Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 29, 2020

Daily Global Market Summary - 29 December 2020

European equity markets closed higher across the region and US/APAC markets were mixed. US government bonds and the dollar closed flat, while benchmark European bonds were higher. CDX closed tighter, but near the widest levels of the day. Gold/oil closed lower and silver/copper were higher on the day.

Americas

- The US equity market closed mixed; S&P 500 +0.9%, DJIA/Nasdaq +0.7%, and Russell 2000 -0.4%.

- 10yr US govt bonds closed flat/0.93% yield and 30yr bonds flat/1.66% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -3bps/295bps.

- DXY US dollar index closed flat/90.34.

- Gold closed -0.1%/$1,880 per ounce, silver +2.4%/$26.54 per ounce, and copper +0.3%/$3.57 per pound.

- Crude oil closed -1.3%/$47.62 per barrel.

- The US House of Representatives is set to vote Monday to replace the $600 stimulus payments in the newly enacted pandemic relief law with the $2,000 President Donald Trump demanded -- a Democratic-led effort that is politically fraught for congressional Republicans and unlikely to become law. The bill would need two-thirds support to clear the House under the procedure being used for the vote, and it remains unclear if enough Republicans will shelve their opposition to higher payments -- partly driven by deficit concerns -- to support Trump's request. (Bloomberg)

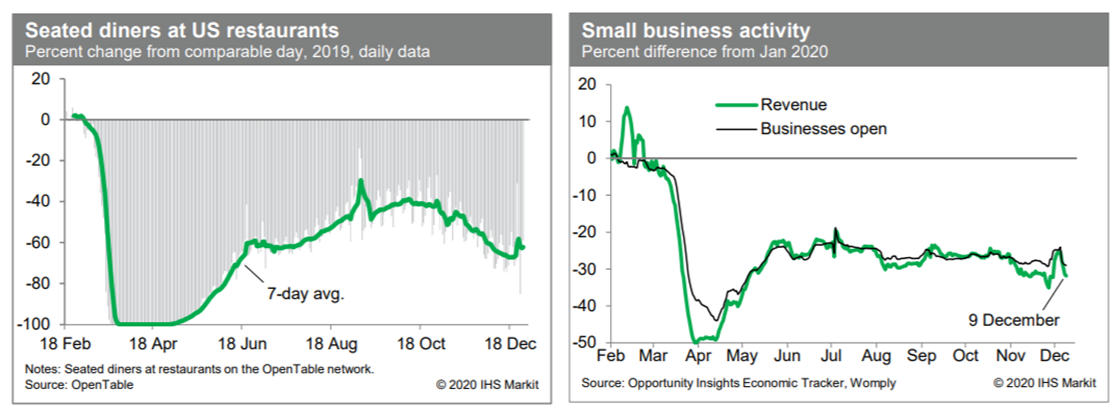

- Averaged over the last seven days, the count of seated diners

on the OpenTable platform, relative to year-earlier levels, was

down about 62%. This was 5 percentage points better than the prior

week's reading, but volatility around the Christmas holiday may

have influenced the latest weekly data so it is too soon to tell if

the downward trend since mid-October has stalled or begun to

reverse. Meanwhile, activity at small businesses (revenue and the

number of small businesses in operation) turned up in the first few

days of December before reversing those gains by 9 December,

according to the Opportunity Insights Economic Tracker. This

followed diminishing activity over most of November and left

small-business activity in line with a flat trend, down materially

from January. (IHS Markit Economists Ben Herzon and Joel

Prakken)

