month in November, while the lagging index slipped back into negative growth.

- The leading index fell 13.3% between February and April. After increasing from May through November, the index remained 2.4% beneath its February level.

- The Conference Board's measure of future growth rose again in November, with the index level recovering after sharp declines in March and April. The index has regained more than half of the level lost during March and April, but it remains 2.4% beneath its February level.

- The three components making the largest positive contributions to the index's growth in November were initial claims for unemployment insurance, building permits, and the S&P 500 index.

- The drags on the index came from average consumer expectations for business conditions, the average workweek for production workers in manufacturing, and manufacturers' new orders of nondefense capital goods excluding aircraft.

- In its press release, the Conference Board remarked, "[the LEI's] pace of improvement has been decelerating in recent months, suggesting a significant moderation in growth as the US economy heads into 2021." We have revised up our forecast of growth in the fourth quarter, as high-frequency data indicate GDP growth has been boosted by unexpected strength in consumer goods, but it remains well below third-quarter growth. In our latest tracking, annualized GDP growth in the fourth quarter is 6.0%, down from the 33.1% rate of growth in the third quarter registered by the Bureau of Economic Analysis's second estimate.

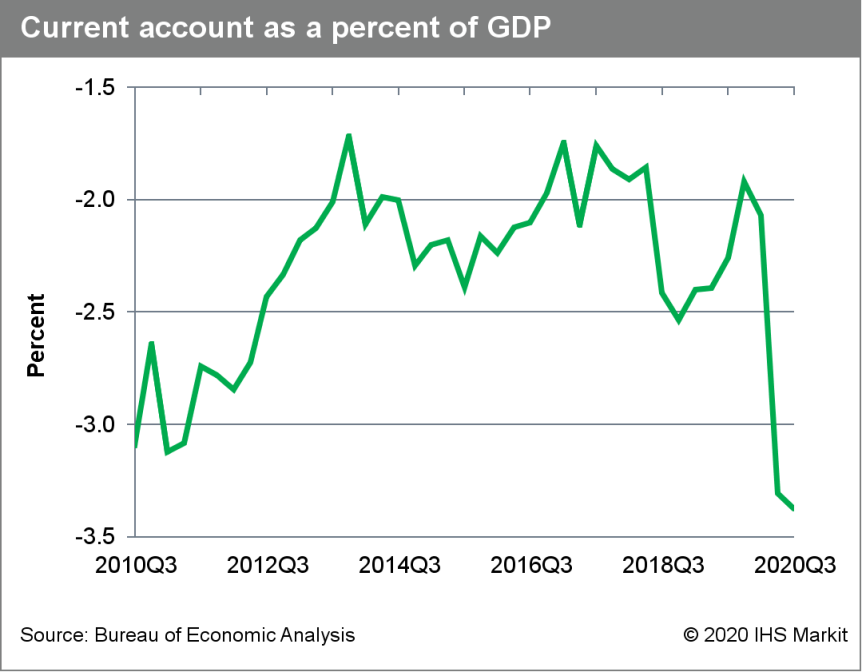

- The US current-account deficit widened by $17.2 billion to

$178.5 billion in the third quarter of 2020. The goods and services

deficit widened by $29.7 billion as imports grew more than exports.

(IHS Markit Economist Patrick Newport)

- The surplus on primary income grew by $14.9 billion to $48.1 billion; the deficit on secondary income (transfers) widened by $2.3 billion to $38.2 billion.

- The current-account deficit moved up a tick to 3.4% of GDP—the largest since the fourth quarter of 2008.

- One should not put too much weight in the first-quarter, second-quarter, and third-quarter numbers because they were tainted by COVID-19, which shut down vast swaths of the global economy, resulting initially in plunging US imports and exports of goods and services and steep declines in earnings domestically and abroad, followed by a rebound that is still ongoing. According to the Bureau of Economic Analysis's press release, "The full economic effects of the COVID-19 pandemic cannot be quantified in the statistics because the impacts are generally embedded in source data and cannot be separately identified."

- The US surplus on primary income is still positive, even though the US net international investment position surpassed $10 trillion this year. The reason: the US rate of return on its foreign holdings greatly exceeds the rest of the world's rate of return on US assets. Economists refer to this as "exorbitant privilege"—the windfall the US enjoys from having the dollar be the currency of choice for international transactions.

- The press release noted that, "A record level of net shipments

of U.S. currency abroad to meet the demand for U.S. currency by

foreign residents increased U.S. currency liabilities, partly

offsetting the net repayment of U.S. deposit liabilities." From the

point of view of the United States, selling currency to foreigners

is near alchemy, because paper bills, which cost cents to

manufacture and are IOUs that will likely never be repaid, are

exchanged for goods and services. About half of the $1.97 trillion

of US currency outstanding is held abroad.

- After being awarded a contract in June 2020 to produce a new Infantry Squad Vehicle for the US Army, General Motors (GM) Defense has announced that renovations have started to prepare for production. The Infantry Squad Vehicle (ISV) will be assembled at a GM property in North Carolina, according to a GM statement. Construction is expected to carry on into the second quarter of 2021, with the production line-up and beginning deliveries in April 2021. The facility will help to manufacture 649 ISVs, as well as support production of as many as 2,065 additional vehicles, if the further contract is authorized. Tim Herrick, interim president of GM Defense, said in the statement, "We have tremendous momentum behind our ISV win, featuring a first-of-its-kind tactical wheeled vehicle that gives our Soldiers speed, durability and performance to enhance mission success. GM Defense is responsible for the design, engineering and manufacturing of the ISV. This facility will enable us to meet our customer's timeline for delivery while continuing our journey to bring commercial technologies and transformative mobility solutions to the defense market." GM Defense notes the location in North Carolina is near its partner Hendrick Motorsports; Hendrick is providing the chrome-moly steel exoskeleton of the vehicle frame. GM won the contract in June 2020 and delivered the first vehicle in October 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Costa Rica's seasonally adjusted IMAE showed a contraction of

6.3% year on year (y/y) compared with October 2019's number.

