Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 23, 2020

Daily Global Market Summary - 23 June 2020

The first wave of flash PMI releases indicated further recovery in June, but most country's manufacturing and services headline numbers still remained in contraction territory. Equity markets closed higher across the globe today with the help of the positive PMI tailwinds, with Nasdaq reaching a new all-time high and gold prices closing at a new multi-year high. Credit indices closed modestly tighter across the US/Europe and IG/HY, while most benchmark government bonds closed lower.

Americas

- US equity markets closed higher and the Nasdaq reached a new all-time high, but all indices closed near the lows of the day; Nasdaq +0.7%, DJIA +0.5%, and S&P 500/Russell 2000 +0.4%.

- 10yr US govt bonds closed +1bp/0.72% yield.

- CDX-NAIG closed -1bp/75bps and CDX-NAHY -6bps/493bps.

- Gold closed +0.9%/$1782 per ounce, which is the highest close since November 2011.

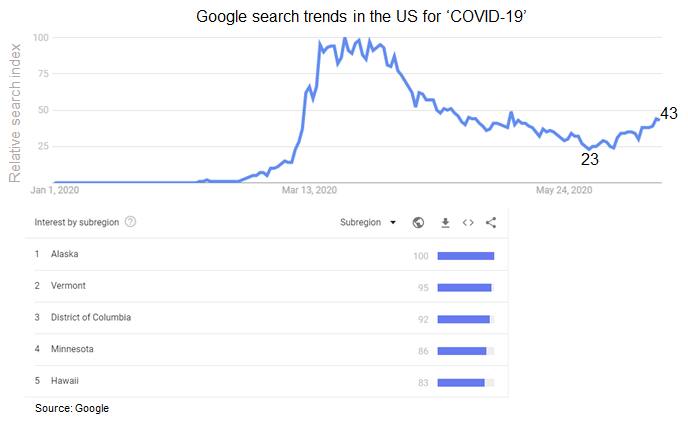

- Google Trends data is indicating a steady uptick in searches

using the term 'COVID-19' after bottoming out 31 May. Searches in

Alaska are currently trending highest, followed by Vermont,

District of Columbia, Minnesota, and Hawaii.

- U.S. private sector firms signaled a notable slowdown in the

rate of output contraction in June, as businesses began to reopen

on a larger scale. Manufacturers and service providers alike

registered much softer declines in output compared to May. (IHS

Markit Economist Chris Williamson)

- Flash U.S. Composite Output Index at 46.8 (37.0 in May). 4-month high.

- Flash U.S. Services Business Activity Index at 46.7 (37.5 in May). 4-month high.

- Flash U.S. Manufacturing PMI at 49.6 (39.8 in May). 4-month high.

- Flash U.S. Manufacturing Output Index at 47.8 (34.4 in May). 4-month high.

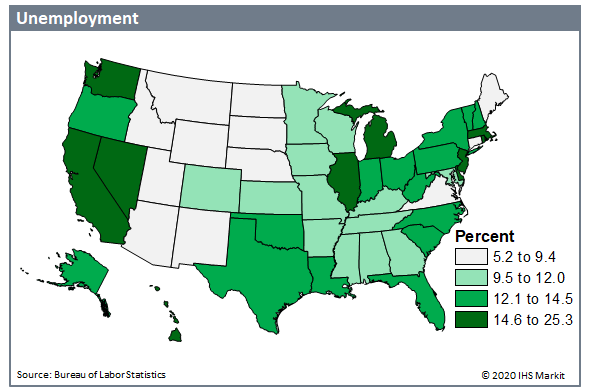

- Total nonfarm payroll employment increased in 49 states in May

2020, gaining a net 2.6 million jobs from the previous month on a

seasonally adjusted basis, according to the most recent report from

the US Bureau of Labor Statistics (BLS). (IHS Markit Economist

Steven Frable)

- Employment increased in most sectors, with the majority of gains concentrated in the food and accommodation services sector as restaurants geared up for soft reopenings. Sectors that participated in early phases of reopening plans, like construction, healthcare, drive-through retail, and manufacturing also added a significant number of jobs

- Most of the largest states led the rebound in absolute terms, including Texas, Pennsylvania, Florida, Michigan, and California. States with looser guidelines for their re-opening, and those that got an earlier start on easing, surged in food and accommodation service sector employment, such as Texas and Florida.

