Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 31, 2020

Daily Global Market Summary - 31 December 2020

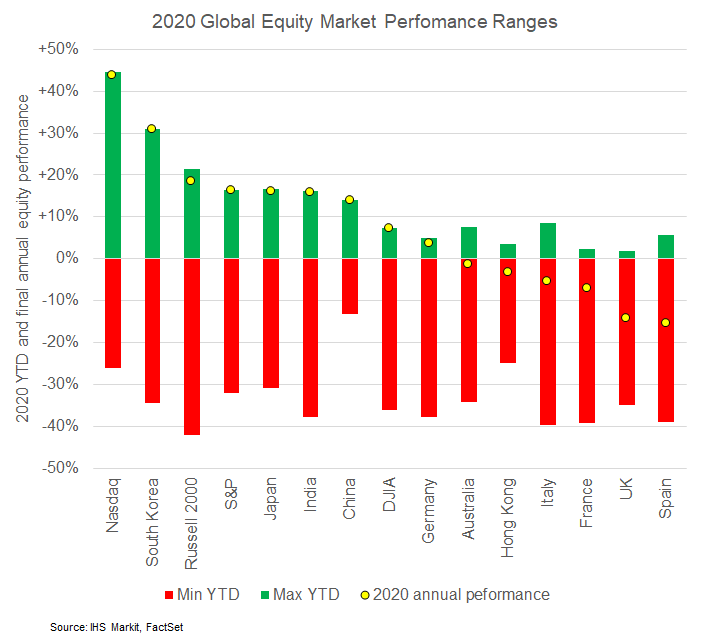

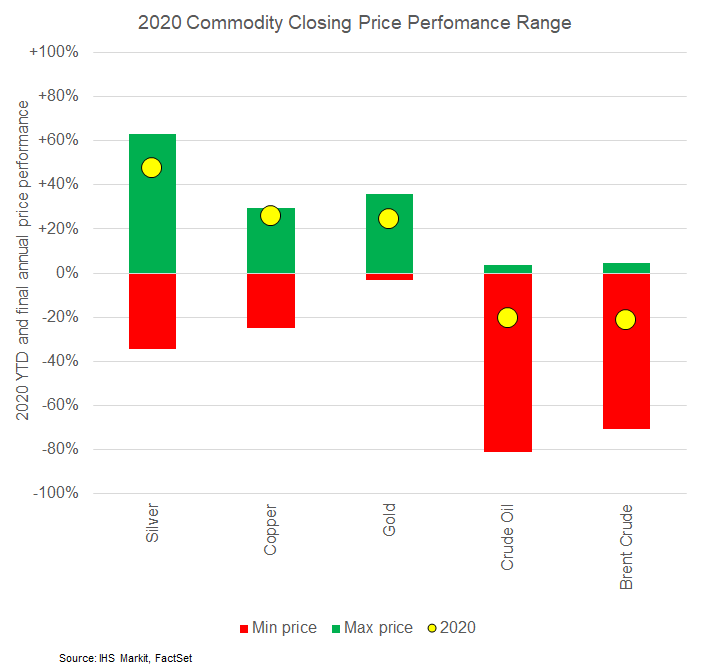

US and APAC equity markets closed mixed, while Europe was lower. US government bonds closed higher and benchmark European government bonds were mixed. The European iTraxx and CDX-NA indices were almost flat on the day, with the latter closing slightly tighter. Gold and oil were higher on the day, while silver and copper closed lower. The combination of unprecedented amounts government stimulus/liquidity and the rapid development of a COVID-19 vaccine drove an unexpectedly rapid recovery from March's lows across equities, credit, and commodities, but the final numbers of 2020 indicate that the year did conclude with a significant spread between the best and worst performing markets.

Americas

- US equity markets closed mixed with the S&P 500 and DJIA closing new record highs; DJIA +0.7%, S&P 500 +0.6%, Nasdaq +0.1%, and Russell 2000 -0.3%.

- The Nasdaq was the best performing global equity index, ending

the year +43.6%:

- 10yr US govt bonds closed -1bp/0.92% yield and 30yr bonds -1bp/1.65% yield.

