Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 22, 2020

Daily Global Market Summary - 22 June 2020

Most APAC and all European equity markets closed lower today, while US indices finished the day in positive territory despite opening lower. WTI closed above the psychologically important level of $40 per barrel for the first time since Russia/Saudi Arabia's announcement of increased production in early March and gold closed at an almost eight-year high. IG/HY credit indices closed weaker in Europe, while US indices were slightly tighter on the day. Tonight's comments on the possible dissolution of the US/China trade deal from White House trade adviser Peter Navarro is already weighing on S&P futures.

Americas

- US equity markets closed higher today; Nasdaq/Russell 2000 +1.1%, S&P 500 +0.7%, and DJIA +0.6%.

- 10yr US govt bonds closed +1bp/0.71% yield.

- CDX-NAIG closed -2bps/76bps and CDX-NAHY -2bps/499bps.

- White House trade adviser Peter Navarro said Monday night (New York time) the trade deal with China is "over," and he linked the breakdown in part to Washington's anger over Beijing's not sounding the alarm earlier about the coronavirus outbreak. (Reuters)

- S&P futures declined as much as 1.7% as of 9:30pm EST on Peter Navarro's comments, but had been slowly recovering from the bottom over the 20min that followed.

- Gold futures closed +0.7%/$1767 per ounce, which is its highest close in almost eight years (note that gold did breach $1,788 per ounce intraday on 14 April of this year).

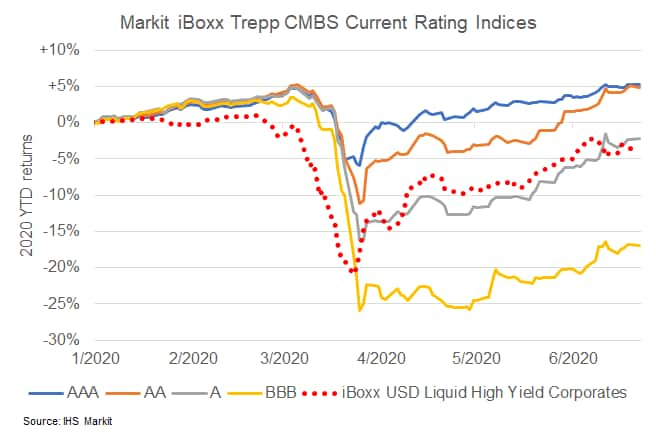

- The below chart shows 2020 YTD returns for the Markit iBoxx

Trepp CMBS Current Rating Indices from AAA to BBB, as well as the

Markit iBoxx USD Liquid High Yield Corporate bond index. The chart

indicates that AAA and AA returns are both near 5% YTD, while

single-A is -2.2%, high yield is -3.7% and BBB -16.9%.

- Crude oil closed +1.8%/$40.46 per barrel, which is the first time close over $40 per barrel since 6 March.