- Payrolls in Pennsylvania and California, on the other hand, increased thanks to an early resumption of much-needed construction work, especially outside major metro areas where face to face contact with the general public was less of a concern.

- Reflecting the improvement in labor markets, unemployment rates decreased in 44 states in May 2020. Indeed, 12 states decreased by 3 percentage points or more. Of the 5 that increased, on the other hand, Delaware (15.8%), Florida (14.5%), Massachusetts (16.9%), and Minnesota (9.9%) set new series highs.

- The highest unemployment rates can still be found in

tourism-dependent states like Nevada (25.3%) and Hawaii

(22.6%).

- US new home sales climbed 16.6% (±15.5%, statistically

significant) in May to a seasonally adjusted annual rate of

676,000; this is not far below the average reading for the last

three quarters, 703,000. (IHS Markit Economist Patrick Newport)

- Sales for the prior three months were revised down a cumulative 51,000.

- The number of units for sale was unchanged at 322,000; completed homes for sale came in at 76,000, down 3,000.

- The months' supply of unsold homes fell 1.1 months to 5.6 months.

- The median price climbed to $317,900, up 1.7% from a year earlier; the average price was down 2.7% year on year at $368,800.

- The Census Bureau this morning (23 June) also released data on housing permits at the state level. Year-to-date single-family housing permits were higher in 28 states this year compared with last year. Nationally, year-to-date housing permits were 1.5% higher than in 2019 (but 4.0% lower than in 2018).

- The US Centers for Medicare & Medicaid Services (CMS) has

released preliminary snapshot on the impact of COVID-19 on Medicare

beneficiaries between 1 January and 16 May. The data obtained from

Medicare claims shows that more than 325,000 Medicare beneficiaries

(518 cases per 100,000 beneficiaries) were diagnosed with COVID-19,

and about 110,000 of those were hospitalized (175 hospitalizations

per 100,000 beneficiaries). (IHS Markit Life Science's Margaret

Labban)

- The most prevalent chronic conditions in hospitalized beneficiaries were hypertension (79%), hyperlipidemia (60%), chronic kidney disease (50%), anemia (50%), and diabetes (50%).

- Around 28% of the hospitalized individuals died in the hospital, 27% were discharged to homes, and 21% were discharged to nursing facilities.

- Half of hospitalizations lasted for fewer than eight days, and 9% for at least 21 days or longer. Medicare payments for fee-for-service COVID-19 hospitalizations reached USD1.9 billion (USD23,094 per hospitalized patient).

- Crude oil closed -0.2%/$40.37 per barrel.

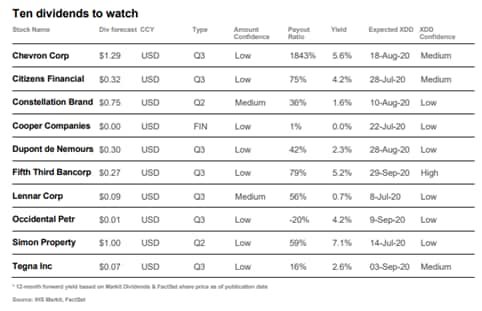

- IHS Markit's Dividends Forecasting research group published a

research report today that included their list of the ten dividend

forecasts you should be aware of. This report highlights dividend

forecasts where IHS Markit noticed conflicting market signals,

rapidly changing expectations, divergence against consensus and

forecasts ranked with "Low confidence" or "High Confidence".

