Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 30, 2020

Daily Global Market Summary - 30 December 2020

Most APAC equity markets closed higher, Europe was mixed, and major US indices were all lower on the day. US government bonds and the dollar were lower, while benchmark European bonds were mixed. iTraxx-Europe and CDX-NAIG closed flat, with iTraxx-Xover tighter and CDX-NAHY wider on the day. Gold and oil closed higher, while silver and copper were lower.

Americas

- The US equity market closed lower; Russell 2000 -1.9%, Nasdaq -0.4%, and S&P 500/DJIA -0.2%.

- 10yr US govt bonds closed +1bp/0.94% yield and 30yr bonds +2bps/1.68%.

- CDX-NAIG closed flat/52bps and CDX-NAHY +4bps/299bps.

- DXY US dollar index closed -0.4%/89.99.

- Gold closed +0.1%/$1,883 per ounce, silver -1.2%/$26.22 per ounce, and copper -0.3%/$3.56 per pound.

- Crude oil closed +0.8%/$48.00 per barrel.

- Senate Majority Leader Mitch McConnell blocked an effort by Democrats to hold a vote on sending bigger stimulus checks to many Americans, amid growing calls within the GOP for the larger coronavirus-relief payments sought by President Trump. The Kentucky Republican, without committing to hold a vote, said the Senate would address Mr. Trump's demands to boost the size of the checks to $2,000 from $600 as well as his concerns about Section 230 of the Communications Decency Act, which regulates online speech, and his complaints about purported election fraud. (WSJ)

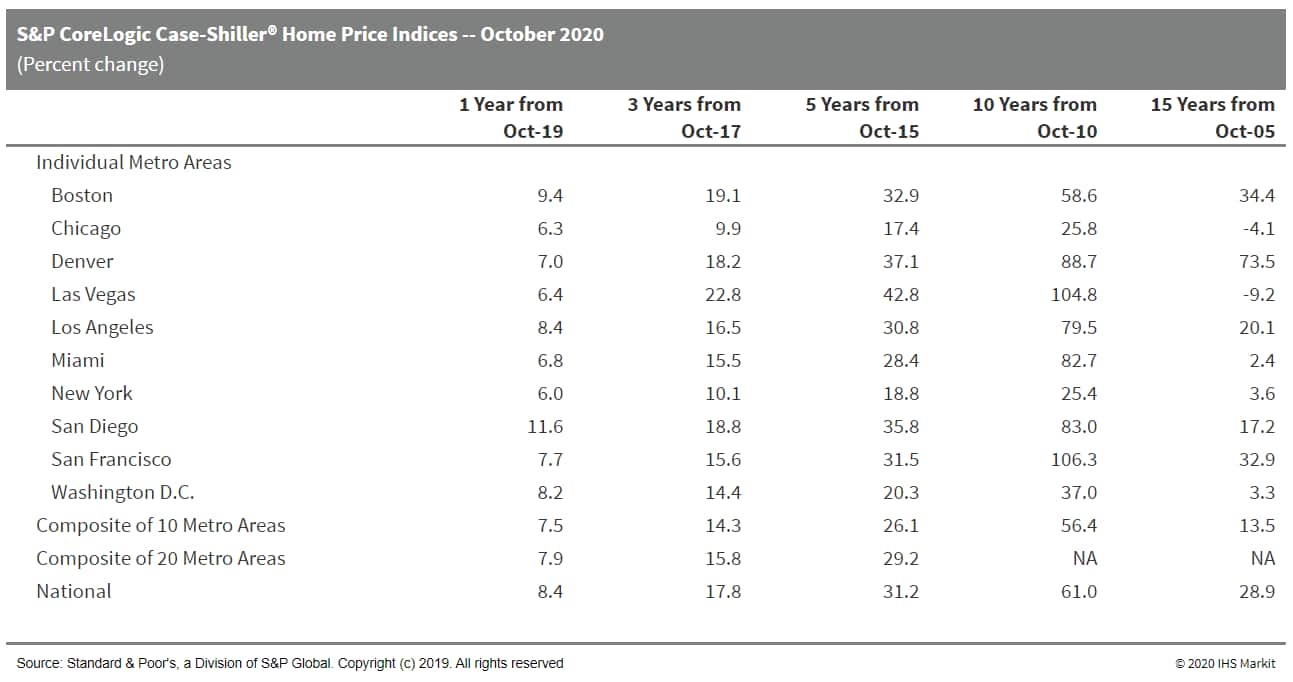

- S&P CoreLogic Case-Shiller data indicates that US

residential real estate markets remained red hot in October.