Economic activity has declined in all industries in 2020 with the

exception of manufacturing (3.4% y/y), information and

communications (0.7% y/y), and scientific, administrative, and

technical professional activities (2.4% y/y). (IHS Markit Economist

Lindsay Jagla)

- The drivers of the annual contraction in economic activity are food service and accommodation (largely due to the shuttering of the tourism industry), retail, transportation and storage, construction, and mining.

- Month-on-month growth has continued unevenly since May and shows a slowdown from the initial rebounds that occurred at the start of the country's economic reopening. In October, economic activity increased by 0.2% m/m from September, monthly growth that is slower than in September and August.

- Costa Rica's monthly economic activity is in line with IHS Markit's expectations that initial recovery following the reopening of the economy would eventually taper off, resulting in slow overall economic growth in 2020.

- While Costa Rica's economic activity continues to improve gradually from the lows seen amid the isolation measures put in place to combat the COVID-19-virus outbreak, the economy will be slow to reach pre-COVID-10 levels. Risks to its recovery include the country's growing fiscal issues that will slow down fiscal stimulus and heighten the risk of social unrest, as well as the continued spread of the COVID-19 virus as the country waits for a vaccine.

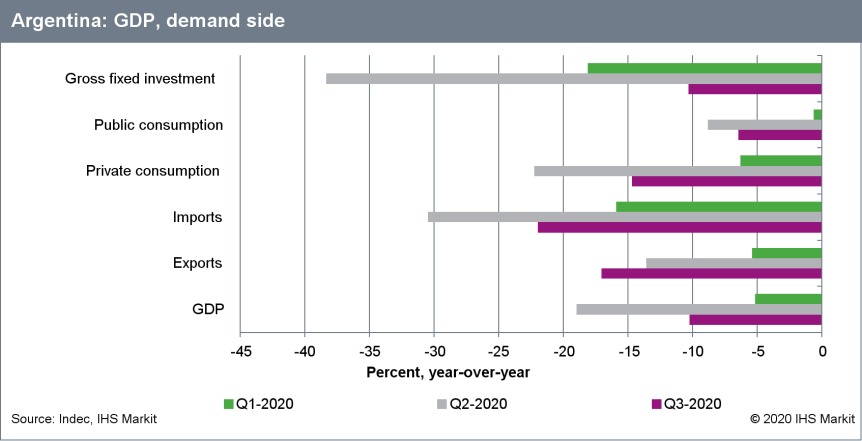

- Correcting for seasonality, Argentina's GDP during the third

quarter of 2020 increased by 12.8% quarter on quarter (q/q) after

declining by 16% q/q in the previous quarter, according to the

revised figures. (IHS Markit Economist Paula Diosquez-Rice)

- The estimate for the GDP deflator in the third quarter of 2020 shows a rise of 35.7% y/y, while the private-sector consumption deflator increased at a higher rate of 36.9% y/y during the same period.

- By sector, the GDP data show mostly annual declines in the third quarter of 2020. For example, hospitality and restaurants posted a decline of 61.5% y/y; the construction sector shrank by 27% y/y; the transport and communication sector dropped by 21.7% y/y; the manufacturing sector decreased by 5.3% y/y; the wholesale and retail sales sector fell by 2.1% y/y; the non-profit and social services sector contracted by 53.8% y/y; and fishing was down by 18.3% y/y.

- Only two sectors recorded a rise in annual terms: activity in the financial intermediation sector increased by 4.6% y/y and the utility sector rose by 2.3% y/y.

- On the demand side, real exports of goods and services decreased by 17% y/y. There were declines in private-sector consumption, which fell by 14.7% y/y, driven by the country's COVID-19-virus-related lockdown and the high inflation rate, and public-sector consumption, which decreased by 6.5% y/y as the inflation rate outpaced the increase in nominal spending.

- Gross fixed-capital formation decreased by 10.3% y/y; this drop was driven by the construction sub-sector, which was down by 15% y/y, while the machinery and durable equipment category decreased by 7% y/y. On the other hand, the transport equipment sector rose by 23% y/y, with the most significant jump recorded in the imported transport equipment sub-component.

- Meanwhile, imports of goods and services decreased by 22% y/y in the third quarter of 2020 as the lockdown was compounded by the annual drop in the value of the local currency, which increased the cost of imported goods.

- The unemployment rate retreated to 11.7% in the third quarter of 2020; however, the labor force remains quite depressed when compared with a year before; the biggest urban area in the country, the extended metro area of the city of Buenos Aires, registered a 13.8% unemployment rate. Meanwhile, the underemployment rate rose to 13.4%.

- The forecast for 2021 GDP has been adjusted upward as the

population's compliance with pandemic restrictions reaches new

lows. The rise in 2021 GDP is driven by the lower comparison base,

the steep drop in 2020, and the private-sector consumption, which,

in turn, is still benefiting from the extensive subsidy programs in

Argentina despite the eminent end of some these programs.