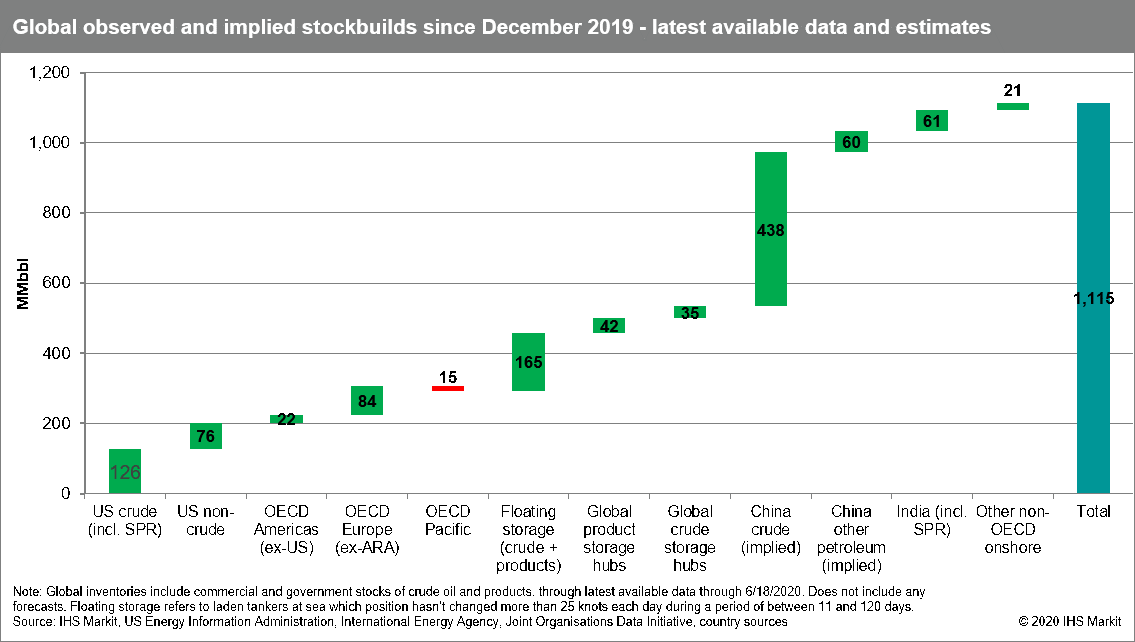

- At some point between the re-opening of economies,

stabilization of US crude inventories, peaking of floating storage

and implementation of OPEC+ cuts, oil markets apparently fell

victim to a bout of short-term amnesia regarding the scale of the

physical crisis that preceded. Setting aside the massive stock

surplus implied in our "paper" supply/demand balances - which will

likely continue to be revised as final 2Q demand data trickles in -

observed, reported and inferred stock builds from available data

all confirm an unprecedented build in 1H2020. According to our

latest estimates, we see combined global liquids (crude, refined

products and NGLs) inventories having risen by more than 1.1

billion barrels relative to December 2019 levels. Markets narrowly

avoided the dreaded "tank tops" scenario, but have stretched the

inventory buffer dramatically, a build that will require time and

sustained market deficits to work down. (IHS Markit Energy

Advisories Roger Diwan, Karim Fawaz, Sean Karst, and Samir

Nangia)

- US existing home sales dropped another 9.7% in May to a

3.91-million-unit annual rate. Single-family sales fell 9.4%, while

condo/coop sales skidded 12.8%. (IHS Markit Economist Patrick

Newport)

- Sales have plunged 32% since February to a level last seen in October 2010. All four regions saw declines for the third straight month.

- Inventory of single-family homes dipped to 1.36 million, the lowest reading for May on record (data goes back to 1982).

- The average price of a single-family home was lower in May than in April. This has never happened before, even when home prices were collapsing in 2007-09—at least since 1968, the statistic's starting point. The decline is likely compositional—a smaller proportion of high-end homes relative to low end homes were sold in May than in April.

- The median price for single-family homes increased 2.4% from a year earlier in May; the average price was up 1.6%.

- May's numbers, which tracks closings, mostly reflect negotiations that took place in March and April, when the COVID-19 response shut down large segments of the housing market. Much has happened since.

- The Mortgage Bankers Association's seasonally adjusted purchase index has skyrocketed 77% in the past nine weeks—to an 11-year high.

- The 30-year and 15-year fixed rate mortgage (Freddie Mac) fell to 3.13% and 2.58%, respectively, last week, both record lows.

- Zillow research reported that pending sales in mid-June were 17.7% higher than a month earlier, but that listings were still dropping.

- The number of home mortgage borrowers more than 30 days late swelled to 4.3 million in May, up 723,000 from the previous month and at the highest level since November 2011, according to property information service Black Knight Inc. More than 8% of all U.S. mortgages were past due or in foreclosure. (Bloomberg)

- The newly created special purpose acquisition vehicle (SPAC) Pershing Square Tontine Holdings, plans to raise up to $3.5bn in an initial public offering on the New York Stock Exchange, according to a regulatory filing. Pershing Square would provide it with an additional $1bn to $3bn. The newly created company is aiming to seize opportunities created by the coronavirus pandemic — anything from start-ups to private equity-backed companies or family-owned businesses in need of capital. (FT)