- Merck & Co. (US) announced that it has entered into an agreement with the US government under which it will receive support for the development, production, and early distribution of investigational biological therapeutic CD24Fc, to be renamed MK-7110, upon its receiving approval of emergency use authorization (EUA) from the United States FDA. The molecule, a potentially first-in-class recombinant fusion protein targeting the innate immune system, was brought into Merck's pipeline under its recent acquisition of Oncoimmune (US), and it is involved in late-stage trials for the treatment of severe and critical COVID-19.. The agreement foresees Merck receiving up to USD356 million for producing and supplying 60,000 - 100,000 doses of MK-7110 to the US government until 30 June 2021, as part of the goals of Operation Warp Speed. MK-7110 is intended to suppress the body's inflammatory response to SARS-CoV-2, which is a major cause of severe illness in patients with COVID-19. Although other immunomodulatory drugs have been tried in the treatment of COVID-19, notably Roche (Switzerland)'s Roactemra (tocilizumab), results have been unconvincing. However, it appears that Merck has been sufficiently convinced of the potential of the molecule, and it will now be able to pursue its development with the financial support of the US government. (IHS Markit Life Sciences' Brendan Melck)

- Nikola and waste company Republic Services had agreed to collaborate on developing a battery-electric refuse truck, but have announced the end of the collaboration. The end of the collaboration also means the cancellation of Republic Services' order for 2,500 units. Hydrogen fuel-cell and battery electric vehicles are being explored by several automakers in the MHCV space, as well as battery electrics. The propulsion systems have advantages in MHCV use, and there are increasing regulatory pressures for a shift to zero-emission vehicles only, even in the MHCV category. Nikola is looking to develop its presence in a space that has the potential for demand growth in the coming decades, but it must first survive a difficult initial development period. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Robotics company Nuro has received a permit to launch a commercial autonomous delivery service in California (US). This is the first ever permit issued from the state's Department of Motor Vehicles (DMV), and it will allow Nuro to charge customers for its driverless delivery service, reports TechCrunch. Nuro will deploy its fleet of light-duty driverless vehicles in Santa Clara and San Mateo counties. The company will initially use autonomous Toyota Priuses to launch the service in early 2021, and later add its own low-speed R2 vehicles, which has no pedals or steering wheel. In a separate statement, Nuro has acquired autonomous truck startup Ike for an undisclosed amount. The companies have already started working on integration of teams and technology and this will support Nuro to "move faster on an ambitious mission to make people's lives better with automated vehicles". It is the second big milestone for Nuro this year. In February, Nuro was granted approval by US regulator the National Highway Traffic Safety Administration (NHTSA) to deploy up to 5,000 autonomous vehicles (AVs) with no traditional controls in Houston, Texas. The company received USD500 million funding in November, bringing its total funding so far to USD1.5 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Lloyd's Register and Northeast Technical Service Co. (NETSCo) have signed an agreement to design and develop a Jones Act compliant wind turbine installation vessel (WTIV). Under the joint development project agreement, NETSCo will handle concept design of the vessel, while Lloyd's Register will review and evaluate the design. The design will focus on "meeting the requirement of current developments along the U.S. East coast and Great Lakes such as crane capacity, deck space and water depth." (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- In October, Mexico's monthly index of economic activity (MIEA)

grew by 1.6% compared with September, driven by growth in industry,

particularly manufacturing. An increase in the number of COVID-19

cases is prompting restrictive measures that will slow down growth.

(IHS Markit Economist Rafael Amiel)

- The National Statistics Office of Mexico (INEGI) reported that the MIEA grew by 1.6% month on month (m/m) in October compared with September; this is based on seasonally adjusted data.

- Growth was driven by industry (up 2.0% m/m), which in turn was propelled by an acceleration in manufacturing and construction. In the first case, the automotive industry played a key role as exports of cars to the United States grew substantially. Construction data are very volatile and do not suggest a trend; this follows a big decline in September.

- Growth in the service sector - the most affected by the pandemic - is still relatively low and will not improve significantly until COVID-19-virus-related restrictions are lifted.

- The MIEA growth rate for September was revised up from 1.0% m/m to 1.2% m/m.

