Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2020

Daily Global Market Summary - 24 June 2020

European and US equity markets closed sharply lower and APAC was mixed, which was at least partially driven by the growing concerns over the rapid growth of COVID-19 infections sidetracking the reopening process in the US and creating further delays in the global economic recovery. European and US credit indices and oil closed lower, while 10yr US government bonds and the US dollar closed higher on the flight to quality.

Americas

- US equity markets closed lower today; Russell 2000 -3.5%, DJIA -2.7%, S&P 500 -2.6%, and Nasdaq -2.2%.

- 10yr US govt bonds rallied into positive territory at the US market open and closed higher at -3bps/0.68% yield.

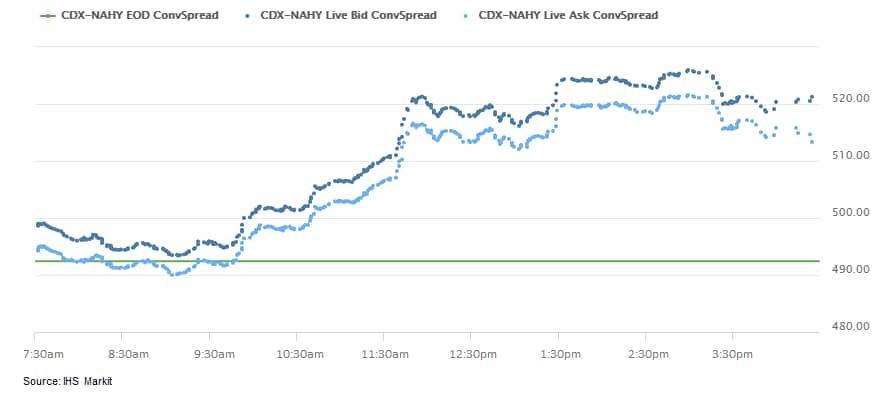

- CDX-NAIG closed +4bps/79bps and CDX-NAHY +24bps.

- Crude oil closed -5.8%/$38.01 per barrel.