- At the annual Apple Worldwide Developer's Conference held on 22 June, Apple announced that BMW would be the first carmaker to enable customers to use iPhone as a fully digital car key. A BMW press release says that it will be the first to offer BMW Digital Key stored securely in Apple Wallet for iPhone, noting that BMW was the first to integrate iPods into vehicles and the first to offer wireless Apple CarPlay. The Digital Key includes security through Apple Wallet and the Secure Element of iPhone, a power reserve that ensures the car keys will still function for up to five hours if the phone turns off due to low battery; the ability to share access with up to five friends via iMessage, and Apple Watch compatibility. Lincoln was the first US brand to offer a phone-as-key feature with the Aviator utility vehicle, though Hyundai also added it for the Sonata in the US as well. owever, these systems use Lincoln and Hyundai's connectivity apps rather than Apple's digital wallet, and while Lincoln's is only compatible with the Apple iOS, Hyundai's launched for Android operating system phones. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Tesla has tentatively scheduled both its Battery Day event and annual shareholders' meeting for 15 September, after having delayed the events due to the COVID-19 pandemic. A Reuters report cites a Twitter post from Tesla CEO Elon Musk as saying, "Tentative date for Tesla Shareholder Meeting & Battery Day is Sept 15. Will include tour of cell production system." The Reuters report also cites sources familiar with the electric vehicle (EV) manufacturer's plans as saying that Tesla is working with Chinese battery maker Contemporary Amperex Technology Ltd (CATL) to jointly develop batteries that will last a million miles and enable profitably when the EVs are sold at the same price or less than a traditional ICE vehicle. Musk promised during Tesla's last two earnings calls that the Battery Day event would include significant news on the company's batteries; however, the scheduled date of the event has been impacted by COVID-19 restrictions on meetings of large groups. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Huntsman (The Woodlands, Texas) has reaffirmed its second-quarter guidance that overall sales will be down 30-35% year over year (YOY). However, the company saw sales improve between April and May, and it expects the trend to continue in June. Results in the polyurethanes division are expected to be modestly better than forecast, mainly on stronger performance in China and in US construction. Results in the textiles effects division have been weaker than expected, largely owing to prolonged mandatory shutdowns in key textile manufacturing regions, says the company. Huntsman expects adjusted EBITDA in the textiles effects division will likely be slightly negative for the second quarter. Results in the performance products division are likely to be in line with the prior guidance, while results in the advanced materials division may fall slightly short because of a deeper-than-expected trough in aerospace, Europe, and India.

- Sasol today announced that the Guerbet alcohol unit at the company's $12.8-billion Lake Charles Chemicals Project (LCCP) in Louisiana achieved beneficial operations on 19 June. The 30,000-metric tons/year unit, the world's largest facility for the product, is Sasol's second Guerbet alcohol production unit, adding to its Brunsbüttel, Germany, plant. It follows three days after Sasol achieved beneficial operations at the site's Ziegler alcohol unit, bringing the online capacity of LCCP's specialty chemicals units to 100% and LCCP's total online nameplate capacity to 86%. Sasol says the Ziegler and Guerbet alcohol plants expand its position of having the world's broadest integrated alcohols and surfactants portfolio. The LCCP Ziegler unit is an extension of an existing Ziegler plant at Lake Charles and the largest of its type in the world, adding nameplate capacity of 173,000 metric tons/year of alcohol and 32,000 metric tons/year of alumina. The addition strengthens Sasol's "significant" economies of scale, the company says.

- The US Court of Appeals for the Ninth Circuit has rejected a request by environmentalists and farmworker advocates to compel the EPA to ban the spraying of three dicamba products. Last week's order leaves in place the EPA's cancellation order for the products and is a victory for ag interests, allowing farmers to spray some 4 million gallons of existing stocks of the herbicides -- Bayer's XtendiMax, Corteva Agriscience's FeXapan and BASF's Engenia - until July 31st. The environmentalists and farmworker group filed its request last week. But the Court's decision - which it issued without explanation - is not the end of the legal controversy around the dicamba-based products. The panel also granted a request by BASF and Corteva to intervene in the case and will consider BASF's motion to recall and stay its June 3rd order that vacated the registrations of the three dicamba products. "BASF will suffer irreparable harm if the mandate is not recalled or is immediately re-issued, including loss of its procedural rights, damage to customer relationships, and tens of millions of dollars in unrecoverable commercial losses," BASF said in its motion with the Ninth Circuit. IHS Markit Crop Science's JR Pegg)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Germany +2.1%, Italy +1.9%, France +1.4%, Spain +1.3%, and UK +1.2%.

- 10yr European govt bonds closed lower across the region except for Italy -3bps; France +4bps, Germany +3bps, and UK +2bps.

- iTraxx-Europe closed -3bps/65bps and iTraxx-Xover -17bps/377bps.

- Brent crude closed -0.8%/$42.73 per barrel.

