Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 19, 2020

Daily Global Market Summary - 19 June 2020

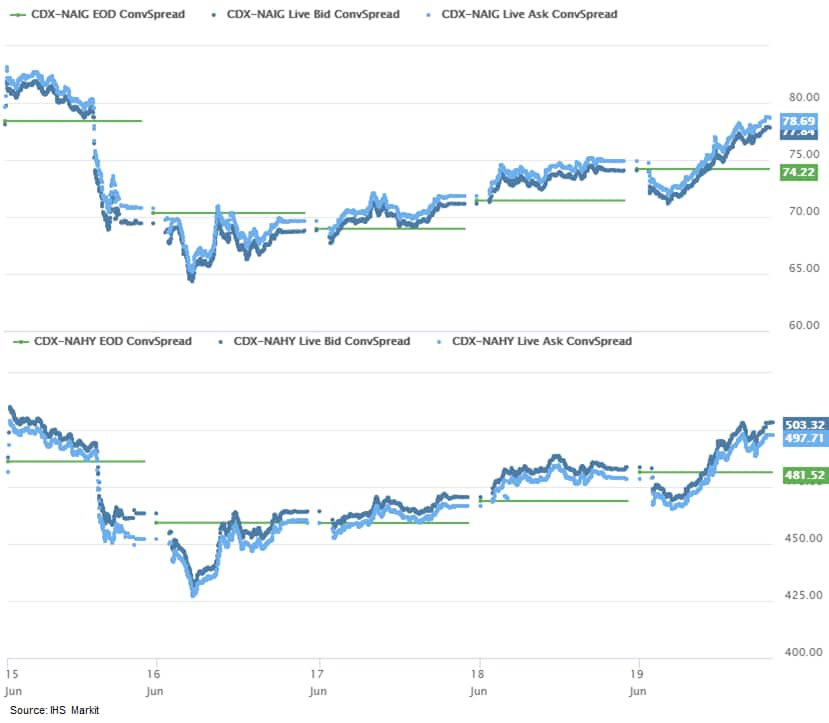

APAC and European equity markets closed higher, as most of those markets were fortunately closed by the time of Apple's announcement that it will be re-closings stores in certain US COVID-19 hotspots. That announcement resulted in a synchronized sell-off in risk assets from equities to oil, but the magnitude of the declines was relatively modest compared to last Thursday. CDX-NAHY appeared to be decoupling from equities this week and other risk assets, closing lower week-over-week versus the gains reported in equities, iTraxx-Xover, and oil.

Americas

- Equities, credit, and oil markets sold off on Apple's announcement shortly after 12:00pm EST that it will again re-close some stores because of recent spikes in coronavirus cases around the U.S. A total of 11 Apple stores will close in Florida, North Carolina, South Carolina and Arizona starting on Saturday. (CNBC)

- Most US equity markets closed lower, except for Nasdaq closing almost flat; DJIA -0.8% and S&P 500/Russell 2000 -0.6%.

- 10yr US govt bonds closed -1bps/0.70% yield and 30yr bonds -2bps/1.46% yield.

- The US CDX indices closed wider for the third consecutive day,

with CDX-NAIG closing at +4bps/78bps and CDX-NAHY +17bps/498bps.

CDX-NAIG is flat and CDX-NAHY is +12bps week-over-week.

- Crude oil was as high as +4.3%/$40.50 per barrel at 10:20am EST today, but Apple's announcement triggered a sell-off after that peak level; albeit still closing higher at +2.3%/$39.75 per barrel.

- In the week ended 6 June, US states reported 1,552,415 initial

claims of unemployment, a slight decrease of 60,325 from the week

prior. Claims fell in 26 states and remain only moderately below

historic highs. (IHS Markit Economists Alex Minelli and Fran

Hagarty)