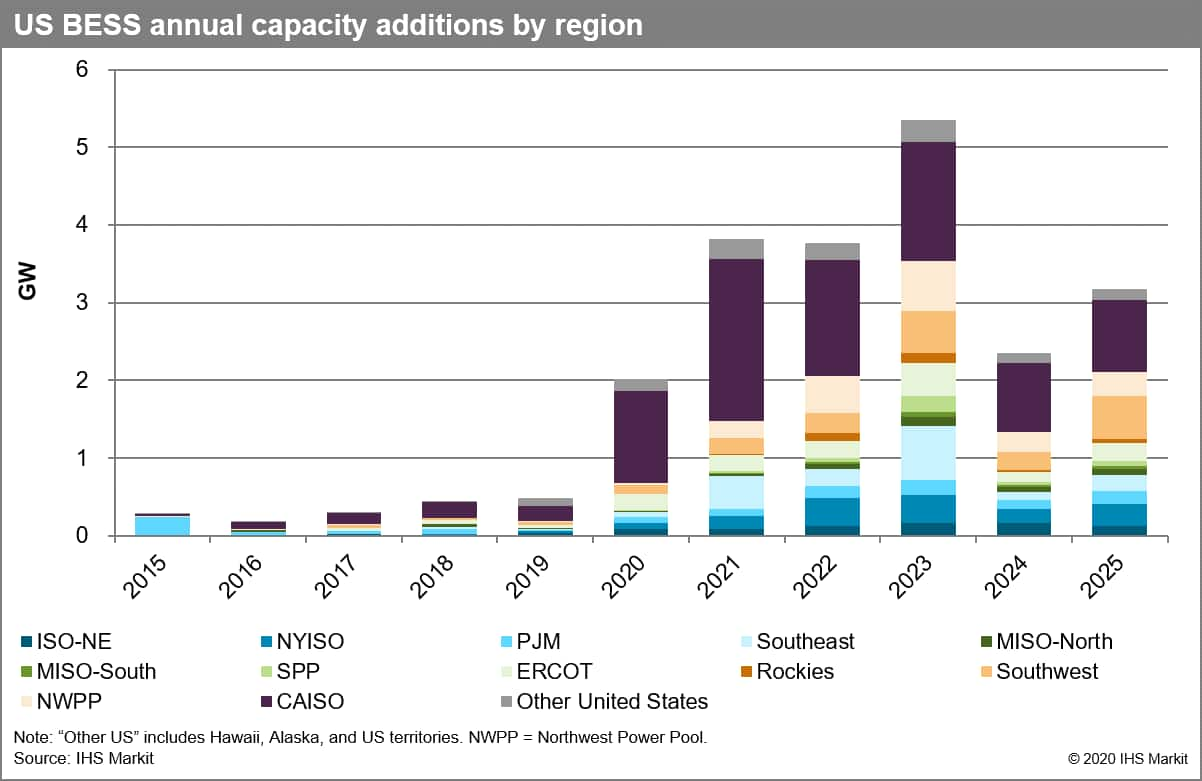

- The US battery storage industry continues to gather momentum as

record levels of project announcements underpin a strong near-term

outlook. Announced project capacity reached 3.2 GW in 2019, more

than double the 2018 total. Much of this capacity is planning to

come online over the next three years. The US is poised to add 20

GW of battery energy storage systems (BESS). Most capacity

additions will be in the front-of-the-meter (FTM) segment, driven

by utility procurement of large centralized plants that can achieve

economies of scale. Half of FTM capacity additions will be

colocated with a source of generation—primarily solar

photovoltaics (PV)—to capture cost savings, tax credits, and

operational synergies. The behind-the-meter (BTM) segment will be

driven by customers looking to optimize their energy bills and

increase resilience to supply disruptions. The market will remain

regionally concentrated over the next five years, with 65% of

additions in western states and 40% in California alone. (IHS

Markit Energy Advisory's Roger Diwan, Sam Huntington, Chloe

Holzinger, and Julian Jansen)

- The US Federal Housing Finance Agency (FHFA) House Price Index

edged up 0.2% month on month (m/m) in April, culminating in a 5.5%

year-on-year (y/y) gain, down from the 5.9% recorded in March and

the 6.0% recorded in February. (IHS Markit Economist Rebecca

Mitchell)

- Prices rose in five of the nine Census divisions, were flat in two (Pacific and Mountain), and declined in New England and the South Atlantic region in the month of April.

- The West South Central states (Oklahoma, Arkansas, Texas, Louisiana) saw the largest monthly gain of 0.8% in April. Meanwhile, on the other end of the spectrum, New England (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut) contracted by 0.2% and the South Atlantic (Delaware, Maryland, District of Columbia, Virginia, West Virginia, North Carolina, South Carolina, Georgia, Florida)division declined by 0.5%.

- Year-on-year price gains were the highest yet again in the Mountain states (Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona, New Mexico) with 6.8% growth. The Middle Atlantic (New York, New Jersey, Pennsylvania) region came in last among the nine again in this metric with annual growth of just 5.0%.

- Five of the nine divisions hit index highs in April; the remaining four achieved their index highs in March or February of this year.

- With supply tight and the market normalizing, we expect home price growth to slow but not become negative. The CoreLogic home price index, which we introduced into our model in May, is expected to slow from 4.5% four-quarter growth in the first quarter to 2.7% in the first quarter of 2021.

- Meat exporters around the world are racing to reassure China that shipments are safe after facilities in the US, Brazil, Germany and UK were shut out of the Chinese market following outbreaks of Covid-19 among workers. China last week rolled out new tests for imported meat and fish after a flurry of coronavirus cases in Beijing. It then surprised the industry by suspending imports from a plant owned by Toennies, Germany's largest pigmeat processor. This was followed by similar suspensions on a Tyson poultry plant in the US, a Tulip pork plant in the UK and an Agra beef facility in Brazil. While some of these suspensions are described as 'voluntary' by Chinese authorities, it is clear they are the result of Beijing's new approach - which saw warning letters sent out to 42 meat producing nations. Meat exporters around the world now fear they too could be shut out of the world's largest market if workers are infected with Covid-19. In a best-case scenario, China will find no evidence of Covid-19 contamination of imported meat and quickly reopen to suspended facilities. There are no guarantees this will happen however as a single Covid finding would likely see the policy extended. Even without evidence of a risk from meat, Beijing may maintain its newly strict approach, which requires overseas suppliers to provide assurances that shipments are free of Covid-19. (IHS Markit Food and Agricultural Commodity's Max Green)

