Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 17, 2021

Daily Global Market Summary - 17 November 2021

All major US and most APAC equity indices closed lower, while Europe was mixed. US government bonds closed higher, while benchmark European bonds were mixed. CDX-NAIG and iTraxx-Europe closed flat, while CDX-NAHY and iTraxx-Xover were slightly wider on the day. Gold and silver closed higher, while the US dollar, oil, natural gas, and copper closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; S&P 500 -0.3%, Nasdaq -0.3%, DJIA -0.6%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed -5bps/1.59% yield and 30yr bonds -6bps/1.98% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +3bps/296bps.

- DXY US dollar index closed -0.1%/95.83.

- Gold closed +0.9%/$1,870 per troy oz, silver +0.9%/$25.17 per troy oz, and copper -2.0%/$4.27 per pound.

- Crude oil closed -3.0%/$78.36 per barrel and natural gas closed -6.8%/$4.91 per mmbtu.

- The agreement between Pfizer (US) and the Medicines Patent Pool (MPP) on the licensing of generic versions of Pfizer's candidate COVID-19 therapeutic in 95 (mostly low-income) countries is very similar to the deal between the MPP and Merck & Co. (US)/Ridgeback Biotherapeutics (US) announced for their candidate oral anti-viral coronavirus disease 2019 (COVID-19) treatment molnupiravir in late October. It is a positive development from the point of view of potential affordability and access, as well as from Pfizer's point of view, in consideration of the rising criticisms faced by COVID-19 vaccine producers for allegedly deprioritizing lower-income markets. Pfizer's application to the US FDA for an emergency use authorization (EUA) follows just over a month after Merck & Co. (US) /Ridgeback (US) filed for an EUA for molnupiravir, raising the possibility (assuming favorable assessments) of two oral COVID-19 therapeutics becoming available in the foreseeable future. On the negative side, the withdrawal by Roche (Switzerland) from its partnership with Atea Therapeutics (US) on the development of Atea's oral anti-viral AT-527 will make the continuation of this project more challenging, although Atea is determined to press ahead. (Life Sciences by GlobalData's Brendan Melck)

- US single-family housing permits moved up 2.7% (plus or minus

1.2%; statistically significant) to a 1.069 million rate.

Single-family permits have slid 16% since January; their

year-to-date totals, nonetheless, are the highest since 2006.

Multifamily permits jumped 6.6% to a solid 581,000-unit annual

rate. (IHS Markit Economist Patrick

Newport)

- Housing starts edged down 0.7% (plus or minus 12.2%, not statistically significant) in October to a 1.520 million annual rate; single-family starts fell for the fourth straight month, dropping 3.9% (plus or minus 9.5%, not statistically significant) to 1.039 million; multifamily starts grew 7.1% to a 481,000-unit yearly rate.

- Builders are working on new units at a furious pace. The number of homes under construction—an item commonly overlooked in this report—increased to a seasonally adjusted 1.451 million in October. That is the highest total since February 1974; it partly explains why builders are finding it hard to locate labor and materials. On top of this, authorized but not started units are at a series high of 265,000 (data start in 2000).

- The number of completed homes, which measures additions to the housing stock, was unchanged at a 1.242 million rate (note: the national housing stock is 142 million).

- Despite steady declines from January and continuing headwinds, total housing starts and single-family housing starts are on track for having their strongest year since 2006. Multifamily starts will post its highest totals since 1986.

- The Census announced that it will begin publishing local and county permits data monthly, beginning with its 17 February release.

- With US President Joe Biden signing the $1.2-trillion

infrastructure bill on 15 November into law, IHS Markit analysts

say the electric vehicle (EV) industry is especially

well-positioned to benefit as funds will soon start flowing to a

variety of existing and new energy transition projects. (IHS Markit

Net-Zero Business Daily's Kevin Adler)

- The bill includes $5 billion to be granted to states to deploy EV charging stations in US and $2.5 billion in grants to public entities to deploy publicly available EV charging infrastructure (as well as hydrogen, propane, and natural gas fueling) 2022 through 2026.

- Biden has tapped former New Orleans Mayor Mitch Landrieu to oversee spending authorized by the legislation and co-chair a task force with National Economic Council Director Brian Deese "to prevent waste fraud and abuse" in the distribution of funds.

