Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 31, 2020

Securities Finance 2020 Snapshot

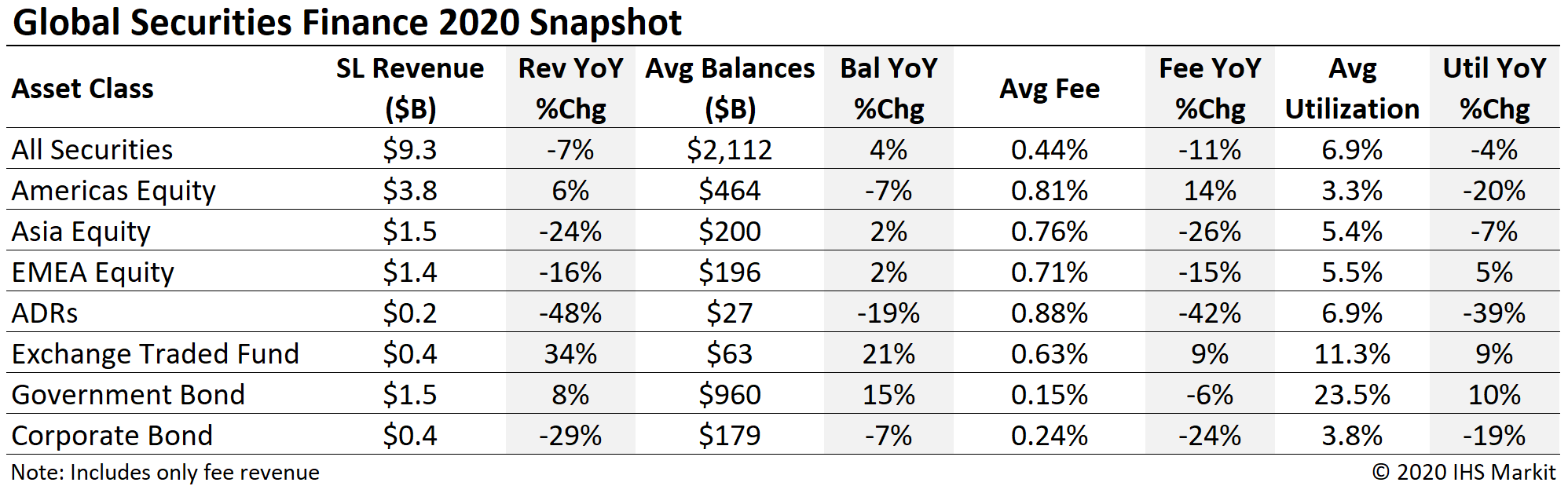

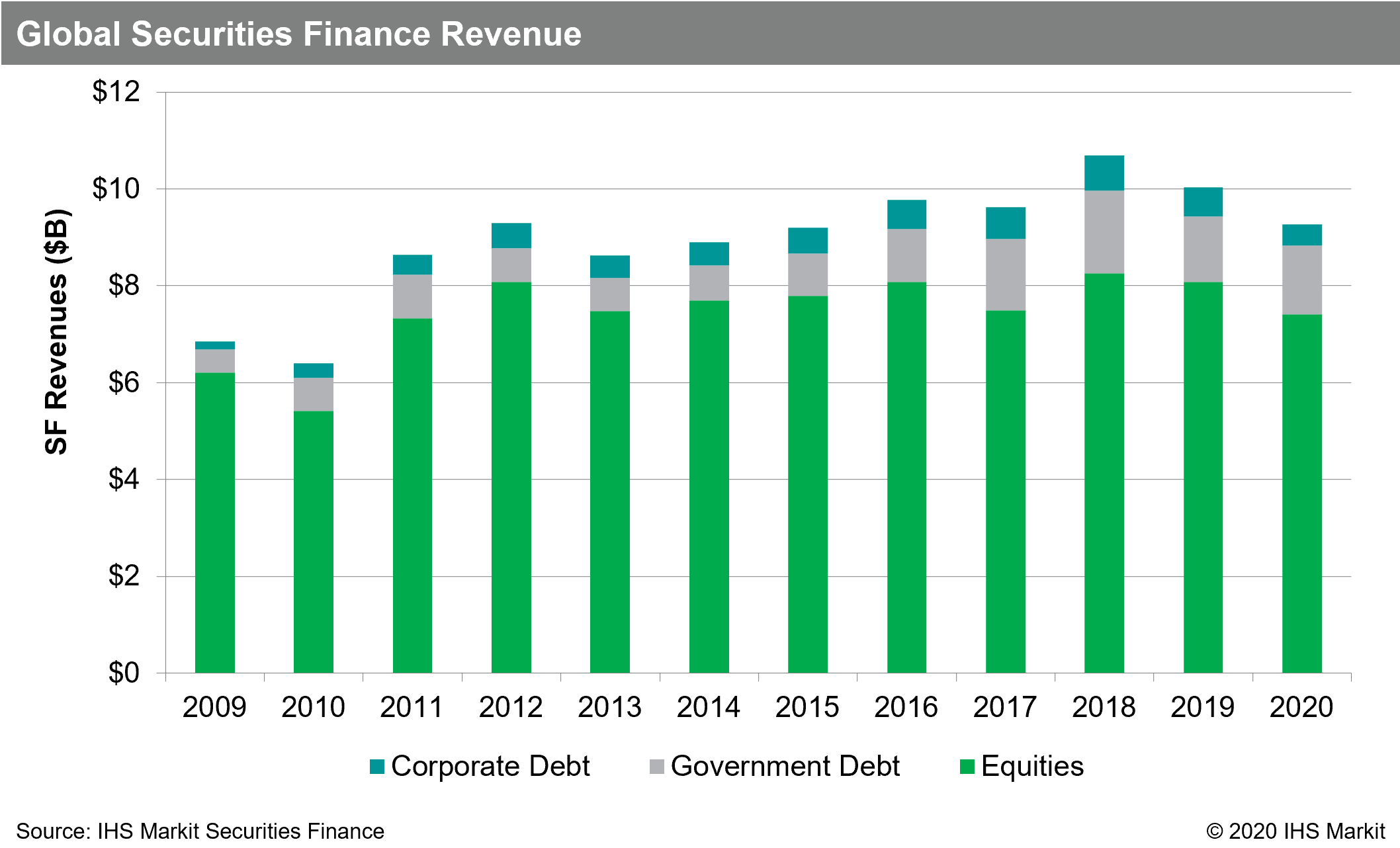

- $9.3bn in FY 2020 securities finance revenue, 7% YoY decline

- Americas equities, ETFs & Government debt post YoY revenue growth

- December 2nd most revenue generating month of 2020

Global securities finance revenue $9.3bn for 2020, a 7% YoY decline. The primary growth drivers for equities were increased borrow demand during the Q1 market decline followed by borrow demand tied to capital raising during the recovery. Peak monthly revenue for 2020 was observed in June, when a trio of US equities delivered outstanding lending returns on the back of corporate action related arbitrage opportunities. A most welcome end to 2020 was made by December notching the 2nd most monthly revenue at just over $900m, an increase of 12% YoY. Lendable assets reached a new all-time in December, nearly $30T, adding to the challenge of increasing utilization going forward, however a similar statement could have been made at lower levels entering 2020 before the surge in utilization during the Q1 decline. Many of the drivers of the revenue upswing in Q4 remain in place heading into 2021, including increased traditional and SPAC IPOs, public short seller campaigns and ETF usage.

Revenue snapshots for H1, Q3, October and November are currently available. We will host 2020 review webinars in local time zones, details to follow.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-2020-snaphsot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-2020-snaphsot.html&text=Securities+Finance+2020+Snapshot+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-2020-snaphsot.html","enabled":true},{"name":"email","url":"?subject=Securities Finance 2020 Snapshot | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-2020-snaphsot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+2020+Snapshot+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-2020-snaphsot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}