- The arrival of the vaccine and approval of a new fiscal stimulus package has prompted the IHS Markit US macro team to revise its forecast for GDP growth. A similar revision will follow for Mexico in the January 2021 forecast round. We anticipate that Mexico's GDP will grow by 3.7% in 2021, but this estimate may increase by 4-5 tenths of a percentage point once we incorporate the new figures for the US economy.

- Mexico is co-operating with COVID-19-virus vaccine developers and should be among the first countries to receive a vaccine. This means that by the end of the third quarter of 2021 most of the population will have been vaccinated and economic activity will reflect Mexico's new normality.

- COVID-19 cases are increasing again in Mexico, which has a traffic light system: Mexico City (Federal District), Baja California, and the state of Mexico are on a "red light", which means that non-essential businesses must close. These three states account for almost 30% of national GDP.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Germany +1.5%, France +1.2%, Italy +0.7%, and Spain +0.5%.

- 10yr European govt bonds closed higher; Italy -5bps, France -2bps, and Germany/Spain -1bp.

- Brent crude closed -0.9%/$50.90 per barrel.

- EU ambassadors have approved the post-Brexit trade agreement

that was announced on Christmas Eve, according to a spokesman from

the German government. However, agri-food industry warns of future

disruption. (IHS Markit Food and Agricultural Policy's Steve

Gillman)

- Over 60% of British agri-food exports go to the bloc, according to the UK farmers union, while FoodDrinkEurope estimates that 73% of the UK's imports of agri-food products came from the EU-27.

- FoodDrinkEurope said it is essential for authorities on both sides to move at "lightning speed" to ensure that border controls can operate efficiently from 1 January.

- Mella Frewen, the trade group's director general, said: "Failure to move quickly will lead to more border chaos and supply chain disruption that will not only put thousands of jobs at risk, but also impact the safe supply of affordable agri-food products to consumers."

- FoodDrinkEurope want government authorities to ensure that businesses understand the new trade requirements and called on the Commission to establish direct communications with agri-food chain operators to identify and solve border any issues that arise over the coming weeks and months.

- Frewen also called for "swift deployment" of the EU's €5 billion Brexit Adjustment Reserve, which hopes to help the sector deal with the costs of the future trading situation, and said EU policymakers still need to scrutinize the EU-UK trade agreement to understand its full implications.

- The European Parliament must still ratify the post-Brexit trade deal, probably by late February, but EU member states have the option to provisionally apply the agreement before their approval.

- GE Renewable Energy has scored a first with its 14 MW Haliade-X offshore wind turbine. The company has been selected by Dogger Bank Wind Farm as the preferred turbine supplier for its Dogger Bank C project. Finalization of the supply agreement and confirmation of the order will take place in the first quarter of 2021, and subject to the project reaching final close, expected to be in late 2021. The turbines are scheduled to be installed in 2025, with completion sometime in 2026. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The CEO of the Volkswagen (VW) Group, Herbert Diess, has said that VW is taking the prospect of Apple entering the automotive space very seriously, according to a Bloomberg report. Apple was reported earlier this week to be targeting a 2024 entry into the automotive market with its 'Project Titan' vehicle project that would employ a brand new battery chemistry. Diess is all too aware that Apple's formidable technology capability and massive cash reserves will make it a potentially formidable competitor. In a Linked-In post Diess said, "We look forward to new competitors who will certainly accelerate the change in our industry and bring in new skills,". He added, "The unbelievable valuation and the practically unlimited access to resources instill a lot of respect in us." (IHS Markit AutoIntelligence's Tim Urquhart)