- Volvo Trucks has announced the deployment of its VNR electric Class 8 electric truck in southern California, United States, at Volvo Trucks North America's TEC Equipment dealership. The truck is to be used to move parts between local dealerships as part of a trial. In a company statement, Peter Voorhoeve, president of Volvo Trucks North America, said, "Volvo Trucks is proud to lead the way in the sustainable electrification of freight movement. Working with our dealership, TEC Equipment, to pilot the first Volvo VNR Electric on the road and in real-world applications is an exciting step toward our plans to commercialize these zero-emission trucks in North America this fall. The all-electric Volvo VNR will become the ideal truck model for short- and regional-haul applications, such as urban distribution and drayage." The dealership has two 50-kW chargers in its truck maintenance bays and a 150-kW charger outside to enable fleet customers to fast-charge vehicles. The electric truck is the result of a program partly aided by regional government support. The new electric truck will be available in 2021 for Southern California businesses to lease from TEC Equipment. This program is part of the Volvo LIGHTS (Low Impact Green Heavy Transport Solutions) project with California's South Coast Air Quality Management District and other organizations, aimed at developing a method for introducing battery electric trucks and bringing them to market at scale. <span/>(IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) has indefinitely delayed a return to three-shift production at its Spring Hill plant in Tennessee, United States, while Ford is intending to resume normal shifts in the US earlier than planned. The Detroit News and The Tennessean newspapers both report a GM statement as saying that the delay was "due to near-term supply constraints and the need to further evaluate market conditions as a result of the COVID-19 pandemic. At this time, we do not have an official return date for third shift. We will continue to monitor business and market conditions moving forward." Meanwhile, Automotive News reports that Ford is to begin running normal shift patterns at all US plants starting on 22 June, ahead of an initial target of 6 July. The contrast between the two automakers' statements reflects the uneven elements to the recovery of production following the COVID-19-related plant shutdowns in the US. While automakers are seeing tight inventories for high-demand products, some are facing more difficulties over other products. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US EPA has defied a judicial order to ban over-the-top uses

of three dicamba herbicides and its decision to allow use of

existing stocks "flies in the face" of the court's mandate,

environmentalists and farmworker advocates said Thursday (June

18th) in a filing with the US Court of Appeals for the Ninth

Circuit. (IHS Markit Crop Science's JR Pegg)

- "From top to bottom, EPA simply disregarded the Court's findings and holdings," the groups said in support of an emergency motion that asks the three-judge panel to compel the agency to ban OTT uses of the products and hold EPA Administrator Andrew Wheeler in contempt.

- At issue is Mr Wheeler's June 8th cancellation order for three dicamba herbicides - Bayer's XtendiMax, BASF's Engenia and Corteva's FeXapan - that also allowed farmers to spray some 4 million gallons of existing stocks until the end of July.

- The pesticides were approved by the EPA to be sprayed on cotton and soybeans genetically modified to tolerate dicamba, but problems with drift and damage to non-target crops have sparked widespread debate about the safety of the herbicides.

- The National Family Farm Coalition, Center for Biological Diversity, Center for Food Safety, and Pesticide Action Network successfully challenged the 2108 conditional registrations, arguing that the EPA had violated the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA) and the Endangered Species Act (ESA).

- The Court concluded that the EPA had "substantially understated the risks it acknowledged and failed entirely to acknowledge other risks" in violation of the FIFRA when it approved use of the pesticides on GM cotton and soybeans in 34 states.

- The Californian walnut sales fall steepened this May. US sales suffered a sharp drop after huge sales in previous months due to panic buying. The sales in May fell by 12.0% year-on-year to 35.8 million pounds on an in-shell basis, leading seasonal data (September 2019-May 2020) to 543.3 mln lbs, 7.3% less y-o-y. In-shell sales recovered in May, totaling 4.8 mln lbs, 78% more y-o-y, and seasonal data fell by 18.5% to 274.0 mln lbs. Domestic shipments fell to 273,740 lbs, 71.6% less y-o-y, after strong sales in previous months. European imports fell by 39.0% to 527,800 lbs. Only Spain experienced rising sales, reaching 219,160 lbs in May 2020, up from 88,180 lbs in May 2019. (IHS Markit Food and Agricultural Commodity's Jose Gutierrez)

