Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Nov 17, 2021

Hong Kong dividend index points under China's regulatory reset

Key Implications

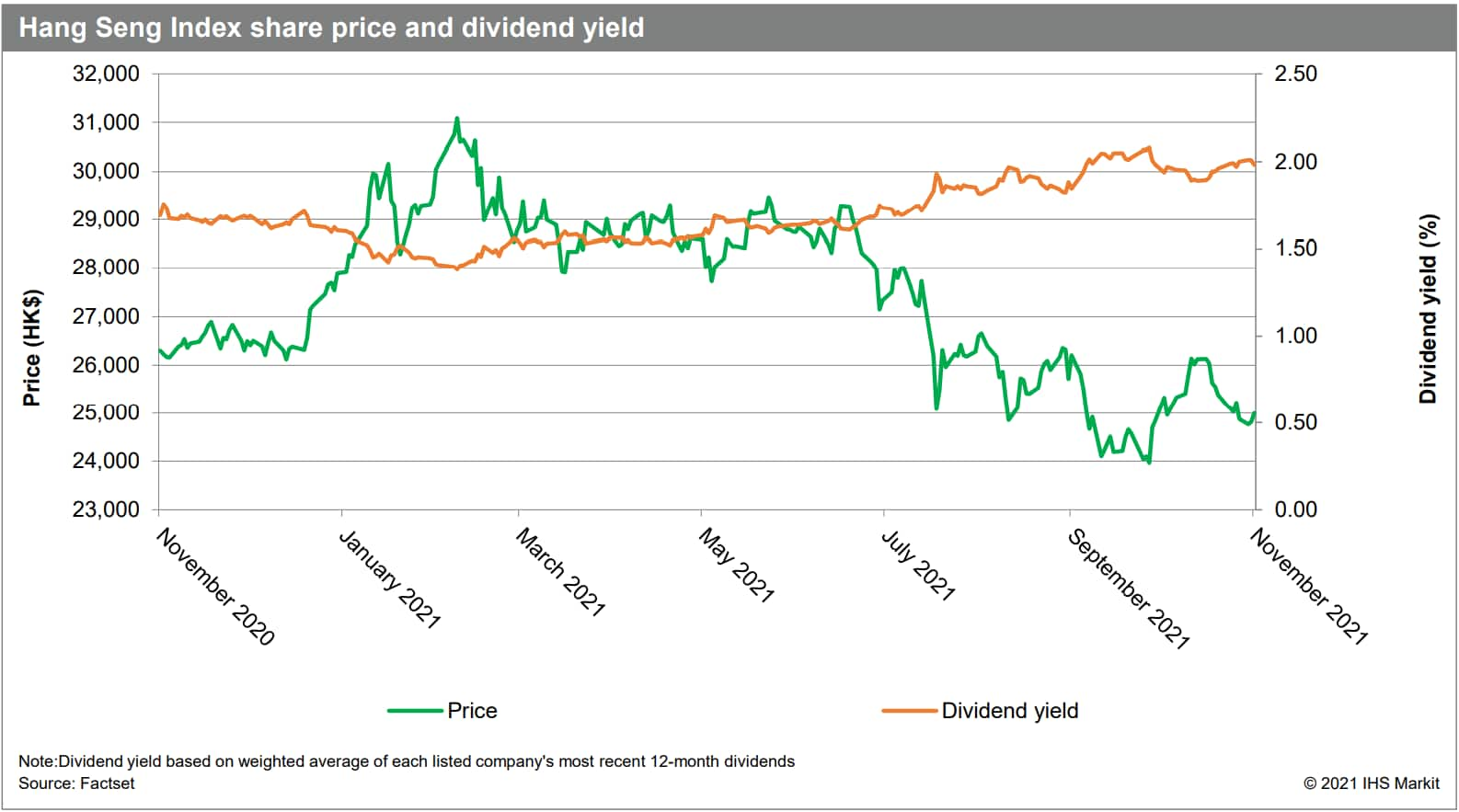

• As waves of regulatory reform of mainland China swept through Hang Seng Index (HSI), market concerns are reflected in the downward trending index price since October, contrary to the upbeat dividend yield.