Monthly growth in home prices accelerated again in October as gains

in the seasonally adjusted 10-city and 20-city composite indices

both reached 1.6%, the fastest pace for either since April 2013.

(IHS Markit Economist Troy Walters)

- Not only were home prices up month on month (m/m) in all 19 cities reporting, increases were all above the 1.0% mark. Gains ranged from 1.1% m/m in Las Vegas to 2.2% in San Diego.

- On an annual basis, home price growth was sharply higher in October. The 10-city index was up 7.5% year on year (y/y) while the 20-city index was up 7.9%.

- Annual home price growth was in positive territory in all 19 cities covered. Phoenix retained the top spot at 12.7%, while Seattle and San Diego, at 11.7% and 11.6%, respectively, also experienced double-digit gains.

- The national index increased by an astounding 8.4% y/y, the fastest pace since March 2014.

- According to data for the three months ending in October, US home prices accelerated sharply for the fourth month in a row. This strength was broad-based, with every market showing a strong increase in appreciation.

- Monthly price gains were not only positive in every city covered, they were at multiyear highs in many. Yearly price appreciation continued to advance, also to multiyear highs.

- Home prices growth, already strong prior to the onset of the COVID-19 pandemic because of limited and shrinking inventories, strengthened considerably in the July-October period.

- The surge in demand was further bolstered by record-low mortgage interest rates. The available supply of homes for sale stood at 1.42 million in October, a 19.8% decline relative to one year earlier. With housing demand still raging from the pandemic, limited supplies and the mortgage interest environment are likely to keep home price appreciation strong well into 2021.

- For the eighth month in a row, data in October were limited to

only 19 cities, as opposed to 20 under normal circumstances. Data

for Wayne County, Michigan, were unavailable so there are no data

for Detroit in this release. Data for previously missing months

(March through September) are now available.

- A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York's Upper West Side and Harlem filed for bankruptcy. Buildings controlled by Emerald Equity Group LLC owe $203 million to LoanCore Capital, stemming from debts tied to properties on East 117th Street and West 107th Street, Dec. 28 bankruptcy filings show. Plans outlined in the documents call for LoanCore to take ownership of the residential complexes, which are home to several hundred tenants. The bankruptcies may foreshadow wider distress among multifamily properties in the coming year. The pressures are especially high in costly markets such as New York, where new regulations make it harder for landlords to raise rents and evict tenants. Some renters have withheld payments during the coronavirus pandemic, giving landlords less income to cover their mortgages. (Bloomberg)

- IHS Markit's Animal Health division published their list if the

Top 20 Animal Health Products on 23 December. The report highlights

that the animal health industry encompasses a broad spectrum of

products used to prevent, control and treat diseases to ensure the

health and productivity of animals. In 2019, the industry's top 20

products generated estimated sales of around $6.7 billion. This

list includes parasiticides, dermatological agents, antimicrobials

and immunological products. (IHS Markit Animal Health)

- Over the past decade, the companion animal segment has been the fastest growing portion of the animal health sector - it represented 75% of sales from the top 20 animal health products in 2019.

- Parasiticides is the largest product group. It features leading brands such as Advantage, Frontline, Heartgard and Revolution within the top 10 animal health products. This segment has also had a number of new product introductions in recent years. Most notable are the chewable parasiticides from the new isoxazoline chemical class (Bravecto, Nexgard, Simparica and Credelio) and Seresto - an antiparasitic collar providing protection for up to eight months.

- The most significant innovation in the companion animal sector has been the introduction of Apoquel and Cytopoint from Zoetis - products that have helped create a much stronger pet dermatology space.

- Cytopoint was the first monoclonal antibody to enter the animal health industry and more biological therapies are likely to follow. This report looks at the other market segments that are likely to yield future blockbusters for companion animals and livestock.

- The leading animal health products were identified through IHS Markit's internal knowledge and company's annual reports. Some of the animal health firms report individual sales of their top-selling products, others provide a total and some offer no information. Therefore, our list of the top 20 animal health products is based on reported sales and best estimations.

- Congress has moved the deadline for states to revise their hemp programs in line with the 2018 Farm Bill and also urged USDA to address industry concerns about its sampling and testing requirements. Language in the omnibus spending bill - signed into law Sunday (December 27) by President Donald Trump - extends authority for 2014 hemp pilot programs until January 1, 2022, a move proponents contend is needed to ensure a smooth transition to the new regulatory regime crafted under the authority of the 2018 Farm Bill. The previous deadline for states to abandon their 2014 hemp programs and shift to the new regime was October 31, 2021, but industry stakeholders called on lawmakers to move the date to the end of the calendar year. Many industry interests and state officials remain wary of USDA's new hemp regulations, warning that the interim final rule released in October 2020 is onerous and unworkable for growers and state regulators. The regulatory framework laid out by the interim final rule is markedly different - and less flexible - than what was permitted under the hemp research provision of the 2014 Farm Bill. Key concerns include the sampling and testing requirements, disposal of "hot crops," federal registration mandates and the involvement of the Drug Enforcement Administration (DEA) in the testing and disposal regulations. (IHS Markit Food and Agricultural Policy's JR Pegg)

