Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 30, 2020

Daily Global Market Summary - 30 December 2020

US equity markets closed higher, Europe was lower, and APAC was mixed. US government bonds closed higher on the day, while benchmark European bonds closed mixed. European iTraxx closed flat across IG and high yield, while CDX-NA indices closed modestly tighter. Oil, gold, and silver were higher on the day and copper closed lower.

Americas

- US equity markets closed higher, with the DJIA closing at a new record high of 30,409; Russell 2000 +1.1%, DJIA/Nasdaq +0.2%, and S&P 500 +0.1%.

- 10yr US govt bonds closed -1bp/0.93% yield and 30yr bonds -2bps/1.66% yield.

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -3bps/296bps.

- The DXY US dollar index closed -0.3%/89.68.

- Gold closed +0.6%/$1,893 per barrel, silver +1.3%/$26.57 per ounce, and copper -0.3%/$3.55 per pound.

- Crude oil closed +0.8%/$48.40 per barrel.

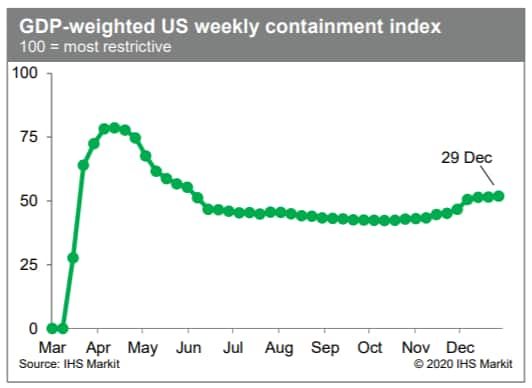

- The IHS Markit GDP-weighted US weekly containment index rose 0.4 index point this week to 51.9, reflecting increasing containment efforts in Massachusetts, Tennessee, and Louisiana. The index is at the highest level since early June, as the rate of new infections remains elevated. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The US Pending Home Sales Index (PHSI) fell for the third straight month in November, edging down 2.6% to a still-solid 125.7, but still up 16.4% from its year-earlier reading. (IHS Markit Economist Patrick Newport)

- All four regional indexes, mirroring the national index, plunged in March and April, shot up over May and August, and have edged down since, but remain more than 10% above their year-earlier level.

- "The latest monthly decline is largely due to the shortage of inventory and fast-rising home prices," wrote Lawrence Yun, the National Association of Realtors' chief economist. (Note: housing has become less affordable in recent months because rising home prices have eroded savings from lower mortgage rates.)

- Applications to buy homes—particularly high-end homes—remain strong: the Mortgage Bankers Association's Purchase Index is currently 26% higher than a year earlier. The index has leveled recently, though—a sign that sales may have peaked.

- The PHSI leads existing home sales by a month or two, according to the National Association of Realtors. Expect solid but flat-to-declining existing home sales in December or January or both.

- The US goods deficit widened in November by $4.4 billion, a larger widening than expected, reflecting unexpected strength in imports. Meanwhile, the combined inventories of wholesalers and retailers rose 0.3% in November, less of an increase than we had assumed. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Exports of goods rose 0.8% in November, and imports of goods rose 2.6%. Imports have already surpassed the pre-pandemic trend, and exports have now reversed a little more than three-quarters of the pandemic-induced decline.

- Areas of relative strength within exports include food, feeds, and beverages; automotive vehicles, parts, and engines; and consumer goods excluding foods and autos.

- The increase in inventories (wholesale plus retail), though smaller than we had anticipated, was the fifth consecutive monthly increase following steep declines earlier this year.

- In response to the unexpected weakness in inventories, we lowered our forecast of fourth-quarter inventory investment by $43 billion.