- IHS Markit estimates the investment will support the construction, maintenance, and operation of approximately 400,000 newly installed Level 2 AC (regular) and Level 3 DC fast chargers in the US between 2022 and 2026. Biden announced in the spring a goal of 500,000 charging units nationwide by 2030.

- "The Biden administration's investment isn't hyperbole and will have a significant impact on US electric vehicle charging supply," said Mark Boyadjis, IHS Markit global automotive technology lead. "However, even an investment at this scale will come up short against the rapid growth of electric cars hitting the road soon, pointing to a need for additional support from municipal, utility, and private investments to fill the gap."

- Sikorsky announced that it has approved the use of sustainable aviation fuel (SAF) or biofuel. A Sikorsky S-92 operated by CHC in Norway was the first to fly using SAF. SAFs can reduce lifecycle carbon emissions by 80% compared to traditional jet fuel. Sikorsky S-92s in Norway will be the first to fly commercial flights using SAF. While SAF will reduce lifecycle emissions, it remains fairly cost prohibitive at 2-3 times more expensive than traditional jet fuel. (IHS Markit Upstream Costs and Technology's Amy Groeschel)

- The US EPA has released its final biological evaluations (BEs) for the herbicides, glyphosate, atrazine and simazine, underlining the potential effects they could have on threatened or endangered species and their habitats. Information from the BEs will be used by the US Fish and Wildlife Service and the National Marine Fisheries Service to develop their biological opinions on the three active ingredients. The Agency notes that all three herbicides are "likely to adversely affect" (LAA) certain listed species and their designated critical habitats. An LAA determination means that the EPA anticipates that at least one individual animal or plant listed under the country's Endangered Species Act (ESA) may be exposed to the herbicides at a "sufficient level" and suffer an adverse effect. It highlights that several registrations of simazine and atrazine were cancelled earlier this month following voluntary requests from their registrants, which reduced the number of LAA determinations in the final BEs for those two herbicides. (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- Uber is resuming its shared-rides service with the new product called UberX Share, reports Reuters. The new service, which allows multiple passengers to share a car travelling in the same direction, will start a pilot in Miami (Florida, US). The UberX Share service offers a 5% upfront discount and users can earn additional discounts in Uber credit, if another rider joins their trip. Uber had suspended its shared rides service, previously known as Uber Pool, in March 2020 in response to the COVID-19 virus pandemic. The new service also limits shared rides to a total of two passengers, who will sit in the back seat. UberX Share is aimed at reducing the previously high losses in the pooled rides segment. In July, Uber's rival Lyft announced its plans of resuming a shared-rides booking option in select US markets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Italy +0.1%, France +0.1%, Germany 0%, UK -0.5%, and Spain -0.5%.

- 10yr European govt bonds closed mixed; UK -2bps, Germany/France flat, and Italy/Spain +1bp.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +3bps/250bps.

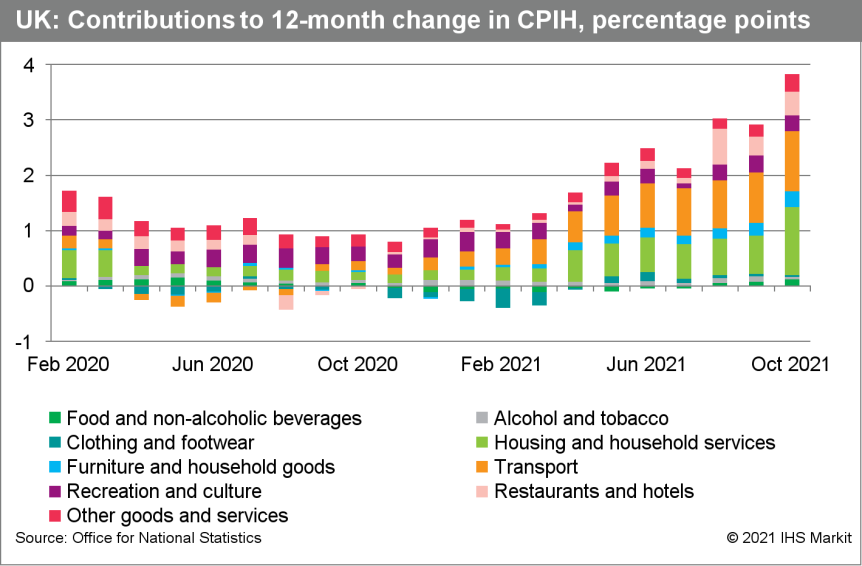

- The Office for National Statistics (ONS) has reported that the

UK's 12-month rate of consumer price index (CPI) inflation

increased from 3.1% in September to 4.2% in October, the highest

rate since November 2011. (IHS Markit Economist Raj

Badiani)

- The rate was above the Bank of England's (BoE) 2% target for inflation.