- Argentina's Minister of Economy Martín Guzmán on 14 December invited the opposition coalition Together for Change (Juntos por el Cambio) to become involved in the restructuring of a USD44-billion loan with the International Monetary Fund (IMF). The new program will need congressional ratification and will take the form of an extended fund facility (EFF), allowing for a longer repayment schedule. Delaying debt-service payments is a critical government goal; under the existing stand-by arrangement, initial repayments to the IMF are due in September 2021. The government expects the EFF to be finalized by April 2021. Although the government has ruled out implementing austerity measures, gradual fiscal adjustment is likely. Argentina's 2021 national budget sets a primary fiscal deficit target of 4.5% of GDP, with IHS Markit estimating a fiscal deficit of 11.8% in 2020 and 8.6% in 2021. IHS Markit's sources in Argentina suggest that the IMF is likely to request deeper spending cuts, and that the government would consider adjusting its fiscal deficit target to below 4%, driven mainly by a lack of financing at acceptable rates rather than the IMF imposing conditionality. The termination of some COVID-19-virus-related assistance programs on 31 December, namely the emergency support to families (Ingreso Familiar de Emergencia: IFE) and the financial aid for private companies to pay salaries (Asistencia de Emergencia al Trabajo y la Producción: ATP) are likely to generate savings worth 2% of GDP, according to IHS Markit's estimates. Further cuts are likely to include unfreezing transport and utility tariffs and adjusting pension calculation mechanisms. However, such measures are likely to be insufficient to achieve significant fiscal improvements. Pensions have barely kept pace with inflation in 2020 and significant savings from changes in the formula for indexation (inflation adjustment) are unlikely. Energy subsidies increased to 2% of GDP in 2020, so significant savings would require steep tariff adjustments, which would be politically unacceptable, representing an extremely unpopular move during economic recession. Government presentation of a clear economic plan would increase the likelihood of the opposition agreeing to work with the government in the IMF renegotiations, also facilitating a new program's passage through Congress. (IHS Markit Country Risk's Paula Diosquez-Rice and Carla Selman)

Europe/Middle East/Africa

- European equity markets closed lower; Spain -1.4%, France -0.4%, Germany/UK -0.3%, and Italy -0.2%.

- 10yr European govt bonds closed mixed; Spain/Italy +3bps, France +1bp, Germany flat, and UK -4bps.

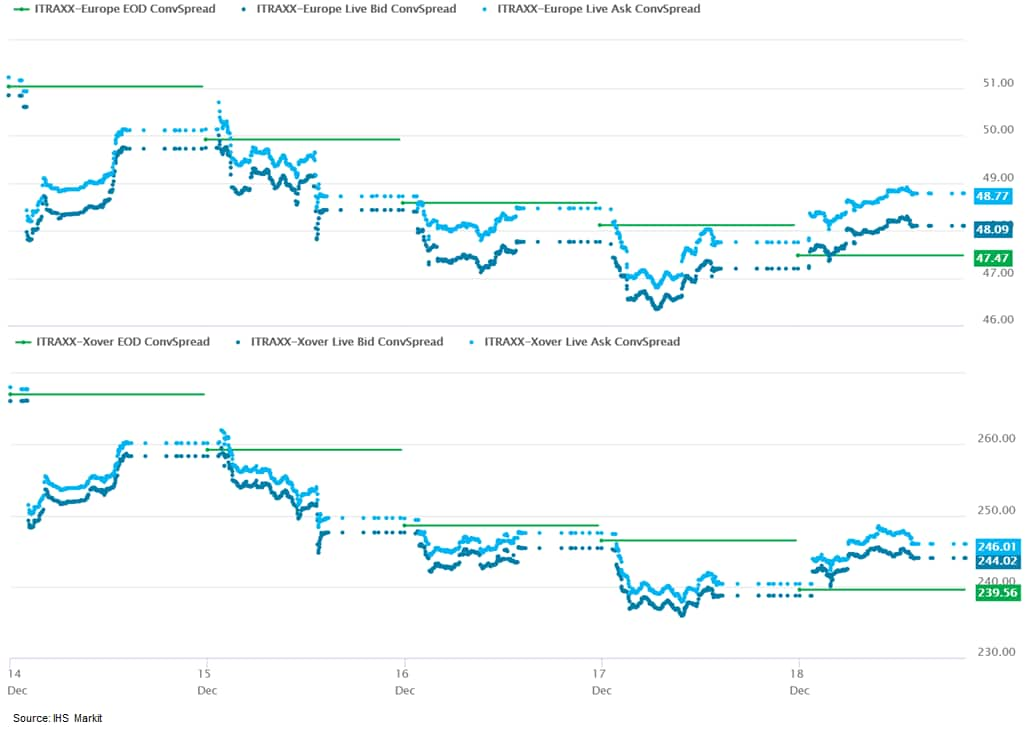

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +5bps/245bps,

which is -3bps and -22bps week-over-week, respectively.

- Brent crude closed +1.5%/$52.26 per barrel.