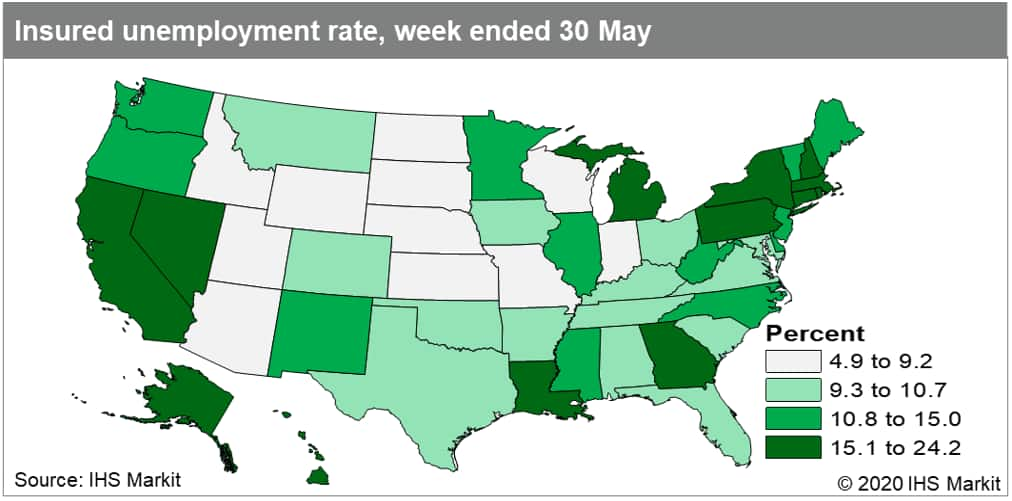

- Continuing claims of unemployment, which lag initial claims by one week, reached 18,419,605 in the week ended 30 May. While 39 states saw a decrease compared with the week prior, the total number of continuing claims was relatively unchanged, decreasing by 225,330 (1.2%) from the previous week.

- The insured unemployment rate, equal to continuing claims divided by covered employment, fell by 0.5 percentage points to 14.1% as 39 states saw a decrease in the week ended 30 May.

- Of the 28 states that saw decreases in initial filings, Florida (-95,546), Texas (-17,001), Georgia (-13,909), Michigan (-11,454), and Maine (-8,034) saw the largest declines in the week ended 6 June. All other states saw increases in initial claims, led by California (27,202), Massachusetts (17,512), Oklahoma (17,149), New York (11,873), and Maryland (9,718).

- In absolute terms, Nevada had the highest insured unemployment

rate at 24.2% followed by Hawaii (20.2%), Michigan (19.7%), New

York (18.0%), and Connecticut (16.3%).

- BMW has confirmed that employees have tested positive for the coronavirus disease 2019 (COVID-19) at its Spartanburg (South Carolina, US) plant, while other reports say workers at General Motors' (GM) Silao (Mexico) plant are reporting cases. According to Automotive News, BMW has confirmed that 14 workers tested positive for COVID-19; the employees are in quarantine and the affected areas have been sanitised and deep-cleaned. A BMW spokesperson confirmed that production was not affected and is quoted as saying, "Each case is unrelated to the other and all affected associates have been placed in quarantine." According to the report, it is unclear when the employees became infected and where in the plant that they worked. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Although the COVID-19 pandemic has left many chemical companies in a weakened financial state, it has not increased the likelihood of M&A activity, say Lori Ryerkerk, CEO of Celanese, and Peter Huntsman, CEO of Huntsman. "The current environment for cash deals is poor," says Ryerkerk. "Valuations are down and earnings are down. People who would be willing to sell, don't want to sell at these kind of multiples. People who are willing to [sell] are not going to find a willing buyer." Ryerkerk and Huntsman discussed the topic with Chemical Week publisher Lyn Tattum during a webcast of IHS Markit's Chemical Executive Conversations on 17 June. "I think for non-cash deals—so mergers or RMTs [reverse Morris trusts] or things like that—there's still room for some of those opportunities, but I think quite frankly, most companies are [focused on] working through the current difficulties and will continue to look more at M&A as we start to move into recovery." Huntsman agrees. "If there's a distressed opportunity, I'd love to see it, but I've said to our shareholders that I think a dollar on your balance sheet today is probably worth two or three dollars just a few months ago, and maybe worth a few dollars more a couple of months from now," he says.

- On 17 June, Belize's Channel 5 "News 5" website reported that the country has started discussions with bondholders to seek temporary relief on a debt-service payment due on 20 August on its outstanding 2034 bond, rolling up the payment until 2021. The source spoke to Financial Secretary Joseph Waight who said that about USD26 million was payable then. A subsequent statement on the government's Facebook page confirmed the report, highlighting the "devastating" effect of curtailed tourist activity and warning that the country's GDP might "contract by … 18% in 2020". The statement noted that "Belize's tourism industry accounted for approximately 60% of the country's foreign exchange earnings", but that such activity has "collapsed". Belize already restructured its one outstanding issue in 2017, shortening its term by four years and adjusting its coupon to ease debt-service burden. (IHS Markit Economist Brian Lawson)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; FTSE 100 +1.1%, Italy +0.7%, France/Germany +0.4%, and Spain +0.3%.