- US fire and water restoration company ServPro has reportedly signed a letter of understanding to buy 1,200 Endurance electric pick-up trucks from early 2021, according to a Work Truck News report. The report cites an announcement from Lordstown Motors saying that ServPro will be among the first commercial fleet customers to receive its trucks. The report says that ServPro sees the long-term goal of sharing the opportunity with neighboring ServPro franchise owners in neighboring states. There is no indication of how large ServPro's total fleet is, or how long the company expects it will take Lordstown Motors to deliver the full allotment of 1,200 vehicles. However, this is only one of several pre-orders and non-binding letters of intent that Lordstown has been able to secure; it follows orders from several Ohio-based companies, including Clean Fuels Ohio, First energy, and Momentum Groups. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Magna has announced plans to invest USD35.4 million to update a Michigan plant to support new seating contracts. The investment will reportedly create 480 jobs at a plant specifically in Highland Park, Michigan; according to Automotive News, partially citing documents from the Michigan Economic Development Corporation, Magna says that about 300 of these jobs will be entry-level. Facility upgrades will include renovation as well as the addition of 5,000 square feet to the plant, 100 new parking spaces, and three shipping docks. Magna's lease on the site expires in December 2022, but the supplier expects to renew it for another five years; the expansion will not be complete until 2023. Magna currently employs 625 people at the site, so the multi-year project will sharply increase employment. There is no indication as to which customers Magna intends to supply, although the facility is near several Fiat Chrysler Automobile (FCA) production locations, including its new Mack Avenue plant (IHS Markit AutoIntelligence's Stephanie Brinley)

- On 23 June, multiple media reported that 29 asset managers co-ordinated by Norway's Storebrand Asset Management wrote on 22 June to seven Brazilian embassies expressing concerns over Brazil's environmental and human rights policies. The investor group manages USD3.75 trillion in aggregate assets and includes the UK's Legal & General, Sumitomo Mitsui Trust Asset Management, Nordea and Brazilian firm Fram Capital. Requesting dialogue on Brazil's policies, it warns that "dismantling of environmental and human rights policies are creating widespread uncertainty" for investment and financial services provision. To our knowledge, Brazil has not responded directly to the letter but Brazil's Agriculture Minister Tereza Cristina is cited by Latin Finance website as favoring increased Brazilian private-sector use of Green Bond issuance, claiming that "the major problem [behind] Amazon deforestation is the illegality and not agriculture". The minister stated that Brazil already has "important legislation" to preserve natural vegetation and that agricultural firms "will have a great share of this green bonds market" to fund development. (IHS Markit Economist Brian Lawson)

- According to the latest data released by Argentina's National

Institute of Statistics and Census (Instituto Nacional de

Estadística y Censos: INDEC), GDP decreased by 5.4% year on year

(y/y) in the first quarter of 2020. Data for 2019 were revised

upwards, leading to a decline of 2.1% y/y. (IHS Markit Economist

Paula Diosquez-Rice)

- Correcting for seasonality, GDP during the first quarter of 2020 decreased by 4.8% quarter on quarter (q/q) after declining in the previous quarter, according to the revised figures.

- The estimate for the GDP deflator in the first quarter of 2020 shows a rise of 53.9% y/y, while the private-sector consumption deflator increased at a higher rate of 54.8% y/y during the same period.

- By sector, the GDP data show mostly declines in the first quarter of 2020; for example, the manufacturing sector decreased by 6.5% y/y, the wholesale and retail sales sector by 6.5% y/y, the construction sector by 20.8% y/y, the financial intermediation and services sector fell by 5.9% y/y, the non-profit and social services sector by 7.2% y/y, hospitality and restaurants down by 10.2% y/y, and fishing was down by 30.4% y/y.

- Only a handful number of sectors showed an increase in annual terms. Activity in the mining sector increased by 0.3% y/y, and the utilities sector rose by 3.8% y/y. The education sector also showed a rise in the first quarter.

- On the demand side, real exports of goods and services decreased by 4.7% y/y. There were declines in private-sector consumption, which fell by 6.6% y/y, driven by the high inflation rate and the start of the country's lockdown in the last 10 days of that quarter; public-sector consumption decreased by 0.7% y/y, as the inflation rate outpaced the increase in nominal spending.