- SK Innovation is on track to meet its schedule of beginning pilot battery production at a new plant in the US state of Georgia in the first half of 2021, reports the Electronic Times. According to the report, SK Innovation plans to supply Volkswagen (VW) with its mid-size to large pouch-type NCM811 batteries, which have an 80% nickel content, from the facility in Georgia. The batteries are to be used in the VW ID.4, which is slated to see US production in 2022. An SK Innovation spokesperson reported as saying, "Our first Georgia plant is 90% completed. We are expecting to receive battery materials in the first half of next year [2021] and start conducting necessary tests for actual production." The report also states that the US International Trade Commission (USITC) is due to make a full decision on 10 February 2021 regarding a dispute between SK Innovation and LG Chem. SK Innovation expects the decision to go in its favor. In addition, SK Innovation broke ground on a second US plant in July. The company plans to manufacture a different battery for the Ford F-150 battery electric truck at the plant in 2023, according to the report (see United States: 5 May 2020: SK Innovation to build second EV battery plant in the US). These batteries will have a nickel content of 90%, the report states. The higher nickel content increases battery density, the report states. SK Innovation aims to produce 200,000 batteries per year at the two US plants, the report states. The company reportedly plans to begin commercial battery production at the second plant in the first quarter of 2023. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Argentine real retail sales decreased by 2.2% year on year

(y/y) in supermarkets, but plunged by almost 68% y/y in shopping

centers in October, as these were still being affected by the

activity restrictions imposed by local governments. In terms of

supermarket sales, less than 5.2% were online purchases; the main

drivers of sales were electronic items and appliances, fresh

produce, and pantry dry goods. (IHS Markit Economist Paula

Diosquez-Rice)

- The economic activity index decreased by 7.4% y/y in October, while the seasonally adjusted data showed a 1.9% m/m increase during the month. For the first 10 months of 2020, the steep declines in March-May drove down the average to an 11.3% y/y decline.

- By sector, the economic activity index data showed mostly declines in October. There were steep declines in the hospitality sector, which was down by 54.5% y/y; the construction sector, which decreased by 13.3% y/y; the transport and communication sector, which dropped by 20.3% y/y; and the manufacturing sector, which fell by 3.5% y/y.

- The outlook for retail sales remains lackluster; consumer confidence declined in December, amid the resurgence in the number of cases in the Buenos Aires extended metropolitan area. Furthermore, Torcuato Di Tella University reported a 3.8% decline for the November index and a 7.2% decline compared with December 2019.

- Customs trade imports increased in November 2020 compared with November 2019 - the second month to post an annual rise in 2020. On the export side, a total decrease in value by 26% y/y in November 2020 was due to a 28.6% y/y decrease in volume and a 4.3% y/y increase in prices. This slump was driven by the decline in agricultural products, manufactured goods, and fuels and energy.

Europe/Middle East/Africa

- European equity markets closed mixed; UK +1.6%, France +0.4%, Spain +0.2%, Italy -0.1%, and Germany -0.2%.

- 10yr European govt bonds closed mixed; UK -4bps, Germany/France -2bps, and Italy/Spain +1bp.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -4bps/240bps.

- Brent closed +0.6%/$51.23 per barrel.

- The Financial Stability Board's 2020 Global Monitoring Report

on Non-Bank Financial Intermediation (NBFI) shows NBFI assets to

have reached USD200 trillion in 2019, versus the global stock of

financial assets of USD404 trillion. (IHS Markit Economist Brian

Lawson)

- The report relies on 2019 data, covering 29 jurisdictions worth 80% of global GDP.

- It states that a key ongoing growth factor was expansion of collective investment vehicles such as hedge, money market and investment funds, which grew an average 11% annually between 2013 and 2019.

- Its main concern is expansion of the "narrow measure of NBFI", activities deemed to generate financial stability risks like those in the banking sector.

- This segment grew 11.1% in 2019 to USD57.1 trillion, 14.2% of global financial assets: its expansion accelerated versus average annual growth of 7.1% between 2013 and 2018.

- A subset thereof involving fixed income and money market funds engage in "liquidity and maturity transformation", making them "susceptible to runs". This group grew 13.5% in 2019 and formed 72.9% of "narrow measure" assets.