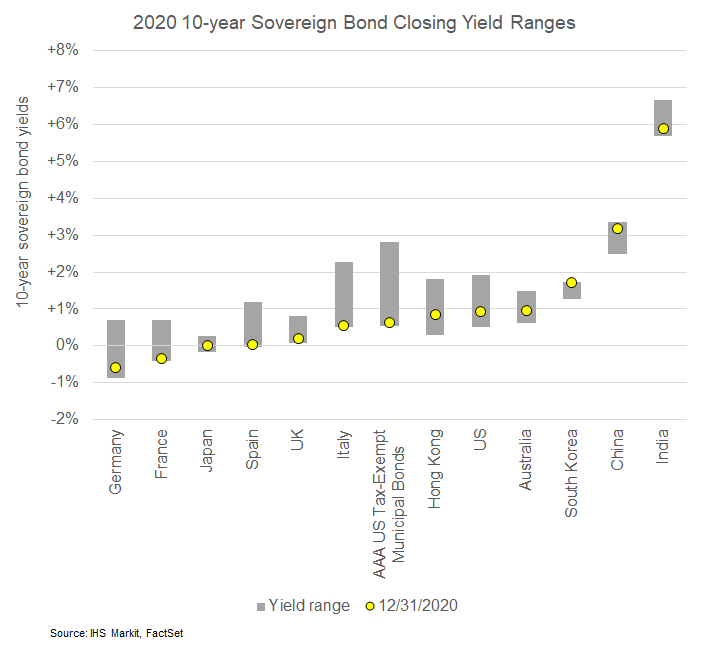

- South Korea and China were the only countries whose 10yr

sovereign bond yield ended the year at the higher end of the 2020

range:

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -3bps/293bps.

- Here is a summary of this year's European iTraxx and CDX-NA

daily spreads from IHS Markit's Price Viewer:

- DXY US dollar index closed +0.3%/89.97 and remains near the lowest level since March 2018.

- Gold closed +0.1%/$1,895 per ounce, silver -0.6%/$26.41 per ounce, and copper -0.8%/$3.52 per pound.

- Crude oil closed +0.2%/$48.52 per barrel.

- Silver ended the year +47.4%, while Brent/WTI were over 20%

lower.

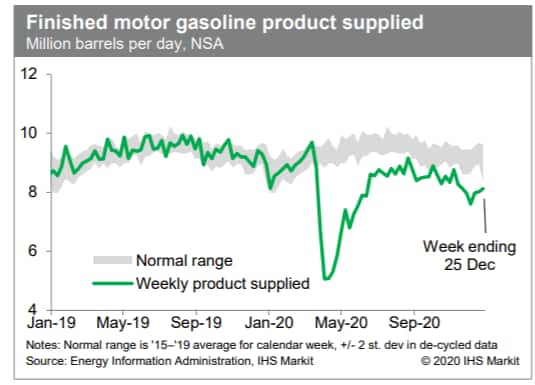

- US consumption of gasoline has turned up over the last couple

of weeks but remains well below a normal range for this time of

year, suggesting reduced internal mobility. (IHS Markit Economists

Ben Herzon and Joel Prakken)

- Seasonally adjusted (SA) US initial claims for unemployment

insurance fell by 19,000 to 787,000 in the week ended 26 December.

The not seasonally adjusted (NSA) tally of initial claims fell by

31,736 to 841,111. Last week's numbers may have been affected by

the Christmas holiday. (IHS Markit Economist Akshat Goel)

- The president signed the Consolidated Appropriations Act, 2021 over the weekend, which provides enhanced benefits of up to $300 per week for 11 weeks, half the amount provided in the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Funding for the Pandemic Unemployment Assistance (PUA) and the Pandemic Emergency Unemployment Compensation (PEUC) programs was also extended by 11 weeks.

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 103,000 to 5,219,000 in the week ended 19 December. Prior to seasonal adjustment, continuing claims fell by 171,035 to 5,258,073. The insured unemployment rate in the week ended 19 December was unchanged at 3.6%.

- Independent contractors, self-employed individuals, or individuals who otherwise would not qualify for benefits in regular state programs can apply for claims under PUA. There were 308,262 unadjusted initial claims for PUA in the week ended 26 December. In the week ended 12 December, continuing claims for PUA fell by 811,465 to 8,459,647.

- Individuals who have exhausted regular benefits are eligible for up to 24 weeks of extended benefits under PEUC. In the week ended 12 December, continuing claims for PEUC fell by 20,377 to 4,772,853. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 12 December, the unadjusted total fell by 799,841 to 19,563,905.

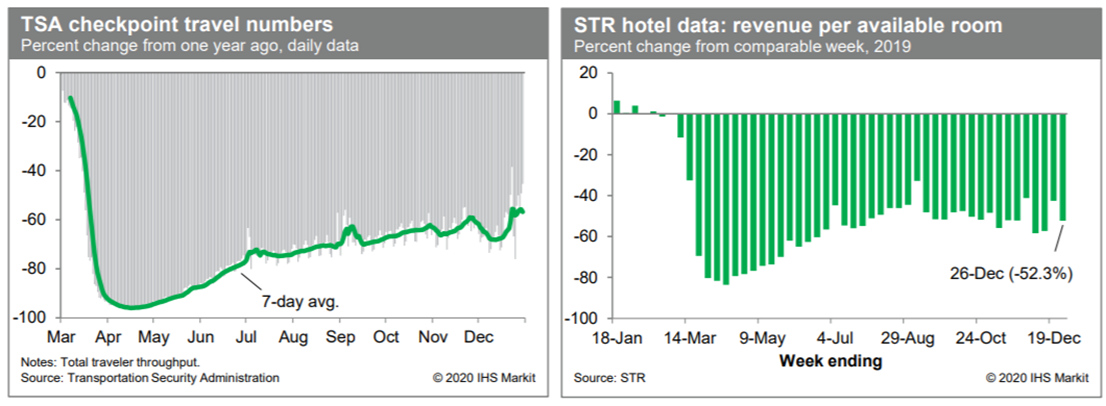

- Passenger throughput at US airports relative to year-earlier

levels generally trended sideways over the last several days after

a sharp increase ahead of the Christmas holiday. On a seven-day

average basis, throughput has risen to its highest level since late

March in the past week as passengers perhaps are prioritizing

holiday travel (relative to business and other leisure travel).