- Most 10yr European govt bonds closed higher except for UK +1bp; Italy/Spain -2bps and France/Germany -1bp.

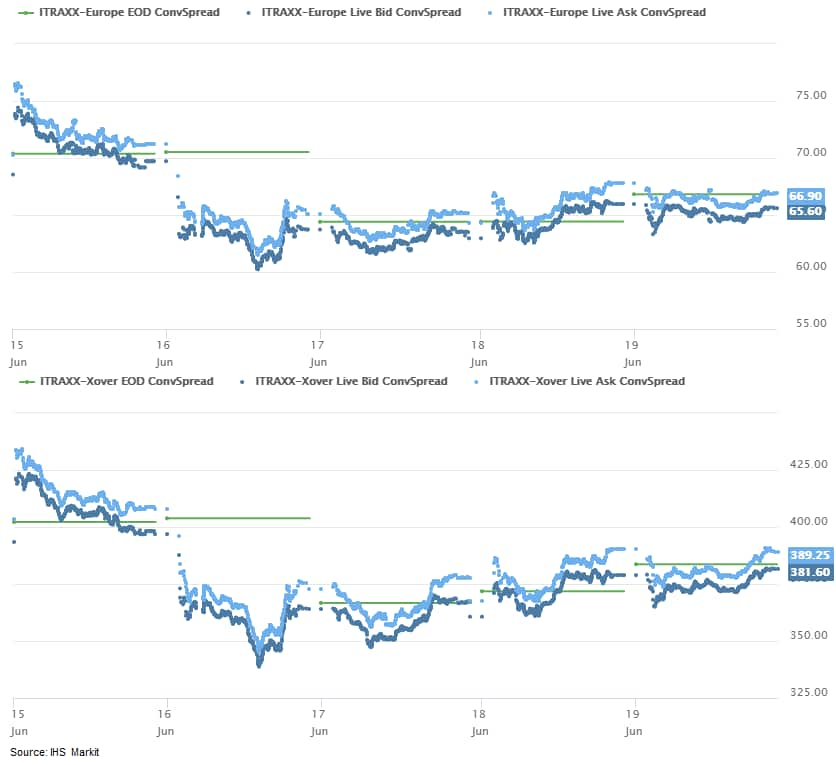

- iTraxx-Europe closed -1bp/66bps and iTraxx-Xover +2bps/385bps.

iTraxx-Europe is -4bps and iTraxx-Xover is -17bps

week-over-week.

- Brent crude closed +1.6%/$41.19 per barrel.

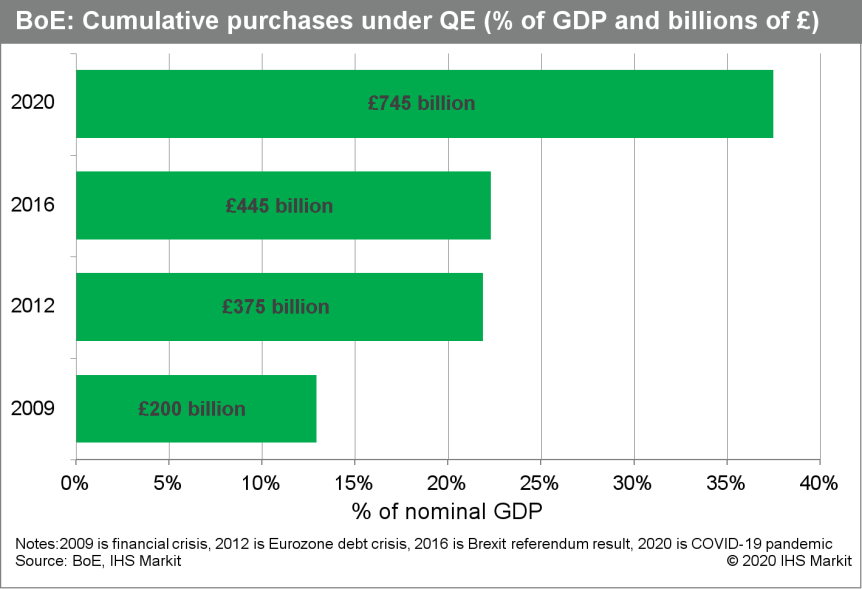

- IHS Markit had anticipated that the Bank of England would

expand its bond-buying scheme by GBP100 billion (USD124 billion),

but it was at the lower end of market expectations, with some

arguing for an expansion of GBP150-200 billion. In addition,

markets did not expect the slower pace of the bond-buying program

after July, while the Bank's chief economist's dissenting vote was

a surprise. (IHS Markit Economist Raj Badiani)

- The Bank of England's Monetary Policy Committee (MPC) voted unanimously to maintain the Bank Rate at 0.1% at its June meeting.