- The report links to prior studies focused on the initial shock caused by the COVID-19 virus pandemic in March 2020. These highlight "large and persistent imbalances in the demand for and supply of liquidity", reporting that dealers had faced "difficulties in absorbing large sales of assets", exacerbated by heavy selling by leveraged and foreign market participants.

- Much NBFI growth reflects the ongoing expansion of savings mechanisms in developed economies, with wider use of collective investment funds. NBFI's expanded share within global financial assets is thus not an automatic concern for global regulators.

- Bentley is planning to introduce models into new segments as part of the automaker's pivot away from internal combustion engine (ICE) vehicles and become a battery electric vehicle (BEV)-only brand by 2030. Bentley's chairman and CEO Adrian Hallmark told Autocar that the company had yet to decide whether these new BEVs will take on the nameplates and lineage of its current line-up, but said, "Our position is to look at customers and segments. As well as moving to electric, we're going to adapt our product range because the world is changing". Reflecting on this, he said, "We want to appeal to more women and be more relevant in future urban environments which are very much different to today, and we want to appeal to modern luxury values which are different to ones from 20 years ago", noting that this will evolve further during the next 10 to 15 years. The comments come just a month after the brand laid out its Bentley100 strategy, for it to become a fully carbon-neutral organization by 2030 and also move to fully BEV products. While its product strategy is not yet fully defined, it is indicative of what can be expected from the automaker. It is interesting to note that the company seems to be planning to create new products more suited to the current and expected limitations of BEV technology, rather than trying to offer customers a product in an existing category that would fail to meet expectations. Indeed, Hallmark has said that Bentley's initial BEV models are likely to complement its current non-BEV range, noting that "for our customers, [the BEV] won't be their only car. (IHS Markit AutoIntelligence's Ian Fletcher)

- Poland exported just over 19,000 tons of NFC apple juice in August this year, the final month of the all-time record season. This brought its seasonal total to slightly under 233,000 tons (and the figures may yet be revised upwards). This is 43,000 tons more than Poland exported in the 2018/19 season and only 7,000 tons less than Poland's full-season 2019/20 AJC exports. Given the rate of increase of NFC juice production and exports, and the slightly lackluster AJC production expected in the current season, it is entirely possible that Polish NFC tonnage will outstrip that of AJC. Three countries combine to be the main buyers of Polish NFC juice. These are, in order, Germany (with 6,880 tons purchased in August), the UK (5,110 tons) and the Netherlands (3,920 tons, much of which will re-exported). No other country took more than about 600 tons. IHS Markit sources say that demand for NFC is stronger than ever at present, driven mainly by the supermarkets who, in turn, are fielding much higher consumer interest. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Russia's Constitutional Court (CC) determined on 25 December that legal disputes between foreign investors and Russia should not be subject to international arbitration even where this is stipulated under international agreements signed by Russia but without formal ratification. The CC ruling relates to the Energy Charter Treaty (ECT), signed by Russia in 1994 and implemented provisionally, but never formally ratified. It overrules three prior international judgments. The International Court of Arbitration in the Hague previously claimed jurisdiction under the ECT, ruling in 2014 in favor of former shareholders of the now-defunct Yukos oil firm. The ruling obliged Russia to pay USD50 billion in damages for having launched tax evasion actions against the company which forced it into bankruptcy and the sale of its assets, deemed in its judgment not to have been in good faith. In February, the Court of Appeals in the Hague confirmed this ruling, and awarded Yukos former shareholders an additional USD7 billion in interest. Russia's Justice Ministry appealed against these judgments to the Dutch Supreme Court but in June 2020 this confirmed the earlier rulings. The Russian Constitutional Court judgment provides the Russian government with justification to refuse to pay the damages awarded by international arbitration in the Yukos case. However, it also sets a precedent for future disputes, especially in sectors such as oil and gas covered by the ECT, but also for production-sharing agreements in the oil, gas and mining sectors, implying significantly restricted recourse for foreign investors in Russia to international arbitration. (IHS Markit Country Risk's Alex Kokcharov)

- The Central Bank of the Republic of Turkey (Türkiye Cumhuriyet

Merkez Bankası: TCMB) raised its main policy rate - the one-week

repo rate - by 200 basis points to 17.0% at its rate-setting

meeting on 24 December. The Turkish currency will remain vulnerable

to periods of sharp depreciation, particularly if President Recep

Tayyib Erdoǧan interferes in monetary policy and pushes for a quick

reversal of the current tightening cycle. (IHS Markit Economist

Andrew Birch)

- The bank's other policy rates - tied to the repo rate - were also adjusted accordingly.

