Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 18, 2020

Daily Global Market Summary - 18 June 2020

Global equity markets closed modestly lower across Europe, but were mixed across APAC and the US indices. Credit indices closed weaker across Europe/US and IG/HY, while US government bonds strengthened. The markets are cautiously watching as the number of COVID-19 cases in certain hotspots continue to rise, with Florida being of particular concern in the US given its steep trajectory of new cases and its percentage of positive tests.

Americas

- Most US equity ended the day close to unchanged; DJIA -0.2%, Russell 2000 flat, S&P 500 +0.1%, and Nasdaq +0.3%.

- 10yr US govt bonds closed -3bps/0.71% yield.

- CDX-NAIG closed +3bps/75bps and CDX-NAHY +13bps/385bps.

- Crude oil +2.3%/$38.84 per barrel

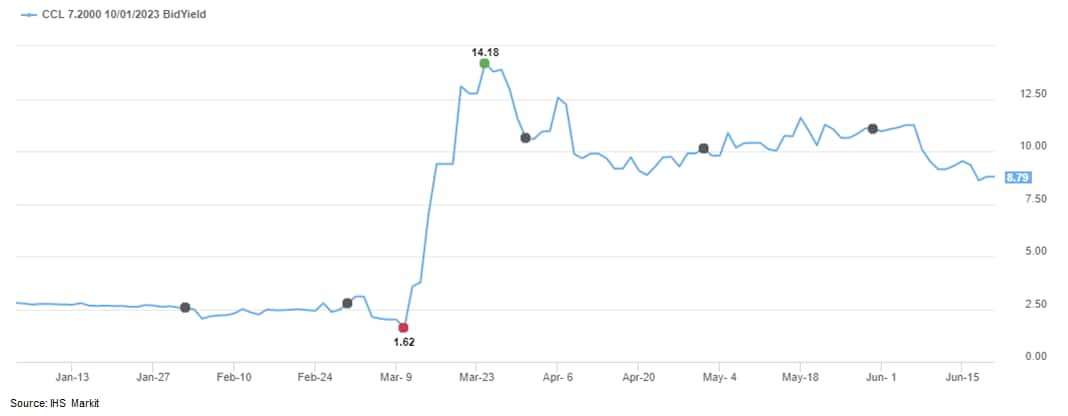

- Carnival Corp. reported a preliminary quarterly loss of more than $4 billion and it warned that it could breach a loan agreement in a prolonged sailing pause. The company posted a preliminary fiscal second-quarter loss of $4.37 billion, or $6.07 a share, compared with a profit of $451 million, or 65 cents a share, in the same period last year. Revenue for the quarter was $700 million, down 85% from a year earlier. The company said it had $7.6 billion in liquidity as of the second quarter ended May 31 and expects to burn about $650 million a month for the second half of the year. (WSJ)

- The chart below is a Price Viewer graph shows the significant

impact that COVID-19 had on the yield for Carnival Corporation's

7.2% 10/2023 USD corporate bond issue:

- Seasonally adjusted US initial claims for unemployment

insurance, at 1,508,000 in the week ended 13 June, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. This was the 13th straight

week with claims in seven figures. (IHS Markit Economist Akshat

Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lag initial claims by a week, fell by 62,000 to 20,544,000 in the week ended 6 June. This is well below the all-time high of 24,912,000 in the week ended 9 May and indicates that as businesses reopen, furloughed workers are cautiously getting recalled.

- The insured unemployment rate in the week ended 6 June stood at 14.1%.

- There were 760,526 unadjusted initial claims for Pandemic Unemployment Assistance in the week ended 13 June. In the week ended 30 May, there were 9,280,644 continuing claims for PUA.