- During 2020, CPI inflation averaged 0.9%.

- Meanwhile, the CPI including owner occupiers' housing costs (the CPIH) rose by 3.8% in the 12 months to October, up from 2.9% in September.

- Energy-related prices continued to rise rapidly on an annual basis, with transport fuel and lubricant prices growing by 21.5% year on year (y/y), the seventh successive double-digit increase. This was in line with global crude oil prices rising by 107.9% y/y to average USD83.5 per barrel (pb) in October, the 10th successive y/y gain.

- In addition, gasoline (petrol) prices also rose by 25.4 pence y/y to 138.6 pence per litre, the highest price since September 2012.

- In addition, the ONS reported notably higher household energy bills after the increased regulatory price cap on domestic natural gas and electricity from 1 October. Therefore, natural gas and electricity prices increased by 28.1% y/y and 18.8% y/y, respectively.

- Meanwhile, restaurant and café prices increased by 6.3% y/y in October, up from a gain of 5.0% y/y in September.

- Food prices rose at a brisker rate, increasing by 1.2% y/y in October from 0.8% y/y in September.

- A further rise in second-hand car prices occurred during October, of 22.8% y/y, because of the shortage of semiconductor chips disrupting production of new vehicles.

- All-services price inflation was 3.2% in October from 2.6% in September; for goods, it stood at 4.9%, up from 3.4% in the previous month.

- Core inflation, excluding energy, food, alcoholic beverages,

and tobacco prices, moved up to 3.4% in October from 2.9% in

September.

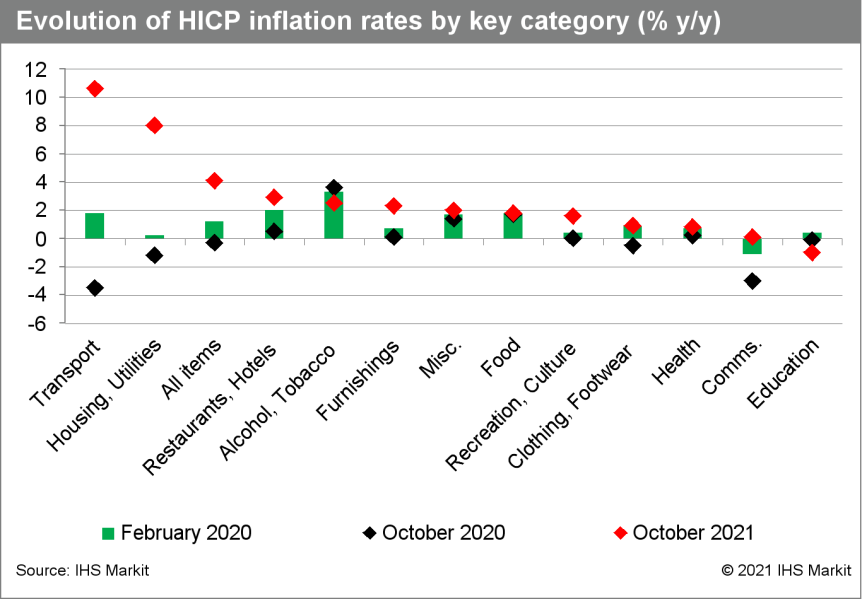

- Eurostat's final October Harmonised Index of Consumer Prices

(HICP) release confirms the sharp rise in headline inflation from

3.4% to 4.1%, matching the highest rate in the history of the

series (back in July 2008). This is well above the initial market

consensus expectation of 3.7%. (IHS Markit Economist Ken

Wattret)

- The 4.4-percentage-point pick-up in the inflation rate over the past 12 months is the biggest by far since the eurozone's inception in 1999.

- The already record-high rate of energy inflation has been revised up further in October's final data, to 23.7% energy, with a weight of less than 10%, is contributing more than half of the overall inflation rate (2.2 percentage points).

- Pass-through effects from prior gains in energy prices are likely to continue to push up headline inflation in the next month or two, but the year-on-year (y/y) rate of increase is expected to level out around the turn of the year and then decelerate sharply during 2022.