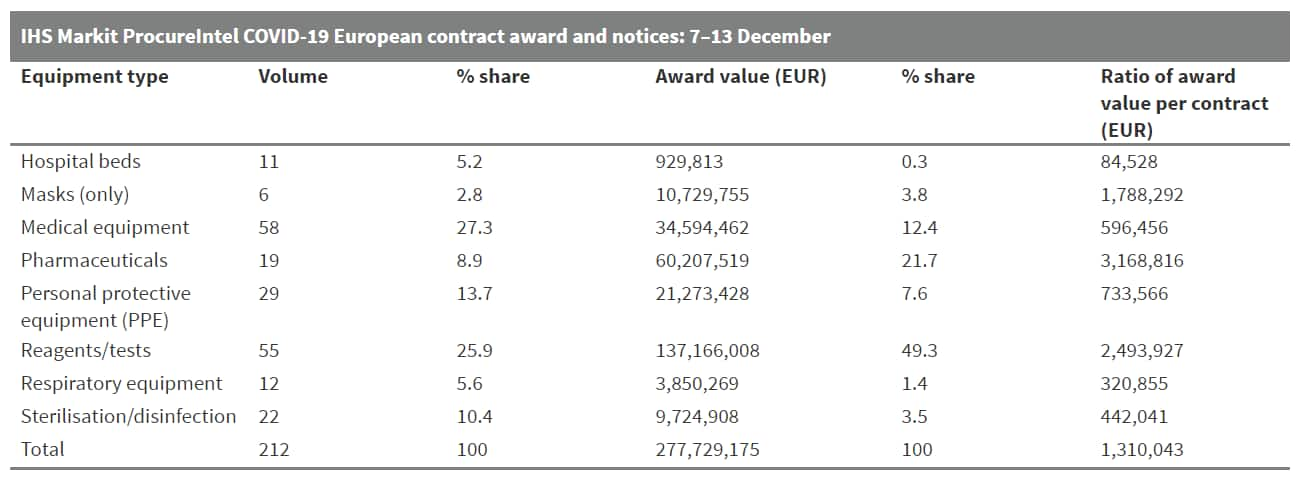

- IHS Markit's weekly ProcureIntel tendering analytics report for

7-13 December identified 212 COVID-19-related European tenders.

This represents a week-on-week increase of 114% compared with 99

tender awards and award notices during the first week of December.

The estimated maximum value of the market, including awards and

award notices, amounted to EUR278 million (USD340 million). The

7-13 December market was driven by demand from reagents/diagnostic

tests, which constituted 49% of the potential maximum award value

of the market. The remainder of the market was held to low single

digit percentage shares in terms of value, with the exceptions of

pharmaceuticals (22%) and medical equipment (12%). According to IHS

Markit ProcureIntel analysis, Romania (33%), the United Kingdom

(28%), and Spain (20%) had the largest value share of the

procurement market, with an estimated combined total of about 81%

of the EUR278 million upper potential value of tenders. (IHS Markit

Life Sciences' Eóin Ryan)

- As expected, the Bank of England (BoE) kept its monetary policy

unchanged following its latest meeting. But it remains ready to act

again to counter the "unusually uncertain" outlook for the economy

because of the COVID-19 virus pandemic and accompanying

restrictions as well as the nature of, and transition to, the new

trading arrangements between the EU and the UK. (IHS Markit

Economist Raj Badiani)

- The BoE's MPC voted unanimously to maintain the Bank Rate at 0.1% at its meeting ended 17 December and did not hold a vote to impose negative rates.

- The MPC voted unanimously for the BoE to continue with its existing programs of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, maintaining the target for the total stock of these purchases at GBP745 billion (USD967.8 billion) by the end of this year.

- As of 16 December, the total stock of the Asset Purchase Facility (APF) was GBP743 billion, representing a rise of GBP299 billion as part of the combined GBP300-billion programs of asset purchases announced on 19 March and 18 June. This consists of GBP289 billion of UK government bonds and GBP10 billion of sterling non-financial investment-grade corporate bonds.

- In addition, the MPC voted unanimously to commence the purchase another GBP150 billion of government bonds to raise the total amount of quantitative easing (QE) from GBP745 billion to GBP895 billion over the course of 2021.

- The MPC again failed to spell out how additional stimulus would lift spending when public and private borrowing costs are already at historically low levels. Indeed, the 10-year gilt yield stands at 0.26%. However, the expanded QE program will help maintain cheap financing costs, with the government facing a public-sector net borrowing requirement around GBP400 billion, and around 20% of GDP in the 2020-21 financial year.

- The inflation outlook is benign. The rate stood at a multi-year low of 0.3% in November and is set to remain below 1.0% until early 2021, below the BoE's 2% target. Lower inflation is due to the impact of lower energy prices and the temporary cut in VAT for the hospitality sector, holiday accommodation, and tourism attractions. However, inflation is likely to be "around 2% in two years' time" because of increasing domestic price pressures as spare capacity diminishes.

- The MPC assumes "an immediate but orderly move to a comprehensive free trade agreement (FTA) with the European Union on 1 January 2021". The EU-UK FTA could mirror the Comprehensive Economic and Trade Agreement (CETA) in place between Canada and the European Union, which removes most tariffs on goods and increases quotas. However, it fails to encourage trade in services, with trade in financial services not included.

- Therefore, the bank assumes that the UK leaving the EU's single market and Customs Union will trigger some restrictions on trade between the UK and the EU. Consequently, it expects that trade in both goods and services "is likely to be lower as a result. In line with empirical evidence, this reduction in trade with the EU is expected to weigh on productivity and GDP over the forecast period."