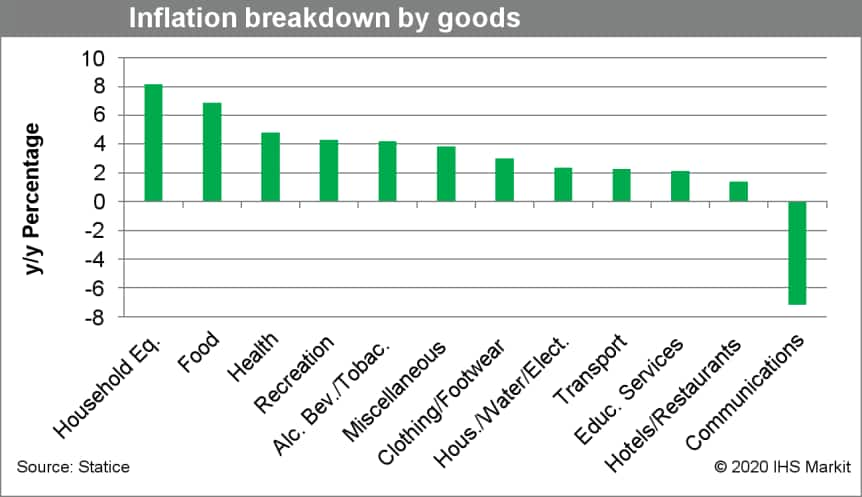

- Iceland's consumer price index rose by 3.6% year on year (y/y)

in December, according to figures released by Statistics Iceland.

Prices had increased by 3.5% y/y in November. (IHS Markit Economist

Diego Iscaro)

- Inflation has averaged 2.8% in 2020, following readings of 3.0% in 2019 and 2.8% in 2018. While inflation had ranged between 1.7% and 2.6% during the first half of the year, a weakening of the krona as a result of lower tourism revenues has led to an acceleration of the inflation rate from July.

- The prices of household equipment and food continued to be the main drivers of the headline inflation rate in December. On the other hand, communication costs fell sharply following a smaller contraction in November.

- Inflation was slightly above our estimates for December, although we still expect a gradual deceleration in early 2021.

- The krona has firmed up as a result of large foreign exchange

interventions by the Central Bank of Iceland (CBI), appreciating by

just below 6% since reaching a seven-year low (on a trade basis) in

October. In our December interim forecast, we expect the krona to

remain relatively stable at the start of 2021, and then gradually

strengthens as exports revenues benefit from improving demand from

vaccine rollouts in key trade partners.

- The director general of KamAZ, Sergey Kogogin, has said that the company plans to produce an electric light commercial vehicle (LCV) based on its Kama-1 electric crossover prototype. KamAZ has developed the Kama-1 in conjunction with the Peter the Great St Petersburg Polytechnic University, and the concept was presented in Moscow two weeks ago. The Kama-1 is KamAZ's first foray into passenger car design, and features a Level 3 intelligent driver assistance system (ADAS). It has a three-door, four-seater compact crossover body style. The vehicle is equipped with a 33 kW/h lithium-ion battery and an 80 kW electric engine, which enable a maximum velocity of 150 km/h and a journey range of 250 km in one charge. The vehicle has been designed initially for urban car-sharing schemes in major cities such as Moscow and St Petersburg, although it may find more traction commercially as a local urban delivery van. However, the electric vehicle market and associated infrastructure in Russia is still very much in its infancy. (IHS Markit AutoIntelligence's Tim Urquhart)

- Sibur, Gazprom Neft, and Uzbekneftegaz have agreed to cooperate

on potential investments in Uzbekistan including a major expansion

of Uzbekneftegaz's Shurtan Gas Chemical Complex (SGCC) and the

proposed construction of a new gas chemicals facility. Gazprom Neft

is the oil subsidiary of Gazprom. (IHS Markit Chemical Advisory)

- "Sibur and Gazprom Neft will explore the possibilities of participating in the implementation of the project to expand the production capacity of the Shurtan Gas Chemical Complex," says Sibur, Russia's largest producer of petrochemicals. The companies will also "consider the possibility of joint implementation of an investment project for the construction of a gas chemical complex based on natural gas resources produced in Uzbekistan with a capacity of up to 3 billion cubic meters," Sibur says. The location for the new complex and potential investment amounts have not been given.