- While continuing claims for regular state programs have declined in the past two weeks, not everyone getting off these benefits is heading back to work. Individuals who have exhausted regular benefits are eligible for up to 13 weeks of extended benefits under the Pandemic Emergency Unemployment Compensation (PEUC). In the week ended 30 May, 1,077,319 individuals were receiving PEUC benefits with 35 states accepting claims for PEUC so far.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. The unadjusted total for the week ended 30 May was 29,165,753; 63% of this total is from regular state programs and 32% from the PUA program.

- The Philadelphia Federal Reserve June 2020 survey built upon

last month's tentative gains, bouncing back well into positive

territory at 27.5. That marks an impressive 70-point jump from the

May level, and the index's first reading above zero since February.

(IHS Markit Economist Tom Jackson)

- Of the surveyed firms, 46% reported increased activity in June compared with May, with 19% reporting declines. Of course, these increases come on the heels of two months' worth of record declines, but still represent a solid move toward recovery.

- The index of new orders, an indicator of demand and a harbinger of future activity, rose to 16.7.

- The index of current shipments showed a big gain in product moving off of loading docks with a reading of 25.3.

- The index of prices paid moved modestly higher, rising 8 points to 11.1.

- The only negative readings were on the labor front, with both the number of employees and average employee workweek modestly negative.

- Chile's central bank left rates unchanged at 0.5% during the 16

June meeting and approved the use of non-conventional liquidity and

credit support. The bank has signaled its willingness to keep rates

at this technical minimum over the next two years. (IHS Markit

Economist Ellie Vorhaben)

- The Central Bank of Chile (Banco Central de Chile: BCC) has announced that it will be implementing a special asset purchase program over the next six months, worth USD8 billion.

- The bank is also considering making available USD16 billion in additional funds to strengthen lending to small and medium-sized businesses and non-bank credit providers; banks have already withdrawn 83% of available funds from the current liquidity support program, the Conditional Facility for Increased Lending.

- Inflation has been decelerating since February, reaching 2.8% in May because of the sharp downturn in economic growth, lower energy costs, and the appreciation of the Chilean peso. Since reaching its trough on 20 March, at CLP867/USD, the peso has gained 8%. On the same day, the price for copper reached its minimum of USD2.3 per pound (0.45kg); prices have since increased by 25%.

- In April, Chile's economic indicator (a proxy for GDP) contracted by 14.1%. May and June could be even worse because quarantine measures are stricter following an uptick in the number of COVID-19 cases in May.

- Tesla has signed a three-year deal with Panasonic, assuring the manufacture and supply of lithium-ion batteries at the Gigafactory plant in Nevada (United States). The deal was disclosed by Tesla in a US Securities and Exchange Commission (SEC) filing. The filing says the agreement was entered into on 10 June and that it is an amendment to the agreement signed on 1 October 2014. Tesla states that the changes include modifications of the agreement's general terms and conditions, so the term expires in 10 years, after Panasonic meets certain manufacturing milestones. In addition, a new pricing agreement that runs through 31 March 2023 was signed. That agreement sets pricing, includes planned investments, and involves new technology. The deal also includes production capacity commitments by Panasonic and purchase volume commitments by Tesla over the first two years. The filing does not disclose what those manufacturing and purchase commitments are. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Merck Animal Health has broadened its digital portfolio with the purchase of US data analytics firm Quantified Ag for an undisclosed fee. Lincoln, Nebraska-headquartered Quantified Ag has developed technology that continuously monitors cattle body temperature and movement in order to detect illness at an early stage. In 2018, Merck invested in Quantified Ag and partially funded its development work. The firm offers cattle producers and feedlot operators an ear tag-based system and sensors to track an animal's biometrics and behavioral data. The technology uses proprietary algorithms to provide real-time reports to users on any mobile device, desktop or tablet. The acquisition brings an extra addition to Merck's offering of digital livestock technology. The company already owns Allflex Livestock Intelligence, which will now hold the Quantified Ag product portfolio. Merck gained Allflex Livestock Intelligence through its deal for Antelliq in 2019 . It specializes in identification and monitoring technology. Like Quantified Ag, Allflex Livestock Intelligence delivers real-time data to help improve livestock management. Aside from the Antelliq transaction, which is the largest digital tech deal in animal health, Merck also recently became a minority investor in New Zealand-based farm management software specialist FarmIQ and acquired Icelandic fish counting specialist Vaki . Merck has so far built the most comprehensive offering of digital tools among the leading animal health majors. (IHS Markit Animal Health's Joseph Harvey)