- Crowley Logistics has added 355 new reefer containers to its fleet. The new units, all 40-foot-long high cubes, are intended for the Central America and Caribbean markets. They have wireless asset monitoring (WAM) technology, which provides continuous monitoring as the reefers move from origin to destination, both at sea and over land, to ensure the integrity of the cold chain in transit. "We realize the importance of having the best refrigerated equipment in the right quantities - all strategically positioned to meet customers' needs during peak perishables season and throughout the rest of the year," said Brett Bennett, senior vice president and general manager of US-based Crowley Logistics. The new containers arrived in Santo Tomas, Guatemala, last week and are already being used in support of Central America's ongoing heavy northbound reefer season. The new containers are equipped with environmentally friendly Star Cool refrigeration units. The company expanded its on-terminal, perishables handling capabilities by constructing a new USDA inspection dock in Port Everglades, Florida, earlier this year. The USD1.6 million dock has more than doubled its capacity to 80 reefers. The dock also has individual, shoreside power plugs for each reefer, allowing for continuous temperature control, cutting cargo handling time and the need to move the container to a separate location for separate USDA inspections. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The United States Department of Defense (DOD) has awarded Moderna Therapeutics (US) a contract worth USD1,966,580,000 for the supply of an additional 100 million doses of its mRNA-based COVID-19 vaccine mRNA-1273. As reported by BioSpace, the additional doses are due to be supplied by 30 June 2021. US financial news source Street Insider has reported on the deal, indicating that the contract involved the participation of the US Army Contracting Command. BioSpace reports that Moderna currently has agreements with the US authorities for the supply of 200 million vaccine doses, not including those covered by the DOD contract. (IHS Markit Life Sciences' Brendan Melck)

- Recently published data by the Central Bank of Costa Rica (Banco Central de Costa Rica: BCCR) show that GDP declined by 7.2% y/y in the third quarter. All components of GDP, except government consumption, remain below 2019 levels. (IHS Markit Economist Lindsay Jagla)

- Although the global spread of the COVID-19 virus continued to put downward pressure on Costa Rica's economic growth in the third quarter, preventing a full recovery to pre-COVID-19 levels, the relaxation of various isolation measures and the transition to economic reactivation resulted in a partial rebound. Thus, after GDP reached record-lows in the second quarter, the economy began to grow slowly, resulting in quarter-on-quarter (q/q) growth of 1.7% in quarter three.

- The reopening of businesses and the resumption of various economic activities boosted internal demand and domestic consumption; compared with the second quarter, private consumption grew by 4.1% q/q and import demand grew by 5.3% q/q.

- Similar reopening and reactivation trends were seen around the world, with Costa Rica's key trading partners also beginning to recover. As a result, demand for Costa Rican exports increased by 5.5% q/q in the third quarter compared with the second.

- Government spending was the only component of GDP to remain at nearly the same level in both the second and third quarters. Government stimulus, which has included a package that provided loans to micro, small, and medium-sized businesses, bonuses for the unemployed, and tax moratoriums, stayed at the same level as the government struggled to scale up stimulus spending during the reactivation phase because of financing constraints.

- On the supply side, almost all economic sectors showed quarterly improvements in the third quarter compared with the second, with the manufacturing sector and information and telecommunications also reaching above 2019 levels. However, agricultural activities, utilities, retail and wholesale, and professional activities in technology, administration, and support services all contracted in quarterly terms for the second quarter in a row, declining even further in the third quarter from the already record-low second-quarter levels.

- The BCCR's data release is in line with our expectation that the economy would partially rebound in the third quarter following the severe contraction in the second. This is largely due to the transition from a focus on COVID-19 containment that resulted in strict lockdown measures in the second quarter to a focus on economic reactivation with a phased reopening plan set in motion in the third quarter.

- We expect the initial rebound following the severe contraction in the second quarter to taper off, preventing a full economic rebound in 2020. Overall, we expect the Costa Rican economy to contract by 5.3% y/y in 2020 even with the beginning of recovery evident in the third quarter.

- Prevalent downside risks continue to dampen the economic outlook. Reopening has stalled both at home and abroad amid the continued spread of COVID-19 cases, which limits the recovery of domestic and external demand.

Europe/Middle East/Africa

- European equity markets closed modestly lower; UK -0.7%, Germany/Spain -0.3%, France -0.2%, and Italy -0.1%.

- European govt bonds closed mixed; Italy/Spain -1bps, Germany/UK flat, and France +1bp.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -1bp/238bps.

- Brent crude closed +0.8%/$51.63 per barrel.