- Gross fixed-capital formation decreased by 18.3% y/y; this drop was driven by the construction subsector, down by 24.5% y/y, while the machinery and durable equipment category decreased by 13% y/y.

- The Central Bank of Paraguay (Banco Central del Paraguay) has

cut rates from 4% to 0.75% in 2020 alone - this is the lowest rate

since the implementation of inflation targeting in 2011. (IHS

Markit Economist Ellie Vorhaben)

- Inflation has been decelerating dramatically, from 2.8% in January to just 0.7% in May. Lower food prices and much weaker energy prices are limiting inflationary pressure; the exchange rate has remained relatively weak, having depreciated by around 3% from the start of 2020.

- The economic indicator, a proxy for GDP, declined by 12.2% annually in April as activity in services, industrial manufacturing, electric energy production, construction, and ranching plummeted.

- Agricultural activity was more robust as a recovery in soybean production supported the sector as a whole.

- Overall, the economy is estimated to have declined by 0.2% through April.

Europe/Middle East/ Africa

- European equity markets closed sharply lower; Germany/Italy -3.4%, Spain -3.3%, UK -3.1%, and France -2.9%.

- 10yr European govt bonds closed mixed; UK/Spain/France -2bps and Germany/Italy flat.

- iTraxx-Europe closed +5bps/69bps and iTraxx-Xover +21bps/397bps.

- Brent crude closed -5.1%/$40.53 per barrel.

- The headline Ifo index - which reflects German business

confidence in industry, services, trade, and construction combined

- posted its second strong increase in a row in June, rising from

79.7 to 86.2. This is the largest monthly increase ever recorded

and broadly represents a return to the level in March. (IHS Markit

Economist Timo Klein)

- It also compares with April's series low of 74.3, considering data since January 2005 when the service sector was first incorporated into the headline measure.

- Nevertheless, June's headline index level is still only in the middle between the all-time low and the long-term average of 97.2.

- Expectations were the driving component by far, posting their second strong increase in a row from 80.5 to 91.4. Expectations have therefore broadly returned to their level during the second half of 2019, prior to the pandemic.

- Expectations in the manufacturing sector improved the most, posting an 18-month high.

- The current conditions index recovered for the first time but only by 2.4 points from 78.9 to 81.3. That said, its cyclical low still managed to stay above the trough observed during March-July 2009 during the recession triggered by the global financial market crisis (then ranging between 77.5 and 78.5).

- June's Ifo survey results confirm that the staggered loosening of the lockdown measures since late April has led to sharply improved expectations, especially in the sectors hurt the most by those measures (retail and services) as well as manufacturing.

- Volkswagen (VW) is in preliminary talks to acquire French car rental firm Europcar, reports Bloomberg. The deal would allow VW to better capitalize on its fleet and support Europcar's finances as the latter struggles to cope with the economic impact of the COVID-19 virus crisis. The final terms of a deal have not been agreed and VW could still opt not to proceed with an offer. This deal would be in line with VW's efforts to expand its mobility services offerings, including rental and leasing programs for new and used electric cars. If the automaker pursues this deal, it would mark a reversal after it sold Europcar to investment firm Eurazeo in 2006 for EUR1.26 billion (USD1.4 billion). Last year, Europcar hired advisers and attracted interest from private equity firms, including Apollo Global Management. (IHS Markit Automotive Mobility's Surabhi Rajpal)