- The signed cooperation agreement for the projects includes "the creation of a gas chemical complex using methanol-to-olefins [MTO] technology, and the expansion of the production capacity of the Shurtan Gas Chemical Complex," says Uzbekistan's energy ministry in an official statement. The cooperation agreements were signed by the two Russian companies and Uzbekneftegaz last week during an official visit to Moscow by a delegation from Uzbekistan's energy ministry.

- The Shurtan complex, operated by state-owned Uzbekneftegaz, currently produces ethylene and more than 134,000 metric tons/year of polyethylene (PE), as well as 116,000 metric tons/year of liquefied petroleum gas (LPG), 103,000 metric tons/year of gas condensate, and 4.1 billion cu meters/year of raw gas, according to the latest information on the SGCC website.

- In October, Lummus Technology was awarded a contract by Enter Engineering (Tashkent, Uzbekistan) to design and supply four steam-cracking furnaces to more than double ethylene production at the facility in the Kashkadarya Region of southwestern Uzbekistan.

- Local press reports in Uzbekistan have previously outlined proposed plans by Uzbekneftegaz to build a new gas chemicals cluster at a provisional cost of $4.25 billion using MTO technology, with up to 10 polymer plants producing up to 250,000 metric tons/year of polypropylene, 100,000 metric tons/year of synthetic rubber, 100,000 metric tons/year of polyethylene terephthalate and ethylene-vinyl acetate, and up to 150,000 metric tons/year of ethylene glycol and PE.

- The National Bank of Ukraine (NBU) released its financial

stability report on 21 December. According to the regulator,

Ukraine's banking sector demonstrated resilience to the

COVID-19-virus pandemic, remaining well-capitalized and able to

absorb losses and increase lending in support of the economic

recovery. (IHS Markit Banking Risk's Greta Butaviciute)

- Credit growth has gradually recovered from contraction in the second quarter, with the fastest lending pace in the SME sector since September and rising mortgage lending since July. The NBU called the latter "an unprecedented phenomenon for Ukraine, given the depth of the crisis and remarkable uncertainty" and attributed lower cost of loans as the key driver. However, the report also warned of rising profitability risks due to narrowing margins as lending rates are likely to fall further in the medium term.

- The report stated that the NBU will introduce new bank capital requirements over the next two years to harmonize national regulation with Basel Committee recommendations.

- Despite recovery in lending, Ukraine's banking sector profitability remains under pressure, with profits from January to October coming in 23% lower than in the same period last year. While this is partially due to increased provisioning, volatile lending and deposit base leave Ukrainian banks' cost of funding high, thus hindering profitability.

- Asset quality is extremely weak, putting further pressure on profitability. While the sector's gross non-performing loan (NPL) ratio improved by 2.9 percentage points since June, it still stood at 45.6% in the third quarter, an extremely high level reflecting the severe credit risk that banks are facing.

- The banking sector's Tier 1 ratio and capital adequacy ratio stood at 16.1% and 21.9%, respectively, in September. However, the sector's capital position is unlikely to strengthen further in the short term, especially because the central bank delayed introducing capital conservation and systemic risk buffers to contain the economic impact of the COVID-19-virus outbreak.

- IHS Markit assesses that the planned introduction of new bank capital requirements in the next few years is risk positive for Ukraine's banking sector as it will strengthen the regulatory framework further by bringing it closer to best international practices.

- The International Monetary Fund (IMF) has agreed to an

extension of Mauritania's Extended Credit Facility (ECF)

arrangement to 5 March 2021. The ECF was due to expire on 5

December and Mauritania requested a three-month extension amid

worsened balance-of-payments issues. (IHS Markit Economist Alisa

Strobel)

- The IMF's three-year ECF, providing access to 90% (SDR115.92 million) of quota, was approved on 6 December 2017 and was set to expire on 5 December 2020. In addition, access to an additional 15.7% of quota (SDR20.24 million) was approved on 2 September 2020. On 23 April, the executive board of the IMF also approved USD130 million in financial assistance to Mauritania under the Rapid Credit Facility (RCF), to address the country's deteriorating balance-of-payments issues resulting from the COVID-19 pandemic.