- The less pronounced rise in October's core inflation rate

excluding food, energy, alcohol, and tobacco prices from 1.9% to

2.1% in the 'flash' estimate has also been revised down a notch in

the final HICP release, to 2.0%. Still, this is the first time that

this measure of the core inflation rate in the eurozone has reached

2% since 2008. The record high was 2.5% in 2002.

- Frozen food is still in demand among households, according to

an online survey carried out by Bofrost Germany through a poll of

1,500 customers between 30 September and 7 October 2021. (IHS

Markit Food and Agricultural Commodities' Cristina Nanni)

- According to the survey, over 86% of the interviewed said they will continue to purchase frozen food through home delivery services. This is because consumers seem to prefer avoiding social contact during shopping with almost half of them (48.2%) going to shop outside of the peak hours or stocking up in order to reduce supermarket trips (36.6%).

- About 24% of respondents said they now order more frequently from frozen food delivery services such as Bofrost. Almost all of those who adjusted their shopping behaviors during the pandemic plan to maintain this habit in the future (94.6%). For example, 90% will keep shopping out of peak hours and 62% will continue to stock-up on staple food.

- For frozen food deliveries, customers seem to appreciate that they are contactless (54%), beside other aspects specific to frozen food consumption such as quick and easy preparation (60%), time saving (57%) and long shelf life (56.7%).

- The Volkswagen (VW) Group plans to massively ramp up investment in its charging and energy unit, Elli, with a target of doubling staff numbers at the unit, according to a Reuters report. The unit will also extend its alliances with charging infrastructure providers as it looks to expand its officially endorsed list of public charging locations and give its customers confidence that the public charging network is fit for purpose for running a battery electric vehicle (BEV) as a main car. VW announced in January that it had recruited Elke Temme, a two-decade veteran of working at German energy companies, RWE and Innogy, to run its energy unit. She has been tasked with procuring actual energy provision to ensure VW owners can charge their cars, as well as ensuring that sufficient domestic and public charging infrastructure is in place. Temme wants to double the current headcount at Elli from 150 to about 300 in 2022, having already tripled it this year. VW understands it has a long way to go before it can match Tesla's public supercharger charging network. It currently has 30,000 fast chargers worldwide, with these superchargers capable of offering 200km of range in just 15 minutes. However, crucially the supercharger network (aside from a small-scale trial currently taking place in the Netherlands) is exclusive to Tesla's own products. VW wants its charging network to be more universal. (IHS Markit AutoIntelligence's Tim Urquhart)

- BMW Group will use chips manufactured by Qualcomm to support advanced driver assist systems (ADAS) and automated functions for its next-generation vehicles. BMW's automated stack will be based on Qualcomm's Snapdragon Ride vision system-on-chip (SoC), which supports functions for all levels of automated vehicle operations. BMW will use a dedicated Qualcomm computer vision-processing chip to analyze data from front, rear, and surround-view cameras. BMW is planning to launch an autonomous vehicle (AV) when it has fully perfected it, something it initially planned to do with the iNext, which was to be offered in 2021 with full Level 5 autonomous features. Now, however, BMW has stated that it will first offer Level 3 with plans to release a 7-Series full-size sedan featuring Intel's automated technology in the next year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Dubai-based ride-sharing startup Swvl has acquired a controlling stake in Latin American mass transit company Viapool, according to a company statement. The deal, which is expected to close in the first quarter of 2022, will allow Swvl to expand its presence to Argentina and Chile. According to a report by Bloomberg, the transaction values Viapool at about USD10 million. Swvl founder and CEO Mostafa Kandil said, "LatAm represents a compelling opportunity for Swvl to continue its global expansion, all the while capitalizing on unmet commuting needs for hundreds of millions of individuals living within urban megacities. Viapool shares our vision of transforming public transportation by making daily commuting more accessible, convenient and sustainable, and has demonstrated impressive growth, unit economics and customer traction. By adding Viapool to the Swvl platform, we will be ideally positioned to scale our operations to additional cities within the region." This is Swvl's second acquisition deal this year after purchasing on-demand bus service Shotl. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- REE Automotive has unveiled its autonomous concept vehicle Leopard, which is based on its new modular electric vehicle (EV) platform. REE Automotive says that its new platform will allow customers to build autonomous EVs to their exact specifications. The concept vehicle is designed for customers such as last-mile autonomous and electric vehicle delivery companies, delivery fleet operators, e-retailers, and technology companies. The Leopard has a battery capacity of 50 kWh, a top speed of 60 mph, and a cargo volume of 180 cubic feet. Daniel Barel, REE co-founder and CEO, said, "Autonomous and electric vehicles 'Powered by REE' offer unsurpassed operational efficiency and the lowest total cost of ownership combined with full flexibility when it comes to integrating top hats in virtually any size, shape or form. We're here to make the shift to a carbon neutral future a reality faster and at scale." REE Automotive says it focuses on revolutionizing the e-mobility industry. REE's two core technologies are the REEcorner and the REEboard. The REEcorner integrates all traditional vehicle components - steering, braking, suspension, and e-motor - into the arch of the wheel. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Kenya's GDP accelerated by 10.2% year on year (y/y) during the