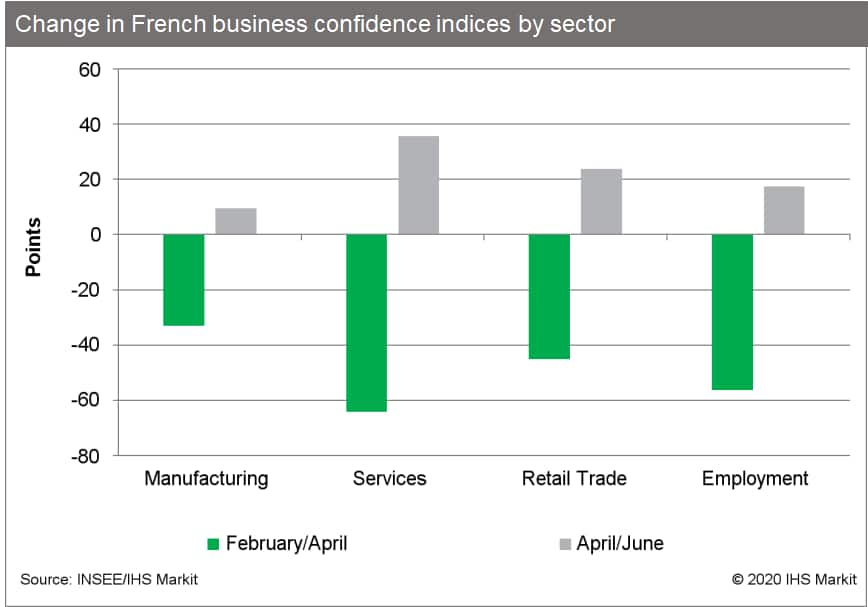

- France's business confidence index stood at 78 in June, up from

60 in May and 53 in April (a survey low). June's monthly

improvement (18 points) was the strongest since the data started to

be collected in 1980. (IHS Markit Economist Diego Iscaro)

- However, the index remains well below the pre-COVID-19 virus level of 105.0 in February and its long-term average of 100. Indeed, excluding the previous two months, June's reading was the weakest since 2009.

- The employment climate indicator also improved to 66 in June, up from 48 in April and 52 in May. It had averaged 104.6 during the first two months of 2020.

- The sectoral breakdown shows confidence in the service and retail trade sectors, which had been significantly affected by the severe lockdown in place between March and May, recovering strongly by 26 points and 21 points, respectively.

- Confidence in the manufacturing sector, which was less affected by the COVID-19 virus crisis, improved by 6 points. The confidence indices remain well below their pre-COVID-19 levels in all sectors.

- Indices measuring recent past activity generally improved in

June, with the exception of the past activity index in the service

sector. However, the most marked improvements were seen in the

indices measuring expected activity and demand levels.

- According to the Swedish National Institute of Economic

Research (NIER), Sweden's economic tendency indicator improved to

75.2 in June, a marked improvement compared with 60.4 in April and

64.4 in May. However, it remains far below the 20-year average of

100. (IHS Markit Economist Daniel Kral)

- The consumer confidence index improved to 84.0 in June, up by 6.3 versus May. Although the improvement was broad-based, the main contribution came from consumers being less pessimistic about the outlook for the Swedish economy over the coming year.

- Manufacturing confidence marked the largest improvement in May-June, up by 12.7 points to 89.1. Producers of capital goods contributed most to the increase, which was driven chiefly by a sharp upward revision of production plans for the next three months.

- UK Prime Minister Boris Johnson has announced a widely expected relaxation of the lockdown in England to halt the spread of the COVID-19 virus. The government notes that the number of COVID-19 virus infections has fallen notably to 1,000 new cases per day. The relaxation includes reducing the 2-meter social distancing rule to 1-meter plus to allow retailers and service providers to operate at a higher capacity. The hospitality sector will reopen, with pubs, bars, restaurants, and hotels in England reopening their doors from 4 July. Some parts of the entertainment and arts industry can reopen, including bingo halls, museums and art galleries, cinemas and theatres, and concert halls (but no live performances). (IHS Markit Economist Raj Badiani)

- McLaren Group is said to be preparing to undertake a legal fight to secure more liquidity for the business. BBC News reports that the automaker has submitted documents for a court case to prevent a group of bondholders blocking its plans to secure new funds using the McLaren Technology Centre and its collection of historic vehicles as collateral. The documents state that it has already "now fully drawn" GBP130 million from an earlier credit agreement and that its shareholders have previously injected GBP291 million in to the business in March that had been intended to "provide the group with ample liquidity in order to fund its business plan" bringing the total invested during the past 18 months to GBP500 million. It added that it requires new funds to be injected in to the business "no later than 17 July" due to an "impending liquidity shortfall". The documents are related to an expedited High Court hearing in London (UK) that is due to take place next week, to determine whether this proposed refinancing could go ahead. Holders of GBP525-million-worth of bonds taken out by the company during 2017 are trying to prevent the use of these assets to underpin a new liquidity injection because they suggest it undermines the security of its own investment. (IHS Markit AutoIntelligence's Ian Fletcher)