- The EU and China have announced a long-awaited deal on an investment treaty, in a move that is aimed at opening up lucrative new corporate opportunities but risks antagonizing president-elect Joe Biden's incoming US administration. The deal will remove some barriers to EU companies' possibilities for investing in China, such as specific joint-venture requirements and caps on foreign equity. Industries where the EU has secured improved access terms include automotive, private healthcare, cloud computing and ancillary services for air transport, the EU's trade commissioner Valdis Dombrovskis said. The improved market access arrangements for car manufacturing cover electric vehicles and hybrids, he noted. (FT)

- CAR magazine reports that Ferrari is planning two EV spin-offs from the upcoming Purosangue utility vehicle, due in 2024 and 2025, citing Ferrari sources. In addition, CAR confirmed the known codename F175 and an early 2022 calendar-year launch. According to the report, the Purosangue will be powered by an 800hp V12 engine at launch, followed by a hybridized V8 engine. However, CAR also reports that the two all-electric spin-offs are planned for 2024 and 2026; these reportedly have the program codes F244 and F245. The report says that these two projects are related to the Purosangue, which has "electric-ready" hardware, which suggests that they will also be some type of utility vehicle. However, the shape of these future projects was not confirmed. The magazine says that the Purosangue's platform is a flat skateboard that is electric-ready, capable of packaging up to four e-motors with an initial output of 610 bhp comprising a scalable fast-charging lithium-ion battery pack with standard capacity of 80 kWh. It also says that its sources have confirmed that the working name of the Purosangue is expected to be the production badge as well. The sport utility vehicle (SUV) is expected to prioritize dynamics over rock crawling performance but is also expected to be sportier than the Lamborghini Urus, Bentley Bentayga, Aston Martin DBX, or Rolls-Royce Cullinan. The development of the Purosangue utility vehicle has been one of the worst-kept secrets, with Ferrari executives sharing some hints earlier. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The European Commission is considering abolishing 'best before' date labels to stop people throwing away edible food because they are confusing them with 'use by' labels. Unlike 'use by' dates which are based on microbiological criteria and signal when it is no longer safe to consume a food, 'best before' dates denote quality so the product is safe to eat but might not taste as good. Consumers often throw away perfectly edible products, adding to the EU's food waste mountain, because the 'best before' date has passed and they believe they can no longer consume the food safely. The idea of abolishing 'best before' date labelling is among several options set out in an Inception impact assessment paper on different plans for a revision of the 2011 food information to consumers regulation (FIC - 1169/2011) on which the Commission is seeking feedback until 3 February. Based on the feedback the Commission will polish up its plans ready for a full 12-week consultation in the first half of 2021. A proposal to revise the FIC regulation will then follow in the fourth quarter of 2022 "Consumers often misunderstand and misuse date marking," explains the paper setting out the Commission's plans for the FIC revision. "According to a 2015 Eurobarometer, less than 1 in 2 consumers understand the meaning of date marking: "use by", which indicates the ultimate food safety date, and 'best before', which refers to the date food retains its optimal quality," the paper continues. "This contributes to the 20% of food that Europeans waste annually. A Commission study on date marking published in 2018 concluded that up to 10% of all food waste generated in the EU could be linked to date marking." (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Advanced Petrochemical Co. (Jubail, Saudi Arabia) says that its wholly owned subsidiary, Advanced Global Investment Co. (AGIC), has signed long-term offtake agreements for the sale of polypropylene (PP) with three international firms totaling almost 620,000 metric tons/year. Agreements have been signed with Vinmar International and with Tricon Dry Chemicals—part of Tricon Energy—for 250,000 metric tons/year each, and with Mitsubishi Corp. for 120,000 metric tons/year, Advanced says in a statement to the Tadawul stock exchange. The value of the contracts will be in accordance with marketing fees specified in the agreements, based on prevailing market prices during the term of the agreements, the statement says. Contracts are for the sale of PP to be manufactured by Advanced Polyolefins Co. (APOC). They will be effective from the date of commercial operations of APOC until 31 December 2028. APOC will build and operate a propane dehydrogenation (PDH) and PP complex at Jubail with design capacity for 843,000 metric tons/year of propylene and 800,000 metric tons/year of PP. Advanced said earlier this month that construction would start in 2021 with start-up scheduled for 2024. Advanced announced in March 2020 the signing of a partnership agreement between AGIC and SK Gas Petrochemical, a unit of SK Gas, to establish APOC as a closed joint-stock firm. (IHS Markit Chemical Advisory)

- Zimbabwe's central bank, the Reserve Bank of Zimbabwe (RBZ), on 18 December decided to keep its key interest rate at 35%. The rate was last raised on 1 July to curb speculative borrowing and support the 8 June updating of the formal market-based foreign-exchange trading system, which came into operation on 23 June. The medium-term lending rate for the productive sector remained at 25%. (IHS Markit Economist Alisa Strobel)

- Although annual headline inflation remains at alarmingly high rates, it continued to decline gradually in November, reaching 401.7%, the lowest rate since January. Furthermore, the economy has recorded an increase in the production of goods and services across most of the productive sectors, according to the RBZ. Productive gains were especially strong during the second half of 2020.