- Fitch Ratings has revised its outlook for Nicaragua's sovereign

risk from Stable to Negative, while maintaining the country's

sovereign credit rating at B- (equivalent to 60 on IHS Markit's

numerical scale). (IHS Markit Economist Paula Diosquez-Rice)

- Fitch Ratings has highlighted that Nicaragua's outlook downgrade was driven by the deterioration of the country's economic and fiscal metrics. Nicaragua has limited resources; monetary policy is constrained by a crawling peg and the current US, Canadian, and EU sanctions will make it more difficult for the country to obtain sizeable funding from multilateral organizations.

- The rating agency noted that Nicaragua has been unable to issue bonds in local currency for the domestic market and has so far issued some 0.3% of GDP in bonds, 72% of which were US-dollar denominated and the interest rate was above 10% on average. Furthermore, Fitch assumes that the 1.2% of GDP in bonds maturing in 2020 will be rolled over in US dollars.

- Nonetheless, Fitch expects Nicaragua's fiscal deficit to be controlled (at an estimated 2.8% of GDP) because the country has not imposed a country lockdown and has not implemented any economic support measures.

Europe/Middle East/ Africa

- European equity markets closed lower across the region; Switzerland -1.1%, Spain -0.9%, UK -0.8%, Italy -0.7%, and Germany/France -0.6%.

- 10yr European govt bonds closed higher across the region; Italy -7bps, UK -4bps, Spain/France -3bps, and Germany -2bps.

- iTraxx-Europe closed +1bp/67bps and iTraxx-Xover +10bps/392bps.

- Brent crude closed +2.1%/$43.08 per barrel.

- The Bank of Russia has reduced its key refinancing rate by 100

basis points to an unprecedented 4.5%, the lowest level in modern

Russia's history. (IHS Markit Economist Lilit Gevorgyan)

- The direction of the Russian central bank's decision is in line with IHS Markit's forecast, but we projected a much smaller, 25-basis-points reduction in June. In a press note, the bank explained that the COVID-19-virus lockdown has had a larger disinflationary effect than previously projected.

- Headline annual inflation eased slightly to 3.0% in May from 3.1% in April. Marginal weakness in food prices was behind the modest deceleration in prices. Core inflation also inched down to 2.8% year on year (y/y) in May from 2.9% y/y in April.

- In a month-on-month (m/m) comparison, the inflationary developments were more pronounced, easing to only 0.2% in May from 1.1% in April, 0.7% in March, and 0.3% in February. Food prices have been the key driver of monthly inflation in recent months, whereas services price gains slowed notably.

- The UK government has announced the introduction of new legislation to protect companies that are key to the COVID-19 public health response from foreign takeovers. The government will be able to scrutinize certain foreign takeovers to ensure that they do not impinge on the UK's emergency public health preparedness, such as the current COVID-19 virus pandemic. According to the press statement, the government is concerned that economic disruption from the pandemic could make some critical healthcare businesses more vulnerable to takeovers from alleged "outwardly hostile" approaches or "malicious parties", especially for firms in financial distress. Under the new amended legislation, the government will have new powers to intervene if a business that is "directly involved in a pandemic response" - such as a vaccine developer or manufacturer of personal protective equipment - becomes the target of a hostile takeover. According to a government statement, changes to the Enterprise Act 2002 will be put before parliament on 22 June, and are expected to come into force on 23 June. (IHS Markit Life Sciences Janet Beal)

- Renault Group has revealed that its global sales were halved

during May as a result of the COVID-19 virus pandemic. According to

data published by the automaker, group demand retreated by 48% year

on year (y/y) to 168,644 units in May. Of this total, passenger car

sales fell 52.4% y/y to 130,370 units, while light commercial

vehicle (LCV) sales contracted by a more modest 24.8% y/y to 38,274

units. (IHS Markit AutoIntelligence's Ian Fletcher)

- At a brand level, sales of the group mainstay Renault brand fell 55.4% y/y to 91,681 units, while Dacia saw a drop in sales of 55.5% y/y to 30,398 units in May.