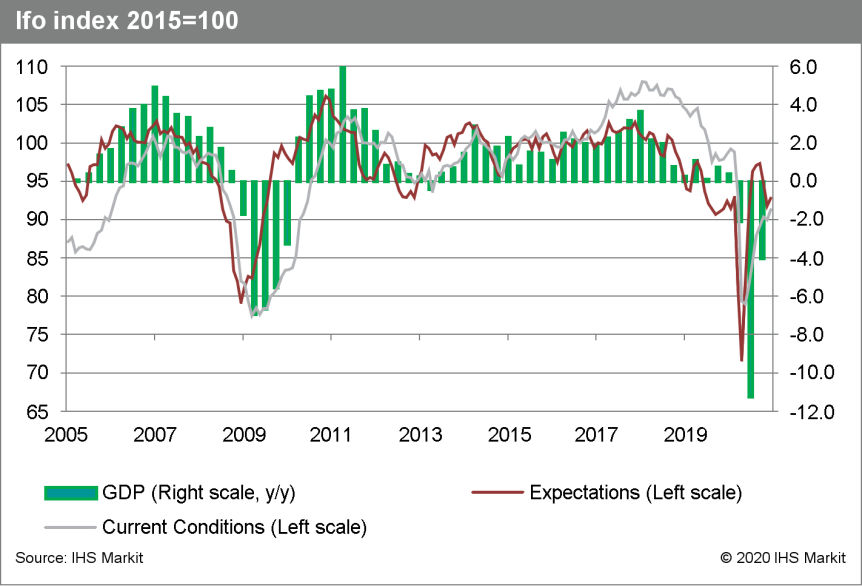

- The headline German Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has unwound about half of the setback endured during

October-November in December, effectively resuming the recovery

observed since May. It increased from 90.9 in November (revised up

from 90.7) to 92.1 in December. This compares to February's

pre-pandemic level of 95.8, an all-time low of 75.4 in April, and a

long-term average of 97.0. The Ifo institute fails to provide a

reason for the rebound, merely stating that the German economy is

showing resilience despite the fact that the renewed strict

lockdown - imposed in mid-December and lasting at least until 10

January 2021 - strongly hurts individual sectors. (IHS Markit

Economist Timo Klein)

- While current conditions outperformed expectations by a wide margin during August-November (catching up with expectations' surge during May-July), this was only marginally so in December. Business expectations increased from 91.8 (revised up from 91.5) to 92.8 current conditions from 90.0 to 91.3. Expectations improved the most in manufacturing, as this sector is the least vulnerable to the lockdown measures imposed in mid-December, but wholesaler optimism about the future also increased markedly. Service-sector confidence about the coming months improved modestly - which nonetheless is noteworthy in view of widespread forced closures of such businesses for now - whereas both retail and construction sector optimism waned. By contrast, current conditions improved in all sectors, even among retailers and in the service sector, although it needs to be considered that most survey responses were returned before the strict lockdown began.

- The breakdown of overall indices by sector, which combines expectations and current conditions, shows that business confidence increased the most among wholesalers and manufacturers in December, followed at a distance by services and retailers. Construction confidence remained flat versus November. In level terms, the manufacturing climate now clearly outperforms that in all other sectors, contrasting with underperformance between early 2018 and mid-2020. This is followed by wholesaler confidence, whereas the other sectors remain (modestly) in negative and thus contraction territory.

- The Ifo graph portraying the cyclical position of the diffusion index of the headline measure - setting the current conditions and expectations balances against each other - signals that the economy remains in downswing territory. However, it has switched direction to move towards boom territory again, which it had briefly entered during August-September already. The assessment of current conditions rebounded from 5.1 to 8.2 while expectations recovered part of their recent setback and gained from -7.5 to -5.5. This is remarkable in view of it being quite uncertain at this point when the tightened COVID-19 related restrictions can be loosened again - many epidemiologists foresee an extension beyond the date of 10 January that the current measures definitely will stay in place.

- December Ifo survey results are a pleasant surprise in view of it having become abundantly clear in early December that the "light lockdown" imposed at the start of November would have to be replaced by a much stricter regime well before Christmas. In particular, the rebound of business expectations is encouraging in view of lingering high uncertainty levels about the evolution of the public health situation and the measures needing to be maintained or taken in response during the first quarter of 2021.

- The degree of damage to German economic activity by the latest

lockdown regime depends heavily on its duration, but manufacturing

sector resilience is expected to provide significant support in any

case, unlike in March-April. This is due to the fact that plant

closures enacted at that time to put various protective measures

and changes in work processes in place to ensure human distancing

requirements were largely one-off investments that do not have to

be repeated in the current second wave of the pandemic. We do not

expect the government to force manufacturing production to close

down, and the supply chain disruptions observed in March-April due

to the impact of the pandemic on Asian (especially Chinese)

economies are not an issue anymore now.