- As expected, the MPC refrained from tipping the policy rate into negative territory. The expanded quantitative easing (QE) is now the favored tool to lower borrowing costs. Indeed, increased Bank of England purchases of UK gilts should push up bond prices, while lowering the rate of return on these assets. The Bank hopes that some investors may decide to divert to other assets or lend to firms.

- Not surprisingly, the MPC voted unanimously for the Bank of

England to continue with the existing program of GBP200 billion

(USD248 billion) of UK government bond and sterling non-financial

investment-grade corporate bond purchases, financed by the issuance

of central bank reserves. In addition, after a majority vote of

8-1, the Bank will increase the target stock of purchased UK

government bonds by an additional GBP100 billion, to take the total

stock of asset purchases to GBP745 billion.

- According to the Office for National Statistics (ONS), UK government borrowing (public-sector net borrowing excluding public-sector banks; PSNB ex) stood at GBP55.2 billion (USD67.9 billion) last month, which was GBP49.5 billion higher than in May 2019 (see first chart below). This was the highest borrowing in any month since records began in January 1993. More encouragingly, the borrowing estimate for April 2020 has been revised down by GBP13.6 billion to GBP48.5 billion, in line with higher calculations for tax receipts and National Insurance contributions. In addition, spending on the Coronavirus Job Retention Scheme (CJRS) was lower than originally reported. (IHS Markit Economist Raj Badiani)

- UK retail spending was better than expected during May after

IHS Markit underestimated the boost from the reopening of DIY

stores and garden centers in the middle of the month. (IHS Markit

Economist Raj Badiani)

- Retail sales (including fuel sales) in volume terms increased by 12.0% month on month (m/m) in May, but sales were still 13.1% below the February level prior to the coronavirus disease 2019 (COVID-19) virus-related lockdown.

- Excluding fuel, retail sales volumes grew by 10.2% m/m in May but were 9.8% lower than a year earlier.

- May's monthly rebound was primarily due to a 42.0% m/m increase in sales in household goods stores, namely hardware, furniture, and paint shops.

- Non-store retailing continued to increase in volume terms in May, posting the strongest growth on record, at 21.0% m/m. It now accounts for around one-third of all retail spending.

- French retail sales declined by 9% year on year (y/y) in May,

following a record collapse of 40% y/y in April and a fall of 20%

y/y in March. On a month-on-month (m/m) basis, sales in May were

53% above their level in April. (IHS Markit Economist Diego Iscaro)

- Sales of food products continued to overperform, rising by 2.5% y/y, following an increase of 0.6% y/y in April. It is worth noting that restaurants in France were only allowed to open for sitting customers in early June. Meanwhile, the decline in sales of industrial products eased from 67% in April to 16% in May, implying a 159% increase on a m/m basis.

- Sales of industrial products were boosted by DIY goods (up 27% y/y) and bicycles (up 8% y/y). Online sales also appear to have been one of the sectors that benefited from the containment measures, rising by 44% y/y in April (May data are not available yet).

- The Bank of Mozambique (BM) has lowered its policy rate (MIMO) by a further 100 basis points to 10.25% during the central bank's June monetary policy committee (MPC) meeting. This follows the BM cutting its policy rate by 150 basis points in April. At the June MPC meeting, the deposit facility (FPD) and lending facility (FPC) rates were also cut by 100 basis points to 7.25% and 13.25% respectively. The mandatory reserve requirement ratios for liabilities in national currency and for liabilities in foreign currency were left unchanged at 11.5% and 34.5% respectively. BM estimates show that headline inflation will remain within the medium-term inflation target range of 5-6%. (IHS Markit Economist Thea Fourie)

Asia-Pacific

- APAC equity markets closed higher across the region; India +1.5%, China +1.0%, Hong Kong +0.7%, Nikkei +0.6%, South Korea +0.4%, and Australia +0.1%.