There was similar strength around the Thanksgiving holiday.

Furthermore, revenue per available room at US hotels last week was

52.3% below the year-earlier level, according to STR. This was down

from the prior week's reading and in line with the sideways trend

of continually weak year-over-year comparisons over the last

several months. By this metric, recovery in the travel sector

stalled during the summer months and has yet to gain renewed

traction. (IHS Markit Economists Ben Herzon and Joel Prakken)

- IHS Markit forecasts that battery electric passenger-car sales

volumes across China, Europe, and the United States will reach 2.45

million units in 2021, or about a 5.4% market share, representing

an increase of 1.7% over 2020. (IHS Markit AutoIntelligence's

Stephanie Brinley)

- Electrification is a growing dynamic in the auto industry, strongly affected by regulatory compliance issues in 2020 and 2021, according to IHS Markit. China and Europe are leading the regulatory push on electrification, and President-elect Joe Biden in the US expected to provide more government support for an electric vehicle (EV) transition as a method to address climate change.

- In the European market in 2020, battery electric vehicle (BEV) sales were boosted substantially by regulatory requirements, despite overall market weakness on the impact of the COVID-19 pandemic. The passenger-car CO2 target of 95 g/km has been phased in during 2020 and will be fully implemented in 2021. The market share of BEV sales increased to nearly 7% in October and was growing in the last quarter of 2020, aiding all major car manufacturers in minimizing the potential regulatory compliance gap.

- Vijay Subramanian, IHS Markit CO2 compliance director, automotive, says, "Excess premiums for 2020 are expected to reach EUR1.04 billion with a market-wide CO2 target miss of 2 g." Although Europe has been a significant regulatory driver of electrification, China remains a leading market for electrified vehicles with its "dual-credit" policy. The 4 liter/100 km CAFC Phase-5 target for 2025, with updated new energy vehicle (NEV) requirements starting from 2021, will be the key driver further intensifying electrification development in the region. Subramanian says, "However, current IHS Markit forecasts predict a BEV market share of nearly 14.6%, representing nearly 3.2 million passenger vehicles in China by 2025 - which will still leave a significant gap and more than 10 million CAFC credit deficits."

- In the US, the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule was finalized and released on 30 March 2020. US fuel-efficiency and emissions rules are set on a national level through the 2026 model year. Xi Wang, IHS Markit powertrain analyst, says, "As a result, relaxation of standards is expected to provide some headwinds to the wave of new BEV vehicles being introduced to the market. However, with the incoming Biden administration, the possibility of the US rejoining the Paris Agreement and the California waiver being reinstated may well incentivize BEVs in the US market sooner rather than later." US emissions and fuel-economy standards for the period following the 2026 model year are expected to be set under President-elect Joe Biden's future administration, which is expected to adopt a more-aggressive policy approach than the current administration.

- During 2020, automakers revealed a number of high-profile new EVs, many of which are arriving in 2021. In addition, automakers such as Volkswagen, Ford, and General Motors have announced increases in EV investment, both for production and for vehicle development. The momentum on automakers' investment has shifted decisively to electrified propulsion.

- Although a transition to a light-vehicle market predominantly made up of BEVs likely remains at least a decade away, more governments announced in the second half of 2020 national or regional initiatives on discouraging or fully banning sales of ICE vehicles anywhere from 2030 to 2045.

- Along with regulatory actions in Europe and China, the narrative on electrification and BEVs as a solution to address climate change has increased in 2020 and will affect the industry in the coming decade.