second quarter of 2021 from a 0.8% expansion during the first

quarter of the year. The bounce back in economic activity was

broad-based, apart from the agriculture, forestry, and fishing

sector, where output slowed by 0.9% y/y during the second quarter.

Severe drought conditions in the northern part of Kenya have been a

drag on the overall agricultural activity for most of 2021. (IHS

Markit Economist Thea

Fourie)

- Sectors recording the strongest growth during the second quarter of 2021 included education (up 67.5% y/y), information and communication (up 25.2% y/y), mining and quarrying (up 17.7% y/y) and professional services, administration, and support services (up 17.6% y/y). Wholesale and retail trade - accounting for 7.8% of GDP and a good gauge of household spending - improved by 9.5% y/y during the second quarter. Accommodation and food services - a gauge for tourism spending - rebounded by 9.1% y/y during the second quarter from a 48.7% y/y contraction recorded during the first quarter of the year.

- Latest statistics released by the Kenya National Bureau of Statistics (KNBS) shows that tourist arrivals to Kenya during July 2021 accounted for only 43% of the pre-pandemic total. Kenya's tourism industry remains susceptible to recurrent regional and global restrictions due to the slow rollout of the COVID-19 vaccine program in the country. Only 4.1% of the population has been fully vaccinated by November 2021.

- Remittance inflows to Kenya accelerated by 20.1% y/y during the first 10 months of 2021, latest statistics by the Central Bank of Kenya shows. Diaspora proceeds exceeded expectations and rose by 10.6% y/y during 2020.

Asia-Pacific

- Most major APAC equity indices closed lower except for Mainland China +0.4%; Hong Kong -0.3%, Japan -0.4%, India -0.5%, Australia -0.7%, and South Korea -1.2%.

- Chinese electric vehicle (EV) maker Xpeng has opened 111 new supercharging stations in China in October, bringing the total number of its supercharging station to 550. As of the end of October, Xpeng's supercharging network covers 158 cities in China. Xpeng also operates 129 destination charging facilities in China, of which 21 were opened in October. The rapid expansion of Xpeng's supercharging network will help the EV startup to attract more customers in China, especially in second- and third-tier cities where EV adoption is hindered by underdeveloped public charging infrastructure. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's private machinery orders (excluding volatiles), a

leading indicator for capital expenditure (capex), held at the

August level in September, following a 2.4% month-on-month (m/m)

drop in August. Orders from manufacturing rebounded by 24.8% m/m,

which offset an 11.7% m/m drop in orders from non-manufacturing.

Orders from the public sector continued to decline, moving down

23.8% m/m following a 1.3% m/m drop in the previous month. Orders

from overseas also fell, with a 14.2% m/m drop after a 14.7% m/m

decrease in August. (IHS Markit Economist Harumi

Taguchi)

- The solid increase in orders from manufacturing was thanks largely to surges in orders from chemical and chemical products (up 266.9% m/m), non-ferrous metals (up 118.0% m/m), and the other miscellaneous manufacturing grouping (up 55.7% m/m), offsetting continued declines in orders from electrical machinery and automobiles and accessories. The weakness in orders from non-manufacturing largely reflected declines after solid rises in orders from wholesale and retail trade, telecommunications, and some other groupings.

- The September results were weaker than IHS Markit's expectations. Although orders from manufacturing rebounded solidly, weaker orders and production associated with supply-chain disruption affected capacity utilization and suppressed orders from auto and related manufacturing. The prolonged negative effects of coronavirus disease 2019 (COVID-19) containment measures also led to a third consecutive quarter of decline in non-manufacturing groupings.