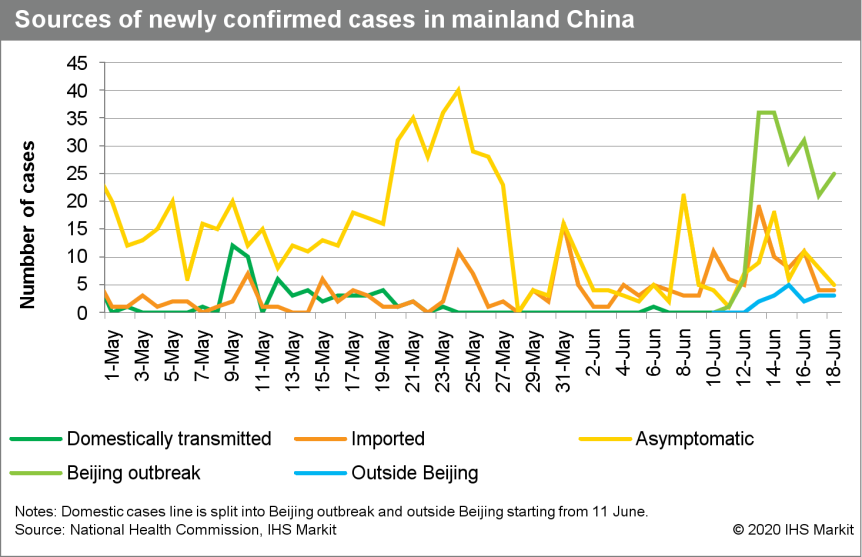

- China's newly confirmed cases have mostly concentrated in

Beijing and no major adjustments for pandemic restrictive measures

have been made by other provincial-level regions. This suggests

limited downside risks on the nation's growth recovery in the near

term. (IHS Markit Economist Lei Yi)

- Beijing raised emergency response back to second level on 16 June, only 10 days after lowering it to third level. Until the recent outbreak starting from 11 June, the capital city had reported zero domestic cases for 56 consecutive days.

- Accordingly, the city tightened pandemic control measures to curb the potential spread, including locking down residential compounds, closing schools and moving classes online, and shutting down indoor entertainment, culture, and sport venues.

- Specifically, travel restrictions have also been put in place, banning people from medium to high risk neighborhoods from leaving Beijing; while people from low-risk neighborhoods should avoid unessential travels, and must test negative within seven days ahead of departure. Flight cancelation rate topped 70% one day after the announcement.

- As of 18 June, infections related to Beijing outbreak have been

reported in Hebei, Liaoning, Sichuan, and Zhejiang Province. In

response, local governments across China have started tracing

people with recent Beijing travel history, and adjusted quarantine

requirements targeting travelers from the capital.

- US Secretary of State Mike Pompeo met with China's former

ambassador to the US and Politburo member Yang Jiechi in Honolulu,

Hawaii on 16 June. (IHS Markit Country Risk's David Li)

- The meeting lasted seven hours, which indicates that both sides are seeking a compromise solution and that a complete breakdown in US-Chinese political and economic relations is unlikely. IHS Markit assesses that the meeting was likely intended to clarify both sides' positions on multiple contentious issues. In a State Department press release, Spokesperson Morgan Ortagus reported that Secretary Pompeo highlighted the importance of "fully reciprocal dealings" in commercial, security, and diplomatic interactions, in addition to "full transparency and information sharing" in the ongoing coronavirus disease 2019 (COVID-19) virus pandemic.

- However, statements and responses from both sides before and after the meeting indicate difficulties in agreeing upon a mutually acceptable de-escalation pathway. Prior to the meeting on the same day, US President Donald Trump signed into law the Uyghur Human Rights Policy Act of 2020, which enables the use of Magnitsky Act-type sanctions against senior officials of the Chinese Communist Party (CPC). Additionally, China's People's Liberation Army Air Force (PLAAF) on 17 June deployed Chengdu J-10C and Shenyang J-11B fighter aircraft into Taiwan's air defense identification zone for the third consecutive day, marking an increase in frequency from previously recorded activity.

- The National People's Congress (NPC) Standing Committee's decision to discuss the Hong Kong National Security Law (NSL) legislation on 18 June - which was not previously on the agenda - indicates a continued threat perception that Hong Kong will be a destabilizing factor for Chinese state control.