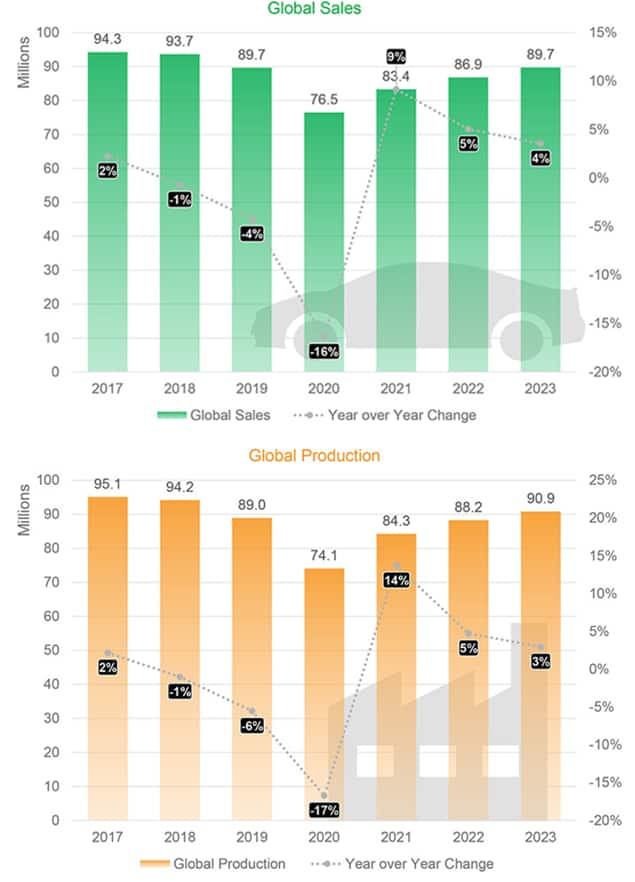

- As we exit 2020 and begin 2021, IHS Markit offers this look at

the decline of 2020 and prospects for improvement in 2021. Although

there remain headwinds, the year is closing with approvals of

multiple COVID-19 vaccines in various countries, as well as a trade

deal framework for the UK exit from the European Union. The

vaccines and elimination of the threat of a no-deal Brexit are

positive signals. Although the decline in global sales and

production was not as dire as expected in the April-May 2020

timeframe, the declines in the second quarter of 2020 were far more

severe than the 8% decline over the two-year 2008 to 2009

recession. IHS Markit forecasts a 9% y/y gain in global auto sales

and a 14% y/y improvement in production in 2021, compared to the

pandemic-induced declines in 2020. IHS Markit's economics team

estimates global real GDP dropped 4.0% y/y in 2020, with a recovery

in 2021 expected to lead to growth of 4.5% y/y. However, IHS Markit

forecasts that it will take until 2023 to reach the level of 2019

again (89.7 million units), as growth in 2022 and 2023 (5% and 4%

respectively) slow from 2021 improvements. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- The USA's Alcohol and Tobacco Tax and Trade Bureau (TTB) has lifted restrictions that prevented vineyards from selling wine in regular-sized cans. Previously, the TTB only allowed wine and hard (alcoholic) cider above 6.9% ABV to be sold in larger cans such as 12.7 ounces (375 milliliters), and only allowed 8.4-oz cans to be sold in packs of three or four, not individually. Now, wine can be sold in the same traditional-sized cans as carbonated soft drinks and beers, such as 12 oz and individually in 8.4 oz. Senator Chuck Schumer, who has advocated on behalf of New York State vineyards for the restrictions to be lifted, applauded the move. According to Schumer's office, in 2019, canned wine sales grew by 68%, resulting in sales of nearly USD200 million, reports WENY News. "New York's USD4.8 billion wine industry was left hanging on the vine by TTB's outdated rules and restrictions," said Schumer. "Today's decision to allow winemakers to sell their products in the most popular-sized cans will lead to further economic growth and allow producers to capitalize on an explosive trend. "I'm proud to have helped New York's wine industry cut through the bureaucratic red tape, can regulations that weren't helping anybody, and uncork the full potential of the Upstate economy." Back in July, Senator Schumer visited Fox Run Vineyards in Penn Yan to call for the TTB to lift the restrictions, arguing that the 12-ounce cans are less expensive and easier to source than the larger cans. He added that a survey showed individually sold cans were most popular among customers. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Researchers at Pacific Northwest National Laboratory (PNNL) have developed a new machine-learning-based tool that uses publicly available traffic data to predict street-level traffic flow. The tool, called Transportation State Estimation Capability (TranSEC), will support traffic engineers to relieve bottlenecks to alleviate city traffic. The new tool combines datasets collected from UBER drivers and other publicly available traffic sensor data to map traffic flow over time. The TranSEC team began using data from the entire 1,500-square-mile Los Angeles metropolitan area to reduce the time needed to create a traffic congestion model from hours to minutes. Arif Khan, a PNNL computer scientist who helped develop TranSEC, said, "What's novel here is the street level estimation over a large metropolitan area. And unlike other models that only work in one specific metro area, our tool is portable and can be applied to any urban area where aggregated traffic data is available." The project is supported by the US Department of Energy's Office of Energy Efficiency and Renewable Energy's Vehicle Technologies Office, Energy Efficient Mobility Systems Program. PNNL is planning to make TranSEC available to municipalities nationwide and eventually use it to help to program autonomous vehicle routes. Uber is involved in multiple projects to help cities curb traffic. It has teamed up with Ford and Lyft to share data that will help the mobility companies to manage traffic in cities. The three companies have committed to SharedStreets, a non-profit organization, to develop standards for private transport companies on shared data. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- European equity markets closed lower; UK -1.5%, Spain -1.0%, and France -0.9%.

- 10yr European govt bonds closed mixed; France +1bp and UK/Spain -1bp.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover +4bps/243bps.

- Brent crude closed +0.3%/$51.80 per barrel.