- The extension has been granted to allow additional time to complete the final IMF ECF review; due to the COVID-19 outbreak, the completion of the review was delayed. The official IMF statement highlighted that the additional time was needed to assess the latest economic developments and assess the government's new Priority Programme and 2021 budget, which is expected to be consistent with ECF-supported program objectives.

- We anticipate the sixth review will show Mauritania's program performance to be in line with IMF requirements, despite the challenges imposed by the COVID-19 pandemic on broader macroeconomic development. The fifth review mission under the ECF, which was concluded in early March 2020, found that Mauritania's performance under the program was broadly on track. IMF preliminary data suggest that the program's quantitative performance criteria for end-June 2020 were met, including the floors on net international reserves and the primary budget balance, as well as ceilings on non-concessional borrowing. Additionally, indicative targets for end-September, for which preliminary data are available, seem to have been met and structural benchmarks are being implemented.

Asia-Pacific

- Most APAC equity markets closed higher except for Hong Kong -0.3%; India +0.8%, Japan +0.7%, South Korea +0.1%, and Mainland China flat.

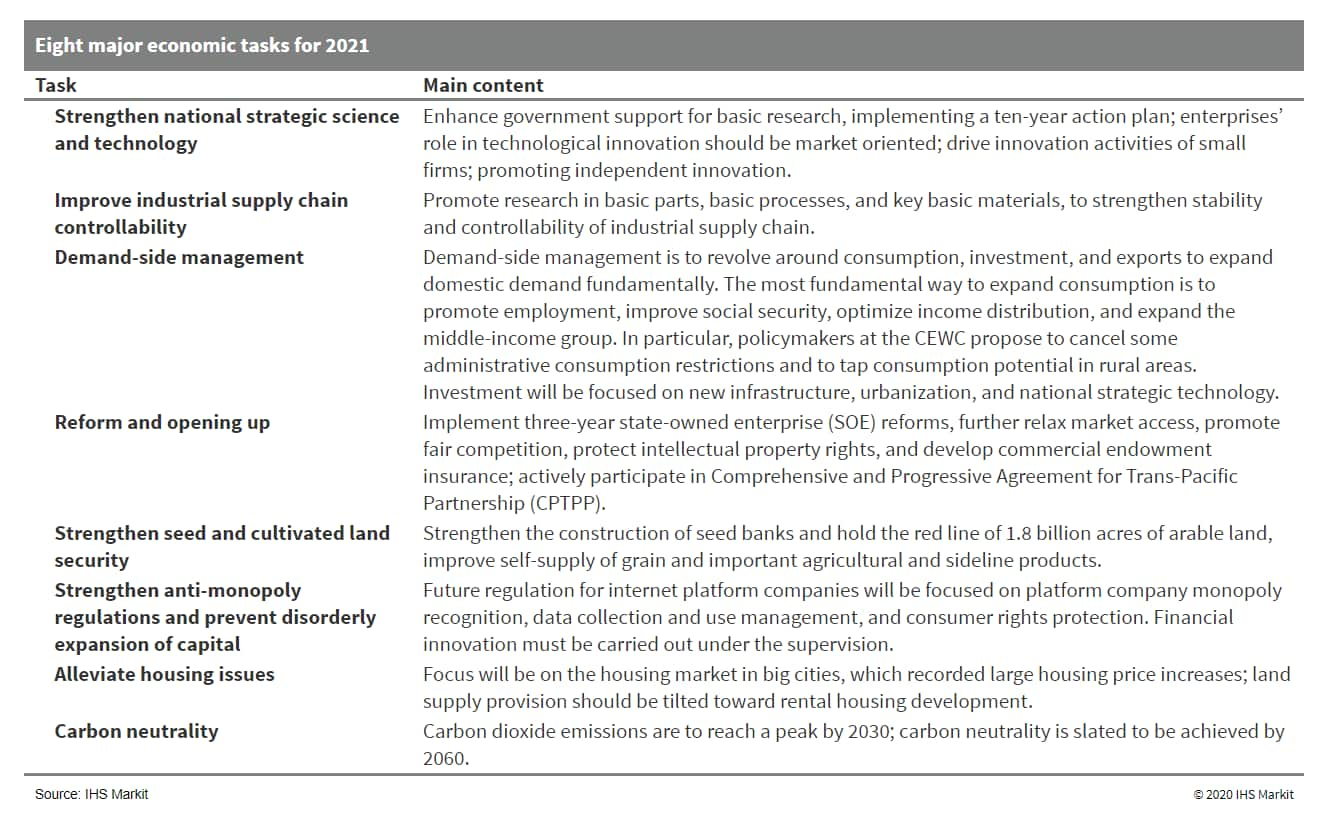

- At the 16-18 December Central Economic Conference (CEWC)

chaired by Chinese President Xi Jinping, policymakers vowed to

maintain stable economic policy and enhance demand-side management

in 2021 to consolidate economic recovery and promote quality

growth. (IHS Markit Economist Yating Xu)

- The current economic recovery remains fragile with various uncertainties. The CEWC confirmed that mainland China will be the only major economy in the world to realize economic expansion in 2020 amid the COVID-19 pandemic. However, policymakers at the meeting also stressed that the uncertainties of the COVID-19 situation overseas and global relationships, the fragile and uneven economic recovery, and various derivative risks caused by the pandemic could still weigh on the economy going forward. For example, the recovery in some contact services remains slow, structural unemployment is still prominent, and companies will be facing great debt repayment pressures in 2021.