- IHS Markit expect Zimbabwe's monetary policy to remain tight in 2021 to address the high price inflation and depreciating currency; Zimbabwe's Ministry of Finance targets annual inflation to slow down drastically to an average of below 135% in 2021. Recent figures by the RBZ for the week ending 13 November show that the Zimbabwean dollar lost 0.2% against the US dollar, from ZWD81.5453/USD1 to ZWD81.6741/USD1 in the foreign-exchange auction market.

- As part of tighter monetary policy, money supply management is expected to remain conservative in the short-term outlook. As the government continues to put emphasis on fiscal consolidation, net credit to the government is expected to continue to decline while growth in broad money will mainly be driven by credit to the private sector. Data available for the month of September show that credit to the private sector was mainly extended towards agriculture at 27.38%, followed by manufacturing at 18.59%, households at 17.00%, distribution at 10.68%, and mining at 10.68%.

- We see multiple challenges for an economic recovery in 2021. Monetary and fiscal policy would need to be maintained in the medium term so that macroeconomic fundamentals reach the stability that would anchor sustainable growth. The lack of structural adjustments and the monetary overhang of past monetary financing of deficits through continued quasi-fiscal activities by the RBZ and the removal of subsidies on fuel and electricity have contributed to the current misbalance in macroeconomic fundamentals.

- The economy is challenged by the country's severe foreign-exchange crunch; therefore, we expect to see continuing emphasis on foreign-exchange auctions in the new year, which will remain the RBZ's key monetary policy instrument. Exchange controls and other restrictions on access to foreign exchange are expected to continue to provide additional deep distortions to economic activity in the short term.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +2.2%, South Korea +1.9%, Mainland China +1.1%, India +0.3%, Australia -0.3%, and Japan -0.5%.

- On 22 December, Asia Securities Industry & Financial Markets Association (ASIFMA) published a report on sustainability data in the Asia-Pacific region, recommending a policy drive to establish common standards. (IHS Markit Economist Brian Lawson)

- The trade body's report, prepared jointly with the Future of Sustainable Data Alliance (FOSDA), reflected a 12-month review including online discussions involving 500 participants.

- It suggests that East Asia is lagging behind global environmental, social and governance (ESG) development with 5% of regional assets under management invested in sustainable projects versus 30% in North America.

- It also argues that rapid economic growth, expanding populations, industrialization and urbanization create large-scale need for climate-related financing.

- In an ASIFA poll, 56% of respondents described "inconsistent data" as the most serious data challenge to ESG development, while 35% of respondents cited "poor quality data".

- The report noted that the region lacks standardized ESG measurement criteria, suggesting that metrics differ between countries and sectors and within industries.

- ASIFMA made eight key policy recommendations. These include global or at least regional convergence towards a principles-based taxonomy, higher and more consistent corporate disclosure standards, encouragement of stronger analysis, policies and regulation to encourage development of ESG/sustainable financing capabilities, and a focus on ESG development through education.

- Mainland China updated the 2020 list of industries in which foreign investment are encouraged on 28 December, according to the National Development and Reform Commission (NDRC) and Ministry of Commerce (MOC). Consisting of two sub-lists—national and central and western regions—the 2020 list was expanded to 1,235 items, up by 127 from 2019. (IHS Markit Economist Lei Yi)

- The national list continued to focus on attracting foreign investment especially into the manufacturing sector for strengthening domestic supply chains, as well as aiming to promote the integration between services and manufacturing.

- Newly added items cover high-end equipment manufacturing in areas including integrated circuits and sophisticated medical devices like ECMO, as well as the application of leading technologies such as 5G, artificial intelligence, and blockchain.

- Other items include waste disposal and clean energy development, which are in line with the nation's transition towards a more environmental-friendly growth path and the carbon neutral pledge.

- On 16 December, NDRC and MOC also published an updated version of the negative market access list applying to all market entities. While the number of total restricted items were reduced to 123 compared with 131 in the 2019 list, the reduction was mostly coming from merging relevant items. Still, specific measures got waived or simplified, especially those relating to regulatory review and approvals.

- Using an annually updated list system helps manage investors' expectations and stabilize foreign investment. Thanks to mainland China's successful pandemic control measures, foreign direct investment (FDI) into the country continued to recover, recording a year-on-year growth of 4.1% through November (USD denominated figures).