- In a press release, Abu Dhabi National Oil Company (ADNOC)

announced the signing of an agreement with a consortium of

investors to sell its 49% stake in ADNOC Gas Pipeline Assets LLC

for $10.1 billion. The consortium comprises Global Infrastructure

Partners, Brookfield Asset Management Inc, Singapore's sovereign

wealth fund GIC Private Limited, Ontario Teachers' Pension Plan

Board, NH Investment & Securities and Snam SpA. The transaction

is expected to close by the end of July 2020. (IHS Markit Upstream

Companies and Transaction's Karan Bhagani)

- Following the closing of the transaction, the consortium will collectively hold a 49% interest in ADNOC Gas Pipeline Assets LLC. ADNOC will control the remaining 51%.

- ADNOC Gas Pipelines leases ADNOC's interest in 38 pipelines, connecting ADNOC's upstream assets to local UAE off-takers, for 20 years. ADNOC will pay the entity a volume-based tariff for ADNOC's share of the sales gas and natural gas liquids that flow through the pipelines. ADNOC Gas Pipelines has a total length of over 982 km.

- This transaction allows ADNOC to tap new pools of global institutional investment capital while maintaining full operational control over the assets, the company said.

- The flash IHS Markit/CIPS UK composite PMI, based on around 80%

of normal replies received from the monthly surveys, showed a

record rise in points terms for a second consecutive month in June.

The headline index, measuring output of both manufacturing and

services, rose from 30.0 in May to 47.6, its highest since February

and up sharply since the all-time low of 13.8 plumbed in April at

the height of the COVID-19 lockdown. (IHS Markit Economist Chris

Williamson)

- Many firms continued to report falling demand as an increasing dampener on business levels, often linked to households and businesses tightening belts and consumer spending being hit by the weakened job market. Overall new order inflows fell again in June, led by export orders dropping particularly sharply again, albeit registering the weakest contraction of overseas demand since February.

- New orders of transport goods (including cars) and electrical and electronic goods fell especially sharply again, most likely reflecting reduced demand for high-ticket items by households amid the ongoing uncertainty caused by the pandemic.

- Indicators from the survey showed employment continuing to fall at a steep rate, albeit with job losses in both manufacturing and services running at the lowest since March. The drop in employment over the past four months has been on an unprecedented scale, although the overall rate of decline eased back in June to below the prior global financial crisis peak rate, helped in part by some companies bringing furloughed employees back to work.

- A law firm in the United Kingdom has announced that it is preparing to take action against Renault and Nissan over the company allegedly using defeat devices on certain vehicles to meet emissions regulations, reports Press Association National Newswire. Damon Parker, senior partner at Harcus Parker, which is launching legal action, stated, "For the first time, we have seen evidence that car manufacturers may be cheating emissions tests of petrol [gasoline], as well as diesel vehicles." He added, "We have written to Renault and Nissan to seek an explanation for these extraordinary results, but the data suggests to me that these vehicles, much like some VWs [Volkswagen] and Mercedes cars, know when they are being tested and are on their best behavior then and only then… These are vehicles which could and should meet European air quality limits in normal use, but rather than spend a little more on research and development, Renault and Nissan appear to have gone down the same path as VW and Mercedes and decided to cheat the tests." Harcus Parker has claimed that owners of affected vehicles are entitled to compensation worth around GBP5,000. Harcus Parker has alleged that up to 1.3 million Renault and Nissan diesel vehicles could have a defeat device installed according to independent data it has seen, and its other evidence includes documents from the UK's Department for Transport showing that a 1.2-litre gasoline Qashqai breaches emissions limits by up to 15 times when driven on the road. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Federal Statistical Office (FSO) reports that growth of

real monthly earnings (including bonus payments) in the whole

German economy (including the public sector and assuming that the

employment structure of the previous year has remained constant for

analytical purposes) in the first quarter decelerated anew from

0.7% year on year (y/y) to 0.4% y/y. This is the lowest since late

2013 and also slightly undershoots the historic (1992-2019) average

of 0.5%. (IHS Markit Economist Timo Klein)

- Nominal wage growth steadied at 2.1% y/y in the first quarter after its plunge from 3.4% to 2.0% in the previous quarter. This is linked to the concurrent increase in the rate of consumer price inflation from 1.2% to 1.6%.

- Nevertheless, the nominal pace of 2.1% is also slightly below its long-term average of 2.2% and well below its post-unification (post-1990) high of 4.0% in the second quarter of 2011 (leaving aside 1992-93 data that are statistically distorted by unification-related structural adjustments).