- Although some Fiat Chrysler Automobiles (FCA) plants will still shut down as normal, some will cancel the production breaks, according to an Automotive News report. The report says that Jefferson North Assembly in Detroit; Toledo Assembly in Ohio; Sterling Heights Assembly in Michigan; Brampton Assembly in Ontario; Saltillo Truck Assembly in Mexico; and Saltillo Van Assembly will not shut down. IHS Markit's May 2020 forecast has FCA's North American production declining to about 1.67 million units in 2020, compared with 2.43 million units in 2019. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Wheat futures settled lower on the prospect of higher export competition from other major wheat origins. Chicago July wheat was down 5 1/4 cents at $4.83 1/2 while Kansas City July was down 4 cents at $4.82 1/2. Minneapolis continued to buck the trend, rising 4 1/2 cents at $5.24 3/4. Recent wheat tenders point to active participation by the EU and Russia. Egypt's GASC purchased 240,000 tons of wheat for shipment around July 25. The purchase is comprised of 120,000 tons from Russia, 60,000 ton from Romania and 60,000 ton from Ukraine. The lowest offer presented in the tender was at $206.95 per ton of Russian wheat. Tunisia's state grains agency purchased 176,000 tons of soft milling wheat in an international tender. The lowest offer presented was $211.98 per ton (C&F). Net US wheat export sales for the 2020/21 marketing year totaled 504,845 tons in the week ending June 11. (IHS Markit Food and Agricultural Commodities' Adriel Cheng)

Europe/Middle East/ Africa

- European equity indices closed lower across the region; Spain -1.2%, Germany/France -0.8%, and Italy/UK -0.5%.

- 10yr European govt bonds closed higher except for UK +4bps; Italy -4bps, Spain/France -3bps, and Germany -1bp.

- iTraxx-Europe closed +3bps/67bps and iTraxx +13bps/385bps.

- Jaguar Land Rover (JLR) is planning to cut around 1,100 workers from its production operations in the United Kingdom. According to a statement released by the Unite union, 400 workers employed through the Manpower agency would be cut at Solihull (UK), with the remainder spread between its other production sites in the country. They are expected to leave around the time of the mid-year shutdown. (IHS Markit AutoIntelligence's Ian Fletcher)

- Japanese telco SoftBank Corporation has led a USD19.5-million Series B funding round for London-based on-demand mobility startup Splyt Technologies. Other participants in the round included American Express Ventures and Splyt's existing investors. SoftBank will take a "significant stake" in Splyt and its global business division head, Daichi Nozaki, will join Splyt's board of directors. This investment is a strategic partnership that will allow Splyt to integrate SoftBank's different app platforms of group companies into a single interface. Splyt was founded in 2015 and focuses on providing its technology to support app operators to integrate their mobility options with other services. Splyt operates an on-demand mobility marketplace and its platform gives its partners access to ride-hailing inventories in more than 1,000 cities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The European Commission has announced its investigation into FCA and PSA merger. The European Union's statement says that the "Commission is concerned that the proposed transaction may reduce competition with respect to light commercial vehicles [vans] below 3.5 ton in the European Economic Area [EEA]." Executive Vice-President Margrethe Vestager, responsible for competition policy, is quoted as saying, "Fiat Chrysler and Peugeot SA, with their large portfolio of brands and models, have a strong position in commercial vans in many European countries. We will carefully assess whether the proposed transaction would negatively affect competition in these markets and ensure that a healthy competitive landscape remains for all the individuals and businesses relying on commercial vans for their activities." The commission notes that in many markets, either PSA or FCA are already market leaders in the segment, and the merger would remove one of the main competitors. The commission also noted it is specifically concerned about the LCV markets in Belgium, Croatia, Czechia, France, Greece, Hungary, Italy, Lithuania, Luxembourg, Poland, Portugal, Slovakia, Slovenia, Spain, and the UK. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to the latest monthly industrial data from Statistics