- Similarly, sales of the predominantly Russian Lada brand retreated by 43.8% y/y to 18,718 units, while the niche Alpine brand's sales dropped 74.8% y/y to 123 units last month.

- Among the brands with positive results in May was the South Korea-only Renault Samsung brand, whose sales grew 87.6% y/y to 9,803 units thanks to the launch of the new XM3, which is sold as the Renault Arkana in other global markets, while there was also some support to the results from the QM6 as well.

- At the same time, the combined sales of its Jinbei and Huasong from its Chinese partnership with Brilliance showed a strong 46.1% y/y gain to 16,777 units, underpinned by Jinbei LCVs.

- The disbanding of a joint venture (JV) between General Motors (GM) and AvtoVAZ has seen Renault Group now include the Chevrolet Niva - now sold under the AvtoVAZ brand - as part of its global sales, with 1,144 units sold this month.

- In its core European region, its light-vehicle sales fell by 53.1% y/y to 85,398 units in May, with a 47.4% y/y fall to 32,147 units suffered in the French market alone.

- Dutch consumer confidence improved in June compared with the

May multi-year low. In June, the consumer confidence index compiled

by Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS)

improved to -27 from -31. Consumers are especially concerned about

the economic situation over the next 12 months, the index for which

stands at -56. Meanwhile, the assessment of the overall economic

climate has remained unchanged at -52. (IHS Markit Economist Daniel

Kral)

- In a separate release, the monthly indicator measuring domestic household consumption has suffered its biggest collapse on record. Based on shopping-day-adjusted data from the CBS, it was down by 17.4% year on year (y/y) in April following a drop of 6.4% y/y in March.

- The labor market continues to deteriorate. According to the CBS, the number of people in paid employment fell by 24,000 in May after a record drop of 160,000 in April. However, the unemployment rate increased from 2.9% to just 3.6% between March and May, as 127,000 out of the 184,00 who lost a job in April-May dropped out of the labor force, keeping the unemployment rate down because of the lower participation rate.

- Dutch technology start-up Connecterra has bagged €7.8 million ($8.7 million) in a series B funding round. The firm is the developer of the Ida digital dairy farm platform. The predictive system uses sensor technology, cloud computing and artificial intelligence (AI) to monitor dairy cows in real time. Ida generates insights aimed at improving animal health and welfare, and in turn farm efficiency. Connecterra's latest fundraising has seen a group of new backers join the firm's investor portfolio. These include ag-tech funding specialist ADM Capital, international food safety business Kersia and Dutch 'impact investor' Pymwymic. Existing supporters who also contributed to the round include Breed Reply and Sistema Venture Capital. According to Connecterra, the amount raised marks the biggest series B snared by a livestock technology company in Europe. The firm explained Ida has "evolved from sensor tech to a full-stack technology and AI platform, combining proprietary sensor hardware, animal data, third-party enterprise data and machine-learning algorithms". The new funding will be used to accelerate the global growth of the platform, including its expansion in leading dairy regions such as Europe, North America and New Zealand. The money will also back further scale-up and development of the technology behind Ida. (IHS Markit Animal Health's Sian Lazell)