- Tesla has signed a deal with Chinese supplier Sichuan Yahua Industrial Group for lithium hydroxide supply. According to a statement from Yahua, Tesla will purchase battery-grade lithium hydroxide from the company starting from 2021; the contract will run through 2025. The value of the deal is estimated to be between USD630 million and USD880 million. According to Reuters, Tesla has already reached a deal with Chinese supplier Ganfeng Lithium to source a key ingredient in electric vehicle (EV) batteries. The US EV maker's new contract with Yahua will enable it to further secure key material supply to support production ramp-up at its Shanghai plant. The contract with Yahua has led to renewed discussions about the possibility of Tesla further lowering the selling price of its Model 3 in the Chinese market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Jiading district has signed an agreement with artificial intelligence (AI) companies to infuse momentum into the development of the automotive industry. The AI companies include Horizon Robotics, CITICPE, and Baidu Group, which will help the district build smart cars and cities, reports SHINE. Horizon Robotics will provide AI chips to help traditional car enterprises in the district to develop smart cars and their computing platform. In Jiading, CITICPE will build its headquarters, which will involve in science technology and intelligent internet of things (IoT) and will also provide financial support for regional industrial development. CITICPE also plans to invest in the "Cloud+ Intelligent Driving Innovation Base" project in Jiading that intends to meet the cloud computing requirements of smart cities. Baidu will establish a demonstration zone in the district to test intelligent connected vehicles. The Chinese government is strongly prioritizing the electrification and autonomous vehicle (AV) sectors for it to gain the leadership position in the global automotive industry. China is pushing to commercialize smart AVs, which is a key part of the country's 'Made in China 2025' plan. Recently, the country released the Technology Roadmap for Intelligent-Connected Vehicles 2.0, which expects vehicles with partial autonomous functions to account for 50% of new vehicle sales by 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Olam group acquired the US chilli grower and processor CPB from the Japanese sauce-maker Mizkan for USD108.5 million this December. The chilli specialist is located in New Mexico and works with manufacturing, retail, private label and foodservice customers. CPB's plantations and factory are close Olam Spices' red chilli manufacturing facility in Las Cruces, New Mexico. "Combining CPB's specialty and green chilli range with our red chilli portfolio (which includes paprika, chilli powder and chilli pepper) means we can deliver a wider range of ingredient solutions for customers looking to satisfy the rising demand for authentic Mexican flavors," the chief officer of Olam Spices, Greg Step, said. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Indian electric vehicle (EV) solutions firm EV Cosmos has partnered with chargeNET Sri Lanka to set up public EV charging stations in India, reports ET Auto. The two companies plan to set up 500 charging stations with installed capacity of 50 MW in the next two years at strategic locations in cities, as well as on highways and around hotels. The stations will be capable of charging an EV in 15-30 minutes. The companies are also looking at integrating solar power into their charging stations. EV Cosmos is a Bhopal-based EV charging solutions provider and chargeNET is a group company of a UK-based CodeGen Group with a manufacturing facility in Sri Lanka. chargeNET has set up more than 80 commercial charging stations in Sri Lanka. The latest development is in line with the Indian government's intention to support the uptake of EVs and related infrastructure. This year's key initiatives by the government include the sanctioning of 2,636 EV charging stations in 62 cities across 24 states or union territories under the second phase of the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme. (IHS Markit AutoIntelligence's Isha Sharma)

- The government of Indonesia and South Korea-based LG Group have signed a memorandum of understanding (MOU) on a USD9.8-billion electric vehicle (EV) battery investment deal, reports Reuters, citing Bahlil Lahadalia, head of Indonesia Investment Coordinating Board. The deal, which was signed on 18 December, would also see LG collaborate with other companies, including Hyundai, and includes investments across the EV supply chain. The agreement makes Indonesia the first country in the world to integrate the electric battery industry from mining to producing EV lithium batteries, according to Lahadalia. Nickel-rich Indonesia is keen to develop a full supply chain for nickel in the country, especially to extract battery chemicals, make batteries, and eventually build EVs. Nickel and cobalt are key materials to make lithium-ion (Li-ion) batteries. The country has stopped exports of unprocessed nickel ore to support investment in its domestic industries. The Indonesian government aims at making the country an electrified-vehicle hub in Asia and beyond, targeting to start production of such vehicles in 2022. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-30-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-30-december-2020.html&text=Daily+Global+Market+Summary+-+30+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-30-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 30 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-30-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+30+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-30-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}