- The agreed EU-UK trade deal is a welcome development for the UK

economy, which is facing the prospect of ever-tighter COVID-19

virus restrictions spilling into 2021. However, the new arrangement

is a "slim" version, dealing predominantly with trade in goods

while paying minimal attention to services. (IHS Markit Economist

Raj Badiani)

- The European Union and the United Kingdom have reached an agreement on their future trading relationship, which will begin once the UK leaves the EU single market and Customs Union on 1 January 2021.

- The ratification process is under way. The deal has been reached given the unanimous backing of the 27 EU ambassadors, while the member states have all given their written approval. In an emergency sitting on 30 December, the UK parliament approved the deal, which has been passed into law.

- Meanwhile, the European Parliament has already announced that it will not hold a vote until early 2021, but the deal is to be applied provisionally until its complete ratification.

- The deal allows "zero tariff, zero quota" trade in goods between the UK and the EU, the UK's biggest trade partner.

- In 2019, UK export of goods to the EU were GBP170 billion (7.7% of UK nominal GDP). Meanwhile, UK import of goods from the EU were GBP266.1 billion.

- The EU has insisted that the UK would only have tariff-free

access to the EU single market if the country commits legally to a

set of "level playing field" principles that minimize the risk that

it will undercut the EU on environmental regulation, workers'

rights, and state aid to businesses. However, the UK insisted that

any trade agreement with the EU has to respect its sovereignty and

freedom. The agreed compromise is as follows:

- Both sides have agreed to a non-regression clause in the deal, meaning that the UK and the EU will not distil the shared rules they currently have on workplace rights and environmental standards.

- A new arbitration mechanism system or a joint partnership council will be formed to resolve any disputes as a result of regulatory divergences between the two parties using international law. Ultimately, this could allow for sanctions in the form of tariffs if either side seriously diverges from the other's regulations.

- Importantly, the UK achieves its primary goal to deny the European Court of Justice (ECJ) a place in settling disputes over the application of the deal.

- The EU dropped its demand for a ratchet mechanism to trigger automatic tariffs if the UK diverges from EU regulations.

- The UK is not required to follow EU rules on state aid subsidies to businesses but must observe the broad principles set out in the treaty.

- Manufacturers also welcomed an agreement over rules of origin, which allows them to self-certify and ensure that the processing of goods also counts under the zero-tariff regime. Stuart Rowley, president of Ford Europe, said, "It is now important to understand the detailed rules of origin which will apply and to create as smooth a transition as possible by maximizing flexibility as businesses adjust to the new trading environment."

- On balance, the EU-UK trade deal still represents good news for UK manufacturers, given its large export base.

- The agreed trade deal for goods, which is a narrow version, is broadly in line with our expectations.

- Despite the limited trade deal, it still represents a welcome relief by removing the risk of failed trade negotiations negatively affecting the UK economy, already scarred by the COVID-19 virus crisis.

- Furthermore, ever-tighter COVID-19 virus restrictions in England and elsewhere in the UK point to renewed GDP losses in the final quarter of 2020 alongside the increasing risk of further weakness in early 2021. Indeed, the UK government has placed 44.1 million or 78.3% of England's population in the toughest tier 4, which orders the closure of non-essential retail outlets and the hospitality and leisure sectors.

- Nevertheless, the trade deal has some shortcomings, namely that large parts of the UK economy are beyond the scope of this agreement, and its future relationship with the EU for much of its services economy and the financial services sector remains undefined.

- A wider agreement to include services was out of reach, particularly with the current UK administration insisting on full sovereignty of its parliament and precedence over the sovereignty of all other parliaments and no jurisdiction of the ECJ in English law.

- With the UK leaving the EU single market and Customs Union, UK exporters will still face additional checks for safety and security documentation, and customs papers, implying that it does not guarantee frictionless trade. Although a deal has been reached, UK traders face a new raft of paperwork and cost. According to industry groups, the UK leaving the EU single market and Customs Union will require UK firms to complete an additional 200 million customs forms at an estimated cost of more than GBP7 billion a year.