- Shell will announce a major restructure by the end of the year as the company prepares to accelerate its shift toward its net-zero emissions goal by 2050, CEO Ben van Beurden has told employees. The restructuring will include workforce reductions as part of broader cost-cutting measures, although no figures have been decided yet, the CEO reportedly said during an internal webcast, according to Reuters. "Ben spoke about positioning the company in the energy transition," said one source. "The company will announce the new shape of the organization by the end of the year." The new structure will not take effect before 2021. In a new video posted up on Shell's official website today under the title 'The opportunity of a green recovery,' van Beurden says that as countries emerge from the COVID-19 pandemic and restart their economies, it is a key moment to "make the right choices for a better world. And that is why society must remain focused on the longer-term challenge of climate change. Because it hasn't gone away. It still needs urgent action. Shell has a big part to play."

- Solvay today provided a trading update for the second quarter, noting that the COVID-19 pandemic has had a major impact on demand from customer industries. An impairment review is under way and likely to lead to a noncash impairment charge estimated at about €1.5 billion ($1.7 billion), with the final number depending on exchange and discount rates as at 30 June 2020. Solvay says that businesses related to oil and gas, automotive, and aerospace were the most significantly impacted, with revenue down about 40%, whereas businesses related to construction and mining were down about 20%. Other key markets such as healthcare, agro/food, home and personal care, and electronics resisted well and helped to offset some of the challenged markets. Solvay's group sales were down 20% on aggregate across April and May versus 2019 levels. Similar demand trends are expected to continue during June. "Decisive actions on structural and temporary cost-reduction programs and the focus on cash generation help to ease some of the effects and position the group for strong growth when markets rebound," the company says.

- A Kurdish Regional Government (KRG) delegation arrived in

Baghdad on 23 June 2020 to resume negotiations with the federal

government over budget allocations. In April, the federal

government stopped distributing the Kurdistan region's budget since

the KRG had not handed over 250,000 barrels of oil per day to

Baghdad as agreed. (IHS Markit Country Risk's Rebecka Freeman)

- On 21 June, the KRG announced that it was reducing all public salaries and allowances for those earning above USD251 per month by 21% and 50% depending on the salary bracket.

- This was announced as a temporary measure for June, but without an agreement resuming budget transfers, it is likely to be extended.

- The federal government has yet to finalize the 2020 budget, and it must do so before 30 June, adding pressure on negotiations.

- Oil exports constitute on average 90% of the overall revenue for both the semi-autonomous region and the federal government. As such, global low oil prices mean that even with a new agreement that upholds the KRG's constitutionally stipulated 12.67% share of the budget, this will be significantly less in monetary terms and will force the KRG to continue to decrease state expenses through austerity measures.

- A sharp decline in Kenya's near-term growth prospects,

reflected in a deterioration in the budget deficit and government

debt-to-GDP ratio, underpins Fitch's revision of Kenya's Issuer

Default Rating (IDR) outlook to Negative from Stable. (IHS Markit

Economist Thea Fourie)

- Fitch expects Kenyan real GDP to expand by 1.0% during 2020, higher than the 2.0% contraction currently assumed by IHS Markit for the year.

- The slowdown in economic activity will reflect a more than 30% fall in Kenya's agricultural exports, made up by horticulture, tea, and coffee products (3% of GDP in 2019), and an expected 20-40% slowdown in travel receipts and remittance inflows (4.3% of GDP in 2019).

- For the fiscal year 2020, Fitch expects the fiscal deficit to widen to 8.6% of GDP, the net effect of weaker growth and below-budget government revenues, tax relief measures adopted during the year, and COVID-19 virus-related spending costs (0.4% of GDP).

- The 2021 national budget has set a target of 7.5% of GDP and allows for spending cuts to offset lower revenue collection.

- The Finance Bill 2020 also allows for new tax revenue measures and the lowering/removal of some tax exemptions.

- Capex spending cuts are assumed during the 2021 fiscal year, which will allow a bigger budget allocation towards President Uhuru Kenyatta's "Big Four" agenda of food security, affordable housing, increasing manufacturing, and universal healthcare. Fitch assumes, however, that the spending cuts are too ambitious and warns of a weak track record of fiscal consolidation. By 2021, Fitch expects the public-sector debt burden to reach 70% of GDP.

- Kenya's external balances and pressure on foreign-reserve holdings will deteriorate in the near term. Fitch expects the current-account deficit to widen to 5.4% of GDP in 2020 from 4.5% of GDP in 2019.