- The breakdown of different types of employment shows that nominal wage growth (total: 2.1%) was somewhat sub-average for full-time employees (1.8% y/y, up from 1.7% in the fourth quarter of 2019) and substantially worse for those working in mini-jobs (-0.7%, down from 1.4%). The latter reflects that hotels and restaurants, a sector in which a large number of such people are traditionally employed, were immediately hit by the lockdown implemented in mid-March.

- The breakdown by skill level (which excludes the mini-job segment) shows that the largest annual increases accrued to skilled employees with special qualifications (2.6% y/y) and unskilled workers (2.4%), followed by employees with average skills (2.2%), semi-skilled workers (1.9%), and finally leading employees (1.4%).

- The pandemic should lead to a major plunge in monthly earnings in the second quarter of 2020, despite the fact that a concurrent drop in inflation from 1.6% in the first quarter to probably 0.6% in the second quarter of 2020 will soften the fall in real wages.

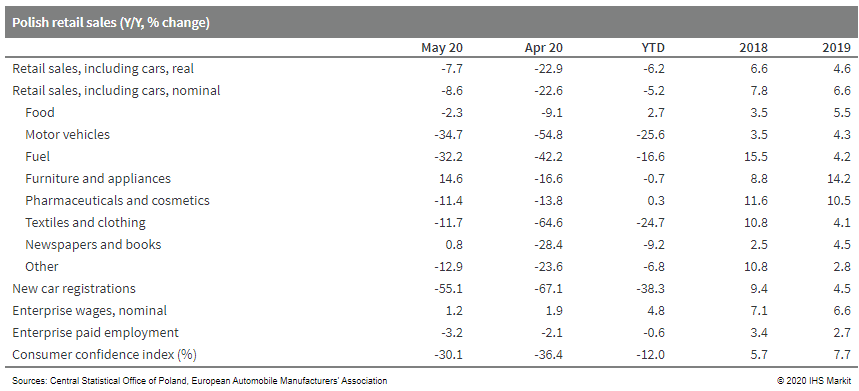

- Real, seasonally adjusted Polish retail sales jumped by 17.4%

month on month (m/m) in May, not enough to compensate for the March

and April declines (of 13.2% m/m and 14.4% m/m, respectively) but

still an impressive result. Including the automotive sector, retail

sales fell by 7.7% year on year (y/y) in real terms and by 8.6% y/y

in nominal terms.

- The main causes of the May decline were motor vehicles and fuel, while pharmaceuticals and clothing also reported steep y/y declines. The retail sector with the strongest results in May was furniture and appliances (up by 14.6% y/y in nominal terms).

- The strength of the May recovery was somewhat surprising, especially since Google's mobility reports signaled a continued steep decline in retail visits. In its June forecast, IHS Markit had projected a nominal decline of 10.0% y/y, indicating that the actual data were better than anticipated, benefitting from the reopening of shopping centers on 4 May.

- Based on the strength of the May results, IHS Markit will

consider upgrading its full-year 2020 projection for Poland's

private consumption (currently at -5.4%) in the July forecast

round.

- In the annual budget speech, the Ugandan government highlighted

in the national budget for FY 2020/21 that the economy is facing

unprecedented times because of the COVID-19 pandemic. Uganda has

witnessed a significant decline in economic output through

disruption to supplies of inputs to manufacturers, as well as

disruption to the activities of small and medium-sized enterprises

(SMEs). Furthermore, one of the greatest impacts of the COVID-19

pandemic felt by the economy is a decline in inflows of foreign

direct investment (FDI), as well as remittances by the diaspora. To

help address the near-term emergency liquidity requirements of

businesses, the government has proposed tax relief measures. (IHS

Markit Economist Alisa Strobel)

- Generally, a main aim of the government's aim is to strengthen Uganda's tax administration and improve efficiency in revenue collection.

- The latest budget targets revenue of UGX21,810 billion (USD5.8 billion) in FY 2020/21, comprising UGX20,219 billion in tax revenue and non-tax revenue of UGX1,591 billion, reaching 14.3% of GDP in total.

- To reach its revenue targets, the government aims to roll out greater use of digital tax stamps as well as to widen the scope of the income tax withholding agents across all sectors.

- Uganda's total public debt stood at USD13.33 billion in December 2019, with external debt at USD8.59 billion, 64.4% of the total debt stock, and domestic debt at 4.74 billion, 35.6% of the total debt stock.