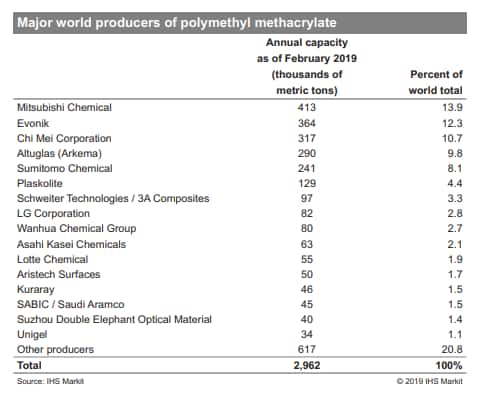

- Arkema has kicked off the sale of its polymethyl methacrylate (PMMA) business (PMMA is the base material for plexiglass), which could raise about €1 billion ($1.1 billion), Bloomberg reports citing people familiar with the matter. Arkema CEO Thierry Le Hénaff announced on 2 April the potential divestment of its methyl methacrylate (MMA) and PMMA business, in line with the company's ambition to become a world leader in specialty materials realigned around adhesive solutions, advanced materials, and coating solutions. Le Hénaff said at that time the best option for MMA and PMMA would be to divest the business, which in 2019 reported combined sales of €600 million. Bloomberg says Arkema has sent teaser documents to potential bidders with an overview of the division. The sale is attracting initial interest from private equity firms including Advent International, Rhône Group, SK Capital Partners, and Triton Partners, Bloomberg says. It adds that Arkema has not decided when to seek first-round bids and could wait until after the summer to solicit offers formally. Arkema is one of the leading producers of PMMA competing with Mitsubishi Chemical, Röhm, and Sumitomo Chemical.

- This below table of the largest global producers of polymethyl

methacrylate is from the May 2019 edition of the IHS Markit

Chemical Economics Handbook on polymethyl methacrylate (PMMA):

- Seasonally adjusted Polish industrial production jumped by

12.2% month on month (m/m) in May, an encouraging result but not

enough to compensate for the March and April declines of 7.4% and

21.3%, respectively. In a year-on-year (y/y) comparison, output

fell by 15.5% in seasonally adjusted terms and by 17.0% in

unadjusted terms, signaling that the recovery will be slow. (IHS

Markit Economist Sharon Fisher)

- In terms of industrial groupings, May's output of capital goods declined the fastest (down by 38.4% y/y), while the drop in other categories was more modest. The category with the best results was non-durable consumer goods, which fell by 8.7% y/y.

- Output declined in 30 out of 34 industrial divisions, with output of motor vehicles continuing to fall dramatically (down by 58.0% y/y). Electrical equipment and tobacco products were among the only industrial divisions to report positive results.

- In other recent releases, May's data have revealed a weakening labor market, with enterprise employment down by 3.2% y/y. Nominal enterprise wage growth slowed to 1.2% y/y in May, down from 7-8% y/y in the first two months of 2020.

- Affected by falling demand, COVID-19 virus shutdowns, high levels of existing inventories, and supply-chain disruptions, May's industrial production results were somewhat worse than we had anticipated, paving the way for a possible downgrade to our full-year 2020 output forecast in the July round (from -7.1% in June). The steep drop in capital goods production was especially worrisome, indicating a sharp decline in investments during the second quarter of 2020.

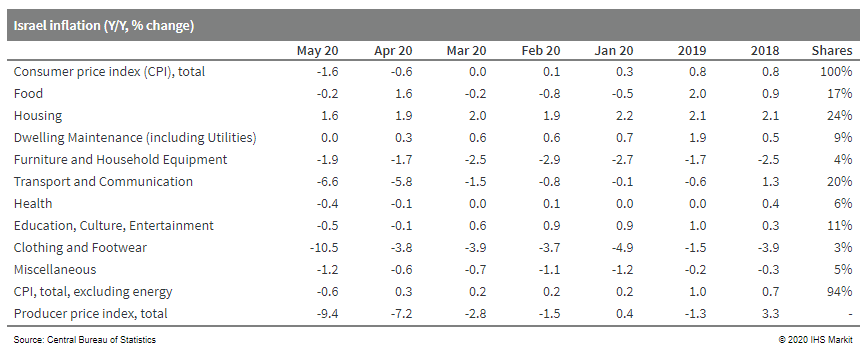

- Israeli consumer price inflation (CPI) fell to -1.6% year on

year (y/y) in May after turning deflationary in April for the first

time since 2017, at -0.6% y/y. (IHS Markit Economist Ana Melica)

- Food price inflation jumped to 1.6% y/y in April but fell back to -0.2% y/y in May, the same rate as in March.

- The largest downward drag on inflation came from transport and communication, contributing -1.3 percentage points to the -1.6% y/y overall drop in May. Transport prices plunged 5.9% y/y in April and 7.0% y/y in May, reflecting lower fuel prices and car rental costs. Communication prices were down 3.5% y/y in April and 3.2% y/y in May.

- The largest upward inflationary pressure came from housing, which contributed 0.4 percentage points in May. Housing price inflation eased but remained the category with the highest inflation rate.