- Although both sides will likely seek to preserve the phase-one trade agreement, a hardline US position would increase the likelihood of a renewed breakdown in trade negotiations. China's purchasing commitments, especially in the manufacturing and energy sectors, appear too ambitious amid a global economic downturn and slow economic growth, indicating that Beijing will likely seek a softer enforcement on these industries while agreeing to increase imports on agricultural products.

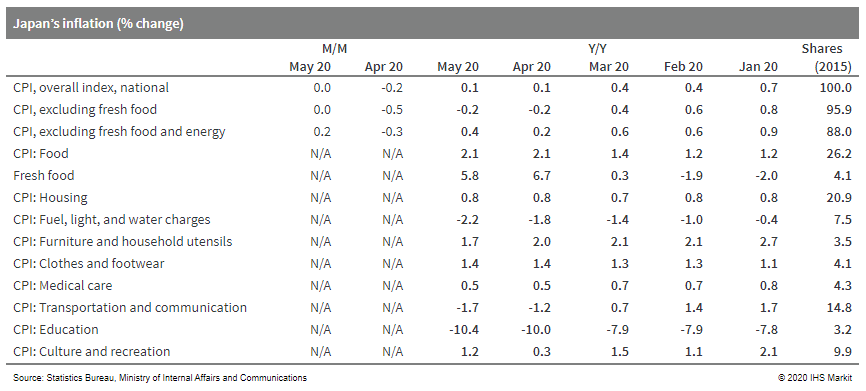

- Japan's Consumer Price Index (CPI) held at the April level on a

seasonally adjusted basis, and year-on-year (y/y) growth also

remained at 0.1% in May. The CPI, excluding fresh food (core CPI),

- a reference series for the Bank of Japan (BoJ) - also held at the

April level and continued to contract by 0.2% y/y, but the CPI,

excluding food and energy (core-core CPI), rose by 0.2% month on

month (m/m) and y/y growth increased by 0.4%, up from 0.2% y/y in

the previous month. Although faster declines in energy prices and

day care/preschool fees were major factors dragging the core CPI to

deflation, those weaknesses were partially offset by softer

decreases in accommodation and package tour fees, as well as

increases in charges for mobile phones, computers, and some

recreational goods. (IHS Markit Economist Harumi Taguchi)

- Nissan plans to cut more shifts at its assembly plants in Japan amid falling demand, according to a company statement. The automaker plans to cancel the night shift at its Kyushu plant's second production line on 29 and 30 June. Vehicle production at Nissan's plant in Oppama will be suspended on 20 and 27 July. In addition, night-shift vehicle production will be suspended on the Kyushu plant's first production line from 20 to 31 July, and on the second production line from 1 to 31 July. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Ratings agency Fitch moved India's long-term foreign-currency issuer default rating to a Negative outlook, while keeping the country's rating at BBB- (40 on IHS Markit's numerical scale). A downgrade to India's rating will arise if the government fails to make headway in reducing the fiscal deficit, or if policymakers do not adequately improve broader economic activity through reforms or shoring up the financial sector. Fitch's primary concerns include the expected protracted damage to fiscal balances from the COVID-19 viral pandemic. The ratings agency projects that India's economy will contract 5.0% in fiscal year (FY) 2020-21 (ended 31 March) due to the pandemic, but that GDP growth will rebound by 9.5% in FY 2021-22. IHS Markit's GDP growth estimates are more pessimistic at -6.3% for FY 2020-21 and growth of just 6.7% in FY 2021-22. According to Fitch, a downgrade to India's rating could arise if the government fails to make clear and meaningful progress in reducing the fiscal deficit and public debt following the pandemic. (IHS Markit Economist Bree Neff)

- Vietnam ratified a free trade agreement (FTA) with the European Union on 8 June. The ratified FTA will cut or eliminate 99% of tariff on goods traded between the Southeast Asian country and the 27-member bloc, according to a report by Reuters. The European Union Vietnam Free Trade Agreement (EVFTA) was approved by the Vietnam's National Assembly, with 94.62% of lawmakers voting in favour of the agreement. The European Parliament approved the EVFTA in February. The EVFTA will come into effect from 1 July 2020 and will result in an elimination of 65% of duties on EU exports to Vietnam, while the remaining will be phased out gradually over the next 10 years. The agreement will eliminate 71% of duties on Vietnam's exports to the EU, with the remaining to be eliminated over a period of seven years. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-june-2020.html&text=Daily+Global+Market+Summary+-+19+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 19 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+19+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-19-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}