- Russian liquid medicines manufacturer Solopharm has announced the delivery of a first batch of medicines to Uganda, as part of the first supply deal in a major planned expansion into the East African market. The first delivery has included liquid medicines for use in ophthalmology, ear, nose, and throat (ENT) specialties, and gastroenterology, along with antiseptics, for both pharmacy supplies and hospital use. According to the company statement, Uganda is now the 13th country covered by Solopharm exports, with the others being Armenia, Azerbaijan, Belarus, Cambodia, Georgia, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, Turkmenistan, Uzbekistan, and Vietnam. Solopharm has indicated that it is also in talks with potential partners to expand exports to Southeast Asia, the Middle East, and Central and South America. (IHS Markit Life Science's Janet Beal)

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +1.6%, India +1.5%, Japan +0.5%, and China/South Korea +0.2%.

- The headline au Jibun Bank flash Composite PMI, compiled by IHS

Markit and covering manufacturing and services, rose 10 index

points from 27.8 to 37.9 in June, the highest level since February.

However, by remaining well below 50, the latest figure signaled a

further marked decline in private sector output at the end of the

second quarter. (IHS Markit Economist Bernard Aw)

- Survey data showed manufacturing production fell substantially in June, with the rate of decline the fastest since the height of the global financial crisis in March 2009. Factories continued to cut output in response to a further sharp fall in new orders. Foreign demand for Japanese manufactured goods remained weak, with the latest decline in export sales among the quickest for over 11 years amid global trade weakness.

- The downturn in services activity meanwhile eased notably from May as more businesses resumed operations thanks to the lifting of lockdown measures. However, social distancing rules and travel restrictions continued to hold back the recovery of the service sector.

- Mitsubishi Motors Corporation (MMC)'s CEO says the automaker is

planning to focus less on large global markets, possibly including

the United States, where the brand does not do as well as in other

markets. Speaking at the company's annual shareholders meeting on

18 June, MMC CEO Takao Kato said that the company intends to pull

back from such "megamarkets", reports Automotive News. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- According to the report, MMC confirmed that it considers the US to be a megamarket and the automaker may place give less priority to the market in future.

- Kato reportedly discussed a new plan called 'Selection and Concentration', which replaces the previous 'Drive for Growth' plan. Kato reportedly said, "Even though we increased sales volume in the megamarkets, we have not yet achieved the level of profit we expected.

- Kato also stated that the company is looking to cut its global fixed costs by 20% through the fiscal year (FY) ending 31 March 2022. "We will start implementing these cost reduction measures as soon as possible. We will cut costs in a variety of areas, including capital expenditure, R&D, advertisement, indirect labor and general expenses to reduce fixed costs," Kato is reported as saying.

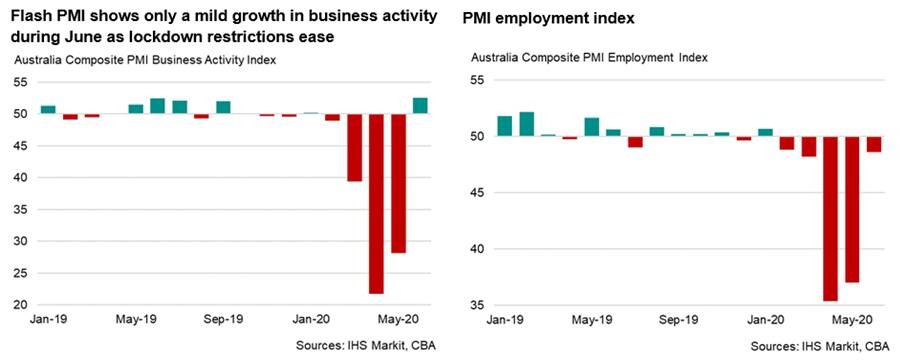

- The Commonwealth Bank Australia Flash PMI, compiled by IHS

Markit and encompassing both the manufacturing and service sectors,

surged by nearly 25 index points to 52.6 in June, up from 28.1 in

May. By breaking above the 50.0 no change level, the latest figure

indicates an increase in business activity for the first time since

January, though the upturn is insufficient to prevent the economy

from falling into a recession during the second quarter. (IHS

Markit Economist Bernard Aw)

- The upturn in business activity was fueled by pent-up domestic demand while the external sector continued to deteriorate. Total new order books grew for the first time since January, though the rate of increase was only marginal.