- German privately owned biopharma major Boehringer Ingelheim has announced that it is to acquire the Swiss clinical-stage biotech NBE-Therapeutics for a total of EUR1.18 billion (USD1.44 billion). According to Boehringer, a binding agreement has been signed that involves the acquisition of all shares in NBE-Therapeutics, which specializes in antibody-drug conjugates (ADCs) and developing targeted cancer therapies using its immune stimulatory iADC platform. As part of the acquisition, Boehringer gains access to NBE-Therapeutics' lead candidate NBE-002, which is undergoing Phase I trials in triple negative breast cancer, and other solid tumors. Additionally, Boehringer also gains access to NBE's platform, which it will harness in the development of what it describes as a "leading ADC portfolio". In addition to the EUR1.18-billion payment, the deal also includes clinical and regulatory milestone payments, although details of these are not provided. The acquisition is subject to the normal regulatory closing conditions, and is expected to be completed during the first quarter of 2021. This is a comparatively large acquisition, particularly for Boehringer Ingelheim, and reflects its strong strategic focus on the oncology space. The company has recently extended its oncology research and development collaboration with Oxford BioTherapeutics and launched a co-operation agreement on cancer immunology with US-based Trutino Biosciences. (IHS Markit Life Sciences' Brendan Melck)

- Volkswagen (VW) has announced that the ID.3 and ID.4 electric vehicles (EVs) will offer optional augmented reality head-up display technology, which it says is a first in the compact segment. The augmented reality display superimposes navigation indicators including turn arrows and markings over actual surroundings. VW says this move continues its strategy of offering high-tech features at affordable prices. Frank Welsch, member of the board of management for development, said in a company statement, "We have introduced a genuine innovation in series production. And we have done this not in a premium vehicle, but in the compact models of the all-electric ID. family. Making pioneering technologies available to a large number of customers is a core competency of Volkswagen." The display projects important information onto the windscreen, separated into two fields and levels. A large window for the dynamic display is in the driver's field of view at a virtual distance of about 10 meters, with a diagonal measuring about 1.8 meters; the far window will display assist system information and turn arrows and starting points for navigation. A close-range window is as a flat band under the far-range window, VW says. That window shows driving speed, road signs, and static information about assist systems and navigation. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ruter, Holo, Toyota Motor Europe, and Sensible 4 have teamed up to launch autonomous mobility trials in Oslo (Norway). Sensible 4 will employ its full stack autonomous vehicle (AV) software in Toyota Proace vehicles that will be integrated into Ruter's public transport service. These AVs will be operated by mobility service provider Holo, which has conducted AV pilot projects in five different countries. This new service will be called "Line 529" and will operate for a period of one year. Initially, two vehicles will be deployed to map the area and conduct five hundred hours of test operation without passengers on board. Following this, residents will be able to use this new service in the first quarter of 2021. Harri Santamala, Sensible 4 CEO, said, "Autonomous vehicles complement the already existing public transportation network by providing new last-mile transportation services. He expressed gratitude for the support provided by Ruter in pursuing this futuristic solution". The new service aims to integrate AVs into public transportation to reduce the need for private car use. AVs hold the potential to revolutionize personal transportation by expanding access to mobility. AVs are used for trials and tests to support ride-hailing and car-sharing services, goods delivery, and first and last mile connectivity. Sensible 4 specializes in developing AV technologies for harsh weather conditions and has developed an autonomous shuttle, the Gacha, with Japanese lifestyle brand Muji. This year, Sensible 4 partnered with SoftBank's driverless bus venture, SB Drive, to accelerate the adoption of autonomous buses in Europe and Japan. Holo was founded in 2016 and claims to have received permits to conduct AV trials in five countries: Sweden, Norway, Finland, Estonia, and Denmark. Holo has transported over 50,000 passengers in AVs covering more than 50,000km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In early December, Denmark's government announced a multi-party parliamentary agreement that ends all new licensing for petroleum E&P with immediate effect, cancels the delayed 8th Licensing Round, and aims to phase out all E&P activities by 2050. The agreement, which commits the signatories to voting in favor of enabling legislation, was supported by the governing Social Democratic party, along with the main opposition Venstre party, the Danish People's Party, the Radical Left, Socialist People's Party, and the Conservative People's Party. The six parties control roughly 149 of 179 seats in Denmark's parliament, the Folketing. With the agreement, Denmark becomes the largest producing province to date to set a timeline to end all hydrocarbon E&P. The decision concludes nearly two years of uncertainty about the future of the country's hydrocarbon sector following the February 2019 closing of the 8th Licensing Round, which drew five applications from four companies. The authorities initially postponed awards for the round so that elections could be held in June 2019, but the newly elected Social Democratic-led government declined to award licenses after taking office, instead indicating in October 2019 that it was reconsidering whether to proceed with the round. In October 2020, Total (the Danish North Sea's largest player) announced that it was withdrawing from the round, followed by two other companies, leading the Ministry of Climate, Energy, and Utilities to call for the parliamentary debate on the sector that ultimately produced the far-reaching December agreement. (IHS Markit E&P Terms and Above-Ground Risk's Kevin Whited)

- The Business Daily reported on 18 December that for the first

10 months of the year 2020, Kenyan banks have reported a pre-tax

profit decline of 29.7%. Profit before tax reduced from KES140.7

billion (USD1.2 billion) in October 2019 to KES98.9 billion in the

same period in 2020; according to the Central Bank of Kenya (CBK),

that is the lowest reported pre-tax profits in five years for the

banking industry. The main reason for the decline in banks'

earnings is the increase in impairments because of challenging

macroeconomic conditions, forcing banks to increase their loan loss

provisions. (IHS Markit Banking Risk's Ana Souto)

- Prior to the COVID-19-virus outbreak, Kenyan banks' earnings were beginning to recover from the interest-rate cap period introduced by the CBK in September 2016 but repealed in November 2019.