- Macroeconomic policy is to be stable in 2021 to maintain the pace of economic recovery and pandemic control. Given the abovementioned uncertainties, macro polices will be focused on maintaining continuity, stability, and sustainability to provide necessary support for the economic recovery. Policies should be "more precise and effective, with no sharp turns and a good grasp of the timeliness and effectiveness". The general principle of "proactive fiscal policy and prudent monetary policy" is to remain unchanged.

- Fiscal policy will be more effective and sustainable with strict supervision on hidden debt. Spending allocation will be tilted toward improving people's livelihood and furthering structural reforms, especially those promoting technological innovation, accelerating economic restructuring, and adjusting income distribution. The issue of local governments' hidden debt was brought up again at the conference; to help address this issue, according to policymakers at the meeting, governments at all levels must "insist on living a tight life".

- Monetary policy will be more precise and reasonable. As stated in the central bank's third-quarter 2020 Monetary Policy Implementation Report, the growth rate of money supply and total social financing (TSF) should basically match nominal GDP growth to keep the macro leverage ratio stable. This is in contrast with the statement made during the early stages of the pandemic that "money supply and TSF growth should be significantly faster than the previous year". Policymakers at the conference also highlighted the importance of balancing "the relationship between economic recovery and risk prevention."

- Technology innovation tops the list of the eight major economic tasks for 2021. The CEWC outlined eight major tasks for 2021 (see table below), including more government engagement in technology development, income distribution adjustment, more housing market control in big cities, and risk management for internet companies and internet finance.

- The 16-18 December CEWC conveyed expectations of stable

economic policy for 2021, easing worries of a rapid retraction of

stimulus measures over the short term. Although the general fiscal

deficit rate in 2021 could be lower compared with 2020, it may

still stay at a relatively high level taking into account the

impact of the epidemic uncertainty. However, considering of the

local governments' debt issues, infrastructure investment is still

likely to face pressure in 2021.