Finland, output adjusted for variation in working days in April

contracted by 3.1% year on year (y/y), after growing by 3.4% y/y in

March and decreasing y/y in the previous two months. Consequently,

the contraction in January-April settled at 0.8% y/y. (IHS

Economist Venla Sipilä)

- While base effects affected the y/y results, month-on-month (m/m) developments also showed weakening results. Indeed, seasonally adjusted output in April fell by 2.2% from March, following m/m growth of 2.3% in February.

- The annual contraction in the mining sector deepened in April, while the poor performance of the metals sector particularly contributed to weakness in manufacturing. M/m developments were especially shaky in the chemical sector, which contracted by 6.8% m/m.

- Preliminary Finnish Customs data show that goods exports in April contracted by 19.8%, while imports fell by a faster rate of 27.5% y/y. Consequently, the trade balance returned to a surplus of EUR190 million (USD214 million), compared with the deficit of EUR320 million in April 2019.

- In January-April, the total value of exports eased by 14.5% y/y while imports slid by 9.3% y/y. The resulting trade deficit of EUR1.2 billion compares unfavorably with the surplus of EUR45 million posted in the same period last year.

- The significant fall of both exports and imports in April was greatly affected by decreased value of transport equipment and oil products. Exports of machinery and equipment and forest industry products also contracted. A base effect from an aircraft purchase worth EUR160 million exacerbated the import slide.

- Exports to other EU member states in April fell by 21.5% y/y, while non-EU exports retreated by 17.9% y/y. In particular, exports to Germany collapsed by 38.4% y/y, to Russia by 25.0%, and to the United States by 28.6% y/y.

- The Norges Bank's Monetary Policy and Financial Stability Committee voted unanimously to keep its policy rate at 0%. The central bank expects the policy rate to remain at 0% over the next couple of years, followed by "a gradual rise as economic conditions normalize." Meanwhile, IHS Markit assumes the first interest rate rise is likely to be delayed until the third quarter of 2024, and the anticipated peak of 1.75% is likely to occur only in 2030. (IHS Markit Economist Raj Badiani)

- The Swiss National Bank (SNB) in its latest regular quarterly

review has not changed policy or deposit rates but has stressed

that it will continue to provide the banking system with fresh

liquidity via its COVID-19 Refinancing Facility (CRF) to ensure

that companies in the real sector do not become insolvent simply

for lack of liquidity. (IHS Markit Economist Timo Klein)

- Both the Swiss Average Rate Overnight (SARON), the key policy rate, and the sight deposit rate have been kept at -0.75%.

- The SNB is also maintaining the higher exemption thresholds (than prior to March 2020) up to which banks do not need to pay any negative interest on their sight deposits at the SNB (allowance factor of 30). This has reduced banks' payments to the central bank and thus their cost burden despite the persistence of a deeply negative interest-rate environment.

- The SNB is extending the deactivation of the countercyclical (equity) capital buffer that banks are normally required to maintain in order to counteract asset overvaluation risks in the Swiss mortgage and real-estate market.

- Montenegro's GDP rose by 2.7% year on year (y/y) during the

first quarter, a surprisingly strong result given the introduction

of the social distancing measures in mid-March aimed at containing

the spread of the COVID-19 virus pandemic. (IHS Markit Sharon

Fisher)

- The first-quarter growth was driven by household demand and fixed investment, while net exports and inventories were negatively affected. Government consumption experienced flat growth.