- In addition to increasing provisions, banks had to restructure loans and grant temporary holiday payments to support borrowers affected by trade disruption because of social-distancing measures instituted by the government to contain the spread of the virus. This resulted in additional pressure in banks' earnings, as evidenced by their pre-tax earnings measured by the pre-tax return on assets that reduced from 3% in March 2019 to 2.2% in March 2020, when last reported.

- According to the CBK's latest Monetary Policy Press release (November 2020), banks had to restructure KES1.38-trillion worth of loans, equivalent to 46.5% of the total sector loans as of October. The sector's non-performing-loan ratio increased from 12% at the end of 2019 to 13.6% in October 2020, and is expected to further deteriorate, requiring banks to raise more provisions given the challenging macroeconomic environment.

- Earlier media reports indicated that tier-1 banks had increased provisioning for loan impairments by KES50 billion in the nine months to September, reflecting the high incidence of default on payments.

- Given the increased credit risks, loan growth has eased. According to IHS Markit's calculations, the sector's year-on-year (y/y) loan growth reduced from 9% for the year ended September 2019 to 7% for the same period in 2020. We project that year-on-year credit growth will remain muted for the fourth quarter of 2020 through 2021, at about 7.4% and 4.7% for 2020 and 2021, respectively, compared with 8.1% in 2019.

Asia-Pacific

- APAC equity markets closed mixed; Australia -1.2%, Hong Kong -0.7%, Mainland China -0.3%, Japan -0.2%, South Kore +0.1%, and India +0.2%.

- The China Banking and Insurance Regulatory Commission (CBIRC)

has approved the establishment of China Galaxy Asset Management

Company Ltd on 17 December. The latter will be the fifth asset

management company (AMC) in China and the first AMC to be given

approval to establish since 1999. (IHS Markit Banking Risk's Angus

Lam)

- According to the press notice on the CBIRC's website, China Galaxy Asset Management Company will have registered capital of CNY10 billion (USD1.5 billion), with state-owned China Galaxy Financial Holdings taking a 65% stake, state-owned Central Huijin Investment taking 13.3%, Nanjing Zijin Investment taking 10%, state-owed Beijing Financial Street Capital taking 6%, and CITIC Securities 5.7%. Among other things, the new AMC will be allowed to purchase and manage bad loans from financial institutions, perform debt-to-equity swaps, issue bonds, perform bankruptcy proceedings, and deal with bad loans from non-financial companies.

- Four state-owned AMCs were set up in 1999 to deal with the rising bad loans issue, and the landscape has remained unchanged for more than 20 years. Over the years, these AMCs have performed other activities, including lending to struggling businesses.

- Although China Galaxy Asset Management Company is not the first AMC to be set up in the last 20 years, with Hong Kong-based NWS Holdings Limited and US-based Oaktree Capital obtaining a license to start private-sector AMCs, the scale is substantially larger with China Galaxy Asset Management Company. The size and backing from state-owned enterprises will suggest significant firepower to deal with bad loans.

- Pony.ai has received permit from Guangzhou authority to test its autonomous trucks on public roads, according to Gasgoo. The company claims that its trucks have passed through many testing items for such complex scenarios as traffic light recognition, obstacle avoidance, car-following, lane merging, overtaking, emergency parking, and travelling across crossroads and roundabouts. The company has launched autonomous mobility pilots in multiple cities across the US and China and as of October 2020, the startup's fleet had run for over 3.5 million miles. Pony.ai was founded in 2016 and develops Level 4 autonomous technology. The company has already received licenses from the Beijing and Shanghai authorities to test its autonomous vehicles on public roads in these cities. (IHS Markit Automotive Mobility's Nitin Budhiraja)

- LG Uplus has demonstrated autonomous parking solution using its high-speed 5G network, reports The Korean Herald. The online video demonstration is conducted in partnership with Hanyang University's ACE Lab and technology company Controlworks. The test car, Genesis GV80 SUV equipped with LiDAR and radar sensors, travelled about five minutes on roads and parked itself in a public parking lot. The vehicle started off on a road 800 meters away from the car park and followed traffic signals using 5G technology on the way to park in a tight space safely. LG Uplus aims to deploy 5G infrastructure in major South Korean cities. The mobile carrier will establish 5G mobile communication infrastructure for South Korea's AV test-bed, K-City. This year, the company partnered with Chemtronics to demonstrate an autonomous shuttle service in a residential area in Sejong city. LG Uplus has also partnered with Hanyang University to demonstrate a 5G-connected AV, named the A1, capable of Level 4 autonomy. BlueSpace was founded in April 2019 and builds software using high cognitive capabilities that can accurately identify the surrounding environment. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Fiat Chrysler Automobiles (FCA) will invest USD150 million to set up a new global digital hub in the southern city of Hyderabad in India, reports Money Control. The facility is expected to create 1,000 new jobs by the end of 2021 and there are plans to increase hiring over the next two to three years. "Our goal is to build an innovation powerhouse that will harnesses the intelligence enabled by data to build new products and services to deliver at the speed of our customers' expectations. One of the key objectives of FCA ICT India is to digitize every aspect of FCA's automotive operations globally and within India, and to shift from legacy to digital through adoption of emerging technologies," said Mamatha Chamarthi, CIO, FCA, North America and Asia Pacific. FCA currently has engineering teams in Chennai and Pune, employing over 1,500 people. This new facility will augment the existing engineering teams and will support FCA's digitization efforts. The new global digital hub will focus on building strategic competencies in areas such as connected vehicle programs, artificial intelligence, data accelerators, and cloud technologies. (IHS Markit AutoIntelligence's Jamal Amir)