- The December move was the second significant rate hike in the two meetings conducted under new Governor Naci Aǧbal. President Erdoǧan installed the current TCMB governor in early November as part of a sweeping overhaul of top economic policy makers, replacing the previous governor before the end of his term.

- The pressure to take additional action intensified after annual inflation pushed to a 15-month high in November. Sustained, high inflation is pushing up expectations, raising the barrier for the future battle against elevated price growth.

- According to the latest TCMB inflation survey, inflation is expected to be 10.9% within 12 months, higher than IHS Markit's current end-November inflation rate forecast of 10.2%. Both our forecast and the inflation expectation are far above the TCMB target rate of 5%, however, forcing the bank into action.

- The more restrictive monetary policy under Aǧbal has resulted in a strong boost to the value of the lira and stabilized the local markets. Bond yields have come down and the lira, as of 25 December, had appreciated by more than 10.0% against the US dollar since Erdoǧan swapped economic policy-makers.

- The higher interest rates are also aimed at attempting to slow the dollarization of the economy, which has continued even after the November rate hike. In the weeks following the November rate decision by the TCMB, foreign-currency deposits at Turkish banks continued to rise by an average of 0.8% per week. The government has pleaded with Turks to resell their foreign currencies for lira, with higher interest rates designed to incentivize the actions.

- The rate hike was more aggressive than anticipated by IHS Markit. We now assess that the TCMB is likely at the end of its rate tightening cycle. Although it is trying to reassert its independence and authority, Erdoǧan is unlikely to allow much further aggressive tightening, particularly in the face of rising COVID-19-virus spread that is causing increasing lockdowns.

- The recent recovery of the lira is a key indicator suggesting that markets may be satisfied with the current levels of interest rates. The lira, as of 25 December, was as strong as it has been against the US dollar since mid-September.

Asia-Pacific

- Most APAC equity markets closed higher except for Mainland China -0.5%; Japan +2.7%, Hong Kong +1.0%, India +0.6%, Australia +0.5%, and South Korea +0.4%.