- Chinese electric vehicle (EV) startup NIO is to unveil a new electric sedan at its 2021 NIO Day event. The new model is expected to feature a 150-kWh battery pack and NIO's NT2.0 NIO Pilot system. NIO has also said it will showcase its second-generation battery-swapping technologies that deliver improved efficiency at its battery-swapping stations. The 2021 NIO Day event will take place on 9 January 2021 in Chengdu, China. NIO says it has several exciting developments to be announced during the NIO Day event, the company's annual event focusing on its new technologies and products. The new sedan is expected to deliver a long driving range using a 150-kWh battery pack. None of its rivals in the EV space currently offers a production model featuring a 150-kWh battery. The new battery is likely to have a higher density compared with the 70-kWh and 100-kWh battery packs currently used in NIO's ES6 and ES8. However, given the battery's high cost, NIO is likely to give consumers the option of a smaller battery with the new sedan. (IHS Markit AutoIntelligence's Abby Chun Tu)

- SsangYong has decided to temporarily suspend production operations at its Pyeongtaek plant on 24 and 28 December, mainly because its suppliers refused to deliver parts, reports Korea JoongAng Daily. "With the disruption of auto parts delivery, production will be suspended," the automaker said in a regulatory filing. SsangYong is negotiating with its suppliers and will resume operations on 29 December, but the schedule can change depending on the situation. Hyundai Mobis, LG Hausys, and S&T Dynamics are among the multiple parts suppliers that have suspended deliveries to SsangYong. The missing parts include headlights and bumpers. The latest development comes after SsangYong filed for court receivership as it struggles with increasing debts amid the COVID-19 virus pandemic. The automaker asked the creditors to roll over the loans but failed to obtain approval from the lenders. This is the second time that SsangYong has placed itself under court receivership after undergoing the same process a decade ago. China-based SAIC Motor Corporation acquired a 51% stake in SsangYong in 2004 but in 2009 relinquished its control of the company in the wake of the economic downturn. (IHS Markit AutoIntelligence's Jamal Amir)

- Domestic milk production in South Korea is to decrease in 2021,

as the government increases efforts to regulate stocks. Import

demand is to be sustained by rapidly growing cheese consumption.

(IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Domestic milk production in South Korea is forecast to decrease 70,000 tons in 2021 to 2.03 million tons, according to the USDA's Foreign Agricultural Service (FAS). This is after the 2020 forecast milk production was raised 70,000 tons to 2.1 million tons. The industry increased production because it expected a higher negotiated milk price in August 2020 from the government, but the expectation never materialized.

- The government has been working to address oversupply of raw milk in the market since 2014, when production reached 2.21 million tons which resulted in 261,862 tons of inventories. Production has been declining ever since, with milk inventories falling below 100,000 tons in 2018 for the first time in five years.

- Milk powder inventories in January 2020 were estimated at 101,167 tons, down more than half from January 2015, but stocks are said to have grown quickly again throughout 2020 as domestic milk production increased and it was not absorbed due to COVID19 related school and foodservice closures. Although dairy processing companies supplied more products through online and offline channels in the belief that consumption at home would increase during the pandemic, their net profits suffered due to aggressive marketing campaigns aimed at promoting consumption.

- Cheese consumption is forecast to increase 8.1% percent in 2021 to 200,000 tons. Consumer tastes are becoming more westernized and more products using cheese are being introduced to the market. As a result, cheese consumption is expected to continue to increase both for direct consumption and in the food processing industry.

- Estimated 2020 cheese consumption is raised 5,000 tons to 185,000 tons based on rising consumption trends.

- According to the latest customs data, Korean dairy imports in January-November 2020 reached 290,600 tons in volume and exceeded USD1.0 billion in value. Particular high increases were seen in imports of cheese, which were up 13% to 137,600 tons.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary---29-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary---29-december-2020.html&text=Daily+Global+Market+Summary+-++29+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary---29-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 29 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary---29-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-++29+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary---29-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}