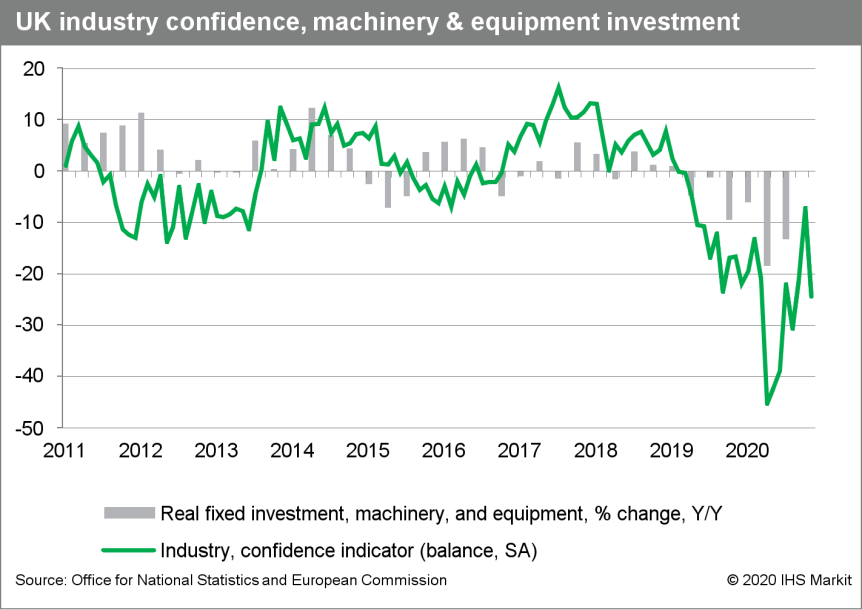

- The stretched Brexit process has taken its toll on the UK's

industrial sector, diluting its willingness to invest. Indeed, the

lack of Brexit clarity has squeezed business investment since 2018,

with firms at first fearing a no-deal Brexit and the threat to

their exports to the EU after the UK leaves the region's Customs

Union and single market. This has led to diminishing industrial

sentiment, triggering a sustained fall in business investment led

by plummeting machinery and equipment investment.

- Rimac Automobili has started pre-series production of its all-electric hypercar 'C_Two' at its facility in Veliko Trgovišće, Croatia, according to a company statement. The automaker will build six pre-series units of the C_Two before full-scale production in 2021. "We're creating an entirely new type of performance vehicle with the C_Two. After thousands of virtual simulation hours, years of design and engineering, and many rough and ready prototypes, it's a very special feeling to see pre-series cars now making their way up our production line. This is the clearest sign yet that the C_Two is almost here, and we can't wait to deliver the cars to our customers in 2021 and to showcase it all over the world," said Rimac Automobili founder and CEO Mate Rimac. In June, Rimac Automobili opened the new production line at its Croatian plant for the C_Two. The production line has already been used for the production of 12 experimental and validation prototype C_Two vehicles, used for the extensive testing program as well as validation and crash testing. Now, the six pre-series cars are essentially production-specification C_Twos, with a fit and finish, drivability, and reliability that is nearly production-ready. Assembling each C_Two pre-series car takes around eight weeks, cutting the production time in half compared to the "nest production" used before the production line was created and allowing for the build of four final vehicles a month at full capacity. The pre-series cars will be used for the final tweaks before full-scale production begins, dedicated to homologation tests, durability tests, trim experimentation, NVH tweaking, and global product evaluation, according to the automaker. The Rimac C_Two is equipped with a 120-kWh battery pack, which gives the car a range of 650 km, based on New European Driving Cycle (NEDC), the automaker claimed when it first revealed the vehicle in 2018. (IHS Markit AutoIntelligence's Jamal Amir)

- Honda's Russian subsidiary will stop supplying new cars to official dealers in Russia beginning in 2022, according to Reuters. The move is reportedly part of Honda's overall operations restructuring efforts. Honda will remain in Russia in the motorcycle and power equipment sectors, and will continue after-sales service for its vehicles in the country. Reuters says Honda's Russia sales in January-November dropped 15% year on year (y/y) to 1,383 vehicles. According to IHS Markit data, Honda's presence in Russia has been minimal for several years. Although Honda's Russia light-vehicle sales spiked to 5,114 units in 2018, that was still only 0.28% of the market. Sales in 2019 fell to 1,837 units and are expected to end 2020 at about 1,600 units, or 0.13% of a 1.466-million-unit market. Since 2010, Honda has carried less than 1% of the Russian light-vehicle market, with its best year on a volume basis in the past decade occurring in 2013, with sales of 25,744 units and market share of 0.92%. (IHS Markit AutoIntelligence's Stephanie Brinley)

- El Nasr Automotive Manufacturing Company and Dongfeng Motor have announced the postponement of the signing of final contracts for a vehicle-assembly partnership, reports Zawya. Egyptian Public Enterprises Minister Hisham Tawfik said that "both parties are still working on the international arbitration clauses of the agreement". Earlier this month, it was reported that El Nasr was preparing to enter a production partnership with Dongfeng. As a part of the arrangement, the manufacturing company plans to produce 25,000 electric vehicles (EVs) at an estimated cost of EGP2.5 billion (USD158.7 million). In addition, Chinese automaker Dongfeng announced earlier this month the signing of a memorandum of understanding (MOU) on the manufacturing of EVs in Egypt. The negotiations on the proposed deal were restarted in March after they were halted due to the COVID-19 pandemic, which hit China at the very start of the year. The Egyptian government has stepped up efforts to attract automakers to build vehicles in the country. Egypt has been a hub for vehicle exports to other Middle Eastern and African countries in recent years. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +1.7%, Hong Kong +0.3%, India flat, and Australia -1.4%.