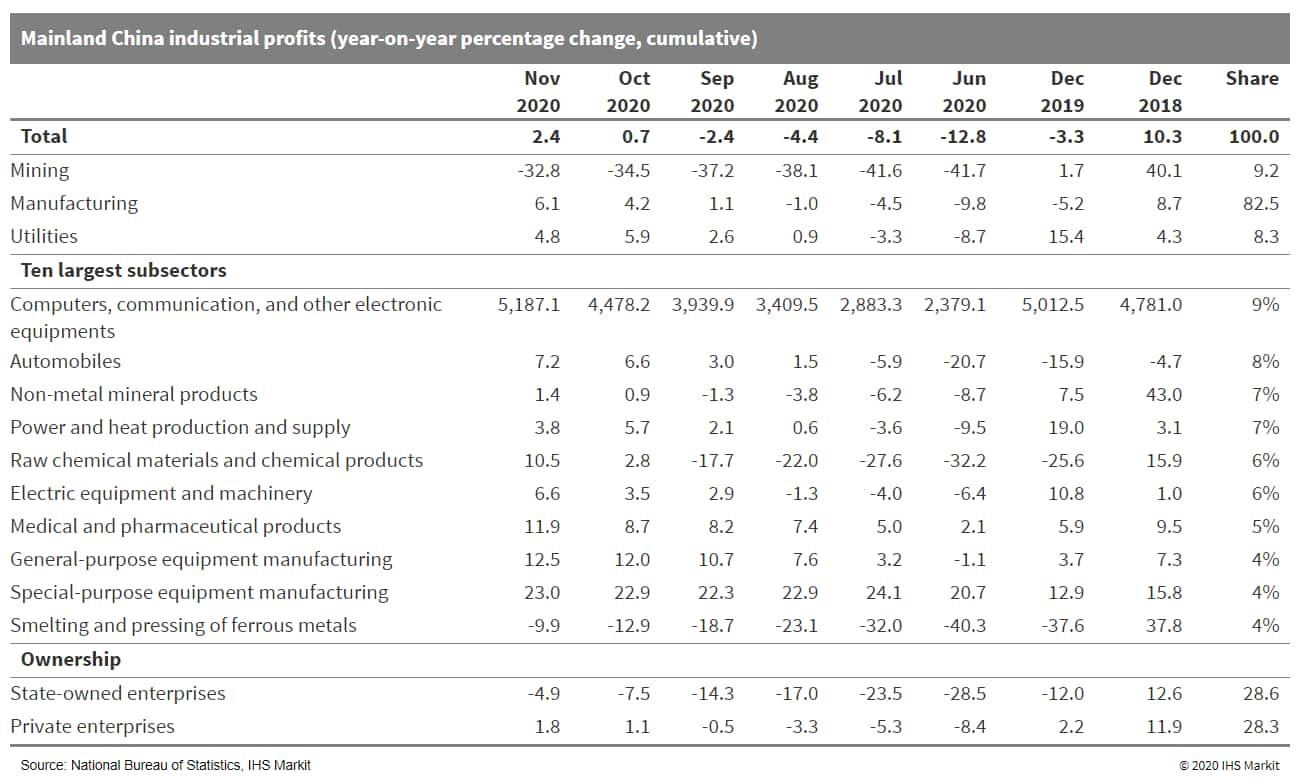

- Mainland Chinese industrial profits rose 15.5% year on year

(y/y) in November, marking the sixth consecutive month of

double-digit growth, according data from the National Bureau of

Statistics (NBS). However, this is a deceleration from the 28.2%

y/y expansion in profits registered in October, largely owing to

the high-base effect. Year to date, profits growth accelerated by

1.7 percentage points to 2.4% y/y, which is faster than the 2.3%

y/y expansion in industrial value-added and the 2.0% deflation in

the industrial Producer Price Index (PPI). The headline growth was

accompanied by rising operating revenue and improving

profitability. (IHS Markit Economist Yating Xu)

- By sector, the manufacturing sector led the headline growth in profits, with broad acceleration noted across the auto, computer, petroleum processing, non-ferrous metals processing, and chemicals segments. However, profits in the mining sector remained in deep contraction, largely dragged down by the petroleum and natural gas exploration segments, which recorded a 70.8% y/y and 24.5% y/y decline in profits, respectively.

- Industrial enterprises continued to build up inventory as the inventory of finished goods increased 7.3% y/y, up 0.4 percentage point from October.

- Profitability improved across ownership, with the private sector continuing to lead the recovery. Private sector year-to-date profit growth accelerated to 1.8% y/y, and the contraction in profits of state-owned sectors narrowed to 4.9% y/y. The average liability-to-asset ratio came in at 56.6%, 0.1 percent point down both month on month and year on year.

- Considering of the continuous strength in property investment and overseas demand, as well as the upturn in PPI and the low base at the end of 2019, year-to-date industrial profit growth is expected to improve further in December.

- However, the momentum of economic recovery may moderate on

uncertainties regarding the COVID-19 situation. More regional

lockdowns are likely with increasing reports of regional outbreaks

since October. As of 27 December, 22 communities in mainland China

have been labeled as "medium-risk" areas, compared with 0 in

September.

- JMEV, the joint venture (JV) between Renault and Jiangling Motors Corporation (JMC), has begun trial production of its first model at its plant in Nanchang (China). The model, coded the GSE, is a compact battery electric sedan. Images of the GSE released by JMEV show that the new model is sporting a new logo, indicating that the automaker is likely to announce a new brand at a later date. According to a statement published on the Nanchang government's official website on 28 December, JMEV plans to begin sales of the GSE in Europe next year. The model will be distributed through Renault's sales network in the European market. Renault currently holds 50% of stake in JMEV, its second electric vehicle (EV) JV in China. Apart from its partnership with JMC, the French automaker also operates a JV with Dongfeng Motor Group, which also specializes in EV manufacturing. After its decision to withdraw from China's traditional passenger vehicle market, Renault has begun to shift its focus to EVs and light commercial vehicles. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's chemical industry has mirrored the overall economy with

a v-shaped recovery. Chemical production in China edged up 0.3% in

2020, a sharp slowdown from growth of 4.9% in 2019, but growth in

China's output of chemicals is expected to accelerate to 5.4% in

2021, according to ACC. (IHS Markit Chemical Advisory)

- China's chemical sector was the first to enter a severe downturn, beginning in December 2019, according to ACC. However, "China was the first nation to emerge from the downturn and by September had fully recovered and entered an expansion stage of the cycle," ACC says.

- The onset of the pandemic in China also highlighted the vulnerability of many international chemical supply chains, which could result in changes starting in 2021, particularly for critical raw materials used in industries such as agriculture, aviation, pharmaceuticals, and semiconductors. "As the pandemic unfolded, chemical supply chains that ran through China were initially disrupted," ACC says. "Concern [overseas] about supply-chain disruptions will lead to near- and on-shoring, accelerating any such decisions already in consideration prior to the pandemic, for example producers negatively impacted by the US-China trade war considering modifications to sourcing."

- Petrochemical markets, meanwhile, are expected to see the continued impact in 2021 from a massive buildup of capacity in China, particularly for key products such as ethylene and para-xylene.