- Lower foreign direct investment inflows mean that Kenya will rely more on debt flows and a draw-down in foreign reserve holdings to finance its "twin" deficits (current-account and fiscal balance deficits).

Asia-Pacific

- APAC equity markets closed mixed; South Korea +1.4%, China +0.3%, Australia +0.2%, Japan -0.1%, Hong Kong -0.5%, and India -1.6%.

- The Drug Controller General of India (DCGI) has granted approval to Jubilant Life Sciences (India) and a local subsidiary of the US generic drug maker Mylan to market their licensed generic versions of Gilead Sciences' antiviral remdesivir for the treatment of COVID-19. The DCGI has already granted authorisations to Cipla (India)'s licensed generic version of remdesivir under the brand name Cipremi, and to Hetero Lab (India)'s licensed generic version of remdesivir under the brand name Covifor. The DCGI has granted approval for restricted emergency use of these licensed generic versions of remdesivir under an accelerated pathway. Jubilant Life Sciences, Mylan, Cipla, and Hetero Labs are four of the five generic drug companies that originally signed non-exclusive licensing agreements with Gilead to enable them to manufacture bioequivalent versions of remdesivir for distribution in 127 countries. Dr Reddy's (India) later also agreed a non-exclusive licensing deal for remdesivir under the same terms. Dr Reddy's is still awaiting DCGI approval for its generic remdesivir. (IHS Markit Life Science's Sacha Baggili)

- Chinese ride-hailing giant Didi Chuxing (DiDi) aims to operate 1 million autonomous cars through its platform by 2030, reports Reuters. This was announced by Meng Xing, the chief operating officer of the company's autonomous vehicle (AV) unit, at an online conference hosted by the Hong Kong-based newspaper South China Morning Post. The company plans to deploy robotaxis in areas where there is a supply shortage of ride-hailing cars. DiDi has been working on AV technologies since 2016. The company plans to launch a pilot robotaxi service in Shanghai that will allow passengers to hail AVs in the city's Jiading district using its app. DiDi is eligible to carry out AV road tests in California (United States), Beijing, Shanghai, and Suzhou. DiDi recently secured its first external investment in its AV division since it became an independent company last year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- WeRide.ai has partnered with Alibaba's mobility app operator AutoNavi to launch a robotaxi service in the Chinese city of Guangzhou, reports the South China Morning Post. WeRide.ai will deploy a fleet of 20 robotaxis serving 144 square kilometres across the city's Huangpu and Guangzhou Development districts, with about 200 pick-up and drop-off points. Users can hail a ride through AutoNavi's Amap app and the service will be free of charge for the first month. Li Zhang, chief operating officer of WeRide, said, "WeRide is developing its technology and operation in parallel. We have launched our own hailing application WeRide Go for Robotaxi and are keen to collaborate with more ride-hailing platforms. Our cooperation with Amap will bring WeRide's Robotaxi to a more developed mobility market. More people could enjoy our Robotaxi service through the collaboration. Together we will explore and build a new kind of business in the future-looking autonomous mobility market." WeRide.ai was founded in 2017 and is headquartered in Guangzhou, with offices in Beijing and Anqing in China and Sunnyvale, California in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Zotye Auto released its 2019 financial report yesterday (23 June). The automaker's revenue plunged 79.78% year on year (y/y) in 2019 to CNY2.99 billion (USD4.23 billion). The net loss to shareholders of the listed company, which was originally estimated at CNY9.3 billion, totalled CNY11.2 billion. The automaker sold 21,200 vehicles in 2019, down 86.29%. Zotye's full-year 2019 financial report reveals the automaker's struggles in a competitive market. Zotye's sales are continuing to worsen in 2020: in the first five months of this year, its sales slumped 96% y/y to 3,573 units. In response to this decline in sales, the automaker is suspending production at its Hunan manufacturing base in China. According to local media reports, Zotye has notified its staff employed by several subsidiaries in the region to take leave from 1 July 2020 to 30 June 2021. Affected employees will be on the automaker's payroll during this period, but their wages will be adjusted according to new policies. Employees are encouraged to look for other job opportunities during the period. (IHS Markit AutoIntelligence's Abby Chun Tu)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2020.html&text=Daily+Global+Market+Summary+-+24+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 24 June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+24+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-24-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}