- Although the breakdown by value added is not yet available, industrial output reported rapid growth in the first quarter, rising by 12.9% y/y, thanks to strong results in all three sectors (manufacturing, mining, and utilities). Positive first-quarter results were also recorded in construction activity and agriculture.

- In line with the positive growth in household demand, nominal retail sales rose by 7.4% y/y in the first quarter. This was despite a steep drop in tourism, with overnight stays plunging by 18.9% y/y owing to a sharp March decline.

- Although the first-quarter result was better than anticipated, IHS Markit estimates that Montenegro will have experienced a steep economic decline starting in April. In the May detailed forecast round, we reduced our full-year GDP outlook for the country and are now projecting an 8.5% drop.

- Toufik Hakkar, CEO of Algeria's energy major Sonatrach, has

provided an update on the company's growth projects against the

background of the COVID-19 pandemic.

- He says that despite reducing staff levels to avoid the spread of COVID-19, oil and gas production volumes had not declined.

- The company is now preparing for the "post-coronavirus" stage, and plans an "imminent signing of several production, petrochemical, and service contracts," he says.

- The group says it continues to explore profitable investment opportunities as part of its expansion in and outside the country. Among priority petrochemical projects, Hakkar singled out the grassroots Hassi Messaoud, Algeria, refinery with a capacity of 5 million metric tons/year, an agreement for which was signed in early 2020.

- Sonatrach is also planning petrochemical projects to transform Algeria's hydrocarbon resources into plastics. These include previously announced propane dehydrogenation (PDH) and polypropylene (PP) plants planned jointly with Total at Arzew, Algeria, and a similar joint venture with Rönesans Endüstri at Ceyhan, Turkey.

- Hakkar reveals that there are other projects under study, including a $6-billion investment to transform oil and gas into polymers at Skikda. This project is in the consultation stage with a foreign partner. Another $6-billion methanol and derivatives project is under study with another partner, he says.

- MilliporeSigma, the US/Canada-based life sciences business of German pharmaceutical, chemical, and life sciences conglomerate Merck KGaA, is working together with US-based 10x Genomics, a specialist in gene sequencing technology, to offer a new option for companies involved in research involving Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) technology. The companies are combining their technologies to allow for the screening of single cells using CRISPR libraries, as stated by Merck KGaA in its press release. According to Andrew Bulpin, head of Process Solutions in the Life Sciences business of Merck KGaA, this will allow for the identification of novel molecular therapeutic targets and speed up the discovery of treatments in autoimmune disease, immuno-oncology, neurodegeneration, and other diseases. As a result of combining single-cell transcriptomics and pooled CRISPR screening, Merck KGaA will be the sole provider of a tool that enables the measurement, simultaneously, of gene perturbation and unbiased gene expression from single cells. (IHS Markit Life Sciences Brendan Melck)

Asia-Pacific

- APAC equity markets closed mixed; India +2.1%, China +0.1%, Hong Kong -0.1%, South Korea -0.4%, Japan -0.5%, and Australia -0.9%.

- A three-day surge in Nintendo shares has propelled the market value of the Japanese games maker to ¥6.6tn ($62 billion) and past the country's biggest bank, retailer and chemical company as investors bet on the long-term role of video games in a coronavirus-stricken world. (FT)

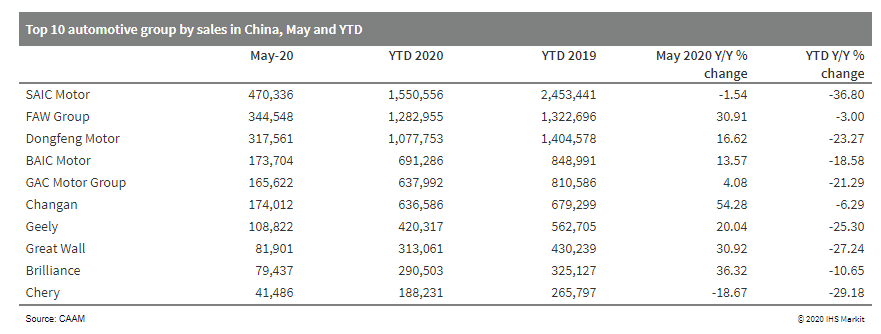

- The Chinese vehicle market experienced a strong month in May.