- Companies including Hengli Petrochemical, Liaoning Bora, Sinochem Quanzhou, Sinopec Zhongke, Wanhua Chemical, and Zhejing Petrochemical started up steam crackers during 2020. China's total ethylene nameplate capacity increased to 32.6 million metric tons/year (MMt/y) last year from 27.1 MMt/y in 2019, according to IHS Markit data. A further six projects, including debottlenecking of existing plants, are set to increase China's ethylene capacity to 38.9 MMt/y in 2021, IHS Markit says.

- The additional supply is expected to undermine the demand and price recovery in China from the COVID-19 pandemic, but the impact will not likely be severe. China's ethylene market has shown "strong resilience" during the pandemic, says William Chen, executive director/global olefins at IHS Markit. China's domestic demand for ethylene increased to 30.3 MMt in 2020 from 27.6 MMt the year before and is set to rise again to 32.8 MMt in 2021, according to IHS Markit data.

- However, these additions and a continued wave of steam cracker projects due for completion over the next five years adding more than 18 MMt/y of capacity will not be enough to bring the country to its goal of ethylene self-sufficiency, according to Chen. IHS Markit projects China will achieve ethylene self-sufficiency of 73% in 2025. As a result, the country will remain a net importer of ethylene equivalent for years to come.

- Meanwhile, China will in 2021 begin its long march to climate neutrality. President Xi Jinping announced last September that the country would become carbon neutral by 2060.

- China plans to reach peak greenhouse gas (GHG) emissions before 2030. The country is the biggest emitter of GHGs mainly due to its widespread use of coal, which accounts for about 64% of China's CO2 emissions.

- Japan's unemployment rate declined by 0.2 percentage point to

2.9% in November, the first decline in six months. The decline was

largely due to an increase in the number of female employees from

the previous month, while labor participation continued to

increase. (IHS Markit Economist Harumi Taguchi)

- The softer year-on-year (y/y) contraction of the number of employees (down by 0.5% y/y) largely reflects increases in information and communications (up by 7.4% y/y), real estate and goods leasing (up by 11.0% y/y), medical and welfare (up by 2.7% y/y), and life-related services (up by 4.3%y/y), although much of these increases were driven by non-regular employees.

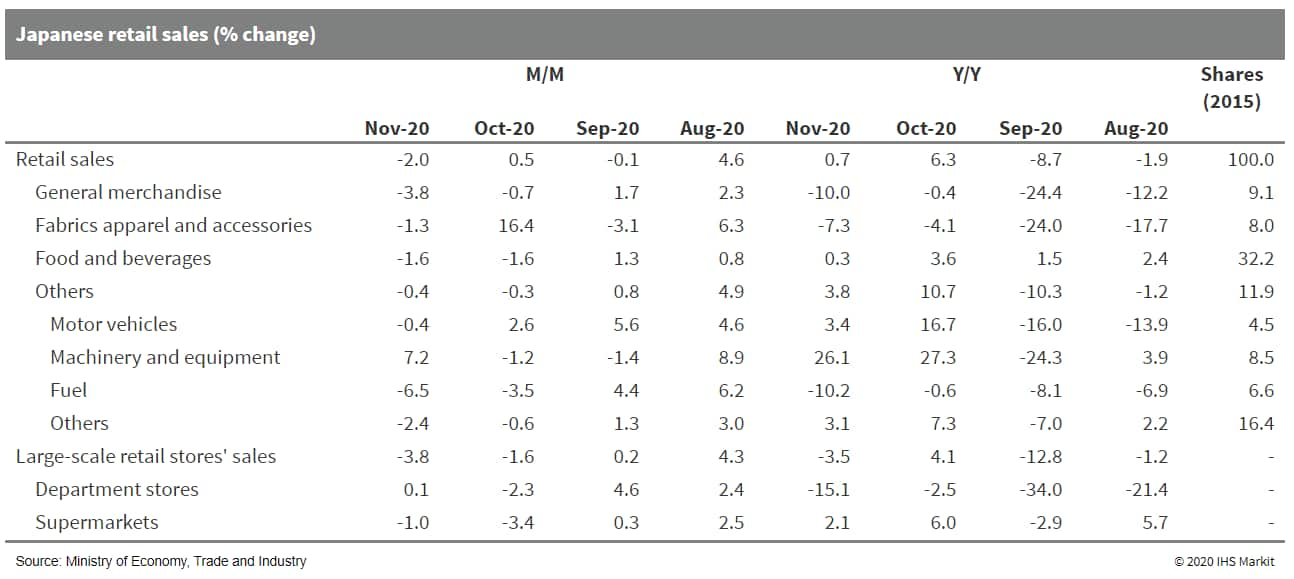

- Retail sales, however, fell by 2.0% month on month (m/m) in November, following a 0.5% m/m rise in the previous month. The weakness largely reflects a drop in fabrics, apparel, and accessories sales following a surge in October; the first decline in automobile sales in the last six months; as well as larger declines in general merchandise and fuel sales. The relatively warm temperatures have also weighed down on the prices and sales of seasonal goods. In addition, the resurgence of the COVID-19 virus pandemic made consumers cautious about going out.