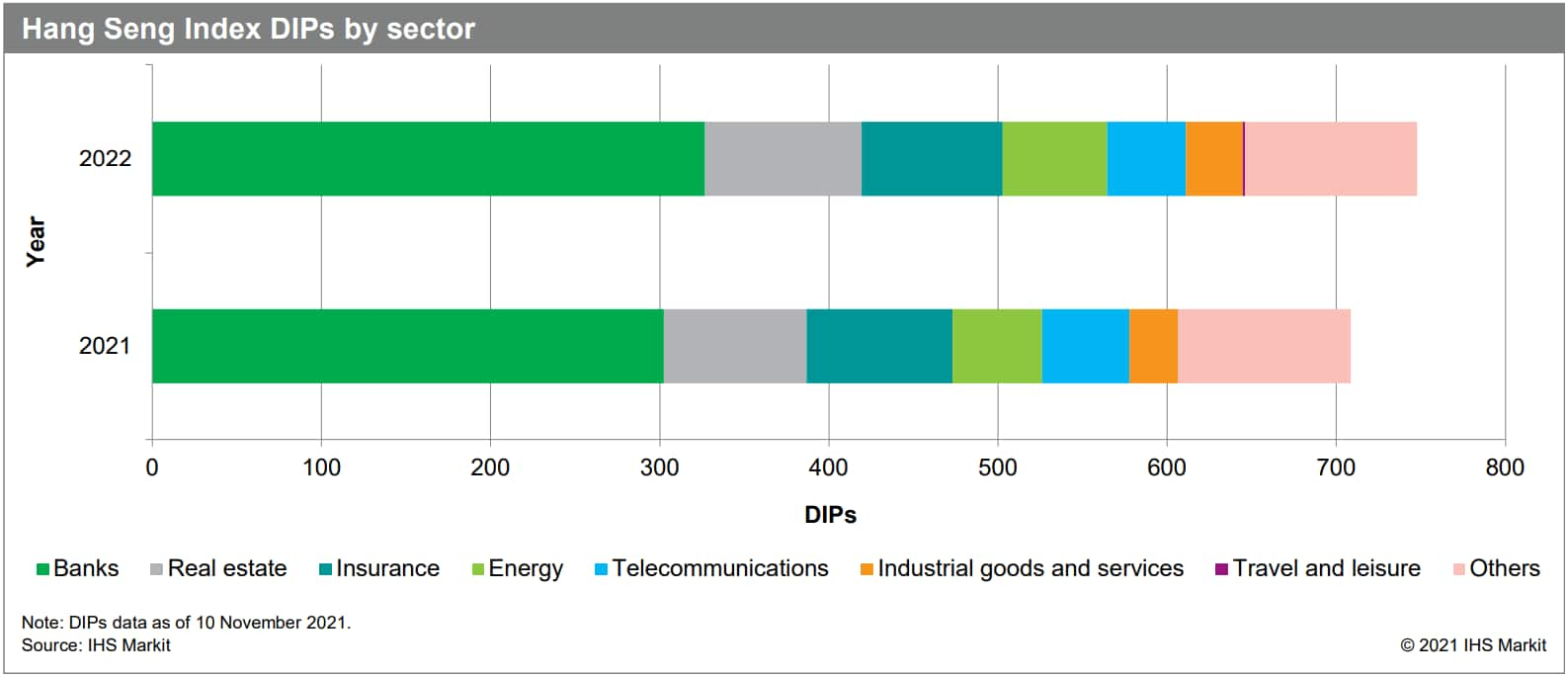

• The dividend index points (DIPs) of HSI are expected to increase from 708.5 in 2021 to 747.8 in 2022, representing a 5.6% year-on-year (y/y) growth.

• The Banking sector, which has seen regulatory overhaul in capital reserve and deposit rates to improve profitability and liquidity this year, is expected to continue to dominate the dividend payments in the market, contributing 43.7% of the total DIPs for 2022, followed by the Real Estate, Insurance, and Energy sectors.

• Despite concerns over the tightening regulations on China's technology giants (Alibaba, Meituan, and Tencent), the DIPs of Hang Seng Tech Index are expected to increase from 24.8 in 2021 to 26.7 in 2022, representing a 7.7% y/y growth, as the top dividend contributors (Lenovo, Haier Smart, and ASM Pacific Technology) are mostly immune from the regulatory changes.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-dividend-index-points-under-chinas-regulatory-reset.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-dividend-index-points-under-chinas-regulatory-reset.html&text=Hong+Kong+dividend+index+points+under+China%27s+regulatory+reset+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-dividend-index-points-under-chinas-regulatory-reset.html","enabled":true},{"name":"email","url":"?subject=Hong Kong dividend index points under China's regulatory reset | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-dividend-index-points-under-chinas-regulatory-reset.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hong+Kong+dividend+index+points+under+China%27s+regulatory+reset+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-dividend-index-points-under-chinas-regulatory-reset.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}