New vehicle sales on a wholesale basis increased by 14.5% year on

year (y/y) to 2.19 million units during the month, while production

rose by 18.2% y/y to 2.19 million units, according to data from the

China Association of Automobile Manufacturers. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Thanks to a rebound in new vehicle demand that began in April, vehicle sales and production volumes in the year to date (YTD; January to May) are narrowing the gap with the same period last year. The passenger vehicle (PV) market posted its first demand increase of the year during May, ending a prolonged decline since July 2018. Sales of PVs rose by 7.0% y/y to 1.67 million units last month, while PV production increased by 11.2% y/y to 1.66 million units.

- The new energy vehicle (NEV) sector and vehicle exports are still in distress during the recovery period from the COVID-19 pandemic. Sales of NEVs, which primarily comprise battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), declined 23.5% y/y to 82,000 units in May.

- In the YTD, sales of NEVs have fallen by 38.7% y/y to 289,000 units.

- Vehicle exports in May decreased 37.4% y/y to 49,000 units. Export volumes of both PVs and commercial vehicles contracted in May.

- PV export volumes fell 36.2% y/y to 35,000 units last month, while commercial vehicle exports fell by 40.2% y/y to 14,000 units.

- Due to demand contractions in international markets, China's vehicle export volumes have fallen by 17.5% y/y to 323,000 units in the YTD.

- We have slightly adjusted our forecast on Chinese light-vehicle

sales and production in 2020. We anticipate light-vehicle sales in

mainland China to decline by 13.4% to 21.5 million units in 2020 as

vehicle demand is likely to face further contraction in the second

half of the year.

- Chinese agrochemical company Jiangsu Changqing's agrochemicals sales were up 12.4% at Yuan 3,287 million ($465.1 million at the current rate) in 2019. Agrochemicals accounted for 97.3% of total revenues, which rose by 12.5% to Yuan 3,377.2 million ($477.9 million). Insecticides were the major product category for the company, accounting for 49.8% of sales. They were followed by herbicides making up 40.7% of revenues, and fungicides with 6.7%. Exports accounted for 58.3% of total revenues. Net profit on total sales rose by 10.4% to Yuan 355.5 million ($50.3 million). (IHS Markit Crop Science's Shuyou Han)

- Hyundai has announced that the first batch of 20 Nexo hydrogen-powered sport utility vehicles (SUVs) has arrived in Australia, according to The Driven website. The vehicles will be deployed in the Australian Capital Territory (ACT) government's fleet across several departments. The vehicle offers a long range of 666 km and is the first fuel-cell electric vehicle (FCEV) certified for sale in Australia. The fleet will be supported by Canberra's first 700-bar hydrogen refueling station, which is expected to open in the third quarter of 2020, according to a report by ACROFAN. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Chittagong Stock Exchange - one of Bangladesh's two stock exchanges - on 17 June urged the government to expand proposals to reduce the corporate tax rate in line with proposals to reduce the rate for non-listed companies. The government proposed a 2.5% percentage point decrease in the tax rate for non-listed companies to 32.5% in its budget for fiscal year (FY) 2021, which was announced on 11 June. Listed companies' tax rate was retained at 25%, and although the government pledged to reduce corporate tax rates more broadly over the next five years, it did not provide specific numbers. Moreover, the government proposed extending expired tax breaks for garment manufacturing - which has been particularly affected by the COVID-19 virus pandemic - that would keep the sector's average tax rate at around 12%. (IHS Markit Country Risk's Asad Ali)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-june-2020.html&text=Daily+Global+Market+Summary+-+18+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}