- Japan's trade balance recorded a deficit of JPY67 billion

(USD586 million) on a non-seasonally adjusted basis in October. The

seasonally adjusted balance also recorded a deficit of JPY445

billion for the sixth consecutive month of deficit, although it

narrowed by 26.6% from the previous month. Exports continued to

rise, but growth softened to 9.4% year on year (y/y) following a

13.0% y/y increase in the previous month. Import growth eased to

26.7% y/y after a 38.2% y/y rise in the previous month. In volume

terms, exports and imports declined by 2.6% y/y and 3.0% y/y,

respectively. (IHS Markit Economist Harumi

Taguchi)

- By products, the major drivers were exports of iron and steel products (up 80.1% y/y), semiconductor machinery (up 45.1% y/y), and semiconductors (up 15.1% y/y). However, the continued weakness for exports largely reflected the negative effects of supply-chain disruption on exports of autos (down 46.4% y/y) and several electric products. By region, growth for exports to Asia softened to 15.0% y/y from 21.3% y/y in September, while exports to the European Union held at the September level (12.1% y/y) and exports to the US turned slightly positive at 0.4% y/y.

- Higher prices for energy and other commodities continued to underpin strong growth for imports. While imports of mineral fuels remained the major driver of imports, contributing 12.3% percentage points of total imports, imports of iron ore (up 113.4% y/y), iron and steel products (up 77.7% y/y), and non-ferrous metals (up 73.7% y/y) remained major contributors to the overall growth of imports. Imports of semiconductors (up 38.4% y/y) and aircraft (up 385.0% y/y) were also major factors behind the increase.

- Honda, in partnership with SoftBank, is deploying 5G standalone (5G SA) and cellular vehicle-to-everything (V2X) communication systems to reduce collisions between pedestrians and vehicles. The companies will demonstrate three use cases by leveraging SoftBank's 5G SA experimental base station installed at Honda's Takasu Proving Ground in Japan and Honda's recognition technology. In the first case, the vehicle's on-board camera recognizes the risk of a pedestrian entering the roadway and sends an alert to the pedestrian's mobile device directly or via a mobile edge computing (MEC) server to reduce collisions involving pedestrians who are visible to vehicles. The second case uses high-speed data communications between the moving vehicle, pedestrians, and other vehicles to reduce collisions involving pedestrians who are not visible to vehicles. The third and final case involves moving vehicles sending information about areas with poor visibility to the MEC server, and if there is a pedestrian present, the MEC server sends an alert to the vehicle and the pedestrian. This will help reduce collisions involving pedestrians by sharing information about areas not visible to vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda has asked its major parts suppliers to achieve net-zero carbon dioxide emissions by 2050, according to The Japan Times, citing a source familiar with the request. According to the proposal, Honda expects its suppliers to cut carbon dioxide emissions by 4% every year, starting from 2025. The suppliers will determine their target, in accordance with their corporate size and products, and then submit a reduction plan towards the 2050 zero-emissions goal. The automaker is also considering providing technical support to suppliers to enable them to meet the targets. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Tesla India announced that it has placed a bulk order for

portable inverters with Oxy Neuron India Private Limited, a startup

based in Noida (India), reports The Times of India. The portable

inverter, called the 'Magic Box Smart Inverter', can be used as an

electric vehicle (EV) charging station. The Magic Box Smart

Inverter starts at INR25,000 (USD335.7), comes in 1KW, 2KW and 3 KW

unit variants, and claims to give almost double battery backup.

E.R. Ashutosh Verma, Founder of Oxy Neuron said, "We have received

our first order of Magic Box Inverter from Tesla India. The

government's support to startups is a boost for startups like ours

to develop more and more innovative products." He added, "The

inverter is expected to solve the issue of electricity backup in

rural India." According to the source, the inverter is an Internet

of Things (IoT) device that can be controlled via a mobile

application, and comes with a 15-year battery life with a five-year

replacement guarantee. This is Tesla's first deal before its Indian

market entry. Oxy Neuron India started at the Startup Innovation

and Incubation Centre (SIIC) situated at the Indian institute of

technology (IIT) Kanpur. The startup, which received its first

order of Magic Box Smart Inverters from Tesla India, has already

innovated solar, oxygen, hydrogen and nitrogen-based original

medical and agricultural products in collaboration with Exalta

India. (IHS Markit AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-november-2021.html&text=Daily+Global+Market+Summary+-+17+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-november-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 November 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+November+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}