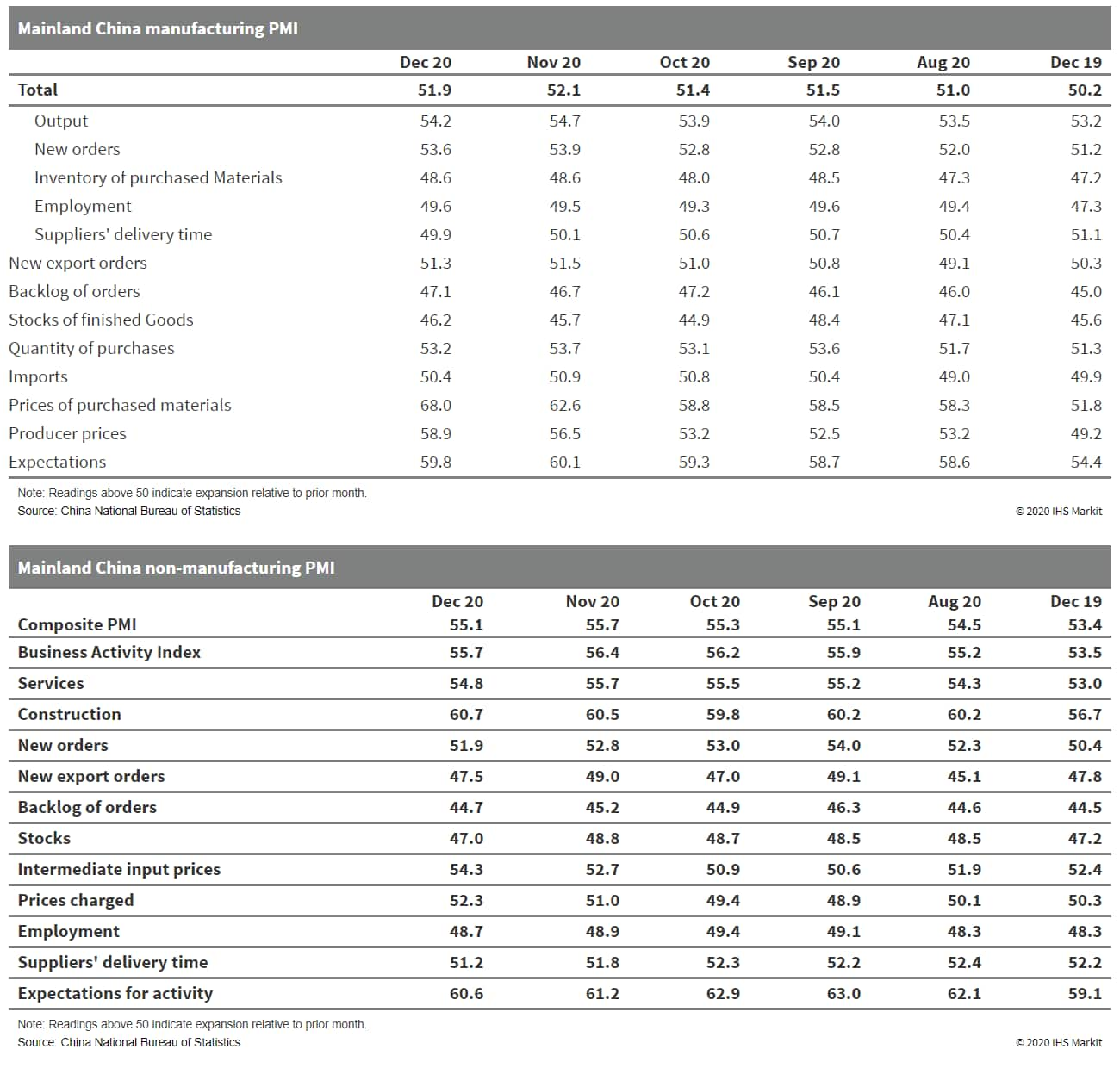

- Mainland China's official manufacturing Purchasing Managers'

Index (PMI) reading stood at 51.9 in December, down 0.2 point from

November. This is the 10th consecutive month that the PMI has

remained above the neutral 50-point mark, indicating expansion.

(IHS Markit Economist Yating Xu)

- Moderation was registered across sub-indices, particularly production and new orders. The new exports orders index declined slightly but remained in expansion, and the expectation index for exporting firms rose for the eighth consecutive month.

- The purchased materials prices and producer prices sub-indexes continued to rise as climbing commodity prices drove up prices in the petroleum processing, ferrous-metals smelting, and non-ferrous metals smelting segments.

- Employment pressure in manufacturing sector further eased with the continuous recovery in demand and supply.

- By sector, the high-tech manufacturing sector continued to lead the headline growth, registering a PMI reading of 55.8, with the production, new orders, and employment indices all in expansion territory and significantly above headline figures.

- By firm scale, The PMI for large- and medium-sized firms stayed in expansion territory, while small firms contracted further with rising cost of materials, logistics and labors.

- Mainland China's non-manufacturing PMI declined by 0.7 point to sit at 55.7 in December, driven by a deceleration in services activity while construction activity continued to accelerate.

- The construction businesses activity index rose by 0.2 point to reach 60.7 owing to the sustained recovery in property and manufacturing investment.