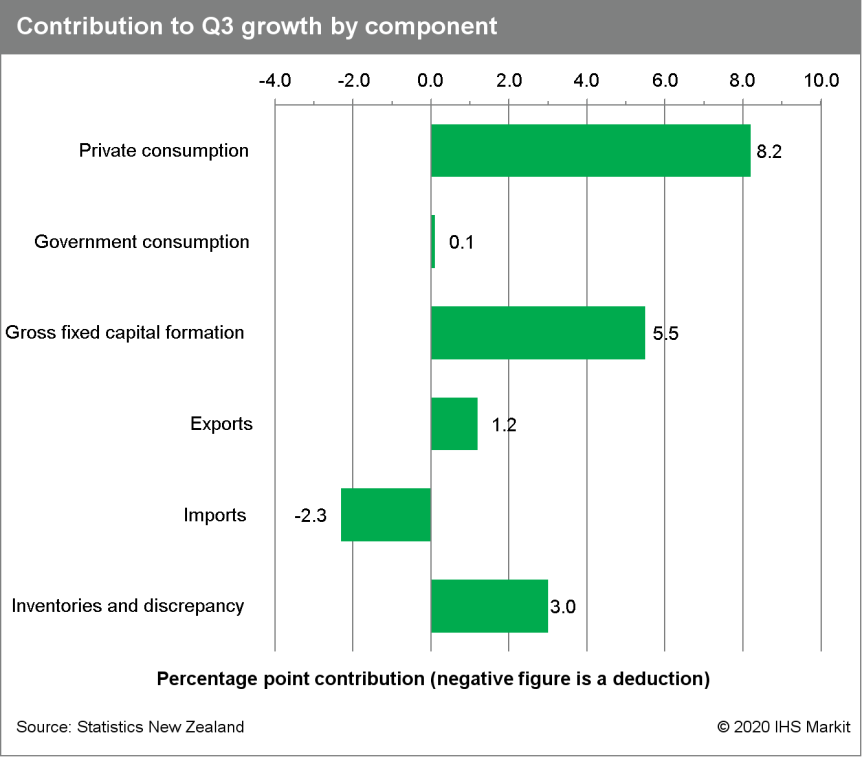

- New Zealand's real expenditure-side GDP rebounded by a record

15.7% quarter on quarter (q/q) in the September quarter as the

COVID-19 virus-related restrictions seen in the previous quarter

finally eased. However, the current account returned to deficit

following last quarter's record surplus, mostly due to imports

recovering from their sharp drop in the June quarter. (IHS Markit

Economist Andrew Vogel)

- In real (inflation-adjusted), seasonally adjusted, quarter-on-quarter (q/q) terms, expenditure-side GDP growth rose 15.7% - by far the fastest pace on record - during the September (third) quarter, surprising on the upside versus market expectations.

- Although the expenditure and production measures of GDP are theoretically equivalent, media and government agencies usually focus on production-side GDP as Statistics New Zealand has determined that the production measure is less volatile. In real gross value-added terms, economic activity rose by a seasonally adjusted 14.0% q/q during the September quarter.

- Private consumption rebounded considerably after two straight quarters of declines, reaching 14.8% q/q, with expenditures on retail, transportation, and accommodation all booming as a result of the easing of strict lockdown measures associated with the COVID-19 virus pandemic. Household spending rose significantly on durable goods (29.7% q/q), non-durable goods (12.3% q/q), and services (12.1% q/q).

- General government consumption was up again (0.3% q/q), albeit by less than the previous quarter as central government spending grew very little (0.1% q/q) without new fiscal stimulus measures undertaken to combat the shock from the COVID-19 pandemic. Local government spending accelerated 2.3% q/q, but its overall contribution to general government consumption is much smaller.

- Gross fixed capital formation also saw a rebound for the quarter, as non-essential business activity (including construction) largely returned to pre-COVID-19 levels, despite Auckland's alert level 3 COVID-19 restrictions in August. By far the largest driver was the recovery in residential building construction (up 42.0% q/q), although the increases in plant, machinery, and transport equipment spending, as well as non-residential building and other construction also contributed significantly as they also rose between 20-40% q/q.

- The inventories and statistical discrepancy component of GDP was notably elevated, adding 3.0 percentage points from growth. This is not entirely unexpected due to the unusually large shock from the country's strict containment measures, but will require monitoring in the coming quarters, as it could trigger significant revisions to growth.

- New Zealand's current account returned to deficit after its first surplus in over a decade last quarter, driven by the large increase in nominal imports (8.8%) relative to the smaller (1.4% q/q) increase in nominal exports. That said, on an annual basis New Zealand's current account deficit is still significantly smaller than last year - just NZD2.6 billion for the September 2020 year versus NZD11.6 billion for the September 2019 year.

- The September quarter results were stronger than IHS Markit's

expectations, and will lead to upward revisions for our 2020 GDP

forecasts, even after a substantial upgrade in our December

forecast to -4.6%. The magnitude of the upgrade for 2021 will be

contingent on fourth-quarter data and high frequency indicators

also pointing to a sustained rebound in economic activity.

Additionally, elevated household debt levels, and reduced inward

migration will weigh on the recovery in 2021, preventing a

significant upgrade to that forecast.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-december-2020.html&text=Daily+Global+Market+Summary+-+18+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}