- Export sales declined further in June, marking a fifth consecutive month of contraction. The downturn in global trade and the ongoing closure of Australian borders continued to weigh on foreign demand for Australia goods and services.

- The labor market meanwhile continued to deteriorate as

operating capacity remained in excess compared to pre-pandemic

levels. Survey data showed employment fall further in June, and

further job losses will lead to a weakening consumption trend,

thereby acting as a dampener on recovery momentum. Official data

indicated that the unemployment rate rose to a 19-year high of 7.1%

in May, with over 824,000 jobs lost in April and May.

- KT has collaborated with research institute Korea Automotive

Technology Institute (Katech) to develop technologies for future

cars, reports Aju Business Daily. The companies will co-develop

technologies for Level 4 autonomous vehicles (AVs) and services for

autonomous operation environments. (IHS Markit Automotive

Mobility's Surabhi Rajpal)

- KT will provide its vehicle-to-everything (V2X) communication technology, high-definition location information service, and remote-control services for AVs.

- KT will also deploy big data and artificial intelligence technologies to collect data from test vehicles to further upgrade its technology.

- V2X technology enables vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure, and facilitates the operations of AVs.

- KT, South Korea's largest telephone company, has plans to build a core telecom infrastructure, including a fifth-generation (5G) wireless network and big data platforms in the country. KT also plans to develop 5G-based V2X terminals for South Korea's AV test bed, K-City.

- Hyundai, Kia, and LG Chem are jointly sponsoring the 'EV & Battery Challenge' (EVBC), a global competition to identify up to 10 electric vehicle (EV) and battery startups for potential investments and collaboration, according to a press release by Hyundai. New Energy Nexus, an international startup support organization, will manage and facilitate the competition. The competition offers startups the opportunity to showcase their respective innovative technologies and unique business models. The chosen startups will have the opportunity to work hand-in-hand with Hyundai, Kia, and LG Chem to develop proof-of-concept projects while leveraging the sponsors' technical expertise, resources, and laboratories. Startups that have working prototypes and are building technologies in EV charging and fleet management, power electronics and components, personalization services and battery management, systems, materials, and recycling and manufacturing are strongly encouraged to participate, according to the press release. IHS Markit forecasts that global production of Hyundai Motor Group's EVs, including Kia's, will grow to around 678,500 units in 2025, up from 103,500 units in 2019. Our forecasts include passenger vehicles and light commercial vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- Local government in Hubei, China published 25 measures on 18

June, aiming to revive local consumption and offset negative growth

impact of the pandemic outbreak. (IHS Markit Economist Lei Yi)

- Roadside trade and night-time economy will be promoted for the recovery of offline consumption, as local government allows catering and retail businesses to set up outdoor stalls, and waive penalties for temporary parking between 8pm to 1am due to consumption needs. Online platforms are also encouraged to lower service fees for individual businesses by at least 50% or reduce the fee rate to less than 10%, helping these small businesses to expand their customer reach with lower costs.

- Consumer credit will be further developed especially for auto and home appliance sectors to stimulate spending. Specifically, local government requires the consumer credit balance at the end of 2020 to be no less than that of 2019. City-level governments within the region should also work on policies to boost the sales of Hubei-produced vehicles where applicable.

- Additionally, the government will offer property tax and urban land use tax reduction for businesses hard hit by the pandemic. Banks should offer more instalment repayment options for enterprises; and micro, small and medium-sized enterprises (MSMEs) could defer their loans due since 25 January 2020 until the end of March 2021, with penalty interests waived.

- Piramal Pharma Solutions (PPS), the pharmaceutical contract development and manufacturing business of Piramal Enterprises Limited (PEL, India), has entered into an agreement with G&W Laboratories (US) to acquire the US company's solid oral dosage drugs manufacturing facility in Sellersville, Pennsylvania. Under the terms of the agreement, PEL, through its affiliate, will acquire a 100% stake in the entity that operates the manufacturing facility and owns the related real estate. According to a PEL press release, the Sellersville site is also able to produce liquids, creams, and ointments and to support product and process development for solid oral dosage and oral liquids, such as immediate release, modified release, chewable, and sublingual solid oral dosage forms. (IHS Markit Life Science's Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2020.html&text=Daily+Global+Market+Summary+-+23+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}