- The November results signal improved employment conditions in

line with the resumption of economic activity. However,

uncertainties over the pandemic could continue to weigh down on the

recovery for employment, particularly in accommodations, and food

and beverages and life-related services. The sluggishness in the

number of self-employed and an uptick in the number of furloughed

workers suggest a potential rise in the unemployment rate in

response to a persistently weak recovery or stricter guidelines and

requests to cut operating hours.

- Japan's index of industrial production (IIP) remained at the

October level in November, but the year-on-year (y/y) contraction

widened to 3.4% from the 3.0% drop in October. While producers'

shipments declined by 0.9% month on month (m/m) in November, the

first drop in six months, inventory continued to fall for the

eighth straight month with a 1.1% decline. The index of the

inventory ratio also slipped by 1.8% m/m. (IHS Markit Economist

Harumi Taguchi)

- Industrial production continued to rise in a broad range of industry groupings, including production, general-purpose machinery, and iron and steel, and rebounded in production of electronic parts and devices and transportation machinery, excluding automobiles. These increases were largely offset by a decline in automobile production. That said, producers' shipments declined across a broad range of industry groupings, offsetting increases in shipments of production and general-purpose machinery, electronic parts and devices, and ceramics/stone/clay products.

- The weaker-than-expected November results reflect drops in new car sales and exports after continued rises. As industry anticipated a 1.1% m/m decline in production in December, industrial production is likely to decline during the month because of weaker demand due to lockdowns in Japan's trade partners and concerns about rising new confirmed COVID-19 cases in the country. The pandemic remains a major downside risk over the short term.

- Looking ahead, the improvement in demand could prompt industrial production to rise back to the pre-pandemic level, given that destocking has progressed and the inventory ratio is back below the year-earlier level in a number of industry groupings. That said, the outlook for a 7.1% rise in industry driven by capital goods in January is probably too ambitious, since the inventory ratio of capital goods remains high relative to other goods, although stronger production has begun to lift demand in capital goods.

- Toyota has launched the C+ pod ultra-compact battery electric vehicle (BEV) in Japan, according to a company statement. Available in limited numbers, the model will be available to corporate users and local governments. The new C+ pod is a rear-wheel-drive two-seater BEV, with 9.2 kW of maximum power output and 56 N.m of peak torque. It is 2,490 mm long, 1,290 mm wide, and 1,550 mm tall, with a wheelbase of 1,780 mm and a turning radius of 3.9 m. The vehicle, with a cruising range of up to 150 km, can achieve a maximum speed of 60 km/h and features a Pre-collision Safety System as standard to detect other vehicles (day and night), pedestrians (day and night), and cyclists (day). An Intelligent Clearance Sonar with Parking Support Brakes (Stationary Objects) is also included to help avoid collisions, or mitigate damage. Toyota is offering the C+ pod in two grades: the X grade, which is priced at JPY1.65 million (USD15,918), and the G grade, priced at JPY1.716 million. Toyota's new compact BEV has been designed to provide short-distance mobility with a range of around 100 km on a single charge. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tesla plans to enter the Indian market in 2021, according to media reports and a comment on Twitter from CEO Elon Musk. On Twitter, Musk replied to a question on whether Tesla will be available in India in January 2021, to which he replied "No, but definitely this year." The Times of India reports that customers will be able to order a Tesla car beginning from January 2021, with deliveries expected in June 2021. It was also reported that Tesla's first product in the market will be the Model 3. As with other markets, the automaker is expected to enter India with online sales rather than dealerships. Reuters reports that India's Transport Minister Nitin Gadkari has confirmed Tesla's arrival to The Indian Express as well, and that the automaker might look at assembly and manufacturing based on the sales response. According to some reports, Tesla first intended to join the Indian market in 2016, including having taken some initial orders for the Model 3 ahead of its production start, although this was delayed owing to infrastructure issues. However, India has been aggressively working towards improving the situation, including an announcement in September 2020 that the government is considering installing electric vehicle (EV) chargers at most gas stations as well as a program called Faster Adoption and Manufacturing of Electric Vehicles. (IHS Markit AutoIntelligence's Stephanie Brinley)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-december-2020.html&text=Daily+Global+Market+Summary+-+30+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 30 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+30+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--30-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}