- Shekel weakness from March into May does not appear to have raised imported product prices, as tradables inflation was -1.4% y/y in March, -3.2% y/y in April, and -4.7% y/y in May. Non-tradables inflation eased by around half but remained positive at 0.4% y/y in May.

- On a month-on-month (m/m) basis, inflation (non-seasonally adjusted) was -0.3% in both April and May. Food prices fell 0.5% m/m in May, following a 1.5% m/m gain in April, as lockdown measures eased after initially raising food demand.

- Housing prices fell 0.3% m/m in May after a 0.2% m/m decline in

April. Transport and communication prices dropped 3.0% m/m in

April, reflecting the plunge in global oil prices and travel

demand, and they fell another 0.4% m/m in May.

Asia-Pacific

- APAC equity markets closed mixed; India +0.5%, Australia flat, China -0.1%, Japan -0.2%, Hong Kong -0.5%, and South Korea -0.7%.

- China's State Council executive meeting held on 17 June

highlighted policy support for small and micro enterprises (SMEs)

as well as prevention of financial risk. At the 12th Shanghai

Lujiazui Financial Forum from 18 to 19 June, vice premier Liu He

affirmed the economic recovery since April and emphasized the

balance between supporting growth and preventing financial risk.

(IHS Markit Economist Yating Xu)

- The governor of the People's Bank of China (PBOC) said that the financial support during the pandemic was temporary and the government should consider of policy exit at a proper time to avoid moral hazard.

- Guo Shuqing, the chairman of China's Banking and Insurance Regulatory Commission (CBIRC) emphasized that China wouldn't flood the economy or monetarizing the fiscal deficit or conducting negative interest rate currently, to keep policy room for a possible second hit. He indicated inflation risk and exist of stimulus as well.

- It was the first time since the beginning of the COVID-19 outbreak that the central government emphasized stimulus-related financial risks, signaling fine-tune of monetary policy and an exist of previous stimulus at some time. It shows the government's cautiousness of outcomes of massive liquidity injection and monetarization.

- China's express delivery firms handled 7.38 billion parcels in

May, surging 41.1% from a year ago, with their business revenues

rising 24.9% year on year (y/y) to 77.2 billion, accelerating from

21.7% y/y growth in April and 0.6% y/y contraction in the first

quarter, according to the State Post Bureau (SPB). The cumulative

business volume in the first five months increased 18.4% y/y with

revenues increasing 9.9% y/y. (IHS Markit Economist Yating Xu)

- With express delivery accounting for three fourths of postal service, postal service revenue and business volume rose 21.9% y/y and 38.4% y/y respectively in May.

- By region, eastern China contributed to 80% of express delivery businesses, while central and western regions accounted for 12.5% and 7.4% respectively.

- In the 2019 China express delivery development report, the SPB expected the express delivery business volume to rise 18% y/y in 2020 and business revenue to rise 16% y/y.

- The acceleration in express delivery businesses indicates an improvement in service GDP in the second quarter. Business volume of postal service rose 7.5% in the first quarter, helping to ease the decline in the GDP component of transportation, storage, and post.

- However, express delivery businesses are expected to peak in the second quarter as offline consumption may recover as the domestic pandemic gets controlled, while overall private consumption will be negatively impacted by income loss after the pent-up demand fades.

- The SPB expected 18% y/y growth in express delivery businesses volume in 2020, compared with a 25.3% y/y growth in 2019.