- The services PMI dropped by 0.9 point to 54.8 as the index for the catering and real estate sales segments further contracted, reflecting the increase in COVID-19 cases in the region since October.

- The indices for financials, the capital market, and telecommunication services stayed in expansion territory.

- The composite output PMI, covering both manufacturing and non-manufacturing sectors, came in at 55.1, down 0.6 point from the previous reading, marking the first decline since August. However, this reading remains above the three-year average of 53.5%.

- Despite declining from the preceding month, the December PMI

reading remains above the seasonal average, and supportive policies

will continue to drive overall economic recovery in 2021. At the

fourth-quarter 2020 meeting of the central bank's monetary policy

committee, authorities vowed to continue efforts to ensure abundant

liquidity, provide targeted support to the real economy, and lower

interest rates.

- Chinese battery maker Contemporary Amperex Technology Limited (CATL) plans to invest CNY39 billion (USD5.97 billion) to build three battery factories to further expand its operations in China, reports China Daily, citing a statement from CATL. The battery maker is said to invest CNY17 billion to build a lithium-ion battery base in Fuding in Ningde, Fujian province. Another CNY12 billion will be used to set up a new plant in Liyang, Jiangsu province, while the remaining CNY10 billion will be used to expand its production base in Yibin, Sichuan province. The battery production capacity of each project has yet to be announced by CATL. Judging from the scale of the combined investment, the three new projects are expected to add an additional capacity of 120 GWh for CATL in the next four years. The company currently has a battery capacity of 53 GWh in China with another 22 GWh under construction. According to its 2019 annual report, its plant utilization rate has already reached over 89%, the highest among battery makers in the country. (IHS Markit AutoIntelligence's Abby Chun Tu)

- New vehicle sales in Malaysia grew by 7.4% year on year (y/y) to 56,489 units during November, according to figures released by the Malaysian Automotive Association (MAA) and data compiled by IHS Markit. Of this total, passenger vehicle sales accounted for 51,174 units, up by 7.2% y/y, while commercial vehicle (CV) sales stood at 5,315 units, up by 10.0% y/y. In the year to date (YTD), total industry sales stood at 454,708 units, down by 17.2% y/y. Of the total, passenger vehicles accounted for 412,977 units, while CVs accounted for 41,731 units. It is important to note that the monthly data do not include sales by BMW, Mini, Mercedes-Benz, and Scania. After experiencing huge slumps in March, April, and May, the Malaysian new vehicle market posted growth for the sixth consecutive month in November. This growth has been the result of the relaxation of COVID-19 virus-related containment measures since the beginning of May; price reductions due to the 100% sales tax exemption on locally assembled CKD models and the 50% exemption on fully imported CBU models; new model launches; and attractive sales promotions from automakers. (IHS Markit AutoIntelligence's Jamal Amir)

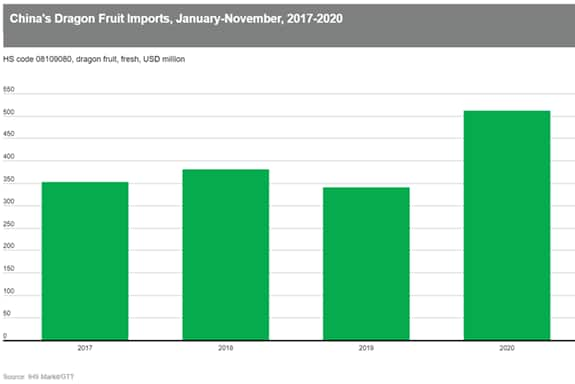

- Dragon fruits are one of the most popular imported fruits in

China. In January-November, China spent over USD500 million cost,

insurance, and freight (CIF) on the fresh fruit from the world.

China is Vietnam's largest trading partner for dragon fruits,

accounting for 80% of its exports. In January-November, China

received 572,000 tons from Vietnam, up 40% from this time last

year. The price was USD900 per ton cif, up 8%. Shipments from

Taiwan halved from last year to 90 tons, at a price of USD2,200/ton

cif. China has expanded its planted areas rapidly over the past

decade, according to local Chinese media. Many farmers have

switched from other crops such as banana to dragon fruits. However,

there is no consensus on the exact planted area. China's Southern

Rural Daily reported that the planted area is about 800,000 to 1.0

million mu (53,333-66,666 hectares). Vietnam is the world's largest

producer, with an output of about 2.0 million tons in 2019. The

white-fleshed variety accounts for 95% of the production. The

open-field season is June-November. The country also has

counter-season crops (December to June) supported by artificial

lighting. With China's expansion in planted areas and anticipated

self-sufficient in the long term, Vietnam is keen to explore and

strengthen trades to India, New Zealand, Australia and Chile. (IHS

Markit Food and Agricultural Commodities' Hope Lee)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-31-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-31-december-2020.html&text=Daily+Global+Market+Summary+-+31+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-31-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 31 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-31-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+31+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-31-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}