- BAIC Group has partnered with Didi Chuxing (DiDi) to custom build vehicles with high-level autonomy in China, reports CAAM News. BAIC claims to be the only Chinese automaker to establish a strategic partnership with DiDi's autonomous vehicle (AV) unit. The companies will jointly focus on developing technologies for Level 4 AVs to promote intelligent mobility in local industries. The automaker has recently partnered with DiDi to lease its cars to customers amid concerns about a fall in personal car ownership due to rising demand for mobility services. In January 2019, BAIC's subsidiary BJEV, which focuses on new energy vehicles (NEVs), formed a joint venture with DiDi, named Jingju, which develops "next-generation connected-car systems" using fleet management and artificial intelligence (AI) technology. In the AV segment, BAIC has partnered with Baidu to develop Level 3 autonomous driving capabilities. At the Auto China 2018 expo in Beijing, BAIC BJEV unveiled its AI vehicle system, Darwin System, and the autonomous model LITE. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's industry ministry plans to ease temporarily quotas designed to boost production of electric cars as the auto industry struggles to recover from the COVID-19 virus pandemic. In a statement published by the Ministry of Industry and Information Technology (MIIT) on 22 June, the government outlined several changes to the current rules that regulate fuel-efficiency standards of passenger vehicles. The aim of the revisions is to allow automakers to benefit from the adopting of fuel-saving technologies through 2023. For instance, under the changes, hybrid vehicles will still be considered to be types of fuel-efficient passenger vehicle, contributing to automakers' average fuel-efficiency target through 2023. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nissan Motor has announced plans to partner with Sunwoda Electric Vehicle Battery on the joint development of next-generation battery for use in electric vehicles (EVs), according to a Nissan company statement. As part of their partnership, the two companies will also consider the development of efficient production technology for the stable supply of the jointly developed in-vehicle battery. A final agreement is expected by the end of 2020. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Kia has partnered with Google Cloud and Megazone to develop an artificial intelligence (AI)-based manual called 'Kia Owner's Manual App', according to a company press release. The Kia Owner's Manual App is a mobile app for customers explaining the features in Kia's vehicles and uses a smartphone camera. Kia will roll out the manual app sequentially from the second half of 2020. "The Kia Owner's Manual App will offer a unique customer experience with our products. Kia drivers will be able to enhance the safety and convenience of ownership with the app, which provides easy and intuitive information on the various functions of their vehicle and our latest technologies," said Kia Motors VP and head of global dealer and service Eui-sung Kim. The Owner's Manual App has an AI-enhanced symbol recognition and uses Google Cloud's AI platform-based image learning technology to allow the app's symbol scanner function to accurately identify in-car switch symbols from any angle. (IHS Markit AutoIntelligence's Jamal Amir)

- Thai vehicle production - including passenger vehicles and

light, medium, and heavy commercial vehicles - plunged by 69.1%

year on year (y/y) to 56,035 units in May, reports Bangkok Post,

citing data released by the Federation of Thai Industries (FTI)

automotive club. (IHS Markit AutoIntelligence's Jamal Amir)

- Exports of completely built-up (CBU) units fell by 68.6% y/y to 29,894 units during the month, and the total value of overseas shipments fell by 64.0% y/y to THB17.5 billion (USD563 million).

- In the year to date, vehicle production in the country was down by 40.2% y/y at 534,428 units, while exports of CBU units declined by 35.0% y/y to 300,501 units and the total value of overseas shipments fell by 32.1% y/y to THB158.7 billion.

- The FTI forecasts the full-year export value to drop by 50% y/y to THB300 billion if a second wave of the virus hits large portions of the globe, compared with THB545.96 billion in export sales in 2019.

- In May, the FTI announced that Thailand's vehicle production in 2020 would likely miss its 1-million-unit target after a 30-year low of 24,711 vehicles produced in April.

- EEW Group will deliver the steel pipe components for 47 jacket foundations at the 376 MW Formosa 2 OWF (offshore wind farm) in Taiwan. Fabrication of the steel pipes with a total tonnage of 47,500 metric tons commenced at EEW Group's facilities in South Korea and Malaysia in January. The units are expected to be completed in October. Saipem and Sembcorp will deliver 32 and 15 jacket foundations respectively. EEW Group is also manufacturing 194 pin piles for Formosa 2 OWF under a subcontract from Jan De Nul, which is the EPCI contractor for the project's foundations and subsea cables. The offshore wind project will feature 47 Siemens Gamesa 8.0-167 offshore wind turbines on jacket foundations which will be installed in water depth of up to 55 m (180 ft). Construction of the OWF is underway and it is expected to be commissioned by the end of 2021. JERA, Macquarie's Green Investment Group and Swancor Renewable Energy are jointly developing Formosa 2. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-june-2020.html&text=Daily+Global+Market+Summary+-+22+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}